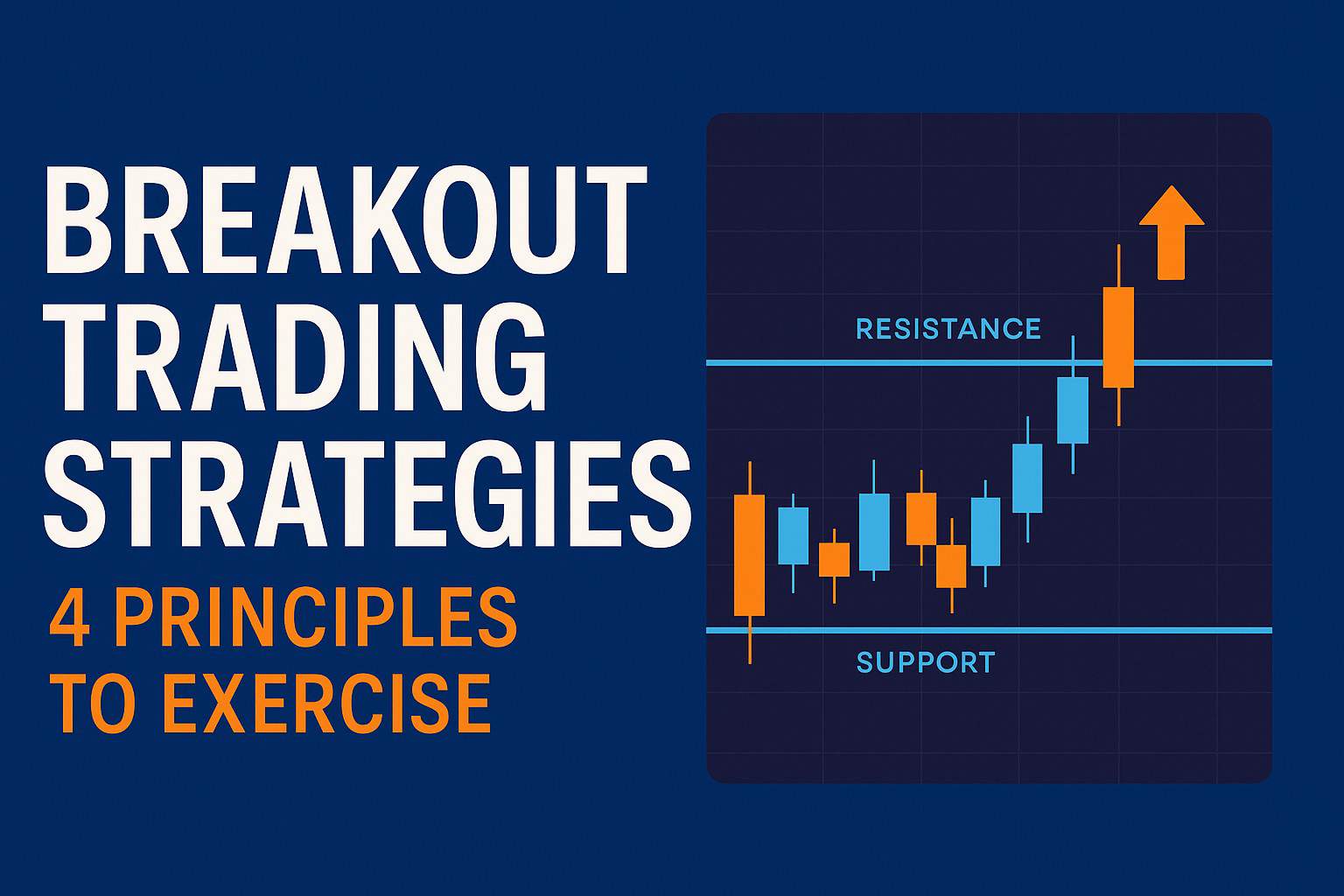

Breakout trading is a widely used Forex strategy that aims to capture significant price movements when a currency pair breaks through critical support or resistance levels.

These breakouts often mark the beginning of strong directional trends. To trade them effectively, you need to understand market psychology, recognize technical setups, and execute trades with discipline.

This guide explains the fundamentals of breakout trading, the price patterns that drive them, and four essential principles for applying breakout strategies with confidence.

By the end, you’ll know how to identify opportunities, manage risk, and improve your consistency in the Forex market.

Summary

Breakout trading capitalizes on price movements when markets push beyond support or resistance levels.

Success requires more than spotting breakouts—it also involves confirmation, risk management, and patience.

This article covers:

- What breakout trading means in Forex

- The role of continuation patterns such as triangles, flags, pennants, and rectangles

- The 4 principles of breakout trading strategies: identifying key levels, confirmation, risk management, and discipline

- Practical tips for success, including demo trading before committing live capital

Quick Reference: 4 Principles of Breakout Trading

| Principle | Method/Focus | Tools for Application |

| Identify Key Levels | Spot critical support and resistance | Horizontal S/R, channel lines |

| Seek Confirmation | Validate breakouts before entering | Candlesticks, RSI, TSI |

| Apply Risk Management | Limit losses and preserve capital | Stop-loss, position sizing, risk-reward ratio |

| Practice Patience & Discipline | Wait for high-probability setups, avoid chasing | Consistent rules, trading plan |

TL;DR – 4 Principles for Breakout Trading

This guide teaches you how to approach breakout trading using four core principles:

- Identify key support and resistance levels

- Wait for confirmation before entering

- Manage risk with stop-losses and risk-reward ratios

- Stay patient and disciplined

For best results, combine breakout setups with other indicators, practice in a demo account, and commit to long-term learning.

What Does Breakout Trading Mean?

Breakout trading is based on the constant push and pull of supply and demand in the foreign exchange (Forex) market.

A breakout occurs when the price decisively moves beyond a significant support or resistance level, signaling a potential shift in sentiment and often the start of a new trend.

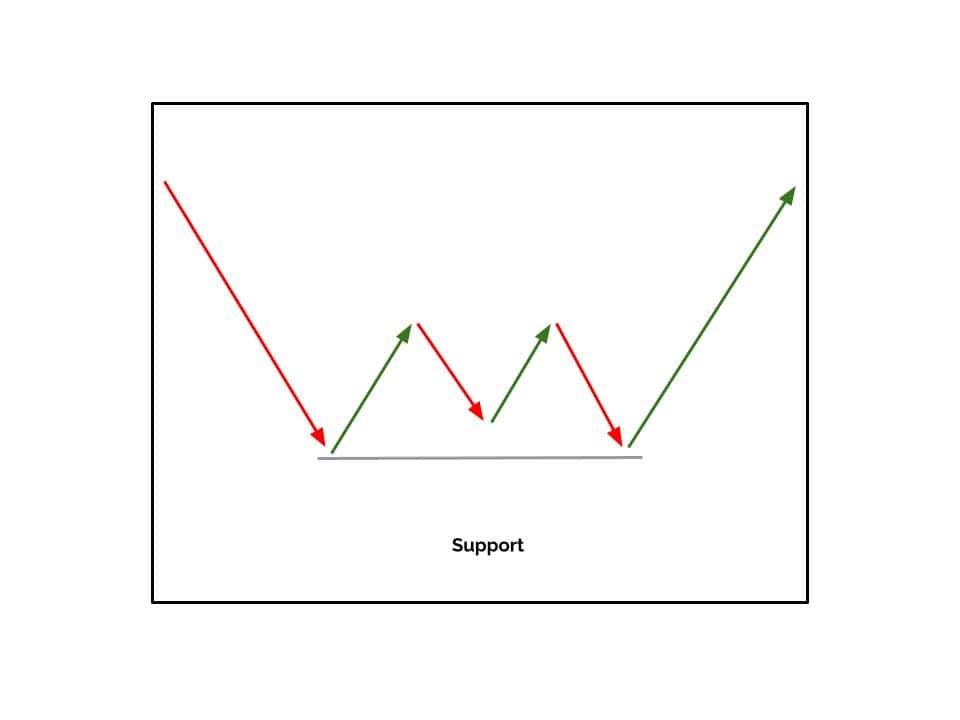

- Support levels act as floors, where buying pressure prevents further decline.

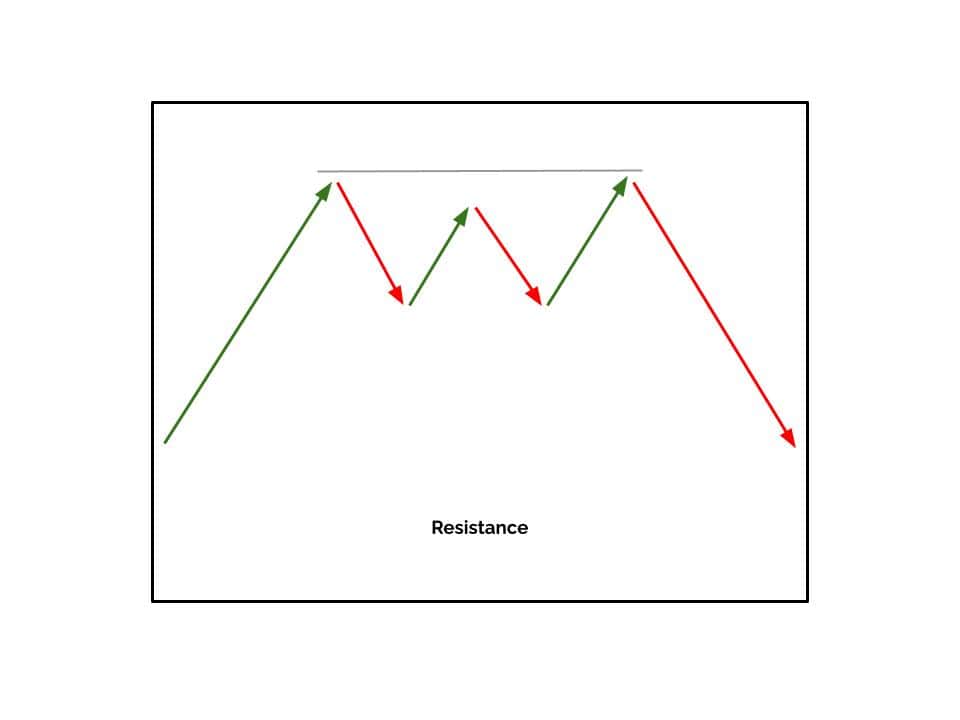

- Resistance levels act as ceilings, where selling pressure prevents further advance.

Breakouts are often triggered by market events such as:

- Sentiment shifts — reactions to economic data, central bank actions, or geopolitical news

- Technical factors — consolidation patterns or narrowing ranges that prime the market for expansion

Recognizing these conditions is the first step toward profitable breakout trading.

What Patterns Contribute to Breakout Trading?

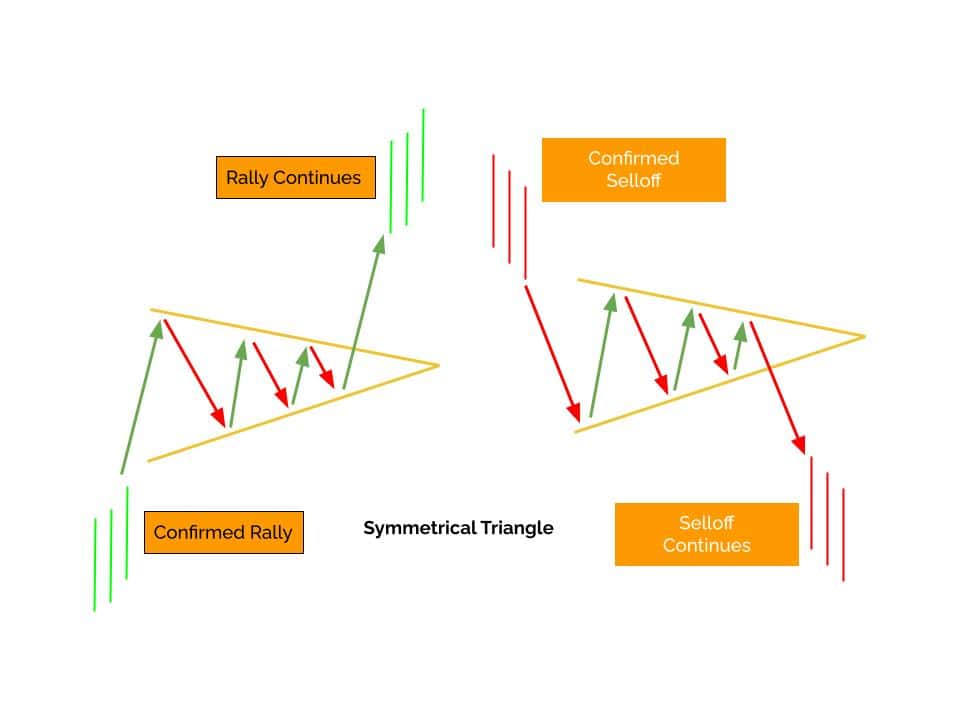

Breakouts usually develop from continuation patterns that form within existing trends. Identifying these setups provides context for when and where a breakout may occur.

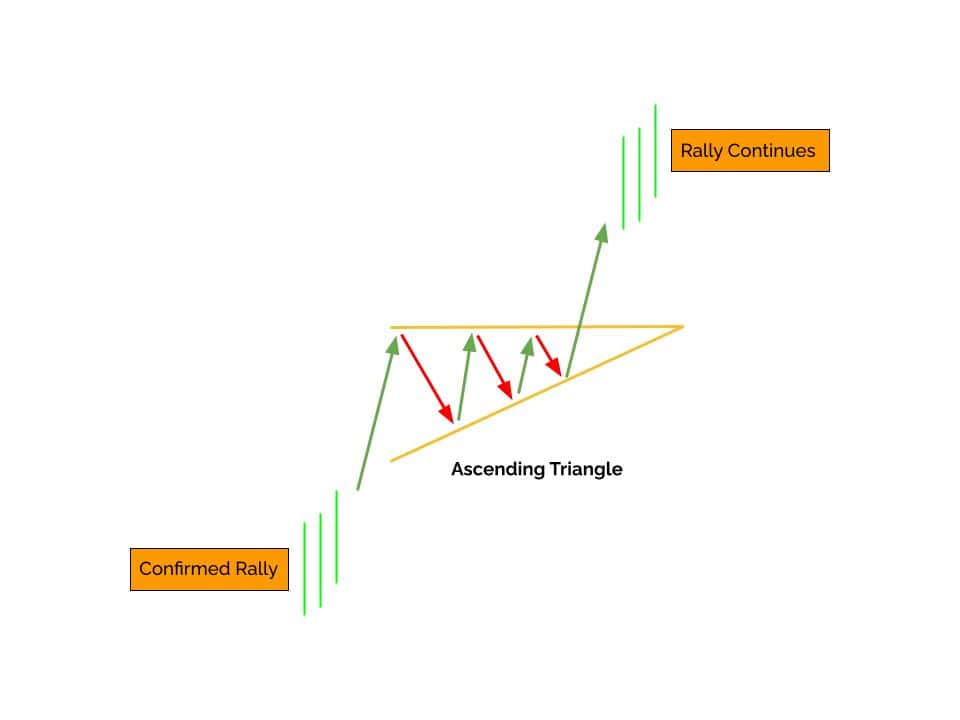

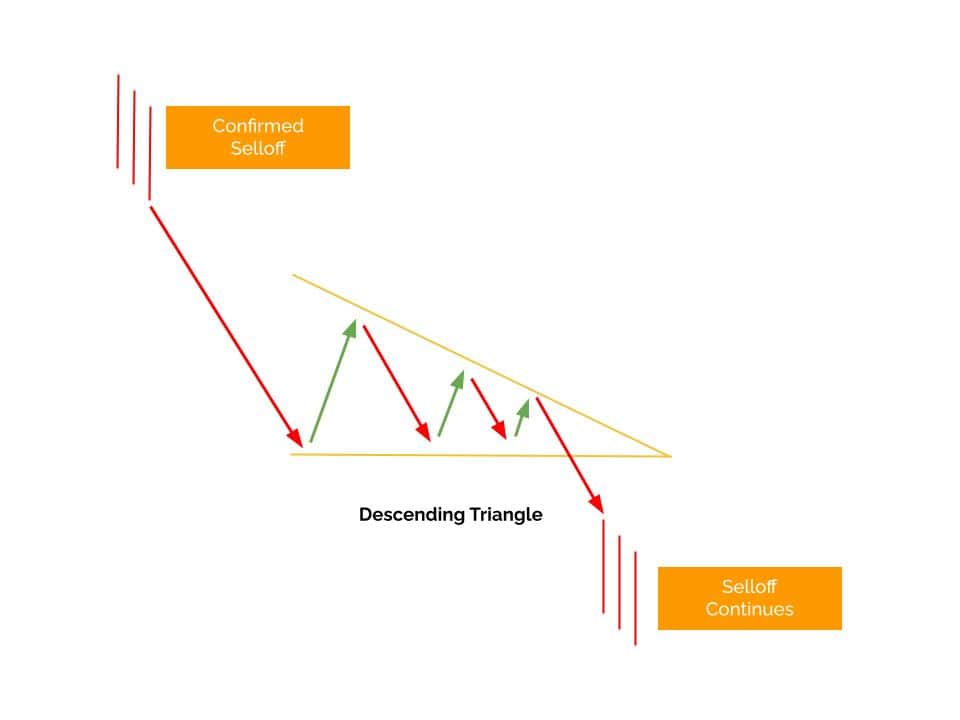

- Triangles: Converging lines show indecision. A breakout midway through the pattern often signals continuation.

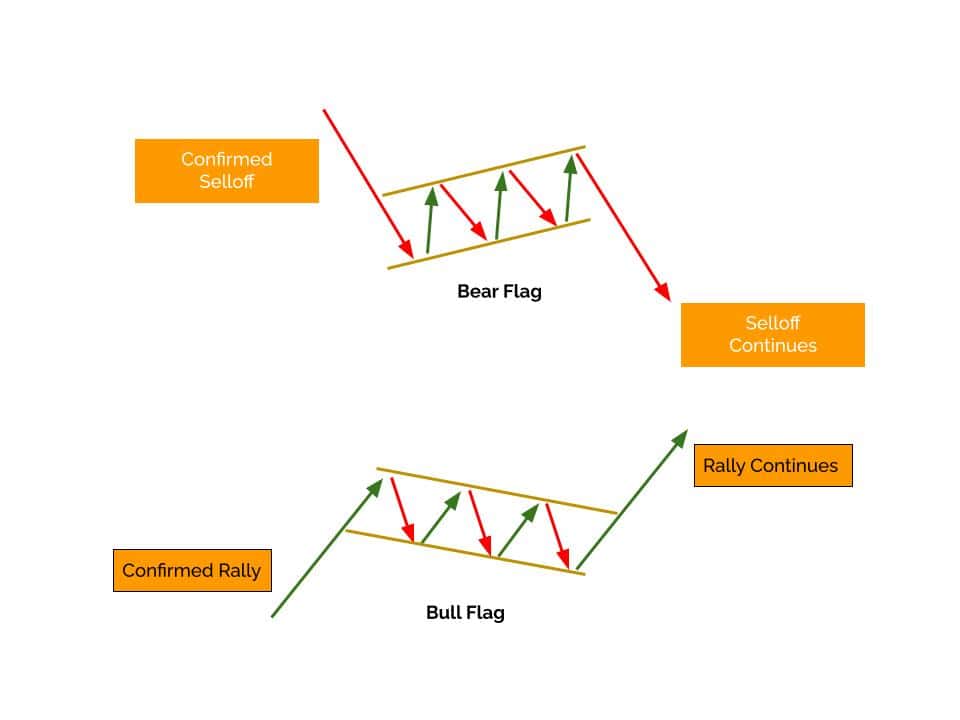

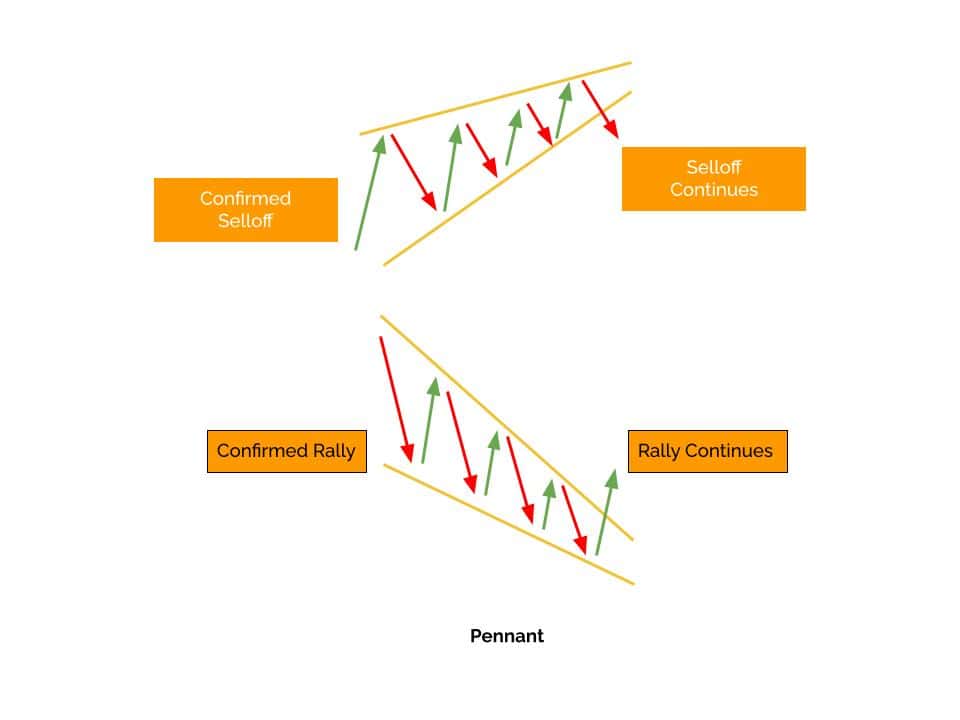

- Flags and Pennants: Short consolidations after sharp moves. Breakouts usually resume the trend with momentum.

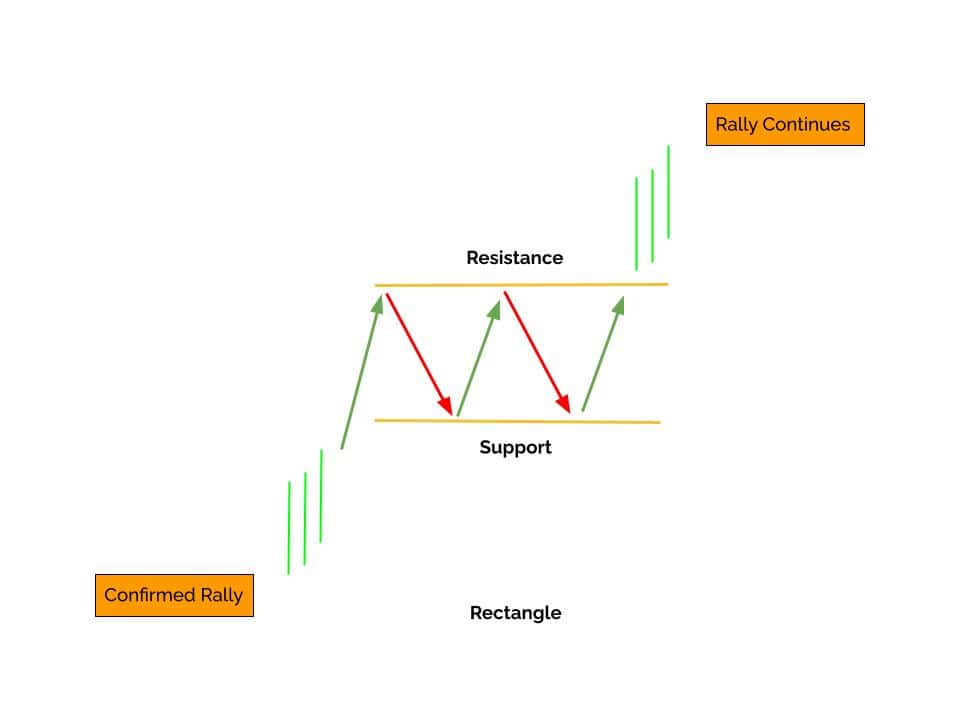

- Rectangles: Horizontal ranges defined by parallel support and resistance. A breakout confirms directional bias.

Trend-following traders favor continuation breakouts to ride established momentum and avoid trading against the prevailing trend.

Looking for a Strategy?

Download the Six Basics of Chart Analysis and sign up for Forex Forecast to learn a bottom-up approach to analyzing Forex markets and weekly market updates.

The 4 Components of Breakout Trading Strategies

To execute breakouts effectively, traders need to focus on four key components: level identification, confirmation, risk management, and discipline. Each one strengthens the reliability of trade setups.

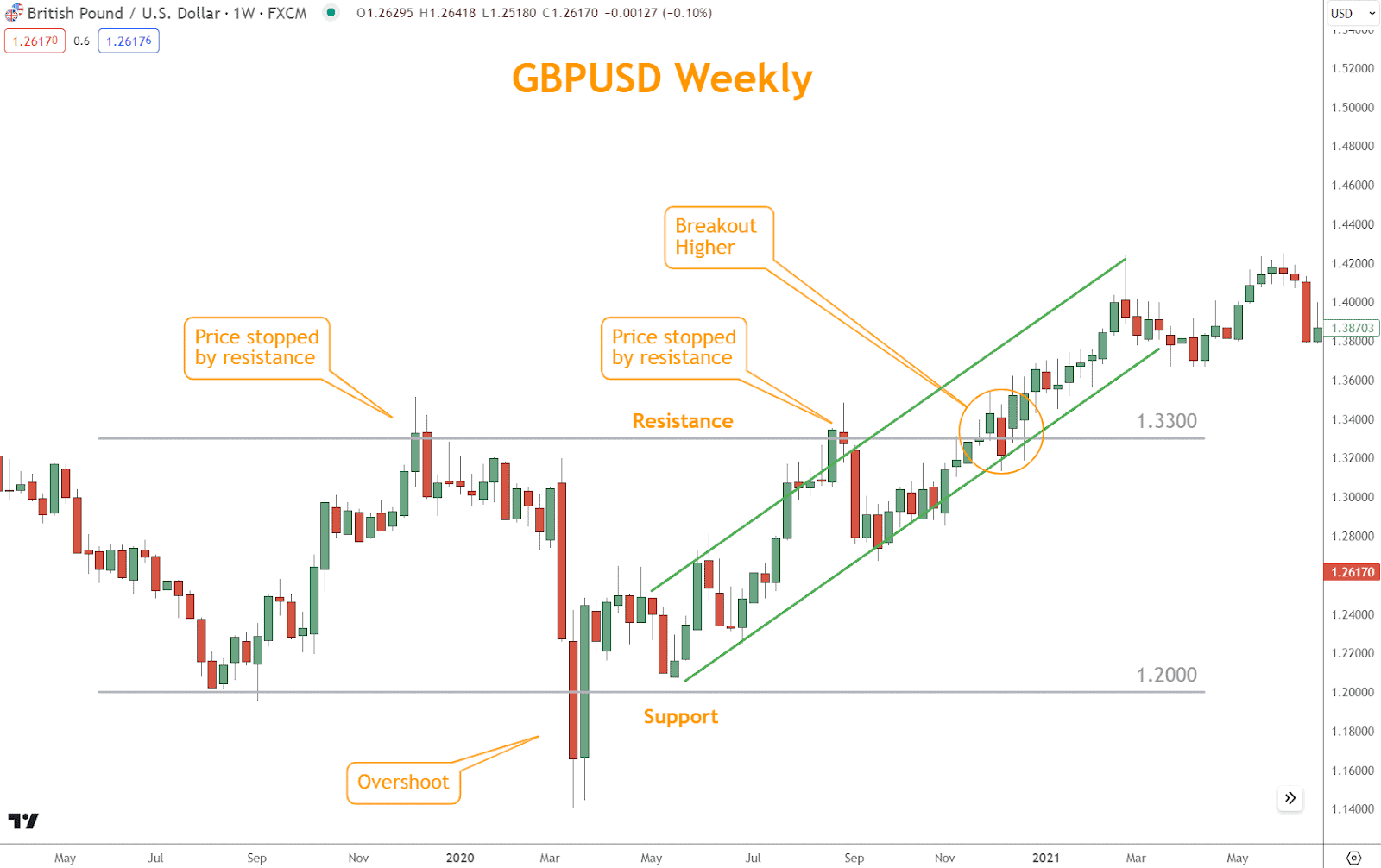

1. Identifying Key Levels

The foundation of breakout trading lies in spotting critical support and resistance levels. Traders rely on:

- Horizontal support and resistance (past turning points)

- Channel lines (trendlines) that highlight the prevailing trend

When breached, these levels often act as catalysts for breakout trades.

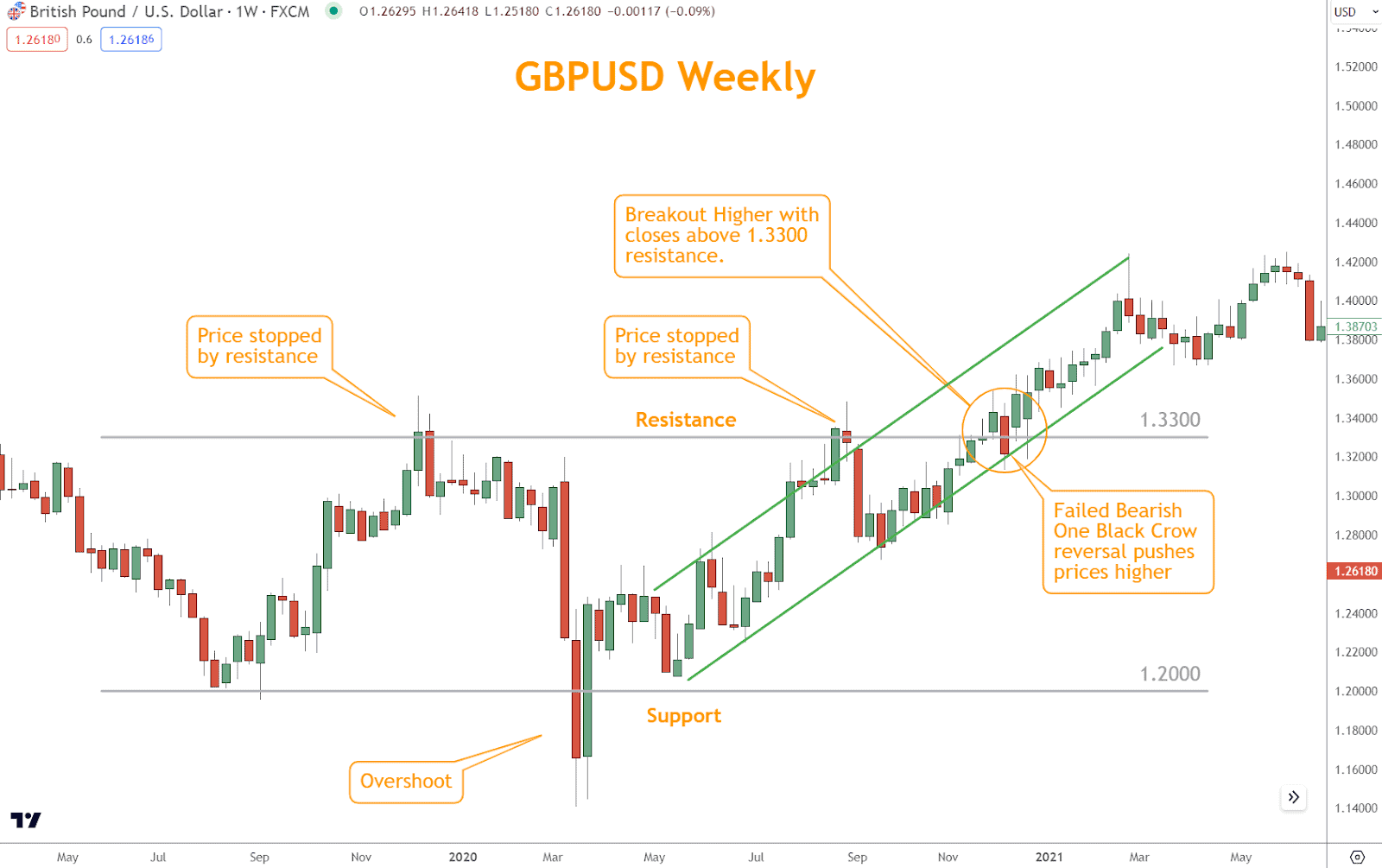

2. Confirmation

Not all breakouts are genuine. Waiting for confirmation helps filter out false moves and protects you from premature entries. Confirmation may come from:

- Closing prices above/below the breakout level

- Candlestick patterns such as engulfing, hammer, or doji at the breakout zone

- Momentum indicators (RSI, TSI) showing energy in the breakout’s direction

3. Risk Management

Even high-probability setups can fail. Risk management ensures you protect capital while giving trades room to develop. Apply the following:

- Stop-loss placement below support or above resistance

- Position sizing that reflects your account size and tolerance

- Risk-reward ratios of at least 1:2 to ensure long-term profitability

4. Patience and Discipline

Breakout trading demands discipline. Avoid chasing impulsive trades and wait for setups that meet your rules. Consistency in execution separates successful traders from those who are driven by emotions.

Practical Tips for Breakout Trading Success

Breakout strategies are powerful, but they require skill and practice. To improve your success rate, consider these tips:

- Start with major pairs: EUR/USD, GBP/USD, and USD/JPY, which offer higher liquidity and cleaner breakouts.

- Combine breakout strategies with indicators: Use moving averages, oscillators, or channel lines for confirmation.

- Always practice risk management: Never risk more than a fixed percentage of capital per trade.

- Keep learning and adapting: Market conditions evolve—adjust strategies and refine your approach regularly.

- Demo trade first: Practice execution in a simulated environment before applying strategies with real money.

Conclusion

Breakout trading in Forex revolves around profiting when the price breaks through major support or resistance levels.

By focusing on continuation patterns, confirming signals, managing risk, and practicing patience, traders can improve consistency and capitalize on high-probability setups.

Success comes from striking a balance between technical skill and discipline, as well as effective risk control. Done right, breakout trading can be a cornerstone of a profitable Forex strategy.

Forex Trading Disclosure Statement

Forex Trading Disclosure Statement

Risk Warning:

Forex trading involves significant risk and may not be suitable for all investors. The leveraged nature of Forex trading can work both for and against you, leading to substantial gains or losses. Before trading Forex, you should carefully consider your financial objectives, experience level, and risk tolerance. It is possible to lose more than your initial investment, and you should only trade with money you can afford to lose.

Market Risks and Volatility:

Forex markets are influenced by global economic, political, and social events, which can result in unpredictable price movements. High market volatility can lead to sudden and substantial changes in currency values, potentially causing losses that exceed your initial deposit.

Leverage Risks:

Leverage amplifies both potential gains and potential losses. While leverage can increase profitability, it also increases the risk of significant losses, including the loss of your entire trading capital.

Trading Tools and Technology Risks:

Forex trading platforms, including those offered by brokers, are subject to technology risks, such as system failures, latency issues, and potential errors in price feeds. Traders should be aware that these risks can impact the execution of trades and trading outcomes.

No Guarantee of Profitability:

Past performance in Forex trading is not indicative of future results. There is no guarantee that you will achieve profits or avoid losses when trading Forex. Market conditions and individual trading strategies vary, and no trading system can eliminate the inherent risks of Forex trading.

Educational Purposes Only:

Any information provided about Forex trading, including strategies, analysis, or market commentary, is for educational purposes only and should not be considered financial advice. Consult a qualified financial advisor or tax professional before making any trading decisions.

Regulatory Compliance:

Forex trading is regulated differently in various jurisdictions. Ensure that you are trading with a licensed and compliant broker in your country of residence.

Responsibility:

You are solely responsible for your trading decisions and the associated risks. It is your duty to understand the terms and conditions of Forex trading, including margin requirements, stop-losses, and other risk management tools.

Acknowledgment:

By engaging in Forex trading, you acknowledge that you have read, understood, and accepted this disclosure statement. You accept full responsibility for the outcomes of your trading decisions and agree to trade at your own risk.