Forex trading strategies are essential for traders seeking to profit from currency price fluctuations.

This article will explore various Forex trading strategies, including bull and bear traps, breakout, and pullback strategies.

We will also explore the distinctions between trading and investing and what constitutes a high-profit trading strategy.

What is Bull and Bear Trap Trading?

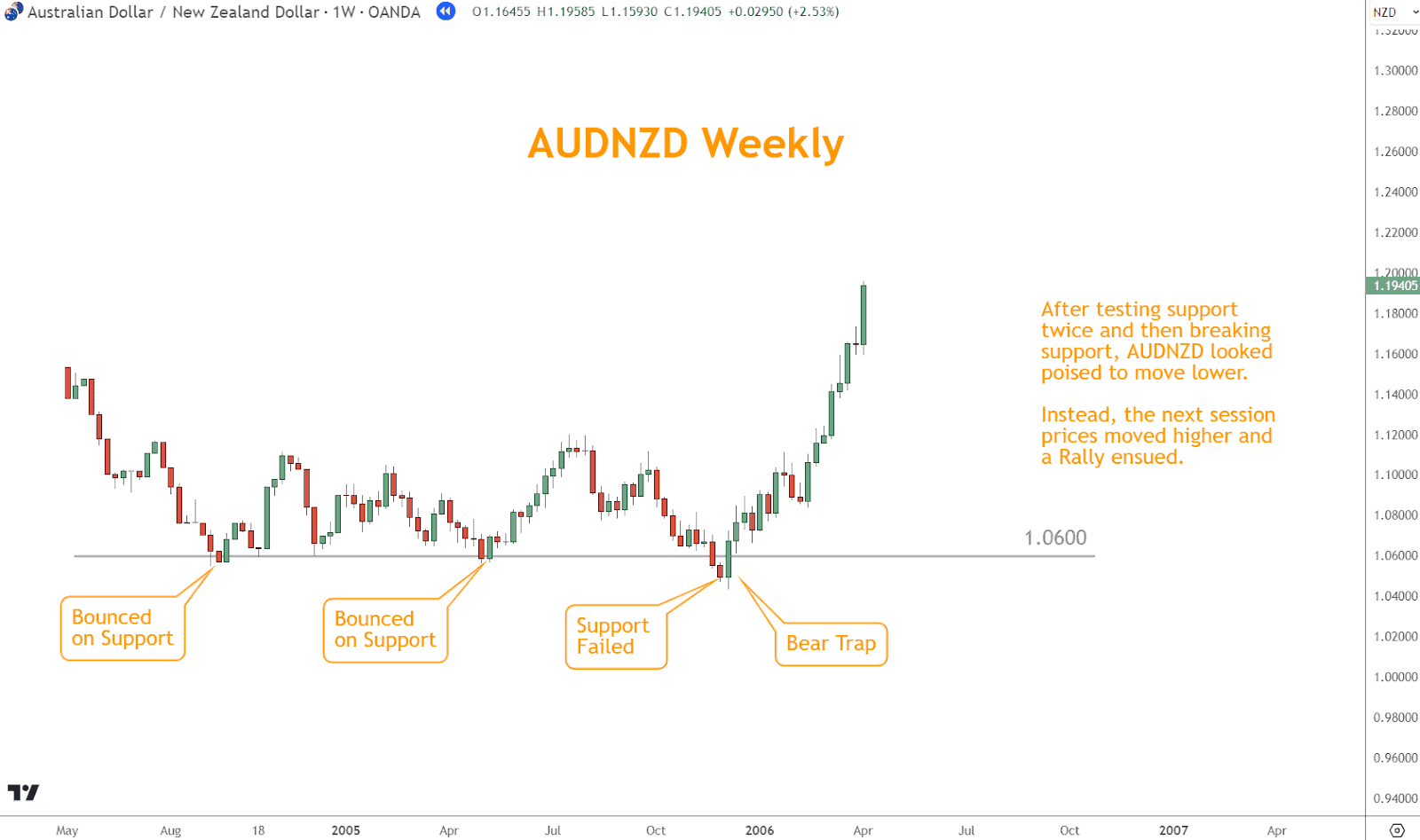

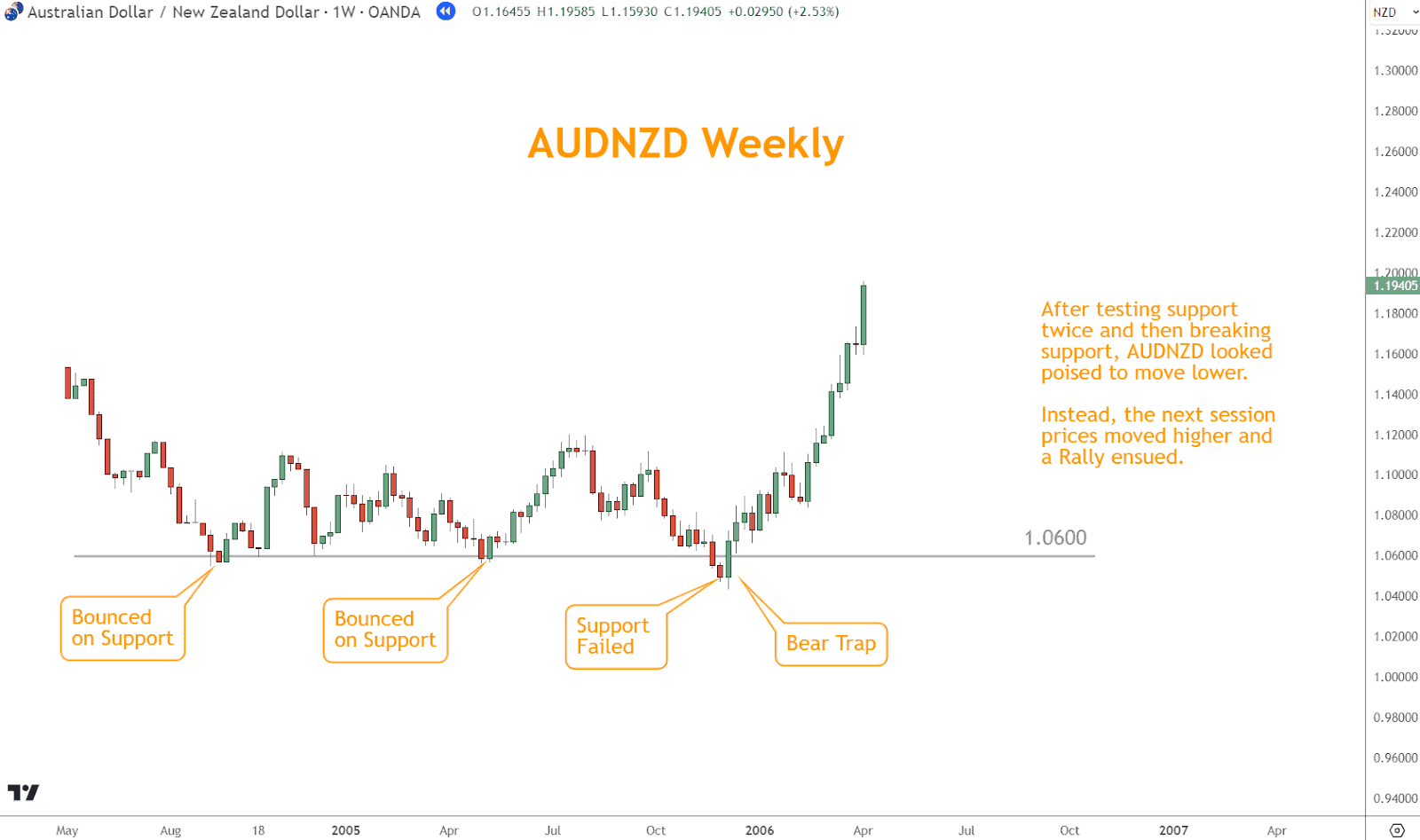

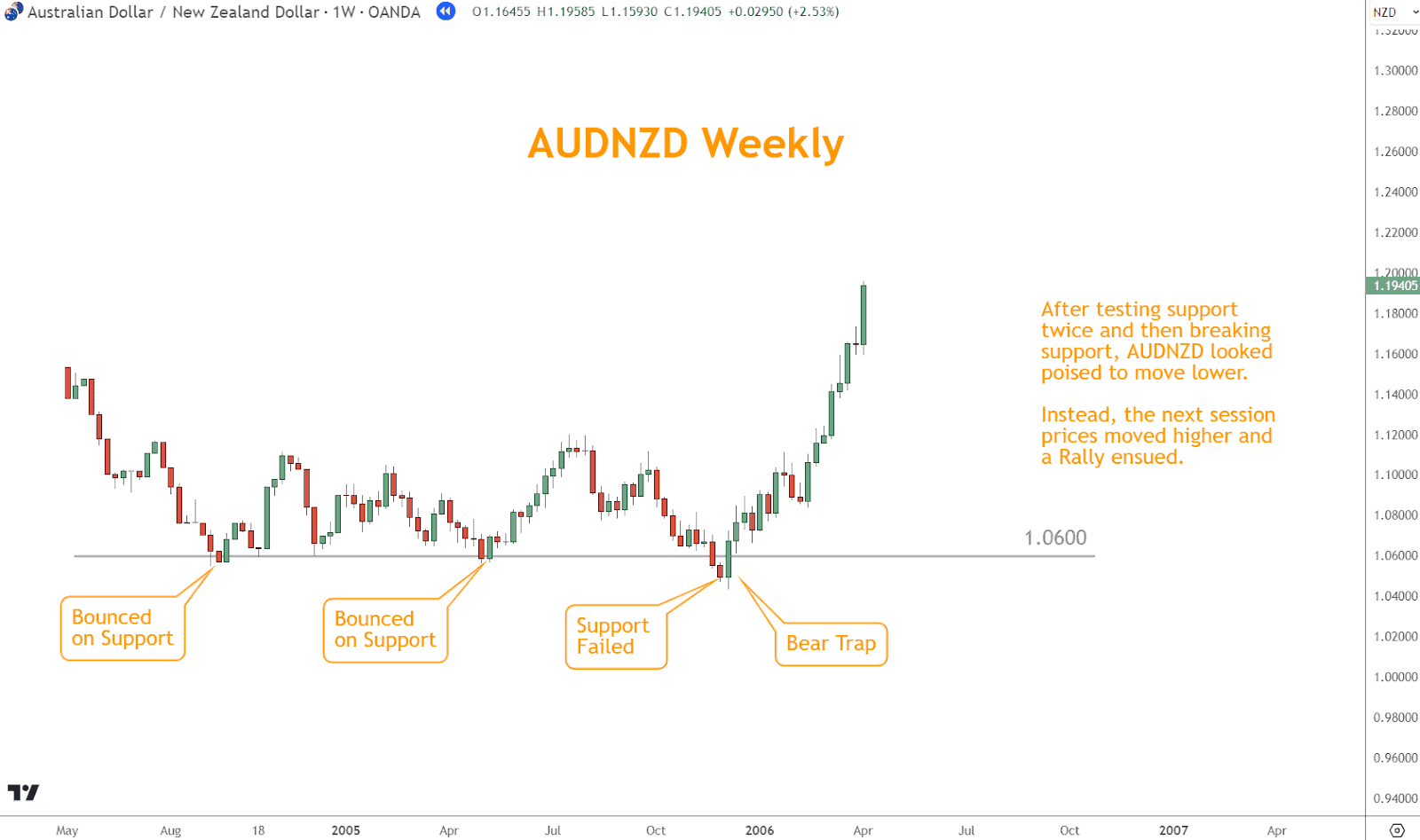

Bull and bear traps are fascinating and often challenging scenarios in the Forex market.

These situations can lead to both profitable opportunities and unexpected losses.

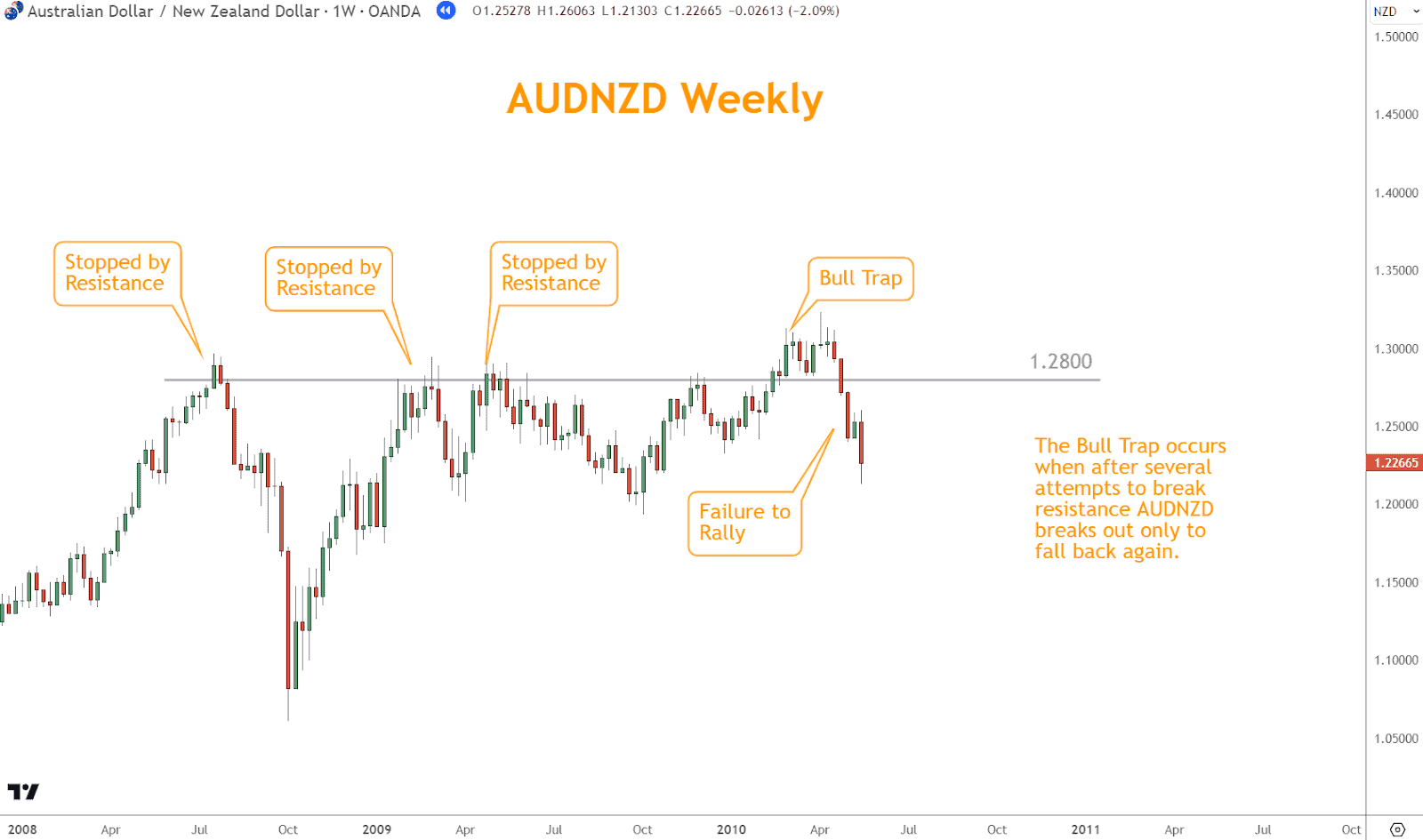

A bull trap occurs when prices appear to be surging upward, luring in optimistic traders who buy into the market at higher prices.

However, just as they start to believe in continuing the bullish trend, prices suddenly reverse, trapping those who bought in at the top.

The reversal can be swift and unexpected, causing significant losses for traders caught in the trap.

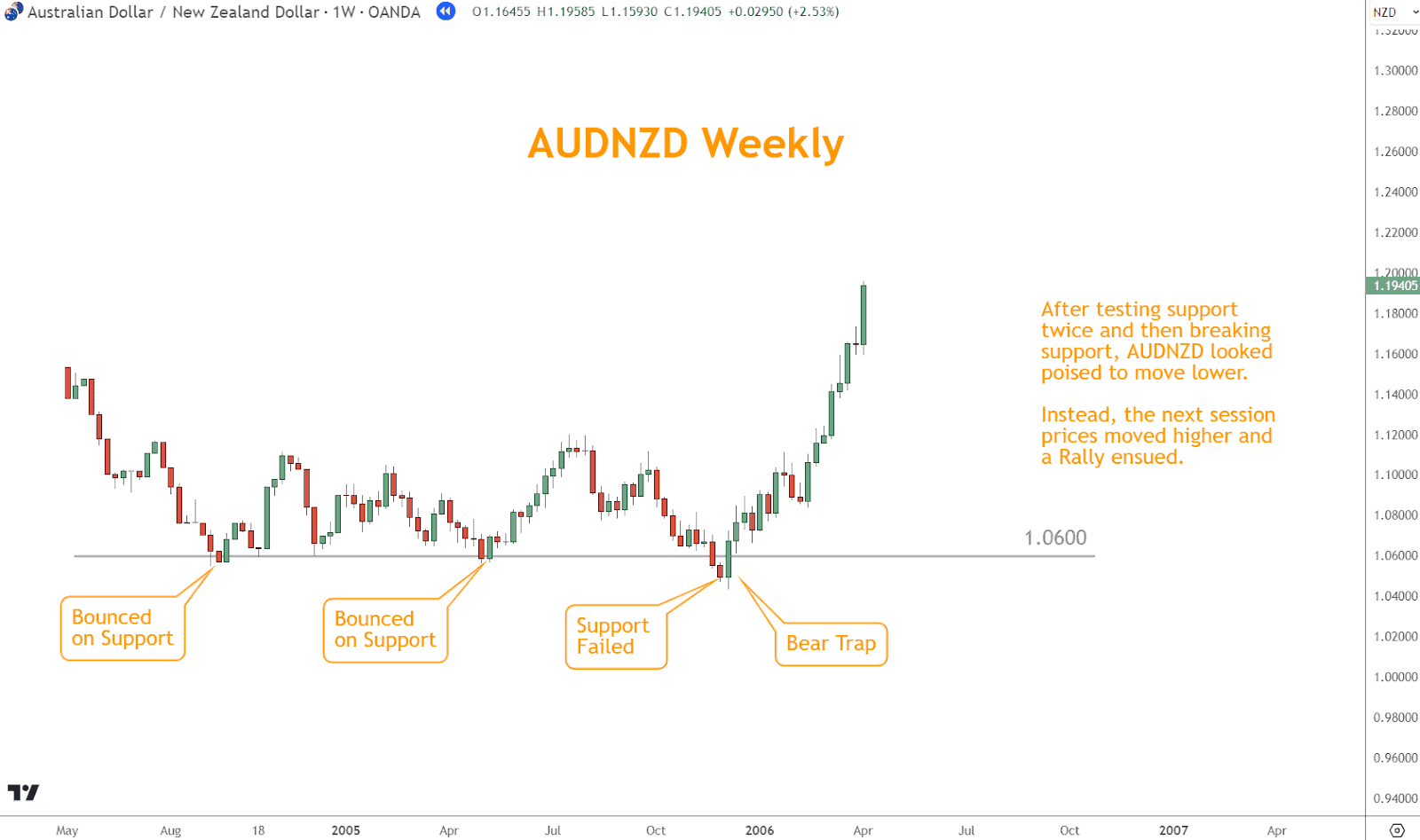

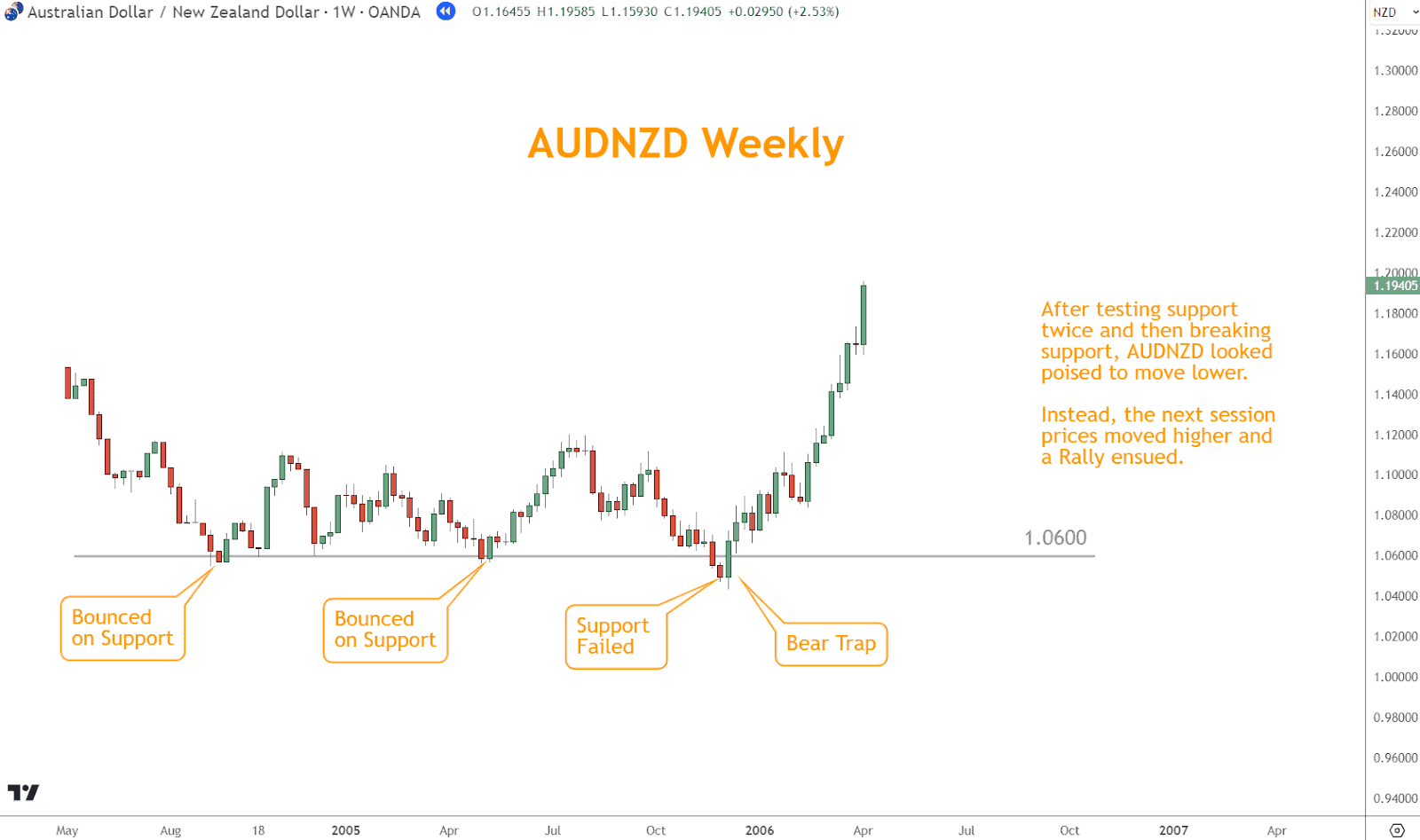

Conversely, a bear trap occurs when prices seem down-trending, convincing bearish traders to short the market and anticipate further declines.

Yet, prices reverse and move upward at a critical moment, trapping those betting on the bearish trend.

These unsuspecting traders may then face losses as the market defies their expectations.

To successfully navigate bull and bear traps, you need a deep understanding of technical analysis and market sentiment.

These traps are reminders the Forex market is unpredictable, and even the most seasoned traders must approach it with caution and a well-considered strategy.

What are Breakout Forex Trading Strategies?

Breakout trading is a strategy aiming to capitalize on significant price movements following a breakout from established support or resistance levels.

The core principle behind breakout trading is identifying critical price levels acting as barriers, preventing the price from rising further (resistance) or falling further (support) in a bullish market and the inverse in a bearish market.

Historical price patterns, such as double tops, double bottoms, or trading ranges, often create these levels.

Traders use various tools and methods to identify potential breakout points:

- Chart Patterns: Chart patterns like triangles, rectangles, or flags can signal impending breakouts.

- For instance, an ascending triangle may indicate an imminent bullish breakout.

- Support and Resistance: Traders often rely on support and resistance levels to spot potential breakouts.

- When prices cross above or below a support and resistance level, it can signal the beginning of a breakout.

To implement a breakout trading strategy effectively, consider the following:

- Confirmation: Confirming a breakout with additional technical indicators, such as the Relative Strength Index (RSI) or the True Strength Index (TSI), can enhance the reliability of the trade signal.

- Risk Management: Setting stop-losses is crucial to limit potential losses if the breakout is false.

- Traders should determine their risk-reward ratio before entering the trade.

- Volatility: Understanding the market’s volatility is vital. Traders must remember breakouts can occur during increased volatility, leading to sudden and significant price movements.

- Being prepared for these market conditions by having a solid trading plan and risk management strategy can help minimize potential losses and maximize profits.

- Timeframes: Traders can adapt breakout trading to various timeframes, ranging from short-term intraday trading to longer-term swing trading.

- Traders should choose timeframes aligning with their trading goals and risk tolerance.

- False Breakouts: It’s important to acknowledge not all breakouts lead to sustained trends.

- False breakouts can result in losses, so traders must be cautious and avoid entering positions too hastily.

By identifying and confirming breakouts using technical analysis and risk management techniques, you can position yourself to take advantage of potentially lucrative trading opportunities while managing risk effectively.

What are Pullback Forex Trading Strategies?

Pullback or retracement trading is a tactical approach in the Forex market seeking to capitalize on temporary price reversals within an established trend.

This strategy acknowledges during a sustained trend, price movements are seldom in a straight line; instead, they tend to include periodic retracements or pullbacks.

Here are vital aspects to consider when implementing pullback trading strategies:

- Identifying Trends: The first step in pullback trading is recognizing the prevailing trend.

- You can use channel lines, moving averages, or trend-following indicators.

- Identifying Pullbacks: Traders establish a trend and then observe for indications of a pullback.

- Temporary price reversals against the prevailing trend often characterize pullbacks, which create lower lows in an uptrend or higher highs in a downtrend.

- Fibonacci Retracement Levels: Pullback traders commonly use Fibonacci retracement levels to identify potential reversal points.

- These levels, including 38.2%, 50%, and 61.8%, are based on the Fibonacci sequence and are believed to act as support and resistance levels.

- Confirmation Indicators: Traders often use confirmation indicators such as the Relative Strength Index (RSI) or Stochastic Oscillator to validate a pullback.

- These indicators can help identify oversold or overbought conditions and gauge the strength of the prevailing trend.

- Entry and Risk Management: Timing is critical in pullback trading. Traders aim to enter the market as the pullback shows signs of exhaustion and the trend resumes.

- Stop-losses are essential to limit potential losses if the pullback turns into a trend reversal.

- Profit Targets: Traders set profit targets based on the potential extent of the pullback and the overall trend’s strength.

- Standard methods include setting targets at previous swing highs or lows, Fibonacci extension levels, or using a risk-reward ratio.

- Psychological Discipline: Successful pullback trading requires discipline and patience.

- It’s essential not to rush into trades but to wait for confirmation the pullback has ended and the trend will likely continue.

- Adaptability: Market conditions can change, and trends may vary in duration and strength.

By carefully identifying pullbacks, using technical tools and indicators, and practicing risk management, you can increase their chances of profiting from price retracements while staying aligned with the overall market trend.

How to Compare Trading vs. Investing

Understanding the distinctions between trading and investing is fundamental when approaching the Forex market.

Both strategies have their unique characteristics, timeframes, and objectives.

Here, we delve into the key differences between trading and investing in the context of the Forex market:

Time Horizon

- Trading: Trading typically involves short to medium-term timeframes. Traders aim to profit from price fluctuations occuring over minutes, hours, or days.

- They may execute multiple trades within a day (day trading) or hold positions for a few days to weeks (swing trading).

- Investing: Investing has a long-term perspective. Investors hold positions for months, years, or even decades, expecting their chosen currency pair to appreciate over time.

Goals and Objectives

- Trading: Traders seek to capitalize on short-term market volatility and take advantage of price movements within a specified timeframe.

- Their primary objective is to generate profits through active trading.

- Investing: Investors aim to build wealth over the long term by holding positions in assets they believe will appreciate over time.

- Their primary goal is wealth preservation and growth.

Risk Tolerance

- Trading: Trading often involves higher levels of risk and volatility.

- Traders must be prepared for rapid market movements and employ strict risk management strategies, such as stop-loss orders, to limit potential losses.

- Investing: Investing is generally less risky because it focuses on long-term trends and fundamentals.

- Investors are typically less affected by short-term market fluctuations and are willing to ride out market downturns.

Strategies

- Trading: Traders use various strategies, such as technical analysis, chart patterns, and indicators, to make short-term trading decisions.

- They often rely on technical factors and may not consider fundamental analysis as extensively.

- Investing: Investors prioritize fundamental analysis, evaluating economic indicators, geopolitical events, and long-term trends to make informed investment decisions.

- They are more concerned with the broader economic and geopolitical context.

Active vs. Passive

- Trading: Trading is an active and hands-on approach to the market.

- Traders actively monitor their positions, execute trades, and adjust strategies based on market conditions.

- Investing: Investing is often a more passive approach.

- Investors make fewer transactions, hold positions for extended periods, and may not actively manage their investments daily.

Capital Commitment

- Trading: Traders may require higher capital as they engage in more frequent trading activities, often using leverage to amplify their positions.

- Investing: Investors can start with smaller capital amounts, as they take a long-term perspective and typically don’t utilize high leverage.

Trading and investing represent two approaches to the Forex market, each with advantages and challenges.

The choice between trading and investing depends on an individual’s risk tolerance, time commitment, financial goals, and preferred trading style.

Traders should carefully consider these factors and select the best approach to their circumstances and objectives.

What Makes a High-Profit Trading Strategy

Several key elements and practices distinguish a high-profit trading strategy from less effective approaches.

Here’s a more detailed exploration of the components making a trading strategy successful in terms of profitability:

Risk Management

Effective risk management is the foundation of any high-profit trading strategy.

Traders prioritize capital preservation and employ risk management techniques, including setting stop-losses, defining position sizes based on risk tolerance, and diversifying their portfolios to spread risk.

Technical Analysis

Technical analysis plays a crucial role in identifying entry and exit points.

Traders use technical indicators, chart patterns, and price action analysis to make informed trading decisions.

These tools help in recognizing trends, potential reversals, and market sentiment.

Fundamental Analysis

While primarily used in investing, some traders also incorporate fundamental analysis to gauge the broader market context.

Fundamental analysis includes monitoring economic data releases, central bank policies, and geopolitical events impacting currency values.

Strategy Development

A high-profit trading strategy is not a one-size-fits-all approach but a well-thought-out plan tailored to a trader’s goals and preferences.

Traders carefully develop strategies to ensure they are robust and align with market conditions.

Discipline and Patience

Successful traders exhibit discipline and patience. They adhere to their trading plans, avoid impulsive decisions, and wait for the proper setups.

Their focus is minimizing emotional trading and prioritizing a rational, data-driven approach.

Continuous Learning

High-profit traders stay updated with market developments, stay curious, and continuously expand their knowledge.

They may experiment with new strategies and adapt to changing market conditions.

Adaptability

Adapting to changing market conditions is crucial. High-profit traders understand what works in one market environment may not work in another.

They are flexible and willing to adjust their strategies when needed.

Consistency

Consistency is critical to long-term success. High-profit traders maintain a consistent trading routine, including regular analysis of trades, performance evaluation, and adherence to predefined rules.

Position Sizing and Risk-Reward Ratio:

Proper position sizing and risk-reward ratio are critical. Traders ensure the potential reward justifies the risk taken in each trade.

A favorable risk-reward ratio helps protect capital and maximize profitability over time.

Trading Psychology

Understanding and managing trading psychology is essential.

High-profit traders are psychologically resilient, can handle losses without emotional distress, and remain focused on long-term goals.

A high-profit trading strategy combines effective risk management, technical and sometimes fundamental analysis, discipline, adaptability, and a commitment to continuous learning.

Conclusion

Understanding and implementing strategies like bull and bear trap, breakout, and pullback trading can significantly enhance your trading success.

Whether you’re a short-term trader or a long-term investor, mastering these strategies and the associated risk management techniques is the key to achieving high-profit outcomes in Forex trading.

What’s the Next Step?

Consider your trading experience and what Forex trading strategies you use today.

In addition, look for opportunities to use what you’ve learned and incorporate it into your trading habits.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about Forex trading strategies.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What is the Primary Difference Between Trading and Investing in the Forex Market?

The critical difference lies in the time horizon and objectives.

Trading involves short to medium-term strategies focusing on profiting from short-term price fluctuations while investing has a long-term perspective aimed at wealth preservation and growth.

How Do Traders Identify Potential Breakout Points in Breakout Trading Strategies?

Traders use various tools, including chart patterns (like triangles or rectangles), moving averages, and technical indicators, such as the Relative Strength Index (RSI), to identify potential breakout points.

They confirm breakouts using additional indicators and employ risk management techniques.

What Makes a Trading Strategy Successful in Terms of Profitability?

A high-profit trading strategy involves effective risk management, technical and sometimes fundamental analysis, discipline, adaptability, continuous learning, consistent routines, proper position sizing, and a favorable risk-reward ratio.