Wedge patterns are reversals with an impressive track record when recognized correctly.

In this article, we will dive deep into the world of wedge patterns in forex trading, starting with an introduction to what they are and how they work.

We will explore two types – the Bullish Falling Wedge and Bearish Rising Wedge – and discuss trading tactics you can implement to create winning trades.

Additionally, we’ll share six winning strategies to combine them with other tools and techniques, such as Momentum indicators, Japanese Candlesticks, and Support and Resistance levels.

With these valuable insights, they will become another weapon in your arsenal.

What are Wedge Patterns in Forex Trading?

Wedge patterns in forex trading are chart patterns that suggest a possible reversal.

There are two types: Rising Wedges, which show a potential Bearish reversal with higher highs and higher lows, and Falling Wedges, which indicate a possible Bullish reversal with lower highs and lower lows.

How to Identify the Bullish Falling Wedge Pattern

The Bullish Falling Wedge pattern is one in forex trading that traders use to identify potential reversals.

It forms during a downtrend and is characterized by two converging lines, with the upper line sloping upwards at a lesser angle than the lower line until the apex is reached.

Traders observe the price movement within the boundaries of this pattern, noting lower highs and lower lows. The breakthrough of the upper line is significant as it suggests a potential bullish breakout, creating opportunities for traders to consider buying positions.

To enhance their success, traders often combine them with various other techniques from technical analysis, amplifying their trading strategies.

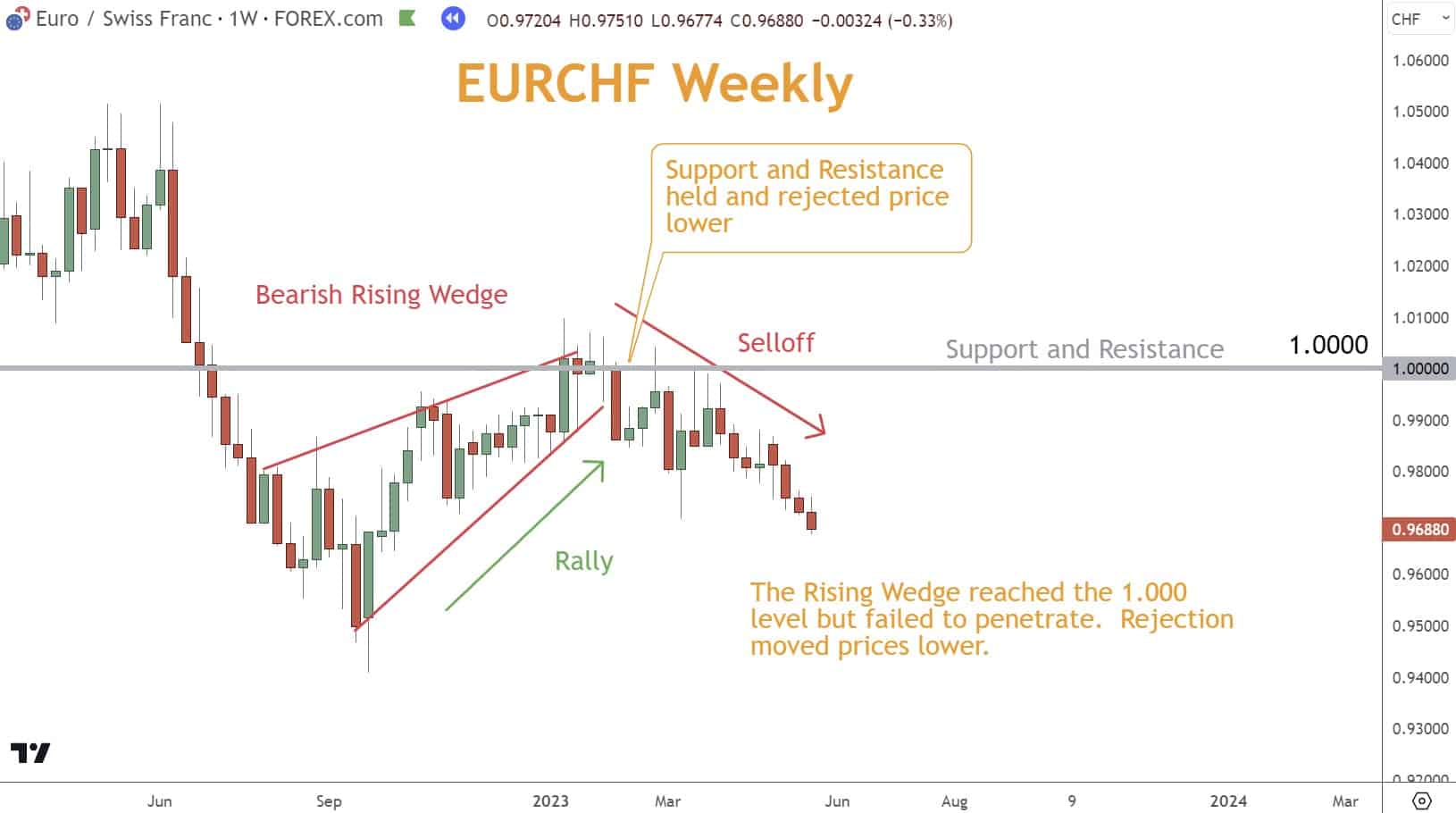

How to Identify the Bearish Rising Wedge Pattern

The Bearish Rising Wedge pattern is a commonly observed chart pattern in Forex trading.

It serves as a Bearish signal during a Rally, suggesting a potential reversal in price direction.

This pattern is characterized by two converging lines, with the upper line sloping upwards at a steeper angle than the lower line until the apex is reached. It indicates that buying pressure is losing strength, and sellers might soon take control of the market.

Traders can augment their trading strategies by combining them with additional forms of technical analysis, enabling them to make well-informed decisions for optimal results.

Curious How to Combine Falling Wedge Patterns with Other Tools and Techniques?

Enhancing your trading strategies and increasing your chances of success can be achieved by combining them with additional tools and techniques.

One practical approach is to utilize Momentum indicators, such as the RSI (Relative Strength Index) or Stochastic, for validation. Momentum indicators assist in identifying possible reversals.

Japanese Candlesticks are another valuable tool to combine with Falling Wedges. These patterns offer insights into market psychology and serve as confirmation for Bullish potential reversals.

Lastly, incorporating Support and Resistance levels into your analysis can further clarify them.

Support and Resistance levels act as pivotal price levels where traders anticipate increased buying or selling pressure. When these levels coincide with them, it substantiates the forex pair’s potential reversal.

By integrating these additional tools and techniques alongside Falling Wedges, you can enhance your decision-making process and significantly improve your chances of achieving successful trades.

Momentum Indicators can Offer Clues

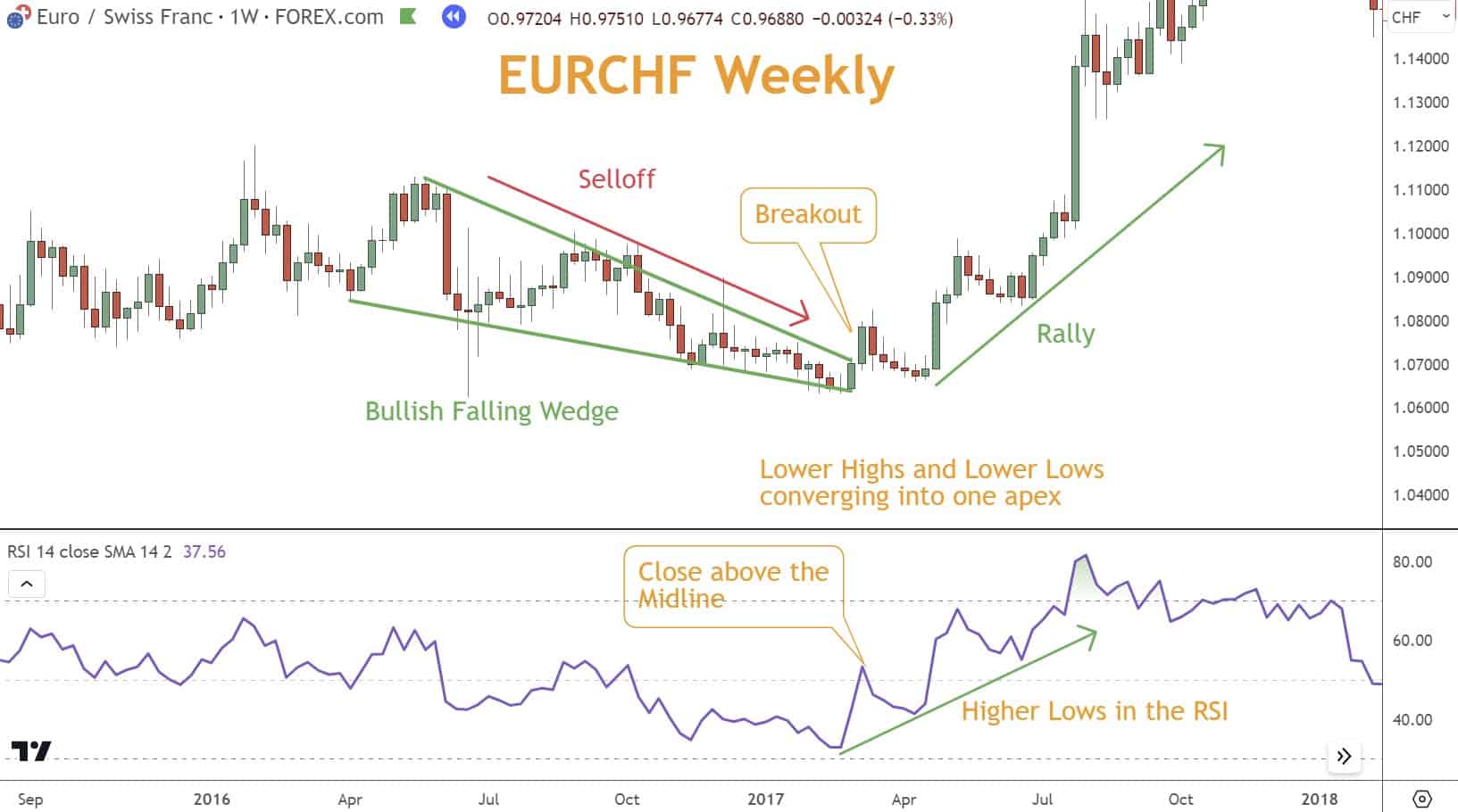

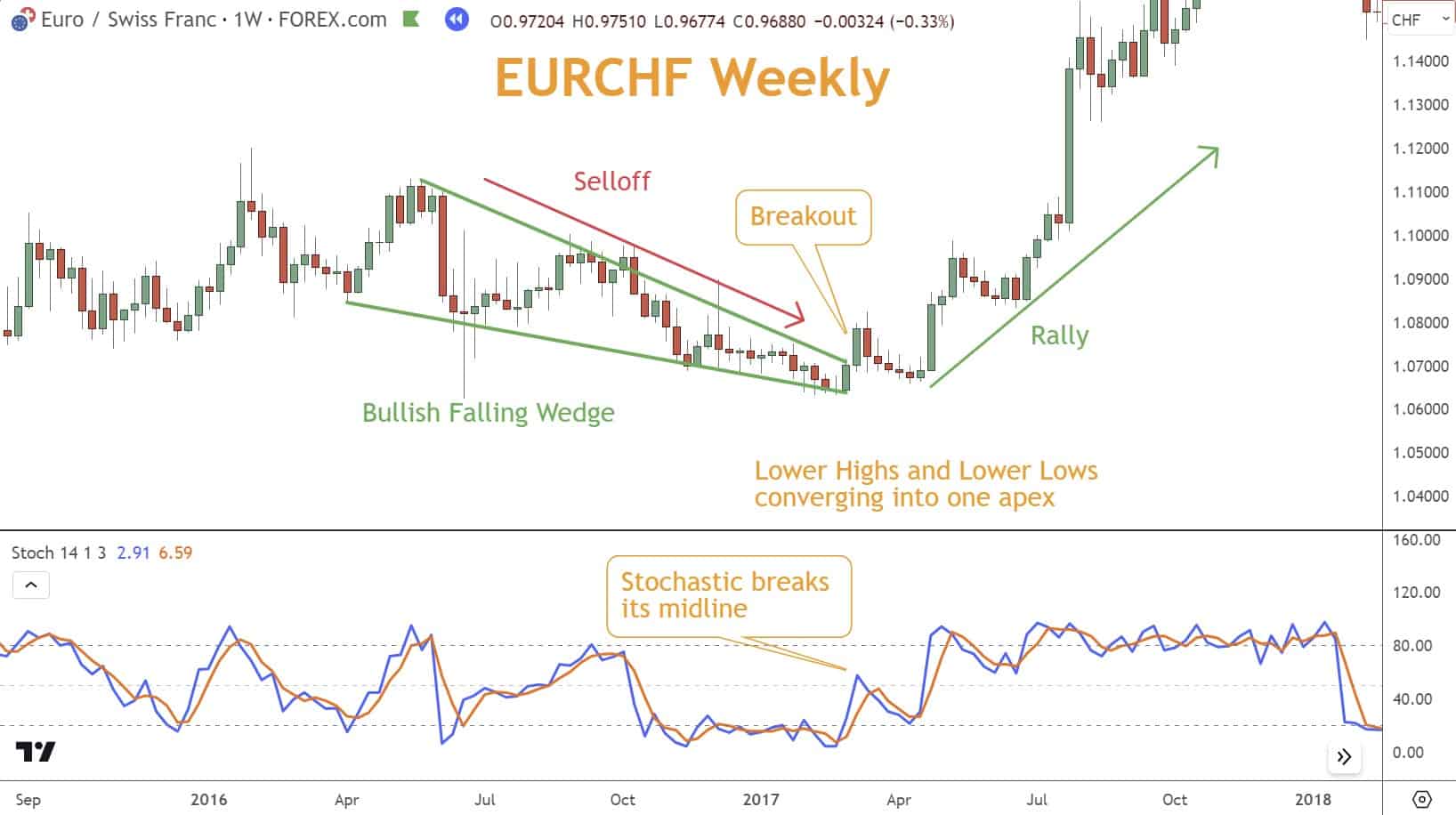

When incorporating wedge patterns into Forex trading strategies, one effective tactic is combining them with Momentum indicators for confirmation.

You can confirm potential trend reversals with greater certainty by utilizing indicators like the Relative Strength Index (RSI) or the Stochastic alongside them.

Identifying a Falling Wedge pattern complemented by a Bullish crossover suggests a higher probability of an upward price reversal.

You do need to exercise patience and wait for confirmation signals from the Momentum indicators, as false breakouts can occur.

By incorporating Momentum indicators into your analysis, you can optimize your trading approach, increase the likelihood of successful trades, and effectively manage risk in the forex market.

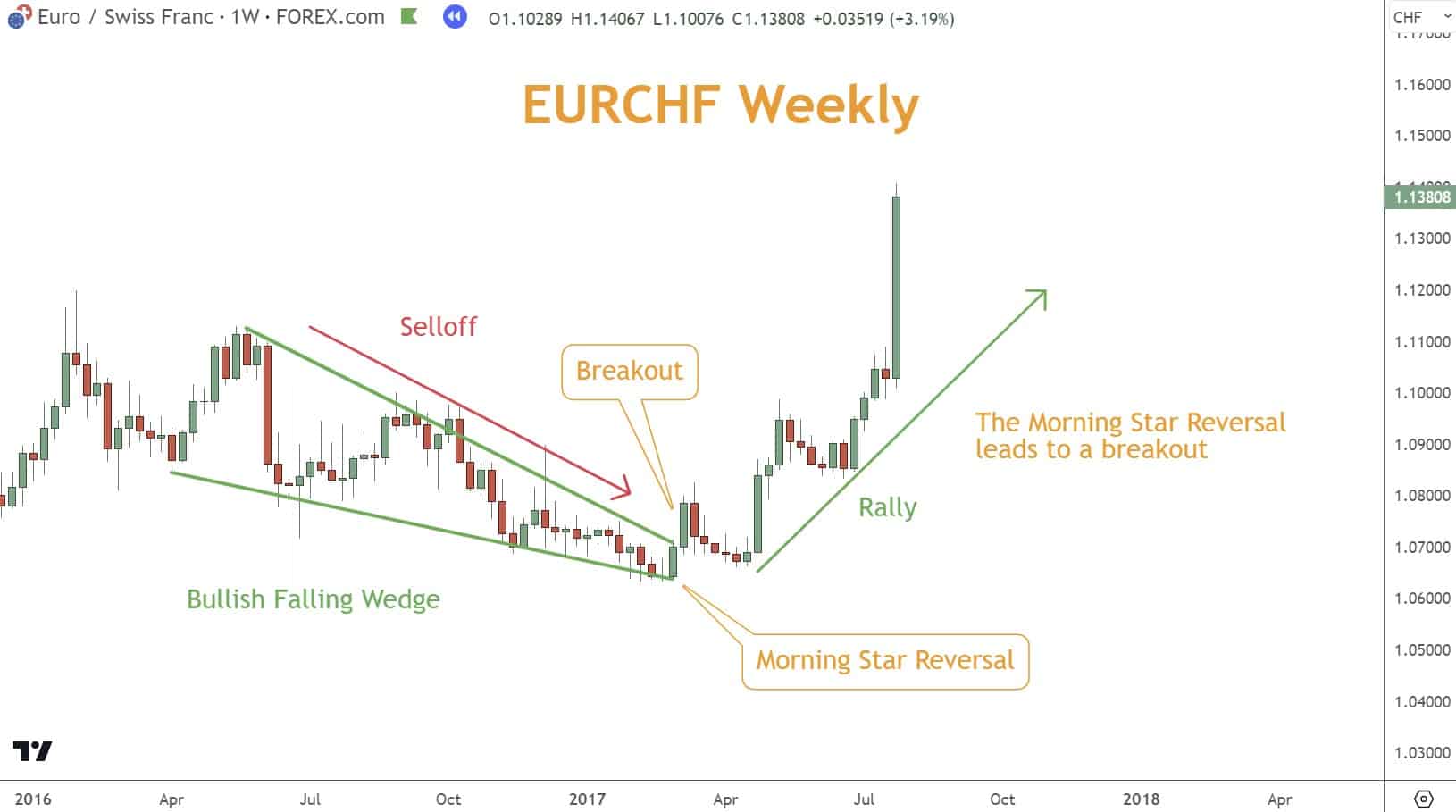

Japanese Candlesticks Confirmation can be Key

Japanese Candlesticks offer valuable insights into trader sentiment and confirm potential reversals.

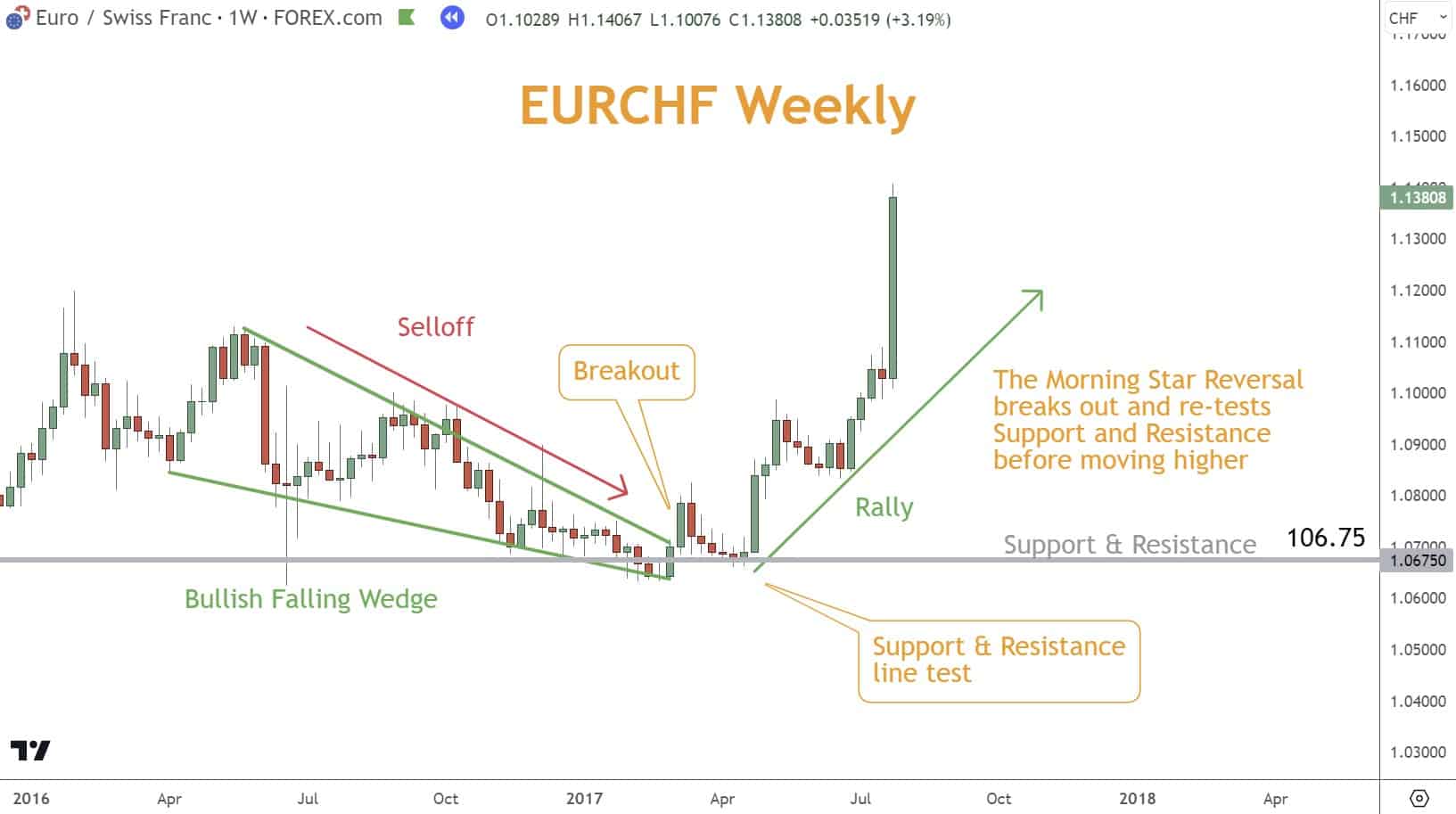

For instance, if a Bullish Morning Star reversal emerges at the end of a Falling Wedge, as seen below, it suggests a potential upward breakout. Moreover, other candlestick patterns like Doji or Hammer formations can enhance the validation of a reversal.

Confirmation techniques also help you plan position sizing, stops, and targets.

Support and Resistance Should Always be Top of Mind

Combining with Support and Resistance levels can significantly enhance trading decisions and manage risk in forex trading.

Traders should seek confluence between them and the price chart’s Support or Resistance levels. A breakout above the upper line confirms a Bullish reversal when combined with horizontal Support or Resistance.

In the example below, EURCHF breaks out into a period of consolidation and ultimately moves higher.

This combination often serves as an effective way to exercise risk management too.

Ever Wonder How to Combine Rising Wedge Patterns with Other Tools and Techniques

When working with wedges, it’s crucial to use extra technical tools and techniques to increase the chances of successful trades.

By leveraging Momentum indicators, traders can confirm the strength of price movements and gain valuable insights into potential trend reversals and entry/exit points.

Japanese Candlesticks also serve as a powerful tool, confirming potential reversals within the formations.

Lastly, integrating Support and Resistance levels into the analysis is equally important. Identifying critical Support or Resistance levels that align with them can increase the accuracy of trades.

Waiting for a breakout below the lower trendline before entering a short position can provide a more decisive confirmation of a bearish reversal.

Momentum Indicators Offer Valuable Clues

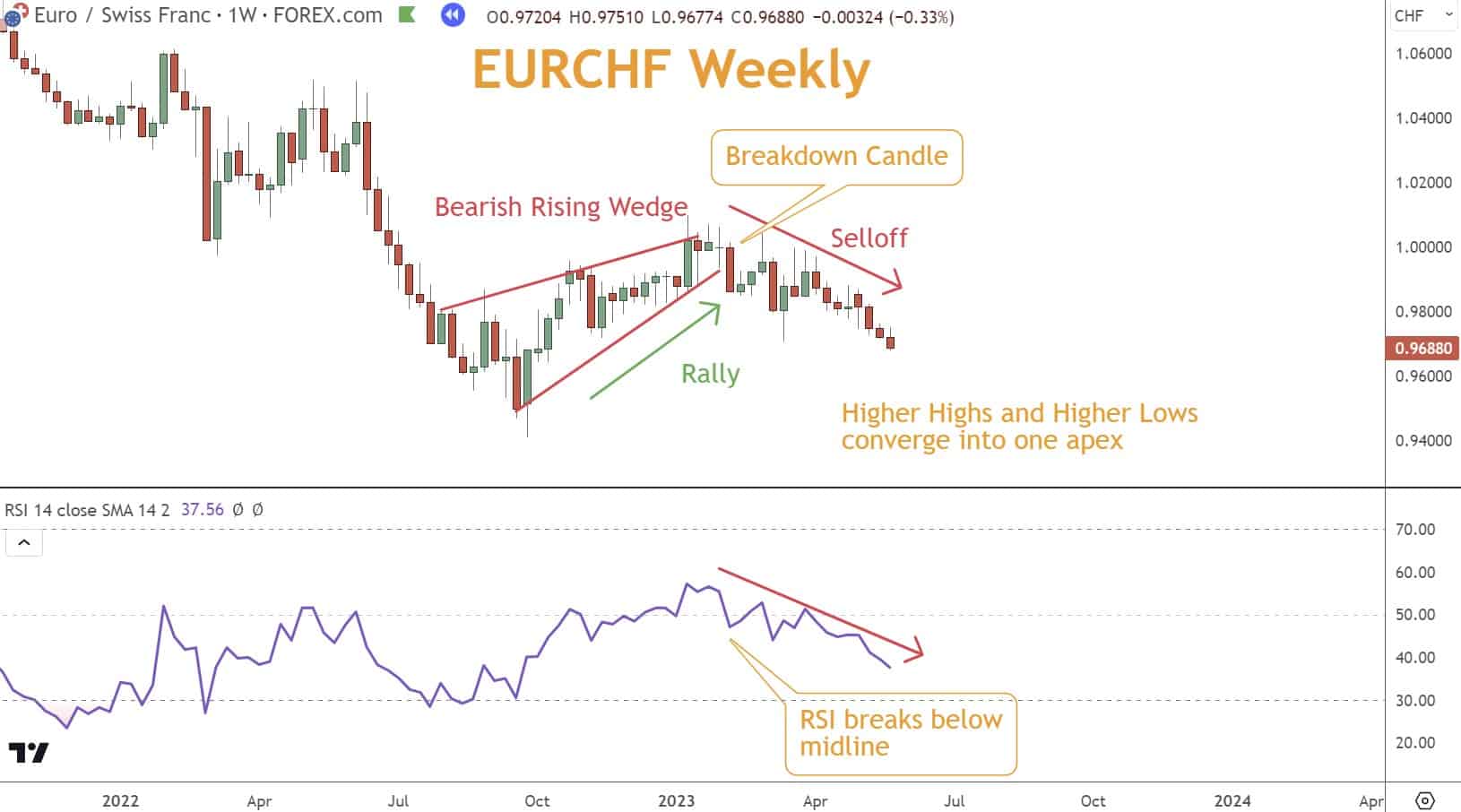

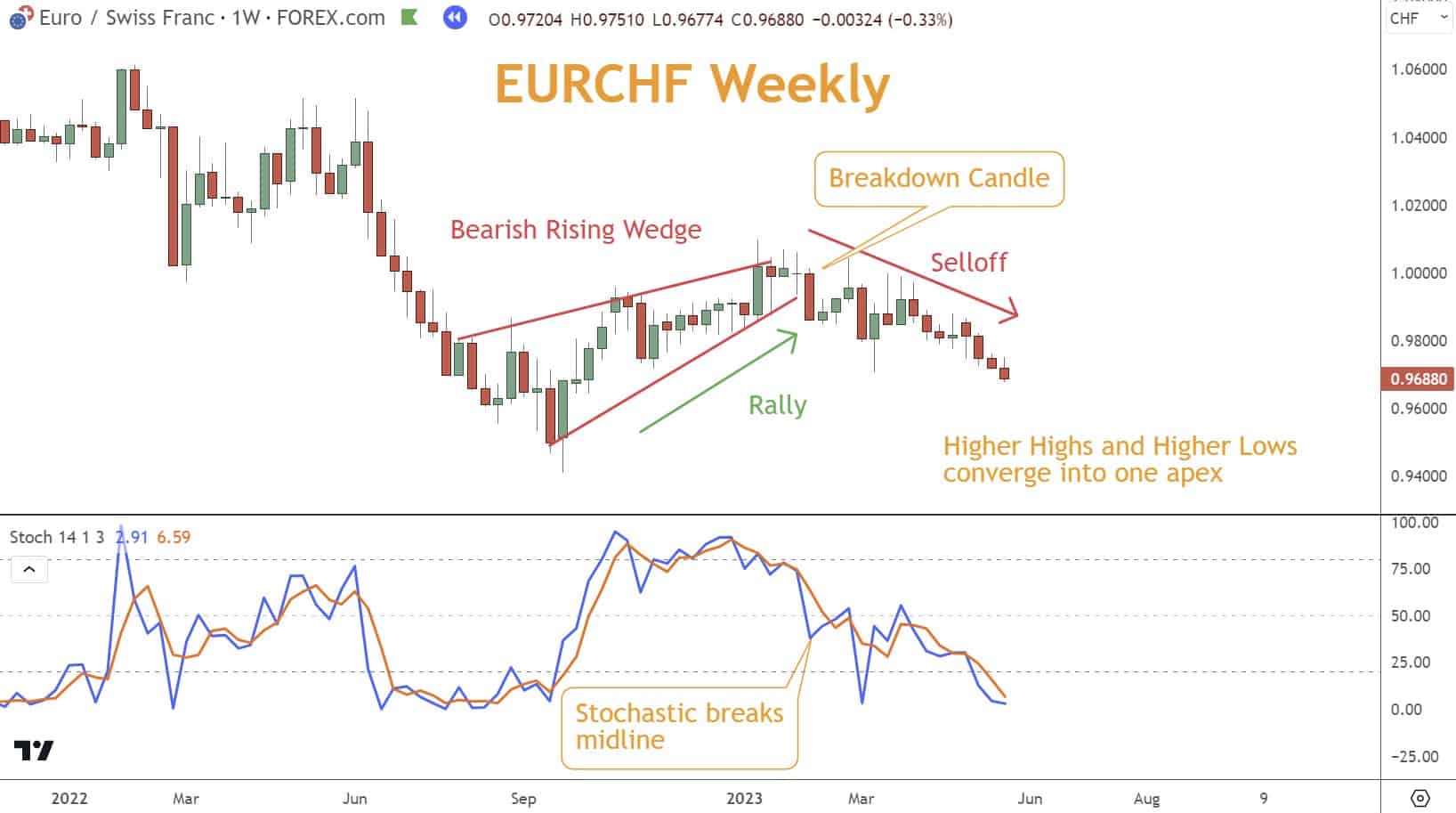

Combining with Momentum indicators can improve timing in your Forex trading.

By integrating technical tools like the Relative Strength Index (RSI) or Stochastic Oscillator with Rising Wedges, traders can enhance their ability to identify potential reversals.

When a Rising Wedge pattern forms and is accompanied by a Bearish crossover on a Momentum indicator, it strengthens the signal for a Bearish reversal.

By incorporating Momentum indicators into the analysis of wedges, you can gain valuable insights and increase your chances of profiting from the Forex market.

Japanese Candlestick Patterns Help Confirm Reversals

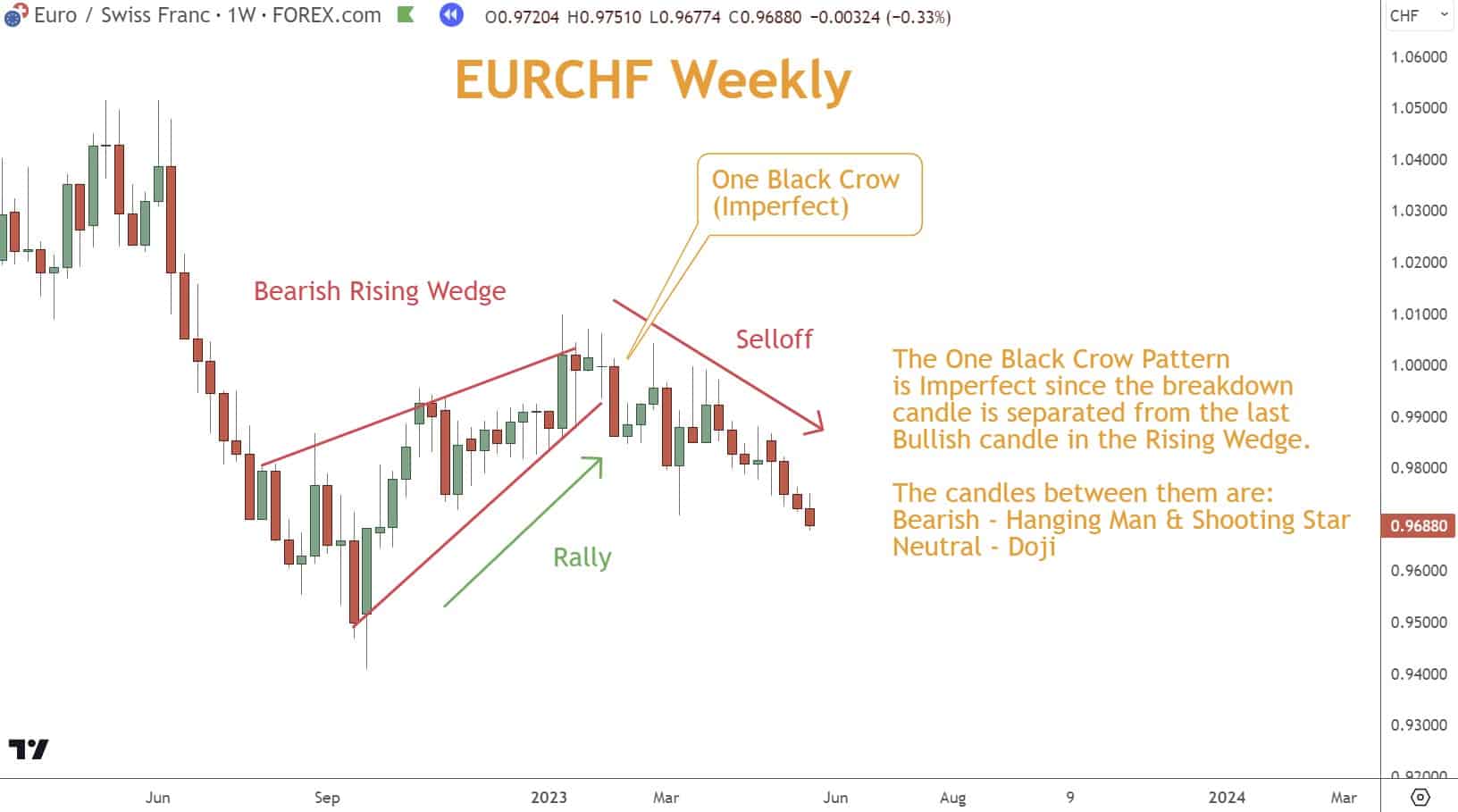

To enhance the reliability of your trading signals, consider combining Rising Wedges with Japanese Candlesticks.

You can strengthen your analysis by looking for Bearish reversal Candlestick patterns like the Bearish One Black Crow (imperfect) pattern seen below.

These candlesticks frequently materialize at the end of the pattern. Such occurrences often suggest a possible downward reversal in price and provide an opportunity to enter short trades.

However, exercise caution and wait to confirm these candlestick patterns before making trading decisions.

Support and Resistance Should Always be in Your Mindset

An excellent technique to strengthen trading signals involving wedge patterns is to combine them with Support and Resistance levels.

When they materialize near a Resistance level, it shows prospects of a potential reversal.

Combining Rising Wedges with Support and Resistance levels can provide stronger trading signals. Traders should pay attention to these areas for potential reversals and exercise their risk management plan.

What’s the Next Step?

Select a favorite candlestick chart and look for wedge patterns using your knowledge.

In addition, look for opportunities to coincide them with other technical analysis tools and techniques to see how they work together.

Combining Momentum, Japanese Candlesticks, and Support and Resistance can give you a comprehensive view and understanding to make trading easier.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis which you can incorporate with what you’ve learned here about Support and Resistance.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and Advance Strategies? I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What is a Wedge Pattern?

A wedge pattern in forex trading is a technical analysis pattern that forms when the price of an asset consolidates between two converging trendlines.

It represents a temporary pause in the prevailing trend and often precedes a reversal, providing opportunities for traders to profit.

What are the Advantages of Using Wedge Patterns as a Trading Strategy?

Wedges offer a clear signal for entering and exiting trades around pattern reversals.

These can help you identify potential turning points in the market and take advantage of them. Additionally, wedges can offer valuable insights into market sentiment and direction.

By understanding the characteristics of wedges, you can make more informed trading decisions and improve your overall profitability.

Are There any Specific Indicators or Tools to Help Confirm a Wedge Pattern in Forex Trading?

Combining wedges with Momentum Indicators, Japanese Candlesticks, and Support and Resistance can increase the likelihood of a successful trade.

Examples of Momentum Indicators are RSI, TSI, CCI, and Stochastic.