In my last two posts, I wrote about the reversal possibilities of EURUSD and GBPUSD.

Both currency pairs have enjoyed a big run against the USD, and I wrote about the likelihood of a near-term correction, which could be a buying opportunity.

The bigger question is whether the USD is going to discover firm footing and rally over the rest of 2025, or is any rally a “buy the dip” opportunity, and should we be USD bearish?

I’m bearish but skeptical of my opinion because I don’t have all the data I wish I had.

The USDJPY pair may hold the answer.

The Yen has a bullish bias resulting from an expanding economy and a central bank that is tightening its policy.

Against weaker pairs such as the New Zealand Dollar, the Yen has been rallying since last summer.

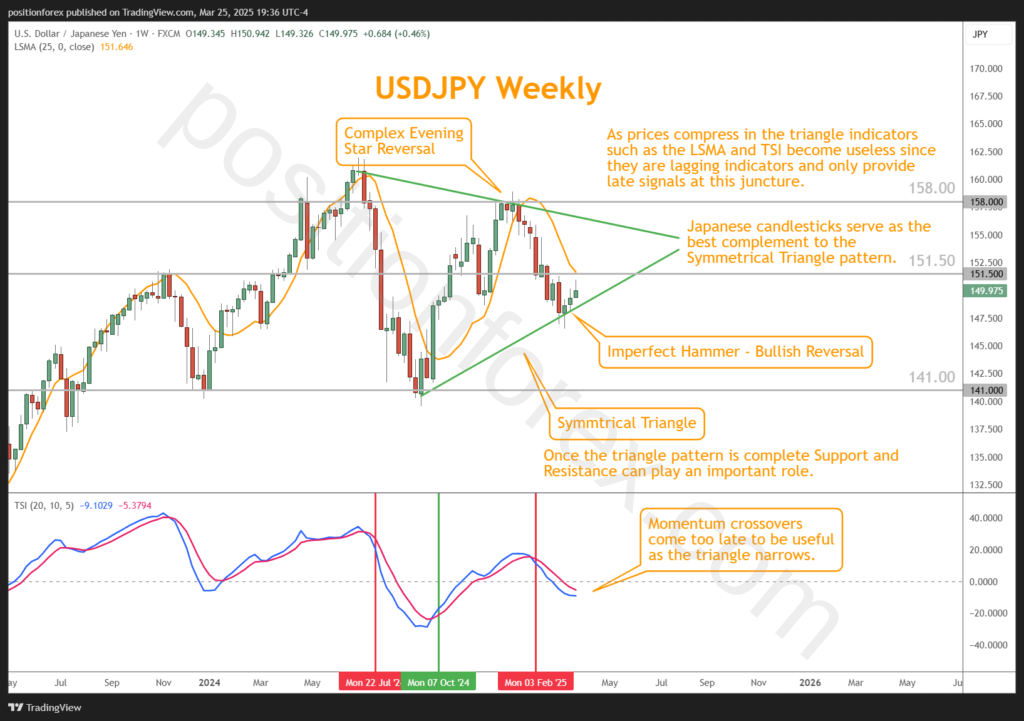

What we’re seeing now in the USDJPY chart is a symmetrical triangle, which you can see here.

Symmetrical triangles symbolize traders figuring out the longer-term direction of each currency.

If this triangle breaks lower, the USD will move lower for the longer term against multiple currencies.

On the other hand, if the USD breaks out higher from this triangle pattern, it will reclaim its strength compared to other currencies and move to new highs.

If the USD continues to move in a symmetrical triangle pattern, its future direction may be revealed by the end of July.

Meanwhile, we’ll monitor the ” buy-the-dip” opportunities and evaluate their quality if they arise.