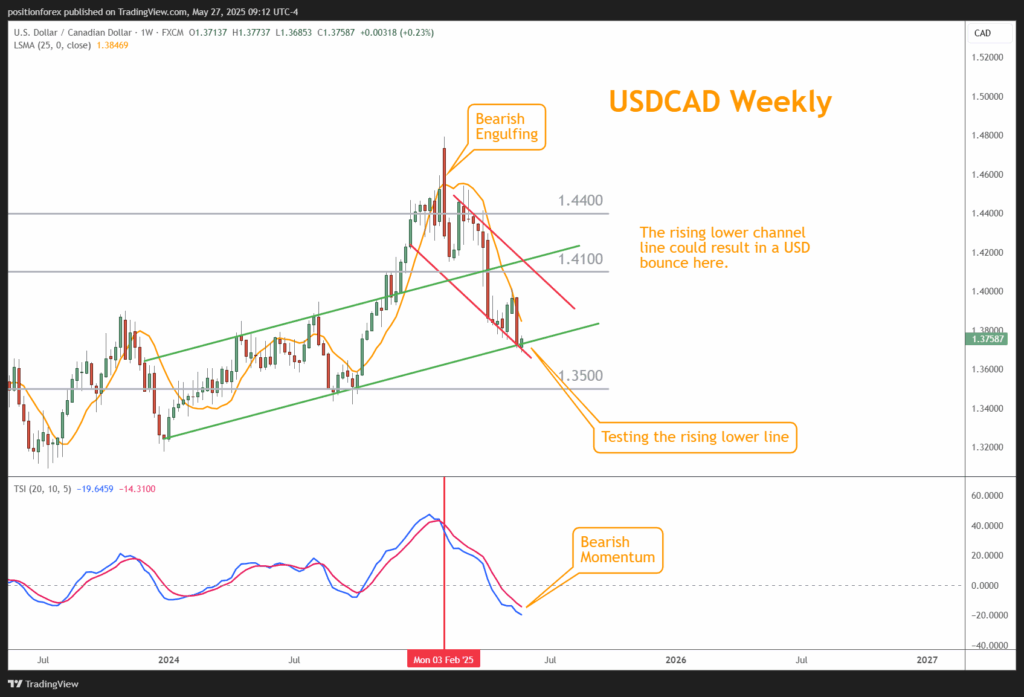

USDCAD is testing a long-term rising channel line, as shown on the chart below.

This channel started at the beginning of 2024, and considering the news flow on Thursday and Friday, there’s a good chance we’ll see either a rally or this level broken.

On Thursday, we will receive the U.S. GDP, followed by Canadian GDP and additional U.S. data, including the CPE Price Index, Personal Spending, and Personal Income.

Traders are already resigned to a weak Canadian Dollar while the economy struggles to find traction.

The wildcard is the U.S., where traders are trying to guess when the Federal Reserve will start reducing rates. A strong GDP, spending, and earnings could drive the USD higher, whereas numbers below consensus could push the USD lower.

Expectations drive the perception, as usual, not the number itself.

The U.S. GDP consensus is for 0.3% negative growth. This will result in two consecutive quarters of negative growth, which is technically a recession.

Any beat will likely convince traders that the Fed will further postpone rate cuts, as inflation remains a top concern.

Looking at the technicals, the USD needs to climb the prior week’s selloff to scare the bears out of their positions and drive a short squeeze.

That momentum will give the pair a chance to reach 1.4100 and start a significant rally.

Anything else will appear to be a counter-trend rally or “dead cat bounce,” and USDCAD will continue to look for new lows.

I’ll update this analysis later this week.