The True Strength Indicator (TSI) is a valuable tool for identifying momentum opportunities in Forex trading.

The TSI offers traders a unique market strength and momentum perspective, allowing for more informed decision-making and enhanced risk management.

In this article, we’ll review the TSI, how to use it in trading, and how to combine it with other indicators for maximum success.

I’ve been trading Forex and other markets since 2007 and have used the TSI as the primary momentum technical indicator over several thousand trades.

What is the True Strength Indicator (TSI)?

Developed by William Blau, the True Strength Indicator (TSI) is a momentum oscillator that offers a unique perspective on market trends and price movements.

Unlike traditional momentum oscillators, such as the Relative Strength Index (RSI) or Stochastic Oscillator, the TSI combines two distinct components to provide a more comprehensive view of market strength and direction.

At its core, the TSI calculates the difference between two smoothed moving averages of price changes: short-term and long-term.

This differential is normalized and smoothed again to generate a final TSI value.

The resulting indicator oscillates around a centerline, offering bullish and bearish momentum insights.

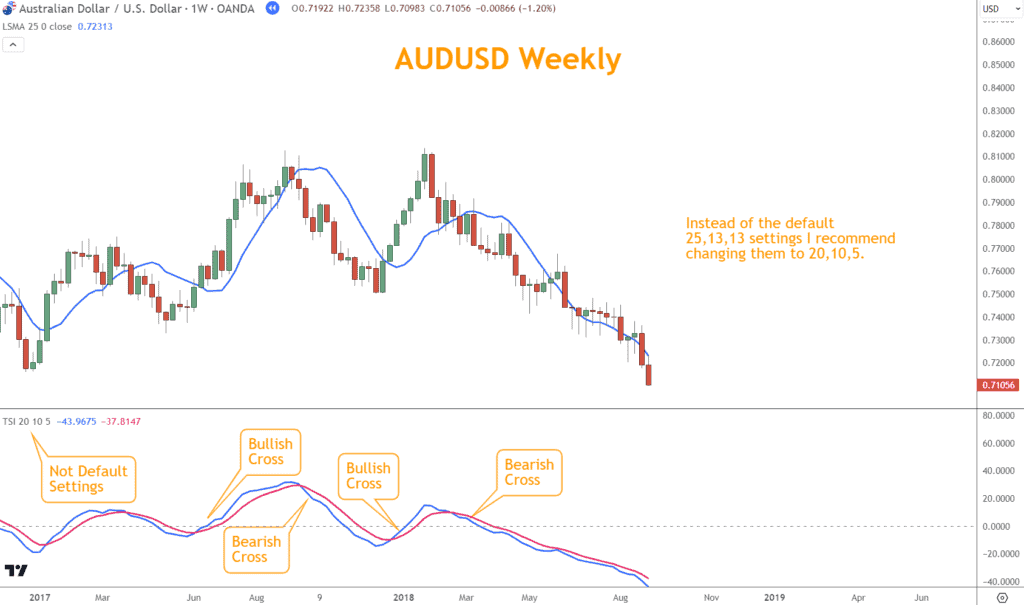

The default TSI settings on most platforms are:

- Long Length: 25

- Short Length: 13

- Signal Length: 13

However, I revise the TSI settings to make it lower and add a caveat to the interpretation:

- Long Length:20

- Short Length:10

- Signal Length: 5

Please note that the two lines must have a distance exceeding 2 for a signal cross to be considered valid.

Using this approach, the True Strength Indicator isn’t as lagging as the default settings, and the caveat acts as a filter against market noise.

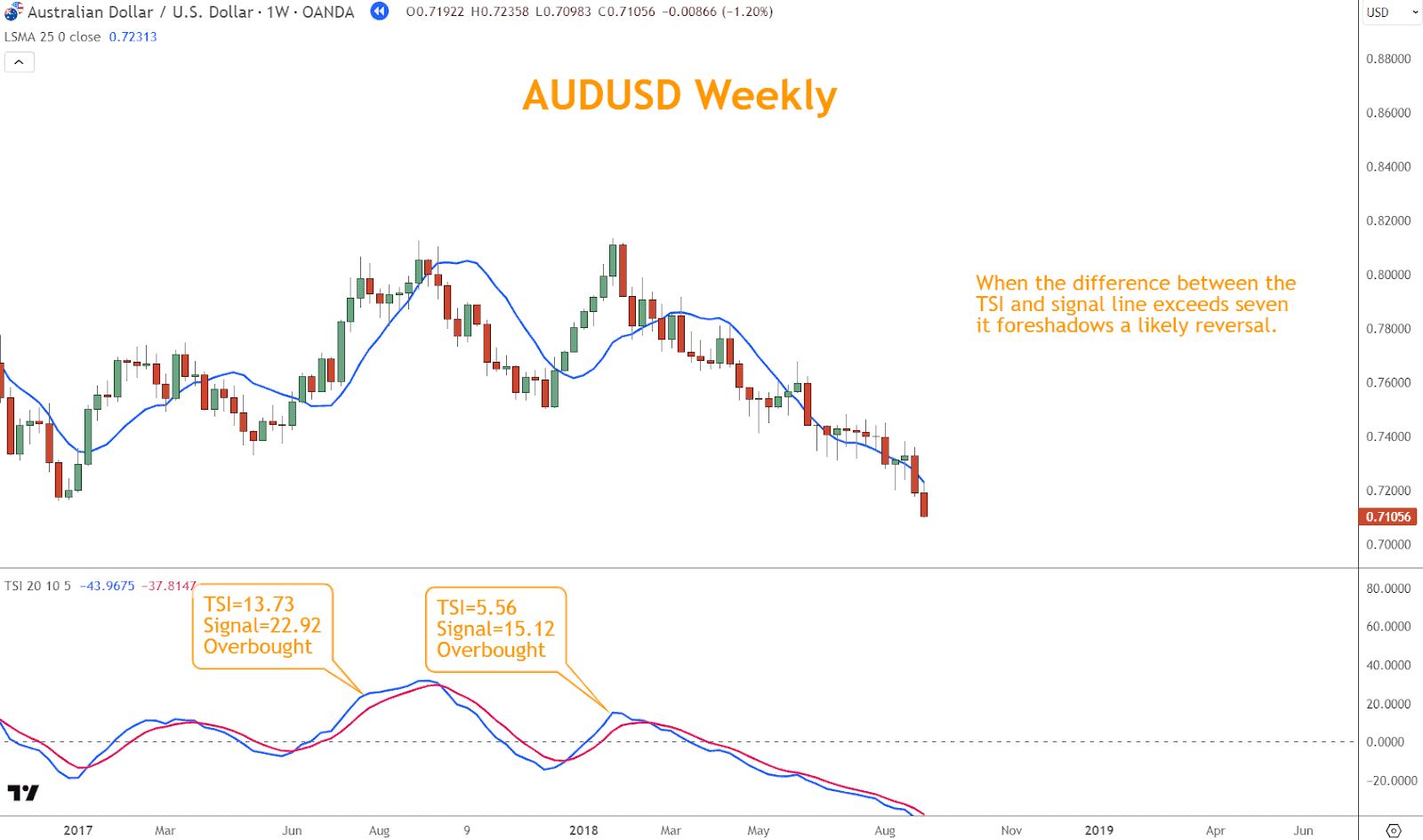

The AUDUSD example below illustrates how the bullish and bearish crosses coincide with changes in direction from rally to selloff.

This signal is excellent for determining risk management when buying or selling AUDUSD.

Interpreting True Strength Indicator Signals

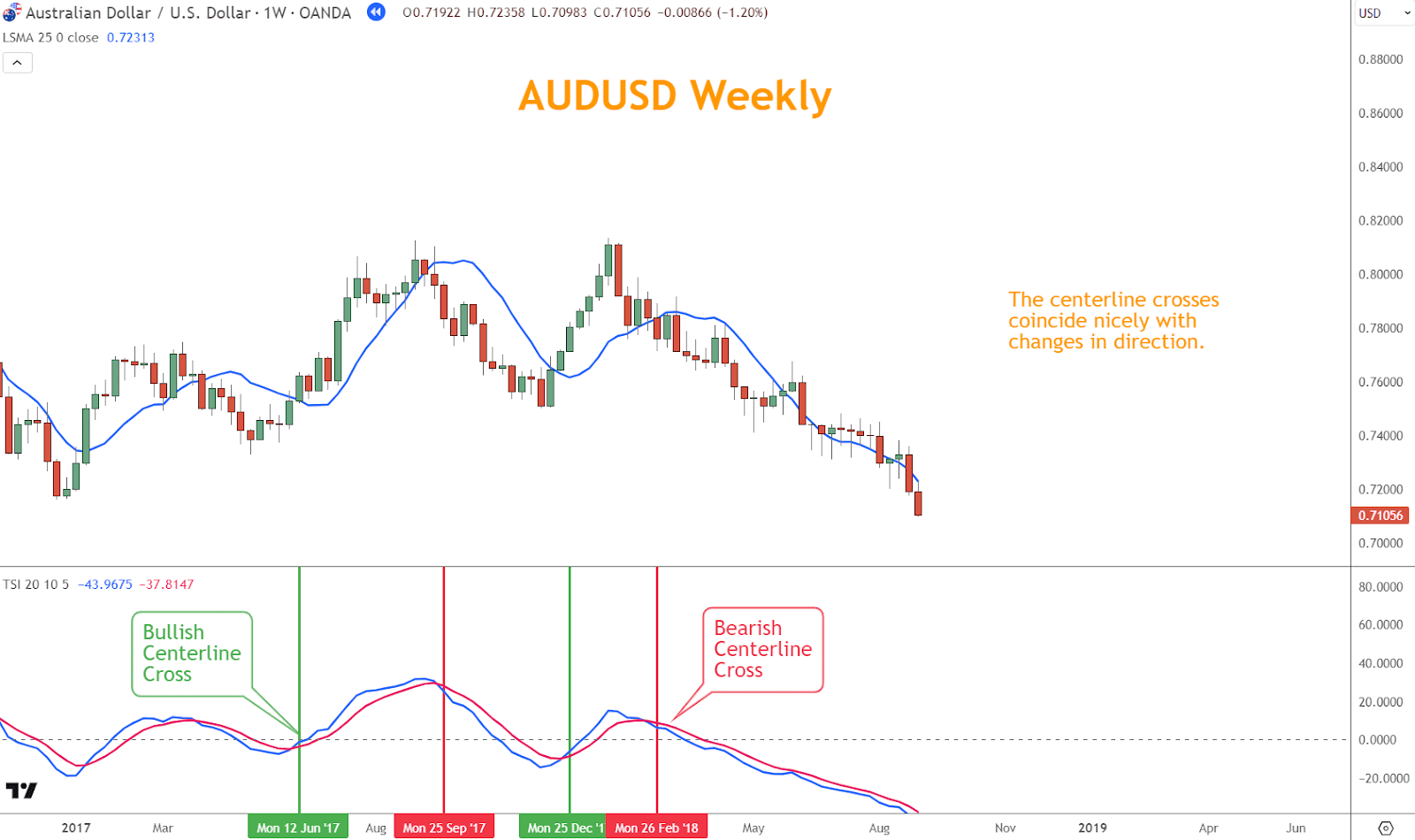

Centerline Crosses:

- Above Zero: Indicates bullish momentum.

- Below Zero: Signals bearish momentum.

It’s worth noting that bullish signals below the centerline and bearish signals above the centerline often successfully represent respective opportunities.

In my practice, the TSI being above or below the centerline doesn’t disqualify a trading opportunity in either direction.

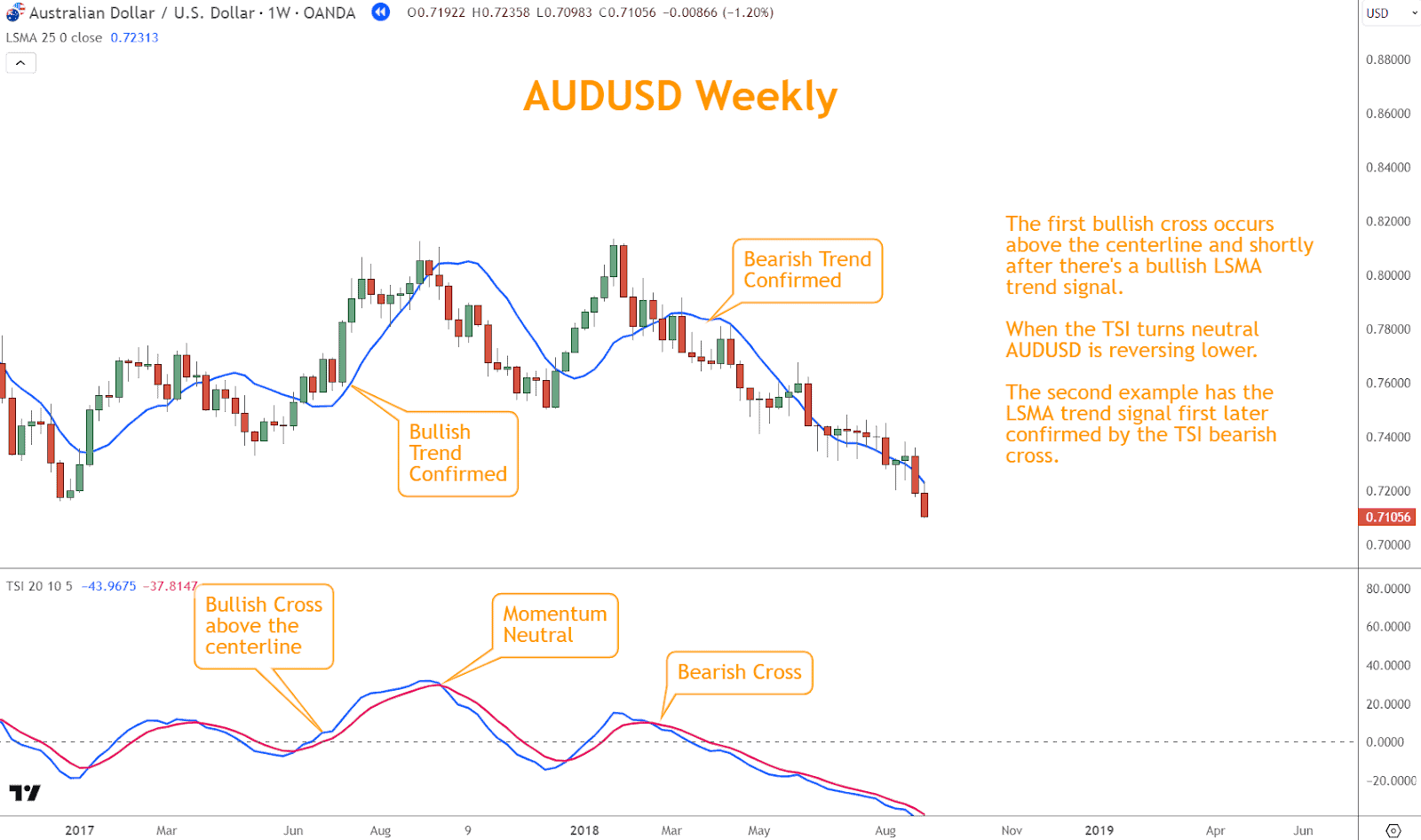

In the example below, you can see how the centerline cross coincides with a directional price change.

These momentum signals provide buy and sell signals on AUDUSD.

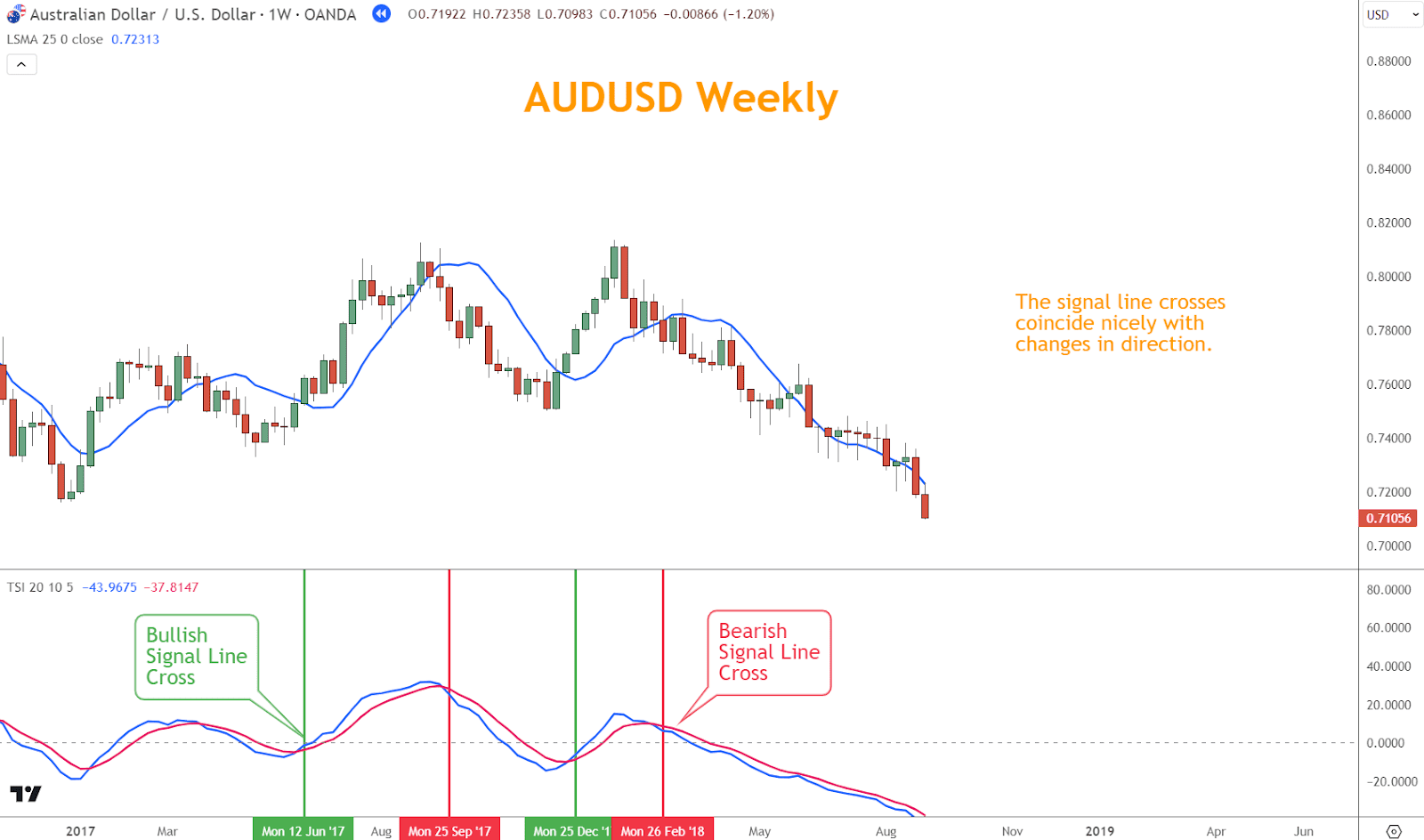

Signal Line Crosses

- Upward Cross: Suggests bullish momentum strengthening.

- Downward Cross: Indicates bearish momentum intensifying.

When the signal line crosses the TSI, the cross is a substantial momentum change signal.

Use the filtering process mentioned earlier to avoid whipsaws and false signals.

In the example below, the bullish and bearish signal line crosses confirm a change in the direction illustrated by the trend line.

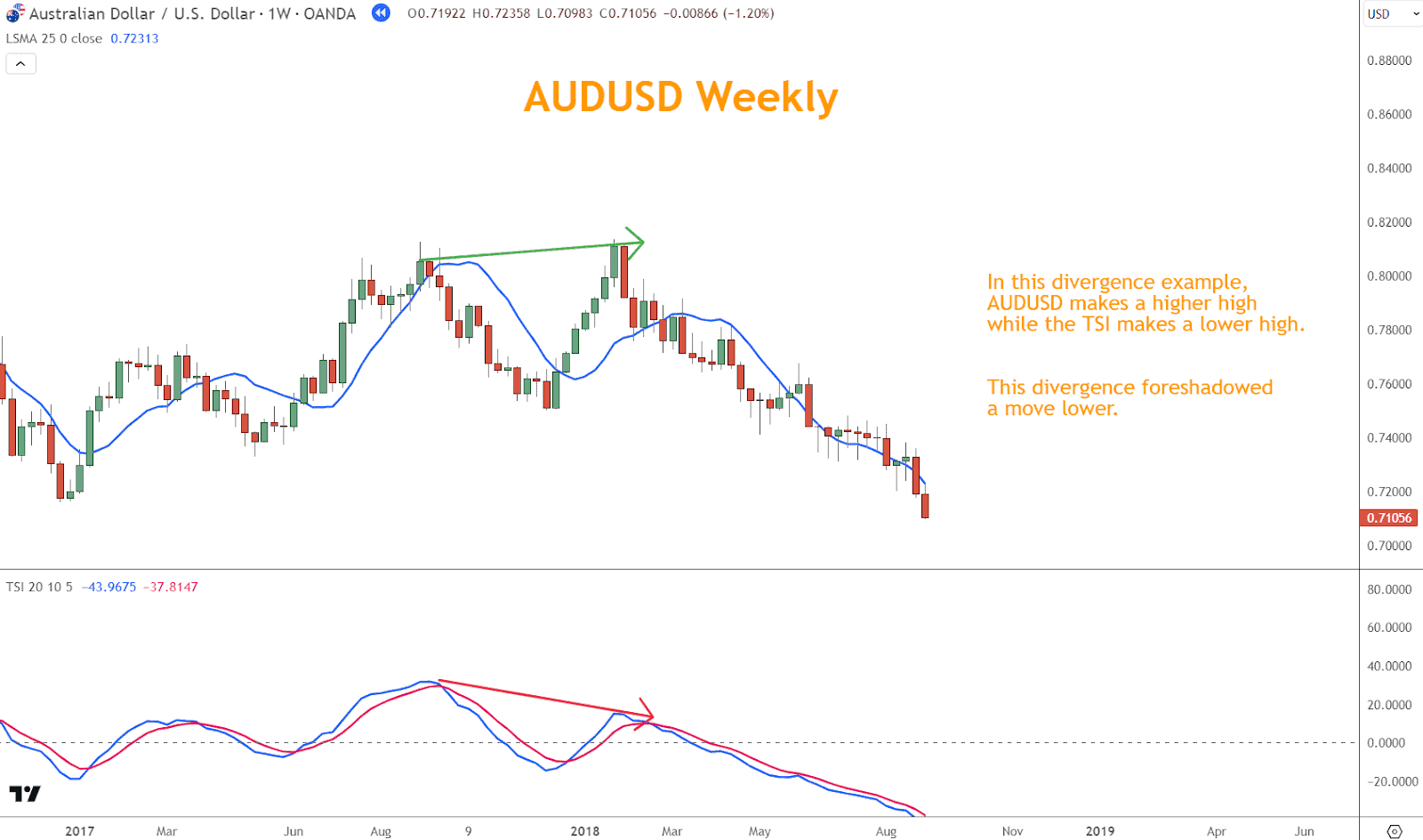

Divergence

The divergence between TSI and price movements can signal potential trend reversals.

The TSI is an excellent tool for recognizing divergence since its smoothed moving averages are easy to use.

In this divergence example, AUDUSD makes a higher high while the TSI produces a lower high.

Overbought and Oversold Levels

TSI doesn’t have traditional overbought and oversold levels.

Instead, traders look for extremes in TSI values to gauge potential reversals.

I implemented a filter to identify bullish and bearish crossovers and used another filter to measure overbought and oversold levels.

When the distance between the TSI and the signal line exceeds seven, the TSI is considered overbought or oversold.

Being overbought or oversold isn’t an automatic signal to act on since trading instruments may remain in overbought and oversold states for extended periods.

Incorporating the True Strength Indicator into Your Trading Strategy

Incorporating the True Strength Indicator (TSI) into your trading strategy can significantly enhance your trading success by optimizing entries and exits.

This section will explore strategies and techniques for effectively integrating the TSI into your trading approach, empowering you to make more informed and profitable trading decisions.

Combining the TSI with the LSMA Trend Indicator

Integrating the True Strength Indicator (TSI) with the Least Squares Moving Average (LSMA) trend indicator can provide a robust framework for identifying and confirming trends in the Forex market.

Combining the TSI’s momentum insights with the LSMA’s smoothed price action representation allows you to filter out noise and focus on significant trend movements.

When the TSI confirms bullish or bearish momentum and the LSMA trend line aligns accordingly, it strengthens the conviction behind trading decisions.

This synergy helps you stay on the right side of the trend and avoid false signals, enhancing the effectiveness of your trading strategy.

The first bullish cross occurs above the centerline, and shortly after, the LSMA trend signal is bullish.

When the TSI turns neutral, AUDUSD reverses lower.

The second example has the LSMA trend signal first, later confirmed by the TSI bearish cross.

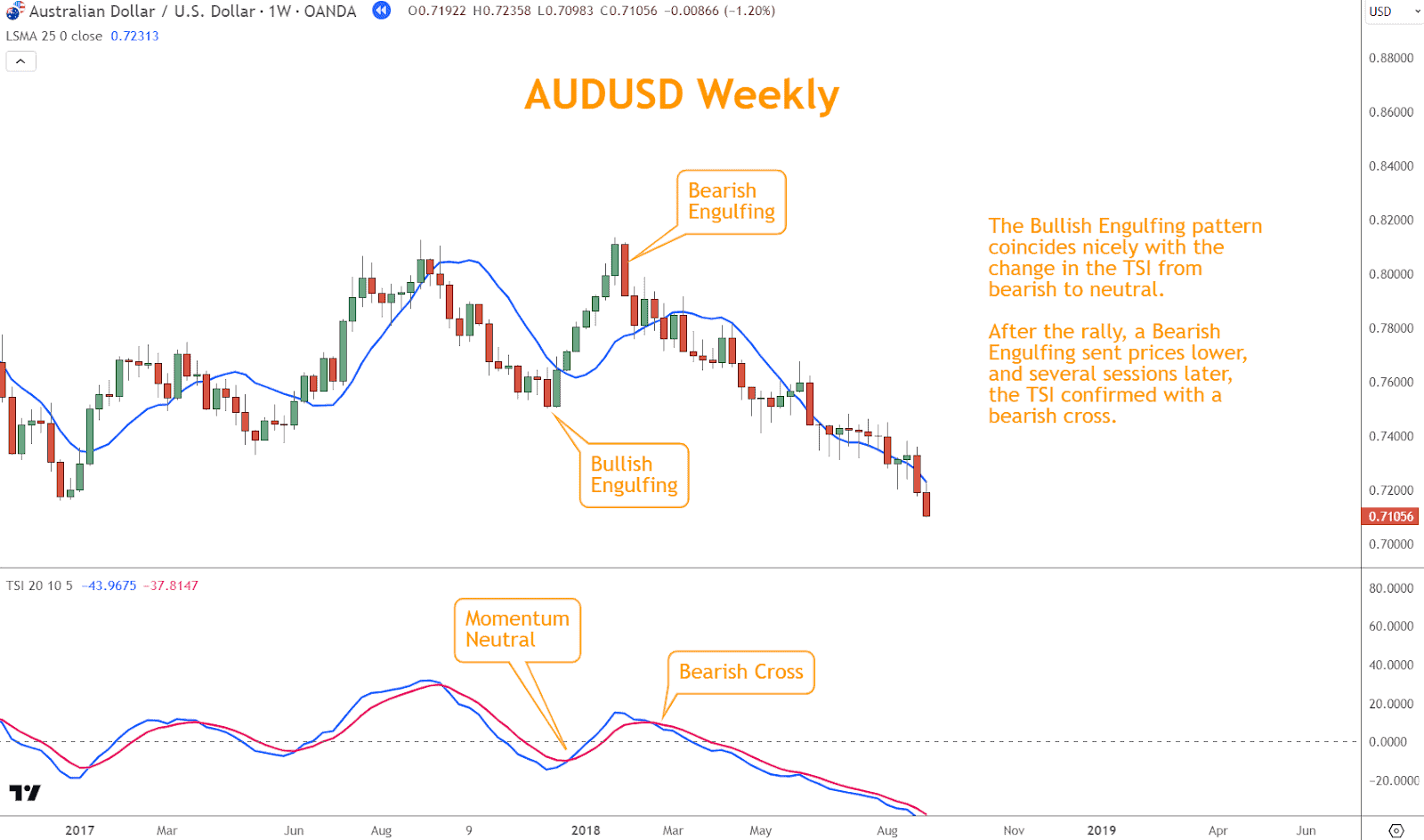

Combining the TSI with Japanese Candlestick Patterns

Traders have long revered Japanese candlestick patterns for their ability to reveal market sentiment and potential trend reversals.

Combined with the True Strength Indicator (TSI), these patterns can offer even greater insight into market dynamics.

Traders can use TSI signals to confirm the strength of candlestick patterns, providing added confidence in their trading decisions.

For example, a bullish candlestick pattern accompanied by rising TSI values suggests increasing bullish momentum, reinforcing the likelihood of a price upswing.

Conversely, a bearish candlestick pattern corroborated by declining TSI values indicates growing bearish pressure, strengthening the case for a potential downturn.

By incorporating TSI analysis alongside Japanese candlestick patterns, traders can fine-tune their entries and exit more precisely.

In the example below, the Bullish Engulfing pattern coincides nicely with the change in the TSI from bearish to neutral.

After the rally, a Bearish Engulfing sent prices lower, and several sessions later, the TSI confirmed with a bearish cross.

Both examples illustrate trading entries combining Japanese candlesticks and confirmation with the TSI.

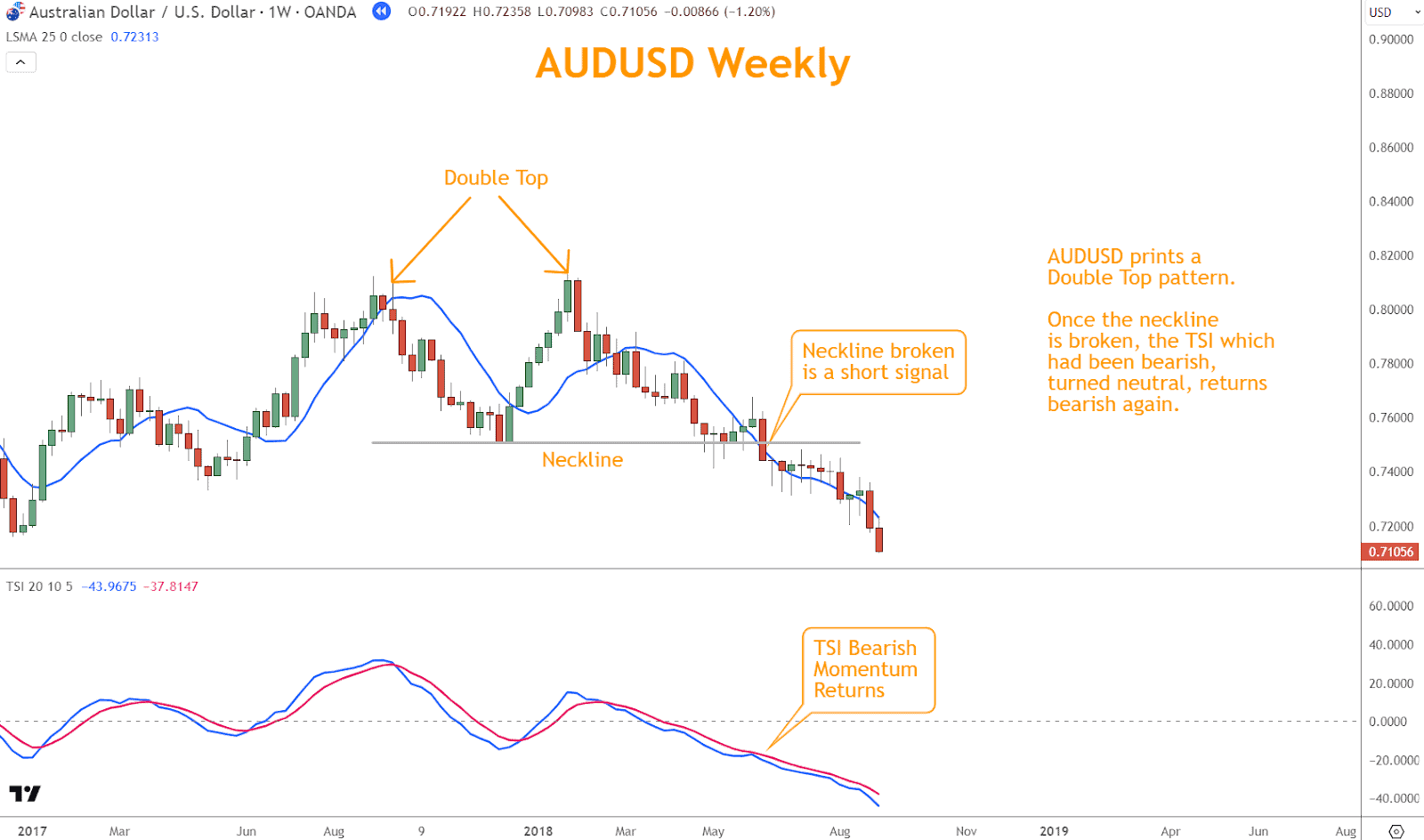

Combining the TSI with Chart Patterns

Chart patterns, such as double tops/bottoms and head and shoulders formations, offer valuable insights into potential price movements and trend continuations or reversals.

These patterns can be even more potent tools for traders when paired with the True Strength Indicator (TSI).

TSI signals can help confirm the validity of chart patterns by indicating the underlying momentum behind price movements.

In the example below, AUDUSD prints a Double Top pattern.

When the neckline breaks, the TSI, which was bearish, becomes neutral before turning bearish once again.

This return to a bearish TSI is an excellent short entry for the double top pattern.

Combining the TSI with Support and Resistance

Support and resistance levels are critical aspects of technical analysis, representing areas where price stalls or reverses.

When paired with the True Strength Indicator (TSI), these levels can offer valuable confirmation of potential reversals or continuations.

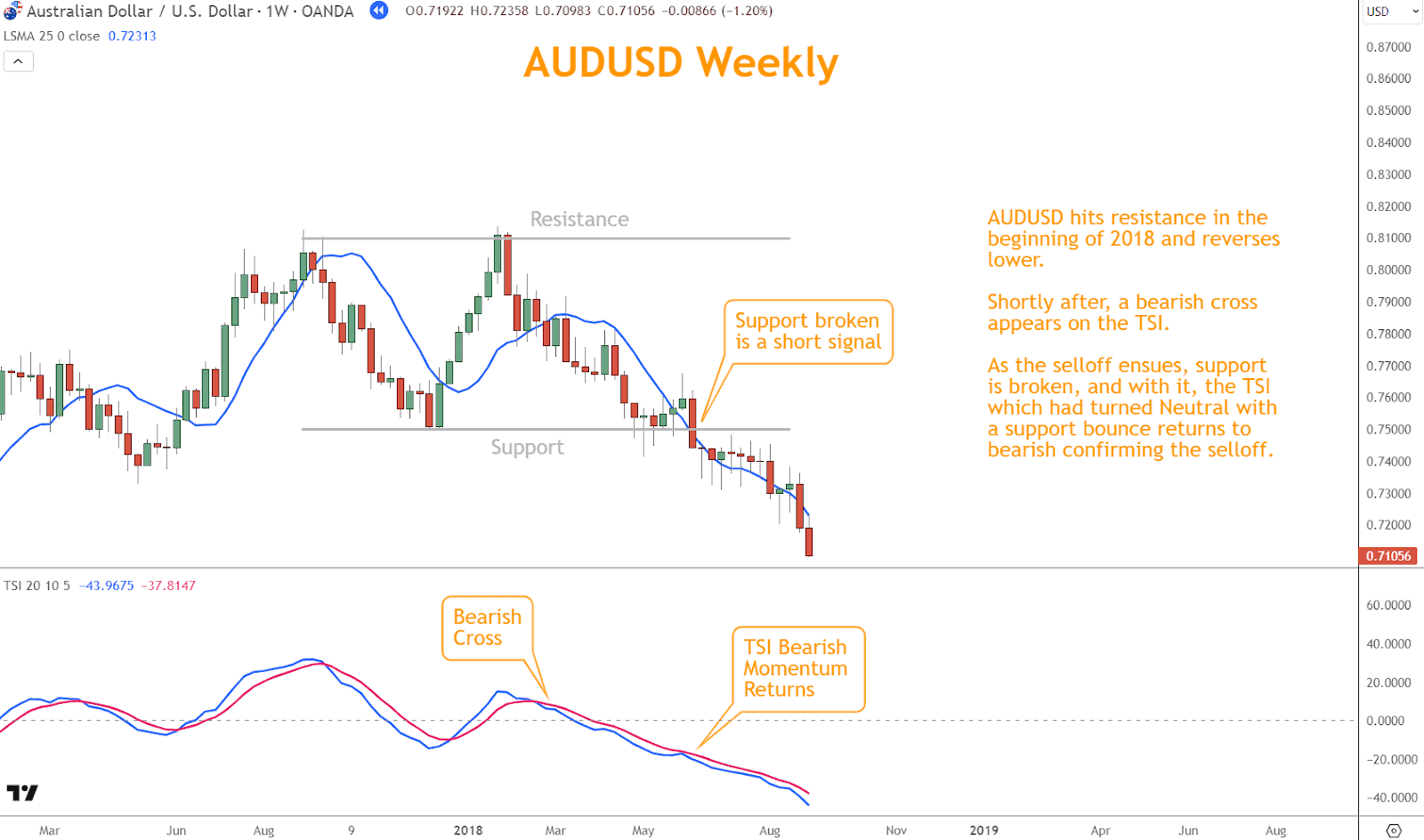

In the example below, AUDUSD hit resistance at the beginning of 2018 and reversed lower.

Shortly after, a bearish cross appears on the TSI.

As the market experiences a selloff, AUDUSD breaks the support level, causing the TSI to turn bearish again.

The TSI had briefly turned neutral after a support bounce, but the selloff confirmed the bearish trend.

Conclusion

The True Strength Indicator (TSI) offers traders a unique market strength and momentum perspective, allowing for more informed decision-making and enhanced risk management.

By understanding how to interpret TSI signals and incorporating them into a comprehensive trading strategy, you can gain an edge in trading currency markets.

Whether confirming trends, identifying reversals, or managing risk, the TSI is valuable for any Forex trader seeking consistent profitability.

What’s the Next Step?

Use what you’ve learned about the TSI indicator and look at your favorite charts.

Look for opportunities to incorporate what you’ve learned here in your trading.

Once you’re ready to trade, choose a strategy and process you believe will work for you.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about trading with the TSI indicator in Forex.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will use the Six Basics of Chart Analysis and Advanced Strategies to show you the trade opportunities I’m watching.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce videos and guides to help you learn and improve trading practices.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What is the True Strength Indicator (TSI), and how does it differ from other Forex Indicators?

The True Strength Indicator (TSI) is a momentum oscillator developed by William Blau.

Unlike traditional indicators like the Relative Strength Index (RSI), the TSI combines two smoothed moving averages to provide a more comprehensive view of market strength and direction.

How can Traders Interpret TSI Signals to make Informed Trading Decisions?

Traders can interpret TSI signals in several ways, including centerline crosses, signal line crosses, divergence, and extremes in TSI values.

Centerline crosses above zero indicate bullish momentum, while crosses below zero suggest bearish momentum.

Signal line crosses and divergence between TSI and price movements can signal potential trend changes.

What are some Practical Ways to Incorporate TSI into a Trading Strategy?

Traders can incorporate TSI into their strategy to confirm trends, identify reversals, combine with other indicators like moving averages or channel lines, and manage risk by setting stop-losses based on TSI signals.

Can the TSI be Combined with other Technical Analysis Tools to Achieve Better Trading Outcomes?

The TSI can be combined with various technical analysis tools such as the LSMA trend indicator, Japanese candlestick patterns, chart patterns, and support and resistance levels to enhance trading signals and improve accuracy in identifying profitable trading opportunities.