Have you been wondering how to trade Triangle Patterns correctly?

What best practices exist?

Are they the same for each Triangle Pattern?

This article will discuss trading different Triangle Patterns and why they are a powerful weapon in your forex trading arsenal.

We’ll also answer some common questions about using these patterns in your strategy, such as:

- What is a triangle trading strategy?

- Do they all use a breakout strategy?

- Are they all continuation patterns?

- And what context does each require?

We’ll also provide some step-by-step guides on how to trade each type, so if you’re serious about improving your trading results, read on to learn how to use Triangle Patterns to your advantage.

What are Triangle Patterns?

Triangle Patterns are technical analysis patterns drawn by connecting at least two peaks or troughs, creating triangles.

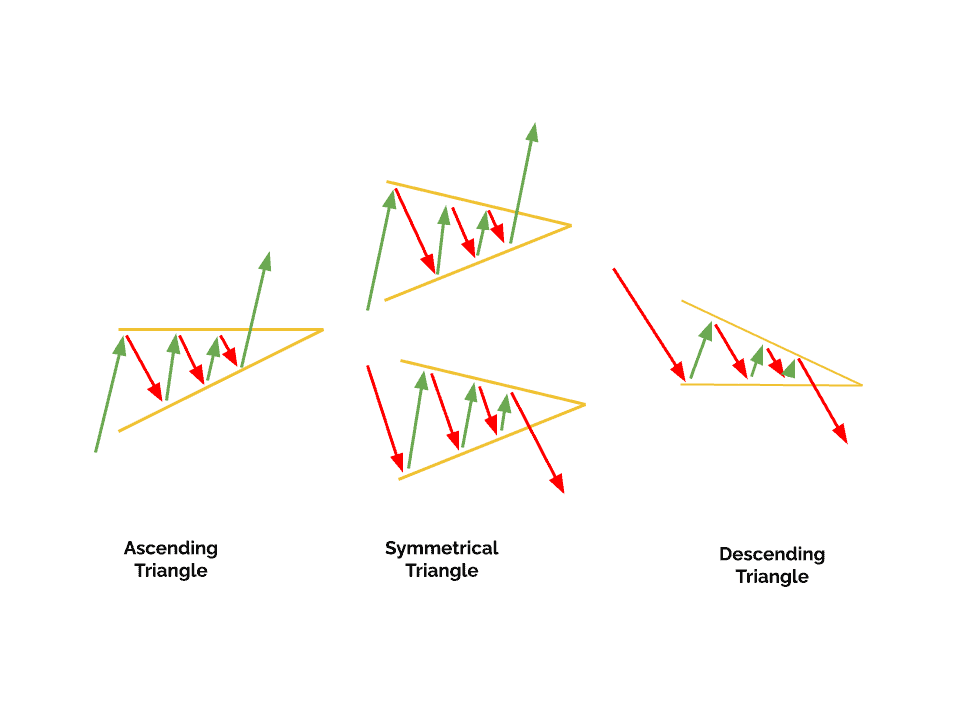

There are three primary variations of these patterns:

- Symmetrical

- Ascending

- Descending

Each signal different market conditions.

All signal some combination of trader exhaustion and indecisiveness, pausing price Momentum and giving the market a chance to catch its breath.

Understanding and using them in the proper context introduces some great opportunities to improve overall performance.

Do all Triangles use a Breakout/Breakdown Strategy? (Rule 1)

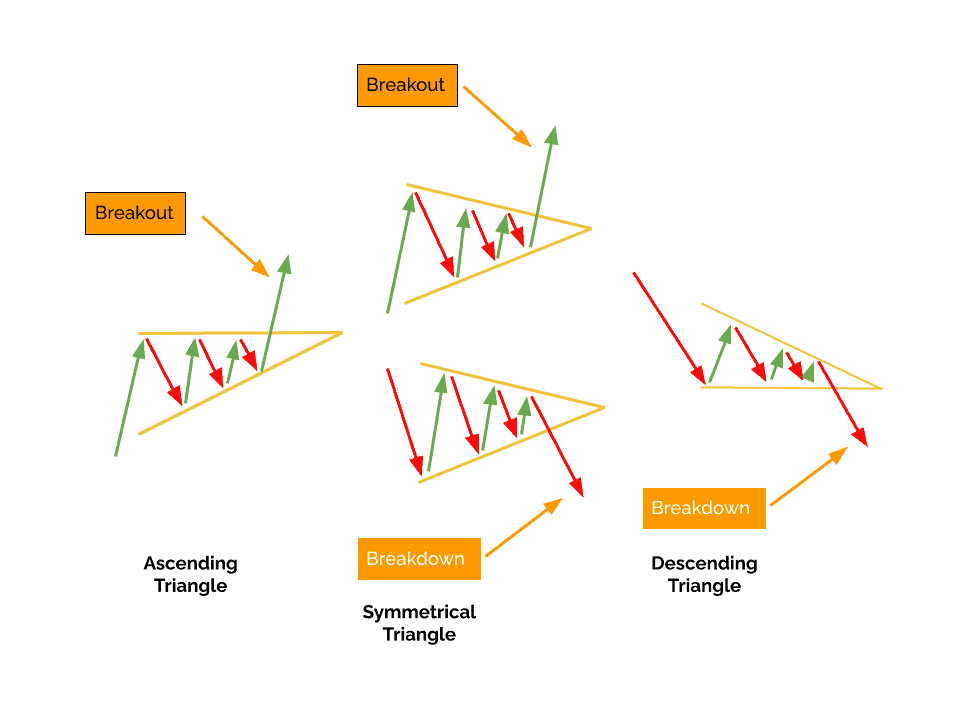

All triangles end with a breakout or breakdown depending on the situation and the pattern.

The reason for this is the nature of what a triangle means. The psychology of a triangle is a withering debate over future prices.

Once the debate ends, an instrument’s price moves again in a determined direction.

This direction always includes a resolution to the debate, which visually appears as either a breakout or a breakdown.

Why are all Triangle Patterns Continuation Patterns? (Rule 2)

They are all continuation patterns because they indicate a temporary period of consolidation in a market that is moving either higher or lower.

This period creates a triangle shape that helps predict the market’s direction once the sideways price action is over.

These shapes form because traders are no longer comfortable with the current Momentum.

These patterns often appear when the price is either Overbought or Oversold, and markets need time to digest the price action before moving forward.

A significant economic news element might also be coming soon, giving more reason for pause. Once traders have resolved their concerns, prices return to their original direction.

If you look at Ascending and Descending Triangle Patterns, you can see the bias is always with the initial direction within the pattern.

However, in a Symmetrical Triangle, other technical elements suggest the original path will resume soon.

Most price action in the pattern is amongst shorter-term traders looking to take advantage of swings within the Triangle. While risky, this strategy contributes to the pattern shape until the longer-term traders return at the breakout.

What context does each Triangle Pattern Require? (Rule 3)

What market context does each require?

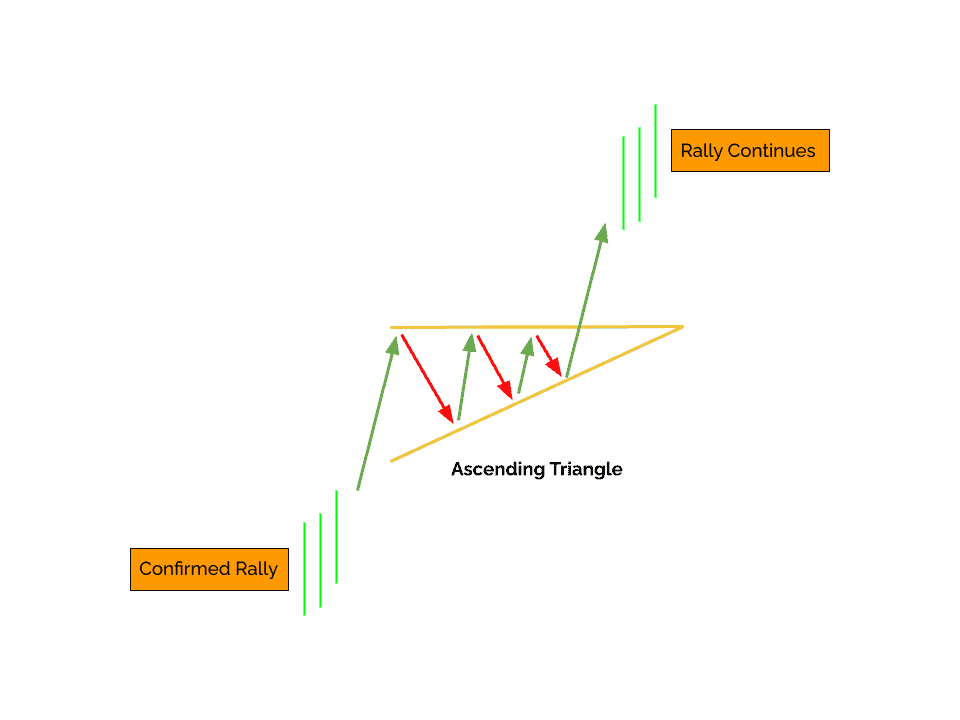

- Ascending Triangles are Bullish and are only valid during confirmed Rallies.

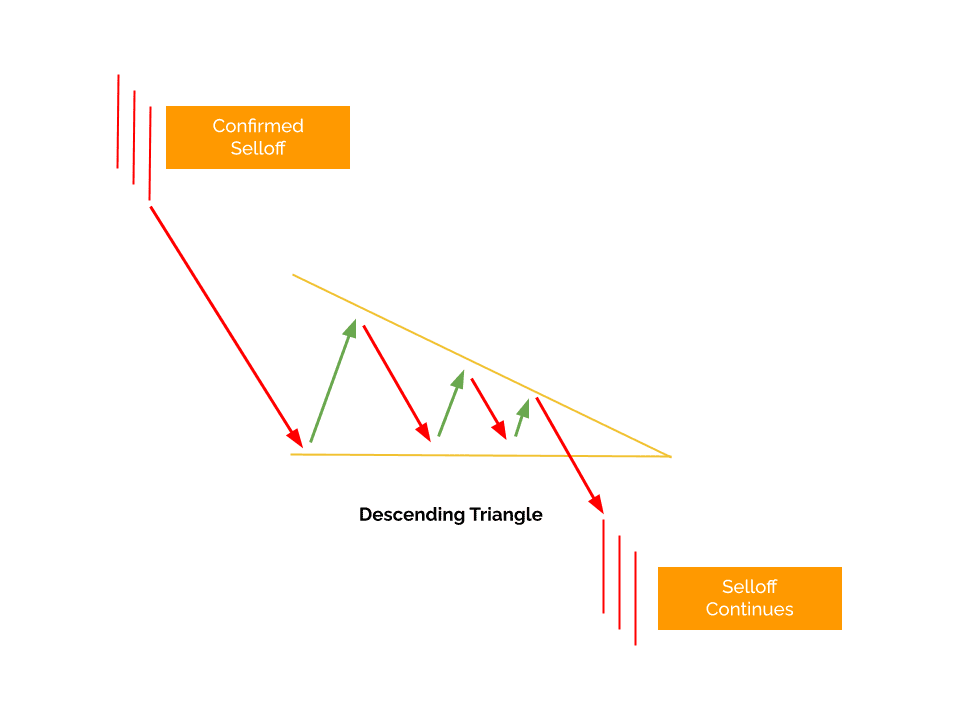

- Descending Triangles are Bearish and are only valid during confirmed Selloffs.

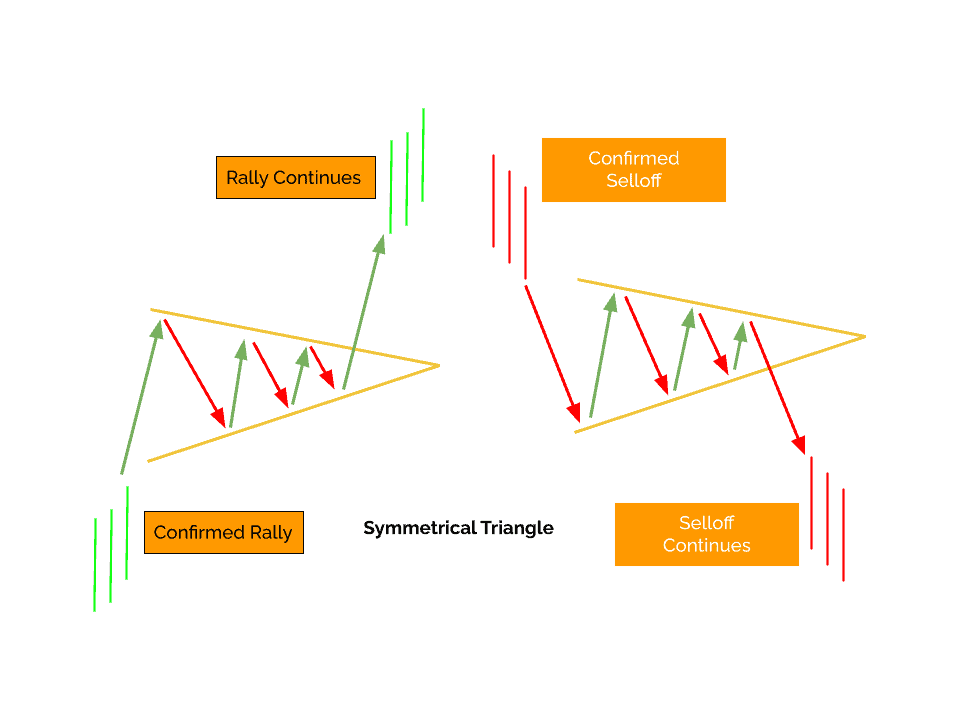

- Symmetrical Triangles can be used in confirmed Rallies or Selloffs and will move prices back to their original direction.

Why does context matter so much? Often, traders misread a Triangle Pattern because they misread the price action before the pattern.

If you don’t have a confirmed market direction, you shouldn’t trade. In addition, a Neutral market also cannot leverage a Triangle Pattern.

As explained earlier, the market psychology at work is all about the loss of Momentum.

During Rallies and Selloffs, these changes are impactful. If an instrument is already consolidating, this psychology doesn’t apply.

How to Trade a Symmetrical Triangle Pattern

A Symmetrical Triangle pattern signals a period of indecision in the market, with buyers and sellers pushing the price back and forth within the Triangle.

First, you must identify and confirm the trading instrument’s current state to exploit this pattern.

For example, is the instrument in a Rally, Selloff, or Neutral?

If the instrument is Neutral, then whatever is developing is not a Triangle Pattern.

But, again, Triangle Patterns are about watching consolidation and buying or selling the breakout. Neutral states are consolidations themselves and don’t spur breakouts.

Once the price breaks out of the Symmetrical Triangle formation, traders may enter a long or short position depending on whether the breakout is Bullish or Bearish.

The breakout will move in the same direction it was moving before the Triangle.

Confirmation of the breakout can be moving above a Support and Resistance level, creating a new Swing High or Low, or another methodology.

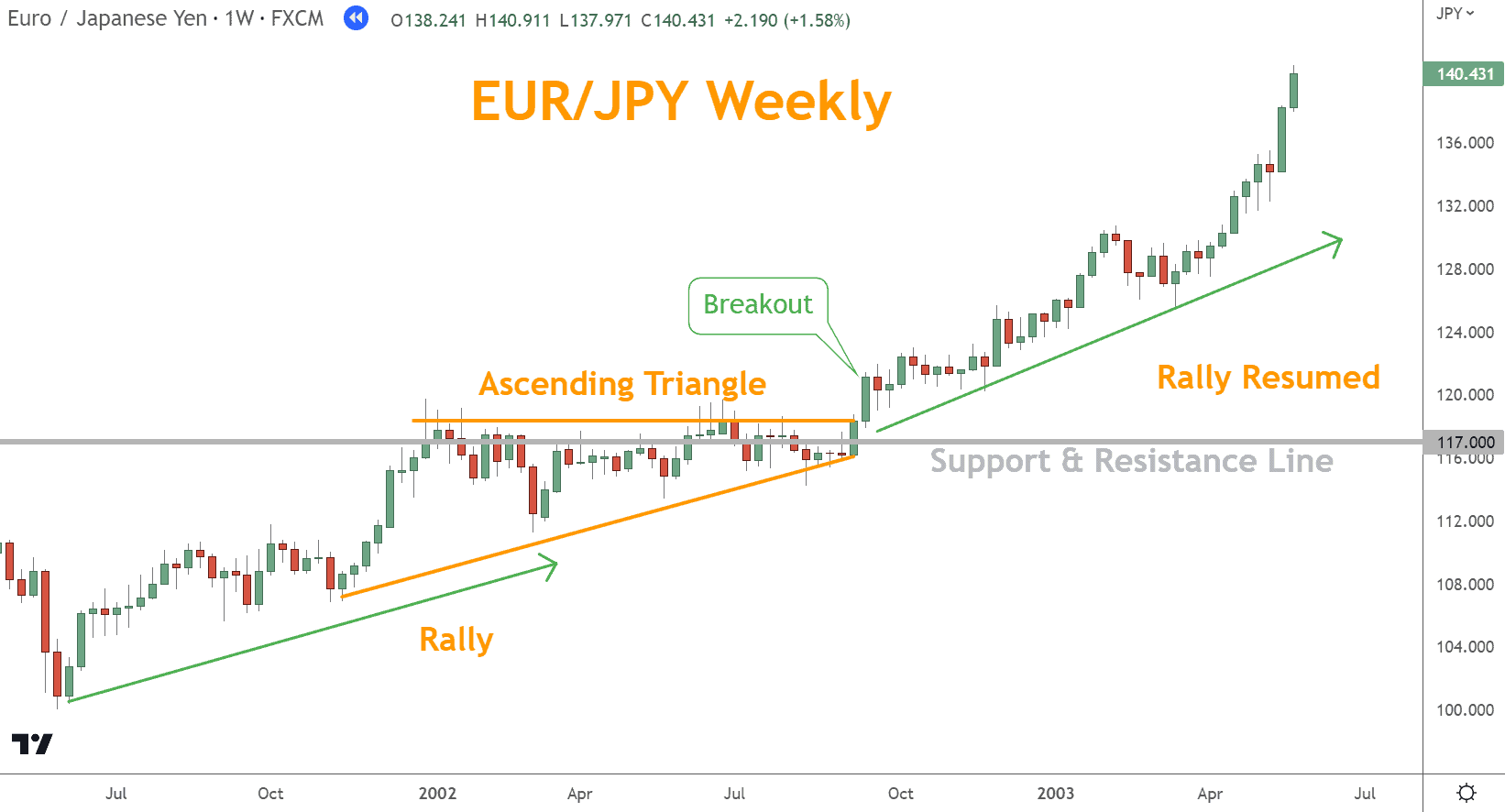

How to Trade an Ascending Triangle Pattern

The Ascending Triangle Pattern is a Bullish continuation pattern formed by a flat top Resistance line and a rising Support line.

The pattern reflects a pause in a Rally until the price reaches the apex of the two lines.

Trading an Ascending Triangle, traders must wait for a breakout above the flat top Resistance line. A confirmed breakout signals that the Bullish uptrend and Momentum will resume.

Moreover, looking for other Bullish pattern indicators that confirm this Triangle’s validity before placing a trade is essential.

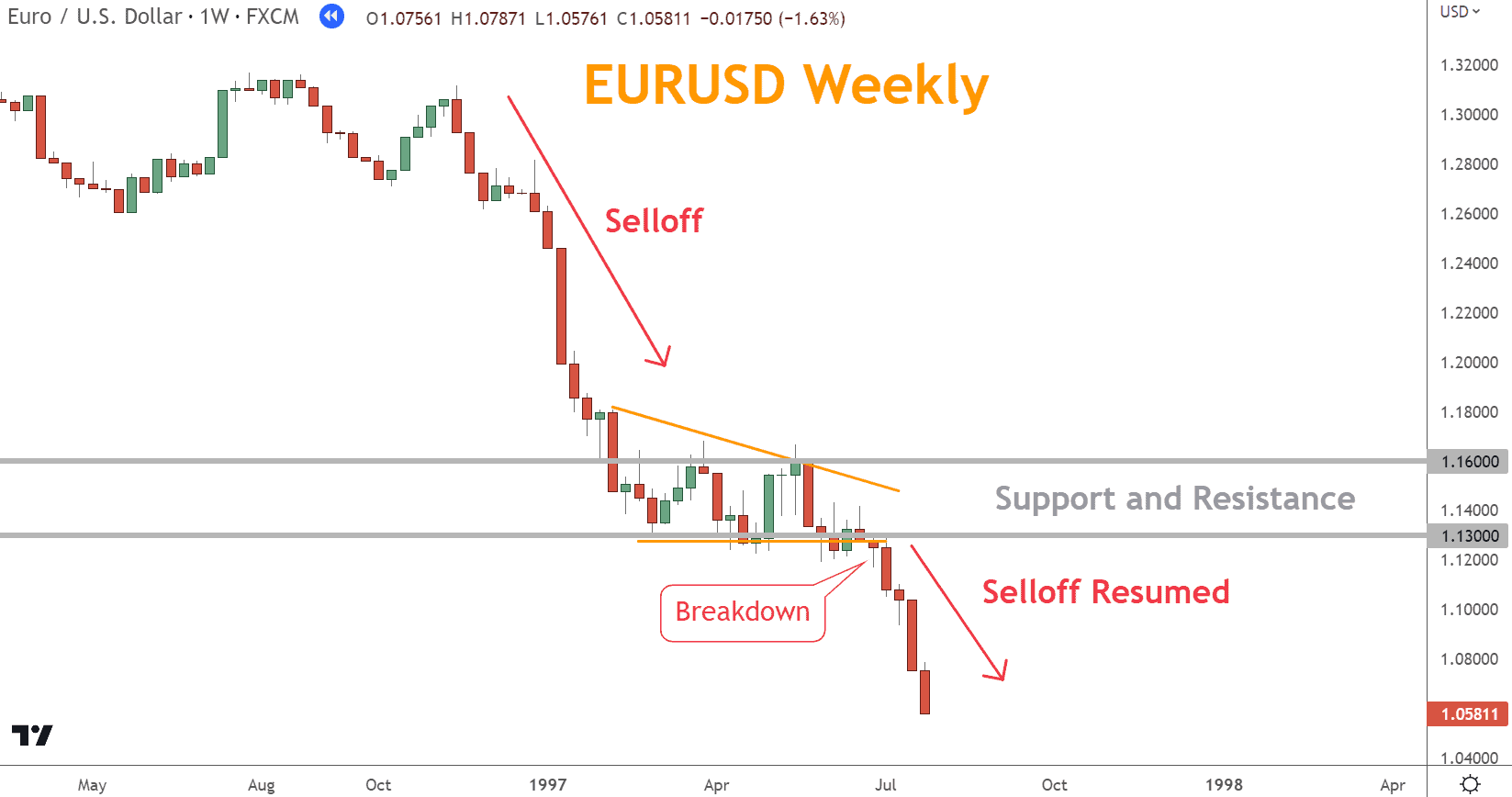

How to Trade a Descending Triangle Pattern

The Descending Triangle Pattern is a Bearish continuation pattern formed by a descending top Resistance line and a flat lower Support bottom line.

Like the Ascending Triangle, the pattern reflects a pause in a Rally until the price reaches the apex of the two lines.

Also similar to an Ascending Triangle, traders must wait for a breakdown below the flat lower Support line. A confirmed breakdown signals that the Bearish downtrend and Momentum will resume.

Moreover, looking for other Bearish pattern indicators confirming this triangle’s validity is essential before placing a trade.

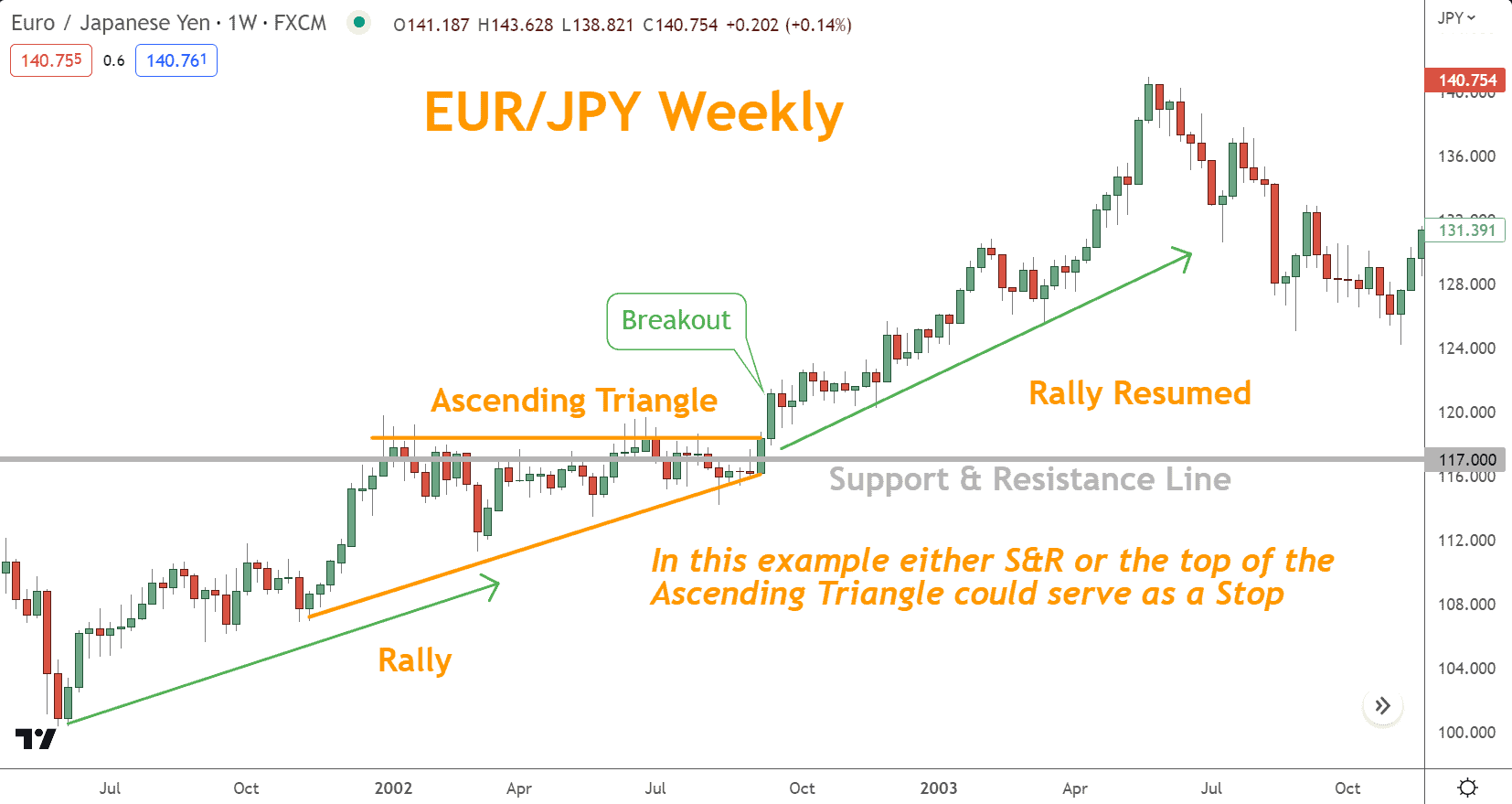

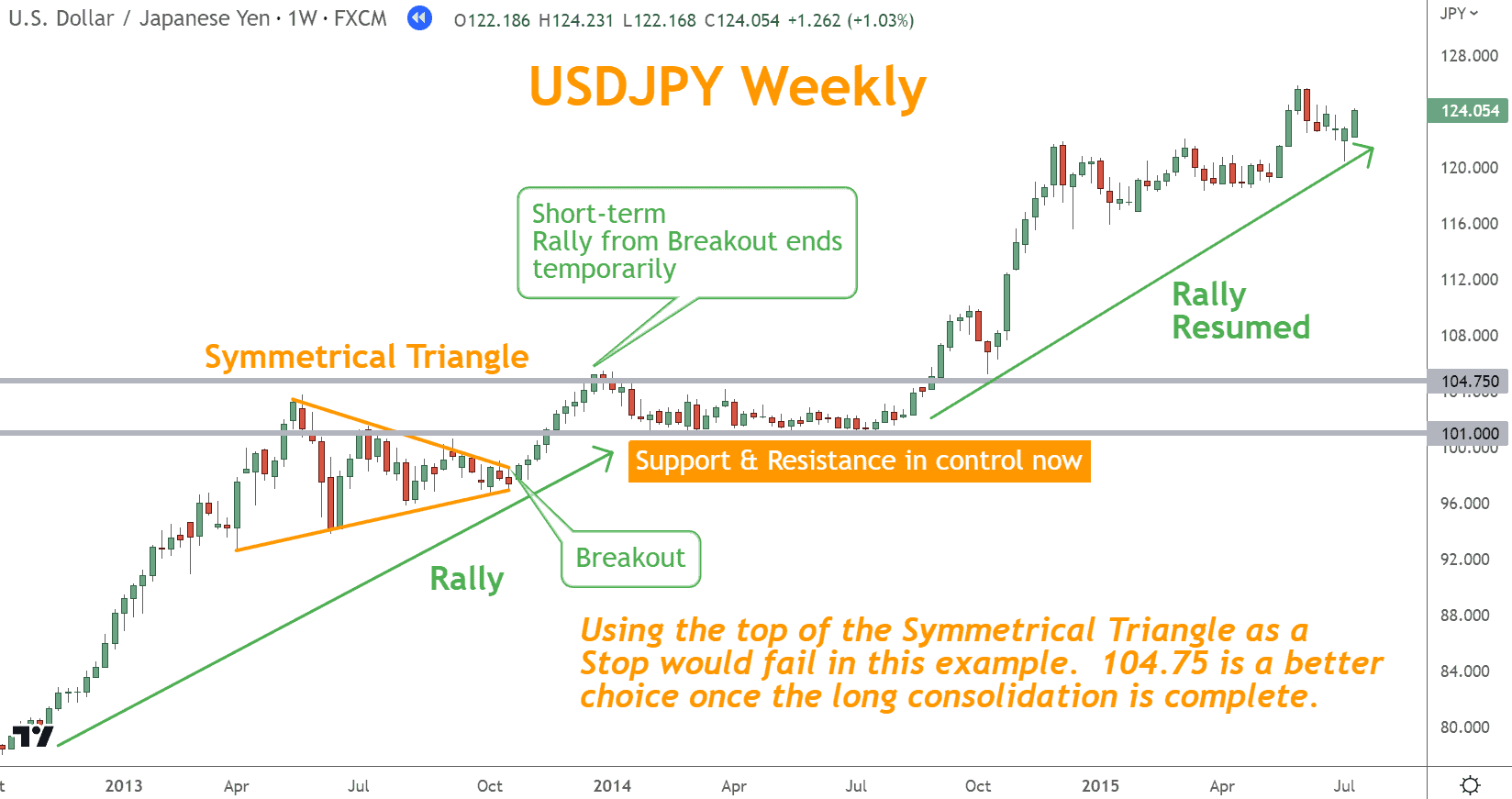

Can you use a Triangle Pattern as a Stop?

One question regarding Triangle Pattern trading is whether using the horizontal line in a pattern as a Stop is possible.

Of course, you can use the horizontal line as a Stop, but you also need to consider Support and Resistance lines in the vicinity.

Usually, a Support and Resistance line near the pattern’s horizontal line will supersede the pattern’s horizontal line.

The reason for this is the traders involved. More prominent Position traders will value Support and Resistance over the pattern horizontal line.

Short-term traders like Swing or Day traders will value the horizontal line more. Since Position traders hold more significant positions, their perspective will outweigh the shorter-term trader’s perspective over time.

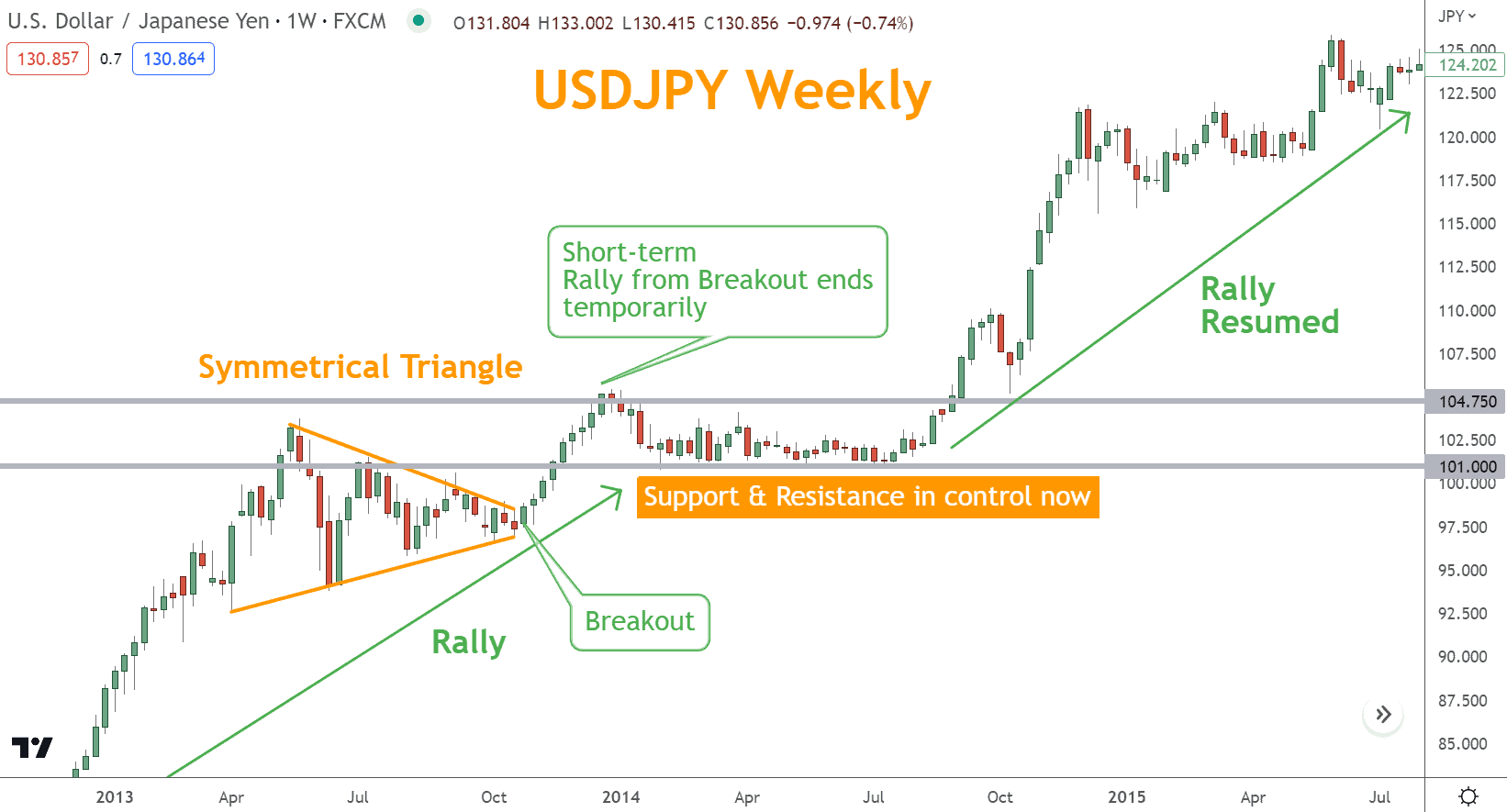

Why Triangle Patterns are so Effective in Position Forex Trading

Triangle patterns are among the most effective Position forex trading strategies because they use more time than most patterns or other signals.

Since Position traders use weekly charts, the consolidation gives the market time to digest the recent price action and take the next step forward.

The use of time makes these patterns more reliable.

Position traders wait for the price to break out of the range to enter a trade, which allows them to take advantage of the Momentum that often follows these breakouts.

These patterns are beneficial for longer-term trades, as they can provide signals triggering Rallies and Selloffs lasting for weeks or even months.

By understanding how to identify and trade these patterns, you can improve your odds of success and reduce your risk of losses.

What Can You Do Next?

Select a favorite forex trading pair and start looking for Triangle Chart Patterns.

Then, consider using these with other indicators to find trading opportunities.

If you need a charting platform, I recommend TradingView, which you can start with here for free. If you open a paid account, we’ll receive a commission.

If you’re new to trading, you may want to open a demo account and try trading with play money before real money.

If you’re unsure how to find forex trading opportunities, learn the Six Basics of Chart Analysis, which you can download for free here.

The “Six Basics” will give you a strong foundation in chart analysis which you can incorporate with what you’ve learned here about Triangles.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast is delivered weekly to your inbox and provides the following:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and Advance Strategies? I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

How do you Trade with Triangle Patterns?

To trade with triangle patterns, it’s essential first to identify the three types: ascending, descending, and symmetrical. They form when the price moves within a narrowing range and eventually breaks out.

These patterns are continuation patterns, so traders usually wait for a price breakout or breakdown and enter a trade in the direction of the movement.

With careful analysis and a solid understanding of market direction, traders can leverage them to make successful trades.

What Does a Triangle Pattern Mean in Trading?

A triangle pattern in trading is a consolidation pattern in which an instrument’s price gradually moves within a narrowing range.

This pattern suggests a continuation of the previous direction.

For example, triangle chart patterns continue the dominant price direction before breaking out.

Triangle trading patterns have three main types: ascending, descending, and symmetrical. Traders commonly identify these patterns by drawing two lines through the peaks and troughs of the formation.