What Does Trend Trading Mean?

Trend trading is a mainstream phrase describing traders who open and close trades based on the behavior of a Technical Analysis Trend indicator or technique.

The thinking behind this strategy is that a profitable trade could come from buying or selling an instrument already moving higher or lower.

A trend would be an attractive opportunity since markets mostly move in ranges.

If most traders believe an instrument is moving and will continue to move in a specific direction, trading in the same trajectory should make for an easy, profitable trade.

Traders develop detailed strategies on how and when to enter a Trend trade and how to exit a Trend trade.

Does it work? Is this a good strategy?

I’ve been trading Forex and other markets since 2007, and in this article, I’ll share my insight and experience across thousands of trades.

What are Popular Trend Trading Indicators and Techniques?

What are some of the methods traders use to identify Trends? What Trend following strategies can be used? For example, can we look at a chart and see a Trend?

Most traders will use a technical indicator to identify a Trend and use this indicator to determine entries and exits.

They may also use a Trend indicator to determine a Stop and Target or choose something else.

This discussion will only focus on indicators or techniques used to identify Trends.

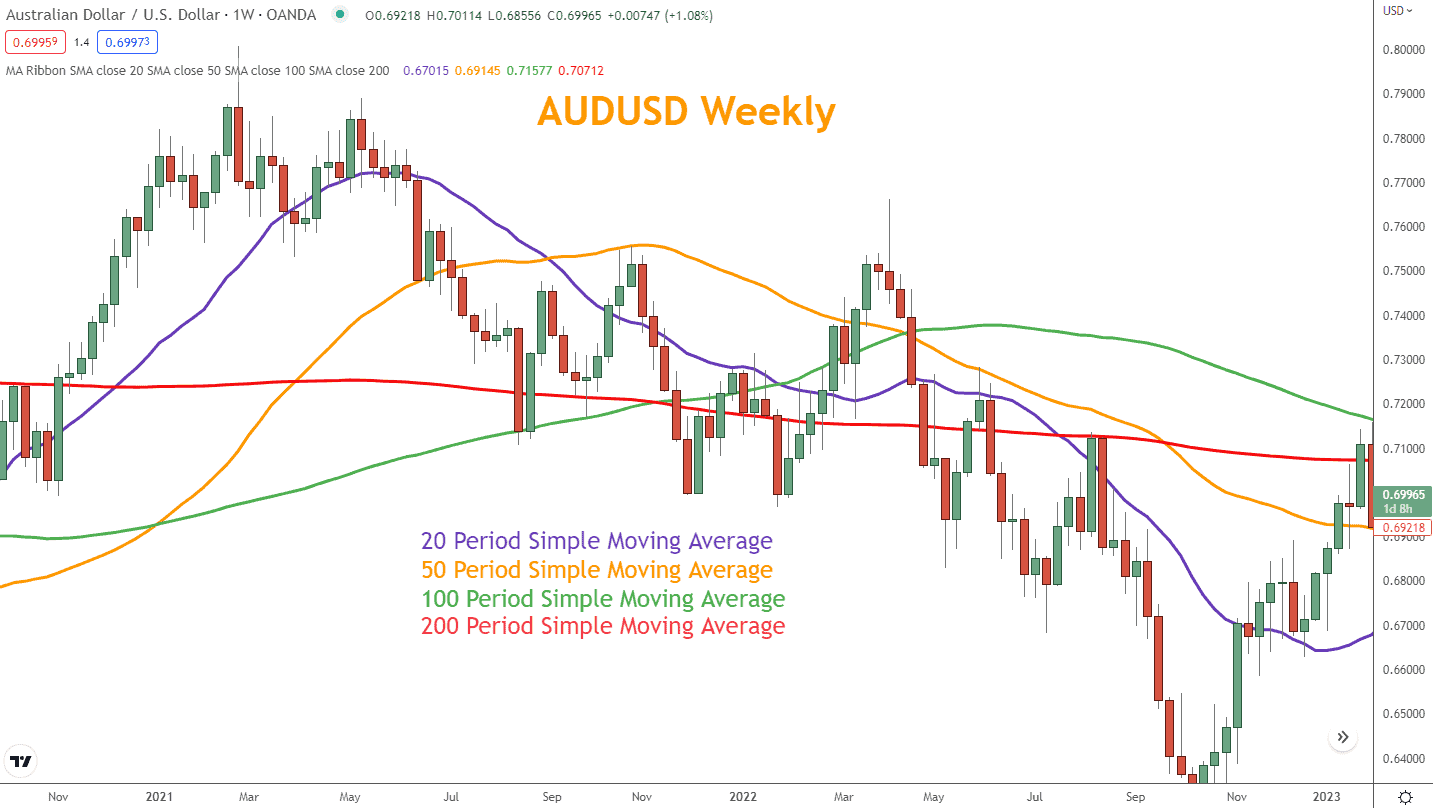

Moving Averages – MA

The most well-known indicator is the Simple Moving Average.

Even popular financial media outlets who frequently shy away from citing technical indicators will talk about the 200-day Simple Moving Average.

What is a Simple Moving Average? It is a line derived by dividing an instrument’s prices over a specific period of days.

For example, traders may conclude that if a moving average line is moving up, the market is in a Bullish or upward Trend; conversely, if it’s moving down, the Trend is Bearish or downward.

This is expressed as an uptrend or downtrend respectively.

By placing the Simple Moving Average on the price chart, traders analyze and make trading decisions. Aside from the 200-day average, the 20, 50, and 100-day averages are also mainstream.

Some traders add these to their charts and make decisions based on their collective behavior.

You can learn more about them here: Moving Average (MA): Purpose, Uses, Formula, and Examples.

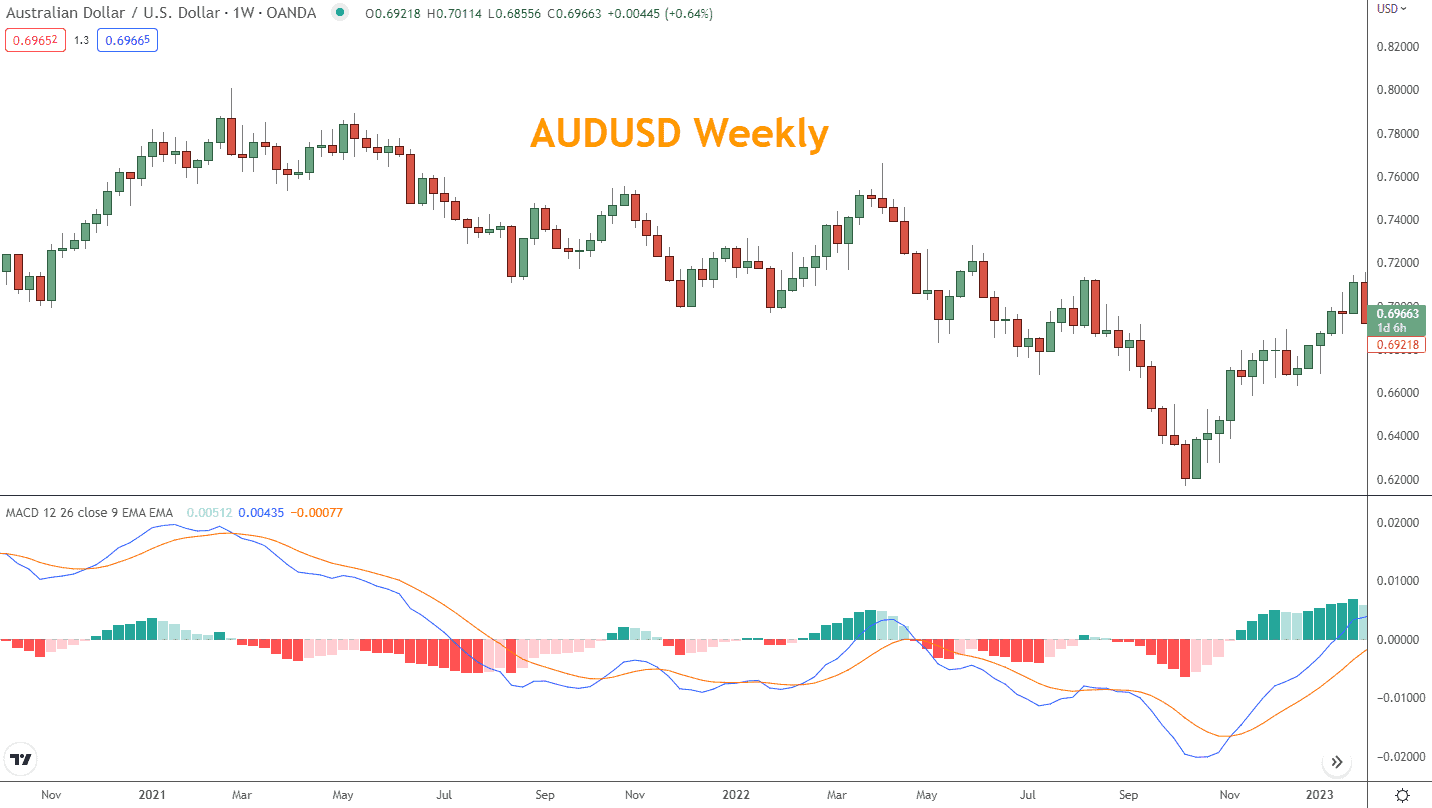

MACD (Moving Average Convergence/Divergence) Indicator

The MACD indicator illustrates the relationship between two moving averages with lines and bars (the bars are called a histogram).

The conventional settings of the two Moving Averages in the MACD indicator are 26 and 12. However, the MACD uses an Exponential Moving Average rather than a Simple Moving Average, placing more weight on recent price movements.

The logic associated with using exponential moving averages is that they can be more helpful since they reflect more recent price movements.

The MACD includes a scoring system with the EMA lines and histogram to help traders make trading decisions.

Strategies such as trading when lines cross each other or move above or below the “zero line” are common.

You can learn more about the MACD here: What is the MACD?

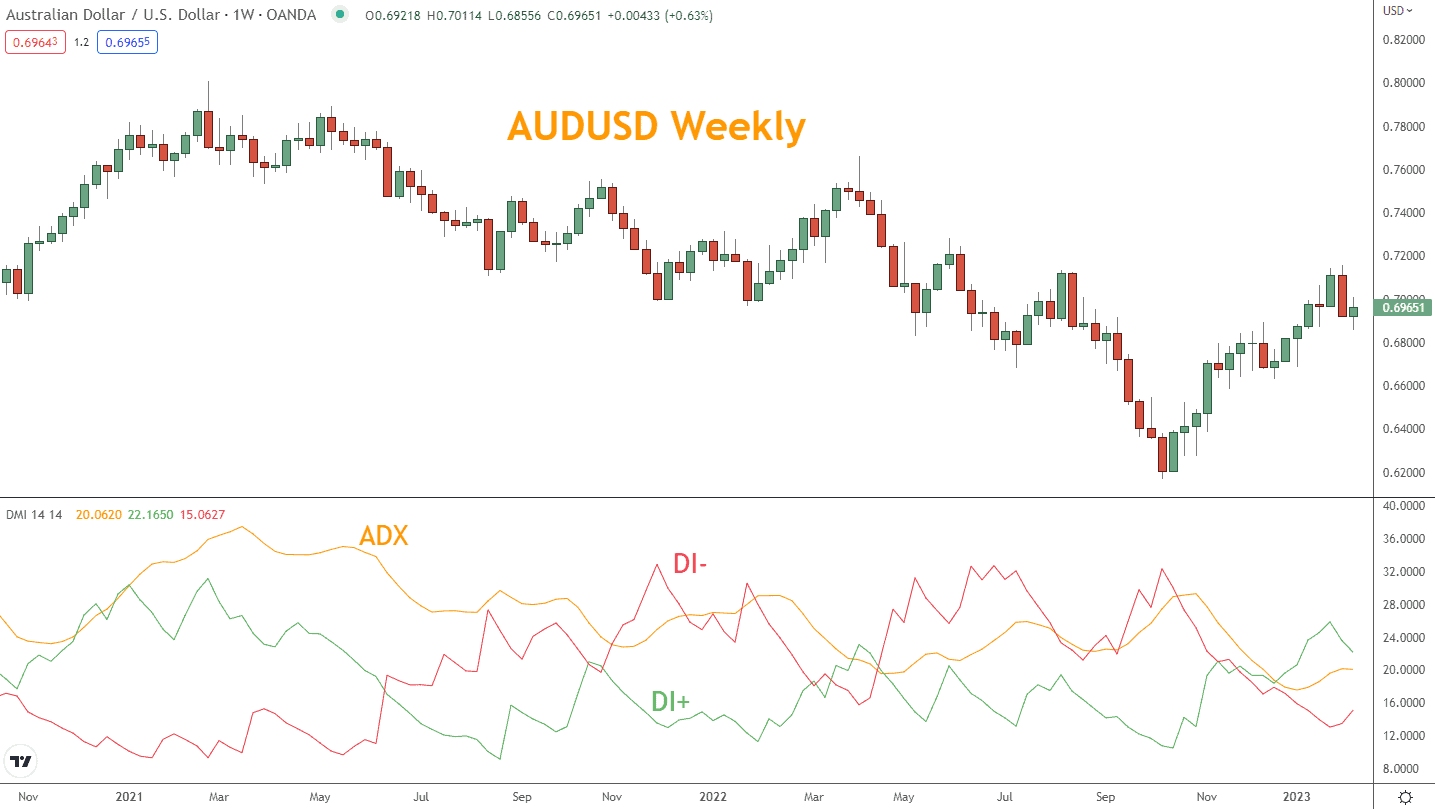

ADX (Average Directional Index)

The ADX indicator, like the MACD, sits outside the price chart and uses three lines to represent a Trend and Trend strength:

- ADX – this line represents the strength of a Trend

- DI+ – this line represents Bullish strength

- DI- – this line represents Bearish strength

A trader named Welles Wilder developed the ADX using Smoothed Moving Averages to derive the indicator lines.

The premise of the indicator is first to see the ADX establish that a Trend exists and then use the DI lines to determine if the Trend is Bullish or Bearish.

Like the MACD, the lines have an arbitrary scoring system that helps traders assess their meaning.

A typical strategy with this indicator is to trade if the ADX line rises above 25 and if one DI line crosses the other.

Traders have a variety of tactics built using these lines and their scoring levels to determine entries and Stop levels.

Learn more about the ADX here: ADX Indicator – Technical Analysis.

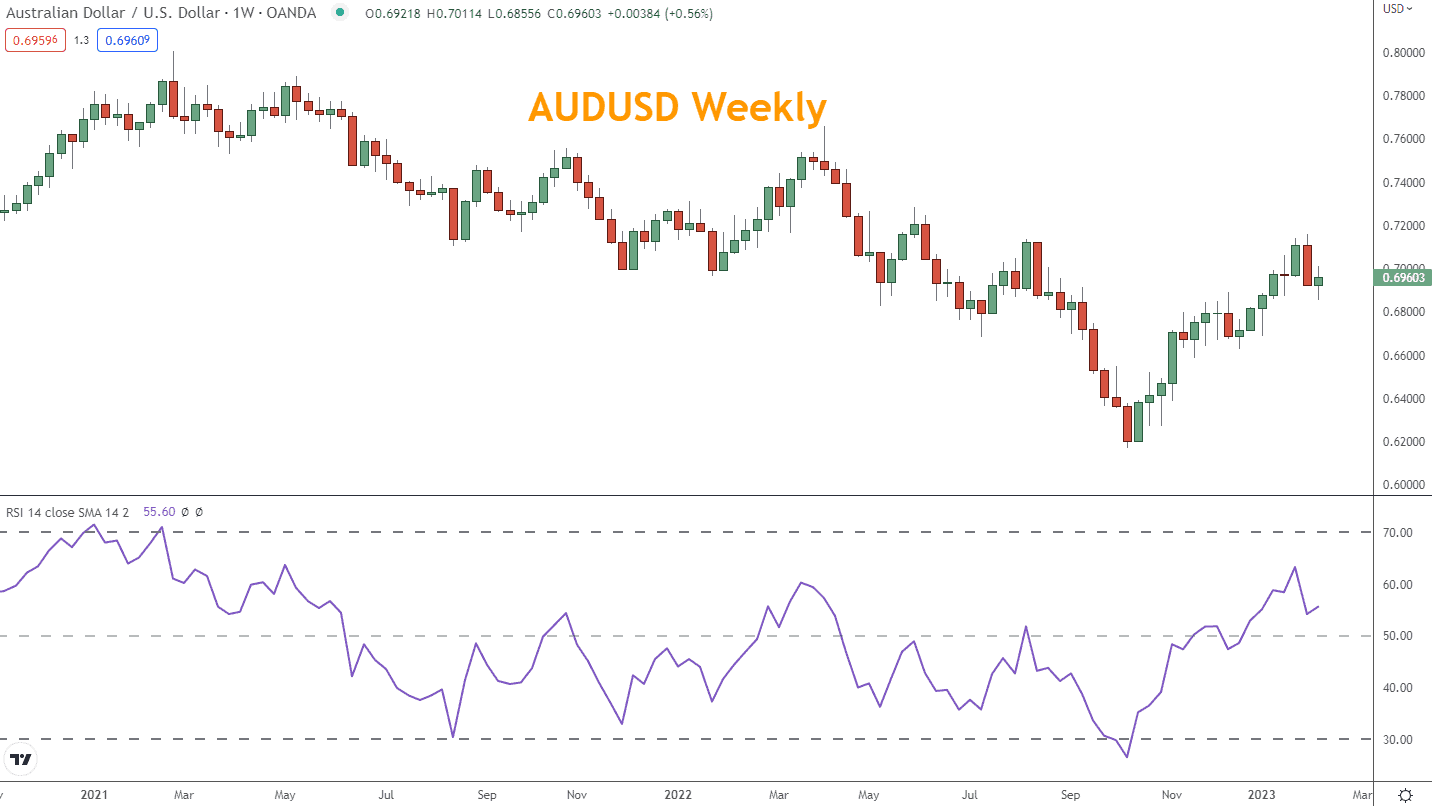

RSI (Relative Strength Index)

The RSI indicator is often cited in articles regarding Trend trading; however, it’s a Momentum indicator. Therefore, they are primarily used by day traders and swing traders to identify changes in Momentum.

This means the RSI line reacts to how quickly an instrument’s price changes and by how much as any Momentum indicator should.

Sitting outside the chart, the RSI is measured on a scale of 0-100. A score above 70 is considered Overbought, and below 30 is Oversold.

Aside from Overbought and Oversold, divergence is another popular day trading and swing trading strategy. If traders see price direction rising and the RSI moving lower, this “divergence” signals a potential reversal.

The opposite behavior is also considered valid, but this technique has a poor track record.

Learn more about the RSI here: Relative Strength Index.

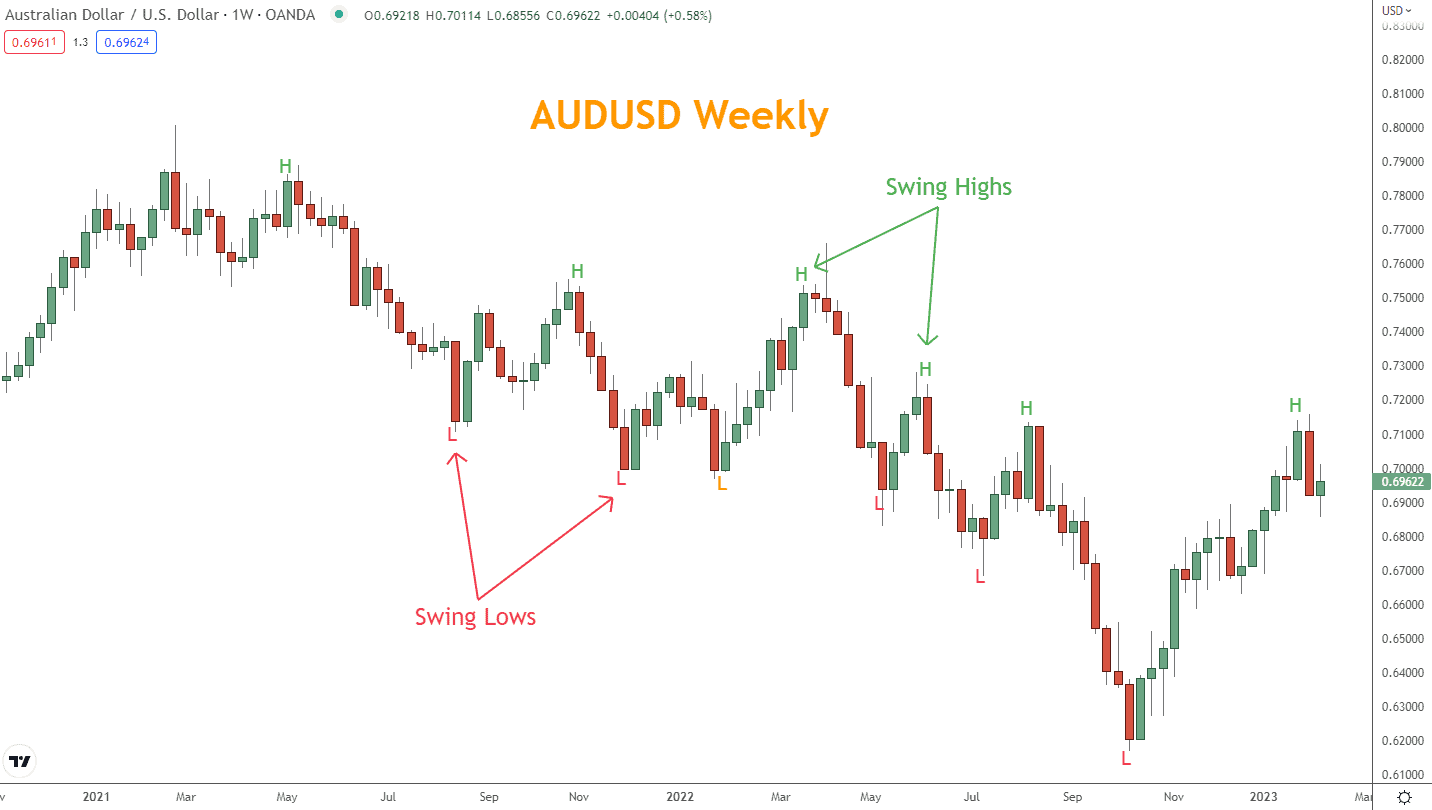

Swing Highs and Swing Lows

One alternative to moving average-based technical indicators is labeling Swing Highs and Lows on a price chart.

The concept is simple. Instrument prices rarely move in a constant direction but instead move in waves.

If prices are “waving up,” in Higher Highs and Higher Lows, traders can declare a Bullish Trend. Conversely, prices making Lower Highs and Lower Lows are in a Bearish Trend.

The challenge of this approach is subjectivity. Unlike indicators based on mathematical calculations, marking Swing Highs and Lows relies on the trader’s judgment.

Various factors can complicate where to label the Highs and Lows, such as candlestick shadows and the degree of difference between candles.

For example, will a difference of one pip on a forex chart constitute a new high? Isn’t market noise a factor in these decisions?

The biggest positive of using Swing Highs and Lows is the traders tuning into the market’s price action and seeing on the chart where traders are buying and selling and with how much conviction.

Traders will need a process to determine Swing Highs and Lows to make this an effective Trend-following tool.

Learn more about Swing Highs and Lows here: Swing High and Swing Low – A great way to trade the trends.

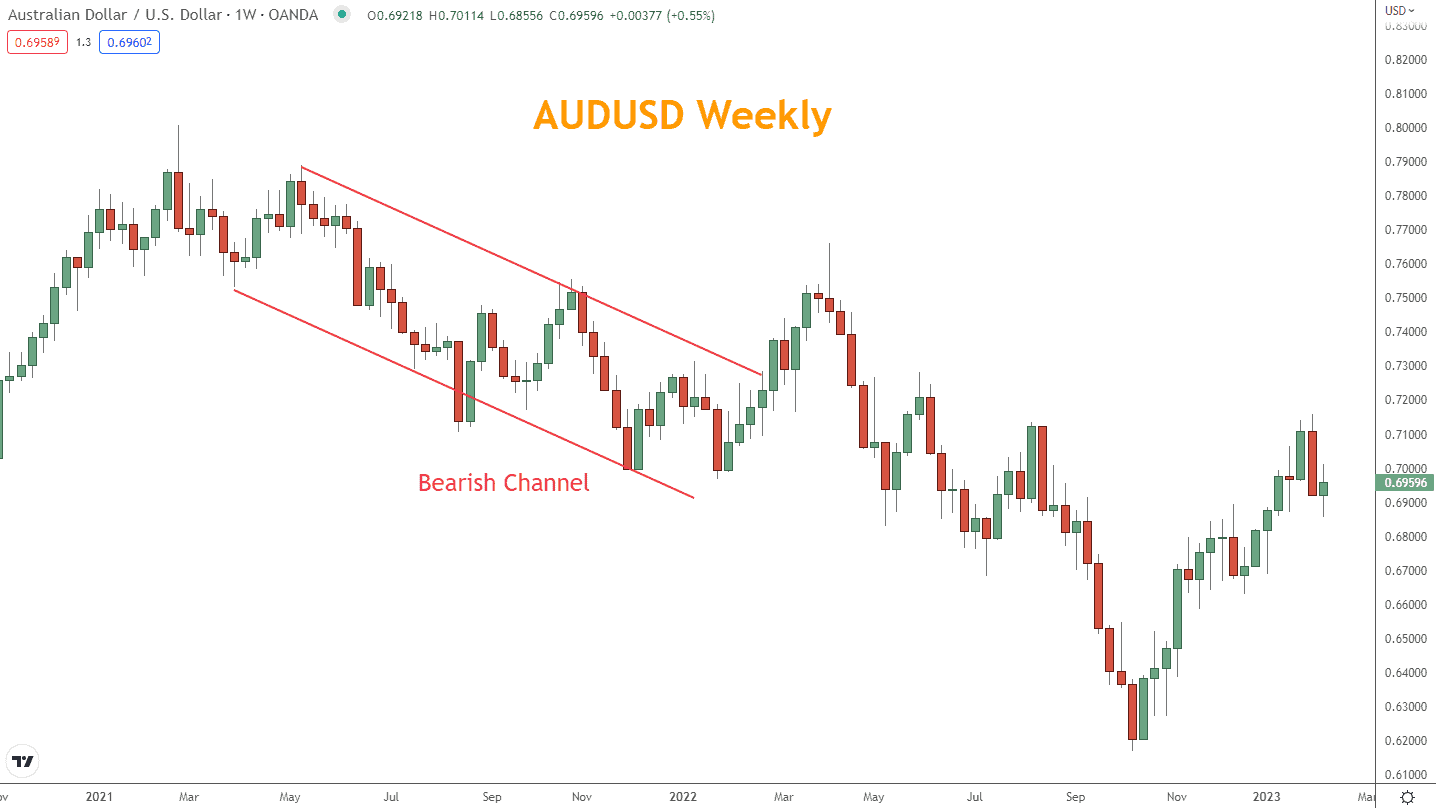

Channel Line or Trendline

Another subjective tool similar to labeling Swing Highs and Lows is drawing a Channel Line, also known as Trendline.

Examining a chart for its swings and connecting Highs to Highs and Lows to Lows, traders can draw “channels” where Trending prices are going.

For example, a channel drawn from highs to lows would be a bearish trend until prices move higher beyond the channel lines.

This move by prices from the channel would be considered a “breakout” and end the Bearish Trend.

Like labeling Swing Highs, the subjectivity of Channel Lines is inexact. Conventional trading tactics require three Bullish and Bearish “touches” to form a line.

These “touches” can be challenging to find or select, so late, the Trend is over before the channel is labeled.

Channels also suffer minor breaks by candlesticks and their shadows. What constitutes a break or not is difficult to determine.

Like Swing Highs, Channel Lines’ positive benefit is carefully tracking prices’ behavior, bringing traders closer to the “message of the market.” Making determinations of market intentions is highly beneficial in trading.

Short-Term vs. Long-Term Trading with Trends: Is There a Difference?

Can Trend trading occur in short-term trading (such as Day Trading or Swing Trading), or is it only available to long-term traders?

Does Trend reflect short-term fluctuations the same as long-term trends? To answer this question, the definition of a Trend is necessary.

Dictionary.com defines a Trend as “the general course or prevailing tendency.” As such, this definition requires another consideration.

For example, is it possible to have a general course or prevailing tendency in an hour?

We must consider that having a “general course or prevailing tendency” requires many market participants. Therefore, regardless of the market, we must consider the timeframe most traders (or investors) participate in.

In every market today, most trades are held by longer-term or Position traders. These traders have positions for over a week and sometimes months or years.

These longer-term traders could be funds or corporations hedging currency risk. They are also significant “whale” traders holding positions for extended periods.

The most famous story is about George Soros, who built a trading position against the British Pound, ultimately earning a one billion dollar profit. You can read the story here: How Soros Made A Billion Dollars And Almost Broke Britain.

Trend trading requires a longer-term strategy since, by definition, traders are trying to join the “general tendency or prevailing course” of an instrument that other longer-term traders control.

Short-term traders attempt to get in and out of positions within a prevailing Trend or a Countertrend. However, this tactic is riskier since you lose the benefit of trading with the market’s most significant players.

Do Trends Have Strength? Are There Strong Trends or Weak Trends?

One frequent point of confusion is the difference between Trend and Momentum. So first, let’s look at a definition of Momentum from dictionary.com: “force or speed of movement.”

While Trend describes the general direction of something, Momentum is about the energy of that direction.

There are different Trend types, but that has nothing to do with Momentum.

Unfortunately, too often, traders conflate these ideas with dire results.

Traders may think prices aggressively moving higher is evidence of a strong Trend. An instrument’s aggressive movements are experiencing Momentum, a shorter-term activity. Momentum can be strong or weak.

There are no strong or weak Trends. Momentum impacts Trend, but if the “general course or prevailing tendency” of an instrument’s price hasn’t changed, its Trend is still intact.

What Trading Strategies Work Best With Trends?

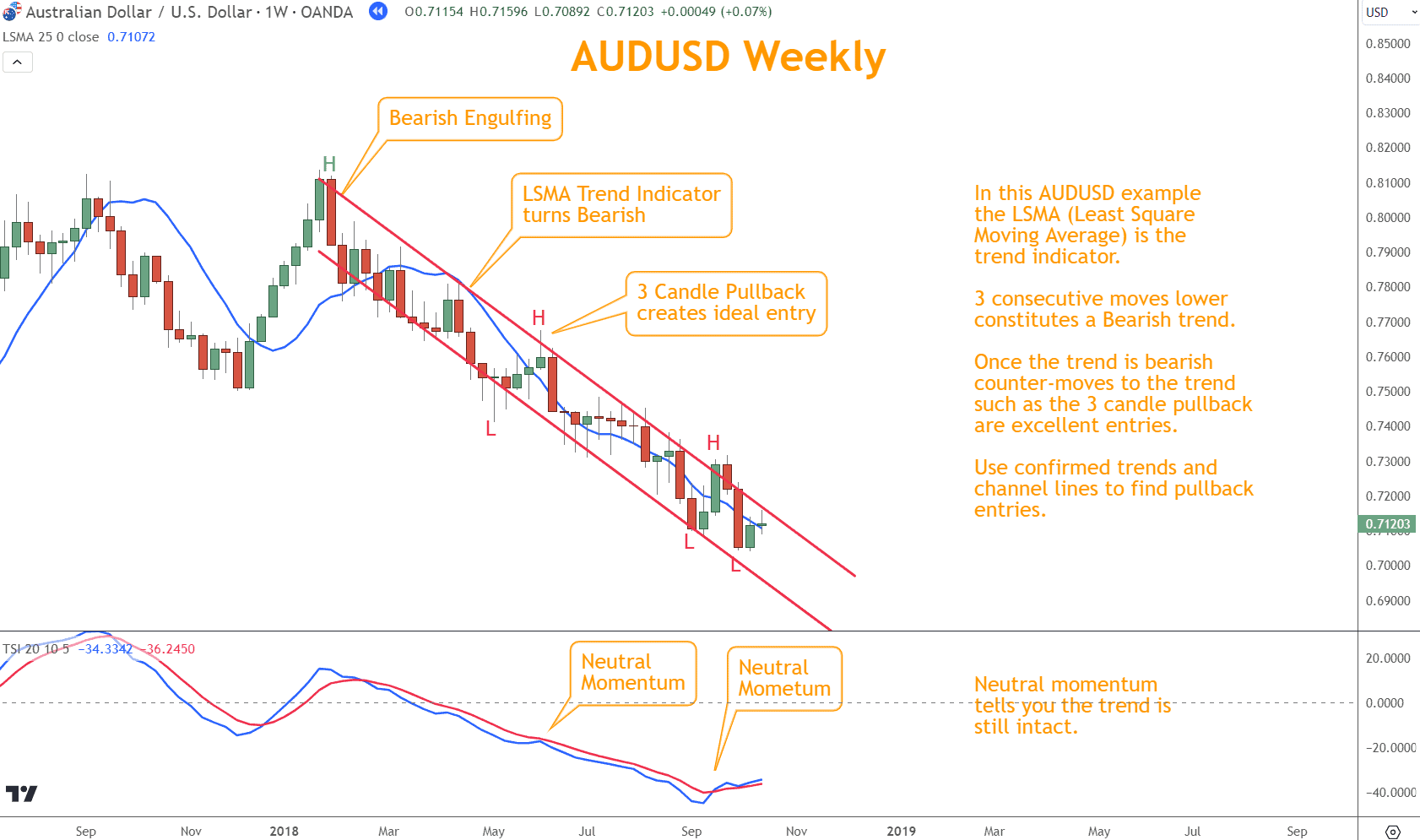

How to use Trends to Trade Pullbacks

Trading pullbacks is like catching a wave in the right direction, whether the market is going up (bullish) or down (bearish).

In a bullish market, when prices are generally going up, wait for a slight drop in prices as their chance to buy in at a better price.

It’s essential to figure out if this drop is just a short break in the upward trend or if it’s the beginning of prices going down for longer.

On the flip side, in a bearish market, where prices mostly fall, look for a slight rise to sell or bet against the market, hoping to make a profit when prices fall again.

In this AUDUSD example, the LSMA (Least Square Moving Average) is the trend indicator.

Using the Six Basics of Chart Analysis method, when the LSMA makes three consecutive moves lower, this constitutes a bearish trend.

Once the trend is bearish, counter-moves to the trend, such as the 3-candle pullback in early June, are excellent entries.

The entry is excellent because the LSMA points lower, and the TSI momentum indicator is neutral.

In addition, the last candle is a Shooting Star – a bearish reversal candle.

Use confirmed trends and channel lines to find pullback entries and achieve confirmation by combining them with momentum indicators such as the RSI or TSI.

Together, you can use this combination to find pullback entries in trends.

Using Trends to Trade Breakouts and Breakdowns

Trading breakouts and breakdowns by utilizing trends is about making timely moves.

A breakout or breakdown is possible when an instrument’s price exceeds a previously established price range in trading.

Breakout means prices are increasing, whereas a breakdown means prices go lower.

Success in this strategy requires careful market observation and an understanding of price history to differentiate between actual breakouts and misleading signals.

The goal is to enter the market as a trend is established and confirmed with other indicators, such as momentum.

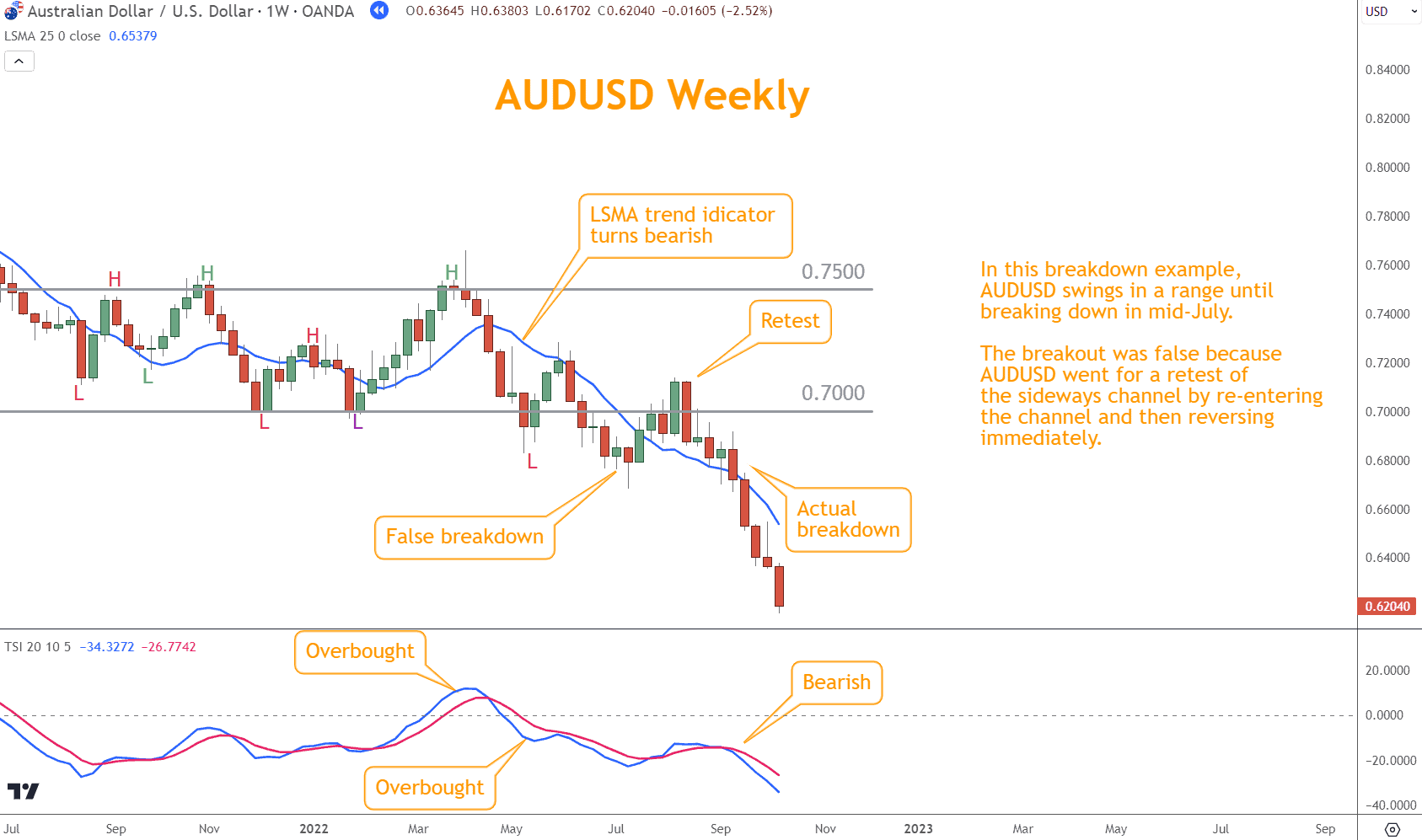

In the AUDUSD example below, prices remain in a range until July.

In mid-July, prices move lower, then reverse into the channel, retesting 0.7000.

When the retest is complete, AUDUSD moves lower and has an actual breakdown.

Trading breakouts and breakdowns require combining a trend indicator such as the LSMA, horizontal support and resistance, and a momentum indicator.

When all three suggest a breakdown or breakout, the key to success is finding the right stop level and corresponding position size.

Breakouts and breakdowns will often retest their previous support and resistance levels, and your trade strategy has to be ready to accommodate this.

False breakouts and breakdowns are typical in trading opportunities where the trend shifts from neutral to a direction.

These transitions are frequently noisy so be prepared to allow for it.

Does Trend Trading Work with Forex?

Trend trading indicators and techniques themselves need to be more efficient and effective. However, there are consistent problems across all the popular methods discussed.

Strategies built using Simple, Exponential, or other Moving Average approaches are usually too late getting into trades and too late getting out.

The lagging nature of these methods means traders will miss most good entries, and their exits will be later than ideal.

Even worse, some traders use Moving Averages as a moving stop.

However, since other market participants don’t see the Moving Average as a price reference, the Stop is random and ineffective.

A more complex Moving Average indicator is the MACD, but using two moving averages instead of one isn’t an improvement. All Moving Average indicators’ lagging nature applies to the MACD.

In addition, a common MACD strategy notorious for numerous false signals is a Divergence strategy. Traders compare the Moving Average peaks of the MACD to the instrument’s price.

If the two move in different directions, they take this as foreshadowing an impending reversal. But, unfortunately, this strategy needs a better track record of success.

The ADX indicator tries to combine Trend and Momentum but does poorly with both. The calculation it uses is complex but rarely creates positive results.

The complex calculations comparing rates of changes in highs and lows combined with a smoothing process don’t alleviate the primary problem of all moving average indicators, which is that they lag prices.

Rapid moves in prices or periods of consolidation wreak havoc with the accuracy and consistency of these indicators, and as a result, they can’t be traded alone.

Using Swing Highs and Lows to measure Trends brings a trader closer to the market’s psychology, which is better than tracking a Moving Average. But, even with that said, it is a poor tool for identifying trends.

Many traders’ tactics require at least three swing highs and lows to be recognized before confirming a trend. The first problem, as mentioned earlier, is the subjectivity associated with this approach.

The second problem is that this is too much price action to let go before making a trading decision and will result in too many missed or erroneous entries.

Applying Channel Lines to charts is similar to Swing Highs and Lows. However, adding lines based upon “Touches” brings the additional challenge of determining when prices break lines and which breaks are consequential.

Any of the described tools and techniques can be helpful in trading, but more is needed to reliably tell you about Trends or how to make a trading decision.

How Should Trends be Used in Trading?

Since establishing that Trends reflect the longer-term direction of prices, they are only valuable for longer-term trading, also known as Position Trading. Position Trading primarily focuses on weekly charts.

Shorter-term traders can use Trends by changing to higher timeframes and trading inside of Trends; however, this is a problematic practice.

The most challenging part is the inability to know when the Trend is changing and how it will affect short-term trading decisions.

If the Trend is entering a period of consolidation or sideways Trend on a weekly chart and a short-term trader assumes it will push prices higher as it has recently, their trades will fail.

Even Position traders need to be wary of Trend indicators and consolidations. These are situations where Trends can mislead traders, resulting in losses.

Ideally, traders combine Trends with other technical and fundamental indicators to better understand market psychology.

What Reversal Strategies Should Traders Combine with Trends?

Trend identification can be a helpful tool for any Position Trader and an excellent choice to start any analysis.

Combining Trends with techniques such as Momentum, Japanese Candlesticks, Chart Patterns, Support and Resistance Lines, and other tools will give any trader a more comprehensive view of any market.

Equally important is the combination of tools should enable traders to make trading decisions, including entries, exits, and position sizing.

Finally, an analysis should always include meaningful suggestions by analysts. Analysis without practical commentary only serves to confuse traders.

The Six Basics of Chart Analysis is an excellent combination of tools to start any analysis and is the technique advocated at positionforex.com.

What’s the Next Step?

Select a favorite forex pair and identify trend trading opportunities on a chart.

When you do, see if you can corroborate other indicators and how they all work together. Then, consider how you would use these together to find trading opportunities.

If you’re unsure how to find trading opportunities, learn the Six Basics of Chart Analysis, which you can download for free here.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about trend trading.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast is delivered weekly to your inbox and provides the following:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What is Trend Trading?

Trend trading is a strategy that focuses on identifying and following the market’s direction.

Traders look for consistent upward or downward price movements to decide when to buy or sell.

The idea is to capitalize on the market’s momentum by entering trades that align with the overall trend.

How can I Identify a Market Trend?

Traders often use technical analysis tools such as moving averages, trendlines, and price action to identify a market trend.

A trend is typically confirmed when prices consistently move in one direction over time.

Higher highs and higher lows mark upward trends, while lower highs and lower lows indicate downward trends.

What are the Best Tools for Trend Trading?

The best tools for trend trading include moving averages, trendlines, and momentum indicators like the Relative Strength Index (RSI) and the True Strength Indicator (TSI).

These tools help traders identify potential entry and exit points by highlighting trends and their strengths.