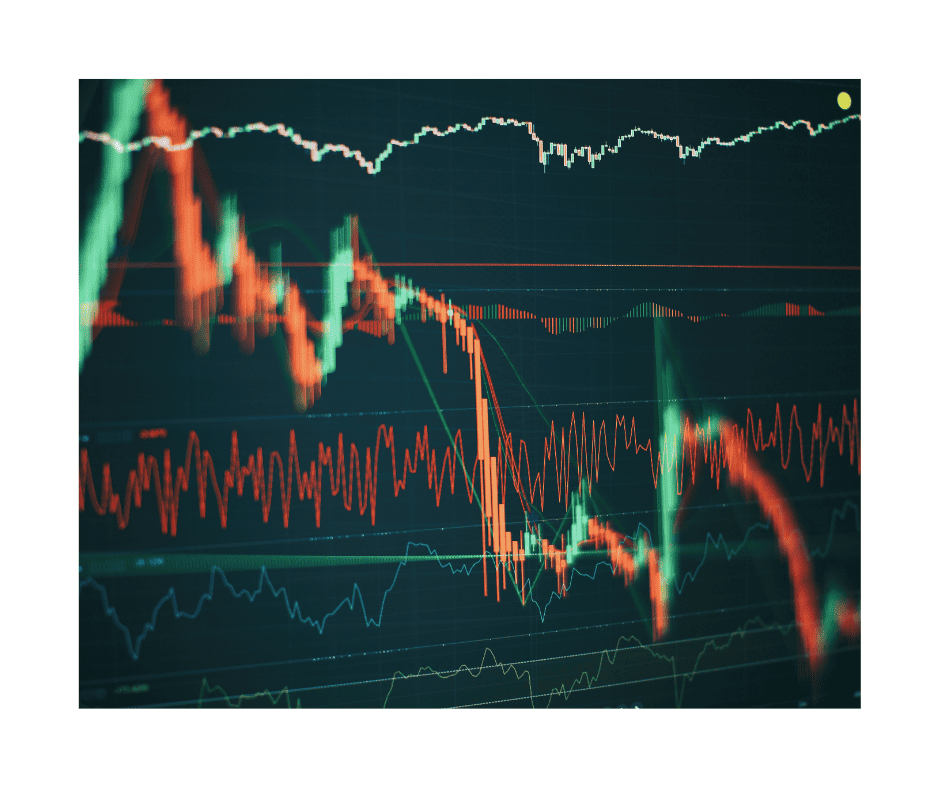

Participating in the Forex market promises excitement and potential profits but has its own “trading truths” you must consider.

To navigate this dynamic financial landscape effectively, you must internalize and apply these foundational principles.

These truths are indispensable guides, aiding you in making informed decisions and pursuing long-term success in Forex trading.

Can You Accept “There Are No Guaranteed Wins”?

You must accept the foundational trading truth that “There Are No Guaranteed Wins” is a fundamental concept.

It signifies that, in Forex trading, no strategy, system, or approach can assure you of a consistently positive outcome on every trade.

This uncertainty is primarily due to the unpredictable and ever-changing nature of the Forex market.

Forex trading involves many factors, such as economic indicators, geopolitical events, and market sentiment, all subject to constant fluctuations.

Even the most seasoned traders face losses at various points in their trading journey.

Acknowledge this reality as an essential trading truth you must accept.

Understanding this truth is vital because it prevents you from chasing after illusory guarantees or quick fixes.

Instead, it encourages a more realistic and pragmatic approach.

If you accept this truth, you are more likely to focus on aspects like risk management, trade analysis, and strategy development, which are essential in achieving long-term success in the Forex market.

Consistency and a disciplined approach, rather than the pursuit of guaranteed wins, become the cornerstones of a trader’s journey toward success.

Why is the Risk Management Trading Truth Paramount?

Controlling the risks involved in trading is crucial. Traders should pay attention to this critical pillar of trading principle.

It highlights the significance of protecting your capital and minimizing potential losses, recognizing that risk is an inherent part of trading.

Here, we delve deeper into why risk management is of utmost importance and how it shapes your trading journey:

- Capital Preservation: The primary goal of effective risk management is to safeguard your trading capital.

- It’s not about avoiding losses altogether, as losses are an inevitable part of trading, but rather ensuring that no single loss can wipe out a substantial portion of your account.

- By using stop-losses, setting a predefined risk percentage per trade, and avoiding over-leverage, you establish a safety net that allows you to stay in the game even after encountering losses.

- Longevity in Trading is a crucial aspect of the trading truth that emphasizes the importance of sustaining a trading career over the long term.

- Achieving longevity in trading is not just about surviving in the market but thriving and consistently growing your account.

- Staying Power: Forex trading is not a get-rich-quick scheme. It’s a profession that requires resilience and patience.

- Many traders start with high expectations but exit the market prematurely due to impatience or unsustainable risk-taking.

- Longevity in trading means having the staying power to weather market fluctuations, learn from losses, and refine your strategies over time.

- Continuous Learning: To have longevity in trading, you must embrace the concept of lifelong learning.

- The Forex market evolves continuously. Staying updated with market news, economic events, and changing trading techniques is essential.

- Dedicate time to enhancing your knowledge and skills, and be open to adapting to changing market conditions.

- Risk Management: Effective risk management leads to longevity in trading.

- Traders prioritizing capital preservation and risk control are more likely to survive and thrive over the long term.

- Protecting your capital and avoiding reckless risk-taking ensures that a series of losses doesn’t wipe out your trading account.

- Building Confidence: As you gain experience and achieve small, consistent wins over time, you’ll build confidence in your trading abilities.

- This confidence can be a valuable asset in maintaining longevity.

- It helps you stick to your trading plan, resist impulsive decisions, and focus on your long-term goals.

- Psychological Resilience: Longevity in trading often requires a strong psychological foundation.

- Market fluctuations can be emotionally challenging, and maintaining mental resilience is essential.

- Setting Realistic Expectations: Having realistic expectations is critical to achieving longevity.

- Understand that losses are part of trading, and instant wealth is not the goal.

- Setting achievable goals and maintaining a balanced perspective can help you avoid frustration and maintain a long-term outlook.

Achieving longevity in trading is about adopting a sustainable approach that values continuous learning, adaptability, risk management, and psychological resilience.

It means being in the market for the long haul, embracing successes and setbacks as opportunities for growth, and staying committed to your trading journey over time.

By doing so, you increase your chances of achieving enduring success in the Forex market.

Success Requires Emotional Control

Emotional truths in trading refer to the profound impact of emotions on your decision-making process and overall success.

Understanding and managing these emotional truths is essential to navigating the financial markets effectively.

Here are emotional truths you should be aware of:

- Emotions Are Inevitable: The first emotional truth is that emotions are integral to trading.

- Whether it’s excitement, fear, greed, or frustration, every trader experiences emotions during their journey.

- Recognizing this fact is crucial because it allows you to anticipate emotional responses and work on managing them.

- Greed and Fear Drive Markets: Two primary emotions, greed and fear, are significant in driving market movements.

- Greed can lead to chasing profits, taking excessive risks, and ignoring potential warning signs.

- On the other hand, fear can result in premature exits, missed opportunities, and irrational decision-making.

- You need to acknowledge these emotions and learn to control them.

- Emotional Discipline Is Essential: Emotional discipline is the ability to make rational decisions in the face of emotional turmoil.

- You will be more successful if you prioritize emotional discipline.

- Stick to your trading plan, set predefined entry and exit points, and avoid impulsive actions driven by emotions.

- This discipline helps you maintain a consistent and objective approach to trading.

- Overtrading Can Be Detrimental: Emotional impulses can lead to overtrading, which is entering too many trades or risking too much capital.

- Often, overtrading stems from the desire to recoup losses quickly or capitalize on perceived opportunities. It can deplete your trading account and lead to significant setbacks.

- Recognizing this emotional trap is essential for avoiding it.

- Trading Psychology Matters: Trading psychology is a field of study that focuses on understanding how emotions impact trading decisions.

- Many successful traders invest time in improving their trading psychology.

- Techniques such as mindfulness, meditation, and keeping a trading journal can help traders better control their emotions and decision-making.

- Learning from Mistakes: Emotions often accompany trading mistakes and losses.

- The emotional truth here is that these setbacks can be valuable learning opportunities.

- If you accept and analyze your mistakes objectively, you can grow from these experiences.

- In trading, coping with losses and setbacks is critical to emotional maturity.

- Emotional Support: Trading can be a solitary endeavor, but emotional support from peers or mentors can be immensely valuable.

- Discussing your experiences and challenges with others who understand the emotional aspects of trading can provide insight and encouragement.

- It can also help you maintain a balanced perspective during winning and losing streaks.

- Maintaining Emotional Resilience: Emotional resilience is the ability to bounce back from losses and setbacks.

- It’s an emotional truth that not every trade will be a winner, and losses are part of the game.

- Building emotional resilience allows you to persevere during difficult times and continue trading with a clear mind and focused strategy.

Emotional truths are an essential aspect of trading that can significantly impact a trader’s success.

Acknowledging the role of emotions in your trading journey and working on emotional discipline and resilience are essential steps toward becoming a more effective trader.

By understanding and managing your emotions, you can make better decisions, reduce impulsive actions, and increase your overall trading success.

How Does the Trading Truth of Diversification Protect Your Trading?

Diversification is a critical trading truth you must grasp and implement in your strategy.

It’s the practice of spreading your trades across different instruments to reduce risk and enhance the potential for long-term profitability.

Let’s dig deeper into the significance of diversification in trading:

- Risk Mitigation: One of the primary reasons for diversification is risk mitigation.

- Not putting all your capital into a single asset or trade decreases the likelihood of significant losses that could wipe out your trading account.

- Different assets may react differently to various market conditions, and diversifying helps balance your risk exposure.

- Market Volatility: Financial markets are inherently volatile. Prices can fluctuate rapidly due to many factors, from economic data releases to geopolitical events.

- Diversifying your portfolio can help buffer the impact of these price swings.

- When one asset faces a downturn, others may remain stable or even rise, mitigating potential losses.

- Asset Correlation: Diversification is most effective when the Forex pairs in your portfolio are not highly correlated.

- Correlation refers to the degree to which two or more assets move with each other.

- You can achieve a more balanced and risk-efficient portfolio by including assets with low or negative correlations.

- Reducing Concentration Risk: Tying up a significant portion of your capital in a single asset or a few highly correlated assets creates concentration risk.

- While this approach can lead to substantial gains if the asset performs well, it exposes you to significant losses if it underperforms or experiences adverse events.

- Diversification reduces concentration risk, making your portfolio more resilient.

- Opportunity for Gains: Diversification not only mitigates risk; it also provides opportunities for gains.

- Trading in a range of Forex pairs increases the likelihood of capturing profitable opportunities across different conditions.

- Even if some trades underperform, others may thrive, contributing to overall account growth.

- Long-Term Perspective: Diversification is especially valuable for traders with a long-term perspective.

- While short-term traders may focus on specific instruments, long-term traders benefit from diversification as it reduces the impact of short-term volatility and market noise.

- Research and Due Diligence: Effective diversification demands research and due diligence.

- You need to evaluate different currency pairs, understand their historical performance, and assess their potential for future growth or stability.

- It’s not about spreading your capital randomly but making informed decisions about where to allocate your resources.

It’s a proactive approach to reducing risk while maintaining the potential for profits.

By spreading your trades across various Forex pairs, you can create a more resilient portfolio that can withstand market fluctuations and increase your chances of achieving your trading objectives.

The Trading Truth of Consistency and Confidence

Your consistency and confidence are two vital aspects of successful trading, and they often go hand in hand.

Consistency

Consistency refers to adhering to a well-defined trading plan and strategy over time.

It’s one of the pillars of profitable trading because it minimizes the impact of impulsive decisions, emotional reactions, and random fluctuations in your results.

Here’s why consistency is crucial:

- Objective Decision-Making: Consistency encourages you to make decisions based on your predetermined strategy rather than reacting emotionally to short-term market fluctuations.

- This objective approach helps maintain a clear and focused mindset.

- Risk Management: If consistent, you are likelier to apply sound risk management practices in every trade.

- Use stop-losses, set position sizes according to risk tolerance, and avoid taking excessive risks.

- This disciplined approach helps protect your capital.

- Learning and Improvement: Consistency allows you to gather data over time, which can be invaluable for evaluating your trading performance.

- By consistently following a trading plan, you can analyze what works and what doesn’t, leading to continuous improvement.

- Reduced Emotional Impact: Emotional ups and downs are part of trading, but consistency can help mitigate their impact.

- When you stick to a predefined plan, emotions are less likely to dictate your actions, leading to a more rational and controlled trading experience.

Confidence

Confidence is the belief in your trading abilities and your chosen strategy.

It’s not about overconfidence, which can lead to reckless trading, but a healthy self-assurance from experience and a well-tested approach.

Here’s why confidence matters:

- Sticking to the Plan: If you’re confident, you are likelier to stick to your trading plan because you trust your strategy.

- You understand that losses are part of the process, and don’t abandon your plan when you encounter setbacks.

- Discipline: Confidence is closely related to discipline. When you have confidence in your strategy, you’re more disciplined in executing it consistently.

- You don’t second-guess your decisions or let fear and doubt paralyze you.

- Resilience: Confidence helps you bounce back from losses and setbacks.

- Instead of dwelling on past mistakes, you will focus on the next opportunity and remain resilient in adversity.

- Mental Clarity: Confidence contributes to mental clarity, essential for effective decision-making.

- When you’re confident in your strategy, you’re less likely to be swayed by external noise or emotions that can cloud your judgment.

- Positive Feedback Loop: Confidence can create a positive feedback loop.

- Successful trades bolster your confidence, leading to more disciplined trading, which, in turn, increases the likelihood of success.

- This cycle can lead to consistent profitability.

Consistency and confidence are intertwined elements of successful trading.

Consistency allows you to stick to a well-thought-out trading plan and strategy, while confidence empowers you to execute that plan with discipline and resilience.

Conclusion

In conclusion, trading in the Forex market can be challenging but rewarding.

Acknowledging and embracing these trading truths can position you for success.

Remember that there are no shortcuts to riches in trading; it requires a combination of education, discipline, and patience to achieve your financial goals.

With the right mindset and a commitment to continual improvement, you can trade the Forex market with confidence and skill.

What’s the Next Step?

Think about your trading habits and patterns and how they compare to the “trading truths” discussed here.

In addition, consider how your “truths” influence your habits and technical strategy.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about trading truths.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What Are Forex Trading Truths?

Forex trading truths are fundamental principles and concepts you should understand and embrace.

They serve as guiding principles in the Forex market, helping you make informed decisions and navigate the complexities of trading effectively.

Why Are Trading Truths Important?

Trading truths are essential because they provide a realistic and practical framework for operating within.

They help you manage risk, make rational decisions, and maintain emotional discipline, ultimately increasing the likelihood of long-term success.

Is There Really No Guaranteed Win in Forex Trading?

That’s correct. There are no guaranteed wins in Forex trading. The Forex market is highly unpredictable and influenced by a multitude of factors.

Even the most experienced traders can experience losses. Focusing on risk management and a well-structured trading plan is crucial instead of seeking guaranteed wins.

How Can I Improve Emotional Control in Trading?

Improving emotional control in trading requires self-awareness and practice.

You can develop emotional discipline by sticking to your trading plan, using stop-losses, avoiding impulsive decisions, and adopting techniques like mindfulness and meditation to manage stress and emotions effectively.

Can I Achieve the Trading Truth of Longevity in Trading?

Yes, achieving longevity in trading is possible. It involves adopting a disciplined and patient approach to trading, continuously learning and adapting to market changes, and practicing effective risk management.

Doing so increases your chances of staying in the market and working towards long-term success.