A trading edge in Forex trading is the ultimate goal for traders focused on success.

Forex trading, or foreign exchange trading, is a complex and dynamic market where currencies worldwide are bought and sold.

To find a trading edge in Forex is essential for entering this exciting and potentially lucrative arena.

This article will explore strategies and principles to help new and experienced traders find a trading edge in the Forex market.

How to Find a Trading Edge in Forex With a Trading Plan?

In Forex trading, meticulous planning sets the stage for success.

Define your objectives: Do you seek steady income, capital growth, or risk mitigation?

Assess your risk tolerance honestly, determining the amount you’re willing to risk per trade and your overall capital loss threshold.

Choose your trading style based on your personality, time commitment, and risk tolerance.

Let’s examine the details in formulating a Forex trading plan:

- Define Your Goals and Objectives: Set clear and realistic goals for your Forex trading.

- What do you want to achieve?

- Are you aiming for steady income, capital growth, or risk mitigation?

- Having specific objectives helps you stay focused and motivated.

- Determine Your Risk Tolerance:

- Assess your risk tolerance honestly.

- Ask yourself how much you are willing to risk on each trade and how much overall capital you can afford to lose without affecting your financial stability.

- Your risk tolerance should guide your position sizing and risk management strategies.

- Choose Your Trading Style: Decide your preferred style based on your personality, time commitment, and risk tolerance.

- Common trading styles include:

- Day Trading: Opening and closing positions within the same trading day.

- Swing Trading: Holding positions for several days or weeks to capture more significant price movements.

- Position Trading: Maintaining positions for weeks, months, or even years based on long-term trends.

- Common trading styles include:

- Select Currency Pairs and Timeframes: Identify the currency pairs you will focus on and the timeframes you will trade.

- Different pairs and timeframes may require unique strategies and analysis methods.

- Define Entry and Exit Criteria:

Your trading plan should include specific criteria for entering and exiting trades, including technical indicators or fundamental analysis.

Knowing when to enter and exit a trade eliminates guesswork and emotional decision-making.

- Set Stop-Loss and Take-Profit Levels: Determine where to place stop-loss to limit potential losses and take-profit levels to secure profits.

- These levels should align with your risk-reward ratio and overall trading strategy.

- Establish Risk Management Rules: Implement strict risk management rules, such as never risking more than a certain percentage of your trading capital on a single trade.

- Adhering to these rules is crucial for preserving your capital over the long term.

- Create a Trading Schedule: Develop a schedule that aligns with your chosen trading style and timeframes.

- Consistency is critical. Stick to your schedule, and avoid overtrading or trading during emotional moments.

- Monitor and Review Your Plan:

- Regularly monitor your trading performance and review your plan to make necessary adjustments.

- Identify what’s working and what needs improvement. Adjust your plan as market conditions change.

- Maintain Emotional Discipline: Emotional discipline is the cornerstone of successful trading.

- Stick to your trading plan, even when faced with losses or unexpected market events.

- Emotions like fear and greed can lead to impulsive decisions that erode your trading edge.

A well-structured trading plan acts as your roadmap in the Forex market.

It keeps you grounded, focused, and disciplined, which is crucial to find a trading edge.

Consistency, continuous learning, and adaptability are essential for refining and optimizing your trading plan.

Develop a Trading Edge in Forex Through Risk Management

Risk management safeguards your capital and ensures that you can continue to trade effectively even in the face of losses.

This section delves into the critical aspects of risk management, including position sizing, stop-loss orders, and the preservation of trading capital.

Let’s examine the components of risk management:

- Determine Your Risk Tolerance: Assessing your risk tolerance is the first step in effective risk management.

- Ask yourself how much you will risk on each trade without feeling undue stress.

- Your risk tolerance should align with your financial situation and emotional resilience.

- Position Sizing: Position sizing determines the capital allocated to each trade.

- A common rule of thumb is to risk at most 2% of your trading capital on a single trade.

- This tactic prevents a series of losing trades from devastating your account.

- Use Stop-Loss Levels: Identifying stop-loss levels is crucial.

- A stop-loss is a predefined price level at which you will close your trade to limit potential losses.

- Set your stop-loss levels based on your trading strategy, risk-reward ratio, and the market’s volatility.

- Diversify Your Trades:

- Avoid putting all your capital into a single trade or currency pair.

- Diversify your trades across different currency pairs to spread risk.

- Diversification reduces the impact of a losing trade on your overall portfolio.

- Avoid Over-Leveraging: While leverage can amplify profits, it also magnifies losses.

- Be cautious with leverage, and avoid over-leveraging your positions.

- Using too much leverage can wipe out your trading account quickly.

- Risk-Reward Ratio:

- Determine a suitable risk-reward ratio for each trade.

- A standard ratio is 1:2 or 1:3, where you aim to make two or three times your initial risk.

- A favorable risk-reward ratio can compensate for a series of losing trades with fewer winning trades.

- Determine a suitable risk-reward ratio for each trade.

- Avoid Revenge Trading: Revenge trading occurs when you try to recoup losses quickly by taking impulsive trades. It often leads to further losses.

- Stick to your trading plan and avoid the temptation to chase losses.

- Monitor and Adjust:

- Regularly monitor your risk management strategies and adapt them as needed.

- As your trading account grows or market conditions change, you may need to adjust your position sizes and risk-reward ratios.

- Maintain Discipline: Emotional discipline is at the core of risk management.

- Fear and greed can lead to impulsive decisions that deviate from your risk management plan.

- Stick to your predefined risk parameters and avoid emotional trading.

- Preserve Capital:

- The primary goal of risk management is to preserve your trading capital.

- Protecting what you have is more important than chasing unrealistic gains.

- By limiting losses, you ensure that you can continue trading and have the opportunity to grow your capital over time.

- Consider Drawdown Limits: Some traders set drawdown limits, determining the maximum percentage of capital they will lose in a specific period.

- They temporarily stop trading to reassess their strategy once they reach this limit.

Effective risk management is not just about avoiding losses; it’s about creating a sustainable trading plan that allows you to find a trading edge in Forex.

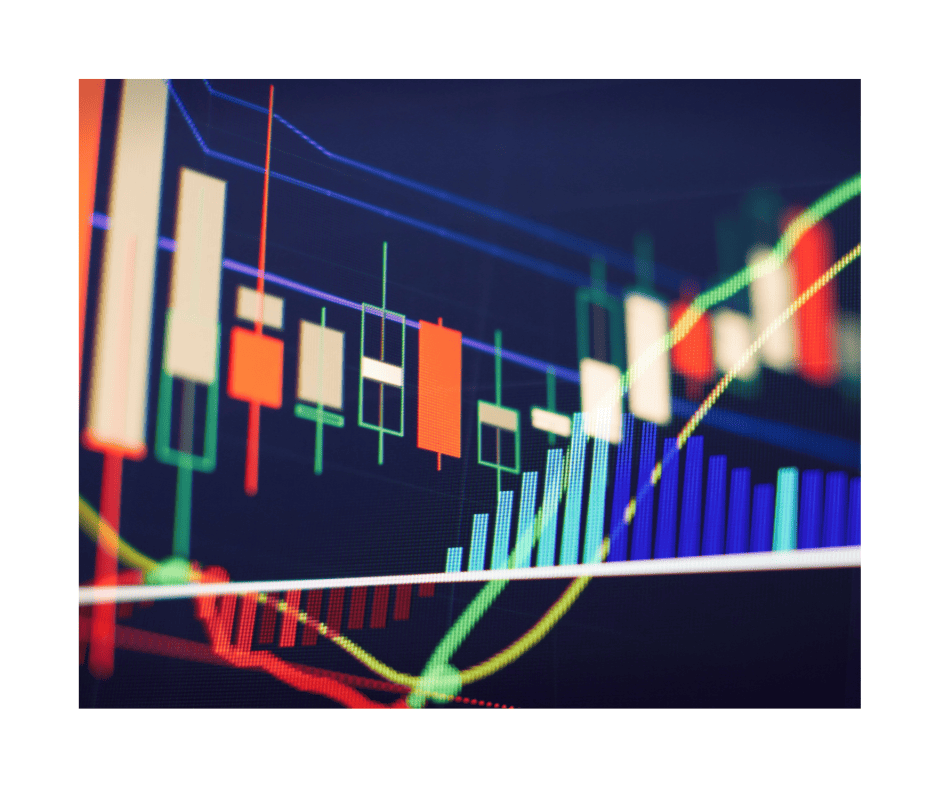

Can Technical Analysis Find a Trading Edge in Forex?

Technical analysis is vital to find a trading edge in Forex.

It involves studying historical price charts and patterns to predict future price movements.

Here are vital aspects to consider when using technical analysis:

- Study Price Charts: Begin by familiarizing yourself with different types of price charts, such as candlestick charts, line charts, and bar charts.

- Candlestick charts are widely used in Forex trading because they provide detailed information about price movements.

- Identify Trends: One of the primary goals of technical analysis is to identify trends in currency pairs.

- Trends can be upward (Bullish), downward (Bearish), or sideways (range-bound).

- Understanding the current trend is crucial for making trading decisions.

- Support and Resistance Levels:

- Support levels are price levels where a currency pair tends to find buying interest, preventing it from falling further (for Bullish trades).

- Resistance levels are where selling interest emerges, preventing upward movement (for Bullish trades).

- Identifying these levels helps you make strategic entry and exit decisions.

- Technical Indicators: Technical indicators are mathematical calculations based on price, volume, or open interest data.

- Common indicators include Moving Averages, Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands.

- These indicators can provide insights into market momentum, trend strength, and potential reversal points.

- Chart Patterns:

- Chart patterns, such as head and shoulders, double tops, double bottoms, and flags, can signal potential reversals or continuations.

- Recognizing these patterns on price charts can help you anticipate future price movements.

- Japanese Candlestick Patterns: Japanese candlestick patterns offer insights into market sentiment and potential reversals.

- Patterns like doji, hammer, and engulfing patterns can provide clues about the direction of future price movements.

- Use Technical Analysis in Conjunction with Fundamental Analysis: While technical analysis focuses on price data, it is essential to use it with fundamental analysis.

- Fundamental factors, such as economic data, geopolitical events, and interest rates, can impact currency prices.

- Combining both analyses can provide a more holistic view of the market.

- Continuous Learning: The field of technical analysis is vast, and there are always new techniques and tools to explore.

- Stay committed to continuous learning and keep up with developments in technical analysis to refine your skills.

- Risk Management: Forex trading has no guarantees, even with technical analysis.

- Implement strong risk management practices to protect your capital, including setting stop-loss orders and managing position sizes.

Technical analysis is a valuable skill that requires practice and experience to master.

It can help you make more informed trading decisions, but using it as part of a comprehensive trading strategy that includes risk management and fundamental analysis is essential.

Can Economic Events Find a Trading Edge in Forex?

Staying informed about economic events is essential to successful Forex trading.

By watching economic calendars and news events, you can make more informed decisions and seize opportunities in this dynamic and ever-changing financial landscape.

- Economic Calendars: Economic calendars are essential tools for Forex traders.

- These calendars provide schedules of upcoming economic events, including economic data releases, central bank announcements, and geopolitical developments.

- Websites and trading platforms often offer free access to economic calendars.

- Key Economic Indicators: Familiarize yourself with key economic indicators significantly impacting currency markets.

- These include:

- Interest Rates: Central banks set interest rates, which can influence the attractiveness of a currency for investors.

- Gross Domestic Product (GDP): GDP measures a country’s economic performance and can signal overall economic health.

- Employment Data: Reports on unemployment rates and job creation can affect currency values.

- Inflation Data: Inflation rates can impact purchasing power and central bank policies.

- Trade Balance: The balance between a country’s exports and imports can affect its currency’s value.

- Political Events: Elections, policy changes, and geopolitical tensions can impact currency significantly.

- These include:

- Focus on Major Economies:

- While events in smaller economies can also impact Forex markets, major economies like the United States, the Eurozone, Japan, and China tend to have the most substantial influence.

- Keep a close eye on economic events in these regions.

- Central Bank Announcements:

- Central banks play a pivotal role in Forex markets.

- Pay attention to central bank statements, decisions on interest rates, and monetary policy changes.

- The tone and direction of central bank policies can significantly affect currency values.

- News and Analysis: Regularly read financial news and analysis from reputable sources.

- Financial news outlets, economic publications, and dedicated Forex news websites can provide valuable insights into market sentiment and upcoming events.

- Economic Reports Release Times:

- Be aware of the release times of economic reports.

- Major economic indicators typically have set release schedules, and market volatility can increase around these times.

- Adjust your trading schedule accordingly.

- Historical Data:

- Study historical data and market reactions to past economic events.

- Understanding how specific releases have impacted currencies in the past can help you anticipate future market movements.

- Sentiment Analysis:

- Sentiment analysis involves gauging market sentiment based on news and social media sentiment indicators.

- Some traders use sentiment analysis tools and platforms to assess market sentiment and potential trading opportunities.

- Fundamental and Technical Analysis: Combine fundamental analysis with technical analysis.

- While fundamental analysis focuses on economic events, technical analysis helps you time your trades and identify entry and exit points.

- Stay Updated in Real-Time: Use technology to stay updated in real-time.

- Many trading platforms offer news feeds and economic event alerts. These can help you react quickly to market-moving news.

Staying informed about economic events is an ongoing process in Forex trading.

If you Practice with a Demo Account it Will Help Find a Trading Edge in Forex

Practice develops proficiency in Forex trading, and a demo account is your virtual training ground.

A demo account is where novice traders sharpen their abilities, and experienced traders refine their techniques—making it indispensable for gaining a trading edge.

- Understanding Demo Accounts: A demo account, or paper trading account, is a virtual trading platform most Forex brokers provide.

- It allows traders to practice trading with virtual funds that simulate real-market conditions.

- The primary purpose of a demo account is to gain experience and build confidence without risking real money.

- Learning the Trading Platform: Before executing trades with real money, it’s vital to become proficient with the trading platform offered by your broker.

- Demo accounts provide a risk-free environment to learn how to use the platform’s features, place orders, set stop-loss and take-profit levels, and navigate the interface.

- Developing Trading Strategies: Demo accounts are ideal for developing and refining trading strategies.

- Traders can test different trading styles, such as day trading, swing trading, or scalping, without the pressure of real financial consequences.

- Experiment with various indicators and entry/exit strategies to find the best one.

- Risk-Free Environment: Trading with a demo account eliminates the fear of losing real money.

- This psychological freedom allows traders to focus on learning and improving their skills without the emotional stress often accompanying live trading.

- Tracking Progress:

- Use a demo account to track your trading progress.

- Keep records of your trades, including entry and exit points, reasons for the trade, and outcomes.

- Reviewing your trading journal helps you identify areas for improvement and measure your growth as a trader.

- Building Confidence: Confidence is a critical element of successful trading.

- Practicing with a demo account helps build confidence in your trading strategies and decision-making abilities.

- As you witness your strategies succeeding in simulated trades, you gain the self-assurance needed for live trading.

- Transition to Live Trading: Once you’ve gained sufficient experience and consistently demonstrated profitability in a demo account, consider transitioning to live trading with real capital.

- Start with a smaller account size to minimize risk and gradually increase your trading size as you gain more confidence.

- Continuous Learning: Even after transitioning to live trading, continue using your demo account to learn and test new strategies.

- The Forex market is dynamic, and staying adaptable is essential for long-term success.

- Avoid Overconfidence: While demo trading is invaluable, it’s crucial to remember that trading with real money involves different emotions and psychological challenges.

- Avoid overconfidence and always apply proper risk management principles in live trading.

Practicing with a demo account is a critical step in a trader’s journey to find a trading edge in Forex.

It provides a risk-free environment to learn, experiment, and develop effective trading strategies while building the confidence necessary for success in the live market.

Is Emotional Discipline a Way to Find a Trading Edge in Forex?

Emotional discipline is the inner strength that distinguishes successful traders from the rest.

By exploring techniques to cultivate emotional discipline, traders can make more objective decisions, adhere to their trading plans, and stay focused on long-term success rather than succumbing to short-term impulses.

In this section, we’ll explore the elements of emotional discipline.

- Emotions in Trading: Emotions play a significant role in trading.

- Familiar emotions traders experience include fear, greed, excitement, frustration, and overconfidence.

- Emotional discipline means acknowledging these feelings and learning to control and channel them effectively.

- Stick to Your Trading Plan: A well-defined trading plan is your anchor in turbulent seas.

- Emotional discipline involves sticking to your plan regardless of temporary emotional swings.

- Deviating from your plan due to fear or greed can lead to impulsive and often detrimental decisions.

- Avoid Overtrading:

- Overtrading, driven by impatience or the desire to recover losses quickly, can lead to significant losses.

- Emotional discipline means adhering to your predetermined trading schedule and not entering excessive trades outside your plan.

- Set Realistic Expectations: Emotional discipline starts with setting realistic expectations.

- Understand that losses are a part of trading, and no strategy guarantees success every time.

- Unrealistic expectations can lead to frustration and emotional trading.

- Manage Stress:

- The fast-paced and high-pressure nature of Forex trading can be stressful.

- Implement stress management techniques, such as deep breathing exercises, meditation, or regular breaks, to stay calm and focused during trading sessions.

- Avoid Revenge Trading:

- Revenge trading occurs when traders attempt to recover losses by making impulsive, emotionally driven trades.

- Recognize this destructive behavior and resist the urge to engage in it. Stick to your plan and risk management rules.

- Keep Emotions in Check:

- Emotional discipline involves being aware of your emotions and keeping them in check.

- When you feel overwhelmed or overly emotional, it’s often best to temporarily step away from the trading screen to regain composure.

- Maintain a Trading Journal:

- Keeping a trading journal is a valuable tool for emotional discipline.

- Record your thoughts, emotions, and the reasons behind each trade.

- Reviewing your journal can help you identify patterns of emotional trading and work on improving your self-control.

- Continuous Learning:

- The more you learn about the Forex market, trading strategies, and risk management, the more confident and disciplined you become.

- Continuous learning and experience are crucial to strengthening emotional discipline.

- Seek Support: Trading can be a solitary endeavor, but seeking support from mentors, trading communities, or professional therapists can be beneficial.

- Talking about your experiences and emotions with others can provide valuable insights and help you maintain discipline.

Emotional discipline is a skill that can be developed and honed over time.

It’s essential for maintaining rational decision-making, sticking to your trading plan, and navigating the emotional ups and downs of Forex trading.

By practicing emotional discipline, you increase your chances of achieving consistent success in the Forex market.

Can Continuous Learning Help Find a Trading Edge in Forex?

Continuous learning is not merely an option but a lifeline that sustains and enhances a trader.

By embracing continuous learning, you can navigate the changing Forex landscape, ensuring that your trading skills remain sharp and your edge stays honed.

Here are the aspects of education you will need to focus on:

- Evolving Strategies:

- Forex trading strategies that were effective in the past may not work as well in the present.

- New market conditions, technological advancements, and shifts in trader sentiment can impact the effectiveness of trading strategies.

- Continuous learning allows traders to update and adapt their strategies to market realities.

- Technical Analysis:

- Technical analysis tools and indicators continue to develop and improve.

- Learning about new technical analysis methods and staying updated on the latest indicators can enhance your ability to identify trading opportunities and make informed decisions.

- Fundamental Analysis: Economic events, geopolitical developments, and central bank policies continually change.

- Staying informed about these factors through continuous learning is essential for successful fundamental analysis and anticipating market movements.

- Technology and Tools: Forex trading technology is constantly evolving.

- New trading platforms, charting tools, and trading algorithms become available regularly.

- Learning how to leverage these tools can give traders a competitive edge.

- Psychology and Discipline: Continuous learning also includes improving the psychological aspects of trading.

- Understanding behavioral biases and learning techniques for maintaining discipline and emotional control is essential for consistent trading success.

- Trading Education: Engage in trading education through books, courses, webinars, and seminars.

- Many reputable sources offer comprehensive trading education that covers a wide range of topics, from basic concepts to advanced strategies.

- Analyzing Past Trades: Regularly reviewing past trades and analyzing your performance is a form of continuous learning.

- It allows you to identify your trading approach’s patterns, strengths, and weaknesses and make necessary adjustments.

- Trading Communities: Joining trading communities and forums can provide valuable insights and foster continuous learning.

- Interacting with other traders, sharing experiences, and seeking advice can lead to new perspectives and strategies.

Continuous learning is an ongoing journey for Forex traders looking to find a trading edge.

It is not limited to gaining knowledge but also involves adapting, evolving, and improving trading skills and strategies.

Why Keeping a Trading Journal Will Find a Trading Edge in Forex

A trading journal serves as a meticulous record of every trade, decision, and emotional state, offering invaluable insights into your strengths, weaknesses, and areas for improvement.

Here are reasons to make journaling a habit:

- Record of Trades: A trading journal is a detailed record of all your trades.

- It includes essential information like entry and exit points, trade duration, position size, currency pairs traded, and whether the trade was a buy or sell.

- This record helps you track your trading history accurately.

- Analyze Your Decisions: The journal allows you to analyze your trading decisions systematically.

- By reviewing your past trades, you can identify patterns and trends in your trading behavior.

- This self-reflection is crucial for recognizing areas that need improvement.

- Identify Strengths and Weaknesses:

- Keeping a trading journal helps you identify your strengths and weaknesses as a trader.

- You can assess which strategies and setups work best for you and which lead to losses.

- This information guides you in refining your trading approach.

- Risk Management Assessment: It’s essential to assess how well you manage risk in your trades.

- A trading journal helps you track whether you adhered to your risk management rules, such as setting stop-loss orders and position sizing.

- You can pinpoint instances where you took excessive risks and learn from them.

- Emotional Analysis:

- Emotions play a significant role in trading.

- A journal allows you to record your emotional state during each trade. Were you feeling anxious, overconfident, or hesitant?

- Understanding how emotions affect your decisions can help you develop emotional discipline.

- Trade Management Assessment: A trading journal helps you assess how well you manage your trades.

- Did you exit a trade prematurely due to fear or greed?

- Did you miss profit-taking opportunities?

- By reviewing your trade management, you can improve your execution skills.

- Adaptation and Strategy Refinement: Your trading journal provides a historical record of your performance.

- By continuously reviewing it, you can adapt and refine your trading strategies.

- You’ll be able to identify which strategies are consistently profitable and which need adjustment.

- Goal Tracking: Maintain a record of your trading goals and whether you achieved them.

- Tracking your goals ensures clear objectives and helps you measure your progress over time.

- Confidence Building: Keeping a trading journal helps build confidence.

- You gain the self-assurance needed for disciplined and consistent trading when you see evidence of successful trades and improvements over time.

- Accountability: A trading journal holds you accountable for your decisions.

- It forces you to take responsibility for your trades, whether they result in profits or losses.

- This accountability encourages continuous improvement.

Regularly reviewing and analyzing your journal entries allows you to identify strengths, weaknesses, and areas for improvement.

Conclusion

If you want to find a trading edge in Forex trading it requires dedication, discipline, and a commitment to learning.

By understanding the basics, developing a trading plan, managing risk, and using technical and fundamental analysis, you can set yourself up for success.

Remember that trading is not a get-rich-quick scheme but a long-term endeavor that rewards those who approach it with patience and diligence.

What’s the Next Step?

Use this article to evaluate your current trading approach and consider how to find a trading edge in Forex.

In addition, look for opportunities to use what you’ve learned in your process.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about how to find a trading edge in Forex.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

Why is Technical Analysis Important in Forex Trading?

Technical analysis is vital in Forex trading as it enables you to analyze historical price charts and patterns to make informed predictions about future price movements.

It provides valuable insights into market trends, support and resistance levels, and potential entry and exit points.

How Can Traders Stay Informed About Economic Events Impacting Forex Markets?

Traders can stay informed about economic events by using economic calendars, monitoring vital economic indicators, and keeping up with central bank announcements.

Additionally, reading financial news, analyzing geopolitical developments, and using sentiment analysis can provide valuable insights.

What Role Does Emotional Discipline Play in how to Find a Trading Edge in Forex?

Emotional discipline is crucial in Forex trading as it involves managing emotions like fear and greed to make rational decisions.

Traders with emotional discipline adhere to their trading plans, avoid impulsive actions, and maintain a focused mindset, essential for consistent success.

Why Should Traders Practice with a Demo Account Before Trading with Real Money?

Practicing with a demo account allows traders to gain experience and confidence without risking real money and find a trading edge in Forex.

It helps traders understand the trading platform, develop and test strategies, and build emotional discipline before transitioning to live trading.