Trading divergence is a powerful technique in technical analysis involving Momentum indicators like the Relative Strength Index (RSI), True Strength Index (TSI), and Commodity Channel Index (CCI) to predict potential market reversals.

This method relies on the discrepancy between an asset’s price action and the Momentum indicated by its indicators.

Understanding how to spot and trade divergences can offer traders an edge.

In this article, I’ll discuss how to trade divergence with Momentum indicators effectively.

What are Momentum Indicators?

Before delving into divergence, let’s first understand what Momentum indicators are.

Momentum indicators are tools used in technical analysis that compare the current closing price of an asset to its previous prices over a certain period.

These indicators help traders identify the speed or strength of a price movement.

Here are three popular Momentum indicators you should know:

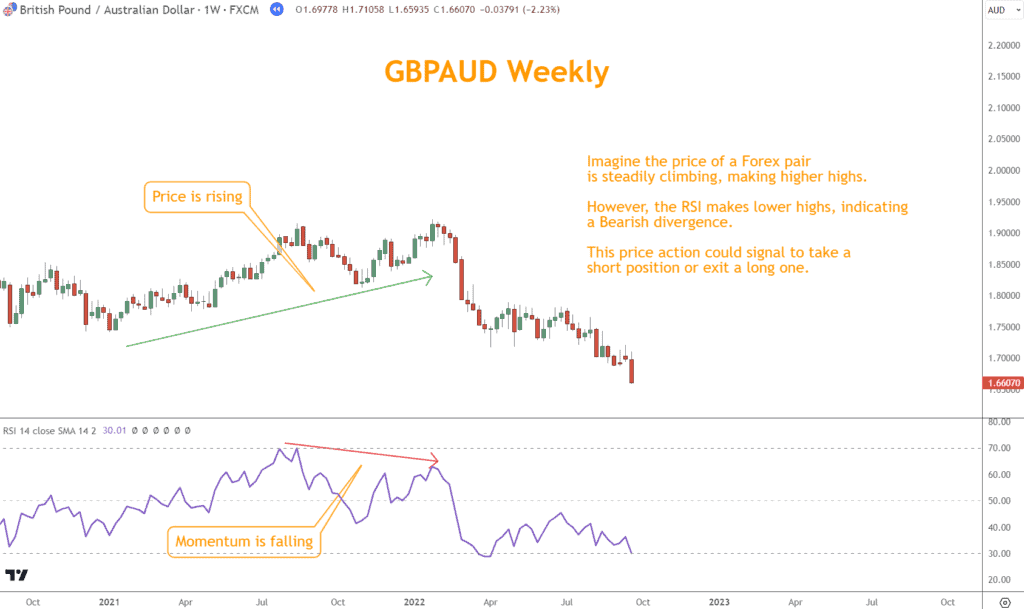

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. It is displayed as an oscillator (a line graph that moves between two extremes) and can read from 0 to 100.

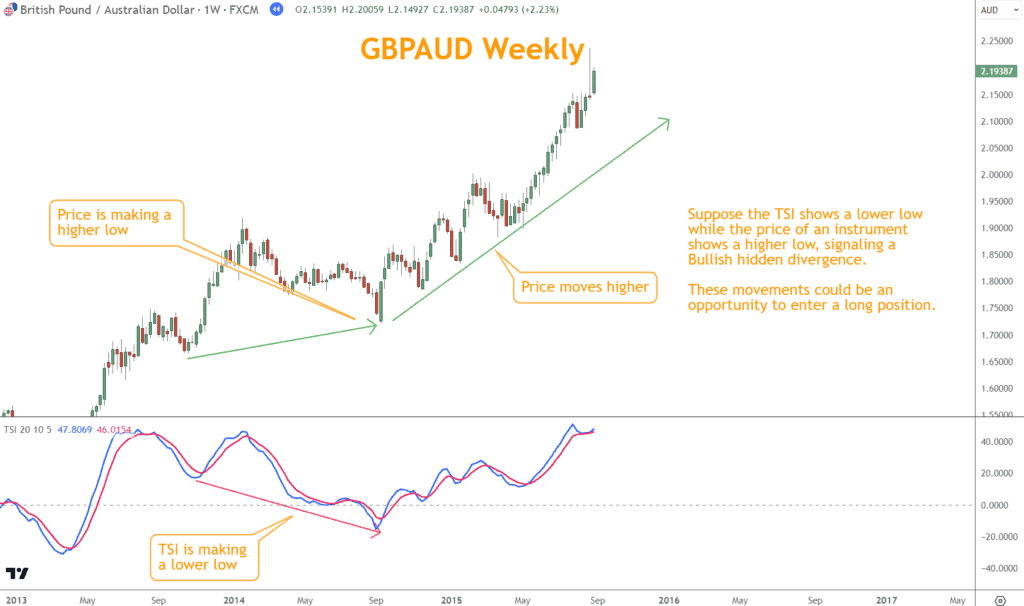

- True Strength Index (TSI): The TSI is a more sophisticated tool that combines price Momentum with a double smoothing process to filter out market noise. It’s beneficial for identifying trends and extreme conditions.

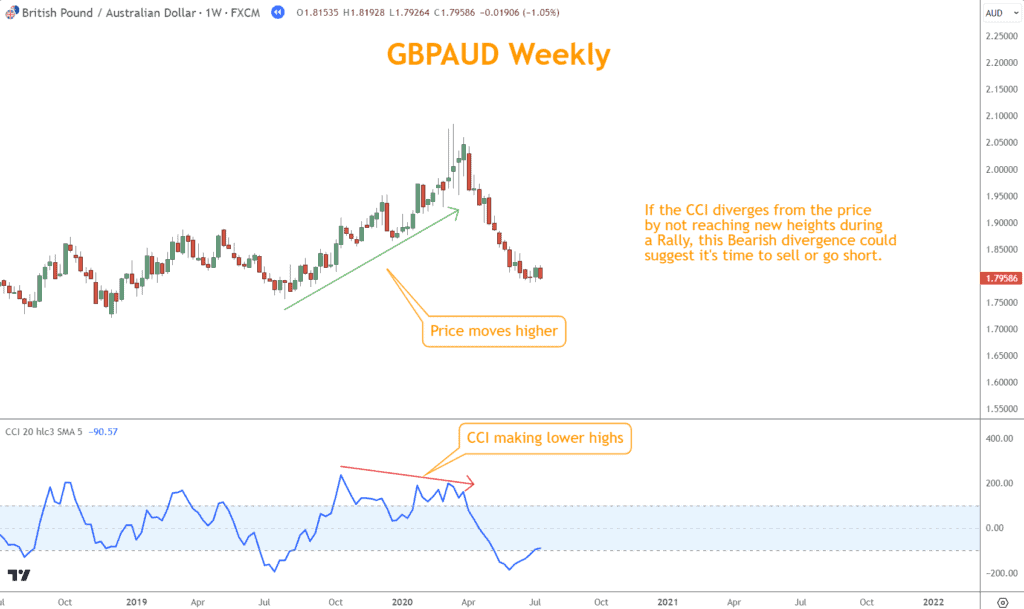

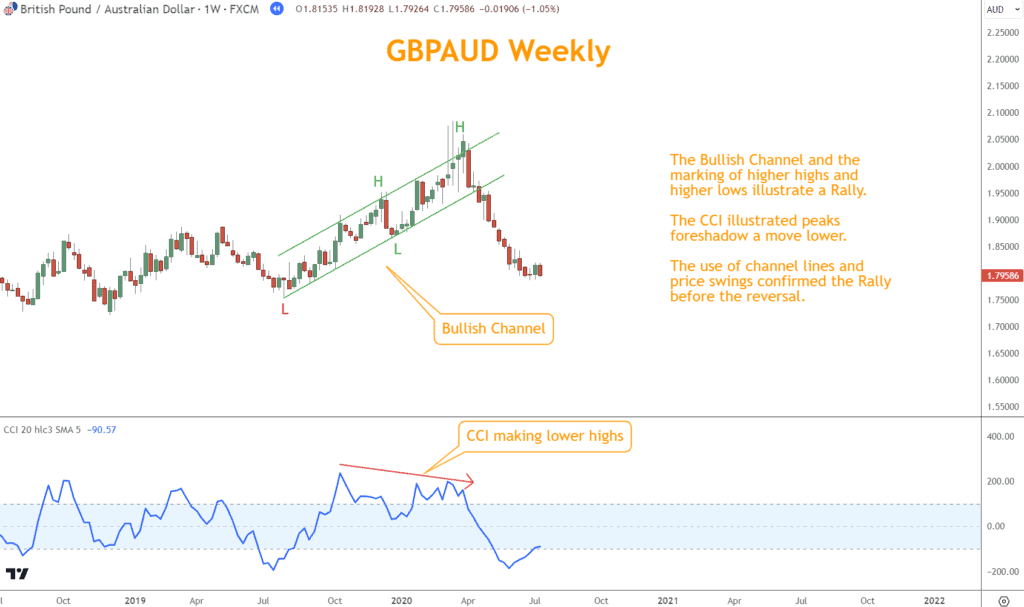

- Commodity Channel Index (CCI): The CCI compares the current price to the average price over a specific period. While initially developed for commodities, it’s widely used in all markets to identify new trends or warnings of extreme conditions.

How Should You Define Divergence?

Divergence occurs when the direction of an instrument’s price and its indicator move in opposite directions.

This scenario can signal that the current price trend is weakening and may soon reverse.

There are two main types of divergence:

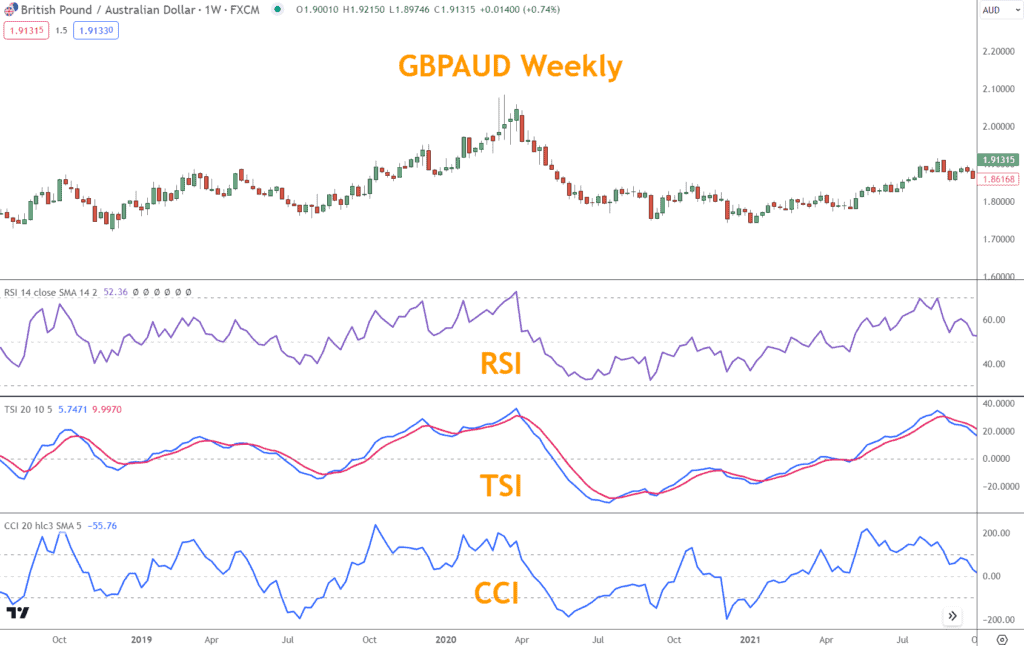

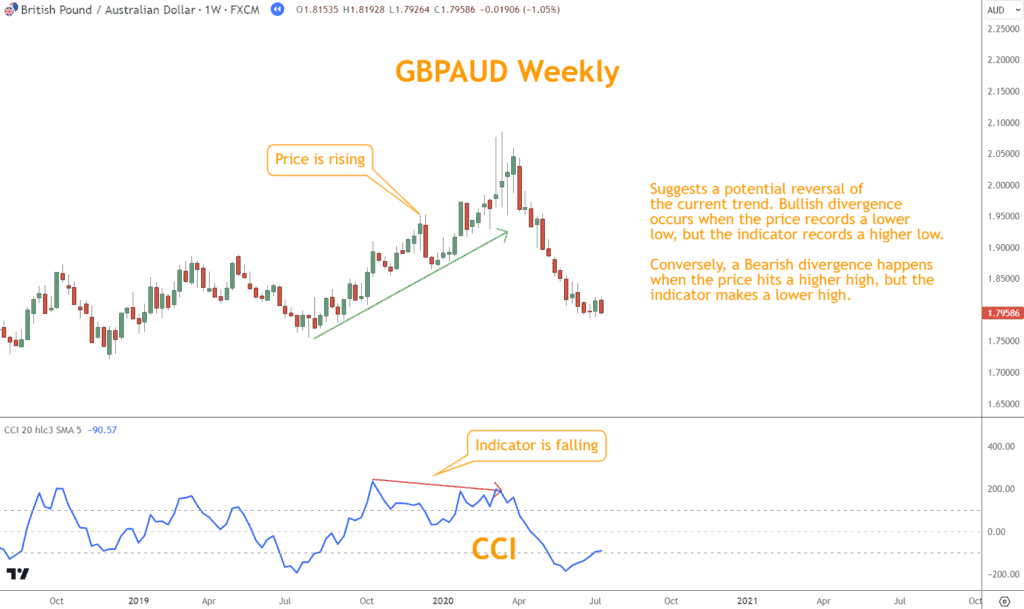

- Regular Divergence: Suggests a potential reversal of the current trend. Bullish divergence occurs when the price records a lower low, but the indicator records a higher low. Conversely, a Bearish divergence happens when the price hits a higher high, but the indicator makes a lower high.

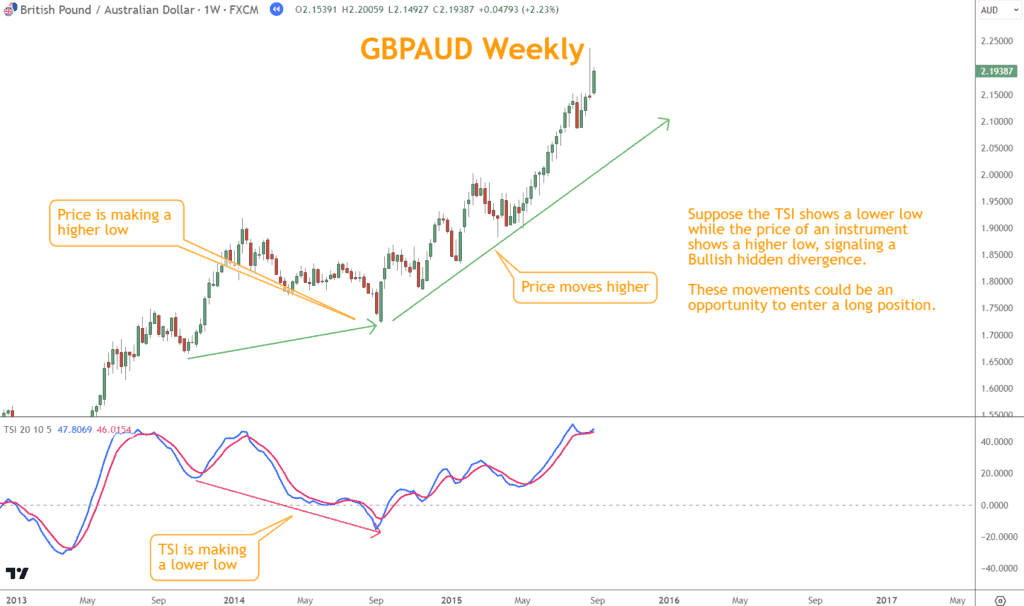

Hidden Divergence: Suggests a continuation of the current trend. In a Bullish trend, the price makes a higher low, but the indicator makes a lower low. In a Bearish trend, the price makes a lower high, but the indicator makes a higher high.

What are the Steps to Trading Divergence with RSI, TSI, and CCI

To trade divergence, follow these steps:

- Identify the Direction: First, determine the market’s direction using channel lines or moving averages. This determination will provide the context for interpreting divergence signals.

- Spot the Divergence: When using RSI, TSI, or CCI, look for instances where the price makes new highs or lows without indicator confirmation. Regular divergence indicates direction reversals, while hidden divergence indicates continuation.

- Confirm the Signal: Waiting for confirmation before acting on a divergence signal is crucial. This confirmation can be a channel line break, a candlestick pattern, or another indicator signal.

Let’s consider a few examples:

- RSI Divergence: Imagine the price of a Forex pair is steadily climbing, making higher highs. However, the RSI makes lower highs, indicating a Bearish divergence. This price action could signal taking a short position or exiting a long one.

- TSI Divergence: Suppose the TSI shows a lower low while the price of an instrument shows a higher low, signaling a Bullish hidden divergence. These movements could be an opportunity to enter a long position.

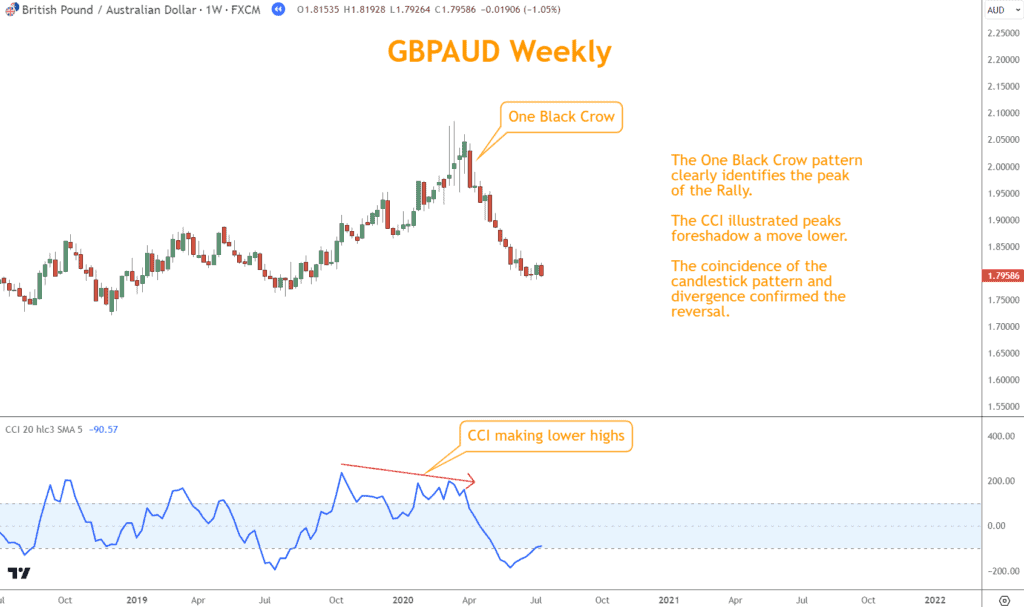

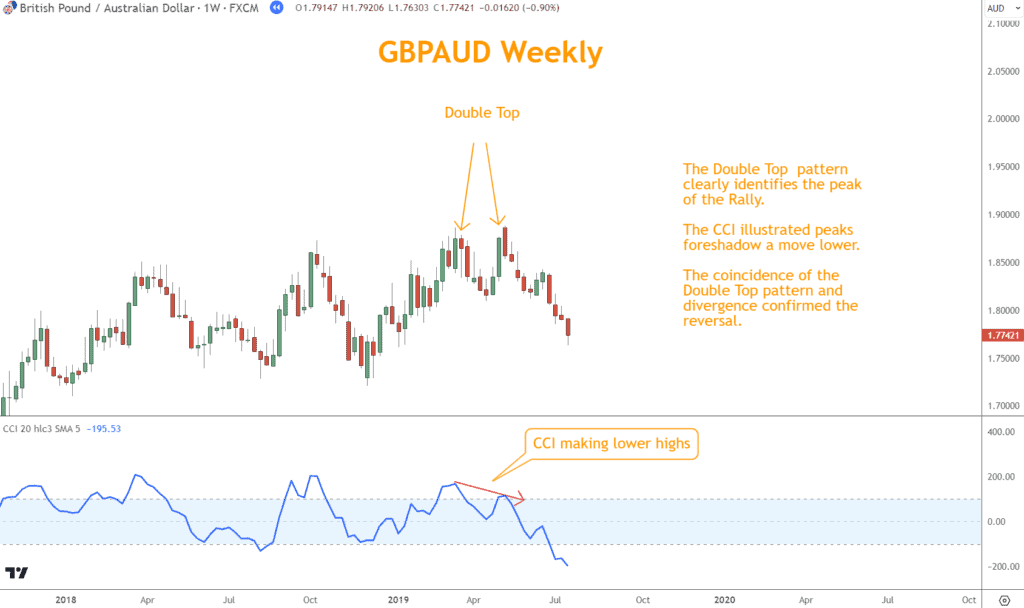

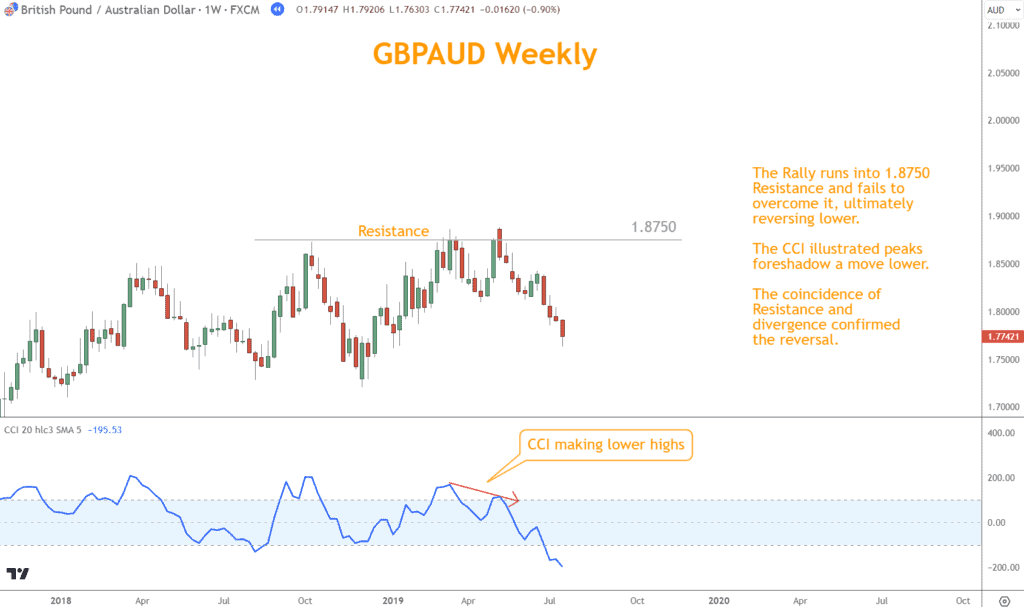

- CCI Divergence: If the CCI diverges from the price by not reaching new heights during a Rally, this Bearish divergence could suggest it’s time to sell or go short.

How to Combine Other Tools When Trading Divergence

Combining divergence with other technical analysis tools can significantly improve the robustness of your trading decisions.

First, use channel lines or swing highs and lows to establish the instrument’s direction. A divergence signal against said direction may require caution or a different strategy.

Japanese candlesticks can provide immediate visual cues about market sentiment and reversal patterns, which can confirm divergence signals.

Incorporating Chart Patterns can also be beneficial, as patterns like Triangles, Head and Shoulders, or Double Tops and Bottoms often precede reversals hinted at by divergence.

Lastly, identify critical Support and Resistance levels; a divergence signal that coincides with a price approaching a solid Support or Resistance level can offer a higher probability trade setup.

It’s also important to remember that no strategy is foolproof; divergence signals are not absolute and should be confirmed with other technical elements to improve accuracy.

As with any trading strategy, it’s critical to test your approach, keep learning from the markets, and adapt as necessary.

Trading divergence effectively can provide a deeper insight into market dynamics, helping you make more informed decisions and improve your trading performance over time.

Conclusion

In conclusion, trading divergence with momentum indicators such as RSI, TSI, and CCI is a technique that can unveil potential shifts in market momentum, offering you a chance to enter or exit trades just before a trend reversal takes place.

This strategy requires an understanding of the underlying mechanics of the indicators and an ability to spot subtle discrepancies between indicator readings and price action.

You can improve your odds of success by integrating divergence trading with other technical analysis tools like trend analysis, Japanese candlesticks, Chart Patterns, and Support and Resistance.

However, it’s crucial to approach divergence trading with discipline, utilizing proper risk management techniques and confirming signals with additional market evidence.

Practice and experience are crucial for trading divergence.

What’s the Next Step?

Select a favorite chart and use what you learned in this article about trading divergence.

In addition, look for opportunities to incorporate multiple indicators in your analysis.

Once you’re ready to trade, choose a strategy and process you believe will work for you.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about Forex trading.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What Indicators Work Best for Trading Divergence?

The most commonly used indicators for spotting divergence are the Relative Strength Index (RSI), the True Strength Index (TSI), and the Commodity Channel Index (CCI).

Each has its unique way of measuring Momentum and can provide valuable divergence signals when analyzed correctly.

Can Trading Divergence be Applied to any Financial Market?

Divergence can apply to any financial market, including Forex, Stocks, Commodities, and Indices.

The key is to adjust the settings of your Momentum indicators to match the volatility and characteristics of the market you are trading.

How can I Confirm a Divergence Signal?

Divergence signal confirmation can arrive using various methods, including waiting for a channel line break, observing reversal patterns in Japanese candlesticks, or looking for confluence with Chart Patterns and critical Support and Resistance levels.

Is Trading Divergence Suitable for Beginners?

Divergence trading can be challenging for beginners because it requires understanding both the price action and the specific behavior of Momentum indicators.

Before incorporating divergence into your trading strategy, acquiring basic knowledge of trading concepts is advisable.

How Often do Divergence Signals Occur?

The frequency of divergence signals depends on market conditions and the analyzed time frame.

Higher time frames may produce fewer signals but are more reliable than those on lower time frames.

Should I Exit My Trade as Soon as Divergence Appears?

Not necessarily. It’s essential to consider the context in which the divergence occurs and whether it aligns with other technical or fundamental signals.

Divergence can sometimes precede a reversal, but not always immediately. It is crucial to have a well-defined risk management strategy and exit plan in place.