This article will dive deep into understanding Channel Lines (also referred to as Channels) in Forex trading, what they are, and how to use them to find trading opportunities.

We will also cover combining with other indicators, such as horizontal Support and Resistance, Japanese Candlesticks, and Momentum indicators.

You will also learn how Channel Line strategies contribute to position size calculation and share tips for avoiding common pitfalls.

What are Channel Lines in Forex Trading?

Understanding the Channel Lines’ concept is essential because it helps identify potential market reversals, Rallies, or Selloffs.

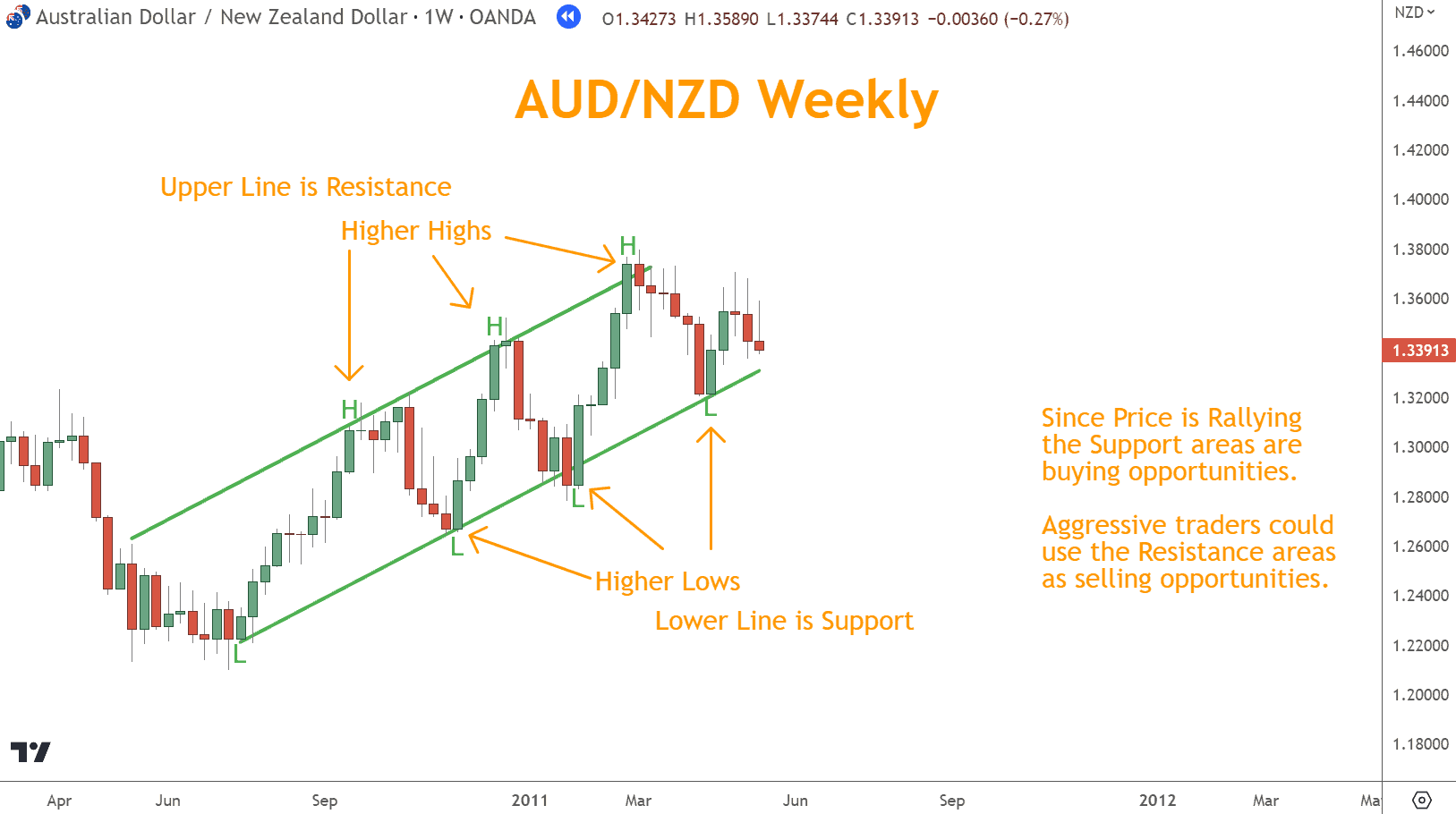

Channels accomplish this by connecting a series of Higher Highs and Higher Lows in a Rally or Lower Highs and Lower Lows in a Selloff. These changes in direction are also referred to as Swing Highs and Swing Lows.

Ideally, three points on one side of prices would be required to confirm the legitimacy of the channel, but in many cases, this isn’t practical.

They can show potential buying and selling opportunities and are conventionally considered Trend trading, with an upper Resistance line and a lower Support line when prices are Rallying and the inverse when they’re in a Selloff.

Avoiding mistakes like false breakouts or relying solely on Channel Lines for trading decisions can significantly improve trading results.

Incorporating other technical indicators allows you to find profitable opportunities even in challenging market conditions.

Can you use Channel Lines to Find Trading Opportunities?

To effectively trade with Channels, you must understand how to use them to find trading opportunities.

This involves identifying the Support and Resistance levels and determining entry and exit points based on price movements. It’s crucial to manage risk by setting the correct number of pips for your stops and targets and position sizing appropriately.

Incorporating these ideas and techniques into your trading can increase the chances of winning trades.

Have you Ever Combined Channel Lines with Other Indicators?

You can use a combination of technicals, such as horizontal Support and Resistance, Japanese Candlesticks, and Momentum indicators to avoid false breakouts and get confirmation of Rallies and Selloffs.

Understanding Channels can help you identify potential trading opportunities; however, combine these strategies with other indicators to increase the likelihood of successful trades.

By discovering a confluence of complementary signals, your chances of winning your trades should increase.

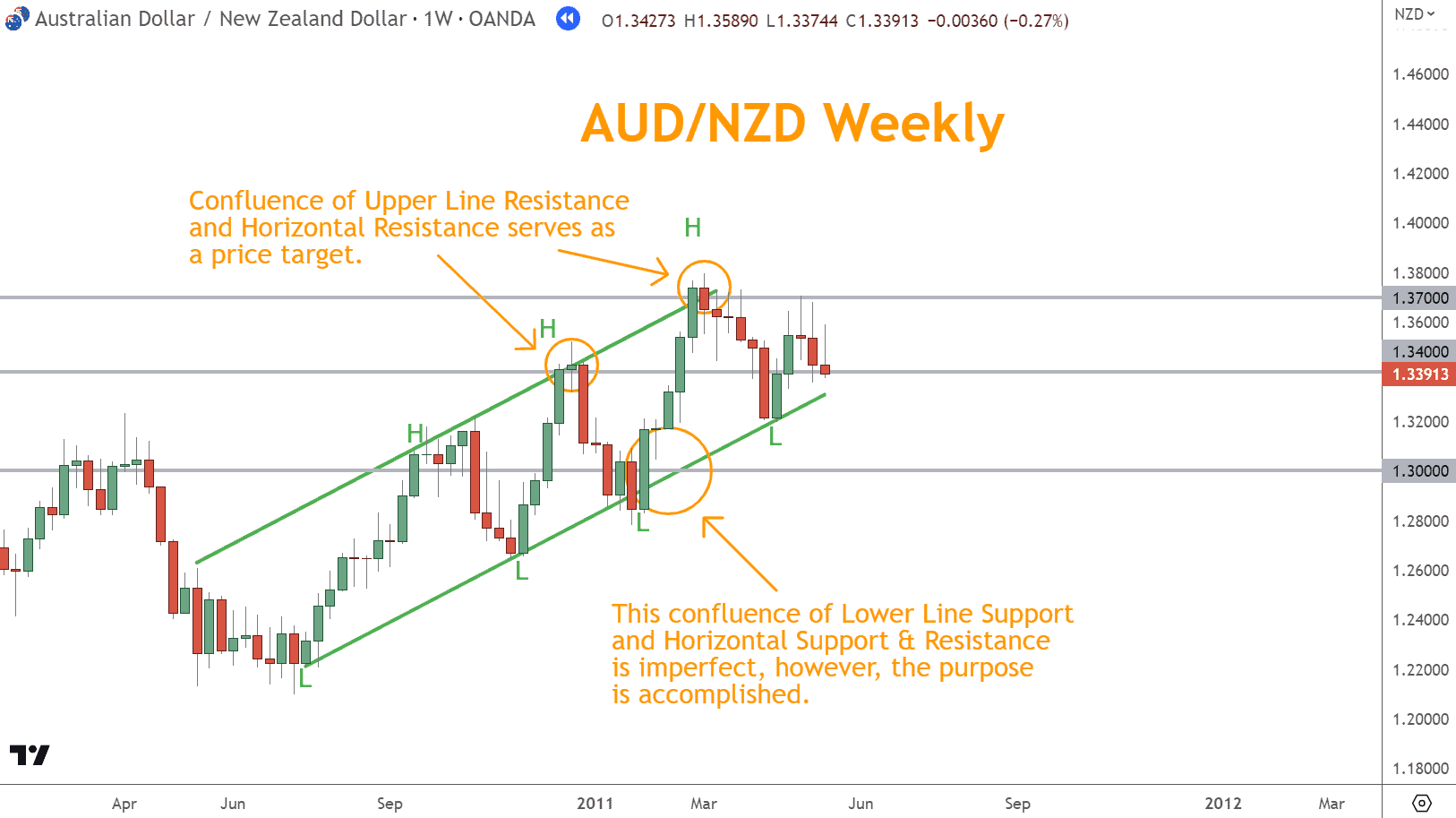

Add Horizontal Support and Resistance – Look for Confluence

Traders who use Channels can combine them with horizontal Support and Resistance levels to identify profitable trading opportunities.

Horizontal Support and Resistance are often at round numbers.

The goal is to find confluence between the two indicators to increase the probability of success. Traders should look for instances where the horizontal level and the Channel Line indicate a potential reversal.

Horizontal Support and Resistance areas on a chart are constructive and serve as potential reversal signals.

When a horizontal level coincides with a Channel Line level, they can recommend strong Support or Resistance.

By using these together, traders can comprehensively understand where a Forex pair is likely to reverse.

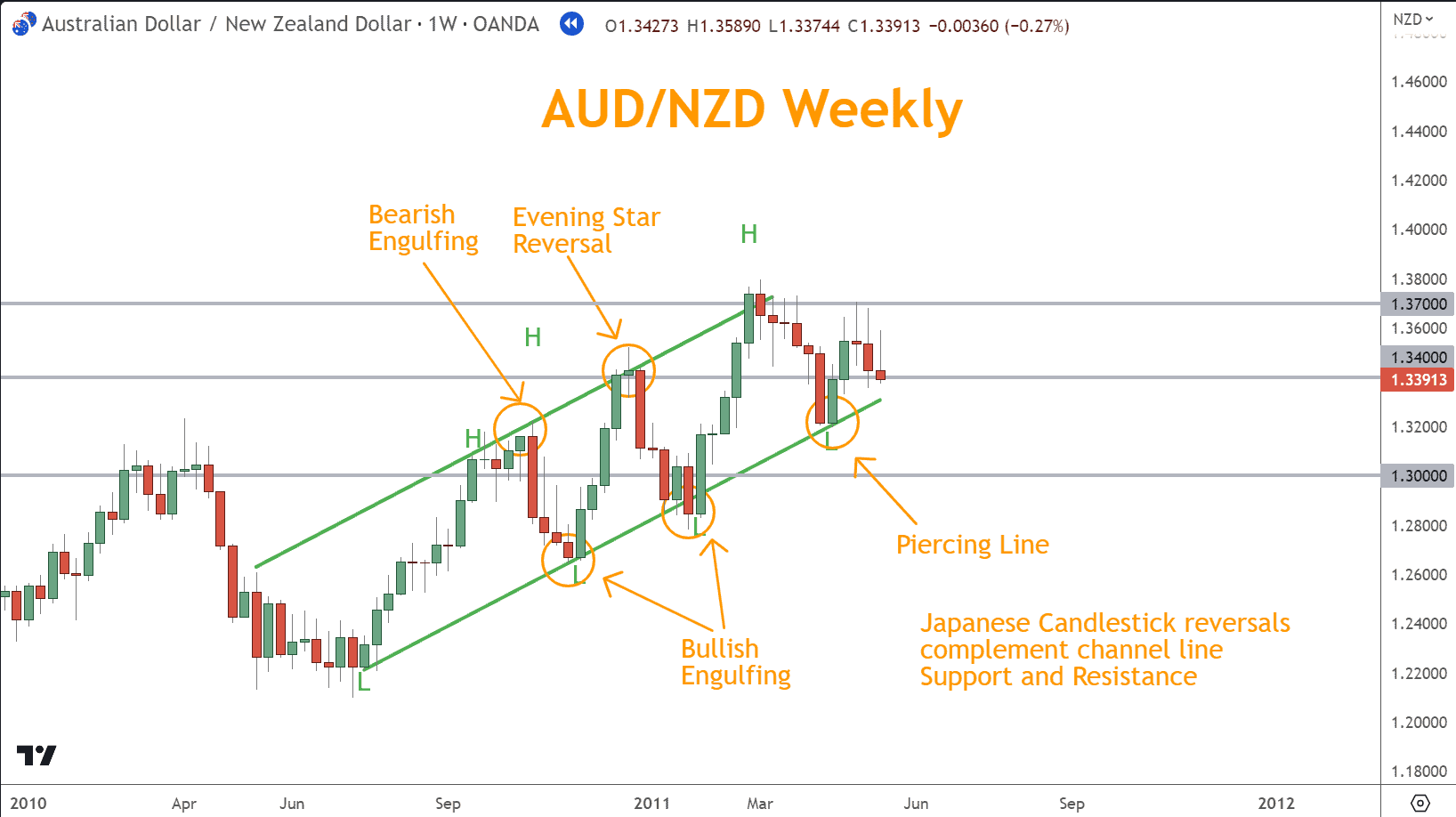

Japanese Candlesticks are for Reversals Too

Incorporating Japanese Candlesticks with Channel Lines Support and Resistance strategy can help you identify profitable trading opportunities.

A Candlestick chart excels at finding reversal opportunities. Bullish candlestick patterns like Bullish Engulfing confirm Support, while Bearish patterns like Evening Star Reversal confirm Resistance zones.

Traders should look for confluence between the two indicators to increase the probability of success.

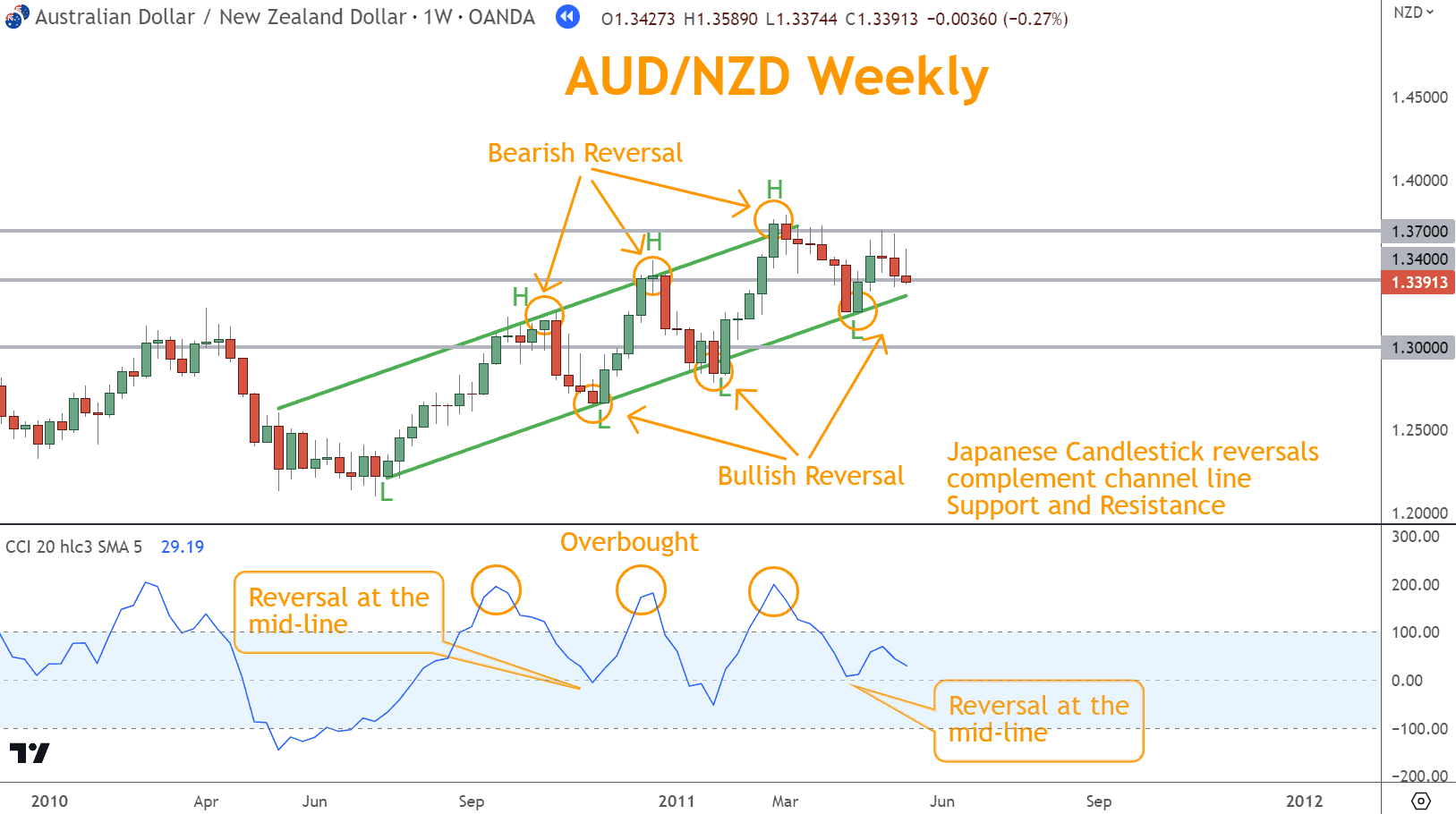

Momentum Indicators – Overbought and Oversold like Support and Resistance

To find profitable trading opportunities using the Channel Lines strategy with Momentum indicators such as the RSI (Relative Strength Indicator) or CCI (Commodity Channel Index), traders should consider price action and market Momentum.

Combining these indicators allows you to identify potential trend reversals and avoid false breakouts.

Momentum indicators provide Overbought and Oversold signals which can help validate Support and Resistance.

Avoiding Pitfalls of Channel Line Trading

You need to be cautious when dealing with Channel Lines Support and Resistance. To ensure profitable trading and avoid the pitfalls of this strategy, one needs to keep the following points in mind:

- Do not rely solely on Channels; use other technical indicators such as Momentum, Japanese Candlesticks, and Support and Resistance to confirm signals.

- Determine whether to include candlestick shadows.

- Shadows often represent very few trades, notably tall shadows.

- Keep an eye out for Chart Patterns.

- Through time what appears as a Channel can change into a Chart Pattern.

- That Chart Pattern could be a completely different opportunity.

Following these guidelines, you can avoid common mistakes in your trading opportunities.

You will Position Size with Channels

Accurate position size calculation is crucial while implementing any successful trading strategy. Position sizing helps traders manage risk and leverage opportunities.

Proper position sizing is essential since they help determine your stop loss and target. If you are unfamiliar with how to position size in Forex, an article here will teach you how.

What’s the Next Step?

Using your knowledge, select a price chart, find a Channel, and identify its structure.

In addition, look for opportunities to coincide Channels with other technical analysis techniques to see how they work together.

Combining Momentum, Japanese Candlesticks, and Support and Resistance can give you a comprehensive view and understanding to make trading easier.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis which you can incorporate with what you’ve learned here.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and Advance Strategies? I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What are Common Mistakes Made With Channels?

Avoid over-relying on channels and ignoring other market indicators. Failure to adjust Channels as the market evolves can also be an issue. It’s crucial to use them alongside other analysis tools and not solely depend on them.

What Alternative Strategies can be used Alongside Channels?

In addition to Channel Line Support & Resistance, numerous alternative techniques and strategies are available. Popular options include Momentum, using Japanese candlesticks, and horizontal Support and Resistance.