Trading breakouts is crucial for making profits in complex Forex markets and taking advantage of lucrative opportunities.

A breakout is when the price moves decisively beyond crucial support or resistance levels.

This shift in market sentiment can lead to significant price movements, which makes them essential to traders.

Understanding the mechanics of trading breakouts, from identifying breakout opportunities to implementing effective strategies, is paramount to capitalizing on trends and maximizing trading outcomes.

I’ve been trading in markets since 2007, and trading breakouts have been a critical part of my trading practice.

In this comprehensive guide, we will explore the fundamentals of trading breakouts in Forex markets, providing practical insights and strategies to help you take advantage of these opportunities.

Table of Contents

- What are Trading Breakouts?

- How Do I Identify Trading Breakouts?

- Strategies for Trading Breakouts

- Conclusion

- What are Your Next Steps?

- Frequently Asked Questions

What are Trading Breakouts?

A breakout occurs when the price of a currency pair breaches a predefined level of support or resistance, marking a decisive shift in market sentiment and potentially signaling the beginning of a new trend.

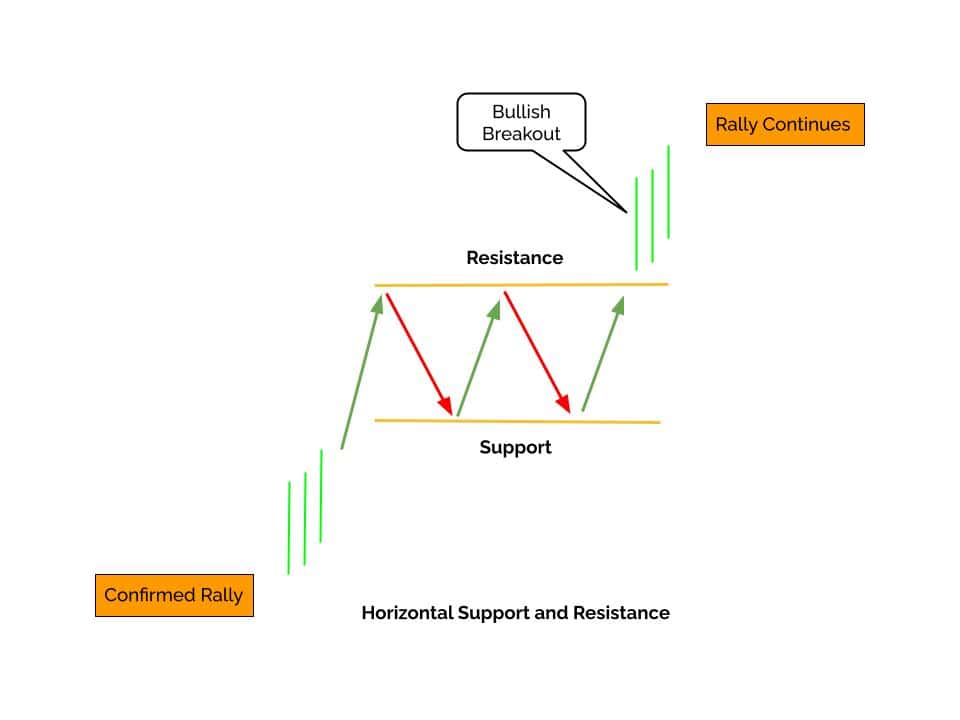

Support and resistance levels serve as areas where buying and selling pressure converge.

In the diagram below, prices are trapped in a horizontal channel until resistance is breached; prices make a bullish breakout and move higher.

When the price surpasses these levels, it often indicates a surge in market activity as traders react to emerging trends or news events.

This influx of buying or selling pressure can propel the price beyond its previous boundaries, creating opportunities for you to capitalize on momentum-driven movements.

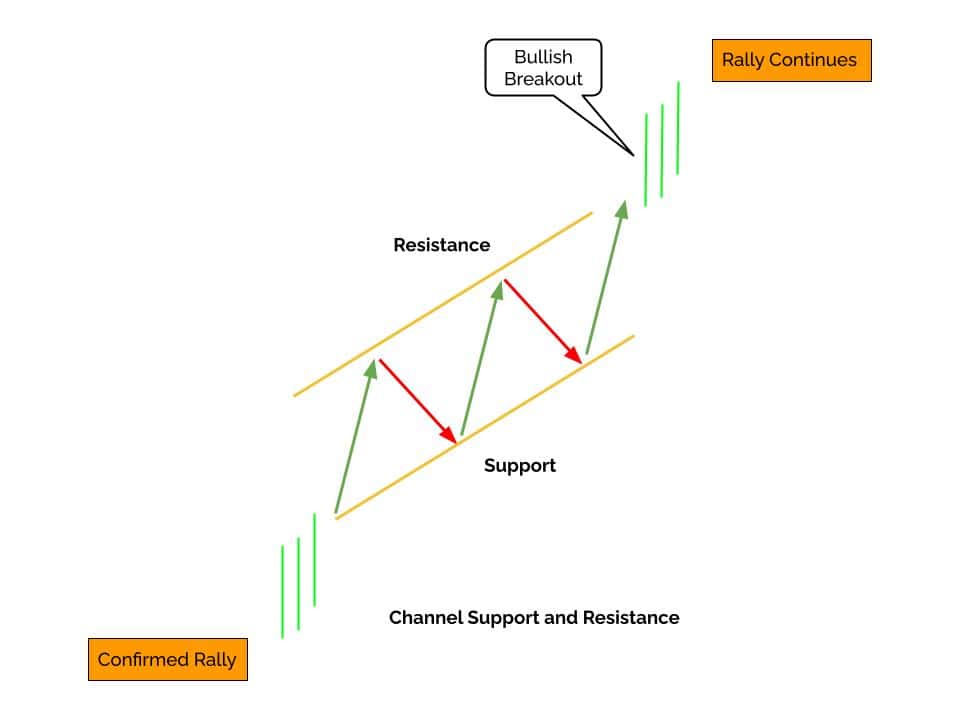

Channel lines (trendlines) are another essential tool for identifying potential breakouts.

Channel lines connect consecutive highs or lows on a price chart, providing visual cues of the market’s direction and highlighting areas where breakouts are likely to occur.

A breakout above a downward trendline or below an upward trendline signifies a potential reversal or continuation of the prevailing trend, offering valuable insights into market dynamics.

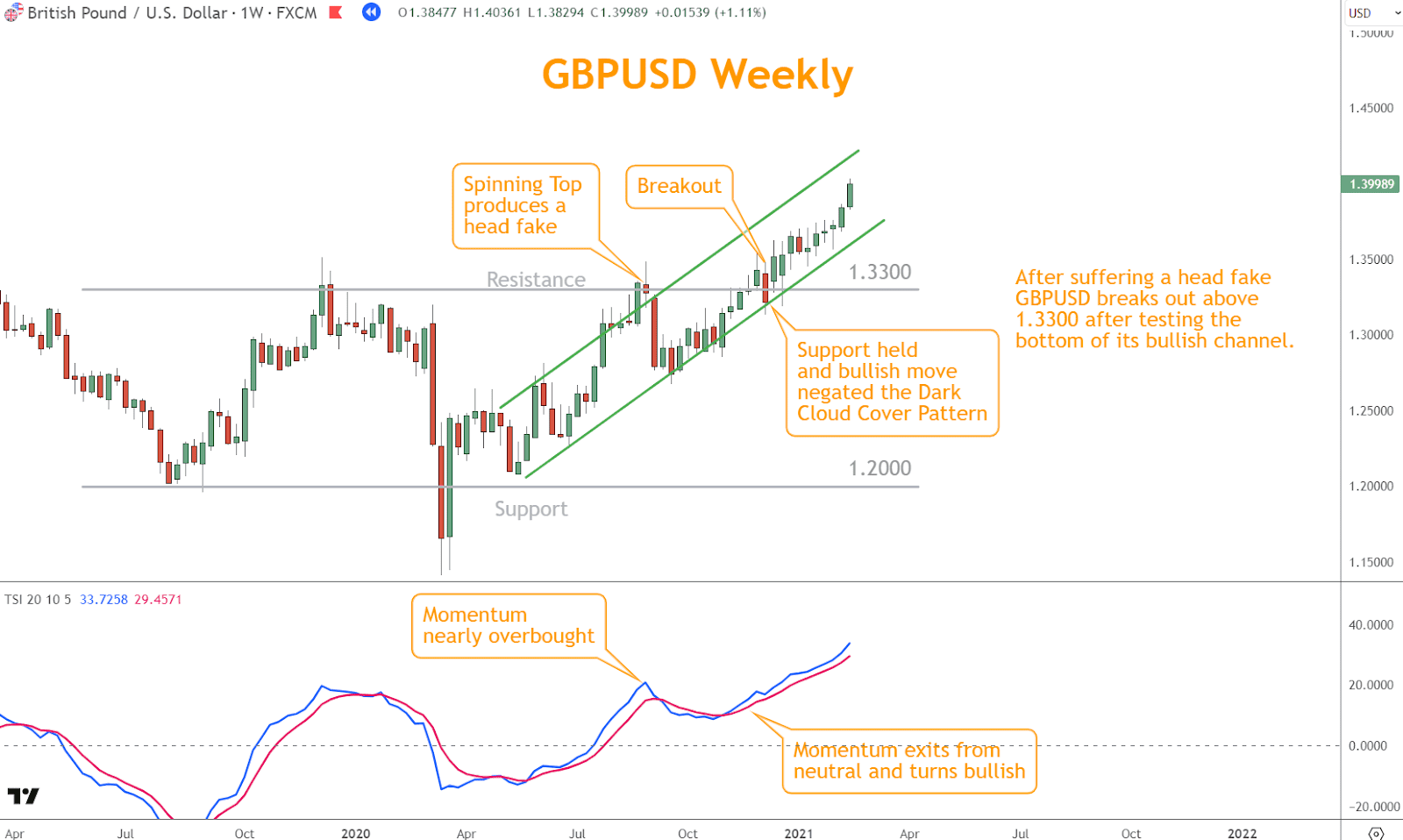

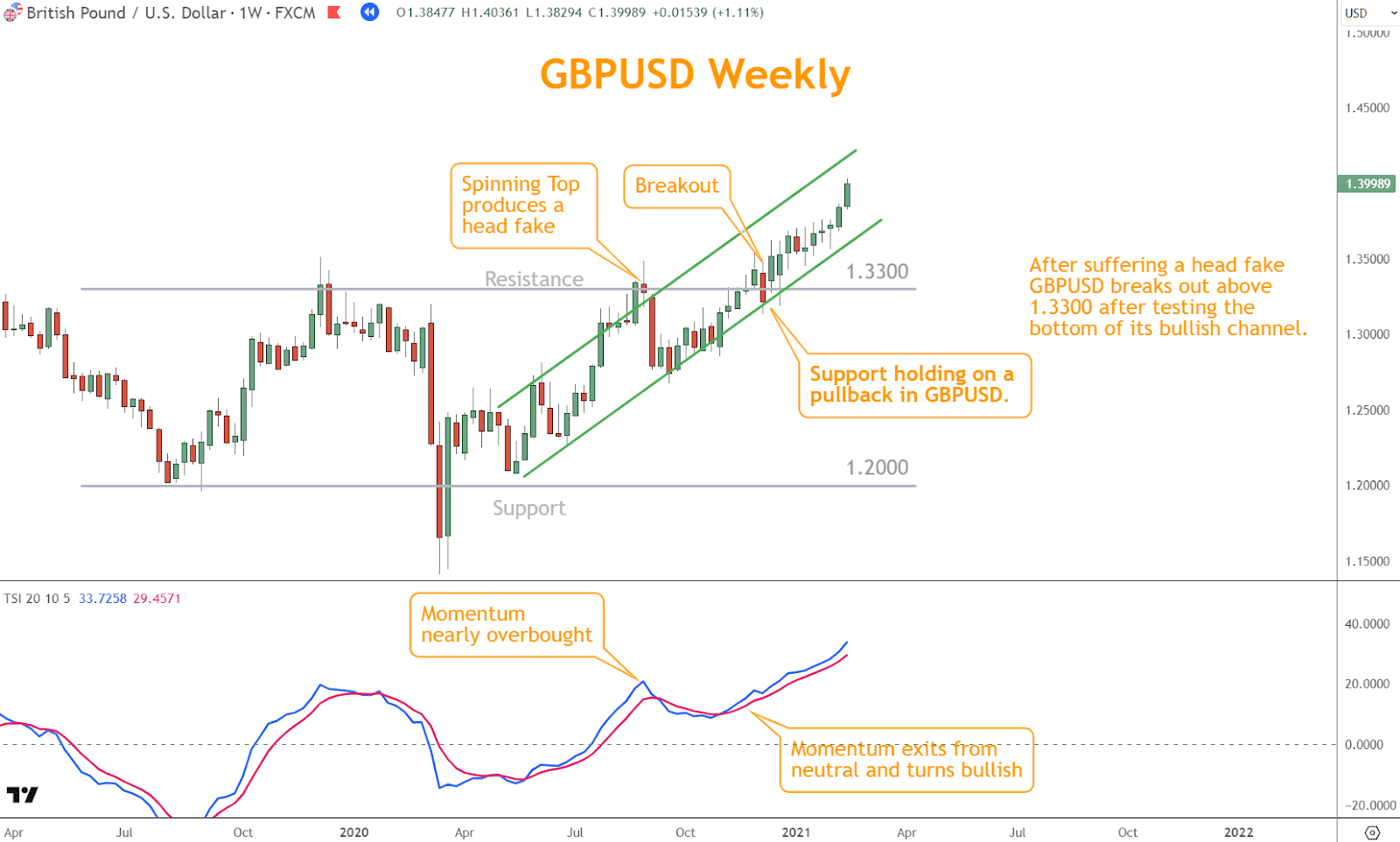

In the example below, prices move in a bullish channel and break out above the upper line of the channel in an accelerated rally.

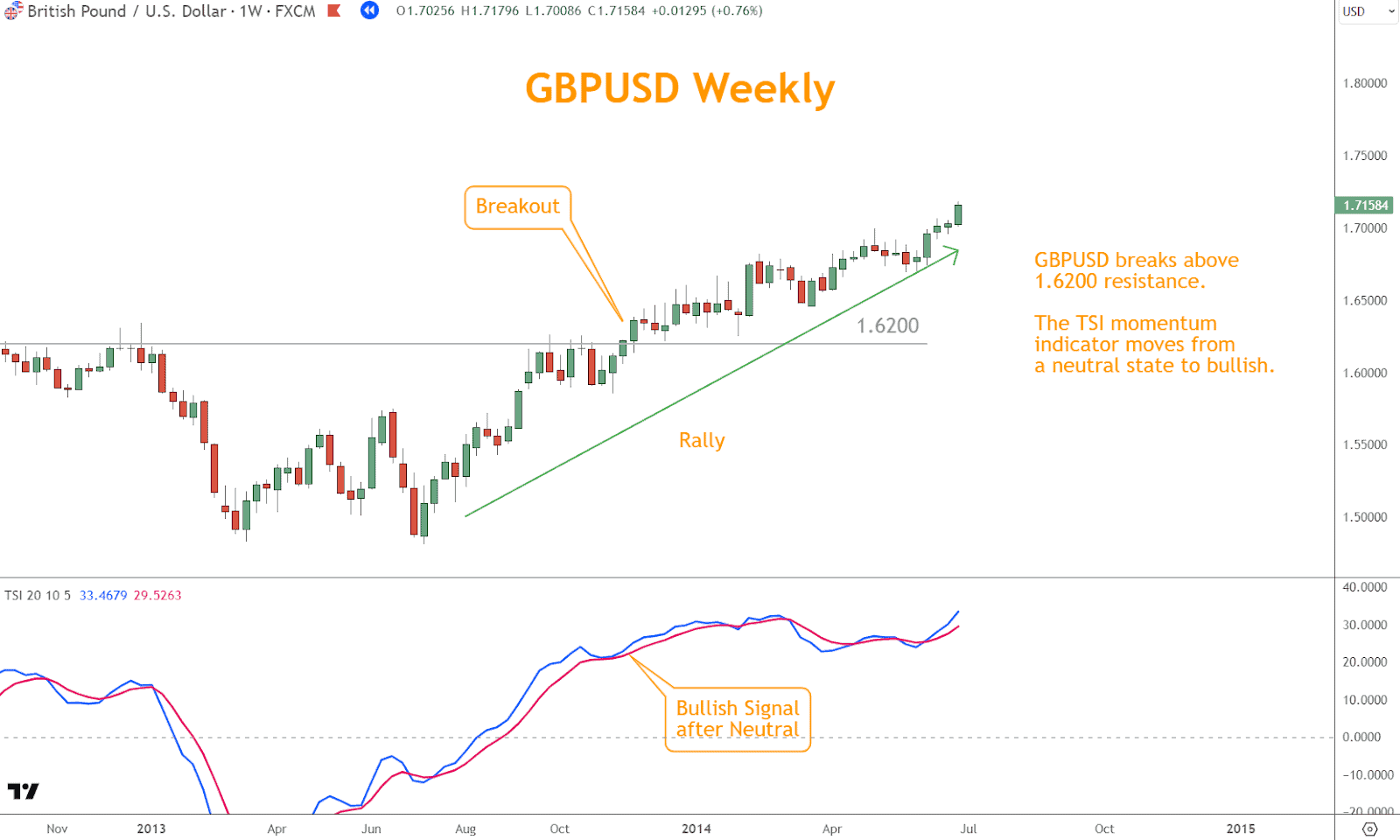

Momentum indicators play a significant role in understanding market momentum and identifying breakout opportunities.

Indicators such as the True Strength Indicator (TSI) or Relative Strength Indicator (RSI) measure the magnitude of price fluctuations, providing valuable insights into market dynamics.

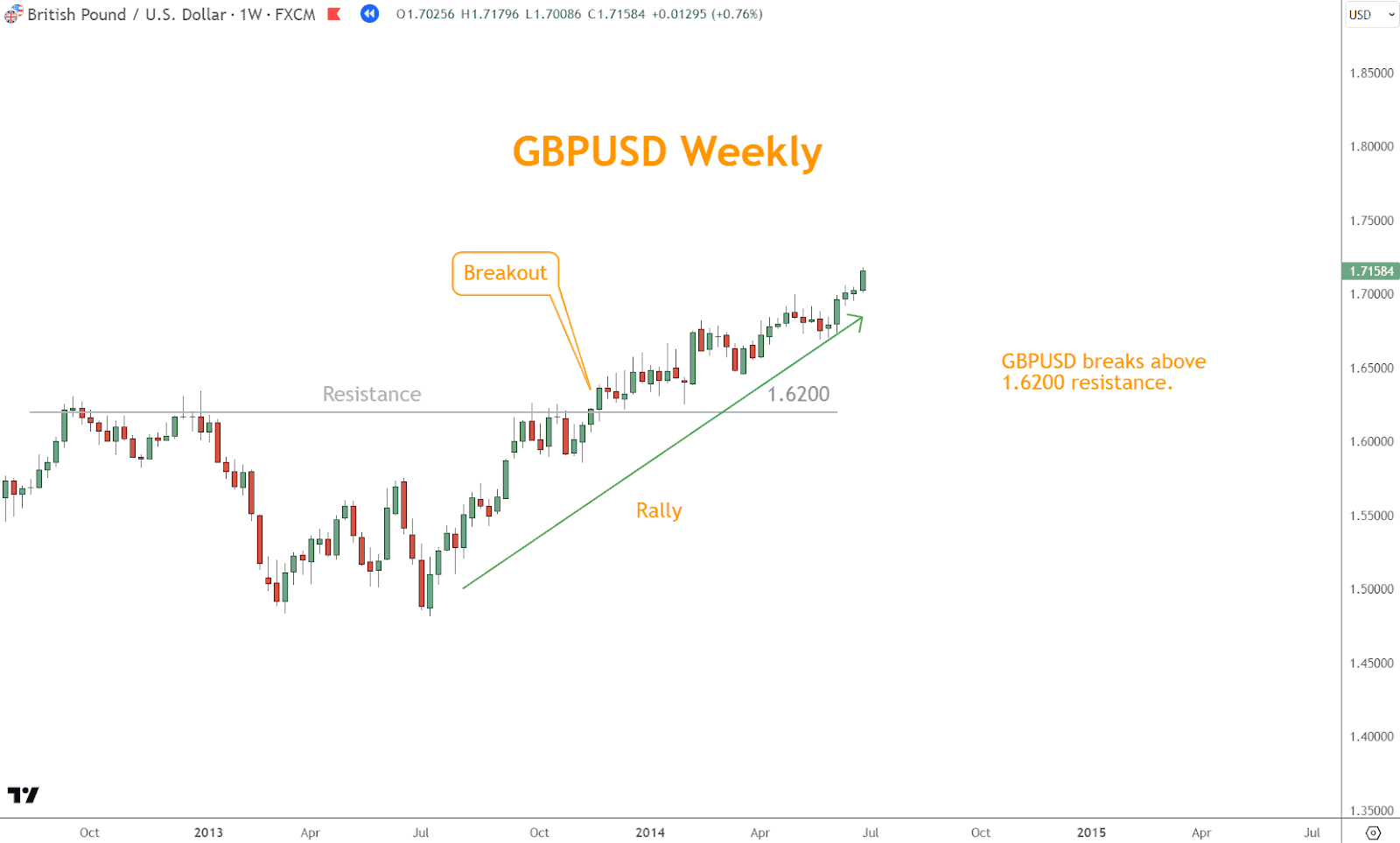

In the example below, GBPUSD is in a rally until it’s stopped by 1.6200 resistance.

After several consolidation sessions, the TSI moved from bullish to neutral.

After three bullish candles, the TSI moved back to bullish in coordination with GBPUSD, closing above 1.6200.

From there, the rally turned higher.

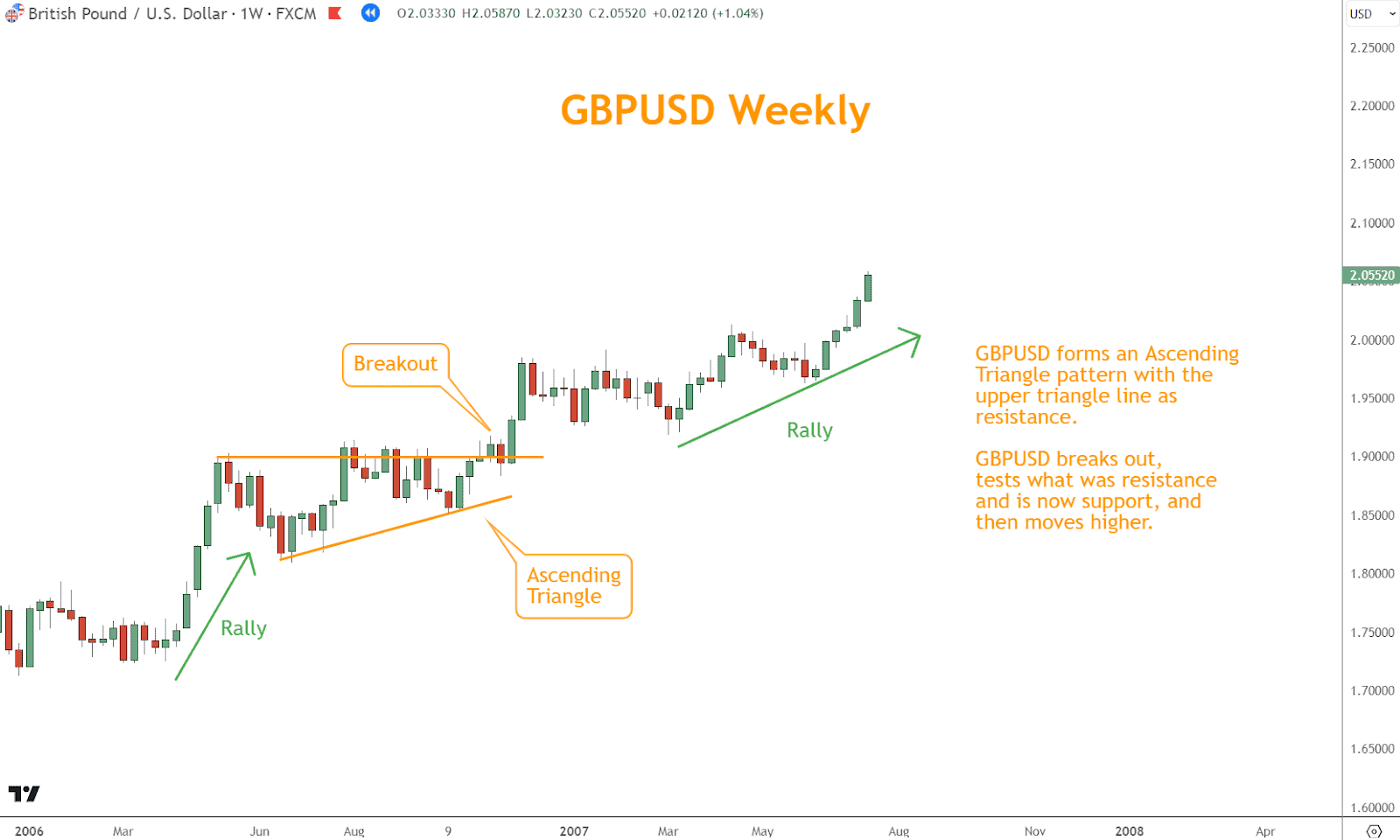

Chart patterns are another tool confirming breakouts.

Patterns such as triangles, rectangles, and flags, form due to price consolidation before a breakout occurs, and they also provide valuable signals for identifying potential breakouts.

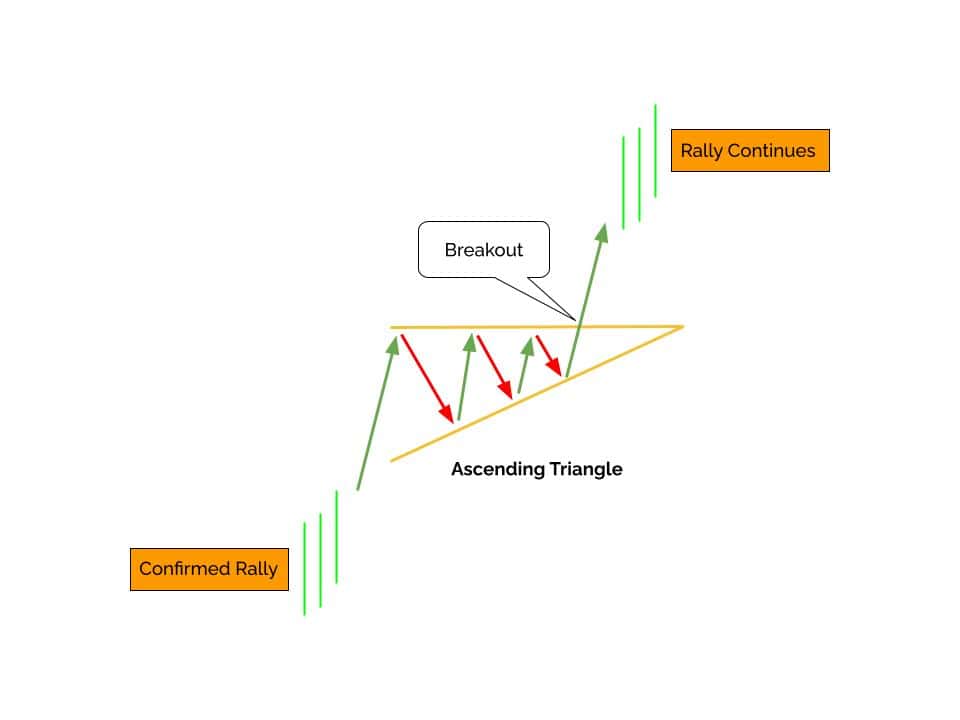

The diagram below shows how an Ascending Triangle pattern offers resistance and a breakout as the price approaches the apex.

Analyze these patterns to anticipate the direction of the breakout and establish entry and exit points based on pattern confirmation.

Combining these analytical tools and techniques can enhance your ability to identify breakout opportunities and make informed trading decisions.

However, it’s essential to exercise caution and wait for confirmation before entering trades, as false breakouts can lead to losses if not properly validated.

How Do I Identify Trading Breakouts?

Identifying breakout opportunities is paramount for traders seeking to capitalize on emerging trends.

Breakouts represent significant shifts in market sentiment, often leading to sharp price movements and lucrative trading opportunities.

Here, we delve into various methods you can use to identify and capitalize on breakout opportunities effectively.

Support and Resistance Levels

Support and resistance levels are valuable technical analysis tools in Forex trading.

These levels represent areas where buying and selling pressure converge, causing the price to stall or reverse direction.

In the chart below, 1.6200 is a significant resistance area GBPUSD struggles to overcome; however, it eventually performs a bullish breakout.

Identifying critical support and resistance levels on price charts lets you anticipate potential breakout points.

When the price decisively breaches these levels, it often indicates a shift in market dynamics, presenting you with opportunities to enter trades in the breakout direction.

Channel Lines

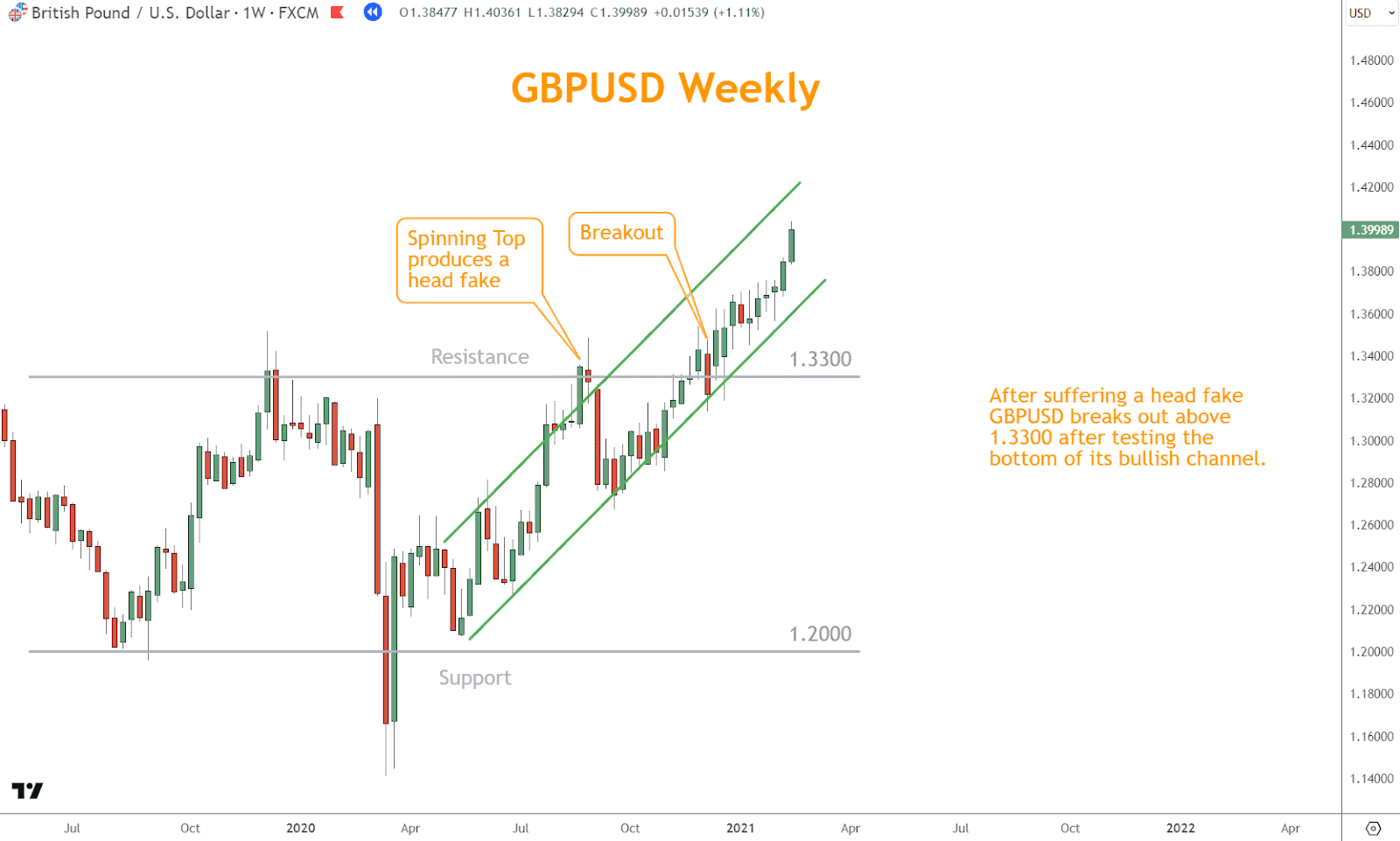

Channel lines help visualize the prevailing market direction by connecting consecutive highs or lows on a price chart.

Breakouts through sloping channel lines signal potential trend reversals or continuations, prompting you to adjust your trading strategies accordingly.

In the example below, GBPUSD initially produces a head fake, tests the bottom of the bullish channel, and runs through 1.3300 resistance.

Channel line analysis is instrumental in identifying breakout opportunities within established trends and anticipating potential trend changes.

Chart Patterns

Chart patterns provide valuable insights into market sentiment and potential breakout opportunities.

Price consolidation before a breakout can form patterns such as triangles, rectangles, and flags.

In the example below, GBPUSD is in a sharp rally when it starts to consolidate, forming an Ascending Triangle pattern.

The upper line of the pattern serves as resistance and, with a break and a retest, ultimately moves prices much higher.

Analyze these patterns to anticipate the direction of the breakout and establish entry and exit points based on pattern confirmation.

Trading breakouts from chart patterns often result in significant price movements, providing profitable trading opportunities.

Fundamental Analysis

Besides technical analysis, fundamental factors can influence Forex trading breakout opportunities.

Economic indicators, central bank decisions, geopolitical events, and market sentiment all shape currency movements and identify potential breakout opportunities.

By staying informed about critical economic events and developments, you can anticipate market reactions and position yourself accordingly to capitalize on breakout opportunities driven by fundamental factors.

By combining these methods, you can develop a comprehensive approach to identifying breakout opportunities and executing profitable trades.

However, it’s essential to exercise caution and wait for confirmation before entering trades, as false breakouts can occur, leading to potential losses if not properly validated.

Looking for a Strategy?

Download the Six Basics of Chart Analysis and sign up for Forex Forecast to learn a bottom-up approach to analyzing Forex markets and weekly market updates.

Strategies for Trading Breakouts

Trading breakouts in Forex markets requires a systematic approach and disciplined execution to capitalize on potential profit opportunities while managing risk effectively.

Here, we explore several strategies you can employ to navigate trading breakouts successfully and maximize your trading outcomes.

Breakout Confirmation

One of the fundamental principles of trading breakouts is waiting for confirmation before entering a trade.

This entails seeking validation of the breakout signal through price action and indicator analysis.

The example below shows how the TSI and a negated Dark Cloud Cover pattern provide breakout confirmation.

During the head fake, the TSI was nearly overbought, which is a risky state for opening a new long trade.

Later, the breakout comes with TSI momentum transitioning from neutral to bullish, which is ideal.

Simultaneously, GBPUSD prints a Dark Cloud Cover pattern, but it fails. A pattern failure can serve as confirmation just as well as a successful pattern.

Look for a strong candle close above or below the breakout level or other coinciding factors.

Waiting for confirmation can help you filter out false breakouts and enter trades more confidently, increasing the probability of success.

Pullback Entries

In some cases, the price may retrace to retest the breakout level before resuming its trend after a breakout occurs.

These pullbacks present favorable entry opportunities to enter trades at better prices, improving your risk-reward profile and maximizing profit potential.

The example below shows the GBPUSD breakout successfully over 1.3300 horizontal resistance and then pullback to channel support.

Price bounced off the channel, returned over 1.3300 resistance, and rallied higher.

By patiently waiting for pullback entries, you can avoid chasing momentum and enter trades with lower levels of risk, increasing the likelihood of a successful outcome.

Conclusion

Trading breakouts in Forex markets can be lucrative for traders seeking to capitalize on trends.

By understanding the fundamentals of breakouts, identifying breakout opportunities, and implementing effective trading strategies, you can unlock the potential for profits in Forex trading.

With discipline, patience, and a well-defined approach, you can harness the power of breakouts to help achieve your trading goals in the Forex market.

What are Your Next Steps?

Select a chart and look for trading breakouts using what you’ve learned.

In addition, look for opportunities to coincide them with other technical analysis tools and techniques to see how they work together.

Identifying and trading breakouts is easier when you incorporate momentum, Japanese candlesticks, and chart patterns, making trading easier.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate into your knowledge of support and resistance tactics.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will use the Six Basics of Chart Analysis and Advanced Strategies to show you the trade opportunities I’m watching.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce videos and guides to help you learn and improve trading practices.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What Are Trading Breakouts in Forex Trading?

Breakouts in Forex trading occur when the price of a currency pair moves beyond a predefined level of support or resistance, signaling a potential shift in market sentiment and the emergence of a new trend.

Breakouts are often accompanied by increased momentum, allowing you to capitalize on significant price movements.

How Can Traders Identify Breakout Opportunities?

You can identify breakout opportunities using various methods, including analyzing support and resistance levels, channel lines, momentum indicators, and chart patterns.

By monitoring price charts and employing technical analysis tools, you can anticipate potential breakout points and position yourself accordingly to capitalize on emerging trends.

What Are Some Common Strategies for Trading Breakouts?

Several strategies can be employed when trading breakouts in Forex markets.

These include breakout confirmation, risk management, follow-through analysis, pullback entries, and multiple timeframe analysis.

Incorporating these strategies into their trading approach can enhance your ability to identify profitable breakout trades and manage risk effectively.

What Are Some Common Pitfalls to Avoid When Trading Breakouts?

While trading breakouts can be profitable, you should avoid several common pitfalls.

These include chasing breakouts without waiting for confirmation, ignoring market context and trend direction, entering trades impulsively without proper analysis, and failing to adapt to changing market conditions.

By being mindful of these pitfalls and maintaining a disciplined approach to trading, you can increase your chances of success when trading breakouts in Forex markets.