The Shooting Star and Inverted Hammer are two patterns that are vital for you to understand because they can provide insight into the market’s next move.

In this article, I will delve into what each pattern means, how to identify them, and, most importantly, how to trade them.

I will also share three tips to help you make informed decisions while trading these patterns.

What are the Shooting Star and Inverted Hammer Candlestick Patterns?

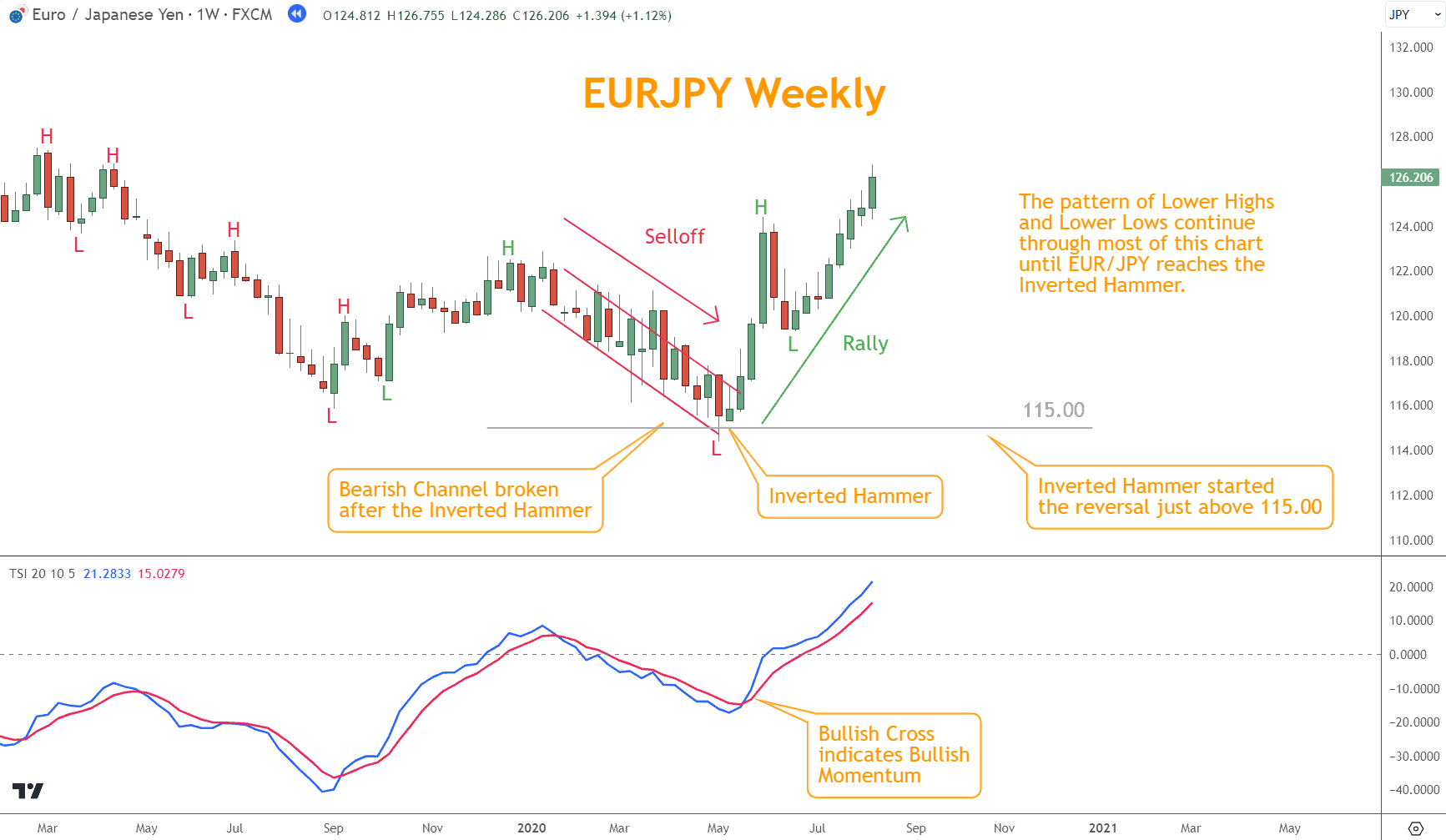

These patterns indicate potential reversals from Rally to Selloff (Shooting Star) or Selloff to Rally (Inverted Hammer).

You can analyze market sentiment and make informed trading decisions using these patterns. Candlestick patterns like these are widely utilized in technical analysis.

Understanding the Basics of These Patterns

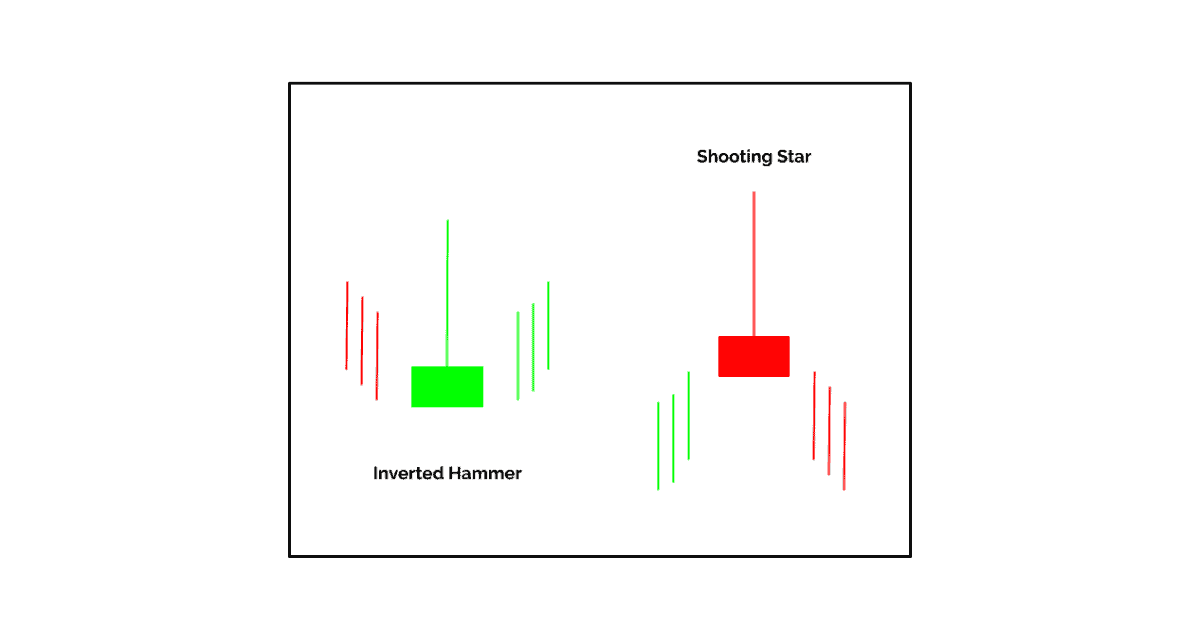

Both patterns have small bodies and long upper shadows, indicating potential reversals in price movement. The critical difference lies in the context in which they form.

A Hanging Man pattern typically occurs at the end of a Selloff, signaling a possible reversal to a Rally.

On the other hand, a Shooting Star pattern forms at the end of a Rally, suggesting a potential reversal to a Selloff.

You can rely on these patterns as simple yet effective means of detecting market patterns. However, it is essential to note that confirmation is crucial before making any trading decisions based on these candlestick formations.

These are just two of many one-candle Japanese Candlestick Patterns, and you can learn more about them in this article: One Candle Japanese Candlestick Patterns: 5 You Must Know.

These patterns serve as early warning signs, but further analysis and confirmation are required to determine their validity.

Identifying the Shooting Star in Forex Trading

The Shooting Star has a small body and a long upper shadow. This pattern typically occurs after a Rally and signifies a potential reversal in the market.

When the pattern forms, it suggests that the Bulls were initially in control but lost Momentum, allowing the Bears to push the price down, reflecting market indecision.

This pattern is often seen as the first sign of a reversal.

The small body of the candlestick represents the opening and closing prices, while the long upper shadow indicates that the Bears were able to push the price down significantly before the session closed. This signifies their increasing strength.

How to Trade the Shooting Star Pattern

Waiting for confirmation after identifying the pattern is crucial when trading.

This confirmation can come as a lower close in the next trading session or with other indicators (I highly suggest the latter). By waiting for confirmation, traders can avoid false signals and increase the reliability of their trades.

To effectively trade this pattern, it is essential to include stop-losses and take profits at predetermined levels.

Trading is a dynamic process, and each trade should be evaluated individually.

Identifying the Inverted Hammer Pattern

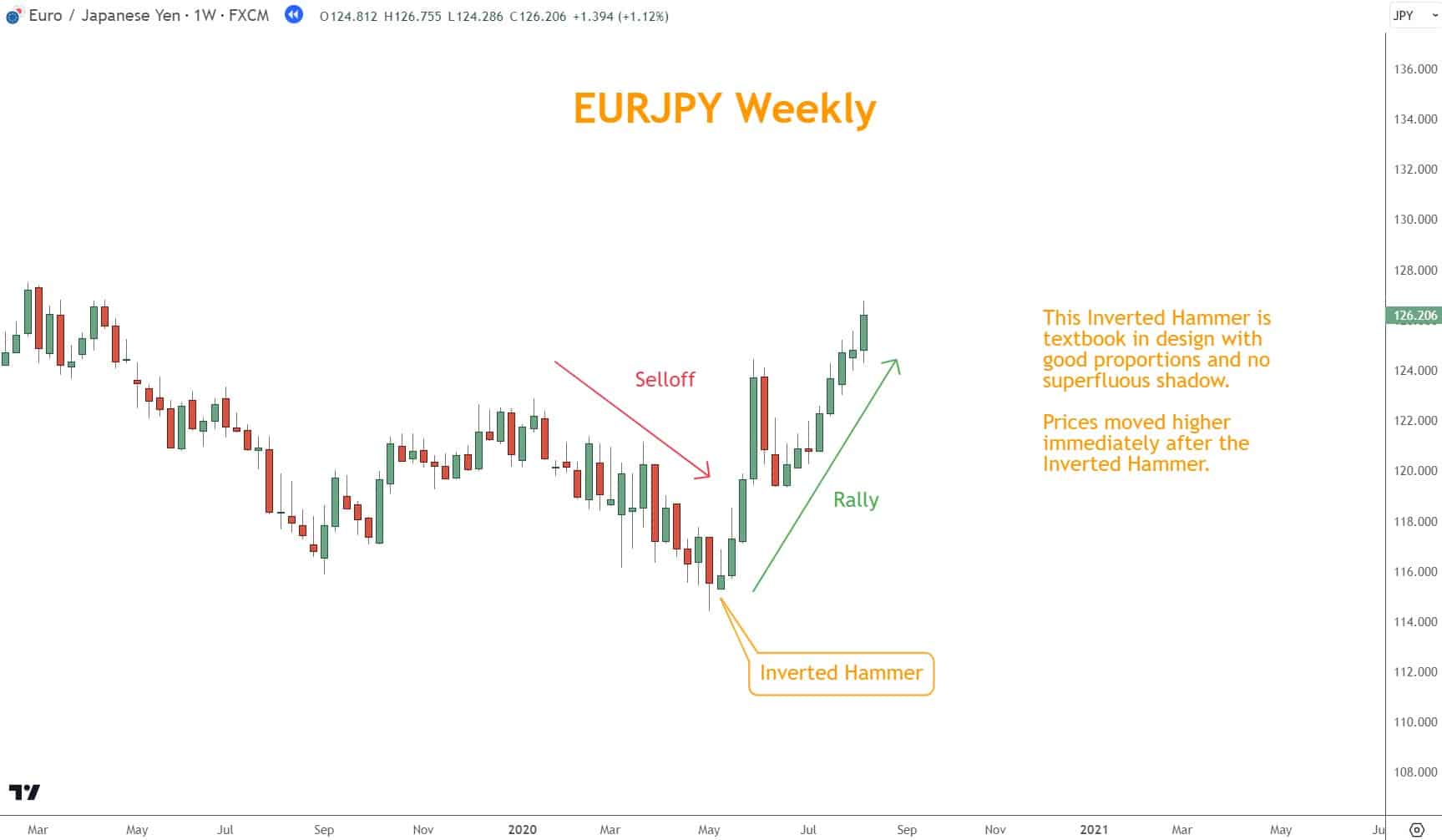

A small body and a long upper shadow characterize the Inverted Hammer pattern, suggesting a potential Bullish reversal.

The small body indicates indecision between buyers and sellers, while the extended upper shadow represents the presence of sellers pushing prices down.

This formation is the first sign of a potential reversal, as it suggests that the selling pressure is weakening and buyers may take control.

This confirms that buyers have regained control, and the forex pair will likely move higher.

How to Trade the Inverted Hammer Pattern

When trading the Inverted Hammer pattern, waiting for confirmation after identifying the pattern is crucial.

This confirmation can come as a robust Bullish candlestick with a new closing high or coincidental confirmation from another indicator. I recommend you get confirmation from other indicators, and later in this post, I will provide an example.

You can increase the probability of a successful trade by waiting for confirmation.

To confirm the Inverted Hammer pattern, traders should look for a green candlestick with an open price higher than the previous day’s close or confirmation from other indicators.

The latter is always my suggestion.

Additionally, it is crucial to use stop-losses to limit potential losses and take profits at predetermined levels. This risk management technique protects you if the trade does not go as expected.

Three Tips for Trading These Reversal Patterns

When trading either of these candle patterns, keeping a few essential tips in mind is important.

- Context is crucial. Consider the overall market trend and price action before making any trading decisions.

- By understanding the bigger picture of news and economics, you can better assess whether these patterns will likely lead to a reversal or continuation.

- Incorporate other indicators for confirmation.

- Momentum, Chart Patterns, and Support and Resistance levels can provide valuable insights into a pattern’s validity.

- Using these indicators in conjunction with the candlestick patterns can strengthen your trading strategy and increase your chances of success.

- Wait for confirmation before entering a trade based on either pattern.

- This means waiting for additional indicators to support your analysis. It could be a break of a critical level or a reversal candlestick pattern that forms after either pattern.

- Patience is vital in trading, and waiting for confirmation can help you avoid false signals and increase your chances of a profitable trade.

Implement these three key tips to maximize your trading success: ensure context is considered, incorporate additional indicators, and wait for confirmation.

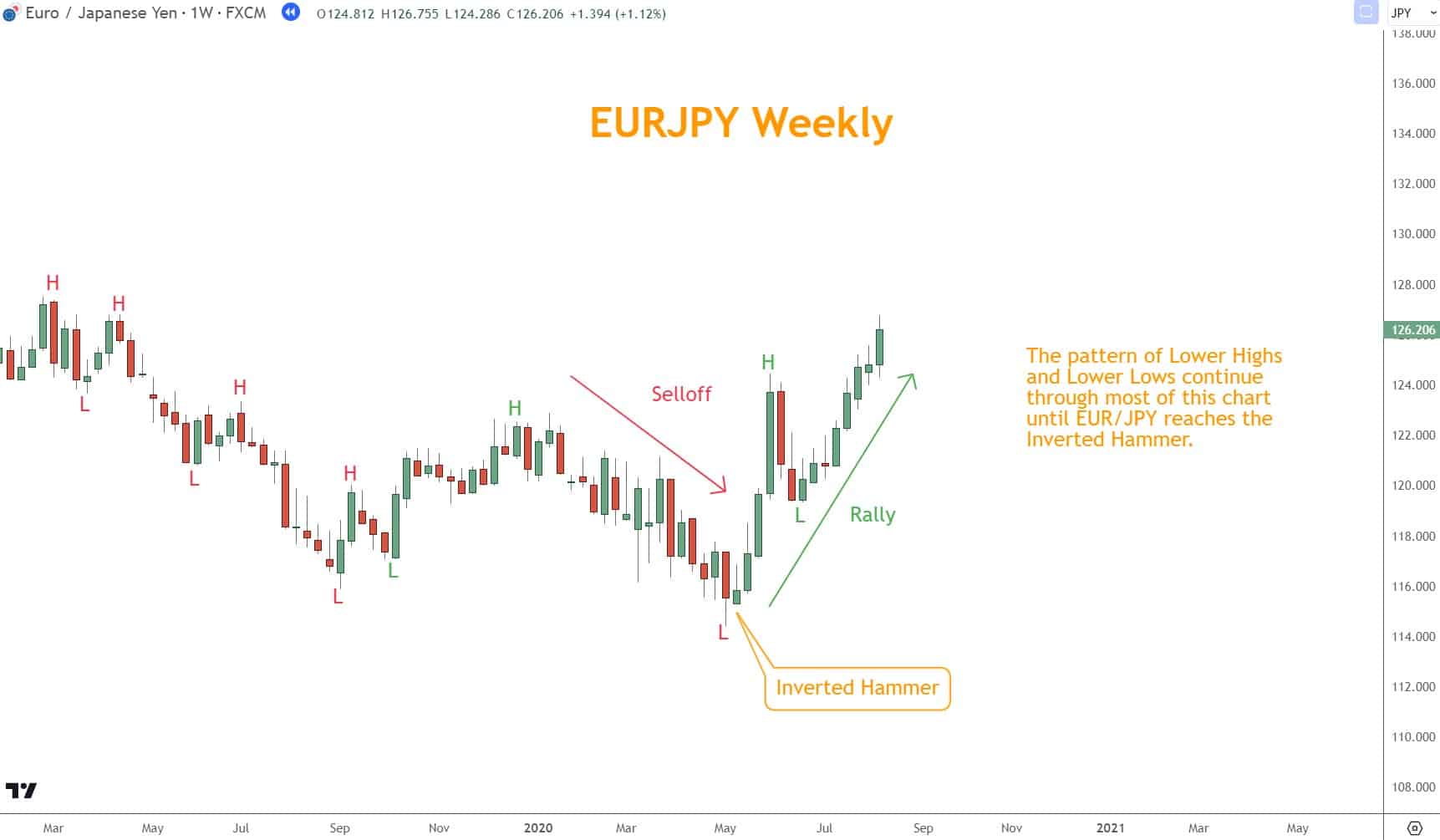

You Need to Identify the Context First

Identifying the context first to make more accurate trading decisions is critical.

This involves analyzing the overall market direction and sentiment, understanding the current price action, and identifying the prevailing direction. Considering economic or political news that could influence markets is also crucial in contextual analysis.

You can better understand the broader trends and potential opportunities by analyzing the overall market direction and sentiment. This involves looking at indicators across financial markets and determining other traders’ current mindset.

Understanding the current price action is essential for identifying the prevailing direction. I encourage you to consider factors of historical performance, providing insights into market sentiment.

Considering what economic or political news could influence markets is another crucial aspect of contextual analysis. These factors can have a significant impact on the market’s behavior.

By analyzing the overall market direction and sentiment, understanding the current price action, and considering relevant news, you can have a deeper look at the market and increase your chances of success.

Incorporate other Indicators

When trading these candle patterns, it is crucial to incorporate other indicators to increase the reliability of your trades.

You can gain further confirmation of these patterns by using additional technical indicators, such as Momentum indicators like the TSI, Chart Patterns, and Support and Resistance levels.

Finding confluence or agreement between indicators can provide higher reliability when trading these patterns.

When multiple indicators align and confirm one of these patterns, the probability of a successful trade increases.

Each indicator provides a unique perspective on price action and market sentiment.

By incorporating other indicators, you can better understand a Forex pair and make more informed trading decisions.

These indicators can help you determine the strength and direction of the pattern and identify potential entry and exit points.

Incorporating other indicators enhances the interpretation of patterns and provides a more comprehensive view of the price action.

This allows you to make better-informed decisions and increases the likelihood of successful trades.

Wait for Confirmation

When considering trades, it is essential to exercise caution and wait for confirmation.

The patterns alone should not be the basis for entering a trade in the financial markets. Instead, it is crucial to wait for confirmation through coinciding indicators that enhance the validity of these patterns.

Confirmation is essential in reducing false signals and increasing trading accuracy.

Traders can better understand market dynamics by incorporating other indicators, such as Momentum indicators like the TSI, chart patterns, and Support and Resistance levels.

Looking for confluence or agreement between multiple indicators adds reliability and strengthens the possibility of success for each pattern.

Waiting for confirmation also includes analyzing the context of the trade.

Considering the overall market direction, sentiment, and prevailing price action helps determine the validity of the Shooting Star or Inverted Hammer formation.

Additionally, considering any economic or political news that may influence the markets provides valuable insight for accurate trading decisions.

By incorporating confirmation via analyzing the context and other indicators, you can make more well-informed decisions and maximize your chances of profitability.

What’s the Next Step?

Select a favorite candlestick chart and look for Shooting Star and Inverted Hammer candlestick patterns using your knowledge.

In addition, look for opportunities to coincide them with other technical analysis tools and techniques to see how they work together.

Combining Momentum, Chart Patterns, and Support and Resistance can give you a comprehensive view and understanding to make trading easier.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about the Shooting Star and Inverted Hammer patterns.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and Advance Strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What are Some Common Mistakes to Avoid When Using These Patterns in Trading?

Some common mistakes to avoid when using these candle patterns in trading include relying solely on these patterns without considering other indicators, not waiting for confirmation, overlooking the market context, and failing to set proper stop-loss and take-profit levels.

Are There Any Other Similar Patterns That Traders Should Know?

Yes, traders should be aware of other candlestick patterns. Some examples of one-candle Japanese Candlestick patterns include the Doji, Hammer, and Hanging Man. These patterns can provide valuable insights into market trends and potential price reversals.