To successfully trade a sideways market, it’s crucial first to understand what this term means in Forex trading.

A sideways market, or a ranging or horizontal market, is when prices move within a narrow range without forming any clear Rally or Selloff.

For you, being able to identify this type of market condition is essential because the usual strategies that work in trending markets won’t work.

In this article, we will explore how technical analysis tools such as Trend, Momentum, Japanese Candlesticks, Chart Patterns, and Support and Resistance levels can be used to make informed trading decisions in a sideways market.

Understanding these technical indicators and techniques is essential to navigating sideways markets profitably.

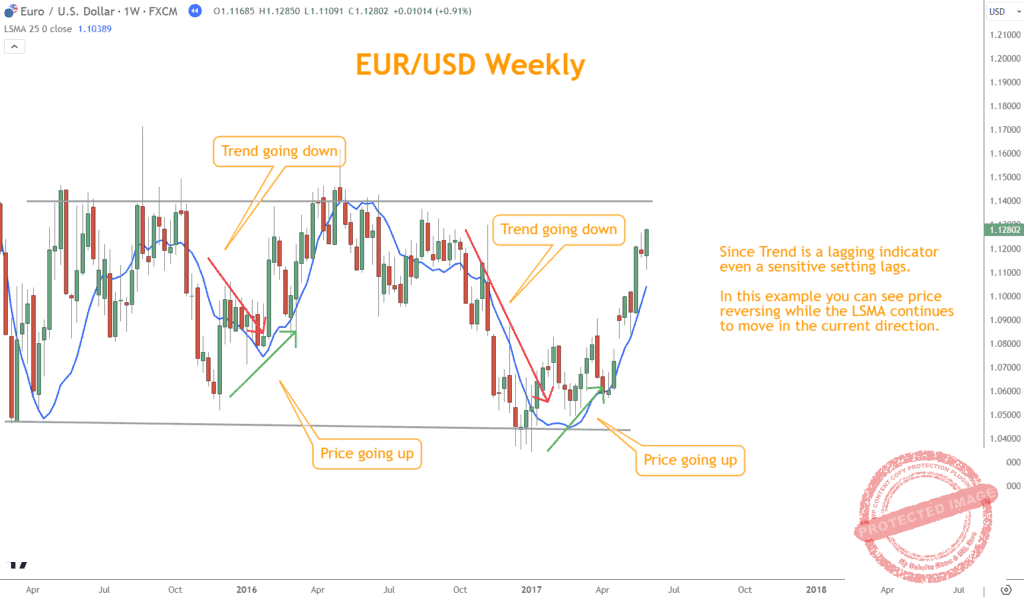

Is Trend a Help or a Hinder in Sideways Markets?

Trend analysis holds a significant place in Forex trading, especially when navigating through a sideways market.

In these conditions, identifying the market’s direction is difficult, as the usual robust signals of Trending markets are absent.

Trend indicators are lagging indicators and, as a result, give false signals in sideways markets.

In a sideways market, prices typically hover around a Moving Average without consistently breaking above or below for extended periods.

Recognizing these patterns allows you to adjust your strategies, possibly opting for range-trading tactics instead of Trend-following ones.

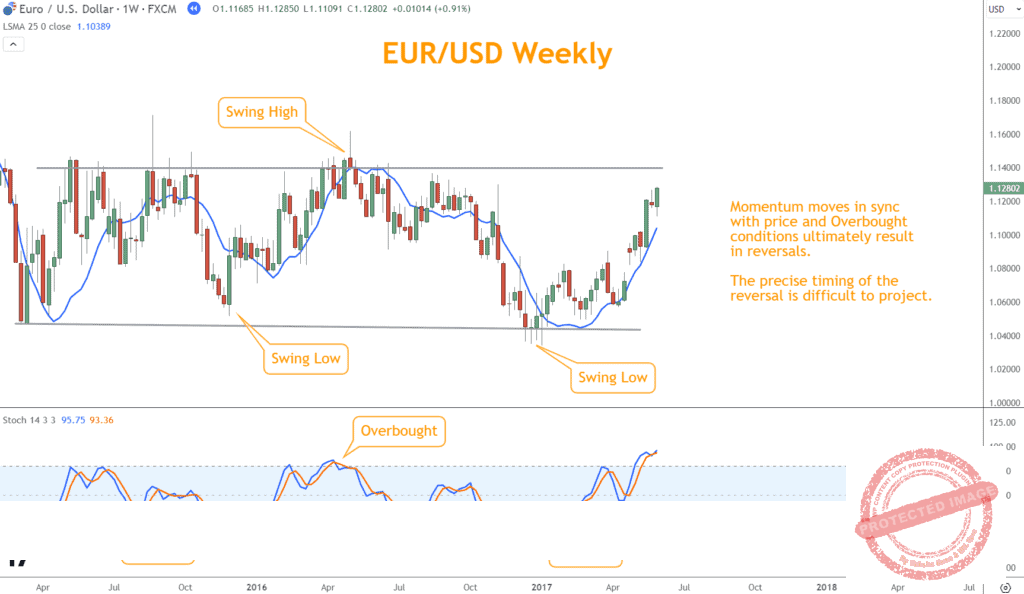

Is Momentum Crucial to Trade a Sideways Market?

Momentum indicators are valuable tools for Forex traders when the market moves sideways. These indicators help traders understand if prices are likely to continue or change direction.

Instruments such as the Relative Strength Index (RSI) and Stochastic Oscillator, which measure the speed and change of price movements, can help you navigate the waves of a non-Trending market.

Within these conditions, Momentum indicators can highlight overbought or oversold regions, signaling traders to anticipate a possible change in price direction.

For instance, an RSI value surpassing 70 might suggest an overbought condition, prompting traders to prepare for a potential downward movement. Conversely, an RSI below 30 might indicate an oversold market, signaling a possible upward reversal.

By interpreting Momentum cues, you can refine entry and exit strategies, profiting from short-term fluctuations when you trade a sideways market.

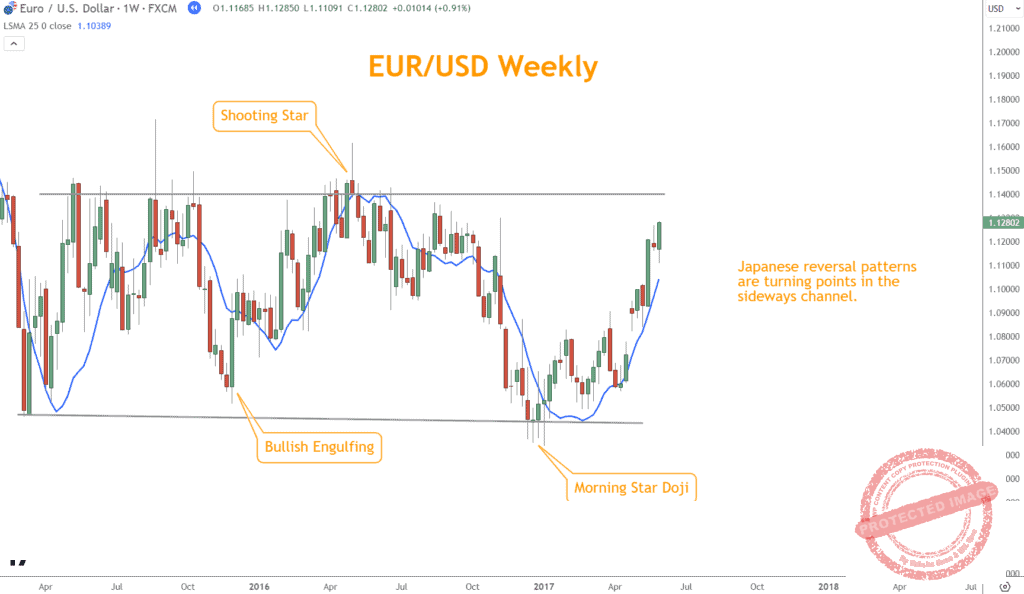

Can you Trade a Sideways Market with Japanese Candlesticks?

Japanese Candlestick patterns are crucial in deciphering price movements and trader sentiment, especially in a sideways market.

These patterns, formed by the price’s open, close, high, and low within a specific timeframe, offer traders visual cues to potential reversals or continuations in the market.

In a sideways market, specific candlestick patterns such as Dojis, Spinning Tops, and Hammers become particularly significant.

A Doji, characterized by a small body and lengthy wicks, indicates indecision in the market, a common occurrence in sideways conditions.

Spinning Tops, with their small bodies and relatively long wicks, also depict a state of balance between buyers and sellers, suggesting a potential shift in control.

Hammers, with their long lower wick and small upper body, can signal a bullish reversal after a decline.

Traders who understand candlestick patterns can accurately assess market sentiment and make better trading decisions.

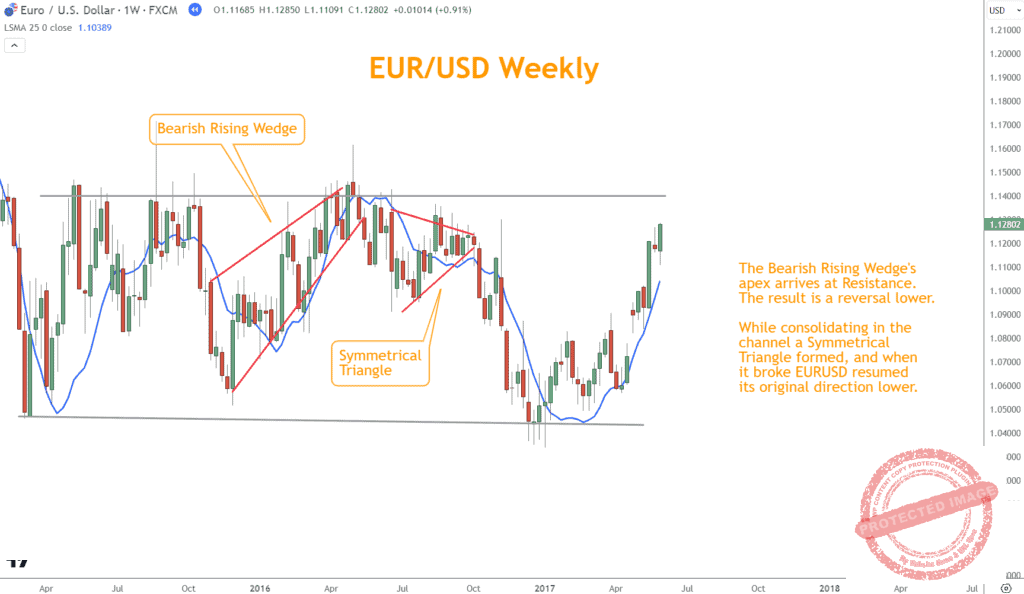

Can Chart Patterns Help Trade a Sideways Market?

Chart patterns are indispensable in Forex trading, offering a visual framework to understand and anticipate price movements, particularly in a sideways market.

In these markets, where prices move within a defined range, Chart Patterns such as Triangles, Rectangles, and Flags become prominent trading tools.

Triangles, formed by converging Trend lines, can indicate a period of consolidation and potential breakout.

Rectangles, marked by parallel horizontal lines, highlight the range-bound nature of the market, providing precise Support and Resistance levels for you to consider.

Flags, characterized by small price fluctuations and parallel Trend lines, may signal a brief consolidation before a continuation of the prior Trend.

Mastery of these Chart Patterns lets you decipher the market’s state of mind, enabling more precise entries and exits.

How Essential are Support and Resistance in a Sideways Market?

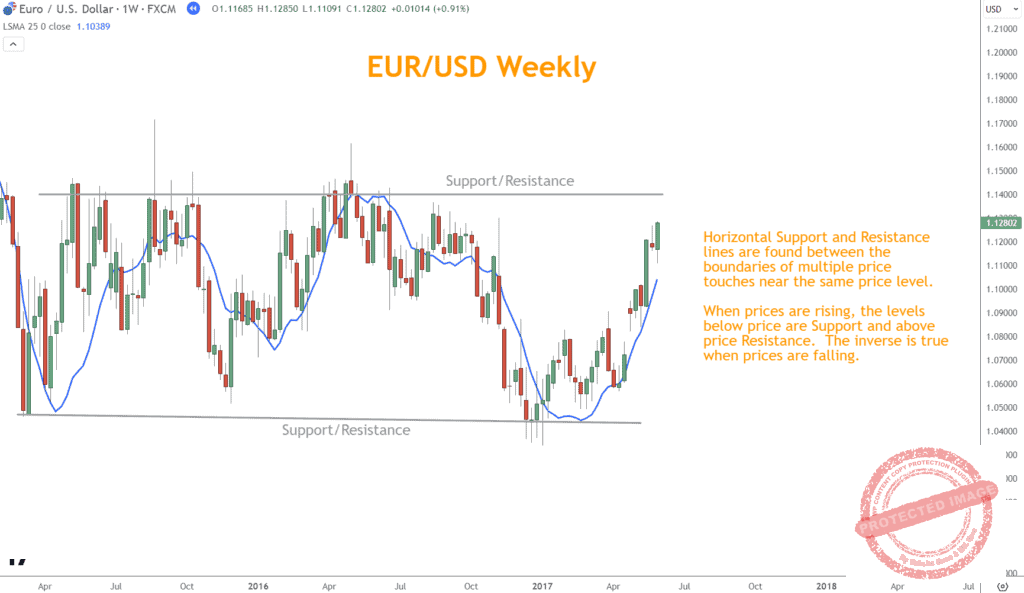

Support and Resistance levels are fundamental components in Forex trading, acting as invisible barriers that influence price movements, particularly in a sideways market.

These levels are crucial for traders as prices bounce between Support and Resistance.

In a sideways market, it is crucial to identify key levels that provide clear boundaries for range-bound price movements.

You can use historical price data to identify these levels, observing where prices have previously reversed or consolidated.

Understanding Support and Resistance enables you to make educated predictions about potential price reversals and breakout points, setting the stage for strategic entries and exits.

Conclusion

To successfully trade in a sideways market, it is essential to accurately identify this market condition and utilize a complete range of technical analysis tools.

The effective use of Trend, Momentum, Japanese Candlesticks, Chart Patterns, and an understanding of Support and Resistance levels is paramount.

Solid risk management strategies and resilient trading psychology are crucial beyond the technical aspects.

When navigating a volatile market, success is not just about profit but also about protecting your capital from risks.

You are encouraged to put the knowledge and strategies acquired into practice, utilizing demo accounts to hone your skills.

What’s the Next Step?

Select a reputable broker and open an account using what you learned in this article about how to trade a sideways market.

In addition, look for opportunities to incorporate multiple indicators in your analysis.

Once you’re ready to trade, choose a strategy and process you believe will work for you.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about Forex trading.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What is the Primary Challenge of Trading in a Sideways Market?

The primary challenge is the lack of clear direction, making it difficult to predict price movements.

Can I use Fundamental Analysis in a Sideways Market?

Yes, fundamental analysis can complement technical analysis, but it’s essential to understand that sideways markets are often less influenced by external events.

Is it Possible to Profit in a Sideways Market?

Yes, by using the right strategies and technical analysis, you can profit from short-term price fluctuations; however, trading sideways markets is one of the riskiest and most unpredictable strategies to choose from.

What is the best Indicator for a Sideways Market?

There is no one-size-fits-all answer, but Momentum indicators and Japanese Candlestick patterns are often the most effective.