Japanese Candlestick patterns offer valuable insights into market reversals and can help you make informed trading decisions. This article will focus on three-candle Japanese Candlestick patterns and how they can give you an edge in the market.

We’ll explore the most common examples: Evening Stars, Morning Stars, Three White Soldiers, and Three Black Crows.

We’ll also discuss combining them with other indicators and techniques, such as Momentum indicators, Chart Patterns, and Support and Resistance levels.

What is a Three Candle Japanese Candlestick Pattern in Forex?

Traders commonly utilize these patterns for forecasting market reversals.

Why? They are graphical representations of price movements in the financial markets. Each candlestick represents a specific period and shows the opening, closing, and high and low prices.

They can provide valuable information about market direction, reversals, and potential trading opportunities.

There are one candle patterns, such as the Hammer and Shooting Star, and two candle patterns, such as the Engulfing or Dark Cloud Cover.

Three candle patterns are more complex and fewer in number but as significant as the other types.

Recognizing and understanding these can help traders make more informed decisions.

Examples of Three Candle Japanese Candlestick Patterns You Can Trade Now

These “triple” candle patterns often look like parts of one and two candle patterns added together.

I’ve selected only these four (two Bullish and two Bearish) because they are the most unique and dissimilar from their one and two-candle counterparts.

The Most Common: Evening Star and Morning Star Reversals

Evening and Morning Stars are two that can indicate potential reversals.

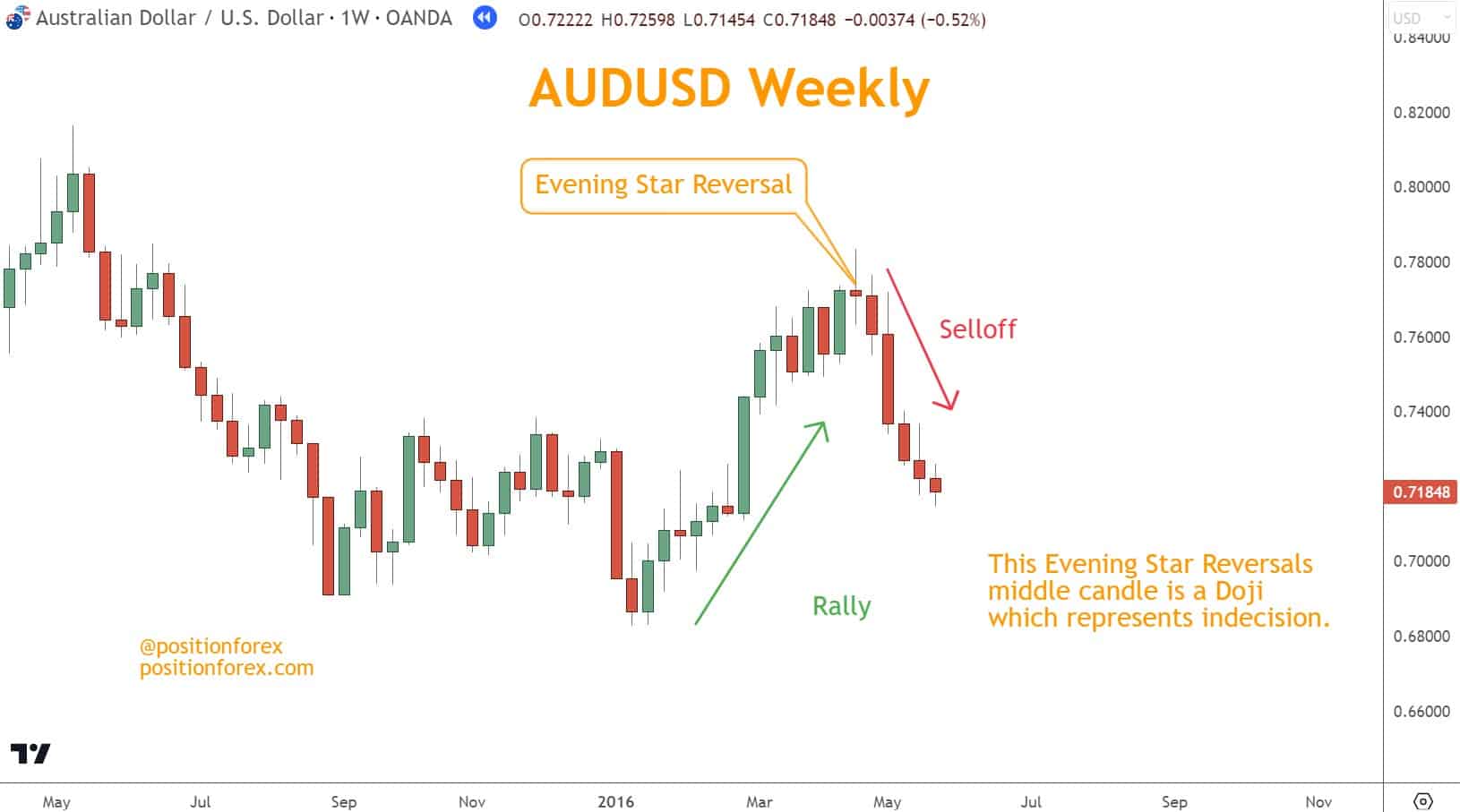

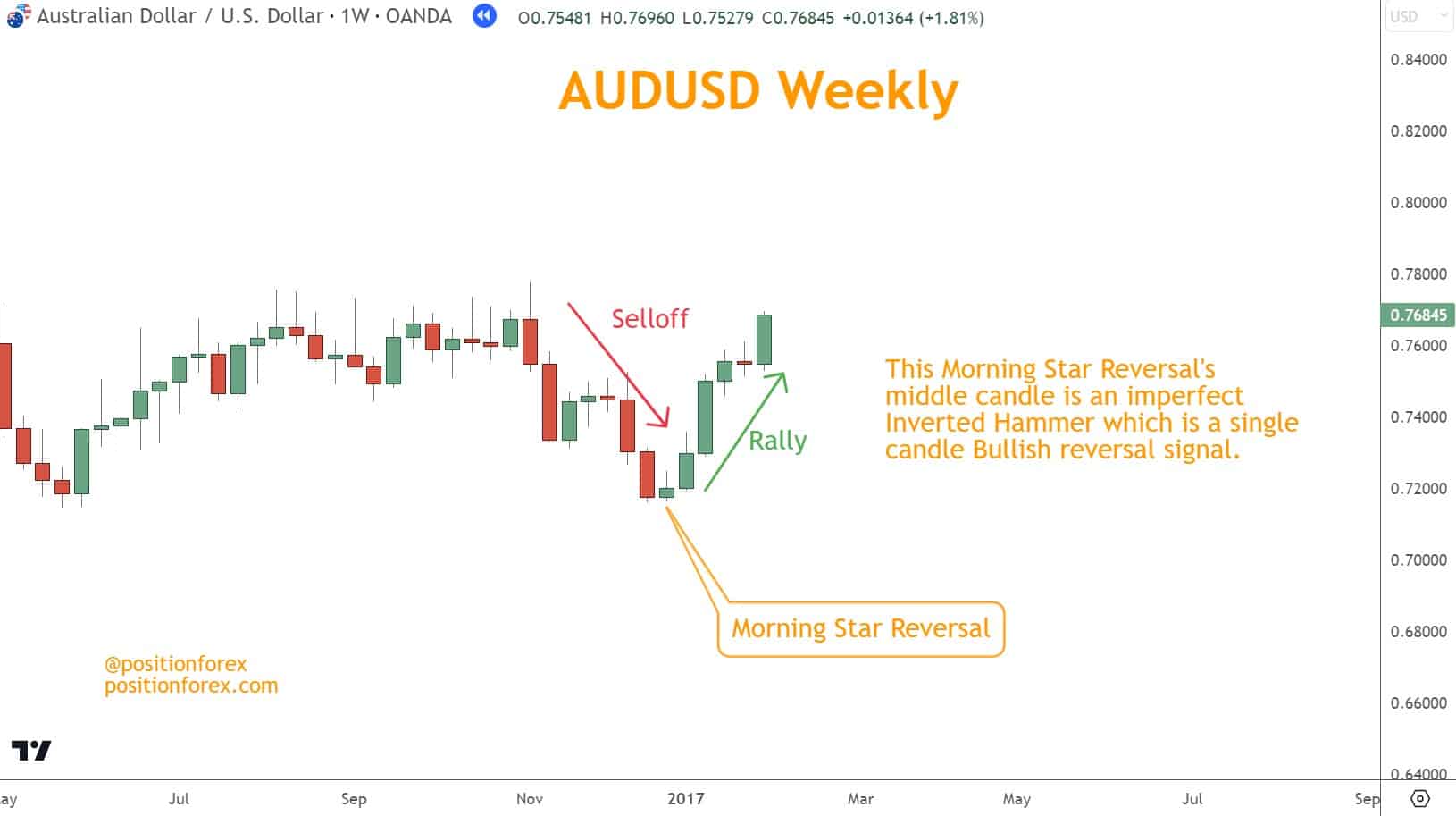

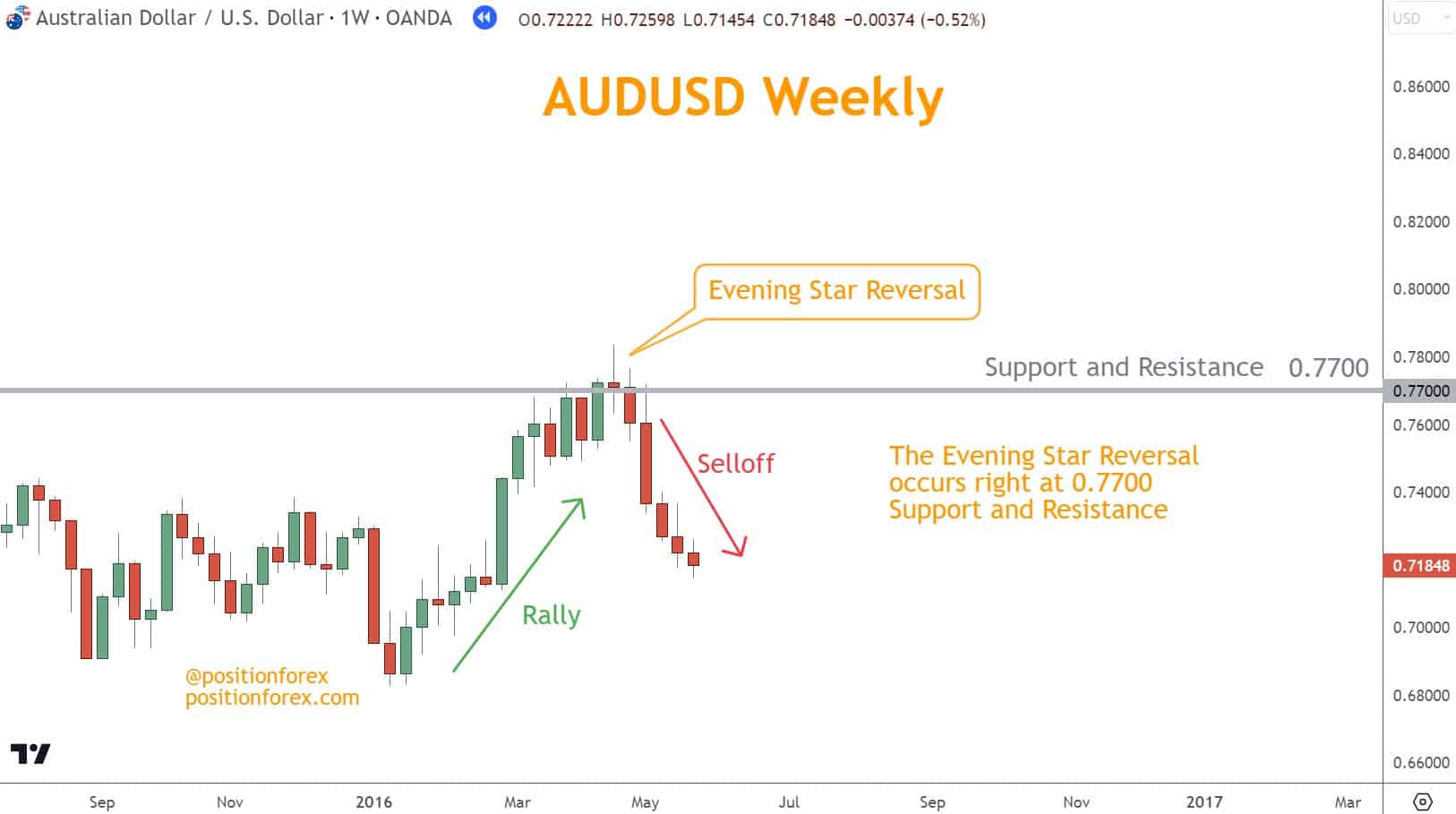

The Evening Star pattern consists of a tall Bullish candle, a smaller candle, and another Bearish candle. It suggests a reversal from a Rally to a Selloff.

On the other hand, the Morning Star pattern is the opposite, with a tall Bearish candle, followed by a smaller candle, and then a Bullish candle. This pattern indicates a potential reversal from a Selloff to a Rally.

They are combined with other technical analysis tools to confirm trading decisions.

However, waiting for confirmation before trading decisions is essential, as false signals can occur.

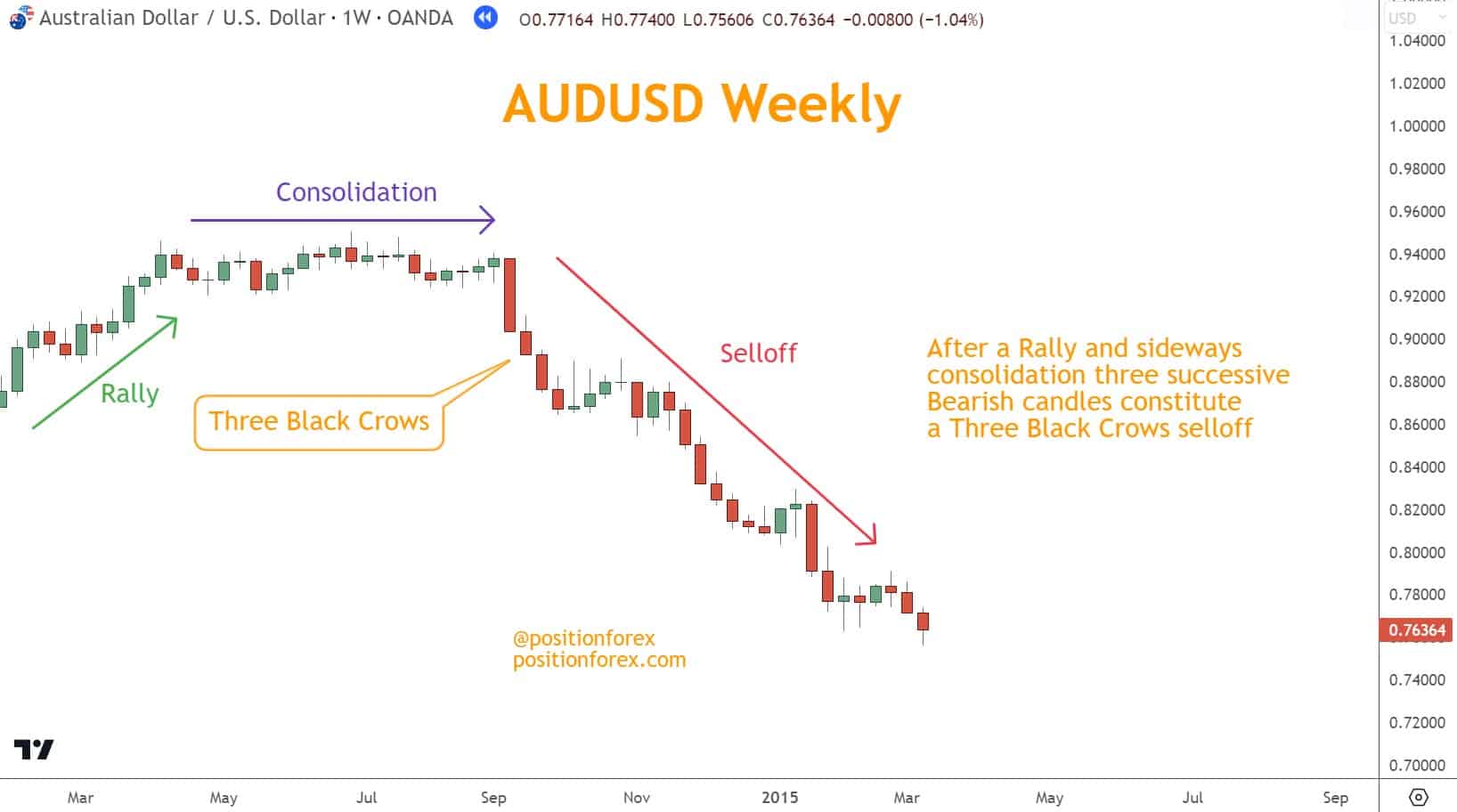

Less Common but Powerful: Three White Soldiers and Three Black Crows

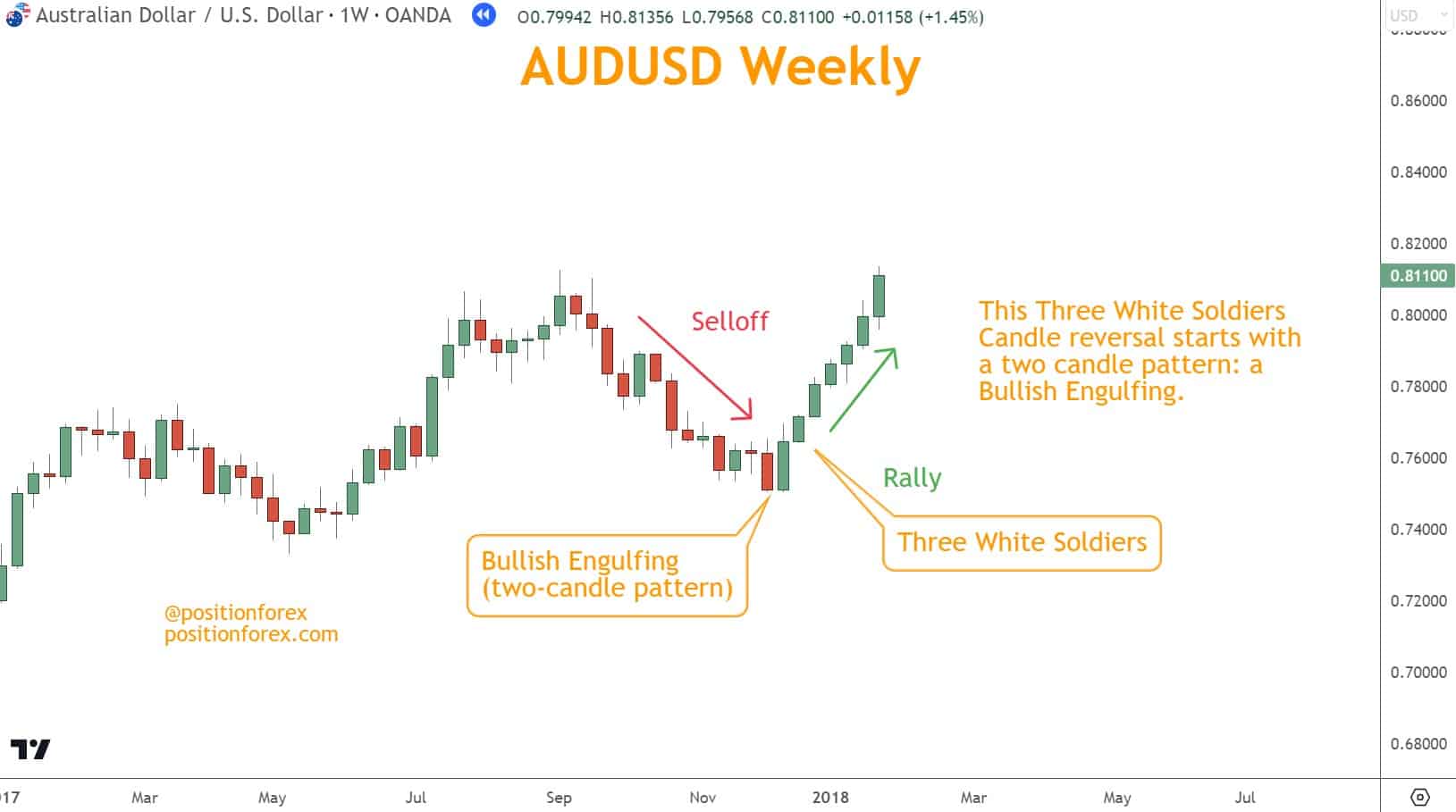

Three White Soldiers and Three Black Crows are powerful candlestick patterns that can indicate a reversal in a forex pair.

This is a Bullish pattern characterized by three consecutive long green candles moving prices higher.

On the other hand, Three Black Crows is a Bearish pattern consisting of three successive long red candles moving prices lower.

Traders often use these to identify potential buying or selling opportunities. However, confirming them with other indicators, Chart Patterns, or Support and Resistance is essential for more accurate predictions.

Should You Combine Them with Other Technical Analysis Indicators and Techniques?

Combining Three Candle Japanese Candlestick Patterns with other Technical Analysis Indicators and Techniques is essential.

These Candlestick Patterns, such as the Morning Star, Evening Star, Three White Soldiers, and Three Black Crows, serve as reliable indicators of reversals. Combining them with other indicators can increase the confirmation of your trading decisions.

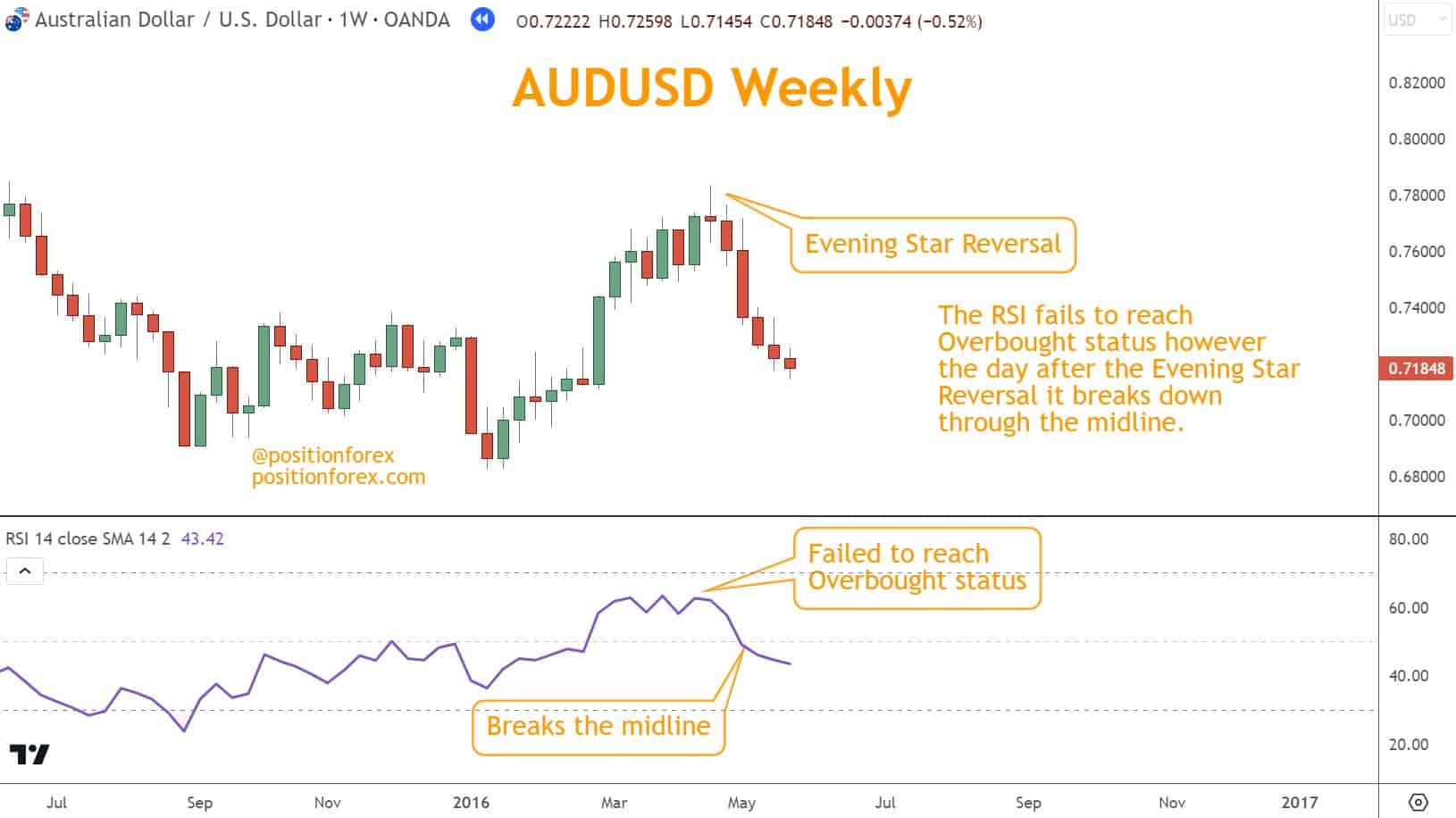

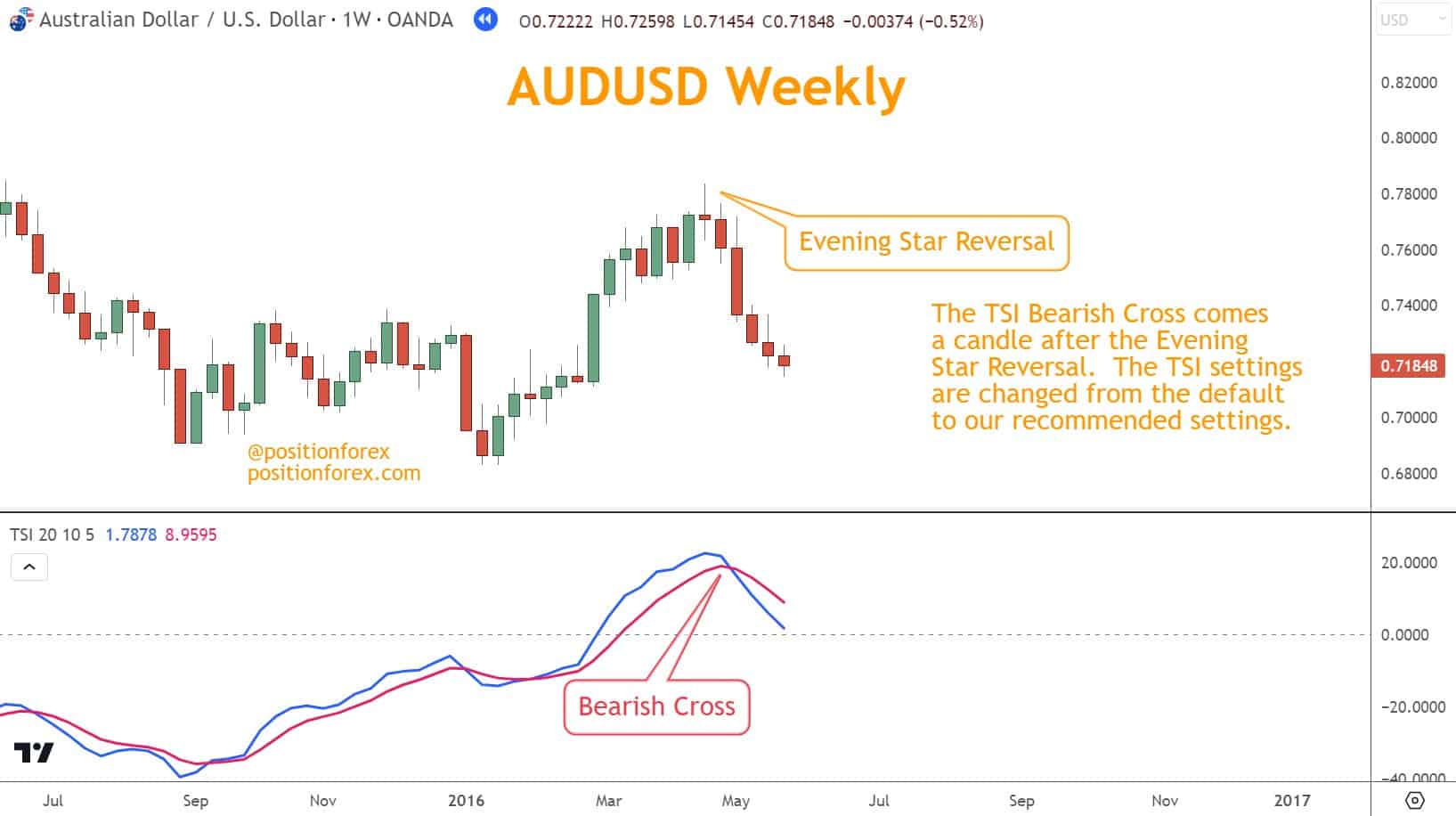

How you can Combine Them With Momentum Indicators

Combining with Momentum indicators such as the Relative Strength Index (RSI) or True Strength Index (TSI) can be beneficial.

Overbought and Oversold levels often coincide with reversals, as described here. The RSI has specific Overbought and Oversold levels, whereas a crossover between the TSI and its signal line defines these levels.

These indicators can help confirm the validity and enhance the trading signals they provide.

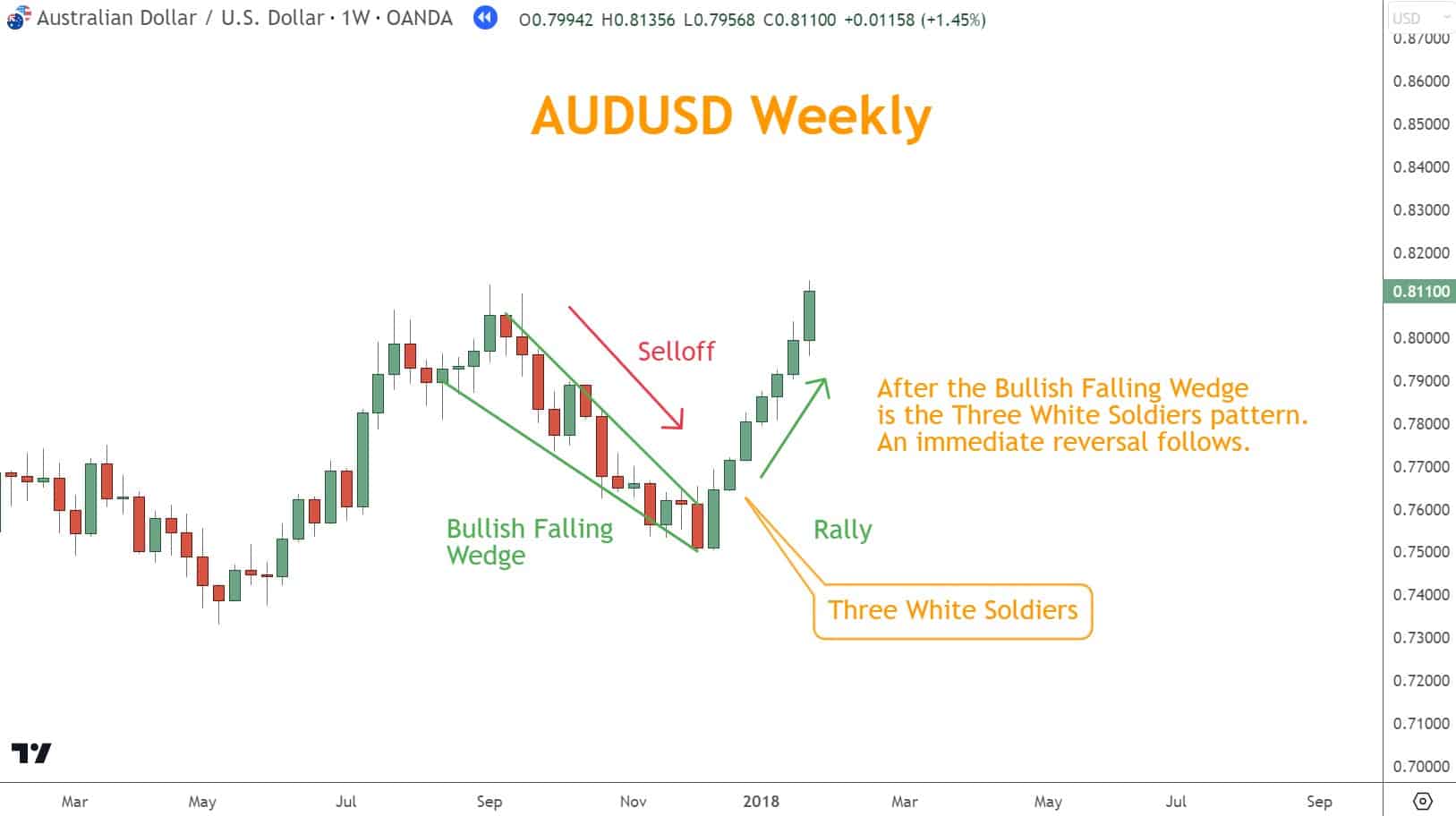

Chart Patterns and Candlesticks Together?

Combining three-candle patterns, like the Morning Star, Evening Star, Three White Soldiers, and Three Black Crows, can enhance your trading.

Chart Patterns such as wedges are reversal patterns, too, and when they coincide with three-candle patterns, they provide additional confirmation.

Support and Resistance is the Easiest Source of Confirmation

Combining three-candle patterns with Support and Resistance levels can provide additional confirmation for potential trading opportunities.

Support levels are price levels where buying pressure is strong enough to prevent further price declines. In contrast, Resistance levels are those where selling pressure is strong enough to prevent further price increases.

When a three-candle pattern forms near a Support level, it may indicate that buyers are stepping in and could lead to a Bullish reversal.

Conversely, when a three-candle pattern forms near a Resistance level, it may indicate that sellers are stepping in and could lead to a Bearish reversal.

What’s the Next Step?

Select a favorite candlesticks chart, look for a three-candle Japanese Candlestick pattern, and, using your knowledge, look for reversals.

In addition, look for opportunities to coincide it with other technical tools and techniques to see how they work together.

Combining Trends, Momentum, Chart Patterns, and Support and Resistance can give you a comprehensive view and understanding to make trading easier.

If you need help developing a process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis which you can incorporate with what you’ve learned here about Support and Resistance.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and Advance Strategies? I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

Can Candlestick Patterns Help Make More Informed Trading Decisions?

Finding them in your favorite charts allows you to gain valuable insights into market sentiment and potential price reversals.

Combining these with other tools can confirm your signals and help you make more informed decisions.

Practicing identifying and interpreting candle patterns is vital to enhance trading skills.

What are Some Common Mistakes When Trading with Japanese Candlesticks?

Some common mistakes to avoid include relying solely on them without considering other indicators or market factors.

You will also need to understand their context within the overall market situation, avoid overtrading, and neglect proper risk management techniques like setting stop-loss orders.