The Golden Cross is a simple technical analysis application made famous by the financial media.

It involves two moving averages – one 50-period short-term and one 200-period long-term – crossing over each other, forecasting a Bullish future in the market—specifically the short-term crossing through the long-term.

In this article, I’ll dive into what exactly a Golden Cross is and why it’s popular in some circles. I’ll also provide examples of how to use this strategy in Forex trading and discuss some fundamental limitations and considerations you need to consider if you are considering implementing it.

I’ll offer tips on improving these trades by leveraging Momentum indicators, Japanese Candlestick patterns, Chart Patterns, and Support and Resistance levels.

Finally, we’ll compare it with its opposite counterpart – the Death Cross – and give you actionable next steps to take your trading to the next level.

What is a Golden Cross in Trading?

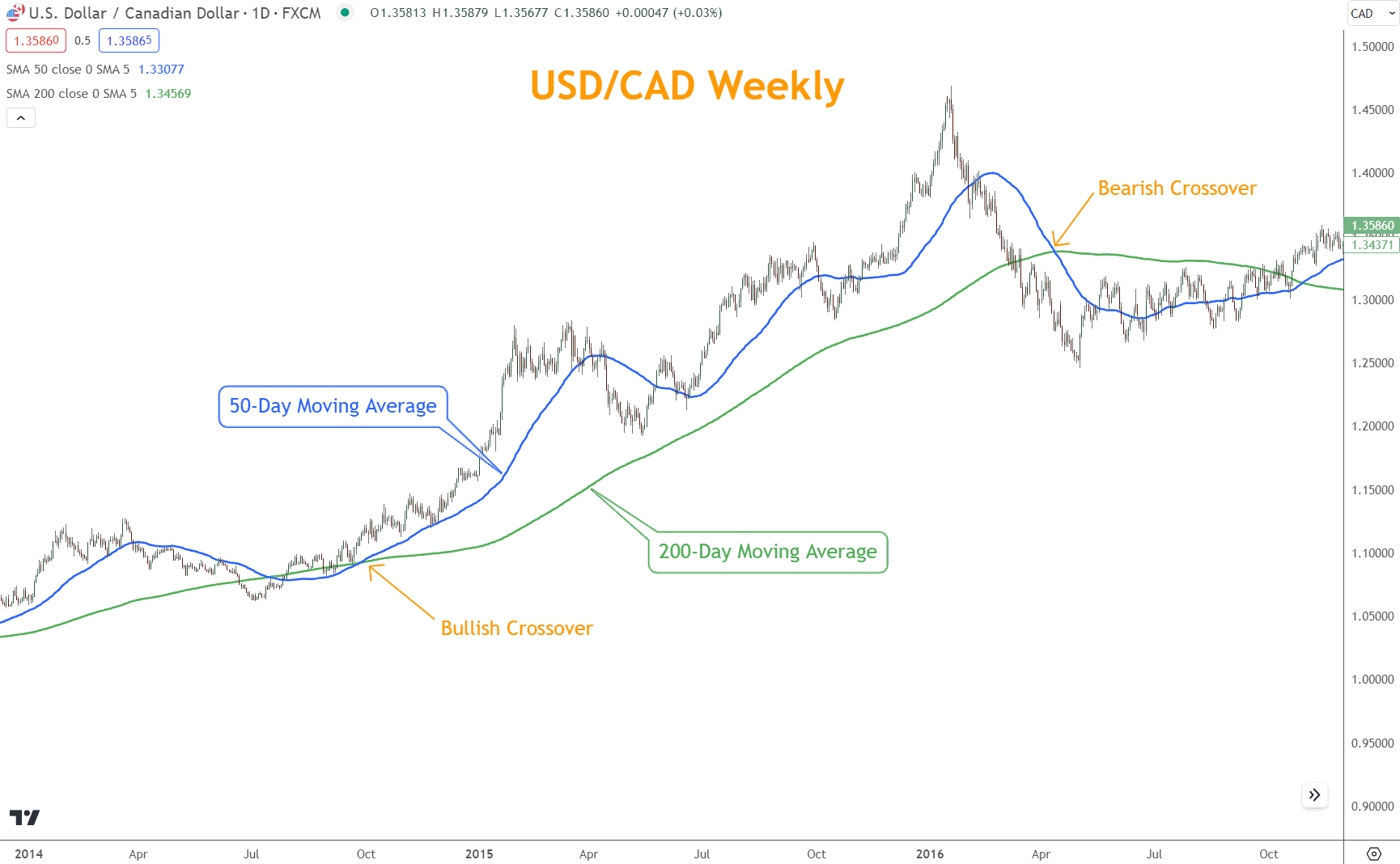

A Golden Cross in trading refers to the Bullish pattern that occurs when a short-term moving average intersects above a long-term moving average.

Traders commonly use it to identify potential buy signals and forecast direction changes in technical analysis. The most widely used moving averages are the 50-day average and 200-day average.

Why has this Strategy Grown in Popularity?

The popularity of this strategy exists because it’s simple to explain and is frequently referenced by the financial mass media. The most commonly referenced topic is the stock market.

Is This a Reliable Signal or Hype?

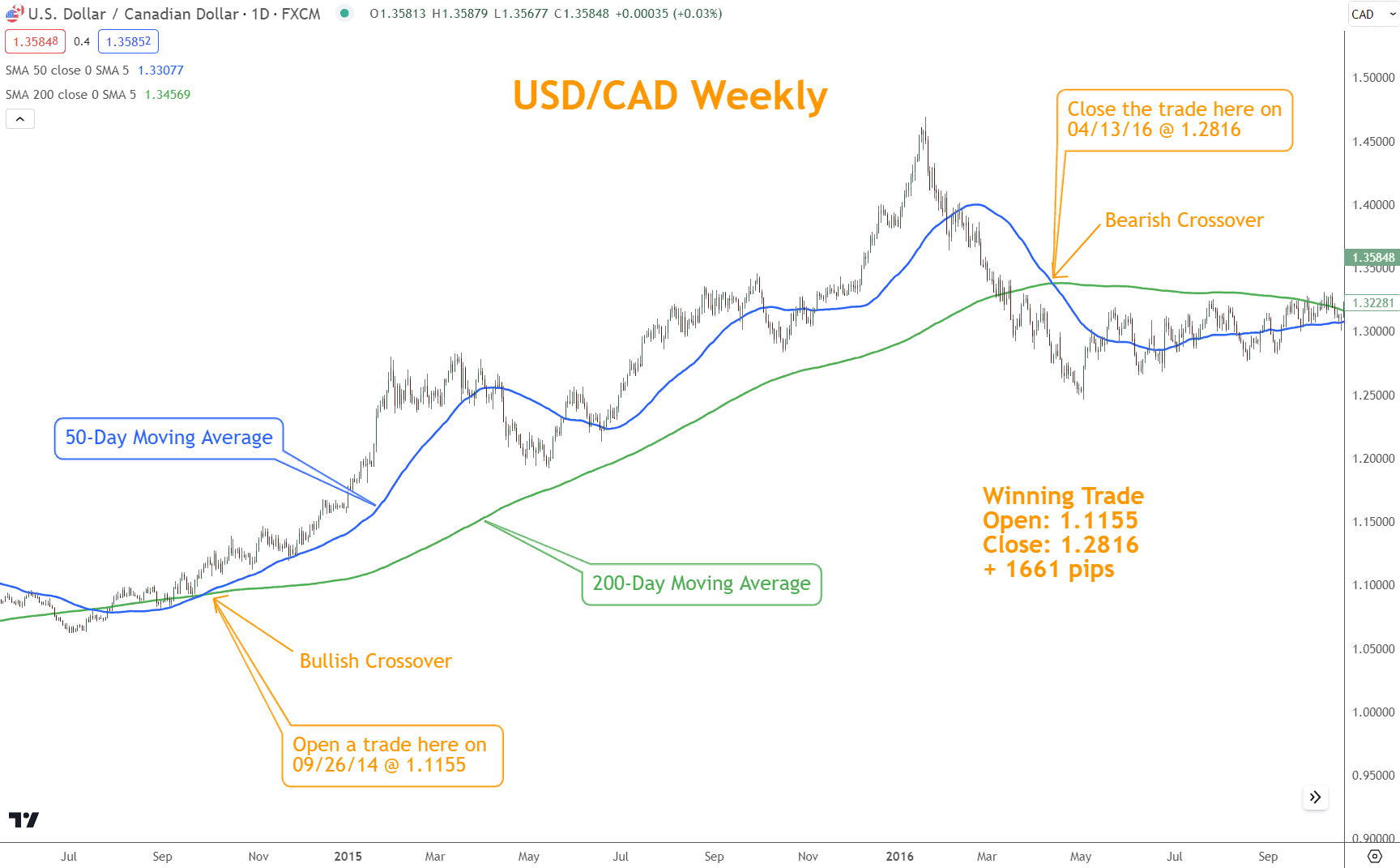

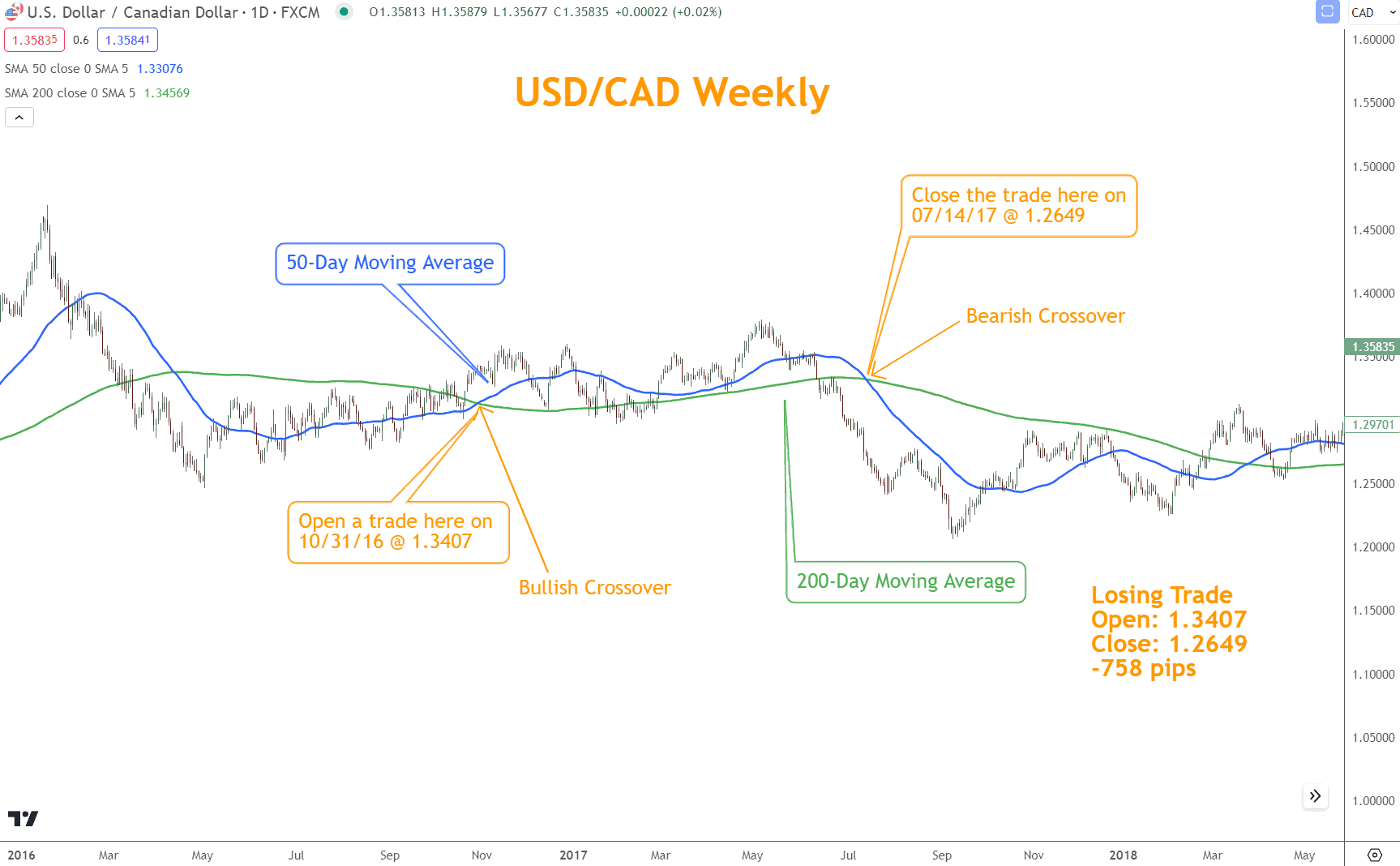

Examples in Forex trading showcase its effectiveness and limitations as a Bullish signal for potential buying opportunities.

Please take a look at these two examples of where it works and where it fails.

There are Serious Limitations to This Signal

Knowing its limits and considering additional factors for a well-informed decision-making process is essential when utilizing this pattern.

False signals and lagging indicators can lead to losses, so it’s crucial to exercise caution and not rely solely on one signal as a foolproof strategy.

Market conditions and other technical indicators should be considered to confirm the validity of the signal. Viewing this signal as a tool rather than the sole basis for trading decisions is essential.

Can You Improve the Golden Cross?

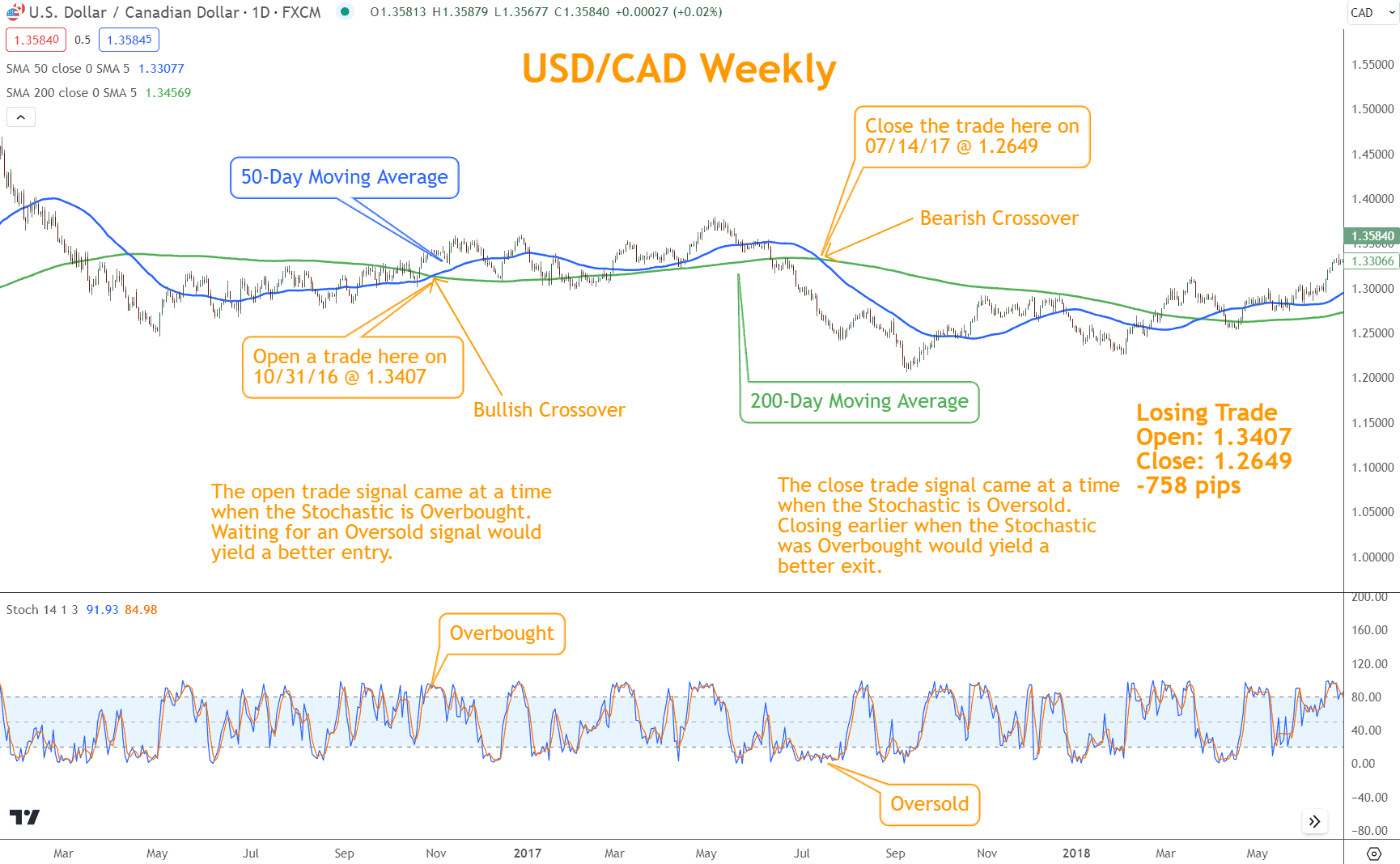

To enhance the effectiveness of the Golden Cross, leverage Momentum indicators to confirm the signal’s strength.

Additionally, combine it with Japanese Candlestick patterns for signs of a reversal. Chart Patterns that align with the Golden Cross can provide some confirmation and consider Support and Resistance levels when trading based on this strategy.

Remember to use it as part of a comprehensive trading approach.

Incorporate a Momentum Indicator

It would be best to consider leveraging Momentum indicators to enhance the accuracy of trading signals generated by the Golden Cross. This can significantly improve the probability of successful trades.

Some popular momentum indicators include the Relative Strength Index (RSI) and Stochastic.

Using these indicators, you can identify Overbought or Oversold conditions before entering trades, leading to more accurate trading signals and increasing the chances of profitable outcomes.

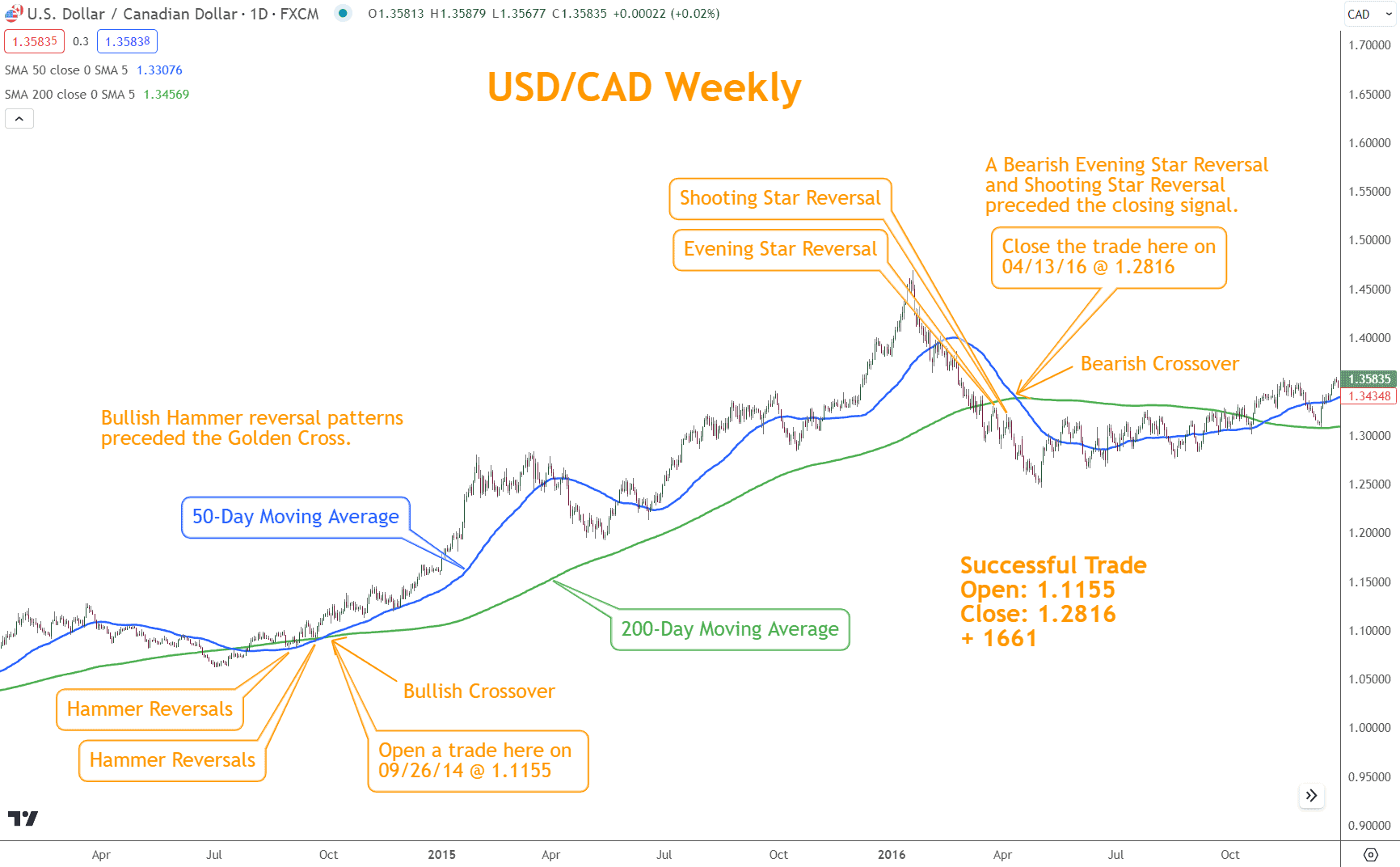

Japanese Candlesticks Can Foreshadow the Next Move

Japanese Candlestick Patterns can provide additional confirmation for any reversal signal. Traders can improve their confidence in the signal if it coincides with supporting Candlestick patterns.

Candlestick Patterns, such as Hammer patterns, can indicate potential Bullish reversals, potentially confirming a new Rally. Bearish reversals such as Evening Star Patterns and Shooting Stars help confirm closing a trade.

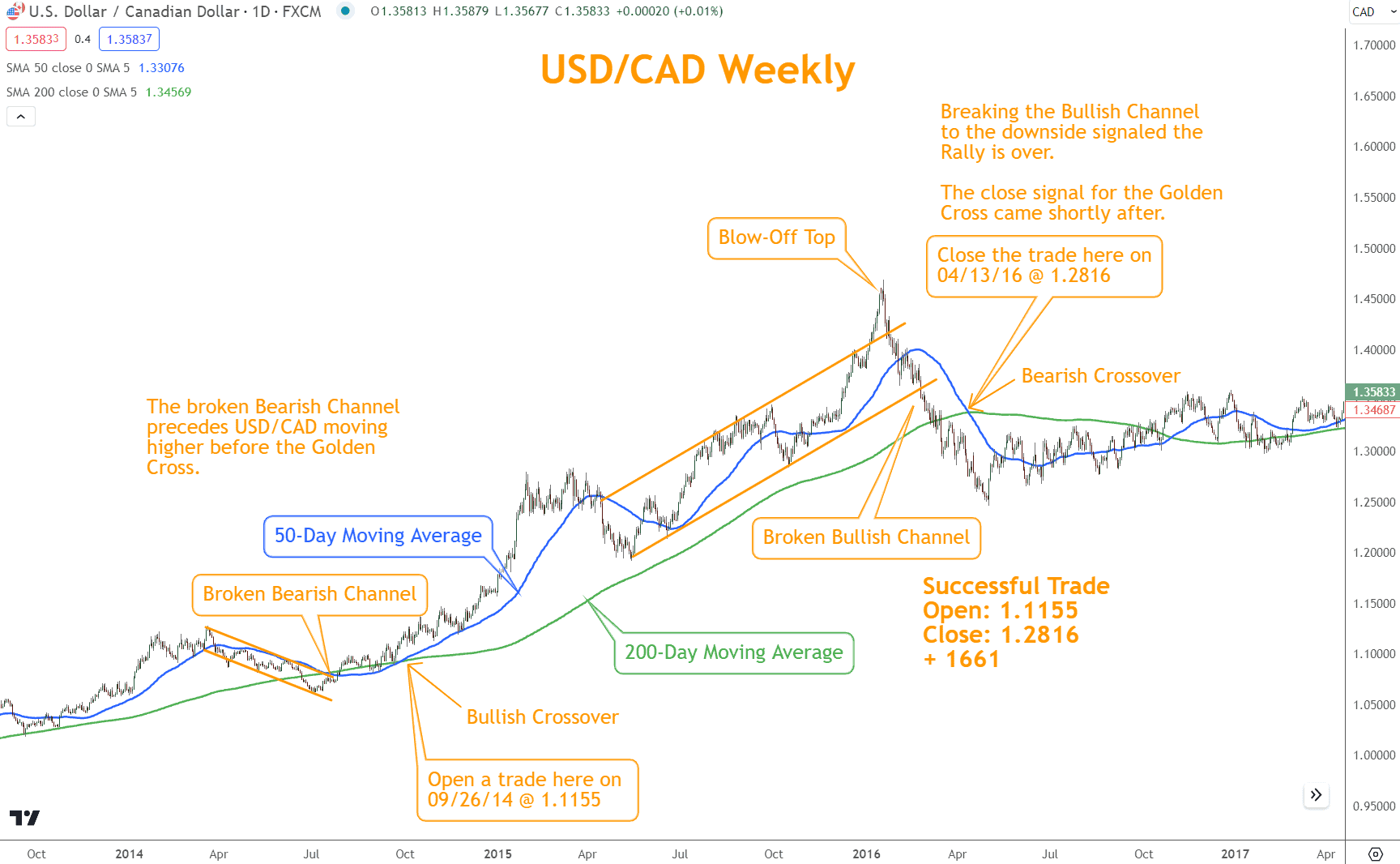

Chart Patterns Can Make it Easier

When using the Golden Cross strategy, it can be beneficial to leverage Chart Patterns to enhance its effectiveness.

By looking for patterns such as ascending triangles, symmetrical triangles, or falling wedges, traders can find additional confirmation of a Bullish direction.

Combining these Chart Patterns can confirm the crossover. It’s important to familiarize yourself with different Chart Patterns and understand their implications for successful trading.

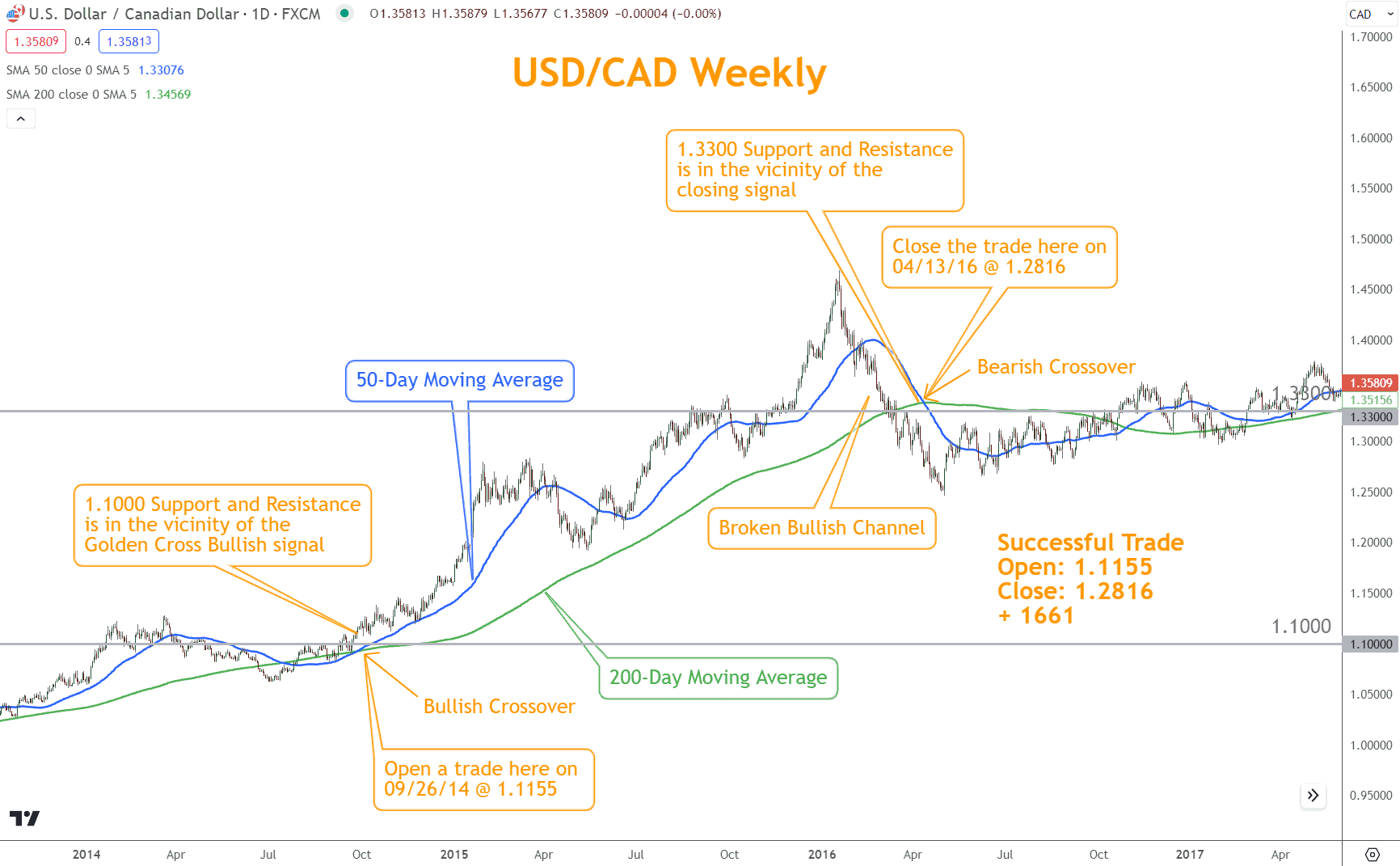

Support and Resistance Might Coincide with the Signal

Support and Resistance levels are crucial when utilizing this strategy in trading.

These levels are crucial as key price levels where the market finds Support or faces Resistance. When combined with the Golden Cross pattern, support levels can be potential buying zones.

Traders look for these areas to enter long positions, anticipating an upside in price action. On the other hand, Resistance levels indicate areas where traders may consider profit-taking or exiting trades.

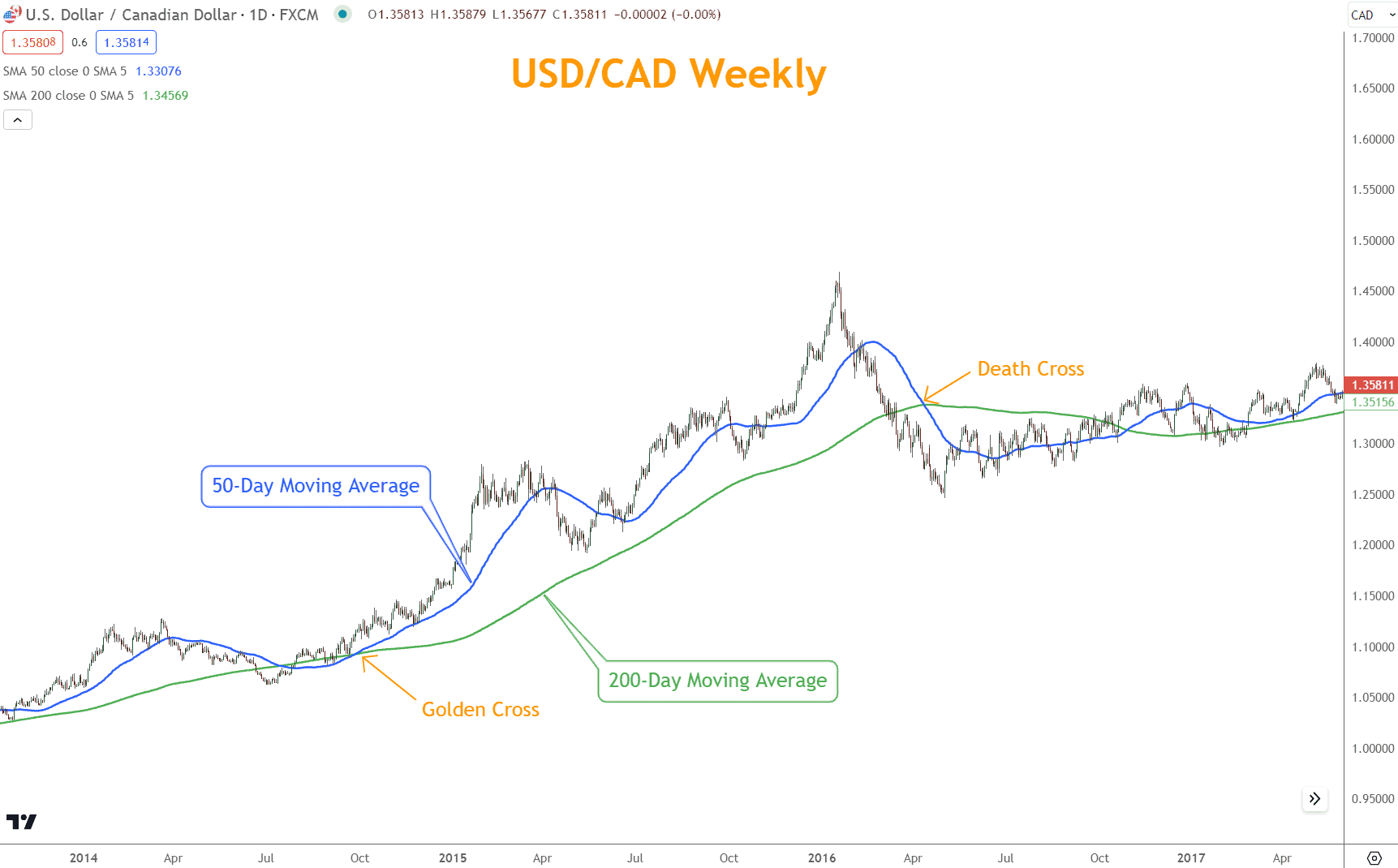

Golden Cross versus Death Cross: What’s the Difference?

The Golden Cross occurs when a short-term moving average intersects above a long-term moving average, while the Death Cross occurs when the opposite happens.

In the same way, the Golden Cross is a Bullish signal, and the Bearish Cross is a Bearish signal.

Sometimes, the Bullish signal identifies a Rally or uptrend, whereas the Bearish signal identifies a Selloff or downtrend. This scenario can also be described as a Bull market or Bear market, respectively, and is built on Trend trading principles.

What’s the Next Step?

Select a favorite candlestick chart and look for a Golden Cross using what you learned in this article.

In addition, look for opportunities to coincide them with other technical analysis tools and techniques to see how they work together.

Combining Momentum, Japanese Candlesticks, Chart Patterns, and Support and Resistance can give you a comprehensive view and understanding to make trading easier.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about these crosses.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What is the Golden Cross strategy, and How Does it Work?

The Golden Cross strategy is a popular trading technique that utilizes two moving averages: short-term and long-term. When the short-term moving average intersects the long-term moving average, it forecasts a Bullish direction.

This strategy has gained popularity among stock traders for its simplicity and ease of understanding.

What are some potential drawbacks to using the Golden Cross strategy?

One drawback of the Golden Cross strategy is its reliance on historical data, which may not always accurately reflect current market conditions. Additionally, the method can generate false signals during periods of market volatility.

Can the Golden Cross strategy be used with other technical analysis tools?

This strategy can be combined with other technical analysis tools. You can understand markets more comprehensively by leveraging tools like Momentum, Japanese Candlesticks, Chart Patterns, and Support and Resistance levels and combining them where possible.