In Forex trading, one of the fundamental skills you need to master is identifying Support and Resistance levels on your price charts.

These critical levels serve as floors and ceilings in price movements.

Support levels represent areas where the price tends to find buying interest, preventing it from falling further, while Resistance levels signify zones where selling pressure can halt upward movements.

This article will delve into the art and science of identifying Support and Resistance levels, helping you navigate the Forex market more confidently and precisely.

What are Support and Resistance Levels?

Before identifying Support and Resistance levels, it’s essential first to understand what they are. These levels play a crucial role in trading and can significantly impact decision-making.

When traders think a specific price is an excellent value for buying or selling, their behavior creates Support and Resistance levels.

This tug-of-war between buying and selling forces creates these significant price levels, making them a cornerstone of technical analysis in the Forex market.

How can I Identify Support and Resistance on Forex Charts?

In Forex trading, identifying Support and Resistance levels is a skill that can significantly enhance your ability to make better trades.

Several tools and techniques are available for this purpose, each offering a unique perspective on price dynamics.

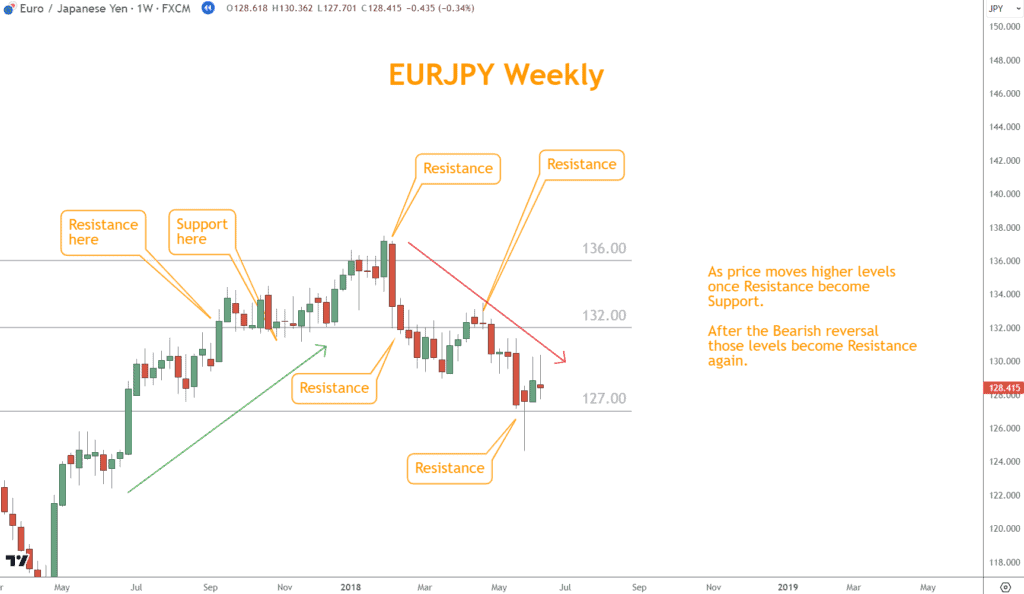

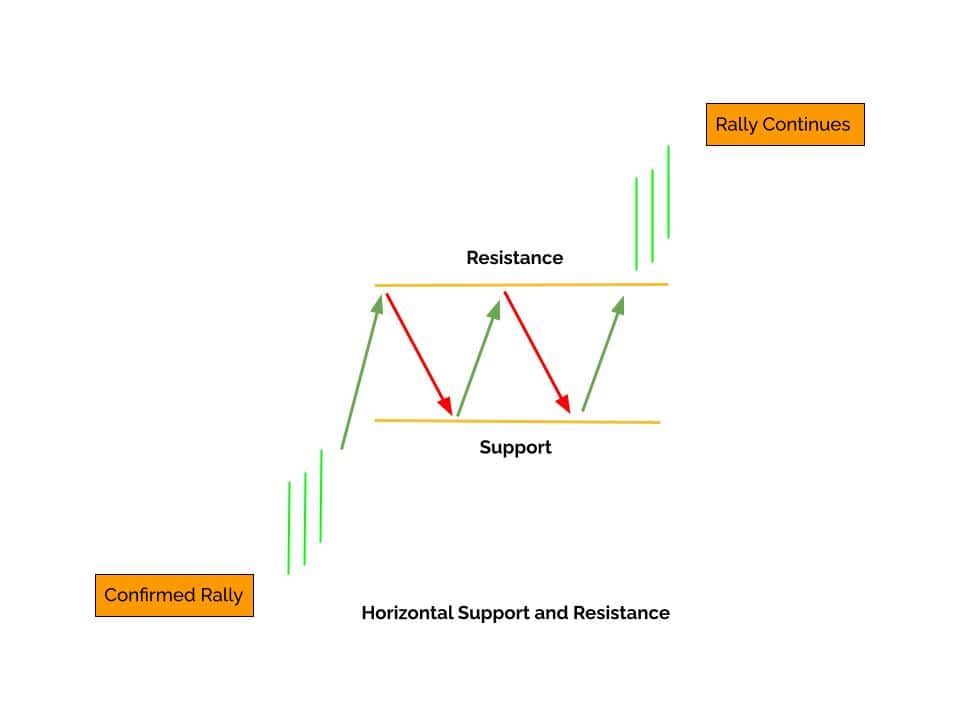

One standard method for analyzing price levels involves drawing horizontal lines across significant points where there has been noticeable buying or selling activity in the past.

This approach can help investors make informed decisions about buying or selling securities.

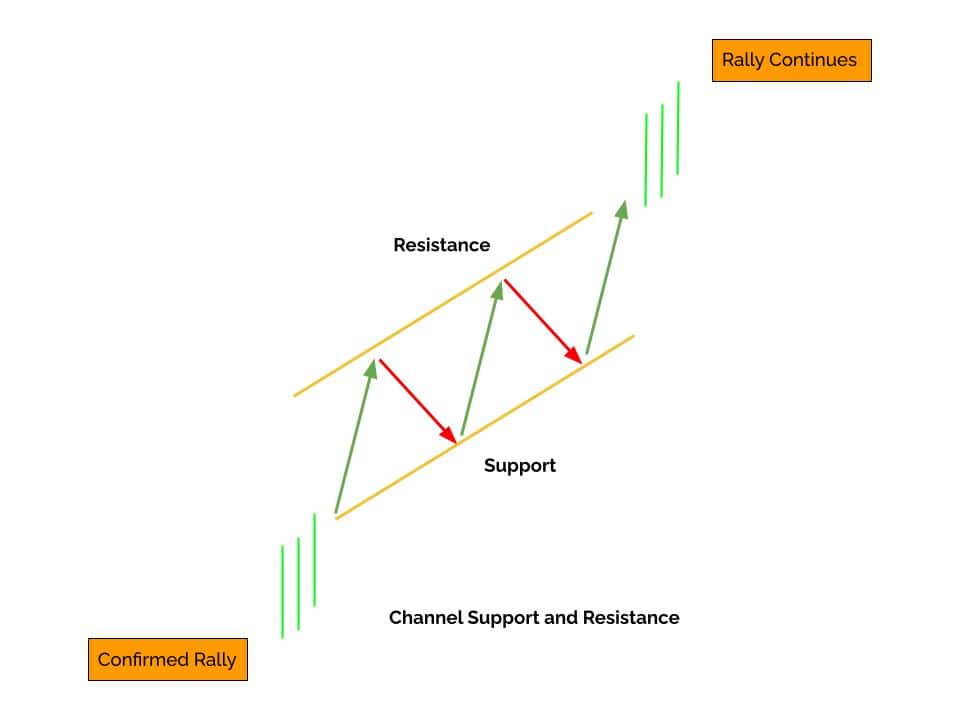

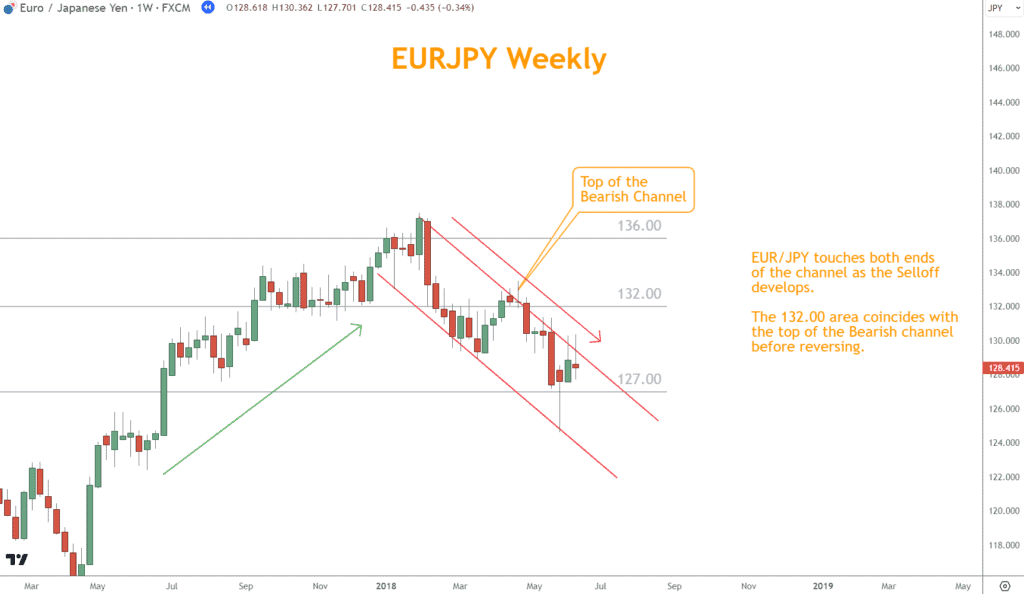

On the other hand, channel lines provide a dynamic way of identifying Support and Resistance by connecting the highs and lows of an underlying Rally or Selloff.

When used in conjunction, these technical tools enable you to understand where prices may find key inflection points in the Forex market.

Practical Tips for Identifying Support and Resistance

Consider several helpful tips to enhance your analysis to effectively identify Support and Resistance levels in Forex trading.

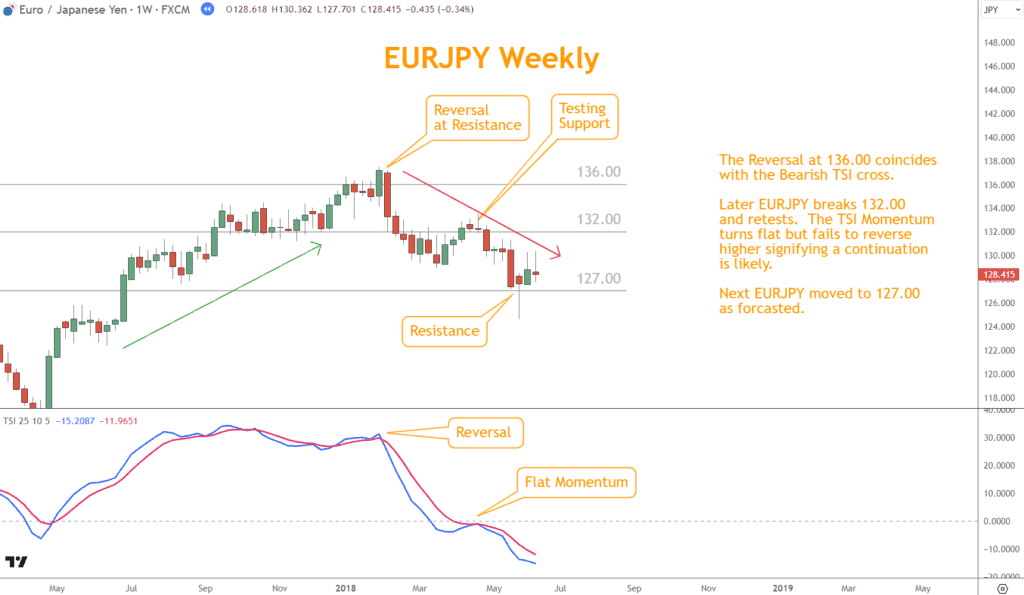

Always confirm your findings using other technical indicators such as Momentum, Candlestick Patterns, and Chart Patterns.

The TSI (True Strength Indicator) is an effective Momentum indicator whose actions often coincide with an instrument’s reaction to a Support or Resistance area.

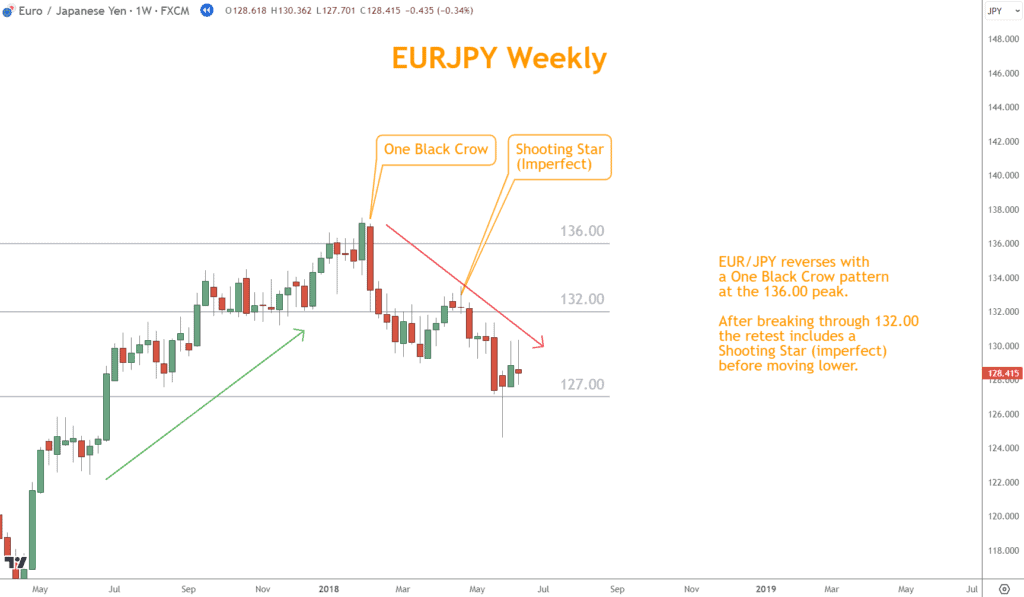

Candlestick patterns often appear at Support and Resistance levels. In this example a One Black Crow appears at 136.00 Resistance. An imperfect Shooting Star continues the Selloff near 132.00.

Chart Patterns often forecast reversals and coincide with critical areas, too. When the Chart Pattern is a Channel, it provides Support and Resistance, too.

This cross-referencing can provide more robust confirmation of essential levels.

In addition, be cautious of false breakouts, which can mislead you into trading mistakes.

Looking for solid confirmation is vital to avoid being fooled by false signals. Keeping it simple and concise can make it easier to understand and follow.

How to Apply Support and Resistance Levels in Trading

Applying Support and Resistance levels in actual Forex trading is where their true value shines through.

These levels are invaluable in setting up well-informed trading strategies.

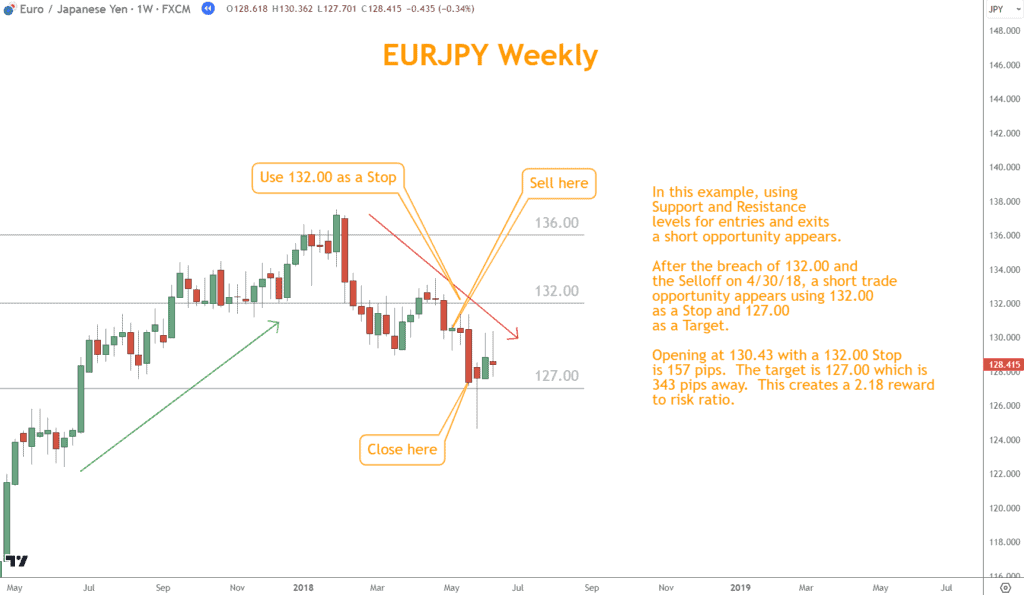

For instance, you can establish stop-loss and take-profit levels based on these Support and Resistance zones, helping you manage risk more precisely and maximize your profits.

Moreover, you can create entry and exit strategies around these levels, taking advantage of price bounces off Support and Resistance or identifying potential breakout opportunities.

By incorporating Support and Resistance into your trading plans, you can develop a structured and disciplined approach, increasing your chances of success.

Conclusion

In conclusion, mastering the art of identifying Support and Resistance levels in Forex trading is a foundational skill that can significantly enhance your trading success.

Market levels are more than just lines on a chart. They represent essential reference points that reflect how people think about the market and can provide insight into potential price changes.

Leverage these levels by assessing the psychology of market participants. By doing so, you can gain valuable insights into potential price movements.

By applying the knowledge gained in this article, you can confidently incorporate Support and Resistance levels into your trading strategies, whether for setting precise stop-loss and take-profit levels, timing entries and exits, or managing risk effectively.

What’s the Next Step?

Select a favorite candlestick chart and look for horizontal Support and Resistance areas using what you learned in this article.

In addition, look for opportunities to coincide them with other technical analysis tools and techniques to see how they work together.

Combining Momentum, Japanese Candlesticks, and Chart Patterns can give you a comprehensive view and understanding to make trading easier.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about these crosses.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What are the Main Differences Between Support and Resistance?

Support levels are price levels where buying interest emerges, preventing further price declines.

On the other hand, Resistance levels are zones where selling pressure often halts price increases. In essence, Support is where price finds demand, while Resistance is where it faces supply.

How do I Determine the Strength of a Support or Resistance Level?

Assess the strength of a Support or Resistance level by counting the number of times the price bounces off or is rejected at that level. If it has held more times, it is considered more substantial.

Can Support Turn into Resistance and Vice Versa?

Yes, Support can transform into Resistance, and vice versa, in a phenomenon known as a role reversal.

When a price breaches a Support level, it becomes Resistance on the way back up.

Similarly, when a price breaks a Resistance level, it becomes Support for subsequent price movements.

How do I Avoid False Breakouts when Trading Around These Levels?

To minimize false breakouts, traders should look for solid confirmation signals, such as candlestick patterns, before entering a trade at a Support or Resistance level.

Can I use Support and Resistance Levels in Conjunction with Other Indicators?

Support and Resistance levels can be effectively combined with technical indicators like Momentum, Japanese Candlesticks, and Chart Patterns to strengthen your trading strategy and decision-making.

Are Support and Resistance Levels on Longer Timeframes More Significant?

Generally, Support and Resistance levels on longer timeframes, such as weekly charts, tend to be more significant and substantially impact price movements. Traders often prioritize these levels over shorter timeframes.

Is it Possible to Trade Solely Based on Support and Resistance Levels?

While trading solely based on Support and Resistance is possible, it’s often more effective when combined with other technical and fundamental analysis tools.

A comprehensive trading strategy that considers multiple factors tends to yield better results.