Support and Resistance are price levels that may cause the price to reverse direction when the price touches them.

If you’re trading forex or any other market, Support and Resistance can be used to gauge where price reversals might occur.

But these price levels aren’t static lines drawn on a chart. Instead, they are dynamic areas formed by countless touches over time.

These touches create an association in traders’ minds that a Support level is a selling point or a Resistance level is a buying point. This psychology behind Support and Resistance makes them so important in forex trading.

In this article, we’ll outline everything you need to know about Support and Resistance lines — what they are, how to draw them, when to trade with them, etc.

Do Support and Resistance Lines Work?

Support and Resistance lines are widely used in trading forex because they are effective.

In addition, there is obvious evidence on price charts of how certain price levels stop and reverse prices. With this knowledge, you can use these lines to determine where to buy or sell a trading instrument.

You will find it helpful to create support and resistance lines when analyzing forex pairs.

These lines help to predict future price movements accurately, and analyze market situations more clearly before trading, thereby increasing profits.

What Is Support, and What is Resistance?

A Support level refers to a price level below the current market price where buying interest is strong enough to prevent the price from falling further.

This is another way of saying it’s a line on the chart representing past buyers who will likely re-enter the market if prices start moving in their favor again (i.e., they hope to buy at a lower level).

Conversely, Resistance refers to a price level above the current market price where the selling interest is strong enough to prevent the price from rising further.

In other words, it’s a line on the chart representing past sellers who will likely re-enter the market if prices start moving against their favor again (i.e., they hope to sell at a higher level).

It is important to note that Support and Resistance lines are not exact numbers. Instead, they represent an area with the potential for the development of Support or Resistance.

When trading with Support and Resistance levels, we often see horizontal lines drawn on charts, as these are the most common.

However, they can also be depicted using channel lines connecting past price points.

Understand the Psychology Behind Support and Resistance to Win

Support and Resistance levels are a consequence of market psychology and herd mentality.

Support levels will see buying orders rise above the current prices when a Selloff is expected to pause or reverse.

Conversely, Resistance levels will see sell orders exceed current prices during a Rally before an anticipated reversal. The market constantly tests Support and Resistance levels.

The key to trading Support and Resistance levels is patience and waiting for a breakout or reversal.

A breakout occurs when prices break above Resistance or below Support. After a breakout, an instrument’s price will often retest the broken level before moving higher or lower.

The false break strategy can be used to trade market breakouts.

A false break occurs when the price breaks out of a level but then quickly reverses, trapping traders who enter into positions too early.

The best way to trade false breaks is by waiting for breakout confirmation and taking advantage when confirmation fails.

Learn To Draw Support And Resistance Levels

Identifying significant levels is essential in drawing Support and Resistance levels.

A level becomes more meaningful if tested multiple times, seen a price rejection, or formed a channel line. When drawing a horizontal line, ensure it’s placed at the point of market turning points.

When drawing channel lines, choose areas where prices changed direction and maintained the channel they were moving in.

You will find learning more about Chart Patterns will also be helpful with channel lines. The purpose of a turning point is where price action changes from moving up to down (or vice versa).

Examine Areas on Your Chart — not Chart Lines (Trendlines)

Support and Resistance are areas on your candlestick chart, not lines.

These are considered areas because market instruments, by their nature, are noisy.

No level is an exact science, and a forex pair will often trade on both sides of a level.

Can Channel Lines Serve as Resistance?

Channel lines (trendlines) are well known for being Support and Resistance levels on a trading chart.

They often intersect horizontal levels producing reversals in Rallies or Selloffs. At least two peaks or troughs must be determined before drawing any channel line on a chart.

In short, channel lines can help you identify key Support and Resistance levels in a given market move.

They can identify areas where a forex pair may break out from the current direction.

Their effectiveness depends mainly on identifying at least two peaks or troughs (three or more is better) that can serve as channel line Support or Resistance levels.

If appropriately applied, channel lines can help traders determine whether to stay or exit a trade based on price action at these identified levels.

Why Focusing on Round Numbers Will Yield Winning Results

Round numbers are whole numbers that the market tends to gravitate towards, such as 1.3000 or 111.00. When these levels are broken, they can act as a catalyst for further price movements.

Round numbers become significant levels because they are easy to remember and reference. You will want to look for levels based on rounded numbers and use them in trading.

You Should Stay Away From Moving Averages

Moving averages are a technical analysis tool many traders use as Support and Resistance levels on charts, but they work poorly.

They are plotted by taking the average value of a variable over a certain period and plotting the average point on a chart.

When using moving averages, you can select a moving average indicator, usually looking back somewhere between 20 and 200 periods.

You may also choose a simple, exponential, or another calculation approach for that moving average, contributing to even greater confusion.

While they are informative, the moving average isn’t a component of the market structure or market conditions from which Support and Resistance are derived.

For these reasons, there are much better tools to apply than moving averages.

Not a Surprise: When Price Breaks Resistance, it Becomes New Support

So if you’re looking to make a long trade on a Forex pair and the price breaks through a significant level, you will want to have a strategy for buying or selling that breakout.

Below are examples of this happening in a Selloff and a Rally.

Here’s an Example of Resistance Becoming Support in Forex

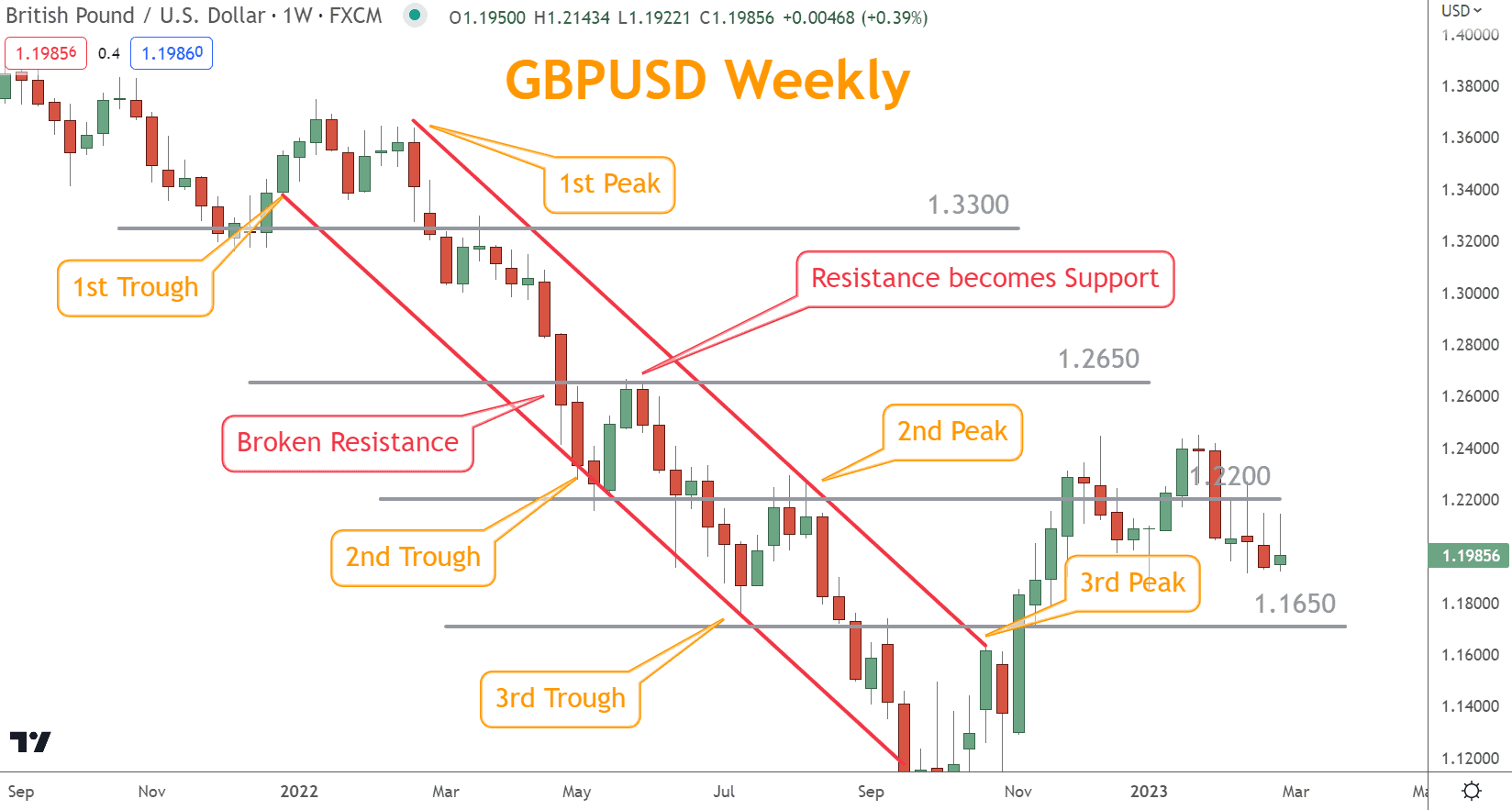

An instrument’s price may break multiple Resistance levels during a Selloff, as shown in the GBP/USD example below.

When Resistance is broken, that level becomes a Support level.

An instrument may retest that level before continuing, which works to validate that the level is correct and significant. This is where short trade opportunities are found.

A level tested many times and not broken is considered major Support or Resistance.

In this helpful example, we can see peaks and troughs we can use to create channel lines.

Channel lines serve as Support and Resistance as the price moves through the channel. In this example, we can see GBP/USD test channel lines and horizontal price level lines.

The first Resistance zone or level in this Selloff is at 1.2650, where on the week of 04/25/22, GBPUSD closed below 1.2650.

In the subsequent two sessions (in this example, weeks), GBP/USD makes new lows and enables the creation of channel lines between troughs 1 and 2.

Before reaching 1.2200 GBP/USD moves higher and tests 1.2650 and is quickly rejected near its old Support zone.

This price action confirms 1.2650 is a significant level and respected level by traders.

This pattern is repeated four sessions later when GBP/USD breaks 1.2200 and retests that level five sessions later.

You will find this price behavior repeated on many instruments repeatedly.

Why? Many traders evaluate Momentum during trading and see that markets breaking significant levels can include overbought and oversold conditions.

As a result, they have a trading strategy designed to exploit that opportunity when they can find it.

Technical Analysts will use broken Resistance areas as a stop-loss area and the next level of Resistance as a target.

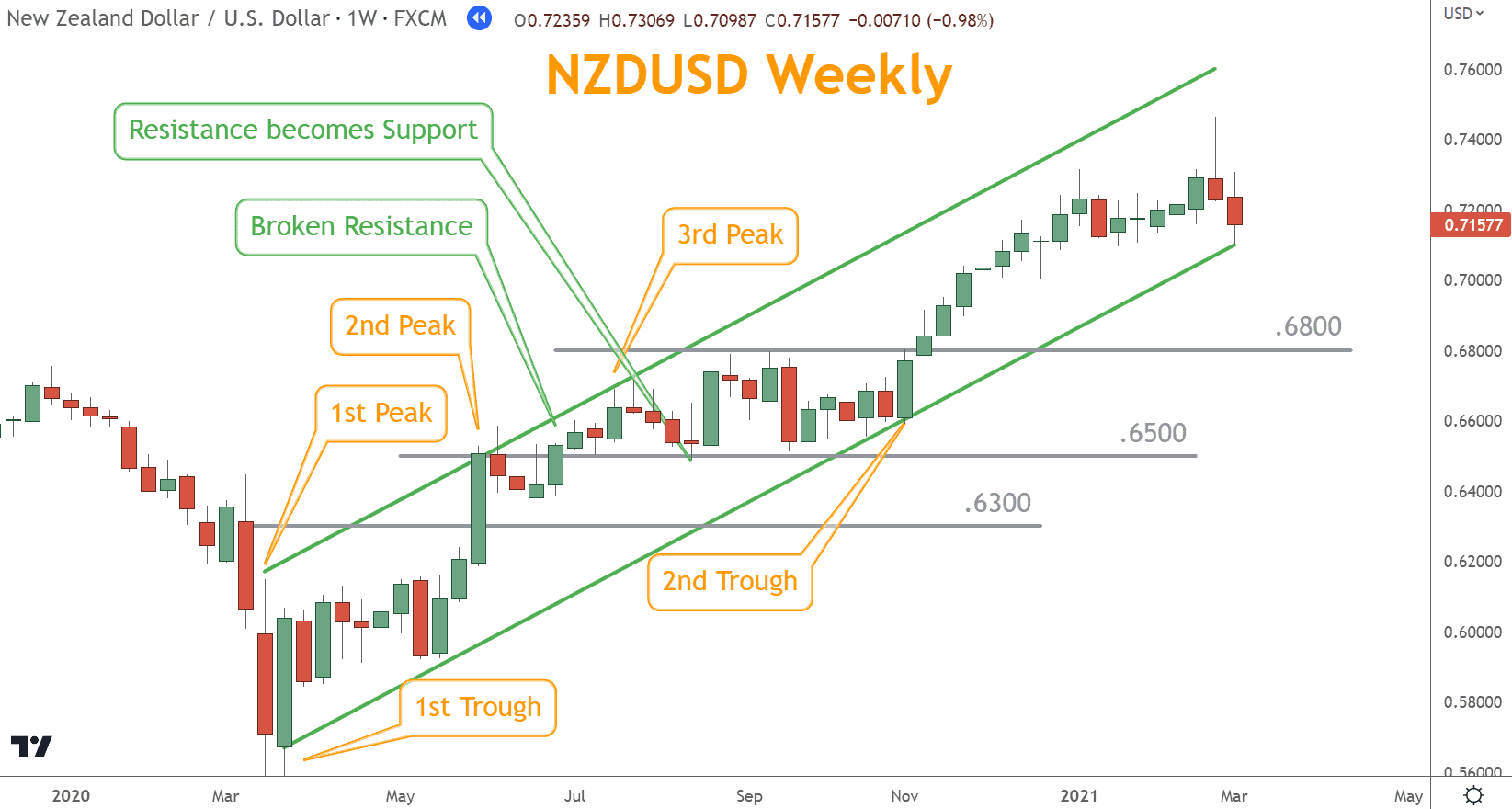

In this example, NZD/USD is in a Rally.

A combination of channel lines and horizontal lines provides Support and Resistance. The initial Rally in the channel runs into 0.6500 Resistance, briefly retreats, and then breaks through.

The upper channel line is tested three sessions later, and price retreats to 0.6500.

After several consolidation candles, NZD/USD finds Resistance again in the lower channel line, moving higher, ultimately breaking the .6800 Resistance level.

Why the long consolidation and trading ranges after the initial break and retest?

Sometimes when an instrument moves aggressively in one direction, a long consolidation follows, reflecting trader exhaustion and uncertainty about the current price level.

The large Marubozu candle leading to the first test of .6500 is an excellent example of an aggressive move.

After a significant move, market participants will want to examine whether more price appreciation is justified or if prices have moved too fast.

The result of this attitude is sideways consolidation.

If an instrument is range bound, short-term traders such as day traders and scalpers will trade this in small time frames while longer-term traders will study the situation and consider their next move.

How Important are Support and Resistance Levels When Trading a Breakout on a 15-Minute Chart?

As evident from the weekly charts in the examples above, Support and Resistance are most reliable on longer timeframe charts.

The reason for this is the number of participants trading lower timeframes.

If trading is thin, it isn’t easy to have confidence in the structure it creates since it was built with few traders involved.

This is one reason why trying to succeed as a day trader or scalper is risky, and a tiny number thrive over time.

If you are determined to trade on 15-minute charts but draw in Support and Resistance lines from weekly charts, you may find very few periods where they intersect.

This is because day trading tends to be in narrow ranges, and the gaps between weekly lines are in the hundreds of pips.

The best way to use any technical indicator or tool is to use it on a higher timeframe where more traders help build the market structure you’re identifying.

More participants mean more confidence in the psychology and intention behind all the candlestick patterns on the chart.

What’s Your Next Step?

Select a favorite forex pair and identify horizontal Support and Resistance levels.

When you do, see if you can find corresponding channel lines and how they all work together. Then, consider how you would use these lines to find trading opportunities.

If you need help finding trading opportunities, learn the Six Basics of Chart Analysis, which you can download for free here.

The “Six Basics” will give you a strong foundation in chart analysis which you can incorporate with what you’ve learned here about Support and Resistance.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and Advance Strategies? I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

Which Indicator is Best for Support and Resistance?

There is no one best indicator for Support and Resistance.

Some common technical indicators used to identify Support and Resistance levels include channel lines, price action patterns, and more.

The best indicator is the number of times an instrument’s price has approached a level, stopped, and reversed.

The more times a forex pair struggles to break or finds Support near a level area, the more strong Support that level is.

Combine that price behavior with other indicators such as Trend, Momentum, Japanese Candlesticks, Chart Patterns, and fundamental analysis, and the likelihood of identifying a reversal near a significant level increases.

Can you trade only using Support and Resistance?

You could trade this way, but it would be like boxing with only one arm.

To increase the likelihood of Resistance trading strategy success, you want to choose a variety of non-overlapping technical analysis indicators to give you as complete an understanding as possible of the market.

Which Timeframe is Best for Support and Resistance?

When looking for reliable levels, a higher time frame is generally preferred.

Identifying significant areas on a chart depends on the trader’s timeframe, from the daily or weekly chart down to an intraday or even minute chart.

You should identify levels over a longer time frame before considering shorter ones.