Knowing how to set a stop-loss is crucial to successful risk management in Forex trading.

Setting a stop-loss is a plan to close a trade if it fails to move in the desired direction.

It limits your losses on a position in a Forex trade. If you can’t learn to live with setting stop losses and trading by them, trading is not for you.

For this article, I recommend opening a browser with TradingView and selecting a Forex chart. Then, follow along with the examples in the article.

TradingView is free if you don’t have an account you can sign up here.

If you sign up for a paid plan using this link we’ll earn a commission.

Table of Contents

- What Does a Stop-Loss Look Like, and Why is it Called a Stop Loss?

- What Does a Stop-Loss Do?

- How to Set a Stop-Loss with Horizontal Support

- Should you Leave “Wiggle Room” for Your Stops?

- Can you add Channel Support?

- Can I Leverage Candlestick Reversal Patterns?

- How About Entering Stop-Losses into the Trading Platform Versus Maintaining a Mental Stop?

- What about Trailing Stops?

- Are Round Numbers Important?

- What are Stop Hunters?

- Conclusion

- Quiz: Understanding Stop-Loss Strategies in Forex

- What’s the Next Step?

- Frequently Asked Questions

- Forex Trading Disclosure Statement

This article will discuss how to set a stop-loss using different techniques, including:

- Horizontal support and resistance

- Channel support and resistance

- Swing highs and swing lows

- Candlestick reversal patterns

We’ll examine each of these individually and the value of combining them when possible.

We’ll also discuss the pros and cons of entering stop-loss orders with your broker versus maintaining a mental stop and manually closing your trade.

What Does a Stop-Loss Look Like, and Why is it Called a Stop Loss?

A stop-loss is a price you choose at a specific distance from the opening price of your trade.

It’s your worst case scenario. In the event you are completely wrong about your trade it’s the loss you accept in your account.

It’s called a stop-loss because it is a predefined level to automatically exit a trade when the price of a your chose Forex pair reaches a certain level.

This practice is designed to “stop” further “losses” by limiting the downside of a position.

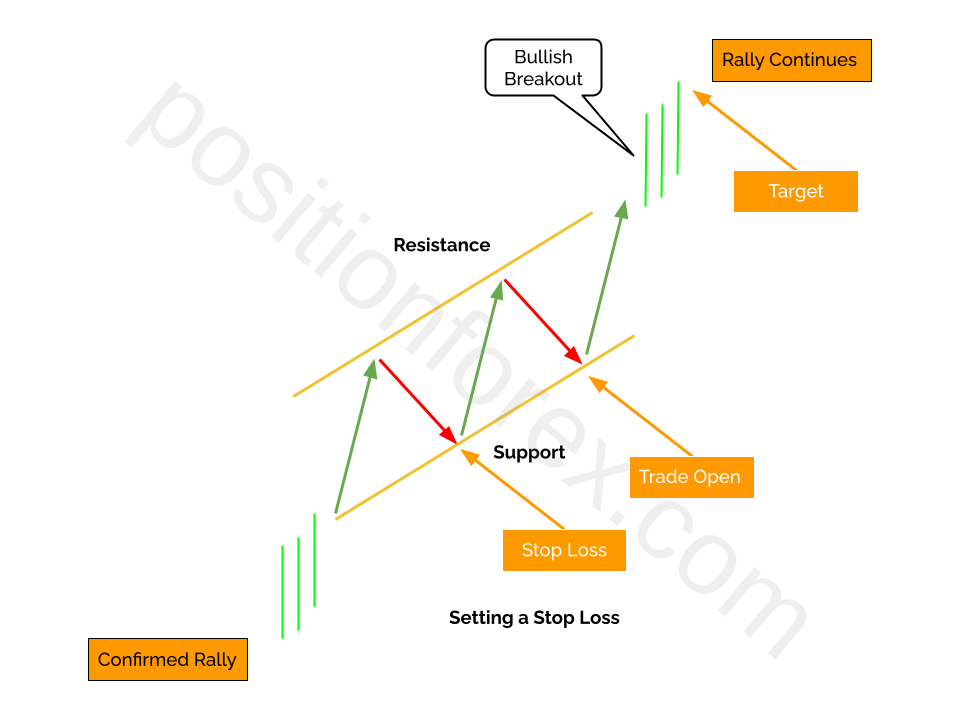

Here’s an oversimplified example visually describing where you might open a trade, select a target, and set a stop-loss.

Price is in a confirmed rally and on a pullback in price a trade is opened.

A stop-loss is selected in an area of prior support and a target is selected at a higher price. The intention is for price to reach the target.

If it fails and falls lower, you will enforce your stop-loss level to limit your account’s losses.

The name reflects its purpose: protecting traders from losing more than they are willing to risk in a particular trade.

I’ve paraphrased this description from an excellent book: Technical Analysis: The Complete Resource for Financial Market Technicians by Charles Kirkpatrick II , Julie Dahlquist.

The link is to Amazon, but I get no commission for it. Although I disagree with some of its content, it’s an excellent book.

The CFTC Glossary provides another definition: This is an order that becomes a market order when a particular price level is reached. A sell stop is placed below the market, and a buy stop is placed above the market. It is sometimes referred to as a stop loss order.

Using your Forex chart, use your eye and consider a spot where you could have opened a trade, selected a target, and set a stop-loss.

A later section of this article discusses whether you should manually enforce your stop-loss or have your broker do it for you.

What Does a Stop-Loss Do?

A stop-loss serves two roles for traders:

- It limits trading losses on an individual trade.

- It’s a component of position sizing to help you calculate the correct trade size.

A stop-loss is critical for managing risk effectively and limiting potential losses.

By setting a stop-loss, you can specify a price at which your position will manually or automatically close, preventing further losses in a market moving against you.

This is especially important in the highly volatile Forex market, where rapid price fluctuations can occur unexpectedly.

Without a stop-loss, you risk significant financial loss, which can compound if the market continues to move unfavorably.

Furthermore, not using a stop-loss can lead to emotional trading decisions, such as holding onto losing positions in the hope of a market reversal, which may not materialize and can exacerbate losses.

A stop-loss not only preserves capital but also enforces discipline in trading strategy, helping you to stick to your initial risk management plans without emotional interference.

By setting a stop-loss, you can limit potential losses and avoid the temptation to hold onto a losing trade in the hope that it will turn around.

This is crucial in the volatile world of Forex trading, where prices can change rapidly.

There are several ways to choose a stop-loss price using technical analysis.

Let’s begin by discussing the most common and my favorite method: horizontal support and resistance

How to Set a Stop-Loss with Horizontal Support

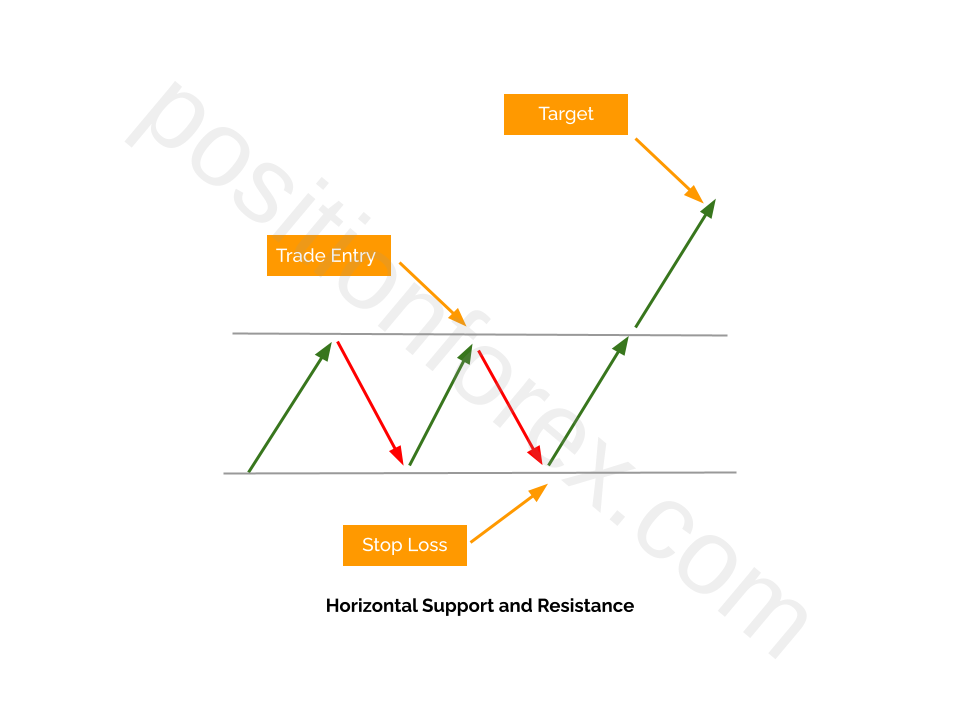

Support and resistance are fundamental concepts in technical analysis.

Consider a long trade where prices are expected to rise.

A selloff might pause at a support level because of demand at that price level.

Selling interest after rising prices causes a rally to pause at a support level.

If you think about short-selling an instrument, reverse the terminology; however, the concepts and rules remain the same.

Stop-Loss Horizontal Support Tactics

The first example illustrates a stop-loss for a long trade.

- Identify support level: Find the price level where the currency pair has consistently bounced up. This is your support level.

- Place stop-loss at support, assuming the last closing price you’re building your trade from is above support.

- Specific time frames should form the basis of trading decisions, utilizing closing prices.

- The longer the time frame, the more reliable the price.

- If the price rests on a support level, you must find another support level for this trade.

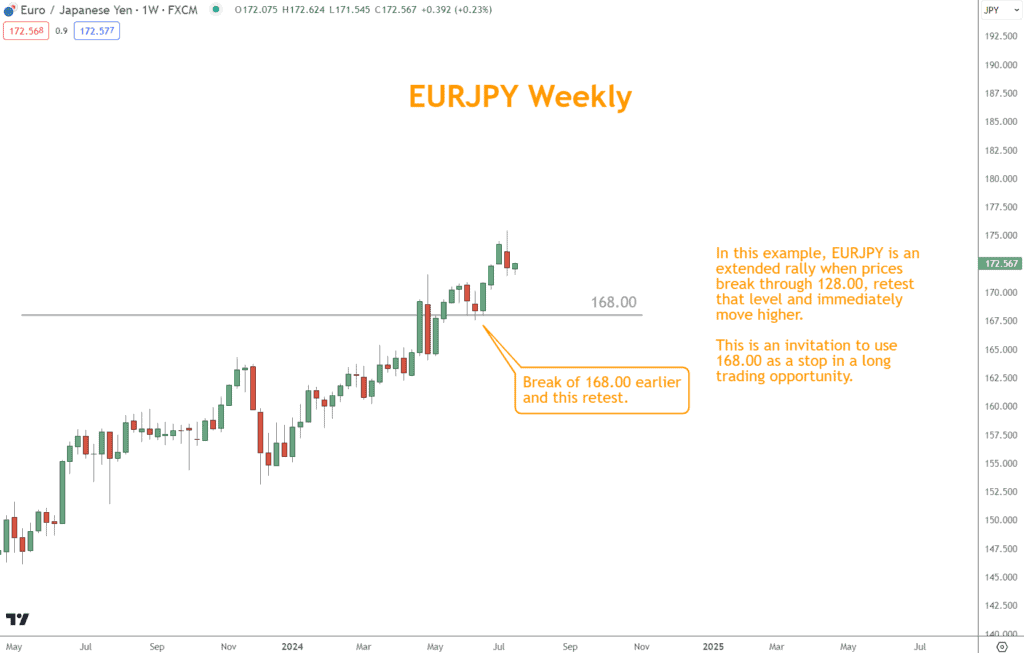

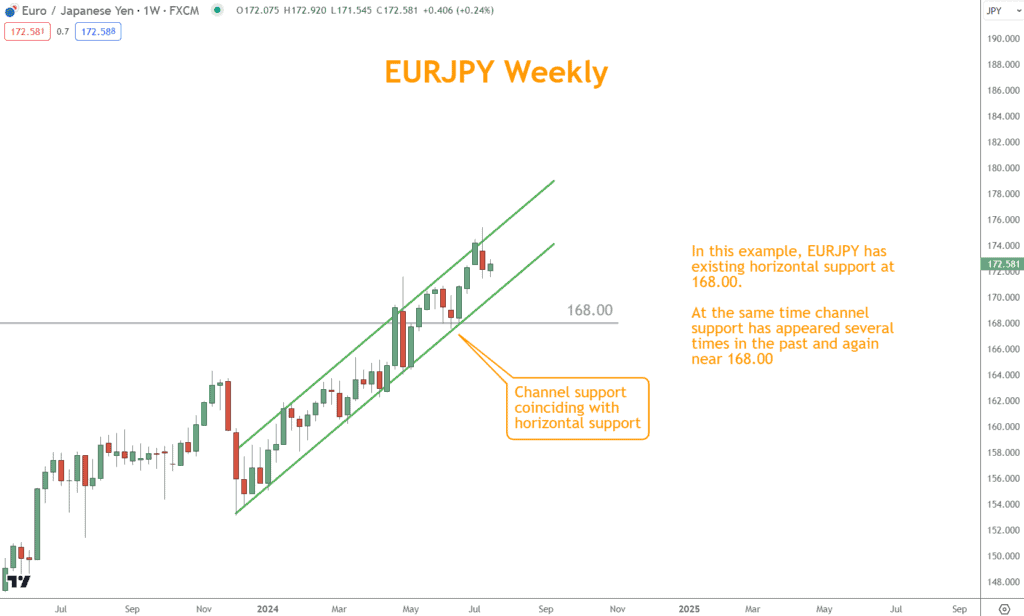

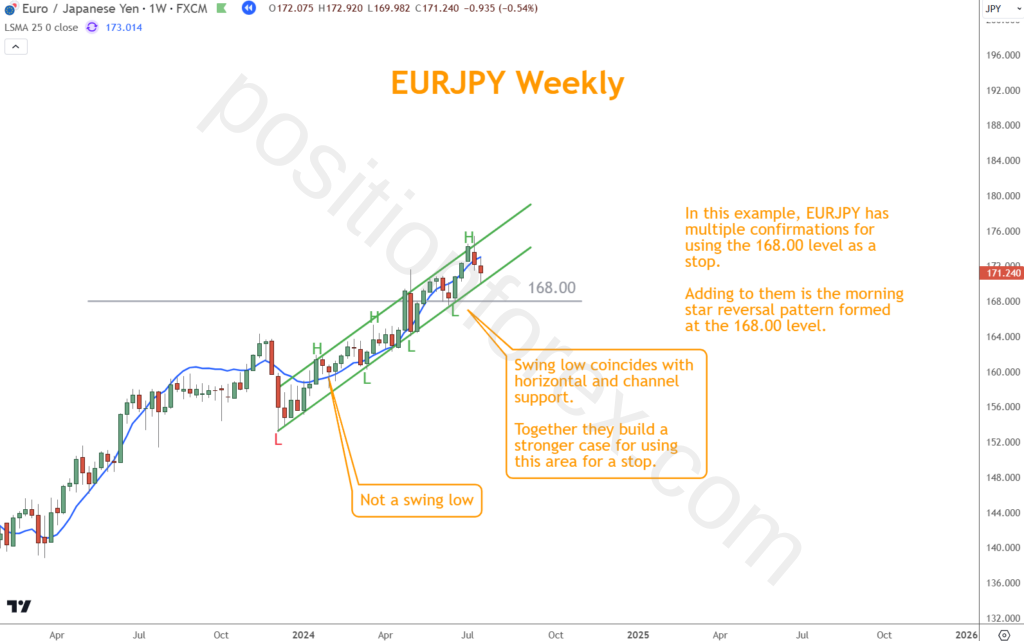

In this EURJPY example, the price breaks through the 168.00 level, retests the level, and moves higher.

This is an excellent example of how to use horizontal support and resistance to establish a stop-loss level.

When prices break through a level, retest it and then move away from it; this is an opportunity to use that level as a stop level.

This approach in a bullish market is sometimes called “buy the dip.”

The same is true for a short trade however, what was resistance is now support.

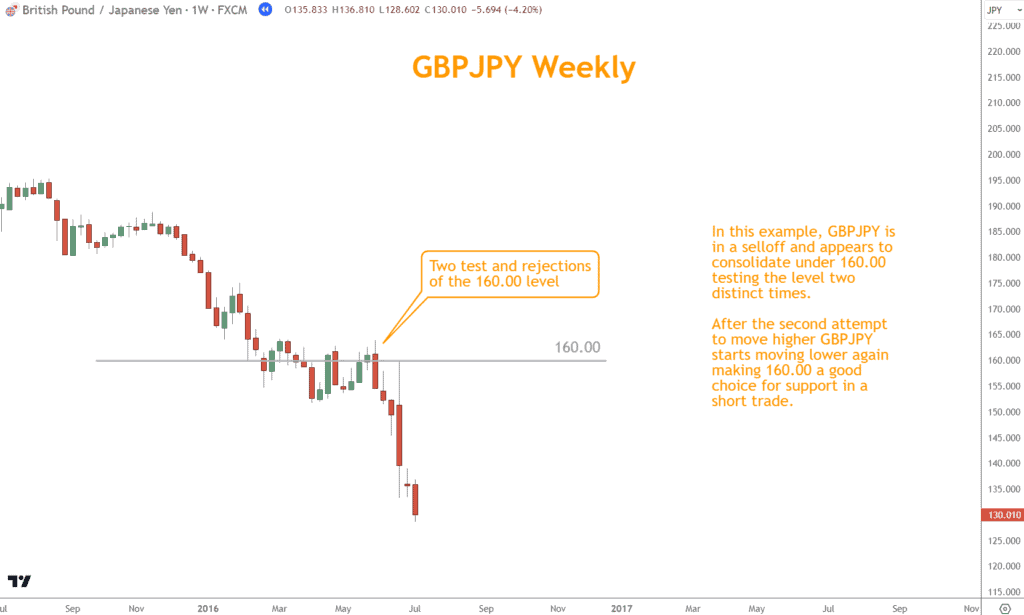

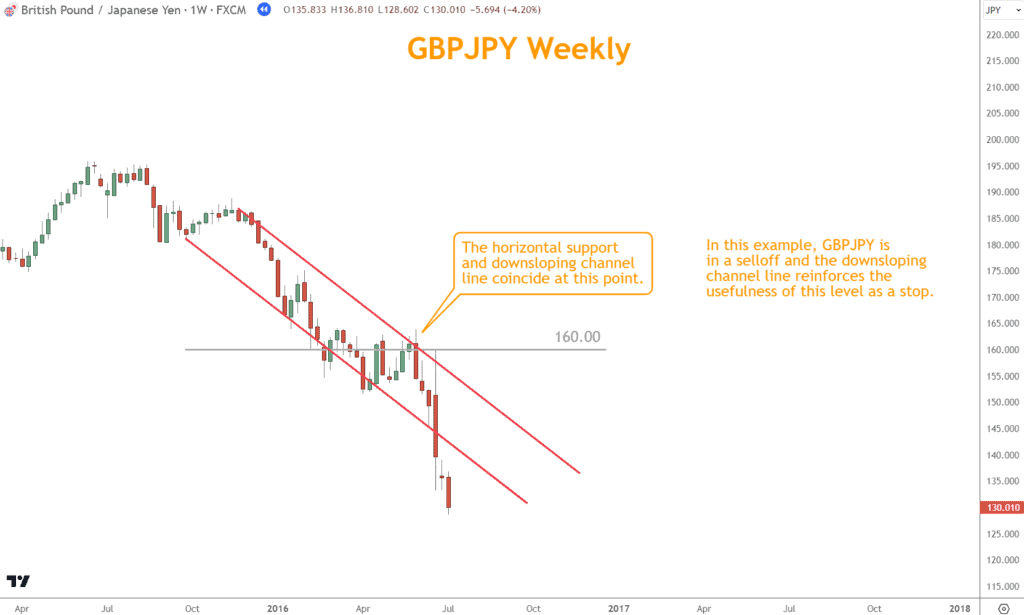

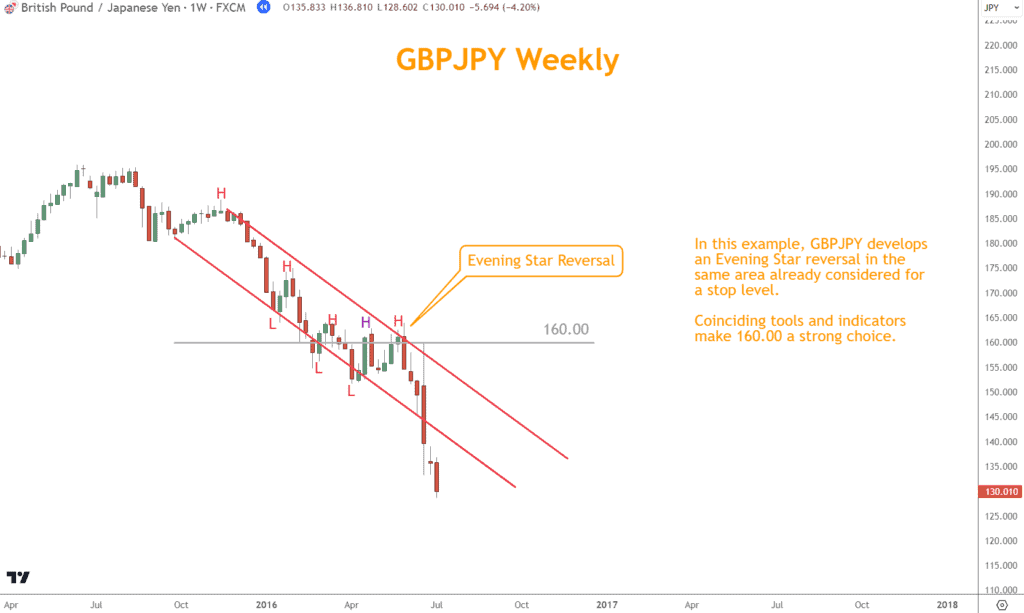

In this GBPJPY example, the selloff consolidates and tests the 160.00 level twice before moving lower.

In a short trade opportunity, 160.00 can serve as support and an appropriate level for a stop.

This tactic also has a cliche – “sell the bounce.”

Should you Leave “Wiggle Room” for Your Stops?

Before considering other techniques, I want to address a common misconception.

Many resources will advise traders to select a price marginally lower than the support line.

The logic is that if the price overshoots, you have “wiggle room” to keep your trade.

I don’t recommend this.

You want to choose a support level where you are confident (as sure as any trader ever can be) that traders will not be testing this level again soon.

If you try to guess with some “wiggle room,” you risk hitting your stop.

It is impossible to predict how much extra room is needed.

In addition, “stop hunters,” discussed later in this article, thrive on closing other traders’ “wiggle room.”

If you think you need “wiggle room” at a support level, you should reconsider the level and your trading tactics around it.

Looking for a Strategy?

Download the Six Basics of Chart Analysis and sign up for Forex Forecast to learn a bottom-up approach to analyzing Forex markets and weekly market updates.

Can you add Channel Support?

Another support and resistance tactic you can use to place a stop-loss is channel support.

Prices form channels when they move between two rising or falling parallel lines.

In a long trade, the upper line is resistance, and the lower line is support.

How to Set a Stop-Loss Using Channel Support

- Identify the Channel: Determine the upper and lower boundaries of the channel.

- Place stop-loss at the Channel: Place stop-loss at support, assuming the last closing price you’re building your trade from is above support.

- Base trading decisions on closing prices for a specific time frame.

- The longer the time frame, the more reliable the price.

- If the price rests on a support level, you must find another support level for this trade.

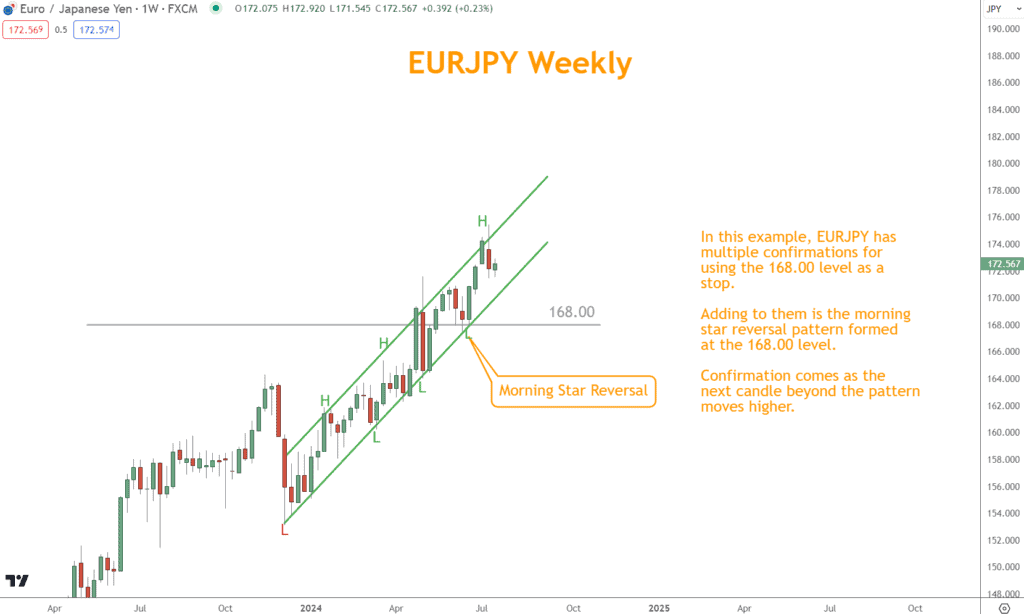

In this EURJPY example, the 168.00 horizontal support level is already a potential stop-loss level.

The lower rising channel line increases the likelihood that this area serves as an effective stop level too.

In the GBPJPY example, the same is true, but in a selloff.

GBPJPY is in a selloff, and the downsloping channel line reinforces the usefulness of this level as a stop.

Swing Highs and Swing Lows

Using swing highs and lows is another tactic to choose a stop-loss.

These are the points where the price changes direction.

Swing highs are the peaks, and swing lows are the troughs.

How to Set a Stop-Loss Using Swing Highs

1. Identify Swing High: Find the most recent peak in the price.

2. Place stop-loss at the swing high.

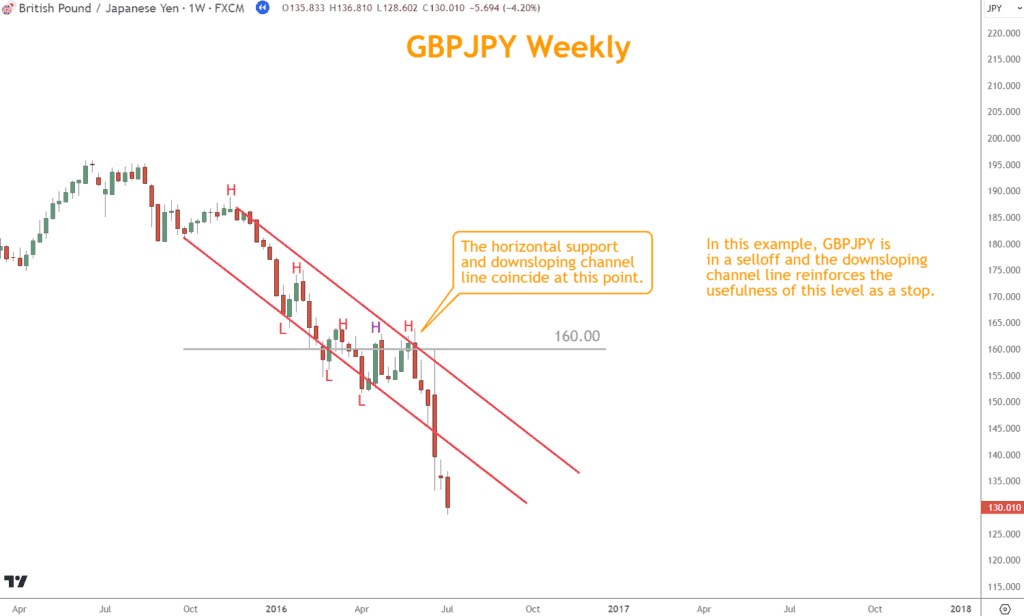

Continuing this example, GBPJPY finds coinciding support with the 160.00 horizontal support level and the upper line of the downsloping channel.

The swing high adds more credence to using this level as resistance.

How to Set a Stop-Loss Using Swing Lows

1. Identify Swing Low: Find the most recent trough in the price.

2. Place stop-loss below swing low

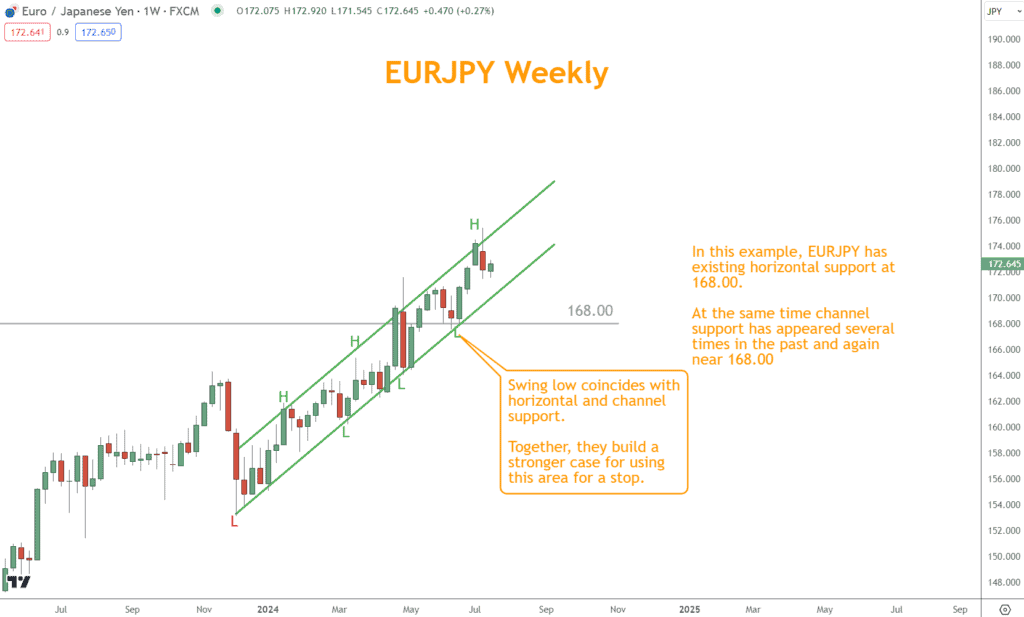

Continuing with our EURJPY example, you see a swing low labeled 168.00.

This adds credence to the already identified horizontal and channel support.

I would like to recommend a tactic associated with choosing swing highs and lows.

Only identify a new “swing” if the prior candlestick(s) have been reversed by more than 50%.

The EURJPY example above has a valid low at 168.00 because the subsequent candle consumed more than 50% of the two prior candles.

This is significant, as you’ll see in the next section about candlestick reversals.

We can see on the same chart however a price reaction that could be identified as a swing low however I recommend you not do so because the candle’s body failed to penetrate it’s prior candle.

Look at the example below:

At the end of January 2024 EURJPY pulled back but since the candle’s body failed to penetrate the prior candle’s body (labeled a swing high) it isn’t considered a swing.

Instead prices continued higher and ultimately made a lower low and the other end of the price channel.

The point of this selection process is to avoid marking every price movement as a swing and instead capture the larger and more significant price movements.

This tactic will make you a better trader by avoiding the “noise” and focusing on the big picture which is what you want to trade.

Can I Leverage Candlestick Reversal Patterns?

Candlestick chart patterns are a popular tool among traders. These patterns can provide excellent stop-loss opportunities.

How to Use Candlestick Reversal Patterns

- Identify the reversal pattern and choose a level to serve as the stop.

- The closing price is always the safest choice, but you can sometimes use the shadow or wick price.

- See the example below.

In the EURJPY example, a Morning Star reversal has developed at the 168.00 level, and we have multiple examples of confirmation for this stop level.

The reverse is true in our GBPJPY example.

An Evening Star reversal rejects the 160.00 level in the selloff, and GBPJPY continues to move lower.

Again, the coincidence of multiple elements confirms 160.00 as an ideal level for a stop.

How About Entering Stop-Losses into the Trading Platform Versus Maintaining a Mental Stop?

You have two options for stop-losses: entering them directly into the trading platform or maintaining a mental stop-loss.

Each approach has its advantages and disadvantages.

Understanding these can help you decide which method best suits your trading style and risk management strategy.

Entering Stop-Losses into the Trading Platform

Pros:

- Automatic Execution: Entering stop-losses into the trading platform has the primary advantage of executing them automatically.

- This makes sure that your trade closes at the predetermined level without your intervention, even if you are not monitoring the market.

- This can fail if the market moves quickly and skips your price. If your price is never part of the bid-ask spread, it may be ignored, costing you losses you didn’t plan on.

- This makes sure that your trade closes at the predetermined level without your intervention, even if you are not monitoring the market.

- Discipline and Consistency: Using platform-based stop-losses helps maintain discipline and consistency in your trading strategy.

- It removes the emotional element of decision-making, which can often lead to poor choices, such as holding onto a losing position in the hope that it will recover.

- The exception to this occurs whena trader moves their stop further away in anticipation of further losses.

- It removes the emotional element of decision-making, which can often lead to poor choices, such as holding onto a losing position in the hope that it will recover.

- Risk Management: Automated stop-losses ensure that you adhere to your risk management rules.

- This is particularly important in volatile markets where prices can move rapidly, potentially leading to significant losses if a stop-loss is not in place.

- No Human Error: Setting a stop-loss directly in the trading platform eliminates the risk of human error.

- You won’t forget to execute the stop-loss or miscalculate the appropriate level.

Cons:

- Stop Hunting: One of the main disadvantages is the possibility of stop hunting, where the market temporarily moves to trigger stop-losses before resuming the original trend.

- This can result in unnecessary losses, particularly in highly liquid and manipulated markets.

- Execution Issues: Technical issues with the trading platform, such as delays or malfunctions, might rarely prevent the stop-loss from being executed at the desired level. This can lead to larger-than-expected losses.

Maintaining a Mental Stop

Pros:

- Flexibility: A mental stop allows you to adjust your exit strategy based on real-time market conditions. If you believe the market is experiencing temporary volatility, you can hold your position longer without stopping prematurely.

- As a position trader, this is a common occurrence where a news item will temporarily move against you beneath your stop, only to recover later and return to the projected direction.

- Avoiding Stop Hunting: By not placing your stop-loss in the platform, you reduce the risk of stop hunting. Market makers and other traders cannot see your stop-loss level, which can protect you from manipulative market moves.

- Adaptability: Mental stops allow you to adapt to unexpected news or market events. You can reconsider your strategy and decide whether to exit or hold based on the latest information.

- I think it’s a good idea to wait until the proscribed trading period is complete before acting on any event. If you’re a position trader and trade at the weekly opening with few exceptions, you should wait until then.

- Making decisions in the middle of the trading period opens you up to emotional trading which is never good.

- I think it’s a good idea to wait until the proscribed trading period is complete before acting on any event. If you’re a position trader and trade at the weekly opening with few exceptions, you should wait until then.

Cons:

- Emotional Decisions: The biggest drawback of mental stops is the potential for emotional decision-making. Fear and greed can cloud your judgment, leading you to ignore your predetermined stop-loss level and hold onto a losing position for too long.

- Lack of Discipline: Maintaining a mental stop requires high discipline. It can be easy to rationalize staying in a losing trade, leading to more considerable losses than initially planned.

- If you can’t plan your trade and trade your plan, Forex trading isn’t for you.

- Constant Monitoring: To effectively use mental stops, you must monitor the market relative to your trade time frame.

- If you trade a short time frame, such as intraday, this can be time-consuming and stressful, especially in fast-moving markets where prices change rapidly.

In my opinion, there are two aspects to this question that you must choose as a trader, which will determine which process is best for you.

If you trade on a short-term time frame, even swing trading, you must enter your stops in the broker’s platform.

This is less than ideal for the reasons you read above.

However, the market can move quickly in small time frames, and you must use technology to react.

You should always use a mental stop if you position trade and use weekly charts like me.

Position trading allows you to trade once a week and avoid needing to monitor a 24×5 market in real time.

What about Trailing Stops?

Trailing stops are dynamic stop-loss orders that automatically adjust to a Forex pair’s current market price.

They are designed to protect gains by enabling a trade to remain open and continue to profit as long as the price moves in a favorable direction.

However, they will close the trade if the market starts to move in an unfavorable direction by a certain distance.

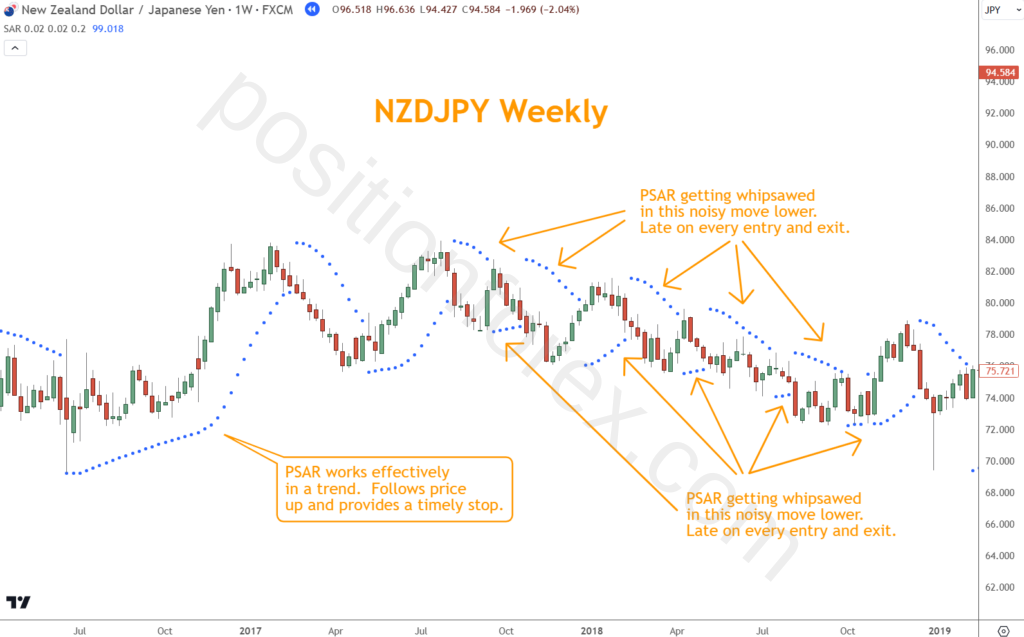

An example of using a trailing stop is the PSAR indicator, which you can see in the chart below. The PSAR is a popular trailing stop tool since it responds to volatility and trends.

Notice how, during periods when the price isn’t trending, the PSAR gets whipsawed and provides poor signals.

Like most indicators the PSAR suffers from lag.

Pros of Using Trailing Stops

- Protection of Profits: Trailing stops move with the market price, locking in profits while providing a safety net against reversals.

- This allows traders to maximize potential gains without manually adjusting their stop-loss levels.

- Hands-Off Management: Once set, trailing stops require no further action from the trader. This makes them ideal for individuals who cannot monitor their daily trades.

- Mitigation of Emotional Decisions: Trailing stops can help traders avoid emotional decision-making by automatically securing profits and limiting losses, adhering to a predetermined strategy regardless of market fluctuations.

Cons of Using Trailing Stops

- Market Volatility: During periods of high volatility, trailing stops might be triggered by temporary price dips that do not reflect an actual market reversal, thus potentially resulting in premature exit from a profitable position.

- Choosing the Right Distance: Setting the optimal trailing stop distance can be challenging. If it’s too tight, the stop might trigger too frequently; if it’s too loose, it may not effectively protect profits.

- No Guarantees on Execution Price: Trailing stops are executed as market orders like other stop orders.

- This means the sale price is not guaranteed and may differ significantly from the set stop price in a rapidly moving market.

Recommendation Against Using Historical Volatility as a Stop Strategy

While some traders consider using historical volatility to set stop-loss orders, I recommend caution with this strategy.

Historical volatility measures past market movements and does not necessarily predict future price action accurately.

Using it as the sole criterion for setting stop-loss levels can lead to either too tight or too loose stops, which do not reflect current market conditions or the instrument’s inherent volatility.

Instead, it’s more effective to consider current market volatility, supported by technical indicators that reflect more immediate market dynamics, to set more responsive and effective stop-loss levels.

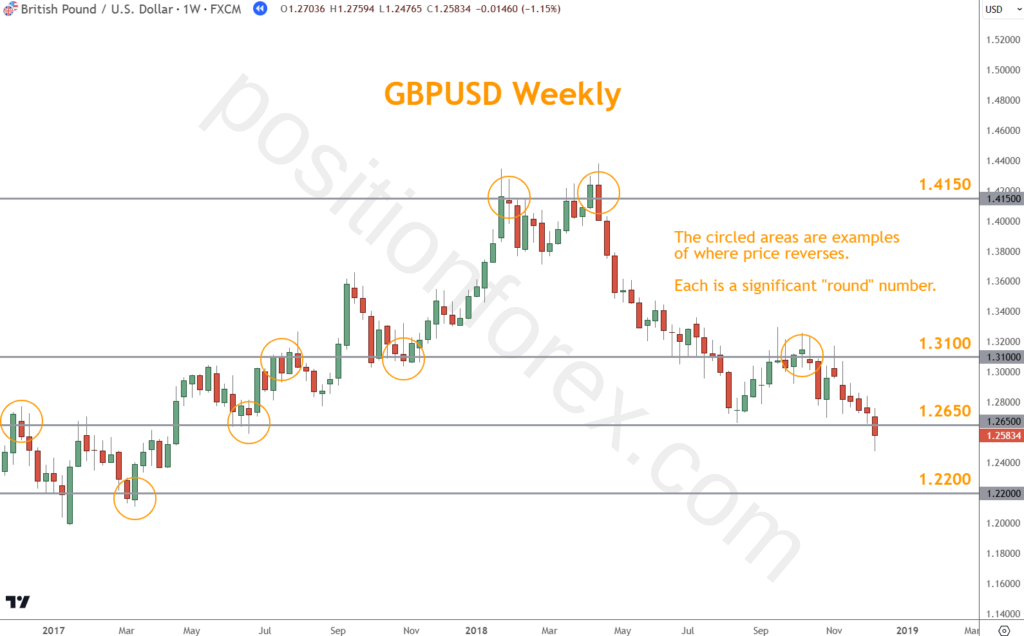

Are Round Numbers Important?

Round numbers play a significant role in Forex trading as stop-loss levels due to their psychological impact on traders and the market.

Often ending in multiple zeros (1.1000, 1.2000, or 110.00), these numbers are easily recognizable and attract many buy or sell orders.

This concentration of orders around round numbers can create strong support or resistance levels, making them ideal points for setting stop-losses.

The GBPUSD example below shows how the price consolidates or reverses at these round numbers. Sometimes, a “.50” can be a significant level, too.

Traders and institutional investors often place their stop-losses at these levels, anticipating potential market reactions.

By understanding the psychological influence of round numbers, you can strategically position your stop-losses to take advantage of these predictable market behaviors.

This will enhance your risk management and improve your chances of avoiding unnecessary stop-outs during periods of volatility.

What are Stop Hunters?

Stop hunters are market participants who attempt to exploit stop-loss orders set by other traders to trigger these stops and profit from the resulting market movements.

Typically, stop hunters include institutional traders, large financial institutions, and sometimes even individual traders with significant market influence.

Their primary strategy involves driving the price of a currency pair to levels where they expect a large number of stop-loss orders to cluster, usually around noticeable technical levels such as recent highs or lows, round numbers, or other significant support and resistance areas.

Here’s how stop hunters operate:

- Identify Clusters of Stops: Stop hunters look for price levels where many traders are likely to have placed stop-loss orders.

- These levels are often just above resistance or below support levels, swing highs and lows, or around round numbers.

- Manipulate the Market: Using their substantial market power, stop hunters push the price toward these stop levels.

- They might place large buy or sell orders to create the momentum needed to reach these levels.

- Triggering Stops: Once the price reaches the targeted level, it triggers the clustered stop-loss orders.

- This results in a flurry of automated selling (for long positions) or buying (for short positions), which can cause a temporary spike or dip in the market.

- Profit from the Movement: After triggering the stops and causing the price to move sharply, stop hunters can take the opposite position to benefit from the price correction that often follows.

- For example, after pushing the price down to trigger sell stops, they might start buying at the lower price, profiting as the price rebounds.

By understanding the tactics of stop hunters, you can better position your stop-losses to avoid these common traps.

One strategy might involve setting stop-losses slightly beyond expected levels or using mental stops to avoid displaying their stop levels to the market.

Remember to protect your positions from being prematurely closed by these exploitative practices.

There are examples of “stop hunters” acting illegally to trigger stops for profit and getting caught.

On June 2, 2017, the U.S. Commodity Futures Trading Commission (CFTC) permanently banned David Liew from CFTC-regulated markets for over two years of spoofing and manipulating gold and silver futures while at a major financial institution.

Liew placed false buy and sell orders to distort market prices and trigger customer stop-loss orders, acting alone and with others from his firm and another institution.

He admitted his misconduct, cooperated with the CFTC investigation, and pleaded guilty to conspiracy to commit wire fraud and spoofing.

A mental stop can protect you from this kind of market manipulation.

Conclusion

Setting a stop-loss is an essential skill for Forex traders.

It helps protect your trading capital and manage risk effectively.

Using horizontal support and resistance, channel support and resistance, swing highs and swing lows, and candlestick reversal patterns, you can set stop-losses that suit different market conditions and trading strategies.

Remember, successful trading isn’t just about making profits. It’s also about minimizing losses.

Here is a 6-question quiz along with an answer key based on the article “Stop Loss in Forex: 3 Tactics for Success.”

This quiz helps you understand the main ideas from the article and focuses on how to use stop-loss strategies in Forex trading.

Quiz: Understanding Stop-Loss Strategies in Forex

Questions:

What is the primary purpose of a stop-loss in Forex trading?

a. To increase the chances of higher profit

b. To automate trading strategies

c. To minimize potential losses

d. To increase the volume of trades

Which of the following is NOT one of the three stop-loss tactics discussed in the article?

a. Volatility-based stop-loss

b. Time-based stop-loss

c. Chart-pattern-based stop-loss

d. Percentage-based stop-loss

How does a volatility-based stop-loss work?

a. By setting a fixed monetary amount for losses

b. By using the average price movement as a guide

c. By choosing stop levels based on past trade results

d. By increasing the stop-loss during market spikes

Why is a percentage-based stop-loss commonly used by traders?

a. It adjusts automatically with market volatility.

b. It ensures a consistent risk relative to account size.

c. It minimizes the need for manual adjustments.

d. It eliminates the possibility of losses entirely.

What is the potential downside of setting a stop-loss too close to the entry price?

a. It may trigger a margin call.

b. It could limit the profitability of the trade.

c. It increases the risk of unnecessary stop-outs.

d. It causes excessive trading fees.

What is a key recommendation for effectively using stop-loss strategies in Forex trading?

a. Avoid using stop-loss during highly volatile markets.

b. Combine stop-loss tactics with thorough market analysis.

c. Use the same stop-loss strategy for all trades.

d. Focus solely on automated stop-loss settings.

Answer Key:

- c. To minimize potential losses

- b. Time-based stop-loss

- b. By using the average price movement as a guide

- b. It ensures a consistent risk relative to account size.

- c. It increases the risk of unnecessary stop-outs.

- b. Combine stop-loss tactics with thorough market analysis.

What’s the Next Step?

Select a chart and find the four tactics discussed here to establish a stop-loss level.

Look for opportunities to incorporate other indicators in your analysis to enhance confirmation.

Once you’re ready to trade, choose a strategy and process you believe will work for you.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis.

If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about stop-losses in Forex trading.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will use the Six Basics of Chart Analysis and Advanced Strategies to show you the trade opportunities I’m watching.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce videos and guides to help you learn and improve trading practices.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What Is a Stop-Loss and Why Is It Important?

A stop-loss is an order a trader places with a broker to close a trade when it reaches a specific price.

It is essential because it helps manage risk by limiting potential losses in a trade.

By setting a stop-loss, you can avoid holding onto losing positions in the hope that the market will turn around, thus protecting your capital.

How Can I Use Horizontal Support and Resistance?

To set a stop-loss using horizontal support, first identify the support level.

Support is a price level at which the currency pair tends to bounce.

Ensure that you place your stop-loss at a long-time support level and believe that this level will not be violated at the end of the next candle close.

What Are Swing Highs and Swing Lows, and How Can They Help?

Swing highs are the peaks where the price changes direction from upward to downward, while swing lows are the troughs where the price changes from downward to upward.

To set a stop-loss using swing highs and lows, identify the most recent swing high or low.

For a long position, place your stop-loss at the recent swing low.

For a short position, place your stop-loss at the recent swing high.

This method helps to account for minor fluctuations and avoids premature stop-outs.

How can one use Candlestick Patterns?

Japanese candlestick patterns are valuable tools for setting stop-loss levels because they provide clear visual signals of potential market reversals and continuations.

The Hammer, Shooting Star, and Engulfing Patterns indicate significant price actions and market sentiment shifts.

For example, you can place a stop-loss at the bottom of the wick of a hammer candlestick in a bullish reversal pattern or at the top of the wick of a shooting star in a bearish reversal.

These strategic placements allow you to exit positions if the market moves against your predictions, thus limiting potential losses while capitalizing on the reliable signals these patterns provide.

Forex Trading Disclosure Statement

Risk Warning:

Forex trading involves significant risk and may not be suitable for all investors. The leveraged nature of Forex trading can work both for and against you, leading to substantial gains or losses. Before trading Forex, you should carefully consider your financial objectives, experience level, and risk tolerance. It is possible to lose more than your initial investment, and you should only trade with money you can afford to lose.

Market Risks and Volatility:

Forex markets are influenced by global economic, political, and social events, which can result in unpredictable price movements. High market volatility can lead to sudden and substantial changes in currency values, potentially causing losses that exceed your initial deposit.

Leverage Risks:

Leverage amplifies both potential gains and potential losses. While leverage can increase profitability, it also increases the risk of significant losses, including the loss of your entire trading capital.

Trading Tools and Technology Risks:

Forex trading platforms, including those offered by brokers, are subject to technology risks, such as system failures, latency issues, and potential errors in price feeds. Traders should be aware that these risks can impact the execution of trades and trading outcomes.

No Guarantee of Profitability:

Past performance in Forex trading is not indicative of future results. There is no guarantee that you will achieve profits or avoid losses when trading Forex. Market conditions and individual trading strategies vary, and no trading system can eliminate the inherent risks of Forex trading.

Educational Purposes Only:

Any information provided about Forex trading, including strategies, analysis, or market commentary, is for educational purposes only and should not be considered financial advice. Consult a qualified financial advisor or tax professional before making any trading decisions.

Regulatory Compliance:

Forex trading is regulated differently in various jurisdictions. Ensure that you are trading with a broker that is licensed and compliant with regulations in your country of residence.

Responsibility:

You are solely responsible for your trading decisions and the risks associated with them. It is your duty to understand the terms and conditions of Forex trading, including margin requirements, stop-losses, and other risk management tools.

Acknowledgment:

By engaging in Forex trading, you acknowledge that you have read, understood, and accepted this disclosure statement. You accept full responsibility for the outcomes of your trading decisions and agree to trade at your own risk.

This disclosure is intended to provide an overview of the risks associated with Forex trading and is not exhaustive. For additional information, consult your broker and other reliable financial resources.