Trading Forex with a small account presents unique challenges and experiences.

Many traders are attracted to making significant profits with limited capital, even though it may initially seem overwhelming.

If you’re trading with a small account, it can take time to navigate all the complexities successfully.

This article will explore some strategies and techniques to help you do that.

We’ll cover the essential steps to help you turn a small account balance into a larger one. These steps include choosing the right broker and managing risks effectively.

If you are new to trading and want to start small, this guide will provide valuable insights to help you.

Setting Up Your Small Account

Small account Forex traders face the challenge of limited capital, but that doesn’t prevent them from success. Choosing the right trading strategy is critical.

Day trading, a technique centered around profiting from small price movements, is particularly challenging for those trading with limited funds.

Day traders aim to make numerous quick trades throughout the day, targeting minimal gains per trade but accumulating profits over time.

With minimal capital comes a limited drawdown, making this strategy the most difficult for all traders, especially those with small account balances.

Swing trading is a less dangerous strategy for small account traders, focusing on capturing medium-term trends lasting from a few days to a week.

Swing traders typically have more flexibility in their trading decisions and can avoid the stress of constant monitoring.

However, smaller stops are required, like day trading, making this strategy dangerous.

Forex traders should consider position trading for several compelling reasons, especially with small accounts.

Firstly, position trading involves holding trades over longer timeframes, reducing the frequency of transactions and transaction costs, which can be a significant advantage for traders with limited capital.

Secondly, this approach allows traders to ride significant market moves, potentially leading to substantial profits while minimizing the need for constant monitoring and decision-making.

Lastly, position trading aligns well with risk management principles, as traders can allocate a smaller portion of their account to each trade, reducing the risk of significant drawdowns and preserving their precious trading capital.

Regardless of the strategy chosen, small account traders should always prioritize risk management and position sizing to safeguard their capital and maximize their trading potential.

The Forex trading best practices apply to trading with a small account or any account size.

Leveraging Leverage Wisely

Leverage can be a double-edged sword for small account traders in the Forex market.

While it can amplify potential gains, it also magnifies the risks. Understanding leverage is crucial; it allows you to control a more substantial position size with less capital.

Small account traders should refrain from excessive leverage, leading to significant losses that can quickly deplete their accounts.

A general rule of thumb is to use leverage sparingly, especially when just starting.

Consider limiting your leverage to a level that allows you to maintain proper risk management, such as 10:1 or less.

This approach will help protect your account from substantial drawdowns while still offering the potential for reasonable profits.

Risk Management

Effective risk management is the cornerstone of success for any trader in any market.

Setting appropriate stop-loss and take-profit levels is a crucial aspect of risk management.

Stop-loss orders protect your account from excessive losses by automatically closing a trade if the market moves against you beyond a certain point.

On the other hand, take-profit orders lock in profits when the market moves in your favor.

Diversification is another critical element in managing risk. By spreading your capital across different currency pairs or assets, you can reduce the impact of a single losing trade on your account.

Finally, mastering trading psychology is vital. Emotional discipline and the ability to stick to your trading plan, even in the face of losses, are critical for long-term success.

Growing Your Small Account

Avoid the temptation to over-leverage or take excessive risks in pursuit of quick riches, which can lead to significant losses.

Instead, focus on making steady, well-calculated trades and maintaining discipline.

You can steadily build your small account into a more substantial and profitable portfolio by staying committed to your trading plan and consistently reinvesting your profits.

Conclusion

In conclusion, trading with a small account in the Forex market presents unique challenges, but with the right strategies and mindset can also lead to substantial rewards.

Small account traders should begin by selecting a reputable broker and account type tailored to their needs, focusing on risk management, and mastering trading strategies suitable for limited capital.

Use leverage judiciously to avoid excessive risk, and ensure that you set stop-loss and take-profit levels to preserve capital.

As your account grows, harness the power of discipline and a strong trading psychology.

Remember that success in forex trading, regardless of account size, hinges on a combination of skill, strategy, and resilience.

What’s the Next Step?

Select a reputable broker and open an account using what you learned in this article.

In addition, look for opportunities to use a demo account first to learn the broker’s platform.

Once you’re ready to trade, choose a strategy and process you believe will work for you.

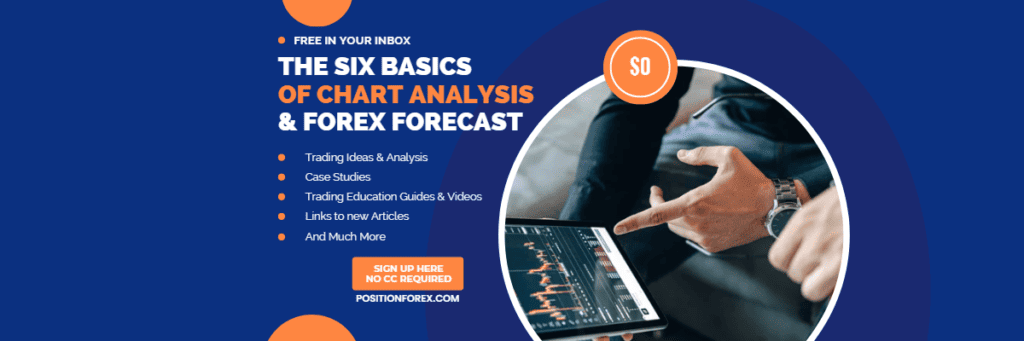

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about Forex trading.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

What is a Small Trading Account?

A small trading account typically refers to an account with limited capital, usually less than $10,000, used for trading various financial instruments, including Forex.

Can I Make Money with a Small Trading Account?

Yes, making money with a small trading account is possible, but requires proper risk management and a well-thought-out trading strategy.

What are Some Common Mistakes Made by Small Account Traders?

Common mistakes include overleveraging, lack of risk management, and emotional trading.

How Much Should I Risk per Trade With a Small Account?

Most trading experts recommend not to risk more than 1-2% of your trading capital on a single trade.

Is it Better to Focus on one Currency Pair or Trade Multiple Pairs with a Small Account?

For small account traders, it’s often better to focus on a few currency pairs and become an expert in their price movements.

What is the Importance of Trading Psychology in Small Account Trading?

Trading psychology is crucial for small account traders as emotions can lead to impulsive decisions and significant losses. Maintaining discipline and a positive mindset is essential.