As a Forex trader, understanding scaling principles is fundamental to your success.

This article will explore these details, including their advantages and potential drawbacks.

We will discuss how these strategies can help maximize profit potential if you manage the risk effectively.

We will also provide insights on determining the right time to scale in or scale out based on market conditions and your trading goals.

Understanding the Concept of Scaling In and Scaling Out in Forex Trading

Scaling in refers to gradually increasing your position size, and scaling out involves slowly reducing your position size.

Both decisions require careful analysis to ensure optimal results.

Conventional wisdom regarding this tactic is to enter positions with smaller initial risks and increase them as the trade progresses.

This technique helps you manage risk and potentially increase profits.

Conversely, closing some of the trade early helps you lock in profits and reduce risk as the trade moves in your favor.

By gradually closing parts of the position, you can protect your gains and minimize potential losses.

Here are some simple guidelines to help you make scaling your trading system easier:

- Always have a risk percentage in mind, e.g., 2% of your account.

- Consider using 1% of your account or some smaller position if a Forex pair is exceptionally volatile.

- If you have a 2% position and your trade is profitable, consider closing half your trade to lock in some profits.

- Don’t add to a 1% position and raise your base cost. If you believed the trade was too volatile when you opened it, don’t add to it, no matter how it’s doing.

- If you scaled out a position after a retracement, you want to re-enter and return to your original position size. Consider the trades unique and make decisions on each trade independently as you move forward.

By employing these techniques effectively, you can maximize your profit potential while minimizing your risk exposure.

Exploring What Scaling In Means in Forex Trading

In investing, which differs from trading, scaling is a beneficial strategy for gradually entering a position and reducing the risk of entering at the wrong time.

Sometimes, this is also referred to as dollar-cost averaging.

This approach allows you to capitalize on market fluctuations and potentially increase your profits.

Dollar cost averaging also allows you to manage risk effectively.

By initially committing only a portion of your capital, your price becomes an average of the instrument’s overall performance. While this strategy is good for investing, it does not make sense for trading.

In trading, we enter a position to exit when certain conditions are met. As a result, we are selective about when we enter and exit, and averaging into a position contradicts that strategy.

Why You Need to Avoid Scaling In

It has drawbacks if you choose to do so when trading in Forex.

One of the main risks is increased exposure to market volatility and risk. As you gradually add to your position, you increase your overall risk in the trade.

If you like the trade that much, you should have chosen a more significant position size in the first place.

Another potential drawback is the possibility of missed opportunities.

A rapidly moving market usually involves chasing prices. If you miss an opportunity, let it go. There will be others.

Additionally, this decision can lead to more significant positions and potential losses if the market reverses and hits a stop loss.

To mitigate risks, it’s vital to have a clear strategy when opening a trade.

By understanding the risks and implementing a sound trading strategy, you can minimize the downsides and optimize their chances of success.

Exploring the Advantage of Scaling Out

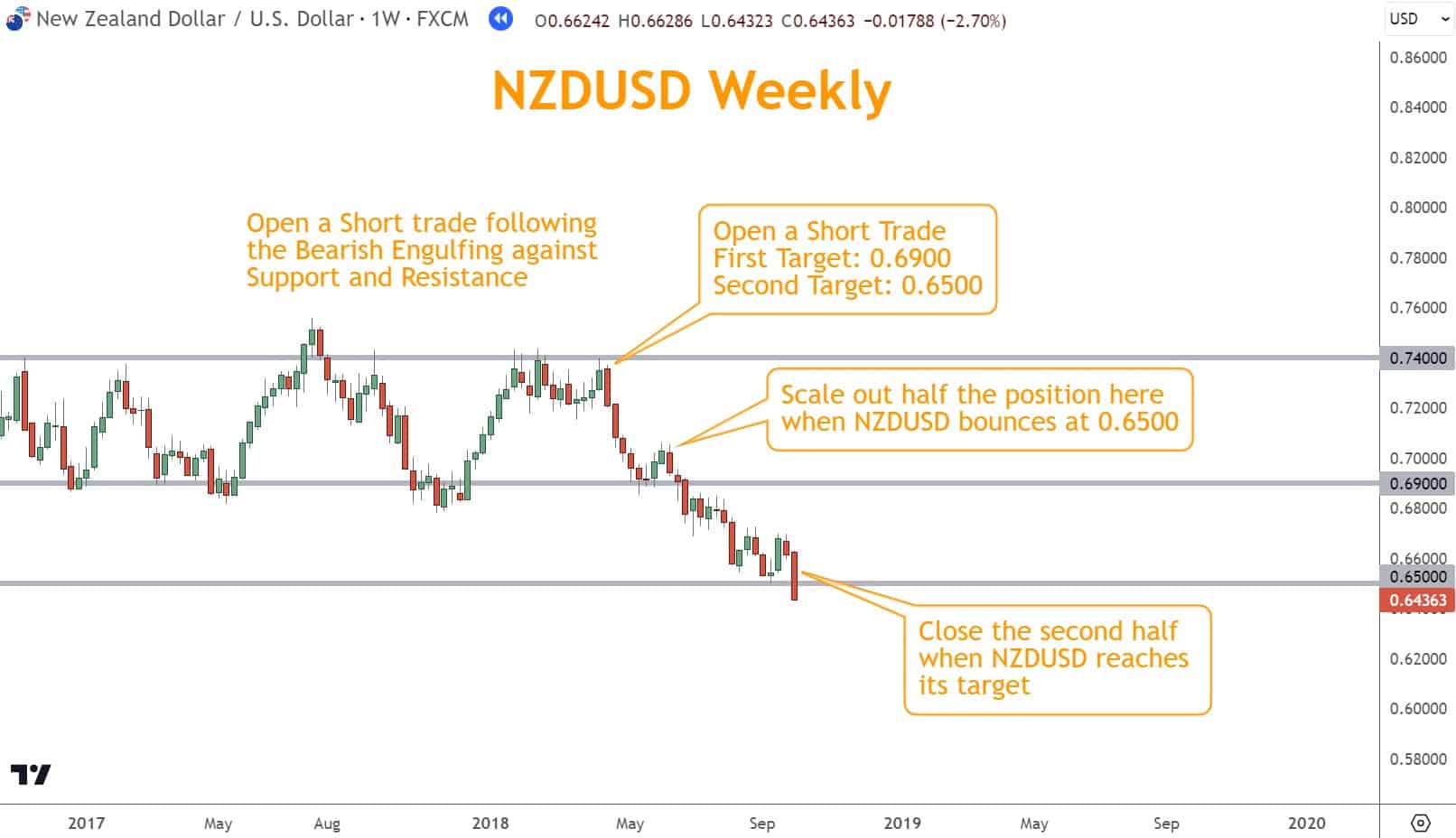

This practice in Forex trading involves gradually closing portions of a trade as it moves in your favor to your first target if you’ve specified one.

This strategy allows you to lock in profitability, leaving the remaining position for further gains.

It is also a technique that protects against sudden price reversals.

You can use technical analysis or predefined profit targets to determine when and how much of your trade to close.

You can trade profitably with the “house’s” money because you’ve already locked profits in.

This strategy requires careful planning, discipline, and attention to market conditions.

There are Definite Benefits to Scaling Out of Forex Trades

One of the key benefits is the ability to lock in profits when you reach your initial profit target while keeping a portion of the trade open for further gains.

This strategy reduces your risk exposure and protects you from potential market reversals.

Additionally, it allows you to take advantage of market volatility by booking profits at different price levels.

This approach can help you manage your emotions and avoid the regret of missing out on potential profits.

Moreover, you will have more cash in your account for new trading opportunities.

What are the Possible Pitfalls?

One possible shortcoming is missed profit opportunities if the market continues to move in your favor.

For example, if the market reverses after you close half your position too early, you may limit your potential gains by partially exiting.

It’s essential to carefully assess the market conditions and your trading strategy before any decision.

This delicate balance between partially closing and letting winners run is crucial for successful Forex trading.

You must find the right balance that aligns with their risk management techniques and overall trading strategy.

By understanding the downsides, you can try to make the best judgment for your trading account.

What’s the Next Step?

Select a favorite candlestick chart, look at it, and use your knowledge to find trading opportunities.

Then, consider how you would manage position sizing with these strategies.

Your knowledge of technical analysis should be what you use to find trading opportunities.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate into what you’ve learned here.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Video

- Want to learn most Six Basics techniques and advanced strategies?

- I produce videos and guides to help you learn and improve trading practices.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.