Is the Relative Strength Indicator (RSI) an indicator you should add to your chart?

Will it help find winning trades?

Why does it get so much attention?

The RSI is one of the most popular indicators in technical analysis, and traders try to use it to find Trends and Momentum.

The RSI provides trading signals using a “50” line describing Overbought and Oversold states.

In this article, we will discuss the difference between RSI and Stochastic and also take a deep dive into techniques such as Overbought and Oversold, channel lines, divergence, and Chart Patterns.

Finally, we will detail how you can integrate with the MACD and SMA to create an RSI strategy.

What is the Relative Strength Indicator?

The Relative Strength Indicator is a popular tool used for trading, particularly in technical analysis.

It’s an oscillator-type indicator that helps identify Momentum, overbought and oversold market conditions, and divergence signals in financial markets.

Using this tool, traders can better understand market Momentum and incorporate it into their other mechanisms to make better trading decisions.

How to Understand RSI Settings

The RSI is a popular technical indicator measuring the speed and change in price movements of a security.

The RSI’s default setting is 14 in most trading platforms. However, traders can adjust these settings depending on individual preferences, market conditions, and trading goals.

Reducing the setting will make the indicator more sensitive and help identify changes in Momentum earlier, enabling earlier trade entries and exits.

The downside of lower settings is more false signals since the indicator is reacting faster to more minor changes in price.

Increasing the setting will reduce the RSI’s reaction time, which may produce fewer signals but will also create late ones.

Either way, no “best RSI setting” works in trending and volatile markets.

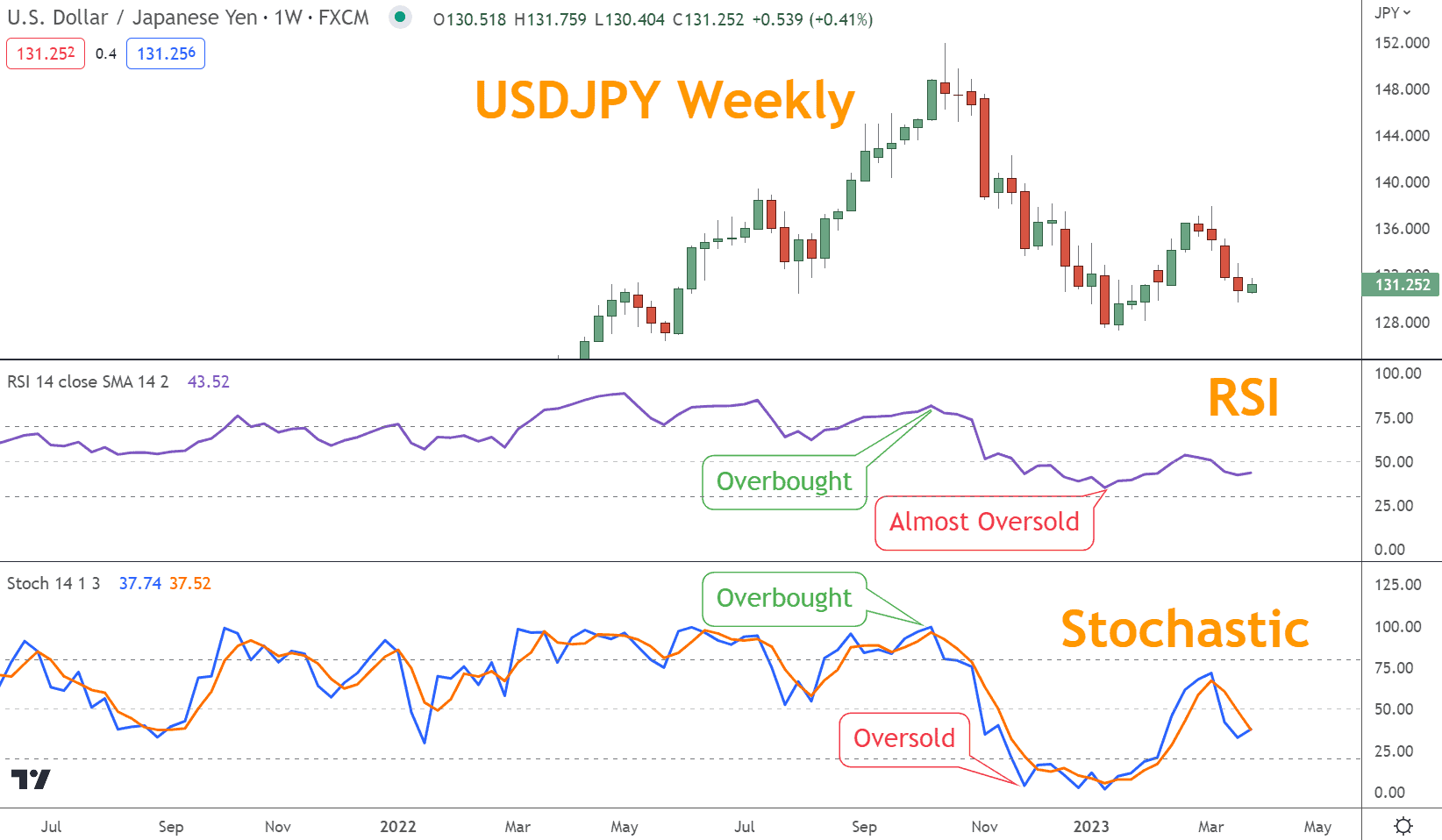

What is the difference between RSI and Stochastic?

The RSI and Stochastic are commonly used oscillators that generate indicators based on different mathematical formulas.

For example, while RSI uses the average gain vs. average loss over a set number of periods, Stochastic uses the closing price relative to the highest high and lowest low over a set number of periods.

One key difference between the two is their Overbought and Oversold levels.

An RSI level of 70 and 30 is Overbought and Oversold, respectively, while Stochastic considers levels of 80 and 20 as Overbought and Oversold, respectively.

Despite the differences in their calculation, both indicators produce similar signals though they’re not the same.

How a Trader can use the RSI in Trading Strategies

One way to maximize the success of RSI trading tactics is to combine them with other technical analysis techniques and technical indicators.

This helps provide a complete market analysis and increases the accuracy of trading decisions.

Overbought and Oversold

Traders can use RSI to measure the market’s Momentum and Overbought/Oversold conditions.

For example, the security may be Overbought when the reading exceeds 70 or Oversold below 30. This may be a signal to enter or exit a trade.

Traders can also use RSI to confirm or contradict other technical indicators or market signals. By understanding what the RSI is describing, traders can use Momentum to their advantage.

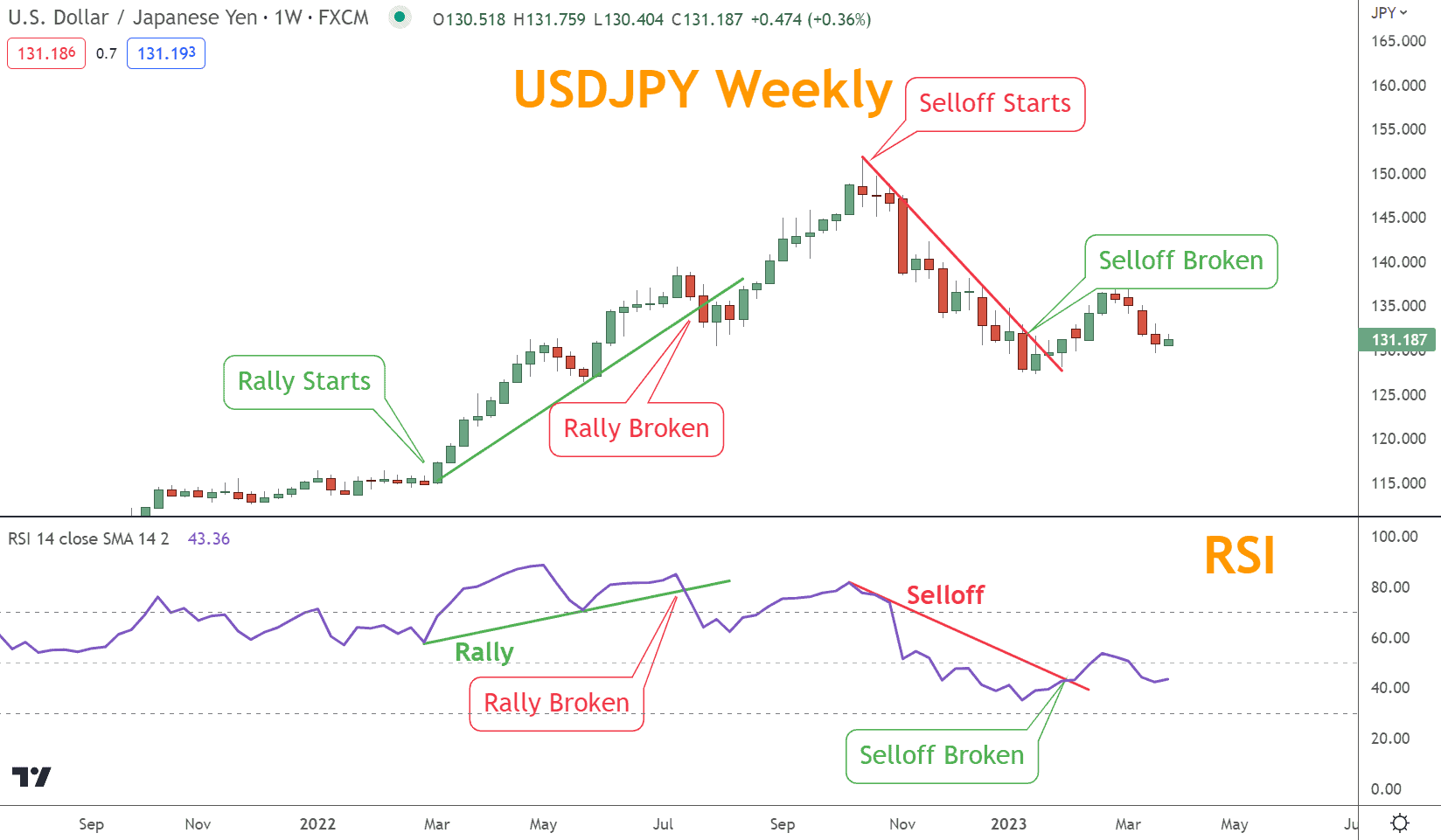

Trendlines

Aside from identifying Overbought and Oversold conditions, trendlines can be applied to the RSI chart to provide leading indicators for price reversal or continuation in the market.

In addition, these lines can demonstrate a Momentum Resistance or Support level for a particular instrument.

To draw an upward trendline on the chart, traders should connect two or more lows when the RSI rises.

Likewise, a downward trendline is drawn by linking two or more highs when the RSI falls. A break of a trendline can signal an impending price reversal or continuation.

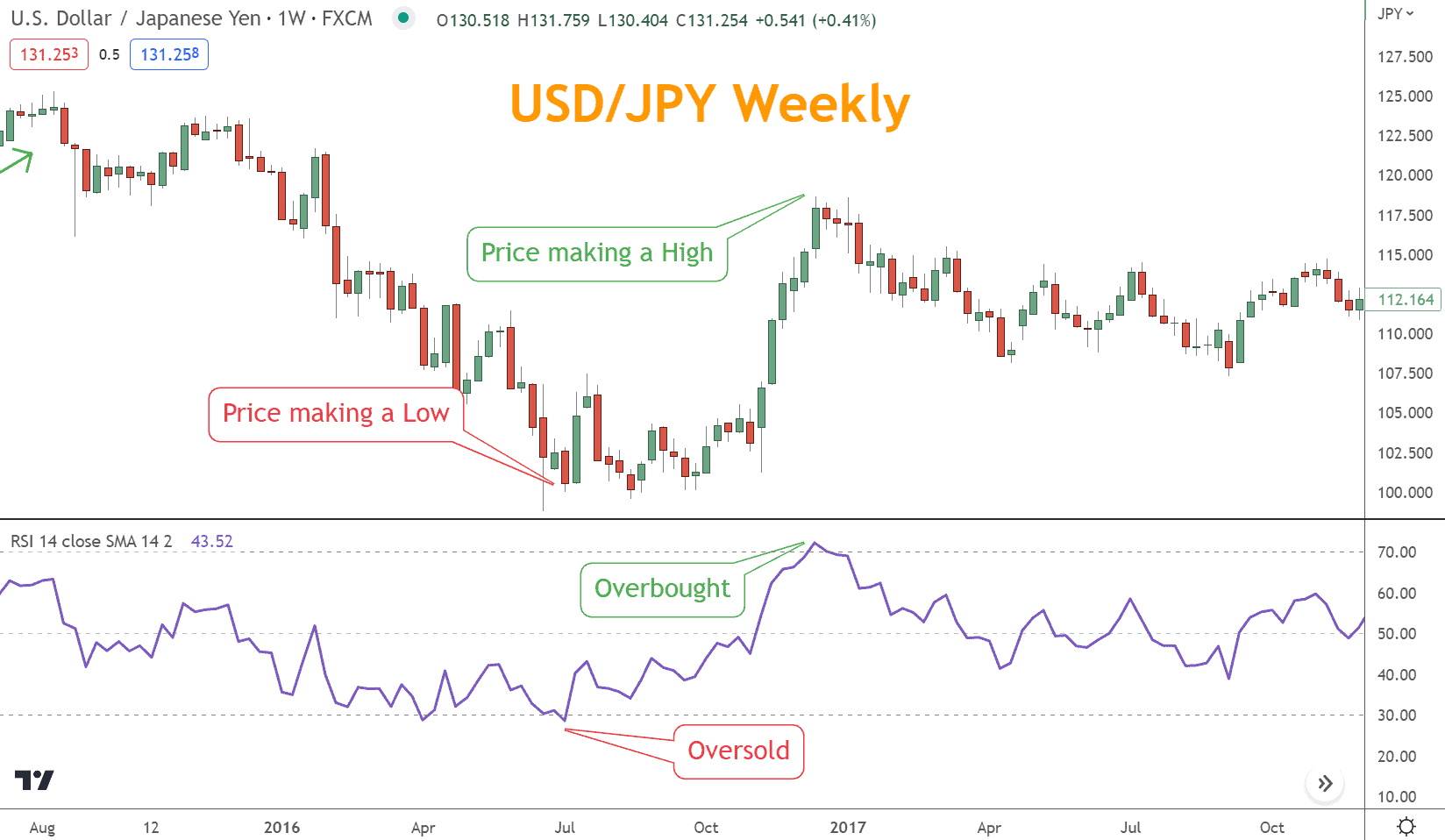

Divergence

Another helpful technique is RSI divergence, which is used to identify potential reversals in the direction of a security’s price.

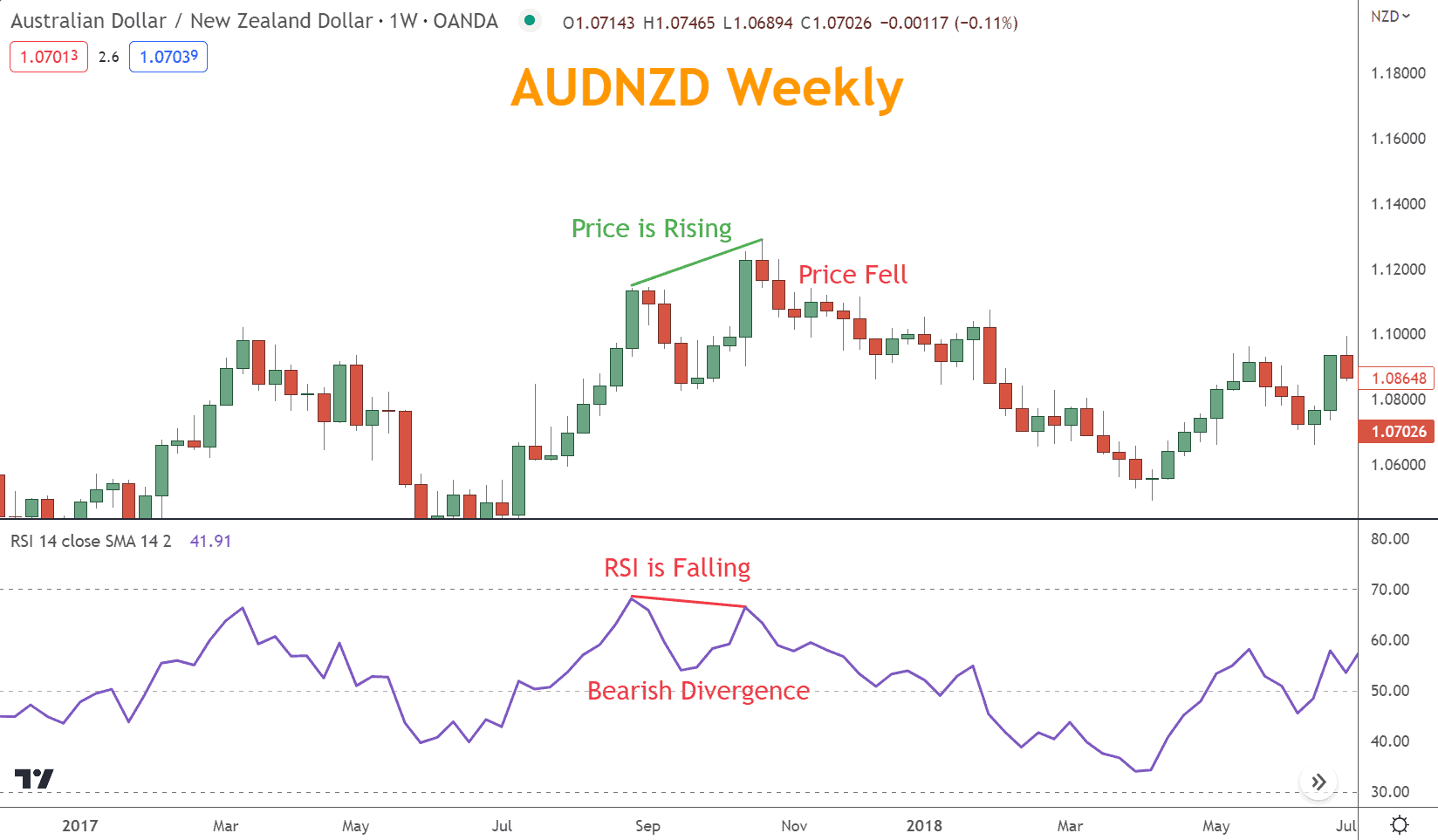

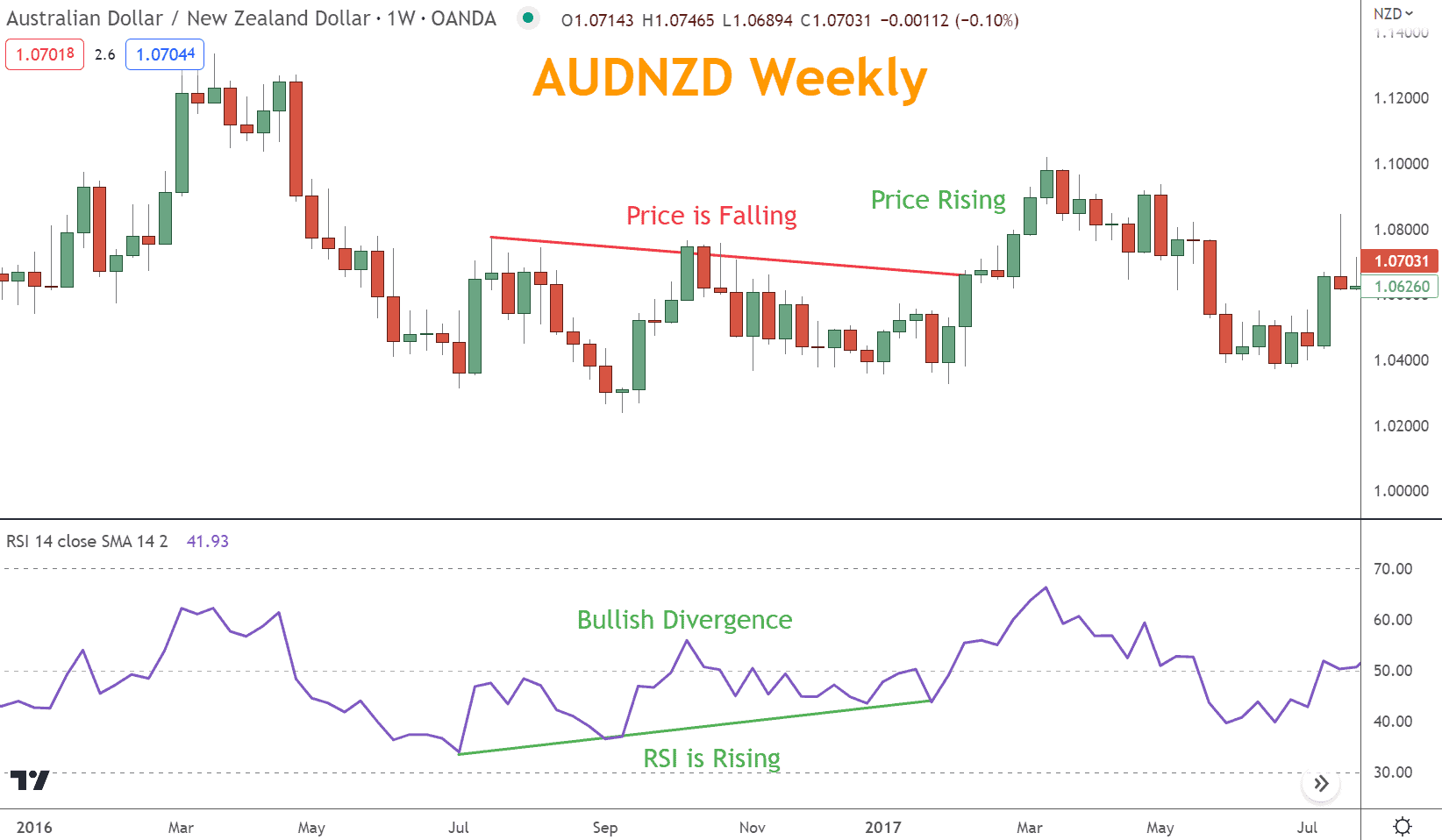

Divergence is noted when the highs or lows of the market price move in a different direction from the highs or lows on the indicator.

For example, if prices are rising, but the RSI is making lower peaks, this is considered a Bearish divergence. In contrast, if prices are falling, but the RSI is making higher troughs, this is regarded as a Bullish divergence.

The divergence indicates Momentum is changing and can signal a possible reversal in future price movements.

By using divergence in trading strategies, traders can identify price reversals and optimize their trade entries and exits.

The divergence technique, however, could be more reliable.

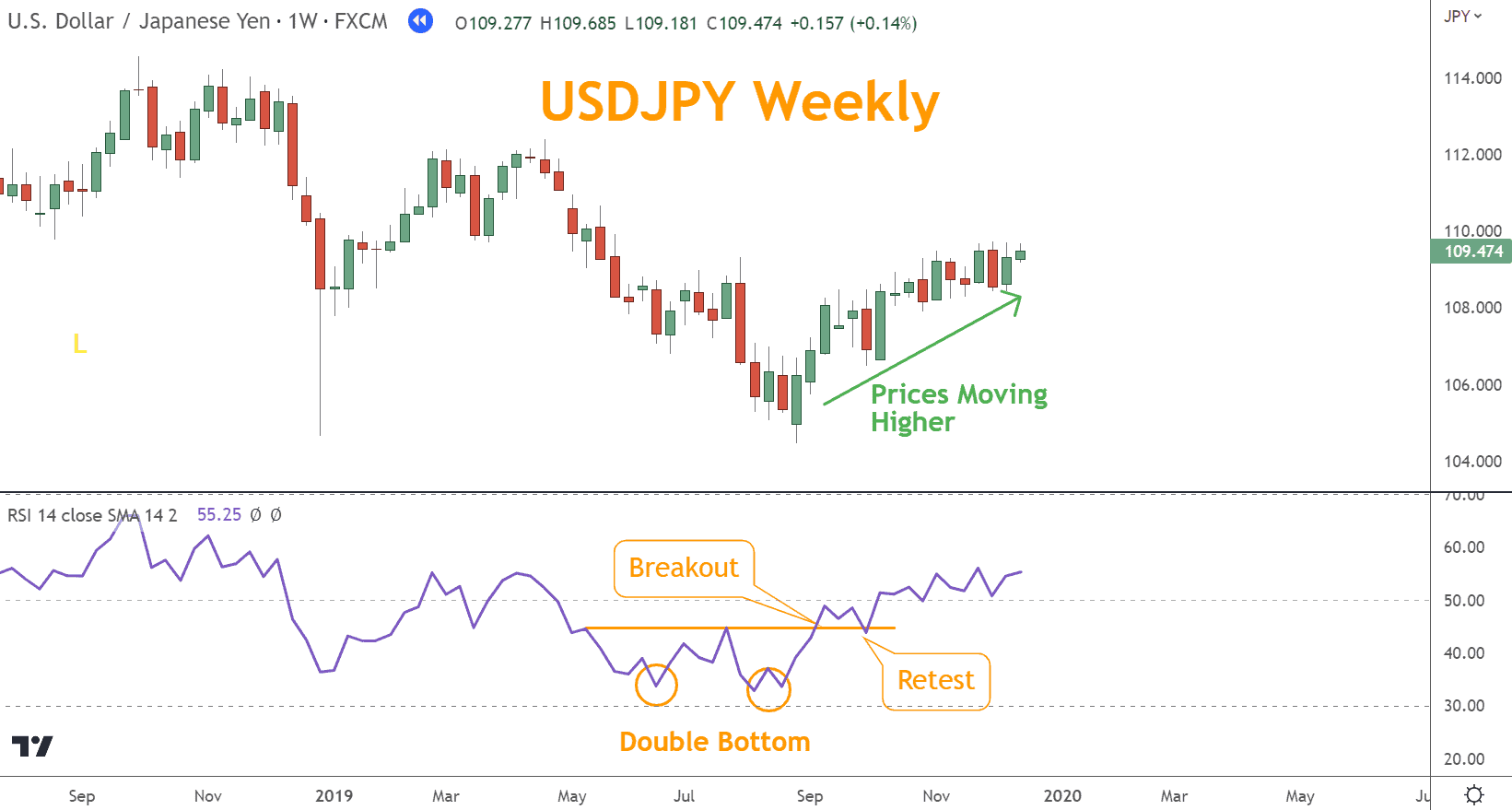

Chart Patterns

Another popular technique amongst traders is finding RSI chart patterns to identify potential trading opportunities that may not be visible on the price chart.

The RSI generates double tops and bottoms, triangles, and wedges that you can use to make more informed trading decisions.

By analyzing these patterns and applying the psychology associated with them, traders can plan trade entries and exits just as they would on an instrument’s price.

Whether using channel lines, divergence, or Chart Patterns, you will find the RSI more effective when combined with other forms of technical analysis.

Trading Strategy and MACD

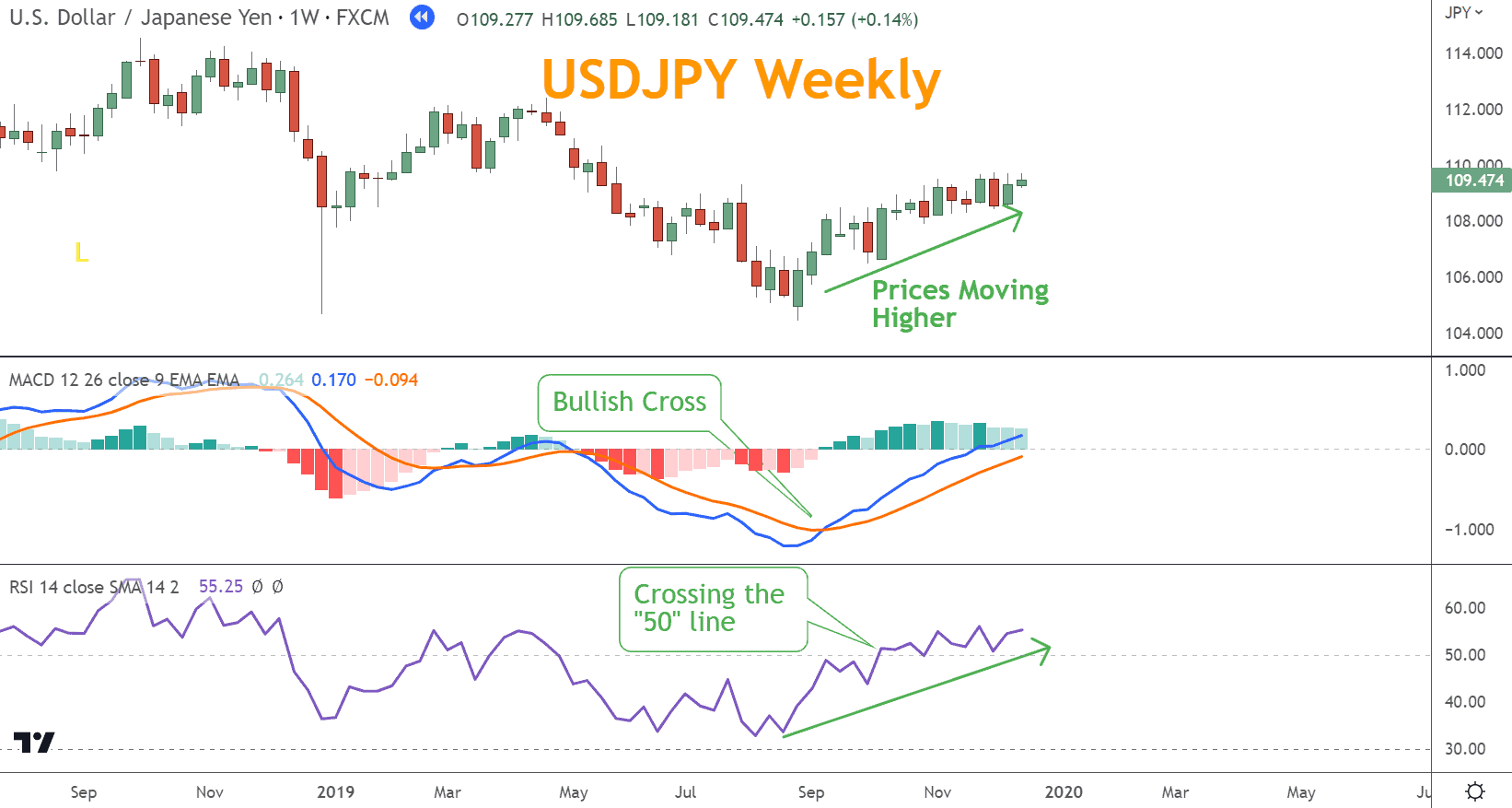

One way to use the RSI in trading strategies is to combine it with the Moving Average Convergence Divergence (MACD) indicator.

The MACD is a trend-following indicator that can help qualify signals from the RSI.

By combining the two indicators, traders can make more informed decisions when entering or exiting trades.

This can help improve overall profitability and reduce potential losses.

You can see in the example below the MACD gives a Bullish Trend signal when its signal line crosses the MACD line. The crossover is beneath the MACD “0” level, making the Bullish signal less certain.

Waiting for the RSI confirmation cross above the “50” line increases the likelihood of success.

Trading Strategy and SMA

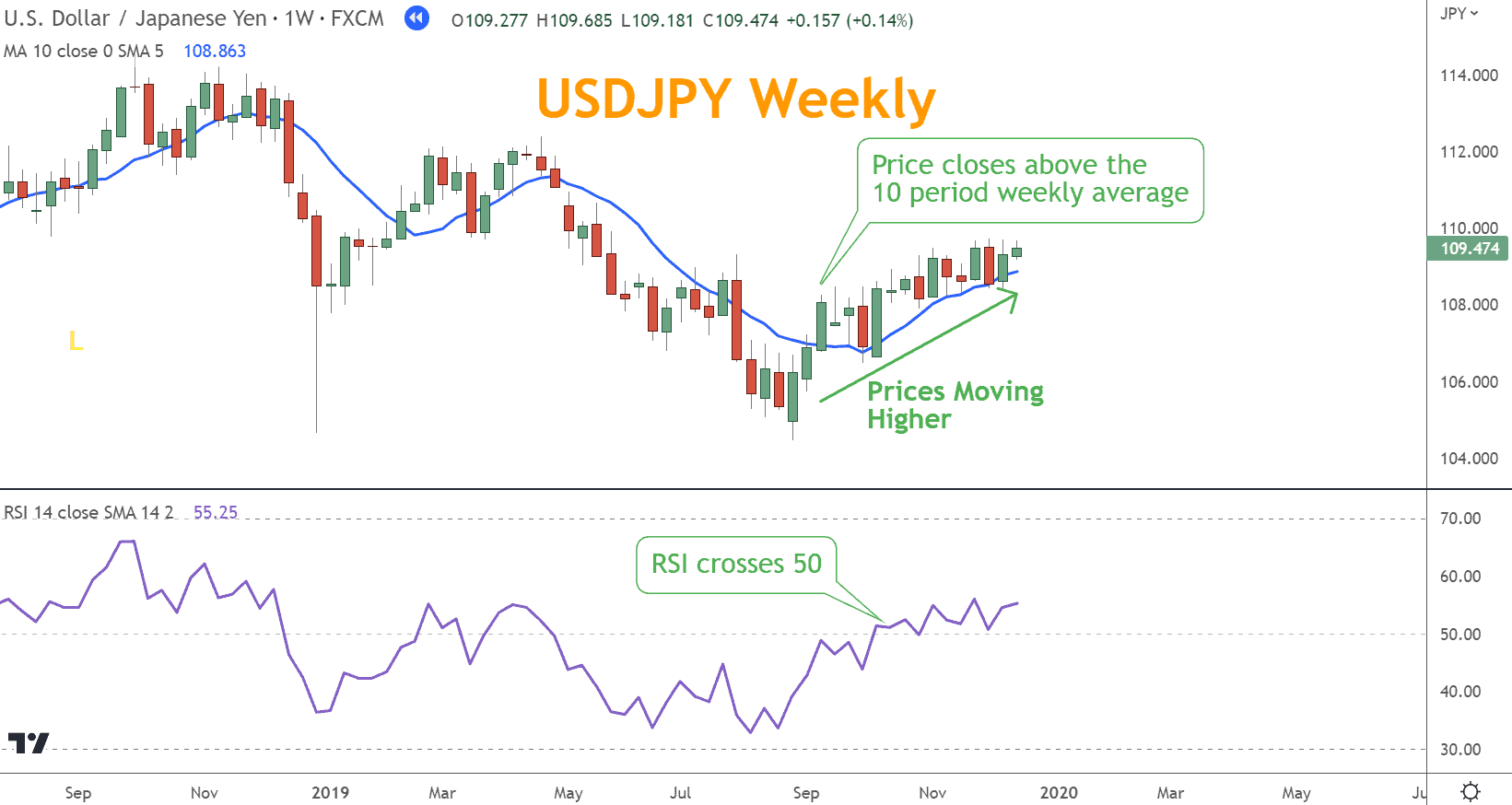

Another way to use the RSI is by combining it with the Simple Moving Average (SMA), another popular trading indicator that helps traders gauge overall price trends.

This combination allows traders to identify when a market is Overbought or Oversold and when it may enter a new Trend.

A 10-period SMA can be used as a filter. The Trend is Bullish when the price is above the SMA and Bearish below the SMA.

Whenever the RSI value crosses the “50” line complementing the Trend analysis, a buy signal or sell signal is given, and a trade can be opened.

A transaction should be closed when there is an Overbought or Oversold reading.

The goal is to find a Trend reversal in an uptrend or downtrend and coordinate that signal with the RSI signal.

Ideally, prices continue to reverse in the opposite direction, and this combination provides many opportunities from recent price changes.

These technical trading systems are employed in day trading, swing trading, and position trading, each in a unique time frame.

What’s Your Next Step?

Select a favorite forex pair, add the RSI indicator to your chart, and identify trading opportunities using one or multiple of the above techniques.

Then, see if you can build a trading system meeting your desired style.

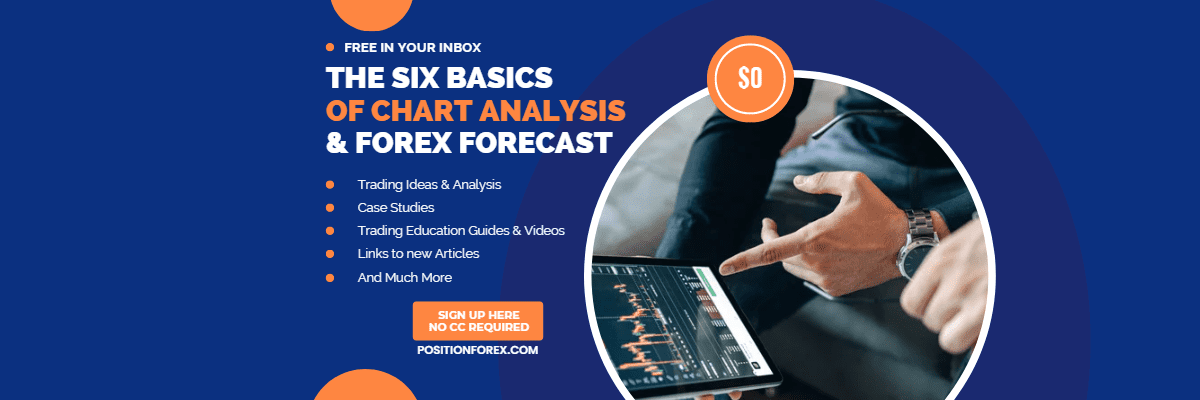

If you need help finding trading opportunities, learn the Six Basics of Chart Analysis, which you can download for free here.

The “Six Basics” will give you a strong foundation in chart analysis which you can incorporate with what you’ve learned here about Trends.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast is delivered weekly to your inbox and provides the following:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and Advance Strategies? I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What is the Best Way to use RSI Indicator?

The best way to use the indicator is to combine it with other tools and techniques in any timeframe.

Since this is only a Momentum indicator combining it with a Trend indicator, Japanese Candlesticks, Chart Patterns, and Support/Resistance is recommended.

What is the Simplest RSI Trading Strategy?

Combining the RSI with a moving average is the most straightforward trading strategy.

The attraction of a simple system is the ease of interpretation on a chart. When a trader can get a binary signal to enter, exit, or avoid a trade, the satisfaction of certainty exists.

The problem is this may lead to trading losses. You should look for a system that is easy enough to execute but powerful enough to help you win.