Retail sales are statistics you should follow in Forex trading to gauge consumer behavior in a given economy.

As a trader, your success often hinges on your ability to analyze and interpret various economic indicators.

I’ve been trading markets since 2007, and retail sales reports often impact a currency’s value.

For beginners, I’ll review the basics of retail sales statistics, including their composition, what they mean for the economy, and how they impact currency values.

For more advanced and experienced traders, we’ll examine the nuances of interpreting this important report and how to use it to trade profitably.

This article will explore how retail sales statistics impact Forex trading and explain how you can leverage this information to make winning trades.

Table of Contents

- What do you Need to Know about Retail Sales in Forex Trading?

- What are Retail Sales Statistics Measuring?

- What Components Comprise Retail Sales Data?

- Why Retail Sales in Forex Trading Matters?

- How You Analyze Retail Sales Data for Forex Trading

- What is the Influence of Retail Sales in Forex Trading?

- Can Retail Sales Alter Interest Rate Expectations?

- What Trading Strategies are Based on Retail Sales in Forex Trading?

- Conclusion

- What’s the Next Step?

- Frequently Asked Questions

What do you Need to Know about Retail Sales in Forex Trading?

Retail sales statistics are a vital component of economic data, offering valuable insights into consumer behavior and the overall health of an economy.

These statistics are significant as weak consumer spending signals a faltering economy and a subsequent decline in currency value.

Here’s a more detailed look at the critical aspects of understanding retail sales statistics.

What are Retail Sales Statistics Measuring?

Consumer Spending: Retail sales statistics measure the total expenditures on goods and services made by individuals or households within a specific time frame, typically monthly or quarterly.

- These expenditures encompass various consumer goods, including clothing, electronics, groceries, dining out, and entertainment services.

Sales Channels: These statistics encompass sales from various retail channels, such as brick-and-mortar stores, e-commerce, and direct sales.

- This comprehensive view provides a holistic understanding of consumer spending patterns.

What Components Comprise Retail Sales Data?

Two readings are provided in every report:

Retail Sales: A comprehensive view of all sales category activity.

Core Retail Sales: Excludes volatile categories like automobiles and gasoline, offering a more stable indicator of consumer spending trends.

- Pay close attention to core retail sales as they can provide a clearer picture of underlying economic conditions.

Seasonal Adjustments: Retail sales data is often seasonally adjusted to account for predictable variations in consumer spending throughout the year, such as holiday shopping surges.

- This adjustment allows for a more accurate comparison of data between different months.

Year-on-Year Comparison: Compare current retail sales figures to the same period in the previous year to identify long-term trends and assess the health of the retail sector.

The specific components can be broken up into two groups: durable and non-durable goods.

Durable goods comprise 35% of the total, and non-durable goods contain 65%.

The components further break down as follows:

- Motor vehicles (20-22%)

- Food and beverages (10-15%)

- General merchandise (10-13%)

- Food and drinking services (11-12%)

- E-commerce (9-11%)

- Gas stations (8-10%)

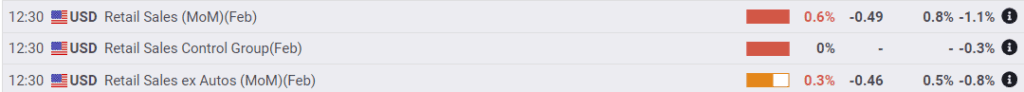

Looking at an economic calendar such as this example from fxstreet.com, retail sales look like this:

The first line demonstrates the month-over-month performance.

From left to right, the first number is the result, the second is the deviation, the third is the consensus prediction, and the fourth is the prior result.

The “control group” is a subset of items in the retail sales numbers that exclude various items and adjust for seasonality. This number is considered more accurate.

Lastly, a larger “control group” includes all sales except those related to the automobile industry.

Retail sales statistics are released monthly.

Why Retail Sales in Forex Trading Matters?

Economic news will impact the way you think about a nation’s economy, and that will reflect on the currency.

The three primary elements to pay attention to are:

Consumer Spending and Economic Health: Retail sales statistics offer a direct window into consumer spending habits, which are a crucial driver of economic growth.

- In Forex trading, a nation’s economic health is a primary consideration, and consumer spending accounts for a significant portion of economic activity.

Influence on Interest Rates: Central banks closely monitor retail sales data when determining their monetary policy, particularly interest rates.

- Strong retail sales figures prompt central banks to consider raising interest rates to prevent inflation, attracting foreign capital, and strengthening the domestic currency.

Market Sentiment: Retail sales data releases can immediately impact market sentiment.

- Positive data can boost confidence, while negative data can create uncertainty, leading to rapid fluctuations in currency exchange rates.

When people spend more money, businesses become more active, which helps the economy grow and attracts investment from other countries.

This spending strengthens the domestic currency since demand for goods requires a nation’s currency and thus increases demand for that currency.

In addition, economic growth attracts investment by foreign and domestic investors, increasing demand for the currency.

If the U.S. posts strong retail sales statistics, generally, the value of the U.S. dollar will increase.

As a trader, if you anticipate strong retail sales in one nation but not in another, find Forex pairs that will illustrate that differential through their performance and buy the stronger currency.

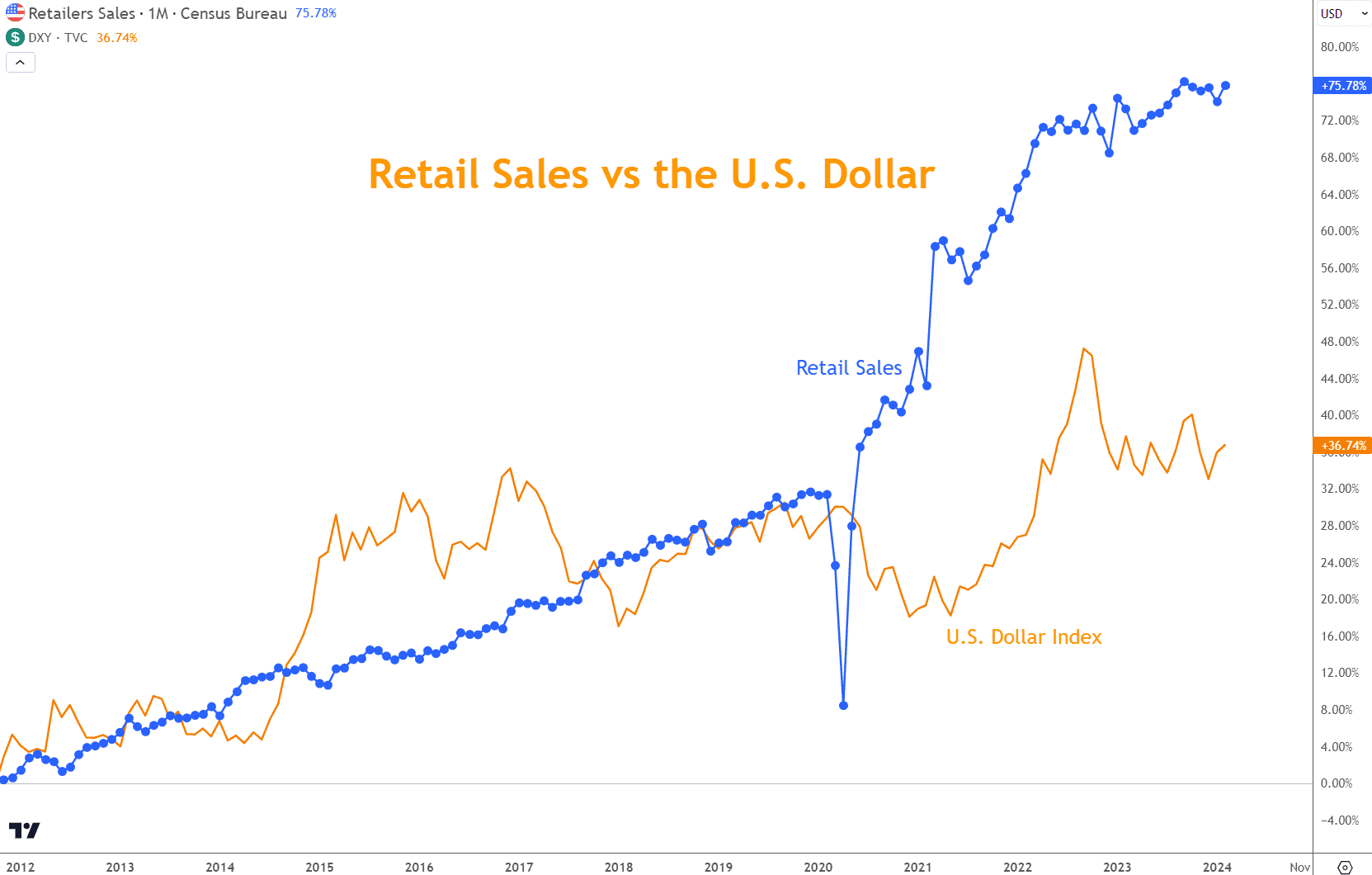

A simple example is a long-term chart comparing U.S. retail sales and the U.S. Dollar Index (DXY).

While many other factors are involved, the chart illustrates that retail sales and the value of the U.S. Dollar have risen over the last twelve years.

Sales have gained roughly twice as fast as the currency; however, this chart doesn’t account for inflation and other factors.

How You Analyze Retail Sales Data for Forex Trading

Economic Calendars: Use economic calendars to keep track of the release dates and times of retail sales data.

Calendars allow you to prepare for potential market movements and volatility associated with the data release.

Expectations vs. actual data: Compare retail sales figures to market expectations. A significant deviation from expectations can trigger market reactions.

- If actual figures exceed expectations, it can lead to a positive response in the currency market and vice versa.

Long-term trends: Consider the longer-term trends in retail sales data. Consistent growth or decline over multiple periods can indicate sustained economic trends, influencing trading decisions.

Correlation with other indicators: To gain a more comprehensive understanding of the economic landscape, analyze how retail sales data correlates with other indicators, such as GDP growth, unemployment rates, and consumer sentiment.

Understanding retail sales statistics is fundamental since they provide valuable insights into consumer behavior and a country’s overall economic health.

By carefully analyzing these statistics, you can make informed decisions, predict potential market movements, and assess the broader economic context, ultimately improving your chances of success.

What is the Influence of Retail Sales in Forex Trading?

When retail sales are strong and on an upward trajectory, it signifies that consumers are confident and are spending more on goods and services.

This consumer confidence is a positive signal for the country’s economy.

A robust retail sales report indicates the nation’s economic outlook is favorable.

As a result, there is increased demand for the country’s currency as foreign investors seek to capitalize on the economy’s perceived strength.

This heightened demand can increase the currency’s exchange rate, making it more valuable than other currencies.

Conversely, if retail sales decline or remain stagnant, it may indicate economic uncertainty or a decline in consumer spending. Such circumstances can lead to a weaker currency in the Forex market.

You may interpret this as a signal that the country’s economy is facing challenges, leading to reduced demand for its currency and a decrease in its value against other currencies.

Therefore, understanding the nuances of retail sales in Forex trading is crucial for traders aiming to anticipate shifts in currency values based on changes in consumer spending patterns.

Looking for a Strategy?

Download the Six Basics of Chart Analysis and sign up for Forex Forecast to learn a bottom-up approach to analyzing Forex markets and weekly market updates.

Can Retail Sales Alter Interest Rate Expectations?

Retail sales figures can significantly influence a central bank’s decision regarding interest rates, which profoundly impacts Forex trading.

When retail sales are robust, central banks may consider raising interest rates as a precautionary measure to curb inflation.

Higher interest rates make the country’s financial assets more appealing to foreign investors due to the promise of greater returns.

This shift in interest rates can attract foreign capital inflows and contribute to the appreciation of the country’s currency in the Forex market.

You will want to monitor central bank decisions closely. They can quickly adjust their policy based on interest rate changes triggered by retail sales data.

Conversely, weak retail sales may prompt central banks to lower interest rates to stimulate economic activity and encourage borrowing and spending.

Lower interest rates can deter foreign investment, potentially depreciating the country’s currency.

Keep a vigilant eye on central bank actions related to interest rates, as they are often tied to retail sales data and can have significant repercussions on currency values.

What Trading Strategies are Based on Retail Sales in Forex Trading?

Fundamental analysis is a cornerstone of Forex trading that involves examining economic indicators like retail sales statistics to make informed decisions. When incorporating retail sales data into their strategies, traders follow these steps.

- Economic Calendar Monitoring: Closely monitor economic calendars, which provide information about when retail sales data will be released.

- By staying informed about release dates, you can plan your activities accordingly.

- Expectations vs. Actual Data: Compare retail sales figures with market expectations.

- If the actual figures exceed expectations, it may create a Bullish sentiment, leading to an initial uptick in the currency’s value.

- Conversely, if the figures fall short of expectations, a Bearish sentiment may emerge, causing a temporary decline in the currency’s value.

- Long-Term Trend Analysis: Consider the longer-term trend in retail sales data.

- Consistent growth or decline in retail sales over several periods can indicate a sustained economic trend, influencing their trading decisions.

- Correlation with Other Indicators: Assess how retail sales data correlates with other economic indicators, such as unemployment rates, GDP growth, and consumer sentiment.

- This comprehensive analysis helps you better understand the broader economic context.

- Risk Assessment: Assess the potential risks before trading based on retail sales data.

- Consider factors like market volatility, political events, and geopolitical tensions, as these can impact currency markets and offset the immediate impact of economic data.

Conclusion

The relationship between Forex trading and retail sales statistics is intricate, with each influencing the other.

Retail sales statistics are a vital component of Forex trading analysis. They provide insights into a country’s economic health, interest rate expectations, and market sentiment, which can have ripple effects on retail sales.

If you understand the impact retail sales data can make, you will make more informed decisions, ultimately improving your chances of success.

What’s the Next Step?

Select a chart, coincide the price action with retail sales statistics announcements, and see the impact.

In addition, look for opportunities to incorporate multiple indicators in your analysis with the retail sales data.

Once you’re ready to trade, choose a strategy and process you believe will work for you.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about retail sales in Forex trading.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will use the Six Basics of Chart Analysis and Advanced Strategies to show you the trade opportunities I’m watching.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce videos and guides to help you learn and improve trading practices.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What are Retail Sales Statistics, and why do they Matter in Forex Trading?

Retail sales statistics measure consumers’ total expenditures on goods and services within a specific time frame.

They matter in Forex trading because they provide insights into a country’s economic health and consumer confidence, influencing currency values and trading decisions.

How Often are Retail Sales Statistics Released, and Where can I Find Them?

Retail sales statistics are typically released monthly or quarterly, depending on the country.

You can find them on financial news websites, economic calendars, or government websites dedicated to economic data releases.

How can I use Retail Sales Data to Inform my Forex Trading Strategy?

To use retail sales data effectively, monitor economic calendars, compare actual data with market expectations, and analyze longer-term trends.

Consider how retail sales data aligns with other economic indicators like GDP growth and unemployment rates to make informed trading decisions.

Can Retail Sales Data Impact Currency Exchange Rates Immediately After Release?

Yes, retail sales data can immediately impact currency exchange rates.

Positive data can boost market sentiment and lead to currency appreciation, while negative data can cause uncertainty and currency depreciation, often resulting in rapid market movements.