Pullback trading, a sophisticated yet accessible technique, involves pinpointing temporary reversals within broader trends, offering opportunities to enter positions at optimal prices.

In this comprehensive guide, we’ll delve deeper into the intricacies of pullback trading strategies, providing insightful analysis and practical tips to help find winning trades.

What is Pullback Trading?

Pullbacks are a crucial aspect of Forex trading, similar to ocean tides.

They represent brief retracements within the broader market trends, like a wave that temporarily recedes before gaining momentum again.

These retracements serve as crucial checkpoints, allowing markets to digest recent price movements and recalibrate before resuming their established trajectory.

Various factors drive pullbacks, including institutional investors taking profits, geopolitical events, and economic data releases that cause shifts in market sentiment.

Pullbacks reflect the market’s inherent tendency toward equilibrium as buyers and sellers pursue the balance of supply and demand.

Traders are adept at deciphering the subtleties of pullbacks and recognize them as windows of opportunity rather than causes for concern.

By understanding the underlying mechanisms driving pullbacks and discerning their significance within the broader context of market trends, you can position yourself strategically to capitalize on these transient fluctuations.

Key to this understanding is the recognition that pullbacks are not signs of impending doom but rather natural manifestations of market dynamics.

Embracing this perspective allows you to approach pullback trading confidently and clearly, viewing them as potential entry points rather than obstacles to be feared.

Spotting Opportunities with Precision

Mastering the art of spotting pullback opportunities requires a keen eye for detail and a deep understanding of market dynamics.

You can employ various technical analysis tools and methodologies to identify potential pullback zones within more significant trends.

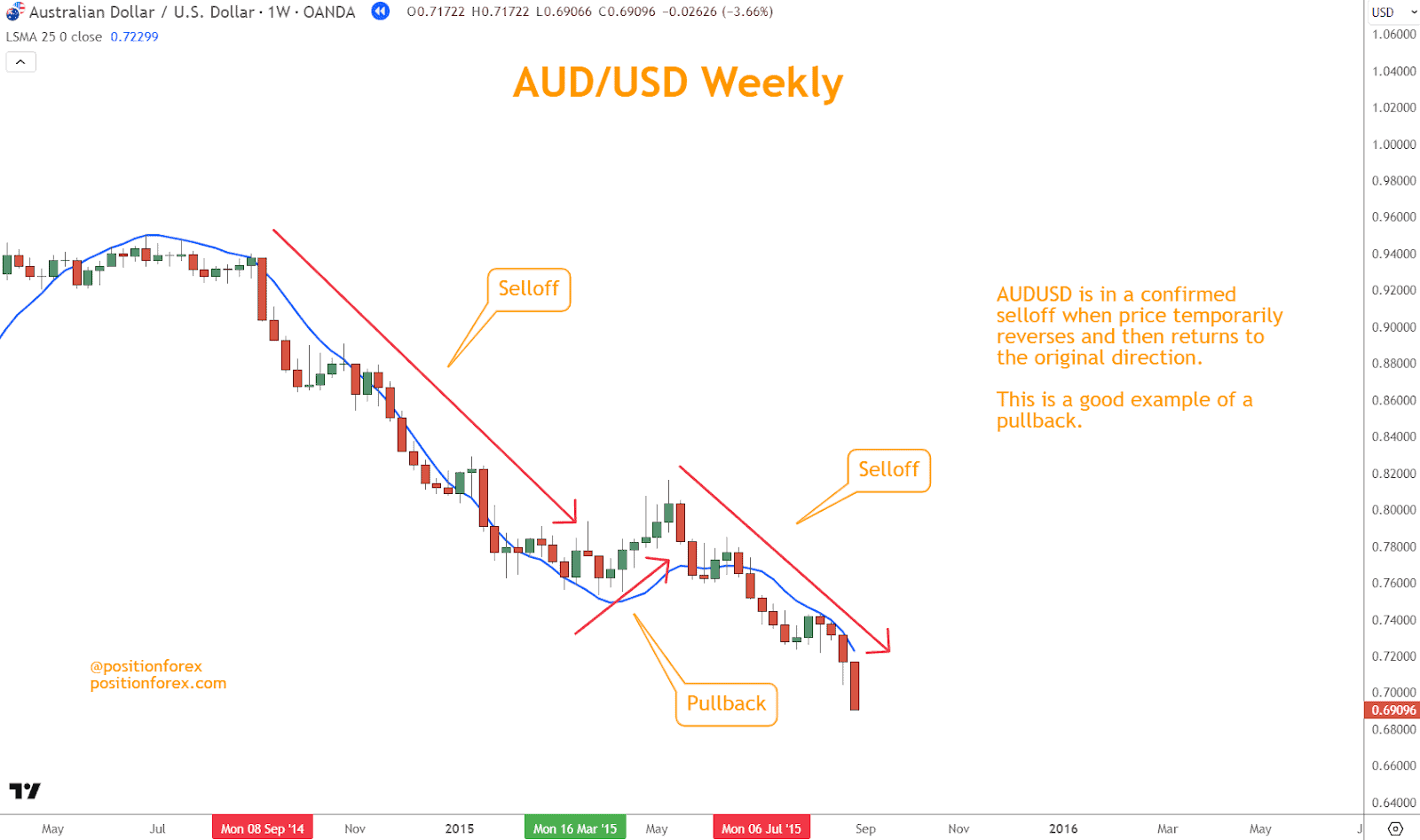

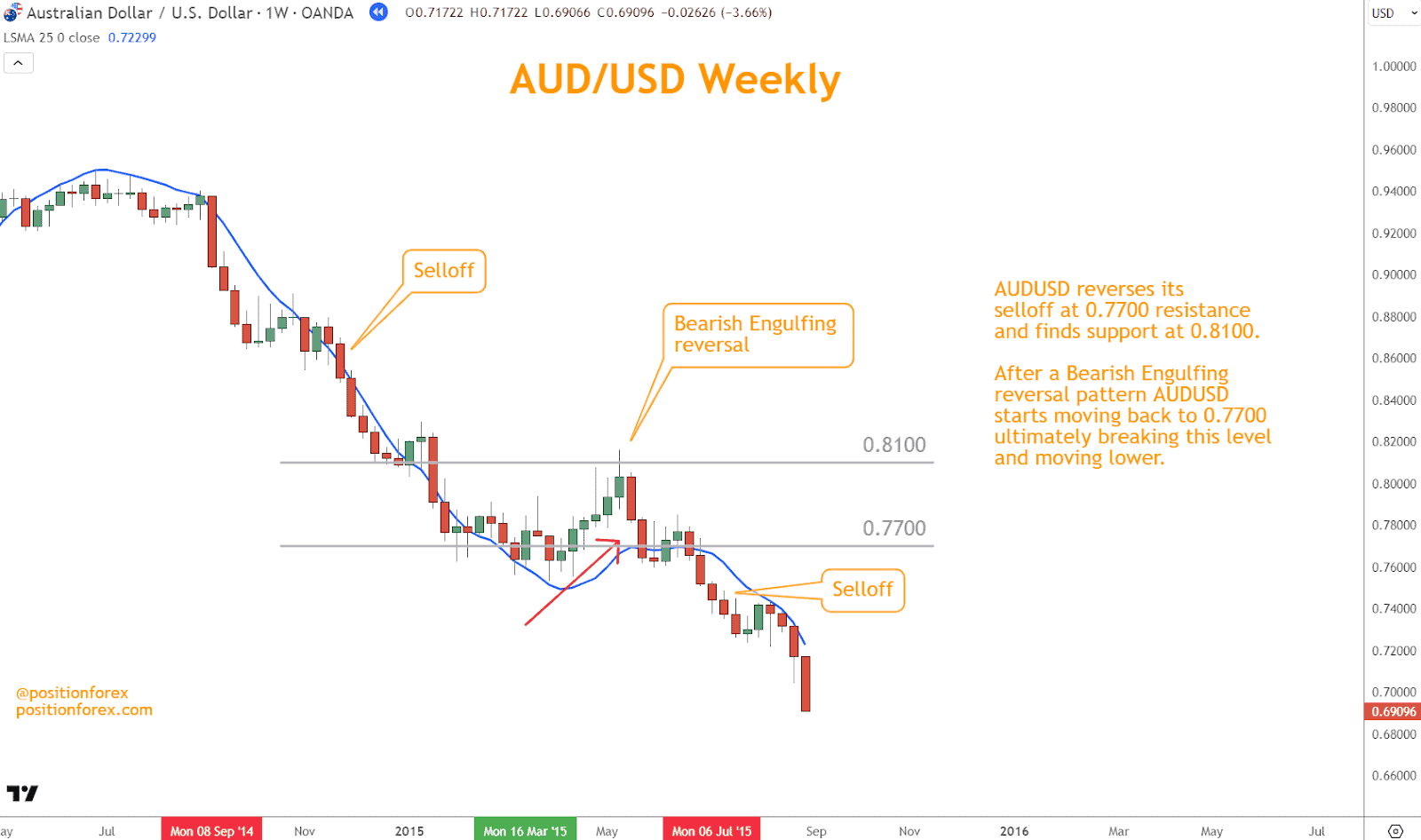

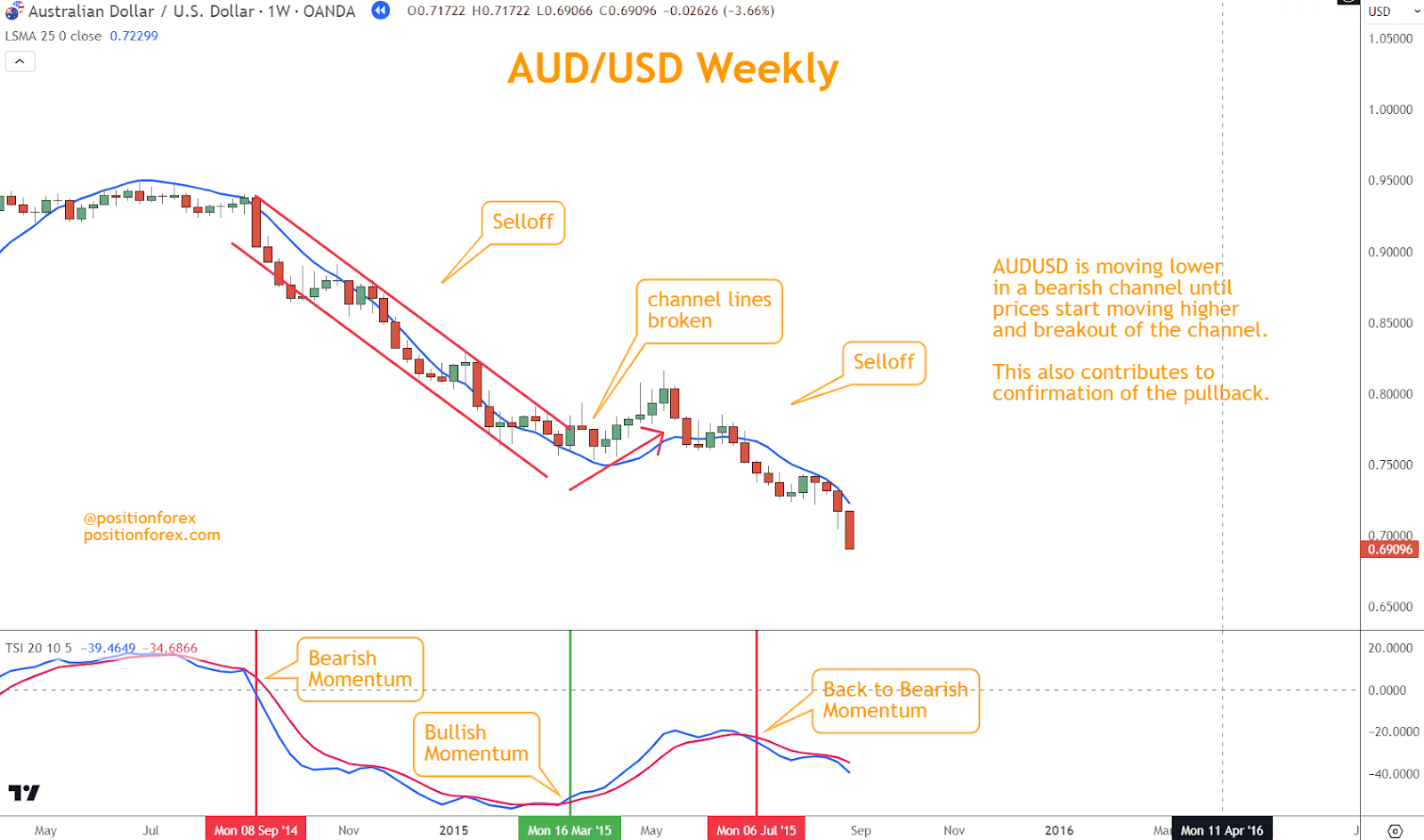

One practical approach is to utilize channel lines, also known as trendlines, which serve as visual guides highlighting the prevailing direction of price movement.

When a currency pair is in a rally, connecting successive swing lows with an upward-sloping channel line can help identify potential support levels where pullbacks may occur.

Conversely, connecting swing highs with a downward-sloping channel line in a downtrend can pinpoint resistance levels where pullbacks might occur.

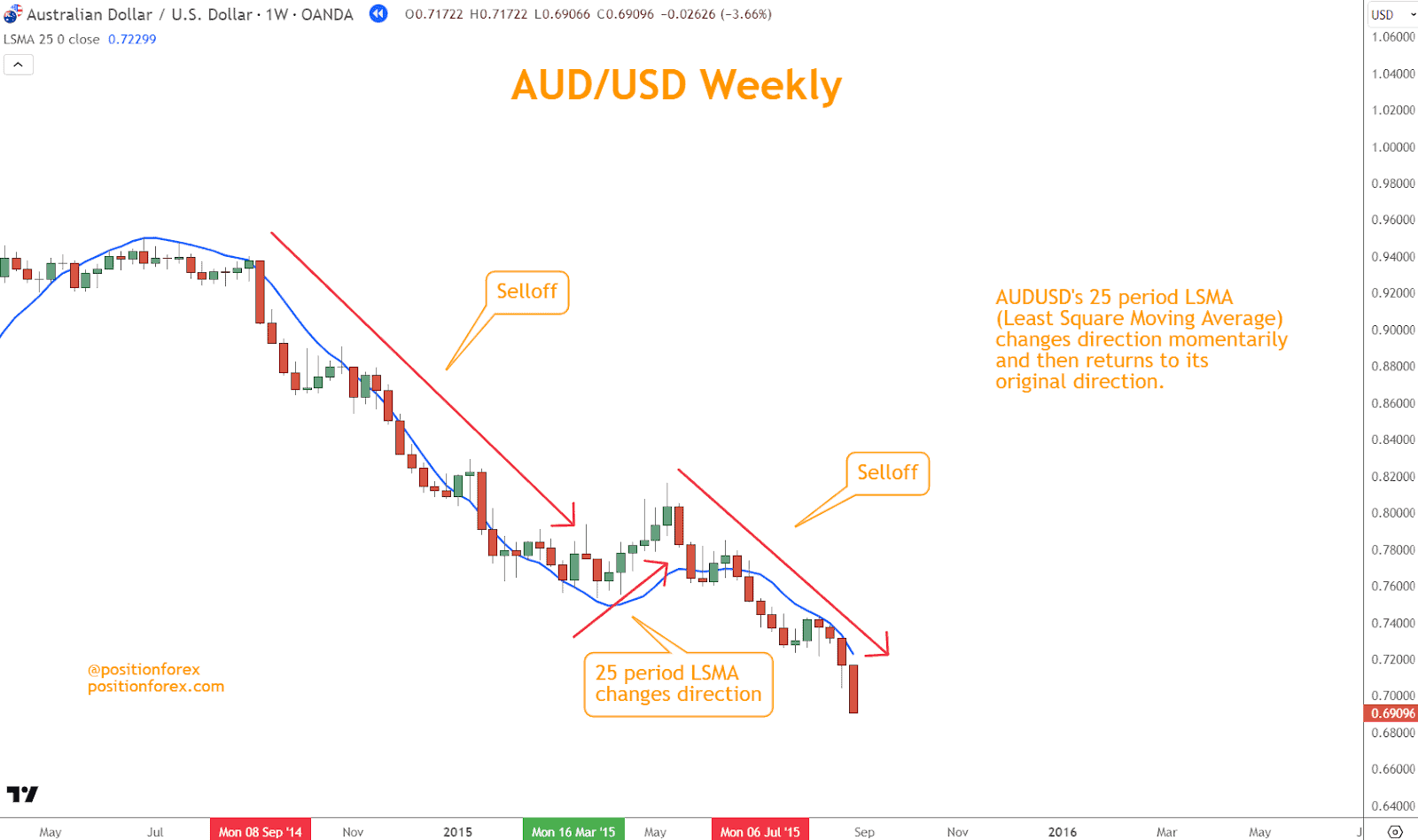

Moving averages also play a crucial role in spotting pullback opportunities.

Traders often use exponential moving averages (EMAs) or simple moving averages (SMAs) to gauge the underlying trend’s strength and direction.

I recommend using the LSMA with a 25-period average.

Furthermore, oscillators such as the Relative Strength Index (RSI) or the True Strength Indicator (TSI) can help you identify overbought or oversold conditions within a direction, signaling when a pullback may be imminent.

Combining multiple technical indicators and observing price action around crucial support and resistance levels can enhance the precision of identifying pullback opportunities.

By patiently waiting for the price to retrace to these levels and confirming the setup with additional technical signals, traders can increase the probability of successful pullback trades.

In essence, spotting pullback opportunities with precision involves a comprehensive analysis of price action, trend dynamics, and key technical indicators.

How to Validate Signals

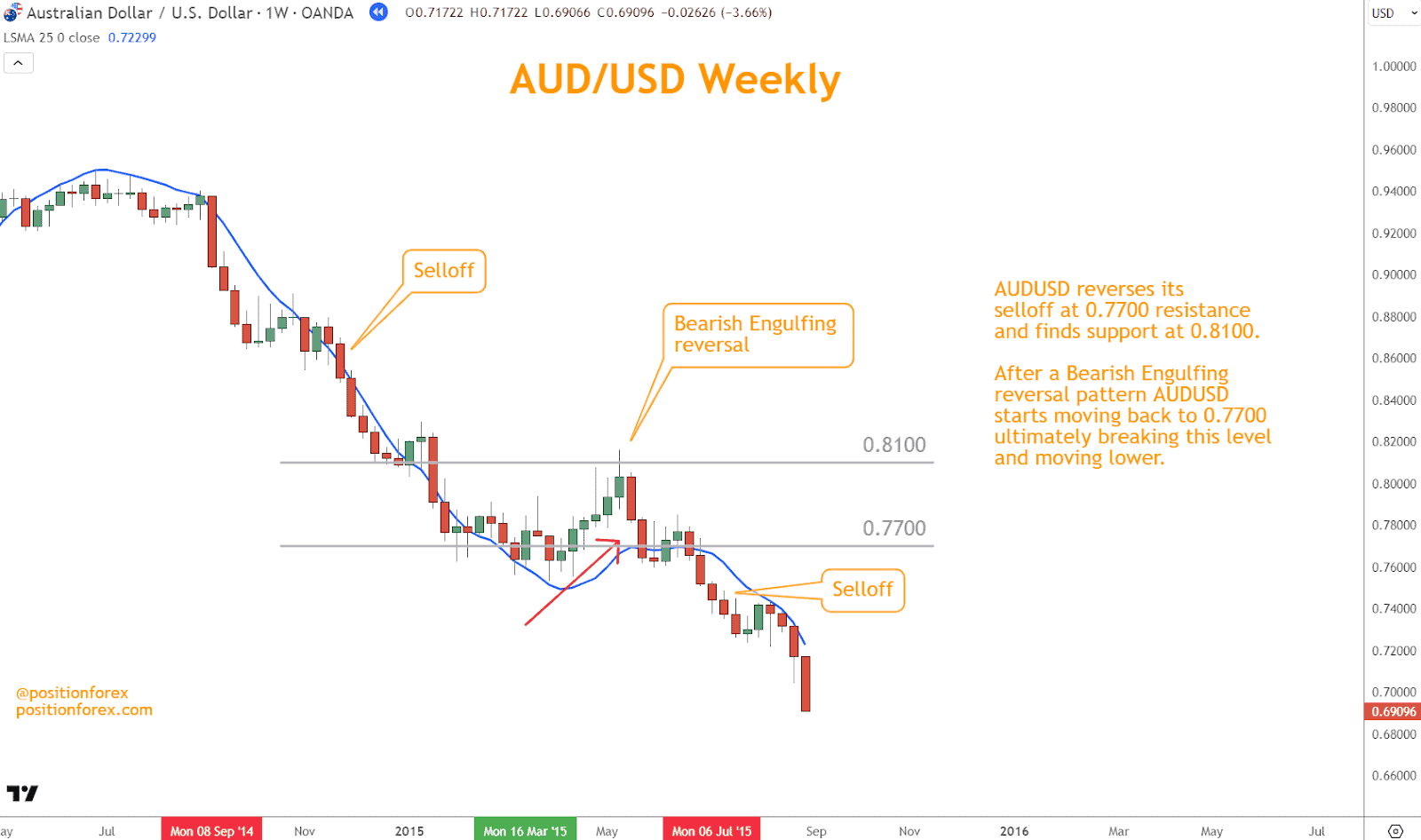

Once you have identified a potential pullback opportunity, validating the signal before entering a trade is essential.

Validation involves confirming that the pullback is a temporary reversal within the more significant direction rather than the beginning of a reversal.

One standard method of validating pullback signals is using candlestick patterns.

Patterns, such as bullish engulfing or hammer formations during a rally or bearish engulfing or shooting star patterns during a downtrend, can confirm the pullback setup.

These patterns indicate shifts in market sentiment and can help you anticipate the resumption of the prevailing direction.

Another validation technique involves monitoring channel lines.

Before a pullback, a break above or below a channel line can confirm that the market continues in the original direction.

For instance, a break above a downward-sloping channel line before a pullback in a selloff suggests that bullish momentum is coming.

By validating pullback signals using multiple technical indicators and confirmation techniques, you can reduce the likelihood of false signals and increase the probability of successful trades.

This disciplined approach ensures that trades are executed confidently and align with the overall market trend, maximizing the potential for profit in Forex trading.

Why Prioritizing Risk Management is Crucial

Successful trading relies heavily on effective risk management, particularly in pullback strategies where market volatility can significantly impact.

You must implement robust risk management techniques to safeguard your capital and mitigate potential losses.

One crucial aspect of risk management is setting appropriate stop-losses.

You should place stop-losses at strategic levels beyond which you consider a trade invalidated.

These orders define the maximum amount you will lose on that trade.

You can limit your downside risk by setting stop-losses based on crucial support and resistance levels or technical indicators while allowing for potential upside gains.

Another critical risk management technique is position sizing.

You should carefully determine the size of each position based on your account size, risk tolerance, and the specific characteristics of the trade.

Using a fixed percentage of account equity or the currency pair’s volatility can help ensure that each trade carries a proportional risk relative to your account balance.

Additionally, traders should diversify their trading activities across multiple currency pairs and asset classes to spread risk and reduce exposure to any market.

Diversification helps mitigate the impact of adverse events in one currency pair while potentially capitalizing on opportunities in others.

Moreover, maintaining a disciplined approach to trading is essential for effective risk management.

What Role Do Patience and Discipline Play?

Patience and discipline are invaluable virtues that distinguish between success and failure.

Pullback trading, in particular, demands a high degree of patience and discipline due to its reliance on waiting for opportune moments amidst market fluctuations.

Patience is essential since you must wait for the market to present favorable setups.

Wait for pullbacks to materialize within the current direction, allowing price action to confirm your analysis before committing to a trade.

Discipline is equally crucial.

It entails adhering to predefined trading plans and strategies without succumbing to emotional impulses or reactionary behaviors.

Follow risk management rules meticulously, setting stop-losses and adhering to position sizing guidelines to protect their capital.

You must also maintain consistency in your approach, executing trades based on objective criteria rather than subjective emotions.

Moreover, discipline extends to managing winning and losing trades.

Successful traders remain disciplined despite adversity, accepting losses gracefully and refraining from impulsive actions that could exacerbate their losses.

Exercising patience and discipline requires a strong mindset and a commitment to self-mastery.

How Continuous Learning and Adaptation Contribute to Successful Trading

In Forex trading, success hinges on embracing continuous learning and adaptation.

The Forex market is influenced by many factors ranging from economic indicators and geopolitical events to technological advancements and shifts in market sentiment.

Learning involves staying abreast of market news and updates, studying technical analysis techniques, and leveraging educational resources such as books, courses, and seminars.

Committing to lifelong learning can enhance your analytical abilities, refine your strategies, and remain agile in changing market conditions.

Adaptation is equally critical in Forex trading, as strategies that were effective in the past may yield different results in the future.

You must be willing to adapt their approach based on shifting market dynamics, emerging trends, and evolving trading environments.

Adapting your approach may involve modifying trading strategies, adjusting risk management techniques, or incorporating new technologies and tools to gain a competitive edge.

Moreover, learning from successes and failures is essential for growth and improvement as a trader.

Conclusion

Pullback trading represents a nuanced yet potent approach to navigating the ever-changing landscape of the Forex market.

By mastering the art of identifying pullback opportunities, validating trades with confirmation signals, and prioritizing rigorous risk management, traders can unlock the full potential of this powerful strategy.

With patience, discipline, and a commitment to continuous learning, traders can embark on a journey toward sustainable profitability in the dynamic world of Forex trading.

Remember, success stems from a harmonious blend of skill, strategy, and unwavering dedication.

What’s the Next Step?

Use what you’ve learned about pullback trading and look at your favorite charts.

Look for opportunities to incorporate what you’ve learned here in your trading.

Once you’re ready to trade, choose a strategy and process you believe will work for you.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about pullback trading in Forex.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What is Pullback Trading, and How Does it Work in Forex?

Pullback trading involves identifying temporary reversals within more significant market trends to enter positions at favorable prices.

It works by waiting for price retracements against the prevailing direction before resuming its original direction.

How can I Identify Opportunities Within Larger Trends?

You can identify pullback opportunities using technical analysis tools such as channel lines, moving averages, and oscillators.

What are Some Effective Confirmation Signals?

Effective confirmation signals include candlestick patterns, channel line breaks, and oscillator divergences.

These signals validate the pullback setup and increase the probability of a successful trade.

What Risk Management Strategies Should I Employ?

Employ robust risk management strategies such as setting stop-losses, proper position sizing, and diversification.

These techniques help protect capital and mitigate potential losses during pullback trading.

How Important is Patience and Discipline?

Patience and discipline are crucial in pullback trading.

They involve waiting for suitable setups, adhering to predefined trading plans, and avoiding emotional decision-making.

Exercising patience and discipline can increase their chances of success in the Forex market.