Position sizing determines the size of each position a trader should take on an individual trade and the equity available in their broker account.

Position sizing limits your loss if the market moves against you.

Position sizing also helps maximize your profits when trading goes in your favor. This article will discuss position sizing and how you can use it to improve your trading.

What is Position Sizing for Forex?

Position sizing determines the number of contracts you can open, long or short, for a particular opportunity, the risk per trade, and overall portfolio risk.

Position sizing helps you keep risk aligned with your trading plan.

Why is Position Sizing Important?

Position Sizing helps you determine the optimal size of your trades for your trading strategy and allows you to take calculated risks without worrying about over-leveraging your account.

Overleveraging your account could lead to a margin call where your broker closes your trades automatically.

Trading without position sizing and a trading plan will likely result in you “blowing up” your account and losing all your equity.

Unfortunately, destroying your account happens to many beginners surprised by the number of pips, position size, and pip value changes in their early trades.

Foreign exchange and forex position sizing are unique in money management.

As a result, trading forex includes a high level of risk, especially for new forex traders.

How do you Calculate Position Size?

To calculate position sizing for forex, you should consider the following:

- the risk percentage for any trade, such as 1% or 2%

- this is the amount you are willing to lose on a single transaction

- the free equity remaining in your account

- the stop-loss you wish to set

- the target you choose to ensure an attractive risk-reward ratio

- the leverage you plan to use, such as 10:1

- the currency pair you’ve selected

A Forex position size and pip value calculator is an easy-to-use tool that can help you accurately determine the size of Forex positions and the risk to your brokerage account

Using a calculator, you can avoid making costly mistakes in forex trading.

A calculator can be used to determine the position size based on the given inputs, but it’s also essential to understand how the calculator derives its answers.

How to Find the Percentage Risk in Your Trade

When position sizing, the first thing to consider is your percentage risk or tolerance.

The percentage risk is the amount of your trading account you’re willing to lose on a single transaction.

For example, if you’re ready to risk 2% of your $10,000 account, you can risk up to $200.

This percentage defines your sizing and the maximum amount of your transaction.

How Much Free Equity do you Have?

Another important consideration is how much free equity remains available after making a loss or reaching breakeven on a previous Forex trade.

This will help you avoid being underfunded and ensure you have enough room to make transactions without putting your account at risk.

Why limit your risk to 1% or 2%? Getting your balance back to where you started can be challenging if you suffer consecutive losses.

Returning to break even will be challenging if you take excessive risk and suffer consecutive losses.

What is the Stop Loss for this Trade? – What are Your Losses?

A stop loss is a price level you use to close out a Forex trade to limit losses.

For example, if you buy the EUR/USD pair at 1.2000 and place a stop loss at 1.1900, you close your transaction if the market moves against you and the currency pair closes at 1.1900.

What is the Profit Target for this Trade – What are Your Profits?

The target is the price level to close out a Forex trade to take profits.

For example, if you buy the EUR/USD pair at 1.2000 and place a target at 1.2050, you close your transaction when the market moves in your favor and the currency pair reaches 1.2050.

Knowing the target isn’t essential in calculating position sizing; however, you should track the value as the risk-reward part of your trading plan.

How to Calculate the Leverage for this Trade

Leverage is the amount of money available for trading compared to the amount in your account.

For example, if you’re trading with 10:1 leverage and have $10,000 available, you can effectively trade up to $100,000 worth of currency.

Leverage magnifies profits and losses; therefore, it’s essential to use it carefully and only risk a small percentage per trade, such as 1% or 2%.

In many articles, I use 10:1 as an example of maximum leverage.

Understanding why excessive leverage will destroy your trading quickly is well illustrated in this investopedia.com article: How Much Leverage Is Right for You in Forex Trades.

You can read and understand why 10:1 is the maximum leverage anyone should be trading with, regardless of their trading style.

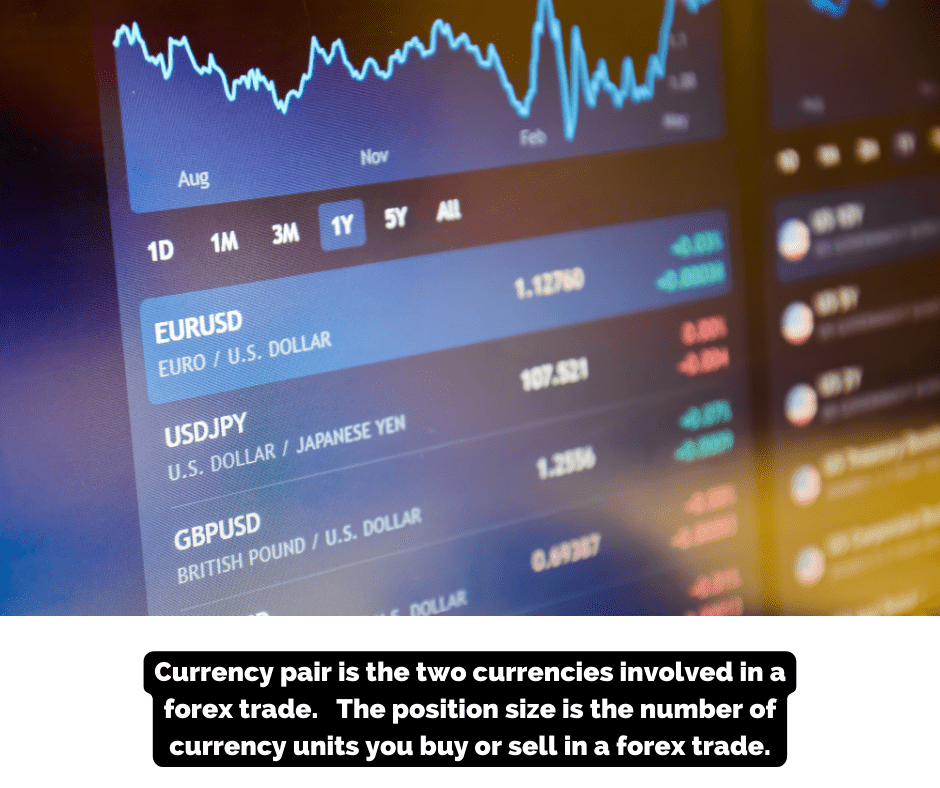

What is the Currency Pair for this Trade?

A currency pair is the two currencies involved in a forex trade. So, for example, if you’re buying the EUR/USD pair, you’re buying Euros and selling U.S. Dollars.

The position size is the number of currency units you buy or sell in a forex trade.

For example, if you’re buying the EUR/USD pair and your currency is U.S. dollars, then one mini lot equals 10,000 Euros (EUR).

An Introduction to Lot Sizes, Pip Values, and Margin

To calculate how much is at risk, you must know what lot size you are using, the value of each pip you’re trading, and how much margin the broker will place in reserve.

Together these will give you everything you need to know about your position size and its impact on your account.

What is Lot Size?

A lot size is the number of currency units that are traded. Lots help standardize pricing and quoting conventions in the market so that all participants know what they’re talking about.

The three most common lot sizes are:

- Standard lot – 100,000 units of currency (10 pip value per standard pip)

- Mini lot – 10,000 units of currency (1 pip value per mini pip)

- Micro lot – 1,000 units of currency (0.1 pip value per micro pip)

Each lot represents a contract. If you are trading four micro lots, that can be described as four contracts.

What’s a Pips’ Value?

Pips are the currency pair’s fourth decimal point in all major pairs except those where the quote currency is the Japanese Yen. With the Yen, it’s the second decimal point.

For example, EUR/USD can be 1.2544, whereas EUR/JPY could be 101.88.

The per pip value varies depending on lot size and currency pair.

Forex brokers today also print a fifth digit called a pipette, used only by scalpers trading for extremely short periods. The pipette doesn’t apply to this discussion of position trading.

Most forex brokers, by default, will only offer micro lots since it provides you the most flexibility and granularity.

Check with your broker by looking at their trading platform. If it isn’t apparent to you, contact them and ask.

What’s Margin?

For every lot you exchange, your Forex broker will reserve an amount of margin from you to protect themselves from your possible losses.

This is the equity that will be unable to you.

For example, if you begin with $10,000 and the trade you want to make requires $100 of margin per micro lot and you wish to use four lots, your broker will reserve $400 of margin.

There is a direct correlation between your chosen leverage and the margin held by your broker.

What if your Account Currency and Quote Currency are the Same or Different?

Each Forex pair has a base currency and a quote currency.

Your account also has a currency. For example, your currency will most likely be U.S. Dollars if you are in the United States.

Therefore, the pip value is straightforward to calculate where the account and quote currencies are the same.

When the two currencies are different, the calculation is more complex.

You should always use a position sizing calculator to be safe, but here is an explanation of the difference between the two.

The Account Currency and the Quote Currency are the Same

If the currency pair is EUR/USD and you want to use one micro lot of U.S. Dollars, how would you calculate the per pip cost? What about the margin?

In this example, since the account and quote currencies are the same, each pip is worth $0.10 per micro lot contract. That’s because micro lots have a 0.1 pip value. So if you use four lots, each pip would be worth $0.40.

If the broker requires $100 of margin per contract, then $400 would be reserved and unavailable for trading.

The Account Currency and the Quote Currency are Different

The methodology is the same, but you need a position calculator to convert the quote currency into your account currency.

In this example, EUR/JPY is trading for 141.90 and using micro lots, and each pip is worth $0.07 per micro lot contract.

Twenty-five micro lots of EUR/JPY result in a per pip cost of $1.75.

If the broker required $22 of margin per micro lot, then $550 would be reserved.

Time to Define the Risk of Your Trade

Now that you know how to calculate the per-pip cost and the associated margin, each trade you make can be sized.

If you have a $10,000 and a 1% risk profile, you are willing to risk $100 on a single transaction. However, if you find a trading opportunity with a 50-pip stop, you know you can risk $2 per pip.

Ideally, you would have a 1:2 risk-reward ratio with a target of at least 100 pips.

If that’s your only transaction and requires $200 of margin, you have more than enough equity.

However, as time goes by and you add more transactions, you must watch your margin total and your free equity.

You don’t want a trade to go against you and have the broker execute a margin call against you, closing your trades.

When Should You Scale in or Scale out your Trade?

You should never scale in your size, even if you believe it will move further in your favor. This is a risky practice that rarely succeeds.

The position size should always stay the same after the initial trade and never raise your break-even point.

If you choose to scale in any way, consider the transaction new and disconnected from the original since the risk profile is entirely different.

If you reach your target and want to take some risk off the table, then scaling out is a good option.

A typical scale-out would be 50% of the original transaction.

Reducing your position size by half is the best option since it will release margin-reducing pressure on your balance for other trading opportunities.

Scaling out of the trade also allows you to move your stop to break even, protecting your gains.

What to do Next?

Choose a few forex pairs and look for some opportunities.

Use a position calculator to identify your per-pip cost and the margin required. You can practice with pen and paper or open a demo account with a Forex broker.

When you’re ready for live trading, you will know how to position size your trades and manage your equity accordingly.

Knowing position sizing will allow you to control your risk and maximize your potential profits.

If you’re unsure how to find trading opportunities learn the Six Basics of Chart Analysis, which you can download for free here.

The “Six Basics” will give you a strong foundation in chart analysis which you can incorporate with what you’ve learned here about position sizing.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- Using the Six Basics of Chart Analysis and Advanced Strategies, I show you the trade opportunities I’m watching.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and Advance Strategies? I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What is a Position Size Calculator in Forex?

A position size calculator is a risk management tool used in the forex market that helps you determine the size of your position.

This calculator allows you to quickly and accurately calculate the size and margin of their position for any currency pair or cross pair you choose.

You must input values like size, leverage, currency pair, stop loss size, and entry price to generate an accurate position size value.

The position size calculator helps you risk only a fraction of your account, ensuring you can make good decisions regarding risk management in your trading.

For instance, it would help you decide the position size you can open without risking more than 1-2% on any single trade.

Thus, the position size calculator is essential for Forex traders in managing risk effectively.

Will Your Broker Tell you how Much you are Risking per Pip?

Your broker should tell you the amount of money you risk per pip or pip value.

The pip value is the amount of currency calculated when trading currency pairs expressed in the account currency.

This value tells us how much each pip movement of the currency pair will make your profit or loss.

How Much Capital Should a Trader Start with When Trading Forex?

If you’re a beginner Forex trader, starting trading with a minimum of $4,000 is recommended.

This money will allow you to trade with leverage and grow your equity slowly over time.

In addition, you should risk at most 1-2 % of your total trading capital on each position when trading Forex. This amount allows for the risk of loss to be kept to a minimum while still allowing for growth.

The minimum recommendation of $4000 to start trading Forex is specific to Position Forex, which is longer-term trading, as I practice here.

Different amounts could be considered for other trading styles, such as day trading or swing trading.

Keeping the inherent risks in mind, an excellent article breaking down this subject is on invezz.com: How Much Money Do I Need to Trade Forex?

What is a Margin Call?

A margin call is when your broker demands that you deposit additional funds to cover the losses incurred on your open positions.

If you do not provide the necessary funds, your broker may close some or all of your open positions to limit their risk exposure.

Margin calls can be a stressful experience for forex traders, so managing risk properly and avoiding over-leveraging oneself in forex trading is essential.