Overtrading in Forex is a temptation that ensnares many traders, and it’s a practice that can lead to financial ruin.

In this article, we will thoroughly examine the dangers associated with overtrading in Forex, delving into the reasons behind it, its adverse effects, and, most importantly, how to steer clear of this destructive trap.

What Is Overtrading in Forex?

Overtrading in Forex is a detrimental practice characterized by the excessive execution of trades within a relatively short timeframe.

It occurs when you engage in a high frequency of buying and selling without adhering to a well-defined trading plan or strategy.

This impulsive behavior can also lead you to take positions that exceed your risk tolerance or available capital.

Emotional impulses, such as greed, fear of missing out (FOMO), and the desire for quick profits drive overtrading.

Recognizing and avoiding overtrading is crucial for those seeking to establish a disciplined and sustainable approach to Forex trading.

Frequency of Trades

Overtrading is characterized by your compulsion to enter and exit positions frequently.

This excessive trading activity deviates from rational and strategic decision-making, which should be the cornerstone of any successful trading approach.

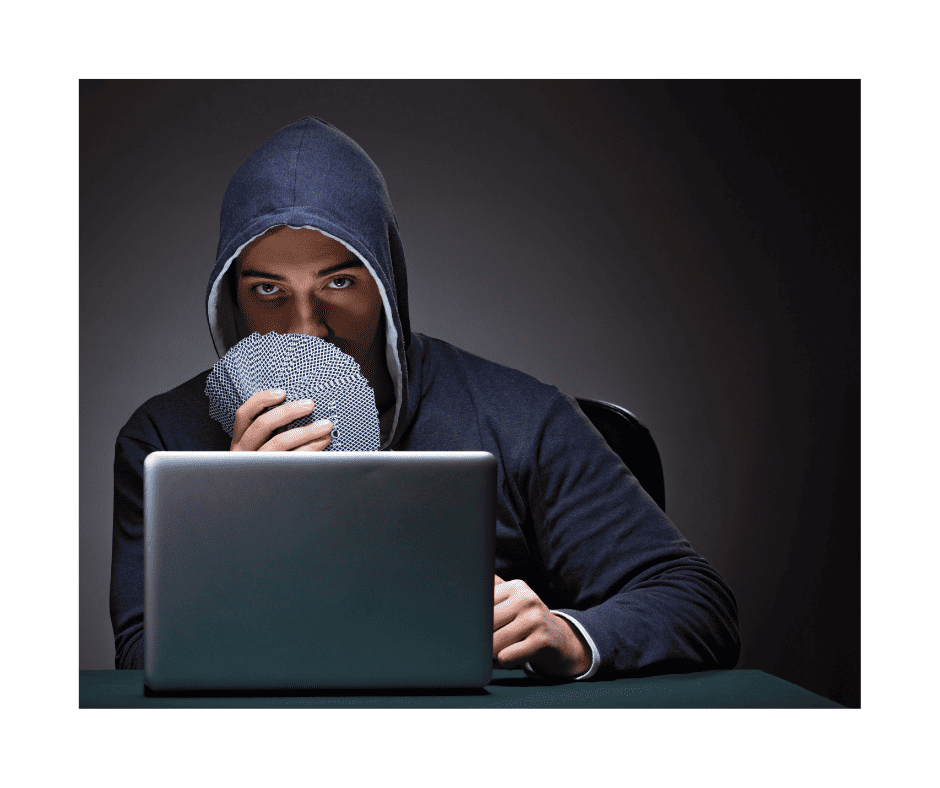

Risk Tolerance and Capital Constraints

One of the most pernicious aspects of overtrading is that it often involves taking positions that exceed your risk tolerance or available capital.

You might expose yourself to more substantial financial risks than you can handle.

It’s akin to a gambler placing bets they cannot afford to lose, and the consequences can be devastating.

Emotional Impulses

Emotions play a significant role in overtrading.

Engaging in this practice makes you susceptible to various emotional drivers, such as greed, fear of missing out (FOMO), and the desire for instant gratification.

The allure of making quick profits can lead you astray, causing you to abandon rational strategies in favor of emotionally charged decisions.

Lack of Strategy

Overtrading often occurs without a well-defined trading strategy.

If you fall into this trap, you are more likely to make impulsive, hasty decisions rather than meticulously analyzing market conditions and adhering to a predetermined plan.

This lack of discipline can result in significant losses.

The Illusion of Productivity

Some traders mistakenly believe that frequent trading equates to greater productivity and a higher chance of success.

Being constantly active in the markets increases their chances of making substantial profits.

However, the truth is that quality should always prevail over quantity in Forex trading.

Effective traders understand that patience and waiting for high-probability setups are essential for long-term success.

Overtrading in Forex is a detrimental behavior marked by excessive trading frequency, high-risk exposure, emotional impulses, and a lack of strategic discipline.

What is the Allure of Overtrading in Forex?

The allure of overtrading in the Forex market has enticed many traders, especially those new to the world of currency trading.

To understand why traders succumb to this temptation, exploring the underlying factors that make overtrading appealing is essential.

False Expectations

One of the primary reasons you may be lured into overtrading is the false expectation that frequent trading leads to more significant profits.

This misconception often stems from a lack of experience and understanding of the Forex market.

You may believe that constantly participating in the market increases their chances of striking it rich quickly.

However, the reality is quite the opposite. Frequent trading can lead to higher transaction costs, increased emotional stress, and greater loss exposure.

The Thrill of Action

Human psychology plays a significant role in the allure of overtrading.

Trading can be an exciting and adrenaline-pumping activity, especially amid multiple trades.

The constant monitoring of price movements and the thrill of making quick decisions can become addicting.

You might be compelled to stay engaged with the market, even when it’s not in your best interest.

Fear of Missing Out (FOMO)

The fear of missing out is a powerful psychological driver that can push you into overtrading.

When you see others profiting from rapid market movements or hear about potential opportunities, you may fear missing out on these gains if you don’t act immediately.

FOMO can lead to impulsive and irrational trading decisions.

Desire for Instant Gratification

Traders who fall prey to this temptation want immediate results and profits.

You may believe that frequent trading is the shortcut to achieving your financial goals swiftly, even though this mindset often leads to losses.

Overconfidence after Wins

Winning streaks can breed overconfidence.

When you experience a series of profitable trades, you may believe you have a special knack for the market.

This overconfidence can lead to a false sense of invincibility, causing you to take undue risks and overtrade, ultimately eroding your gains.

Lack of Patience

Patience is a virtue in Forex trading, but it’s a virtue that’s often in short supply.

Many traders lack the patience to wait for high-probability setups that align with their trading strategies.

Instead, they rush into trades, hoping for quick wins and immediate satisfaction.

Recognizing these psychological and emotional triggers is crucial if you are seeking to avoid the pitfalls of overtrading and adopt a more disciplined and sustainable approach to currency trading.

The Dangers of Overtrading in Forex

Overtrading in Forex is a perilous practice that can have severe repercussions for you, both financially and emotionally.

Here are the key risks and adverse outcomes associated with overtrading.

Increased Transaction Costs

One of the immediate consequences of overtrading is the substantial increase in transaction costs.

Every trade in the Forex market involves expenses such as spreads and commissions.

When you engage in excessive trading, you incur these costs more frequently, significantly affecting your profits.

In essence, even if you make winning trades, the higher transaction costs may offset your gains.

Emotional Exhaustion and Stress

Overtrading is emotionally taxing. The constant monitoring of charts, the fear of losses, and the pressure to perform can lead to emotional exhaustion and stress.

If you overtrade, you are more likely to experience burnout, hindering your decision-making abilities and overall well-being.

Loss of Objectivity

Frequent trading often results in a loss of objectivity.

Overtrading will make you more prone to deviating from your trading plans and making irrational choices.

Instead of relying on well-thought-out strategies, you react emotionally to market fluctuations, leading to poor decision-making and losses.

Risk of Large Losses

The most significant danger of overtrading is the increased risk of substantial losses.

You are more susceptible to significant drawdowns when you take positions beyond your risk tolerance or available capital.

Moreover, excessive use of leverage can amplify gains and losses.

A series of bad trades can lead to the depletion of a substantial portion of your trading capital.

Reduced Profitability

Ironically, overtrading often leads to reduced profitability.

This may seem counterintuitive, but the high frequency of trades can result in shallow analysis and a lack of focus on quality trading opportunities.

Quality always surpasses quantity in Forex trading, and overtraders may be spread too thin, making it challenging to manage their positions effectively.

Negative Psychological Impact

The psychological toll of overtrading cannot be overstated.

When you experience frequent losses due to overtrading, you can suffer from self-doubt, anxiety, and a loss of confidence in your abilities.

These negative emotions can further perpetuate impulsive trading behavior and a vicious cycle of losses.

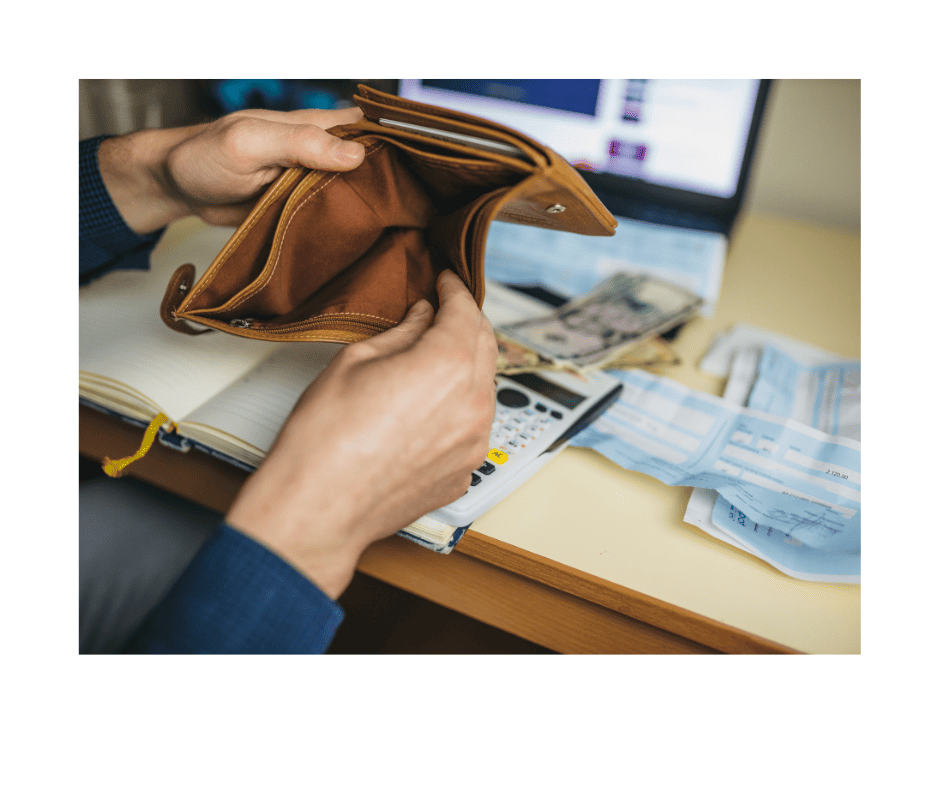

Erosion of Trading Capital

Over time, overtrading can erode your trading capital to a point where it becomes challenging to recover.

As losses accumulate, you may find yourself in a problematic financial hole to climb out of, leading to financial ruin in extreme cases.

Avoiding the pitfalls of overtrading requires discipline, risk management, and a focus on quality over quantity in trading decisions.

How to Avoid Overtrading in Forex

Avoiding overtrading is essential to achieving long-term success and financial stability in the Forex market.

Here are actionable steps to help you steer clear of the allure of overtrading and establish a disciplined trading approach.

Develop a Solid Trading Plan

A well-defined trading plan enables responsible trading. It should include straightforward entry and exit strategies, risk management rules, and trading criteria.

With a plan in place, you have a structured framework to follow, reducing the likelihood of impulsive trading decisions.

Set Realistic Goals

Establishing achievable profit targets and risk tolerance levels is crucial.

Realize consistent, moderate gains are more sustainable than doubling your account overnight.

Setting realistic expectations can help you avoid chasing unrealistic profits through overtrading.

Identify Stop-Loss Levels

Always use stop-losses for every trade. These orders allow you to limit potential losses by defining a point at which you will exit a losing position.

It’s a vital risk management tool that prevents you from holding onto losing trades for too long, helping to protect your capital.

Trade with Discipline

Avoid making decisions based on emotions or impulsivity.

Stick to your trading plan, and don’t let fear or greed dictate your actions. Maintaining emotional control is essential for avoiding overtrading.

Trade Less Frequently

Reduce the number of trades you make. Quality should always take precedence over quantity in Forex trading.

Wait for high-probability setups that align with your trading strategy.

This approach allows you to focus on trades with a higher likelihood of success.

Avoid Chasing Losses

Resist the urge to recover losses quickly by making impulsive trades.

Chasing losses often leads to overtrading and can exacerbate losses.

Accept that losses are a natural part of trading and focus on sticking to your plan instead of trying to recoup losses in a rush.

Manage Your Leverage

Leverage can magnify both profits and losses. Only use leverage if you fully understand its implications and can manage the associated risks.

Consider reducing your leverage to lower the stakes and potential losses in each trade.

Maintain a Trading Journal

Keep a detailed trading journal to record your trades, strategies, and emotions. After each trade, review your performance and identify areas for improvement.

Learning from your mistakes and successes is essential for continuous growth as a trader.

Practice Patience

Patience is a virtue in Forex trading. Understand that opportunities will come, but not every market movement is an opportunity.

Avoid the temptation to enter trades simply for the sake of action. Be patient, and wait for trades that align with your plan and strategy.

Seek Education and Mentorship

Continuously improve your trading skills by seeking education and mentorship.

Learning from experienced traders and staying updated on market trends and analysis can enhance your decision-making and help you avoid common pitfalls.

Remember that successful trading is not about how often you trade but how well you trade.

Conclusion

Overtrading is a perilous practice that can lead to financial disaster in Forex trading.

It is essential to recognize the allure of overtrading and the dangers it presents.

By developing a solid trading plan, setting realistic goals, and maintaining discipline, traders can avoid falling into the overtrading trap and work towards achieving consistent, sustainable success in the Forex market.

Remember, in Forex trading, it’s not about how often you trade but how well you trade that matters.

What’s the Next Step?

Review your habits and trading practices and consider if you are overtrading in Forex.

In addition, look for opportunities to incorporate these best practices in your trading.

Once you’re ready to trade, choose a strategy and process you believe will work for you.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about overtrading in Forex.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What is Overtrading in Forex?

Overtrading in Forex refers to executing excessive trades quickly, often driven by impulsive decisions and emotions.

It typically involves taking positions beyond one’s risk tolerance or available capital.

Why is Overtrading Dangerous?

Overtrading is dangerous because it can lead to increased transaction costs, emotional exhaustion, loss of objectivity, a higher risk of significant losses, reduced profitability, negative psychological impact, and the potential erosion of trading capital.

It can significantly impact a trader’s financial and emotional well-being.

What Are the Common Triggers for Overtrading?

False expectations of quick profits often trigger overtrading, the allure of constant action, fear of missing out (FOMO), the desire for instant gratification, overconfidence after winning streaks, and a lack of patience.

These psychological factors can lead traders into the overtrading trap.

How Can I Avoid Overtrading in Forex?

To avoid overtrading, you should:

- Develop a solid trading plan with precise entry and exit strategies.

- Set realistic profit goals and risk tolerance levels.

- Implement stop-losses for risk management.

- Trade with discipline, avoiding emotional decisions.

- Reduce the frequency of trades and focus on quality setups.

- Avoid chasing losses and accept them as part of trading.

- Manage leverage cautiously and consider lower levels.

- Maintain a trading journal for self-assessment.

- Practice patience and wait for high-probability trades.

- Seek education and mentorship to improve your skills.

Can Overtrading Be Profitable in the Short Term?

While overtrading may yield sporadic profits in the short term due to luck or market volatility, it is not a sustainable or reliable strategy.

Over time, the risks associated with overtrading tend to outweigh any short-term gains.

A disciplined, long-term approach will likely result in consistent and profitable trading.