What are Momentum Indicators For?

Momentum indicators can measure the speed and strength of price movements over a specific time frame and determine Overbought and Oversold conditions.

Their primary function is to help traders identify potential reversals or continuations in price trends.

These indicators provide insights into the market’s sentiment and the force behind price movements by gauging the velocity of price changes.

Some of the most popular Momentum indicators include the Relative Strength Index (RSI), Commodity Channel Index (CCI), and the Stochastic Oscillator.

Each of these tools offers a unique perspective on market Momentum and, when used correctly, can aid traders in making more informed decisions about entry and exit points.

What Overbought and Oversold Mean?

When we talk about something being “Overbought” or “Oversold” in trading, we’re referring to the idea that an asset’s price might have moved too far too quickly and could be due for a correction.

Imagine a stretched rubber band; the more you pull it, the more it wants to snap back.

“Overbought” typically means that the price has risen quickly and might be higher than its actual value, suggesting it could drop soon.

Conversely, “Oversold” means the price has fallen sharply and might be lower than its true value, hinting at a potential rise. These concepts can help you gauge if an asset is trading at a fair price or is due for a change in direction.

How Important are Momentum and Overbought and Oversold Indicators?

Momentum indicators aren’t just about speed; they’re about direction and force, too.

Think of them like the wind. If you feel a strong gust, you know something’s up. In trading, these indicators help pinpoint when the “wind” (or Momentum) behind a price move might be dying down or picking up.

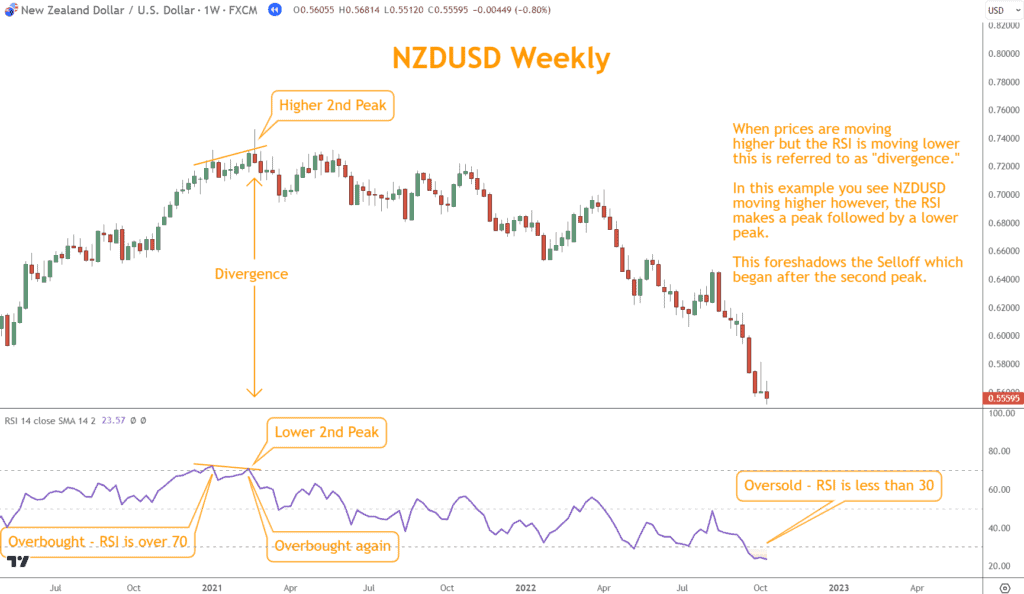

For instance, if a currency’s price is rising, but the Momentum is slowing, it could be a sign that the trend might reverse soon.

This is especially true when the price and the indicator start moving in opposite directions, a phenomenon called “divergence.” By spotting these early signs, you can get a heads-up on potential shifts in the market, helping you make better decisions.

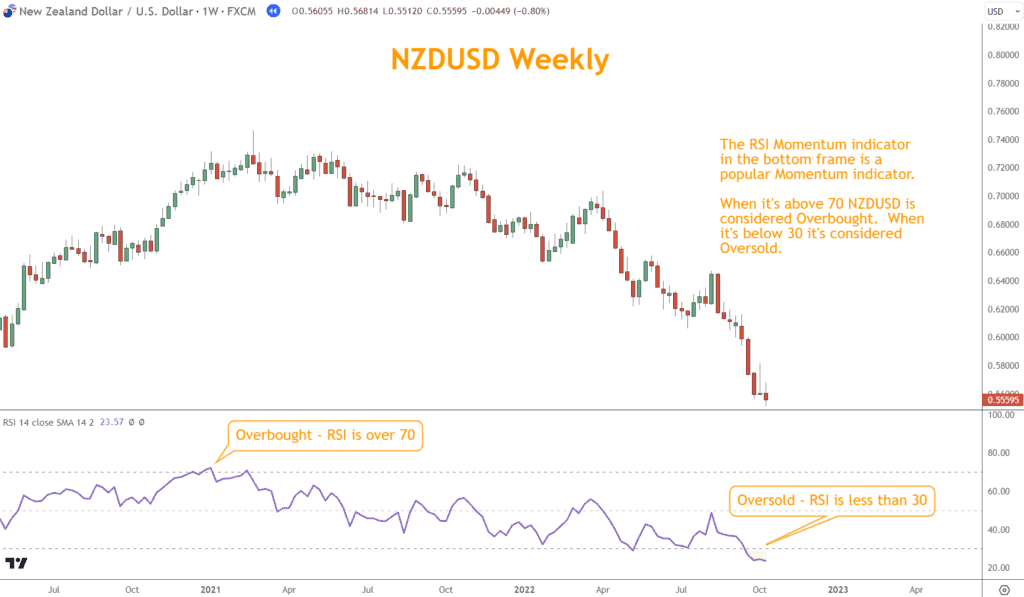

Relative Strength Index (RSI)

RSI measures the strength and speed of price movements ranging from 0 to 100.

When the RSI exceeds 70, it tells you the asset might be “Overbought” and could be due for a drop.

Conversely, when it dips below 30, it’s hinting that the asset might be “Oversold” and could bounce back up.

But the catch is that just because RSI hits these levels doesn’t guarantee a reversal.

It’s more of a heads-up, a nudge to look closer and see if other signs are pointing in the same direction. It’s a favorite tool for many traders because it’s straightforward and can give quick insights into potential market turns.

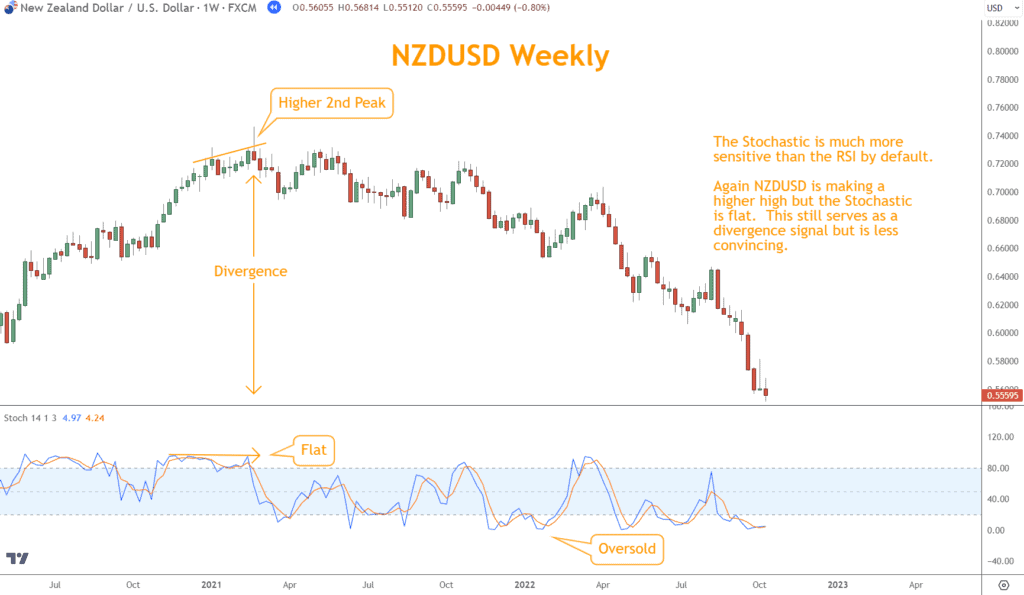

Stochastic Oscillator

The Stochastic Oscillator moves between 0 and 100 like the RSI and helps traders figure out if an asset is potentially in “Overbought” or “Oversold” territory.

When the reading goes above 80, it’s like a yellow light flashing “caution” because the asset might be Overbought. On the other hand, a reading below 20 suggests the instrument could be Oversold, hinting at a possible upward swing.

It’s most effective when combined with other indicators and used in the right market conditions. It’s all about getting different perspectives to make a well-informed decision.

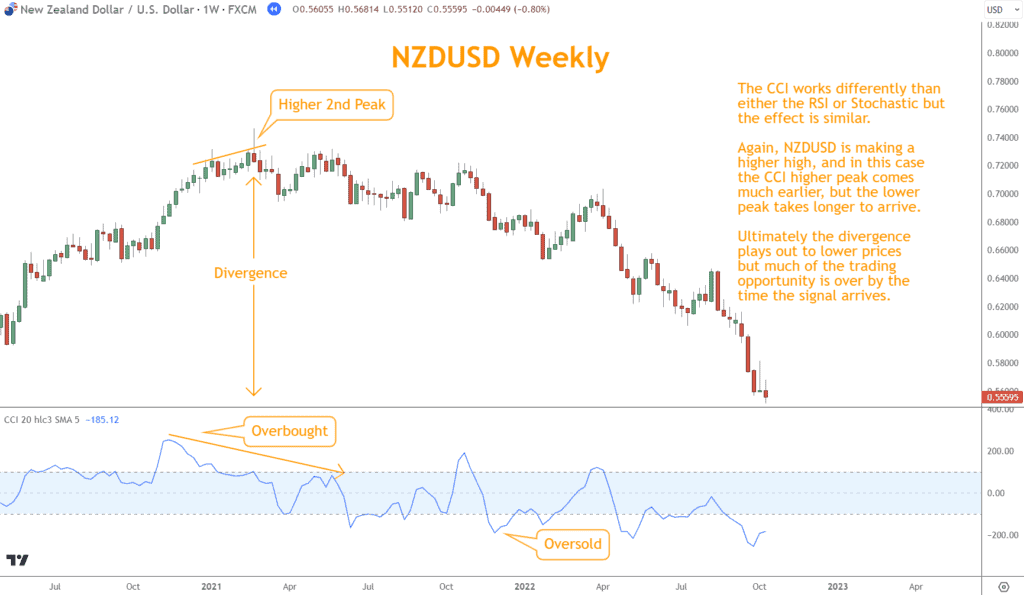

Commodity Channel Index (CCI)

Forex traders often add the CCI to their toolkits, even though it was originally designed for commodities.

At its core, the CCI looks at how far the current price is from its average over a set period, usually 14 days. When the CCI shoots above +100, it’s like a flare going up, signaling that the asset might be Overbought and could be gearing up for a downturn.

Conversely, if it dives below -100, it’s a hint that the asset might be Oversold and could be on the verge of an upward swing.

But here’s the kicker: sometimes the price and CCI don’t agree, moving in opposite directions.

This “divergence” can be a sneaky clue about a potential price shift. As with all tools, it’s best used with others to get the complete picture without getting caught off guard.

Three Tactics for How to Use Overbought and Oversold Conditions for Better Trading Accuracy

Understanding Overbought and Oversold signals is one thing, but applying them in real-time trading scenarios is where the rubber meets the road.

Traders often use these signals as a part of a broader strategy, blending them with other technical analysis tools and economic news to make a strategy.

For instance, spotting an Oversold signal might be a cue to dig deeper: Are there upcoming news events that could affect the asset? What are other indicators suggesting? Is the broader market supportive?

Acting on these signals isn’t about making knee-jerk reactions. Instead, it’s about piecing together a puzzle, ensuring the broader picture aligns with the specific Overbought or Oversold cues.

I recommend using the three tactics below to confirm Overbought and Oversold best.

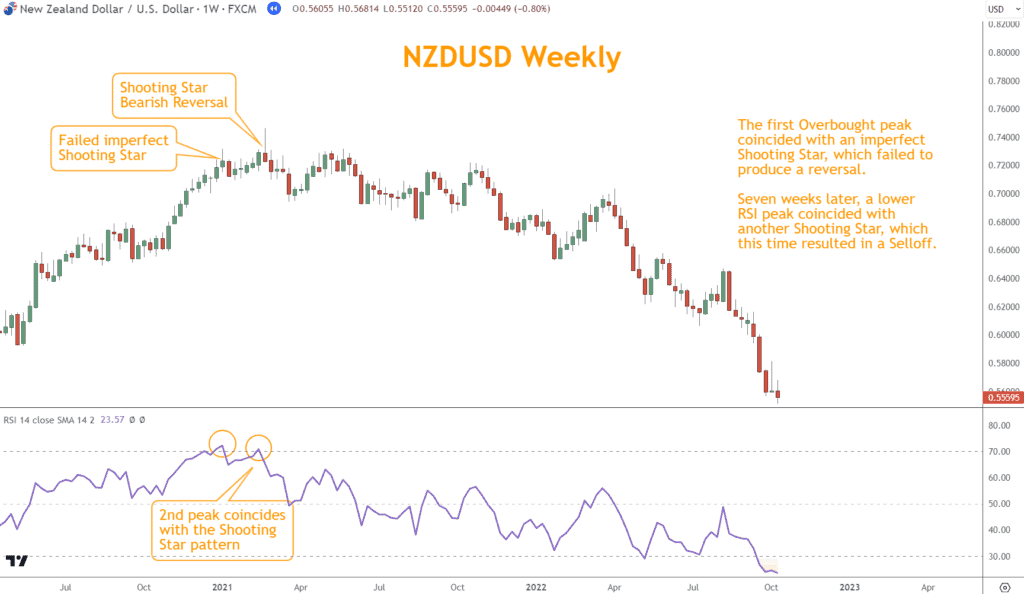

Japanese Candlestick Patterns

Combining Overbought and Oversold Momentum signals with Japanese Candlestick patterns can be a game-changer. Why?

While Momentum signals give you a sense of the market’s pulse, candlestick patterns provide a visual narrative of traders’ mindsets and potential future price movements.

For instance, if your Momentum indicator suggests an Overbought condition and you spot a Bearish Candlestick pattern like the “Evening Star,” it can reinforce the idea that a price reversal is imminent.

This combination allows you to gauge the market’s Momentum and visualize the psychology behind price movements, offering a more holistic view of potential market turns.

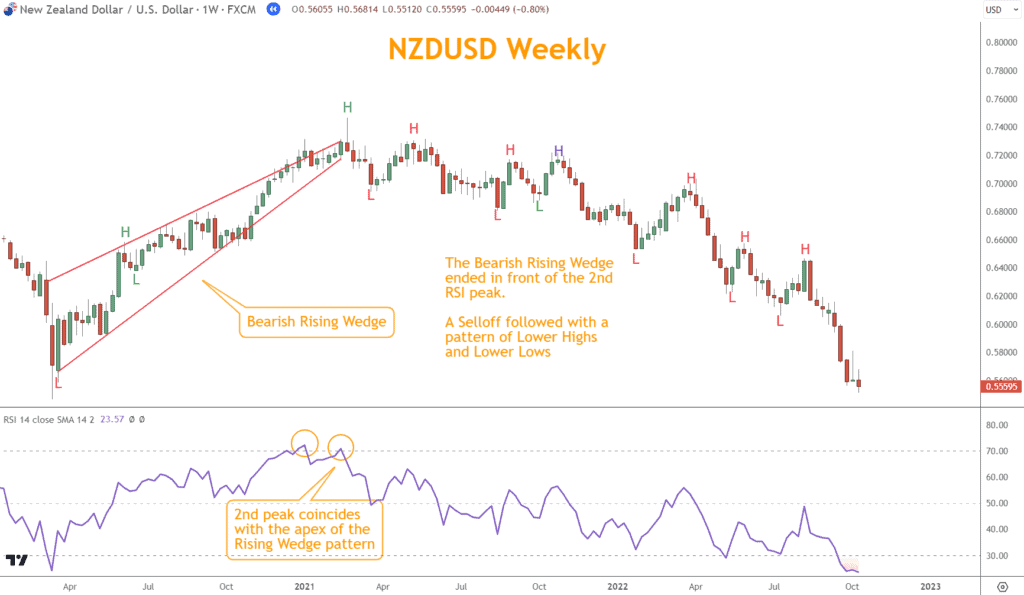

Chart Patterns

Chart Patterns, like the Head and Shoulders or Double Tops and Bottoms, signal potential continuation or reversal of trends.

When you overlay these with Overbought and Oversold Momentum signals, it’s like having both a map and a compass in your trading journey.

For example, suppose you identify a forming “Double Top” pattern (which typically signals a Bearish reversal) in an Overbought zone.

In that case, it can strengthen your conviction that the price might drop soon. By marrying these two tools, you can enhance their predictive accuracy, making more informed decisions based on the broader landscape and the immediate Momentum.

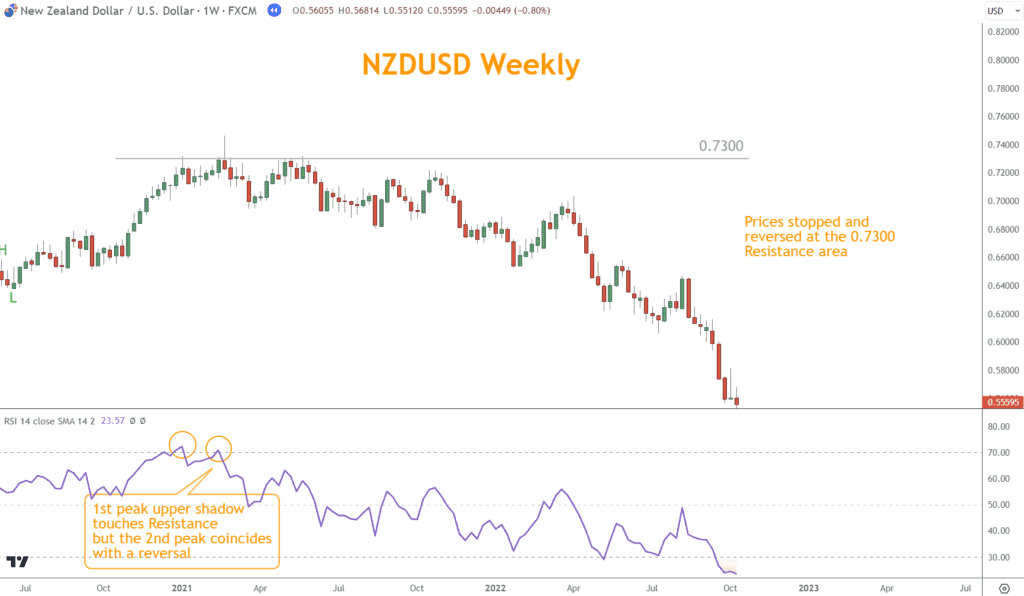

Support and Resistance

Support and Resistance levels are the floors and ceilings of the Forex market, indicating price points where assets historically have had difficulty moving below or above.

These levels gain even more significance when paired with Overbought and Oversold Momentum signals.

Imagine spotting an Oversold signal as the price approaches a known support level.

This confluence indicates that the price might bounce back up, as the Support level acts as a safety net, preventing the price from falling further.

Conversely, an Overbought signal near a Resistance level can be a warning bell, hinting at a potential price drop. By integrating these tools, you can pinpoint high-probability entry and exit points, optimizing your trading strategies for better returns.

Is it Flawless? What’s the Downside?

Navigating trading using Momentum indicators is helpful, but there’s always uncertainty.

Just because an asset is labeled “Overbought” doesn’t mean it’ll immediately plummet; similarly, an “Oversold” tag doesn’t guarantee a swift rise.

Influenced by geopolitical events, economic data, and herd mentality, market dynamics can keep prices in Overbought or Oversold territories longer than anticipated.

Moreover, relying solely on these indicators can be dangerous to your trades.

For a more holistic view, you should combine Momentum indicators with other tools, as illustrated earlier.

What Can You Take Away From This?

Understanding Overbought and Oversold zones is foundational for trading with Momentum indicators.

Just beware: these indicators alone don’t paint the whole market picture.

They serve as crucial alerts, nudging you to delve deeper, cross-reference with other tools, and stay attuned to the broader market narrative.

What’s the Next Step?

Select a favorite candlestick chart and look for Overbought and Oversold areas on a Momentum indicator using what you learned in this article.

In addition, look for opportunities to coincide them with other technical analysis tools and techniques to see how they work together.

Combining Japanese Candlesticks, Chart Patterns, and Support and Resistance can give you a comprehensive view and understanding to make trading easier.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about these crosses.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

Can an Asset Remain Overbought or Oversold for Extended Periods?

Yes, especially during strong uptrends or downtrends. It’s essential to consider the broader market context.

Are Overbought and Oversold Indicators Foolproof?

No. While these indicators can be helpful, only a combination of tools paints a complete market picture. It’s crucial to use them in conjunction with other analysis tools.

Why do Prices Continue to Rise Even When Indicators Show Overbought Conditions?

Several factors influence price, including market sentiment, news events, and fundamental elements. Overbought conditions suggest the possibility of a reversal, not a guarantee.