The One White Soldier and One Black Crow are distinctive Japanese candlestick patterns foreshadowing potential market reversals.

Each pattern, characterized by a specific arrangement of candles, paints a picture of the tug-of-war between buyers and sellers.

While the One White Soldier signals a possible Bullish turnaround after a Selloff, the One Black Crow warns of a Bearish shift following a Rally.

Their presence on a chart, especially when corroborated by other indicators, can be a valuable source of confirmation if you are considering a trade.

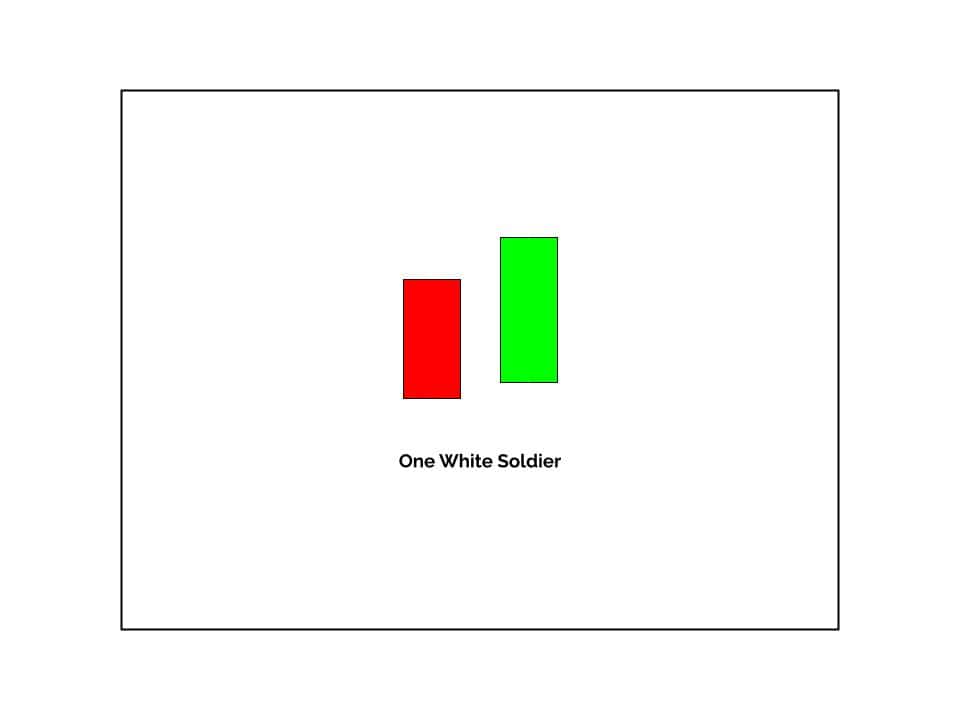

What is the One White Soldier?

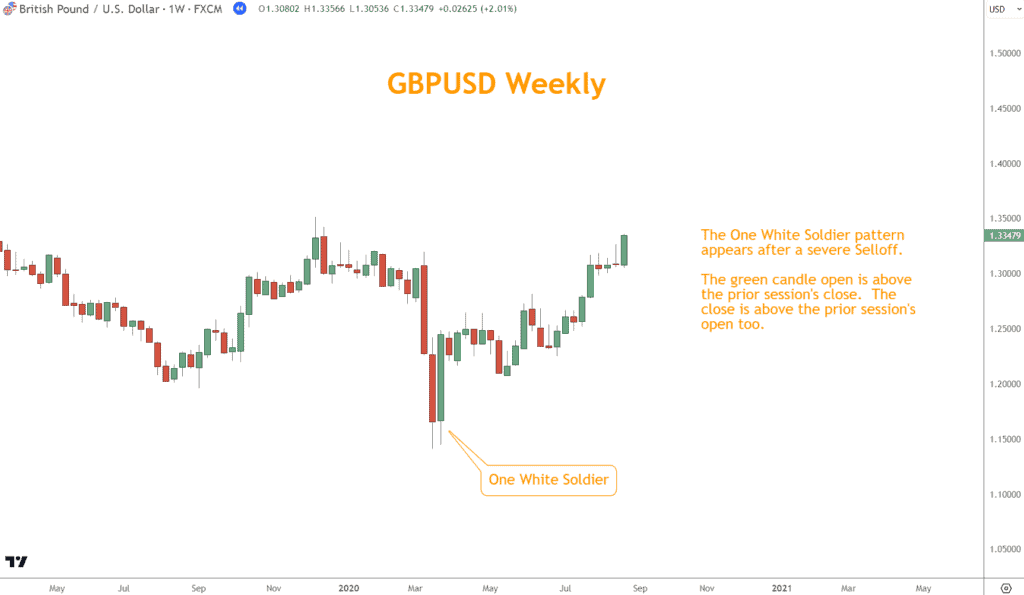

The One White Soldier emerges after a prevailing downtrend.

The pattern includes two candles. The first candle is long and red, which shows that the market is Bearish.

But the story changes when a long green candle appears next.

This green candle, opening below the previous day’s close but surging to close above its open, signifies a potential Bullish resurgence.

Such a shift in sentiment, primarily if it occurs after a pronounced Selloff, can strongly indicate a change in the market’s direction.

While the pattern is noteworthy, you should seek additional confirmation from other indicators to validate the impending Bullish reversal.

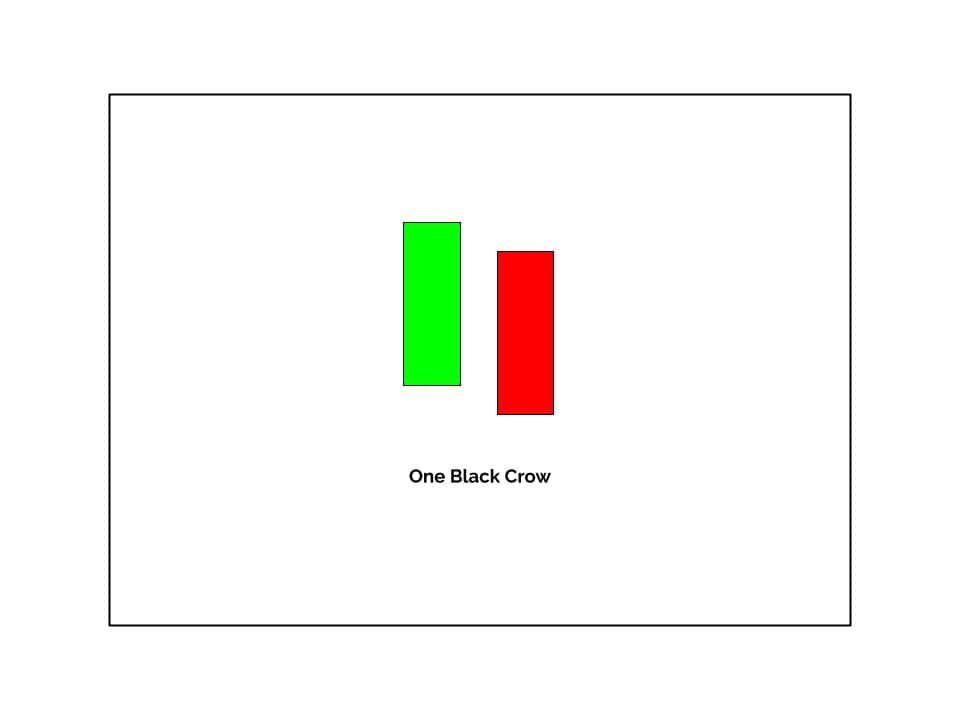

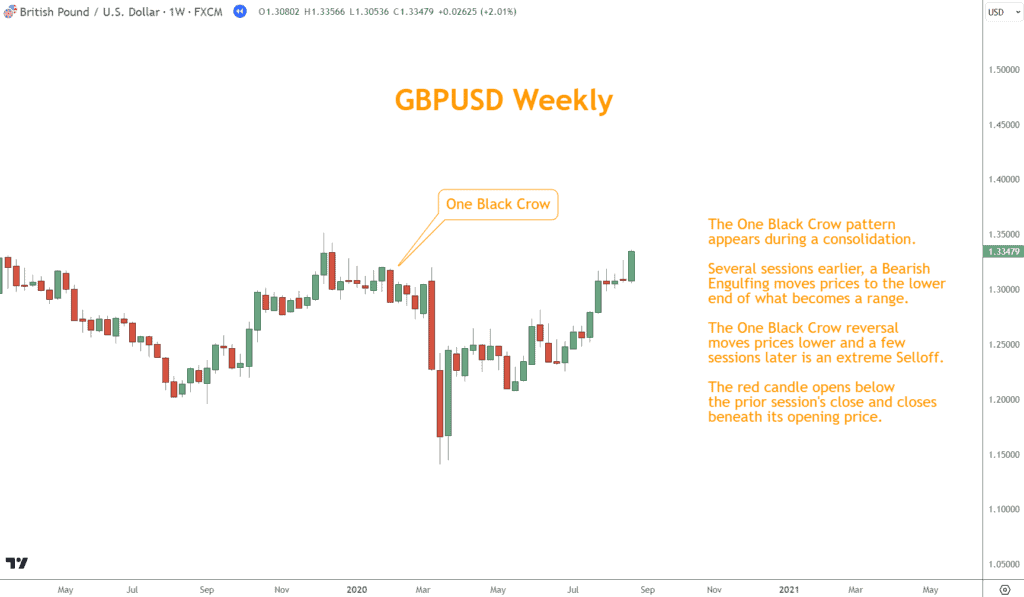

How is the One Black Crow different?

In an established Rally, the appearance of the One Black Crow is a warning of a shift in market sentiment.

The pattern happens in two candles. First, there’s a long green candle that shows Bullish enthusiasm. But then, a long red candle tells a different story.

Opening above the prior day’s close but descending to close below its open, this red candle suggests that the bears might be gaining ground.

The juxtaposition of these two candles, especially during a Rally, can be a precursor to a Bearish reversal.

Smart traders don’t rely solely on the One Black Crow as a signal. They look for additional indicators or market information to support their trades.

Complementary Indicators can Unlock the One White Soldier and One Black Crow Patterns

By looking at the One White Soldier or One Black Crow, along with other indicators, traders can gain insight into possible market changes.

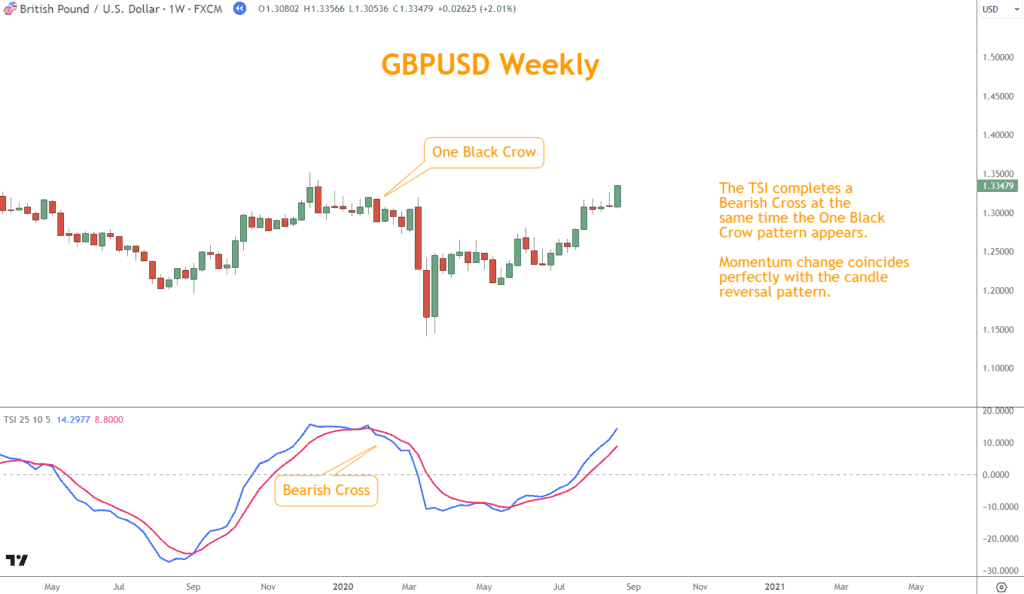

The True Strength Index (TSI), a Momentum oscillator, is particularly adept at gauging the energy of a Forex pair.

When the TSI exhibits a Bullish crossover with the One White Soldier or a Bearish crossover alongside the One Black Crow, it amplifies the reversal signal’s credibility.

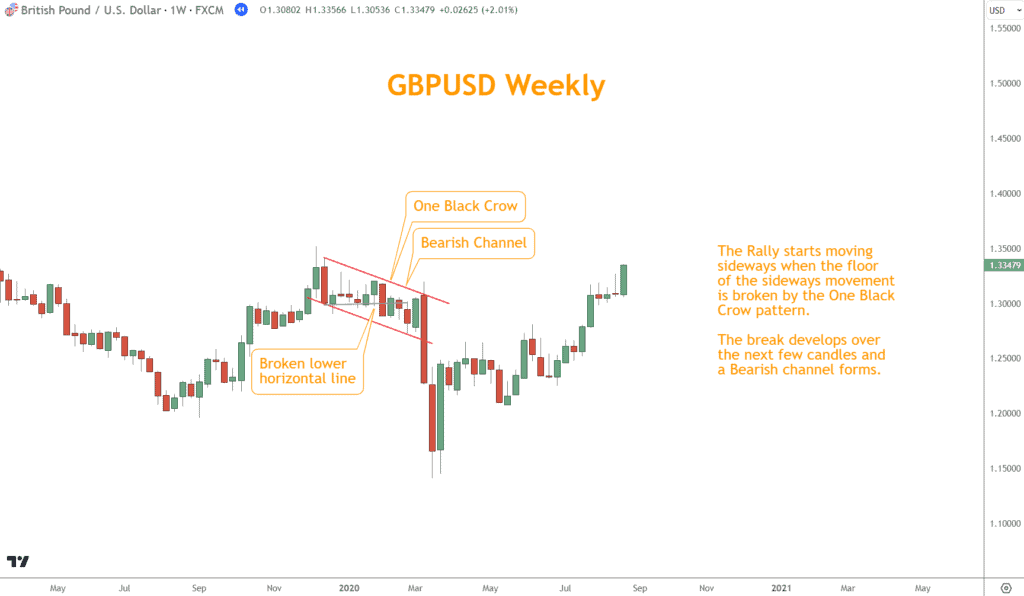

Additionally, Chart Patterns, such as Channels, Triangles, or Flags, can offer contextual clues about the broader market trajectory.

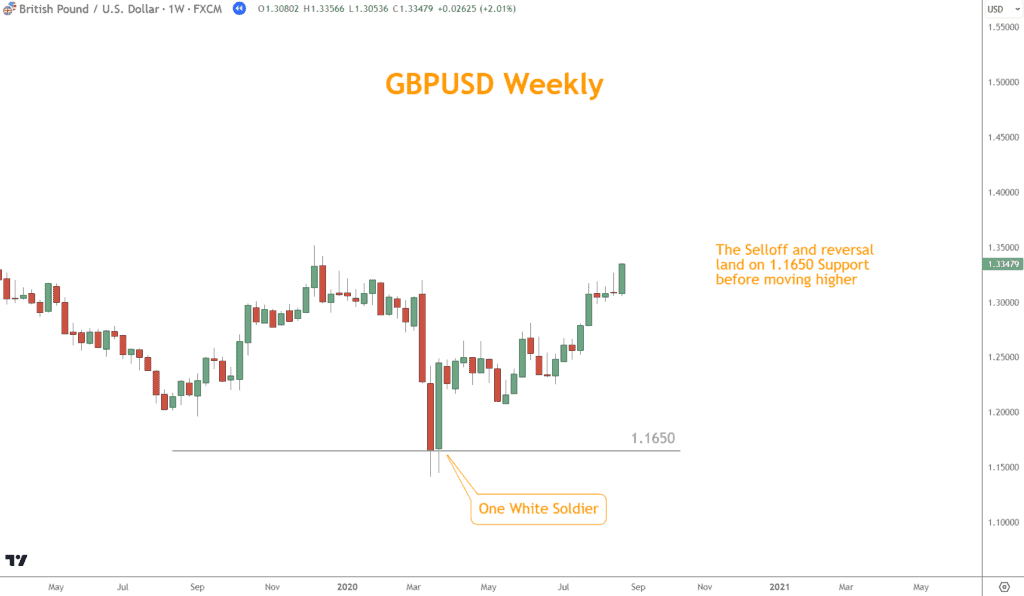

Similarly, the One White Soldier near established Support levels can underscore the pattern’s Bearish implications, making the case for a potential downturn even more compelling.

By integrating these complementary indicators with the One White Soldier or One Black Crow, you can achieve a more holistic and informed perspective on market movements.

Conclusion

Traders can gain insight into potential market reversals by observing the One White Soldier and One Black Crow, part of the Japanese candlestick patterns.

Combining these patterns with complementary indicators, such as the TSI, Chart Patterns, and Support or Resistance levels, can reveal the market’s sentiment and better understand its true strength.

While these patterns and indicators are helpful, you must exercise due diligence, continually educate yourself, and employ sound risk management strategies in your trading endeavors.

What’s the Next Step?

Select a favorite chart and look for One White Soldier and One Black Crow patterns using what you learned in this article.

In addition, look for opportunities to coincide them with other technical analysis tools and techniques to see how they work together.

Combining Momentum, Chart Patterns, and Support and Resistance can give you a comprehensive view and understanding to make trading easier.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about these crosses.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

Can these Patterns be used in Isolation?

While they can provide signals independently, their reliability increases when combined with other indicators and patterns.

How Often Do These Patterns Lead to Significant Reversals?

No pattern guarantees a reversal, but these patterns are more likely when confirmed with complementary indicators.

Are There any Variations of These Patterns?

Yes, there are multiple candlestick patterns, but the principles of reversal and continuation remain consistent.

How do I set Stop-Loss Orders When Trading These Patterns?

A common approach is to set a stop-loss just below the low of the One White Soldier or above the high of the One Black Crow.