One-candle Japanese candlestick patterns can predict reversals in the proper context.

Create these patterns using the open, high, low, and close price data from one Candlestick in a Rally or a Selloff context.

Traders use numerous one-candle Japanese candlestick patterns in their trading.

The most popular include Doji, Hammer, Hanging Man, and many more.

Each pattern has a specific meaning and can help you make informed trading decisions.

I’ve been trading Forex and other markets since 2007, and in this article, I will share my experience using Japanese candlesticks in my trading.

I’ll also illustrate using them with other tools and indicators for higher success probability.

To make the most of One Candle Japanese Candlesticks, traders should use them alongside other technical indicators and charting tools.

What are the Advantages of Using One Candle Japanese Candlestick Patterns?

Candlestick patterns are a convenient and effective way to track an instrument’s behavior. Advantages include:

- Available on every timeframe

- A single candle provides a lot of information

- Reflects market psychology with a glance

- Can be combined to tell a broader story

- Works well with other forms of technical analysis

What are the Limitations of Using One Candle Japanese Candlestick Patterns?

No technical indicator is perfect, and Japanese Candlesticks have limitations, too:

- They cannot help determine the market depth and volume.

- They may be difficult to interpret for inexperienced traders due to the extensive range of variations in each pattern.

- This leads to misinterpretation and wrong conclusions, resulting in loss of money.

- Contradicting signals can create confusion and noise.

- They aren’t traded effectively alone or in the wrong context.

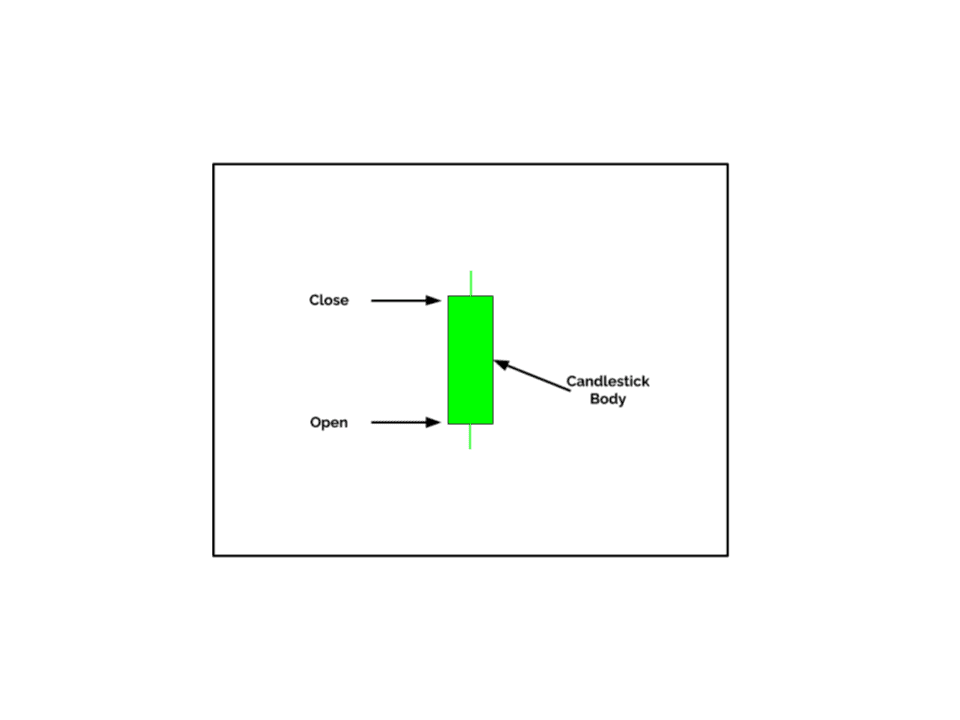

What are a Candlestick’s Components?

Each Candlestick contains the opening price of a trading session, the high price, the low price, and the closing price.

Regarding technical analysis, candlestick charts provide vital information about trader attitudes and psychology.

The three components of a candlestick are the body, the shadows or wicks, and the color.

First: The Candlestick Body

A candlestick body is an area between the open price and the closing price of a candlestick.

The candlestick body can be either filled or hollow, depending on whether the closing price is higher or lower than the opening price.

Understanding how to read candlestick bodies can help traders make better decisions when trading in any market.

For example, long-body candlesticks such as the Marubozu candle indicate strong buying or selling pressure in a market.

In contrast, short-body candlesticks such as the Spinning Top or Doji Candle indicate indecision in the market.

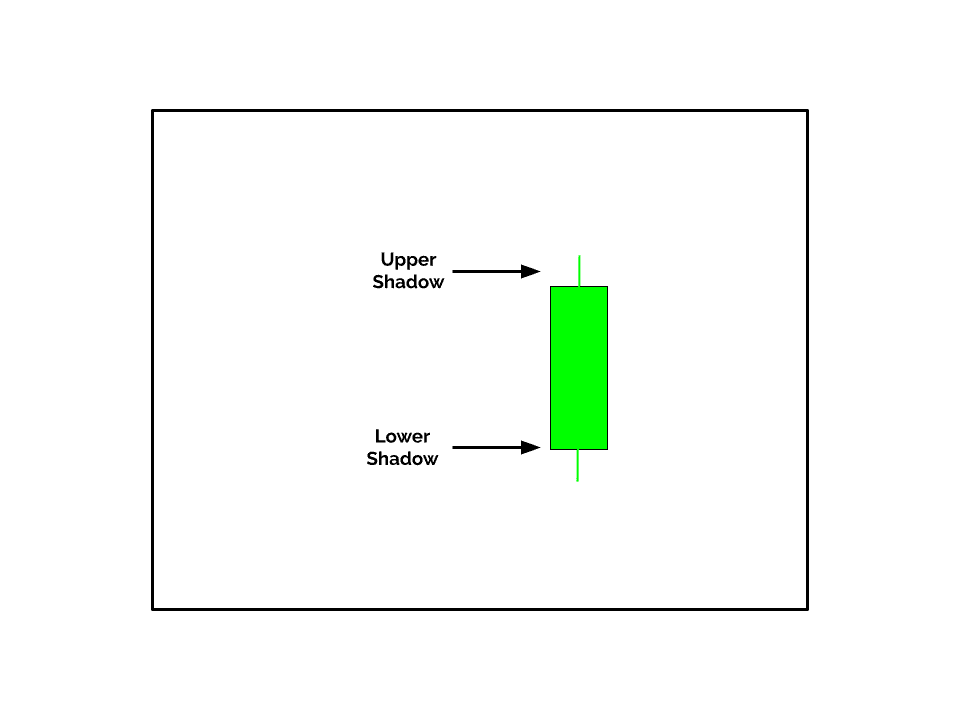

Second: The Shadows or Wicks Capture the Extremes

Candlestick shadows, also called wicks, represent the highest and lowest prices achieved during a period and are displayed at the top and bottom of the candlestick.

The shadow represents the price volatility of an asset.

Longer shadows, such as a Hammer candle, indicate higher price volatility, while the shorter wicks of a Spinning Top indicate lower price volatility.

Third: The Candle Color Tells A Lot

The candle’s color indicates whether it’s Bullish or Bearish.

In Japanese candlestick patterns, traders generally use white or green candlesticks to indicate upward movement, while they use black or red candlesticks to show a downward motion.

In Japanese candlestick patterns, white or green candlesticks are generally used to indicate upward movement, while black or red candlesticks are used to show a downward motion.

Candlestick color can influence pattern determination.

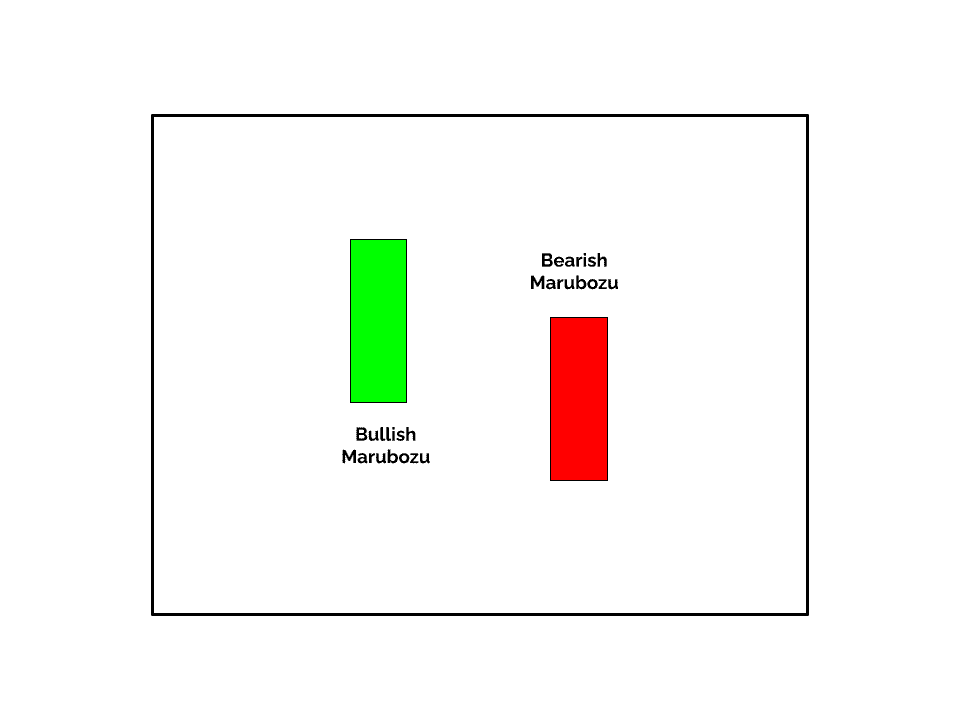

Why the Marubozu is the Only Continuation Candle Pattern

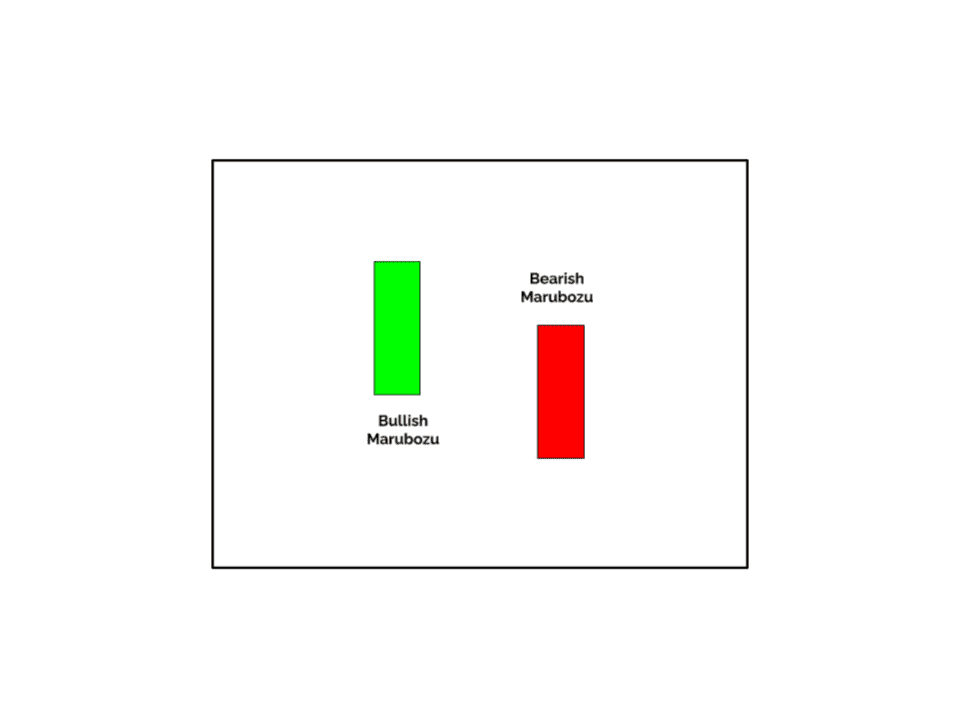

A Marubozu is a one-candle Japanese candlestick pattern with a very long body compared to other candles.

Depending on the Candlestick’s color, the Marubozu pattern can be either Bullish or Bearish.

A Bullish Marubozu indicates intense buying pressure in the market, while a Bearish Marubozu candle shows that selling pressures dominated during the period.

Many traders consider this particular Candlestick a continuation signal, indicating that the price trend is likely to continue in the same direction after this pattern is formed.

This Candlestick is often considered a continuation signal, which means that the price trend will likely continue in the same direction after this pattern forms.

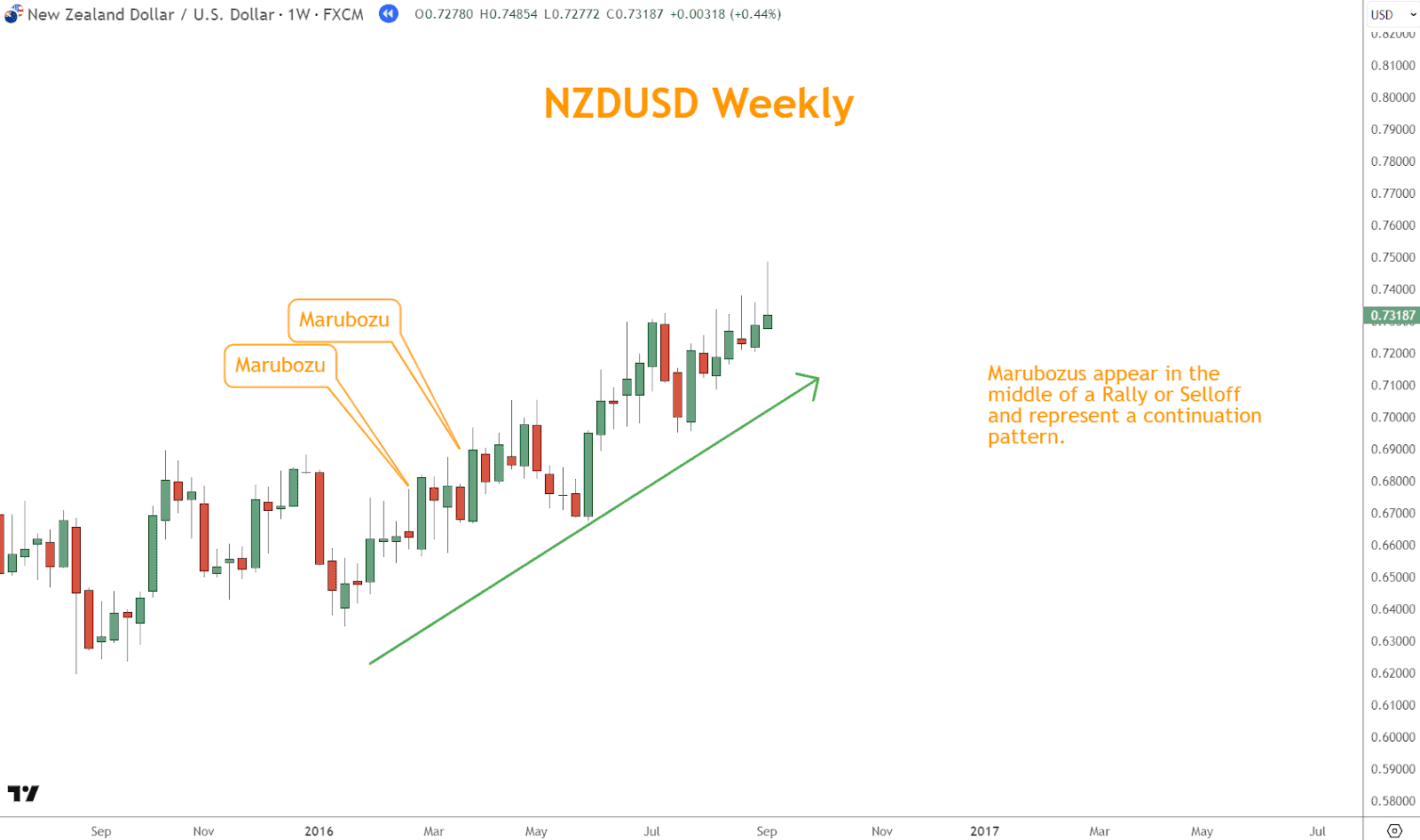

In the example below, a clear rally is in place, and multiple Marubozu candles appear during this rally.

These candles validate the rally and act as continuation confirmation.

The Marubozu is the only candle considered a continuation pattern. Other Japanese Candlestick patterns are considered reversals.

Marubozu candles are often found in two candle patterns, such as harami, engulfing, piercing, and cloud cover.

In this scenario, they are part of a reversal pattern and are no longer considered a continuation pattern.

Five One Candle Japanese Candlestick Patterns are the Foundation of all Reversal Patterns

These Candle Patterns are potent reversal patterns on their own. However, they are even more compelling when part of a multi-candle reversal.

In our Candlestick Patterns article, we detail more complex patterns, and these three appear in most of them.

Learning how One Candle Japanese Candlestick Patterns work and the psychology they represent will bolster your trading skills.

Hammer and Hanging Man

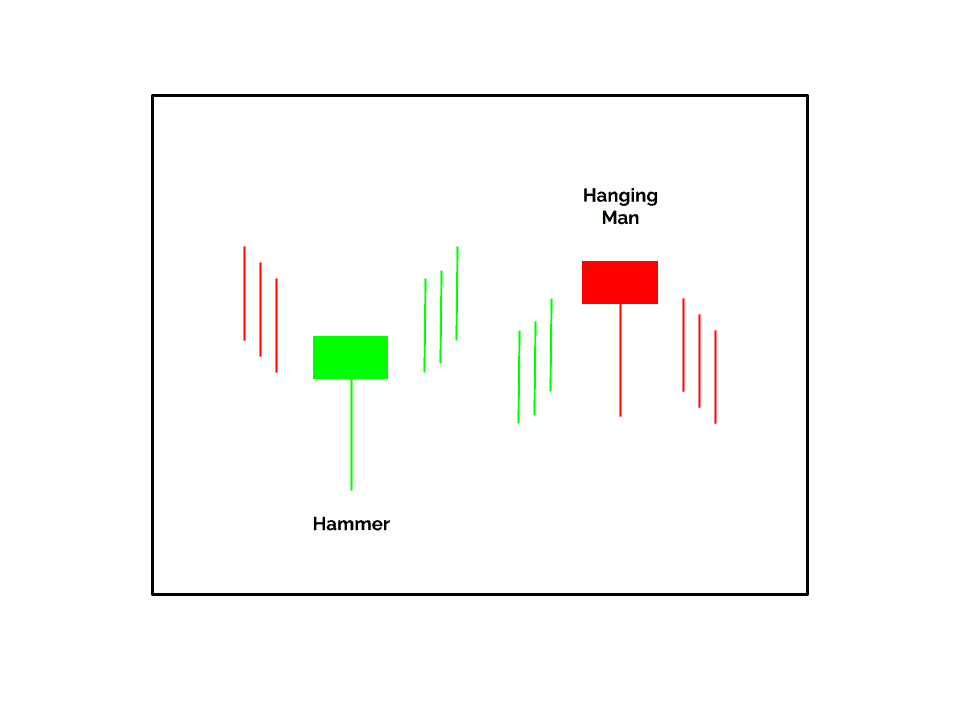

The Hammer and Hanging Man candlestick patterns are two types of one-candlestick reversal patterns characterized by small bodies, a single long shadow on one end, and either no shadow or a short one on the other.

These candlesticks have a similar appearance, featuring short bodies and long lower shadows.

However, it’s important to note that they require confirmation before acting based on them.

For instance, when observing a Hammer pattern, typically spotted at the bottom of a selloff, it signals a bullish reversal.

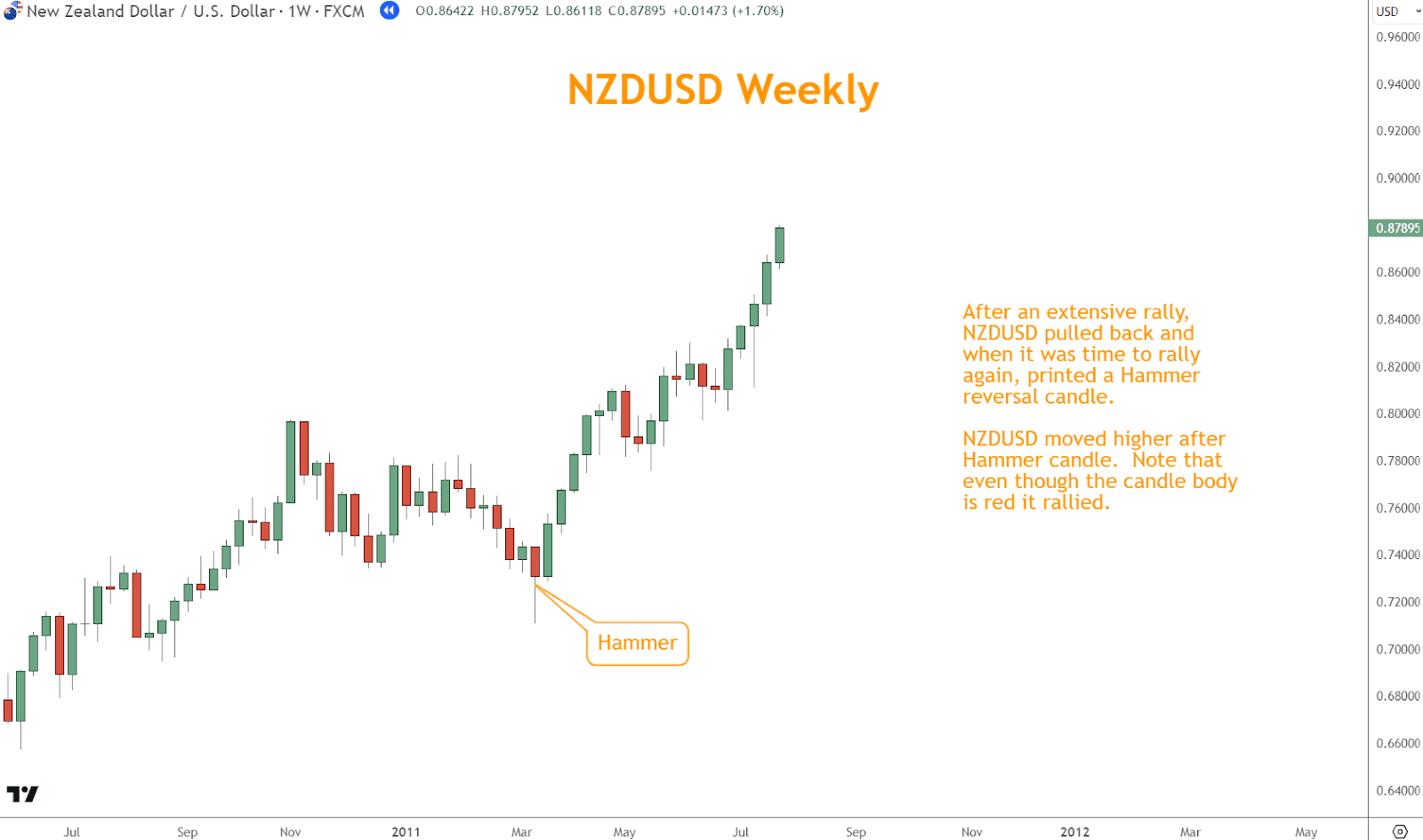

In the example below, you can see NZDUSD pulling back from its rally, printing a hammer candle, and then moving higher.

Conversely, a Hanging Man pattern at the end of a rally indicates a bearish reversal.

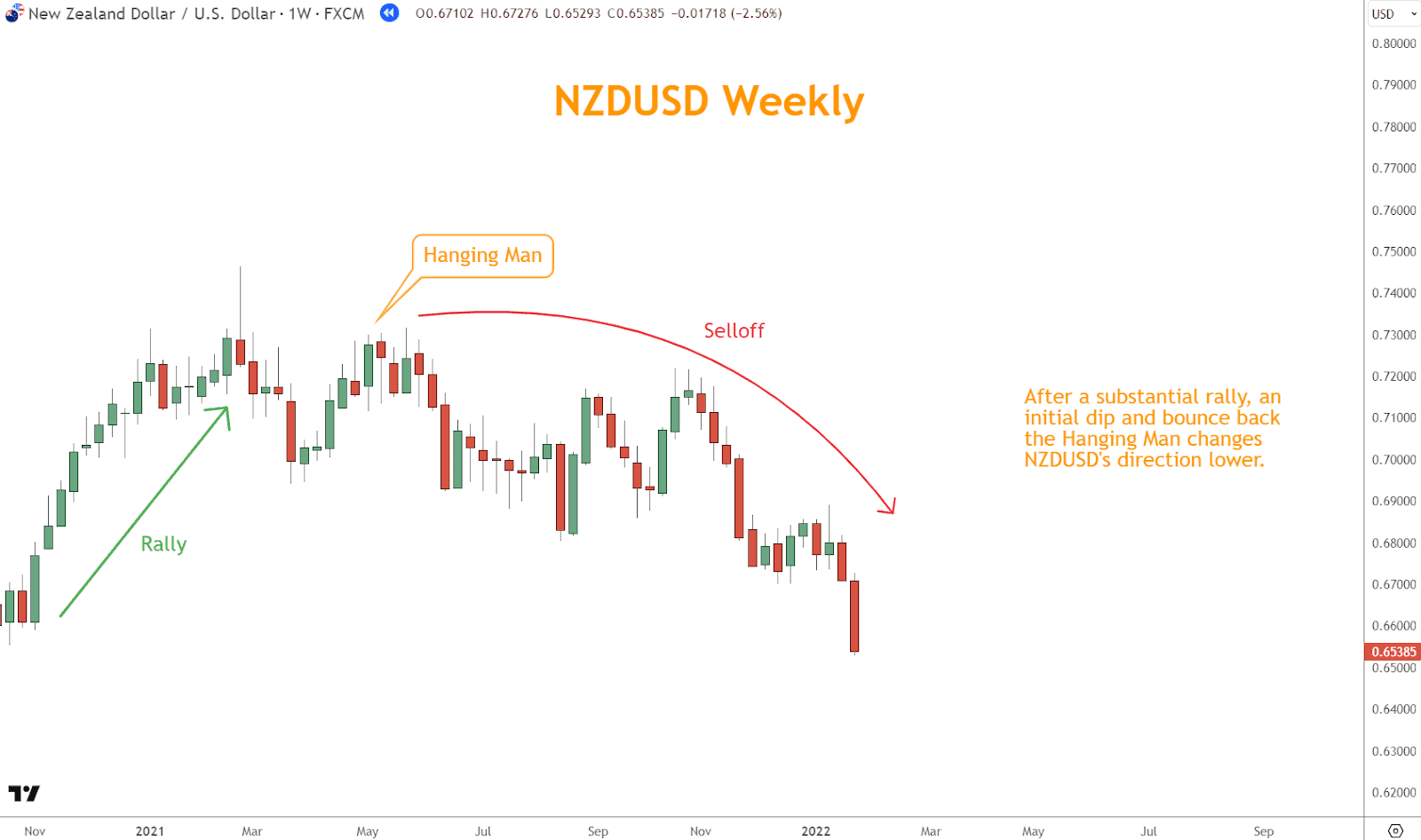

In the example below, the rally ends with the Hanging Man’s arrival, and a Selloff ensues.

The underlying psychology behind these one-candle patterns lies in the market’s struggle to propel an instrument further in the same direction.

The Hammer reflects the bulls’ determination to reverse the price trend by rejecting further declines and increasing prices.

If the closing price surpasses the opening price, the candle finishes green, indicating a stronger bullish conviction.

Conversely, the Hanging Man signifies a battle between bulls and bears.

Initially, bears test the market, pushing the price down, but bulls step in to rescue the momentum, leading to a close closer to the candle’s opening.

This behavior highlights the fragility of the ongoing rally and the potential for a reversal.

However, confirming such a reversal depends on whether the bulls achieve a higher close, indicating continued bullish sentiment.

Confirmation of both patterns requires the reversal to commence promptly.

Ideally, the candle immediately following the Hammer or Hanging Man should initiate an apparent reversal in the new direction.

Additionally, complementary indicators can be utilized to confirm the reversal signal further.

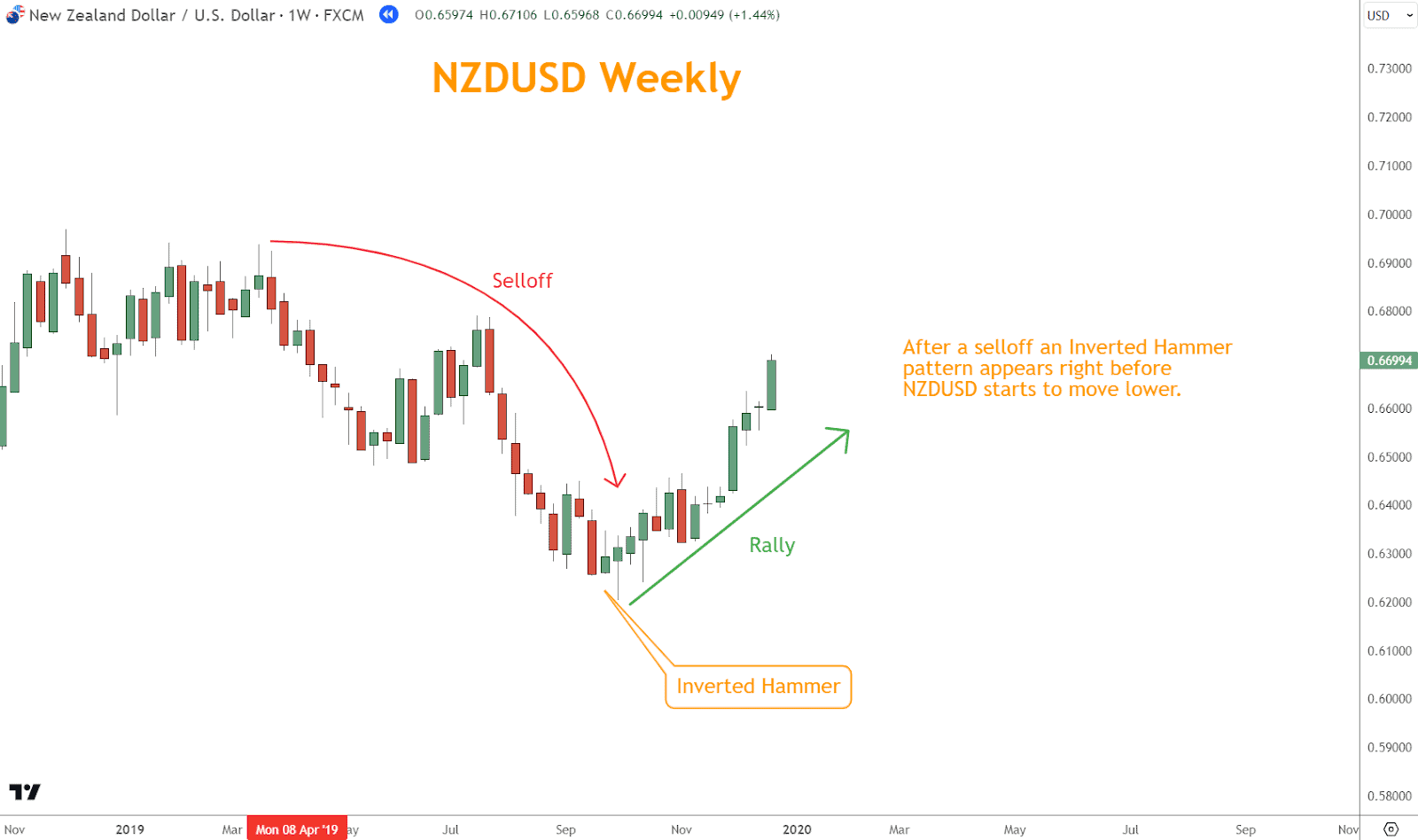

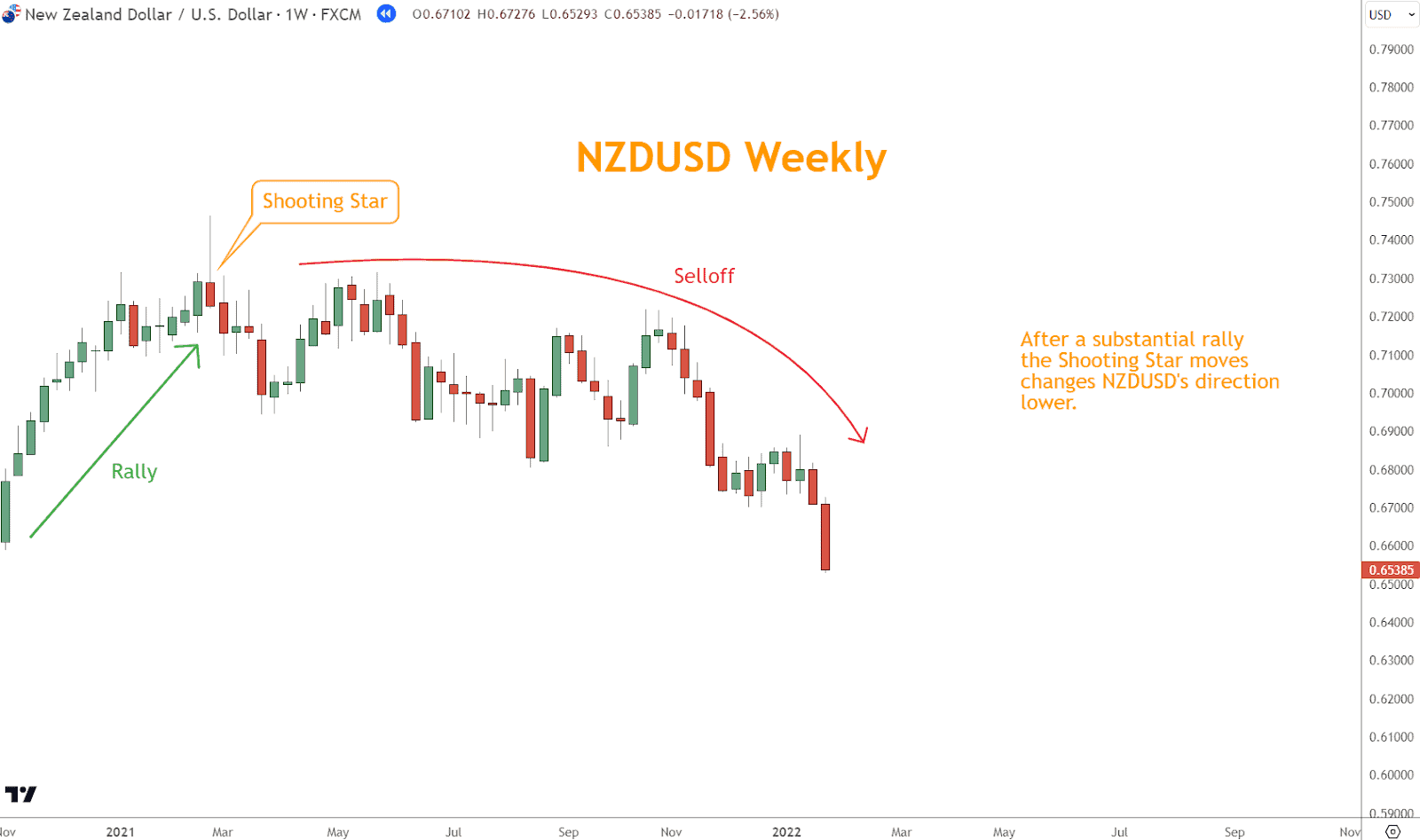

Inverted Hammer and Shooting Star

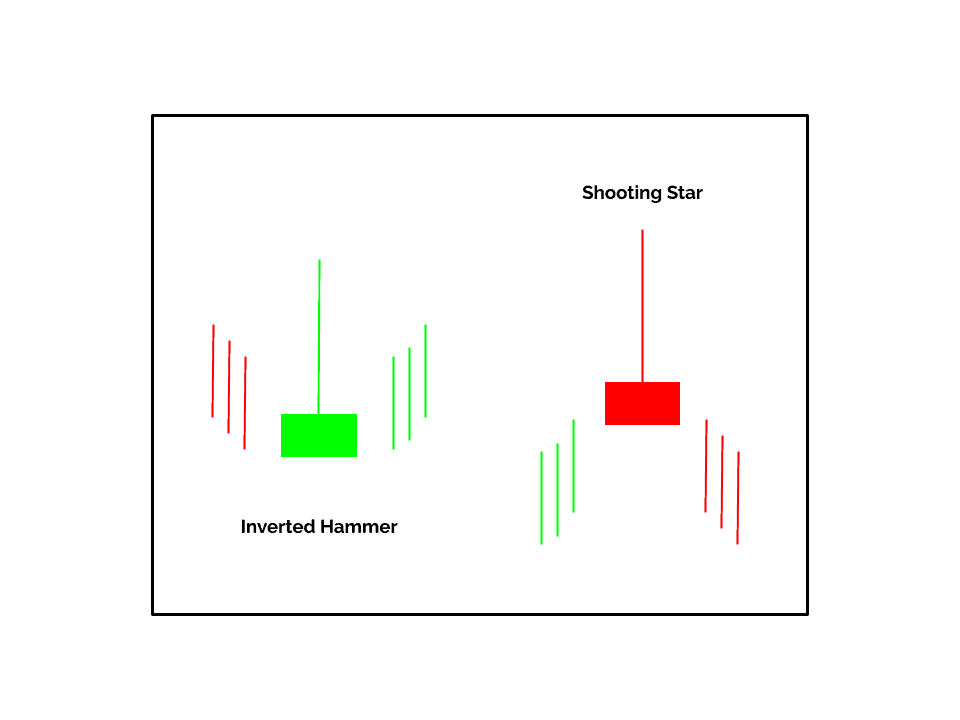

The Inverted Hammer and the Shooting Star are similar one-candle Japanee candlestick reversal patterns, with the Inverted Hammer at the end of Selloffs and the Shooting Star at the top of Rallies.

Both candlesticks have short bodies and long upper shadows, indicating the possibility of a reversal.

The Inverted Hammer is a Bullish reversal candlestick with a small body and long upper shadow, indicating a Bullish reversal.

In the example below, the selloff ends after the Inverted Hammer candle. Prices immediately reverse higher.

In contrast, the Shooting Star is a Bearish reversal candlestick, with a long upper shadow and short body, appearing at the end of a Rally.

In the example below, the Shooting Star appears at the end of a rally, setting up a selloff lasting many months.

Like the Hammer and Hanging Man, they look like each other, but the trader psychology they reflect is different.

Like the Hanging Man, the Inverted Hammer demonstrates the current selloff’s fragility by temporarily reversing the Bearish Momentum.

By comparison, the Shooting Star reflects a failure by the Bulls to push prices higher instead of closing near the candle’s opening.

Again, if the Bulls can generate a Bullish Inverted Hammer, it implies they have more Momentum, and the likelihood of a Bullish reversal is higher.

If the Shooting Star candle finishes with a red candle, the Bears have more control, and a reversal is more likely.

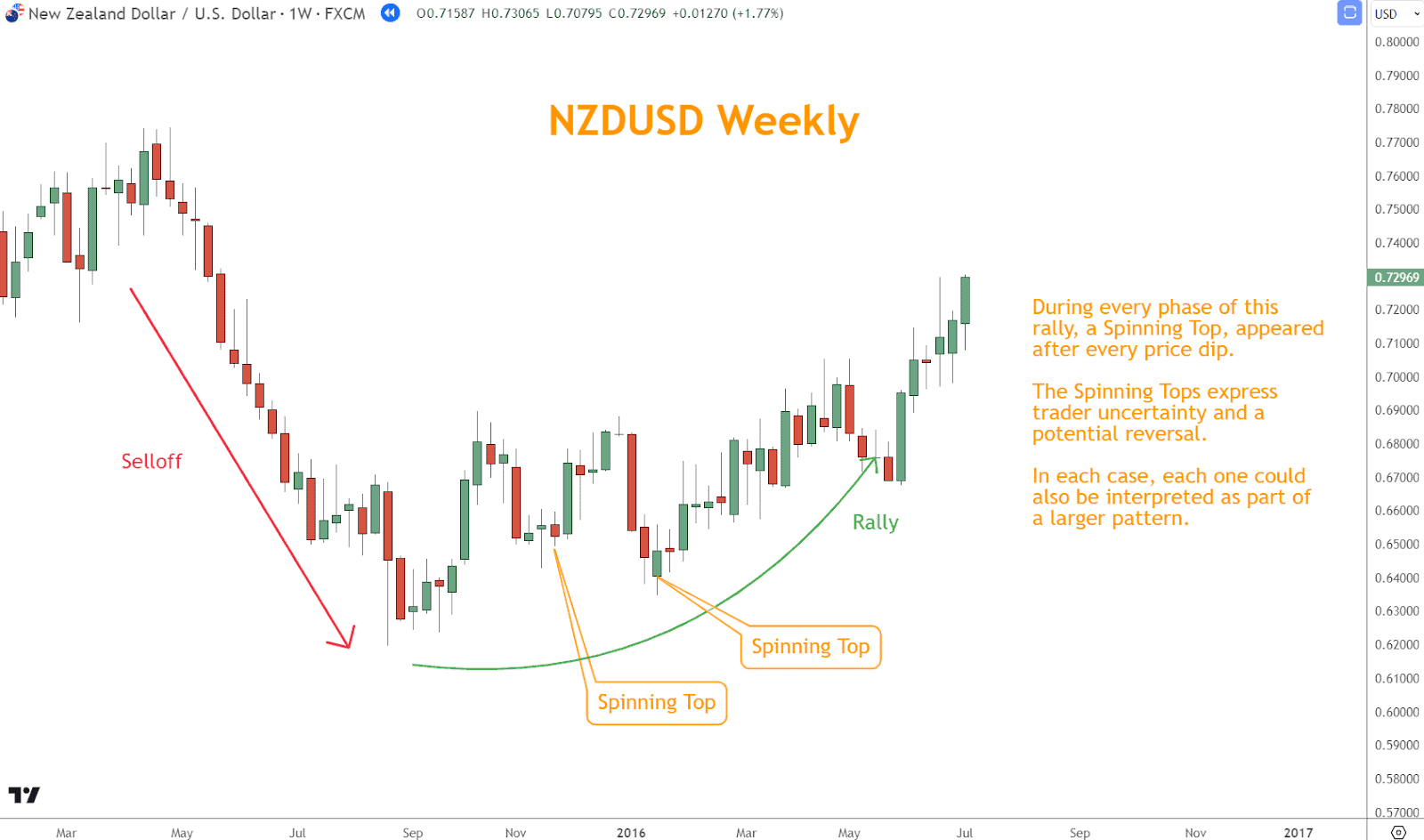

Spinning Top

The Spinning Top candlestick pattern is a reversal signal, demonstrating trader indecision.

The candlestick has a long shadow on top and another long shadow on the bottom, with a small body in between.

This pattern can occur at the top of Rallies (Bearish reversal) or at the end of Selloffs (Bullish reversal).

In the example below, a Spinning Top appears at the bottom of a selloff and marks a Bullish reversal as part of a larger, more complex pattern.

Within each pullback of the rally, a Spinning Top appeared, and prices reversed higher.

Spinning Tops occur because they are “tired” after an extended move higher or lower.

If trader indecision develops during a Rally, it indicates that selling pressure is increasing despite higher prices; traders should look for Bearish confirmation before taking action.

How is the Doji Candle Pattern Different?

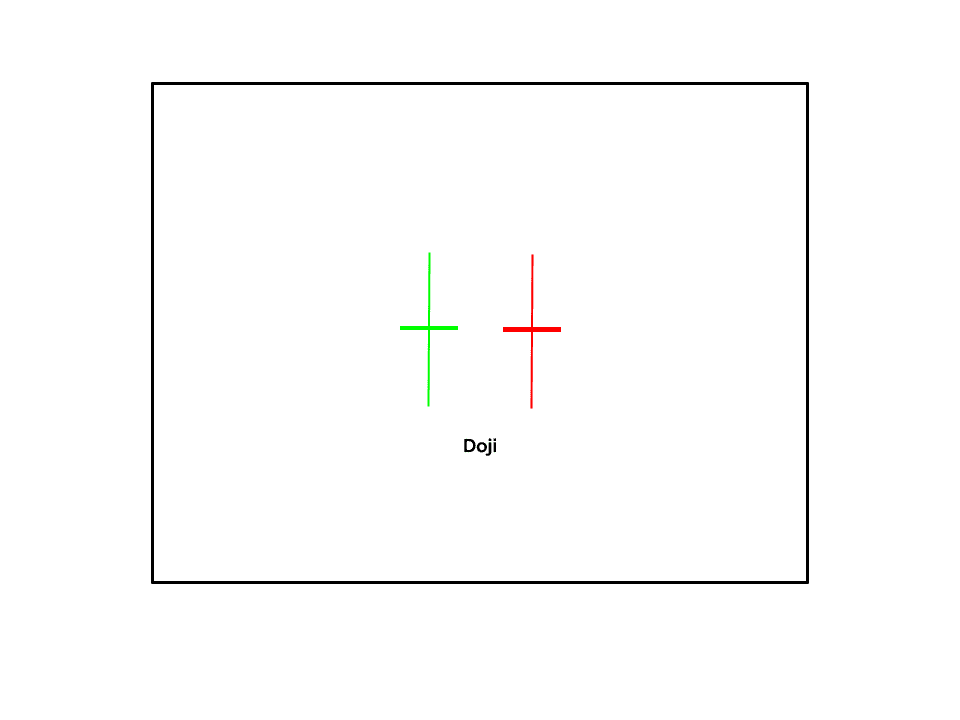

The Doji is a one-candlestick reversal pattern like the Spinning Top, but it has nearly identical open and close.

This is a more extreme example of trader uncertainty and can foreshadow a reversal.

There are a few interesting variations to the Doji, but traders reconsider the market when the close is in the candle’s center with large shadows above and below.

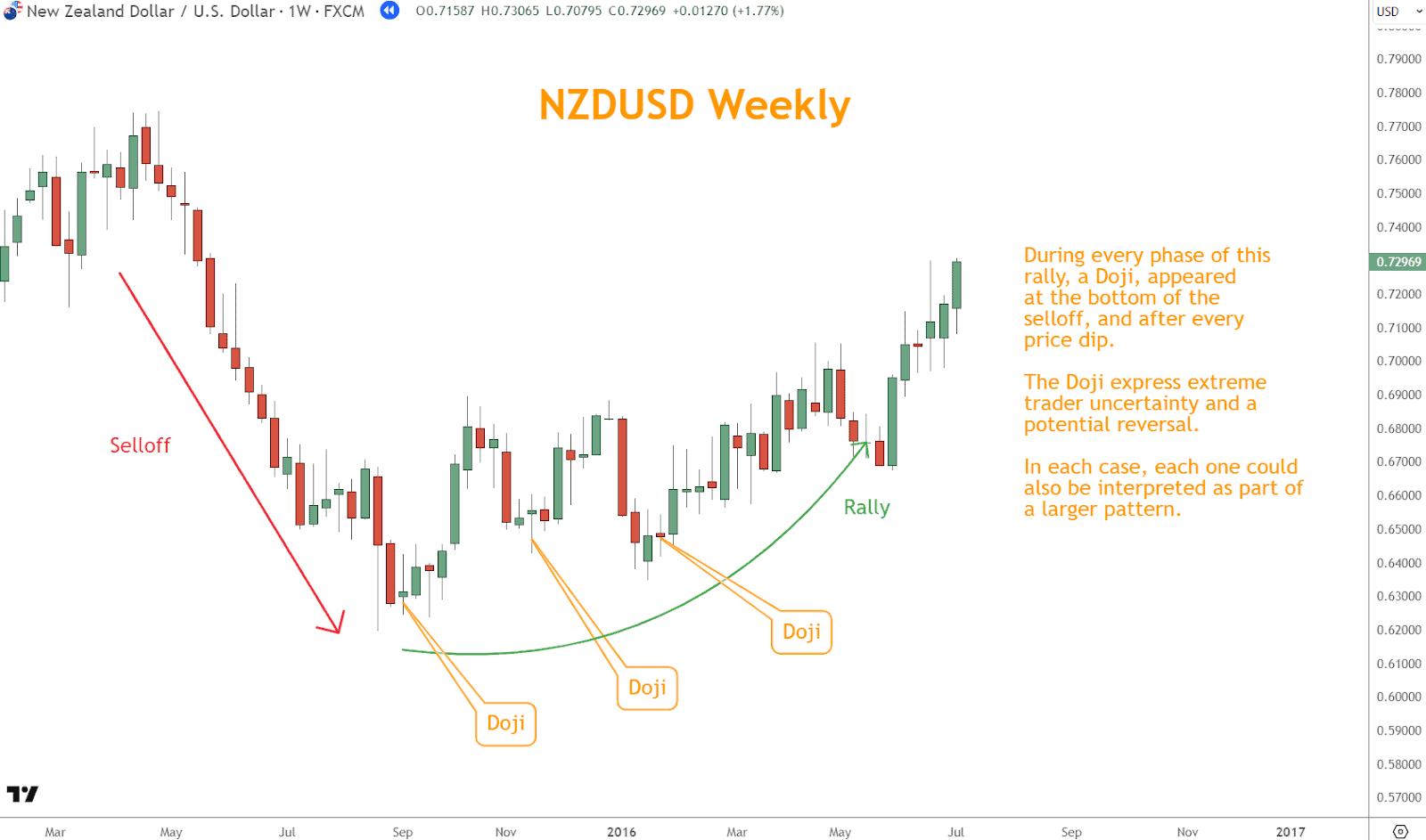

In the example below, NZDUSD printed a Doji at the end of the selloff and every pullback in the subsequent rally.

The Doji Candlestick is part of two three-candle pattern reversals: Morning Star and Evening Star.

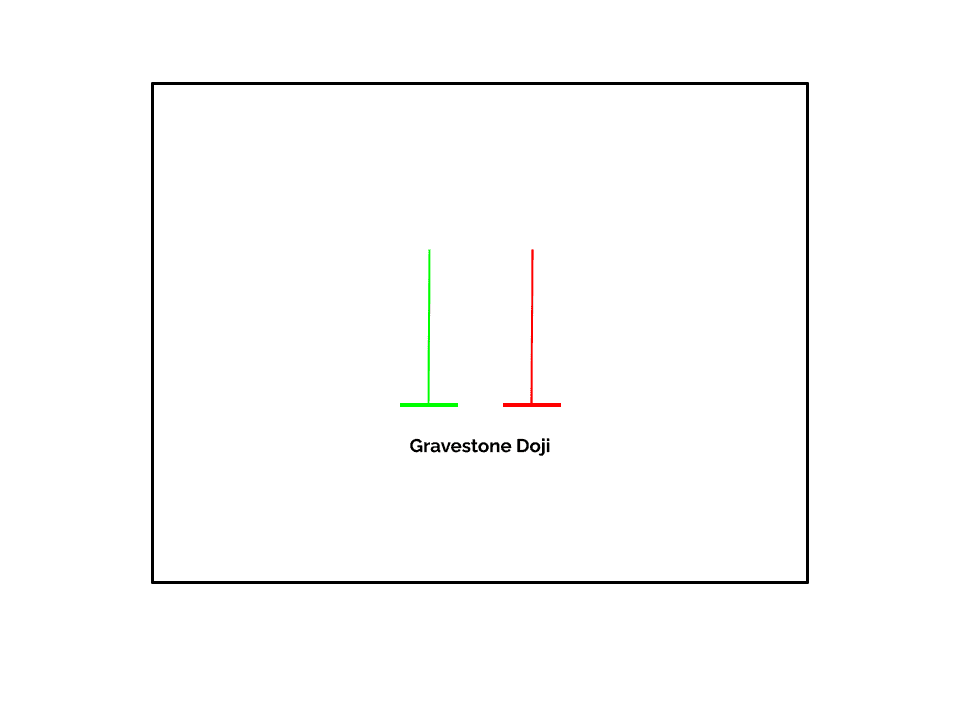

Gravestone Doji

A Gravestone Doji is a one-candlestick pattern resembling a Shooting Star appearing at the top of a Rally.

This candle pattern reflects the Bears’ wrestling control over the Bulls.

However, there is no small body, but rather an open and closed at the same price.

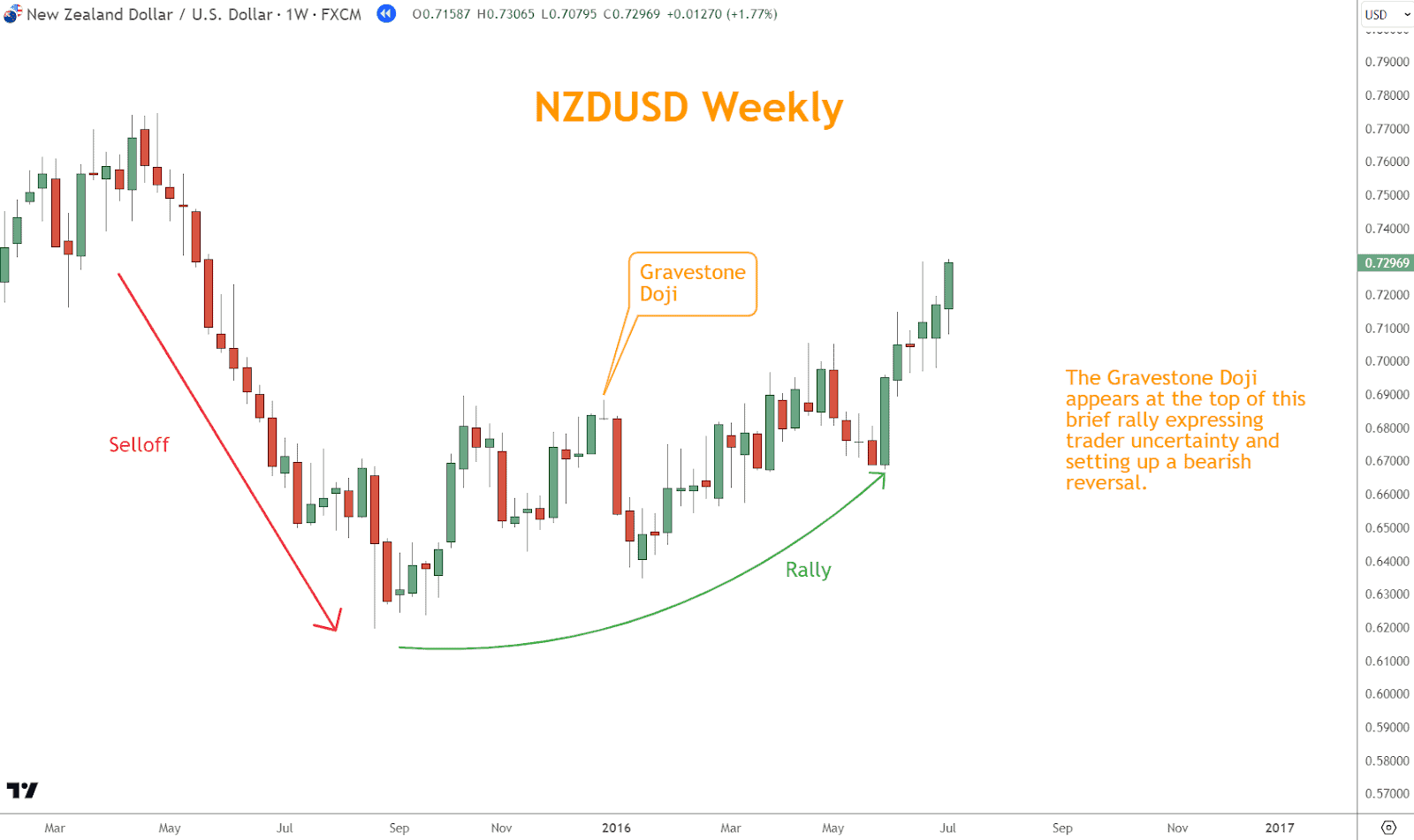

In the example below, the Gravestone Doji marks the end of a brief rally and sets up a downside reversal.

Traders believed NZDUSD had moved too far too fast.

This price action reflects a more neutral trader mindset than a green or red body.

Dragonfly Doji

A Dragonfly Doji is a one candlestick pattern resembling a Hammer at the bottom of a Selloff, but there is little to no body because it’s a Doji.

Like a Hammer, this is a Bullish reversal pattern, and since there is no body, it reflects a more neutral sentiment than a Hammer with either a green or red body.

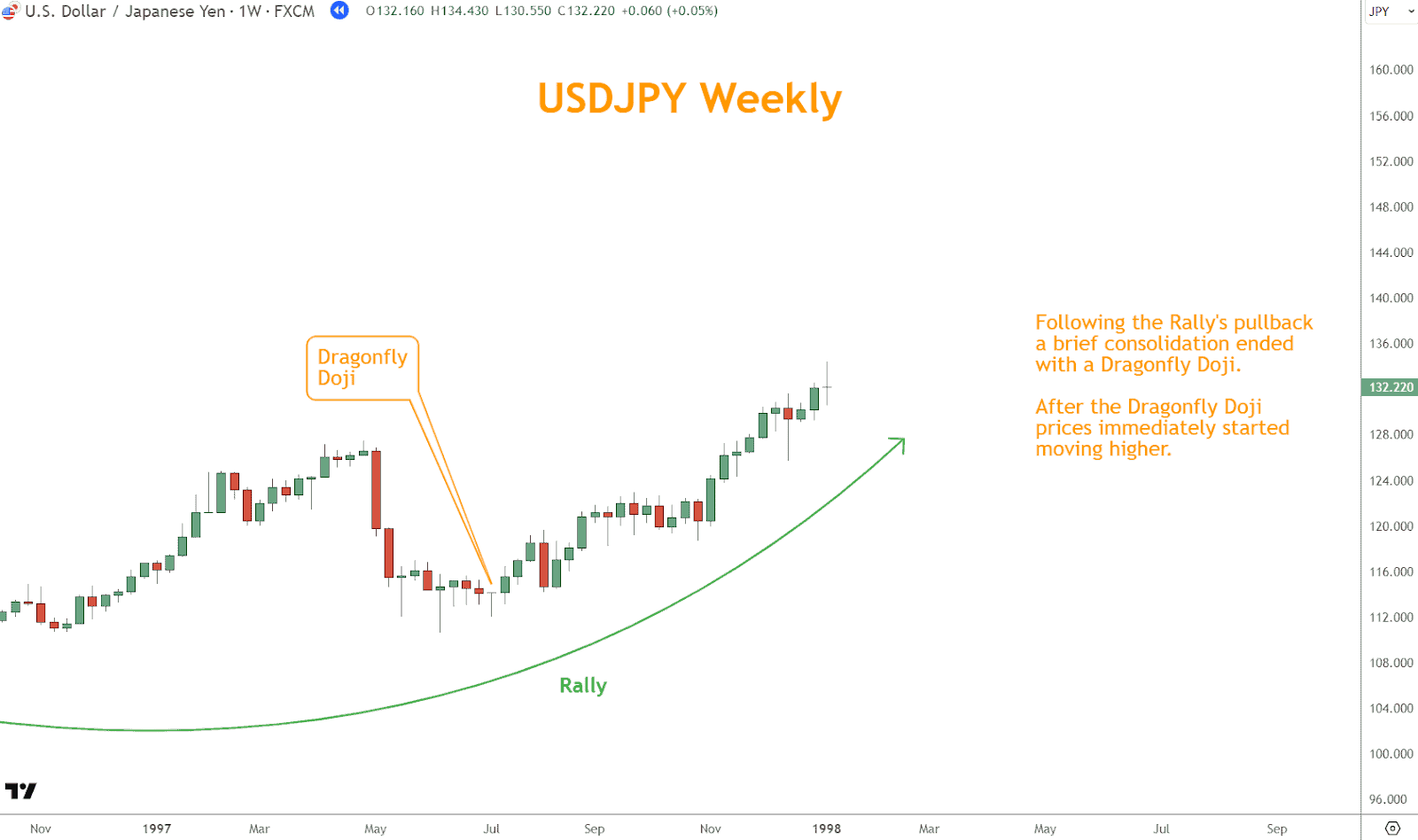

In the example below, the rally resumes after a consolidation period and the appearance of a Dragonfly Doji.

The Dragonfly Doji appears at the end of a pullback and consolidation in the longer rally.

Combining one-candle Japanese candlestick patterns with technical analysis tools

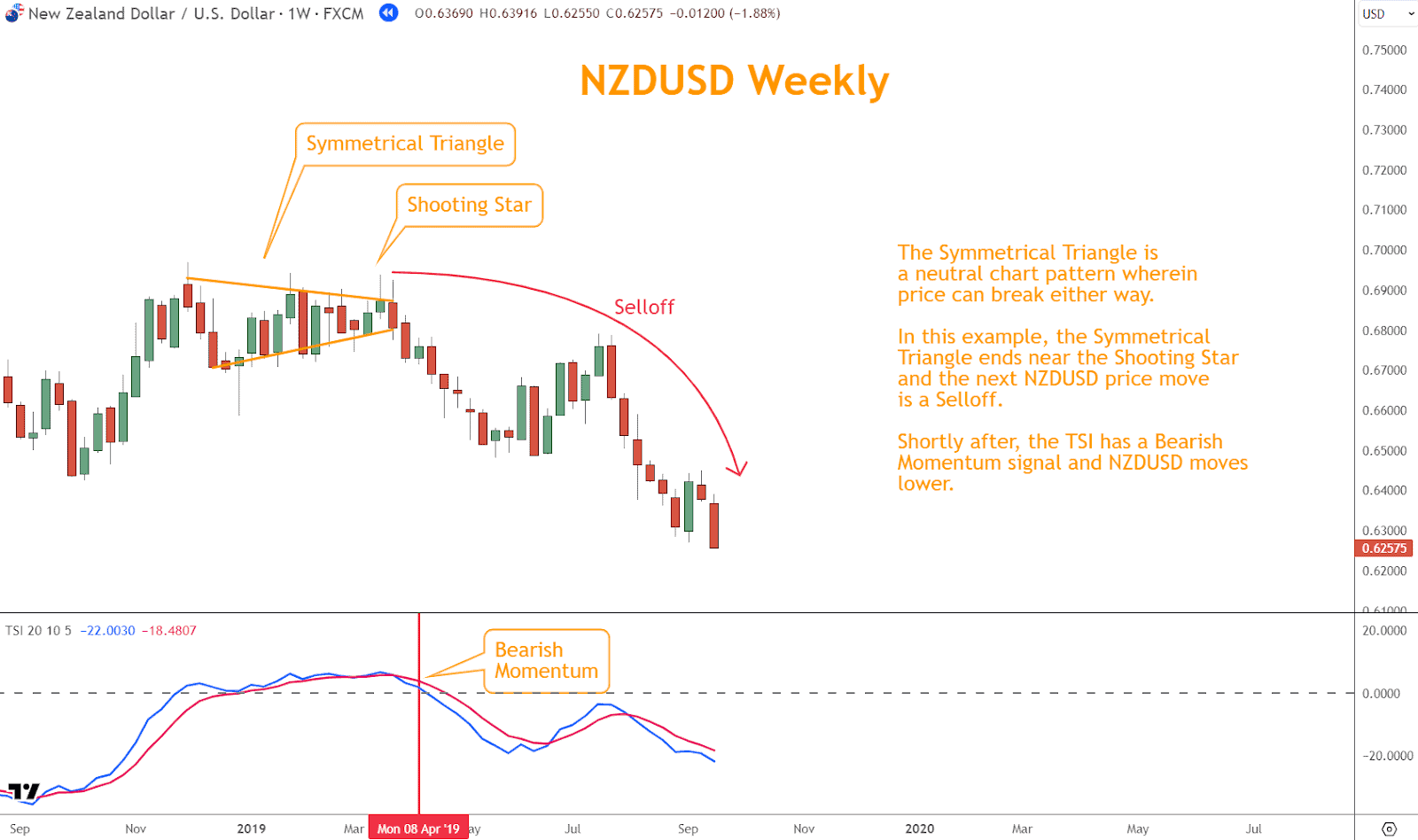

Combining one-candle Japanese candlestick patterns with technical analysis tools such as the True Strength Index (TSI), chart patterns, and support and resistance levels can significantly enhance your ability to make informed decisions in the financial markets.

Firstly, integrating Japanese candlestick patterns with the TSI provides a comprehensive view of price action and momentum.

Candlestick patterns offer insights into market sentiment and potential trend reversals within a single trading session.

At the same time, the TSI measures the strength and direction of price momentum over a specified period.

By combining these two approaches, you can identify convergence or divergence between price movements and momentum, thereby confirming or invalidating potential trade setups.

For example, a bullish candlestick pattern accompanied by a bullish TSI cross suggests a buying opportunity, reinforcing the likelihood of a price reversal to the upside.

In both the bullish and bearish examples, momentum provided a confirmation signal shortly after the single candle signal.

The bearish signal came after the Shooting Star, and the bullish signal came after the Inverted Hammer.

Secondly, incorporating Japanese candlestick patterns into the analysis of chart patterns adds depth to technical analysis by providing additional confirmation signals.

Chart patterns, such as triangles, head and shoulders, and flags, offer valuable insights into market psychology and potential price movements over a longer timeframe.

By identifying candlestick patterns within these chart patterns, traders can validate the pattern’s reliability and improve the timing of their trades.

In the example below, a Shooting Star pattern occurring at the end of a Symmetrical triangle pattern enhances the probability of a successful breakout to the downside, providing traders with a high probability trading opportunity.

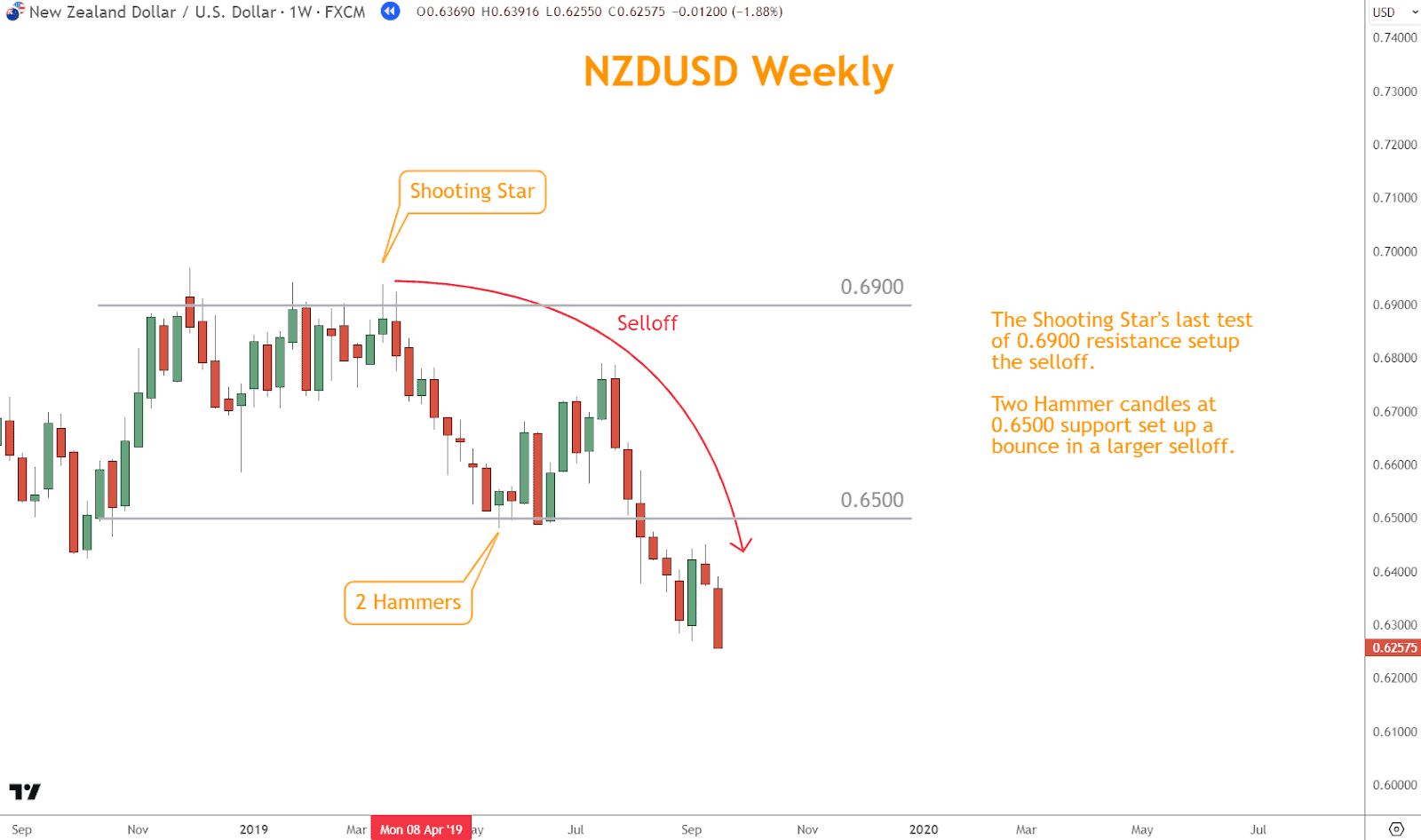

Furthermore, integrating Japanese candlestick patterns with support and resistance levels enhances the accuracy of trade entries and exits.

Support and resistance levels represent price levels where buying or selling pressure is historically significant, often leading to reversals or continuations in price trends.

By identifying candlestick patterns forming near crucial support or resistance levels, traders can anticipate potential price reactions and adjust their trading strategies accordingly.

Combining one-candle Japanese candlestick patterns with technical analysis tools such as the TSI, chart patterns, and support and resistance levels offers traders a comprehensive approach to analyzing price action and making well-informed trading decisions.

What are your Next Steps?

Using what you’ve learned, select a chart and look for One Candle Japanese Candlestick pattern reversals.

In addition, look for opportunities to coincide them with other technical analysis tools and techniques to see how they work together.

Discover how they appear alone and with other candles to form patterns.

One can incorporate these patterns into a trading strategy.

You can make these patterns part of a trading strategy.

If you don’t have a trading strategy, consider using our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about one-candle Japanese Candlestick patterns.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies? I produce Videos and Guides to help you learn and improve your trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What Are One Candle Japanese Candlestick Patterns?

One-candle Japanese candlestick patterns, or single candlestick patterns, are formations on a price chart with just one candlestick.

These patterns provide valuable insights into market sentiment and potential price movements based on the characteristics of the candlestick.

How Do I Identify One Candle Japanese Candlestick Patterns?

To identify one-candle Japanese candlestick patterns, you must understand the significance of different candlestick shapes and their positions within the overall trend.

Common one-candle patterns include the Doji, Hammer, Shooting Star, and Spinning Top.

Each pattern has unique characteristics that signal potential shifts in market direction.

What Is the Significance of One Candle Japanese Candlestick Patterns?

One candle Japanese candlestick patterns provide traders valuable information about market psychology and potential price reversals or continuations.

These patterns can indicate indecision, bullishness, or bearishness, depending on the shape and location of the trend.

Traders use them to make informed decisions about entry and exit points in the market.

How Can I Use One Candle Japanese Candlestick Patterns in My Trading Strategy?

Incorporating one-candle Japanese candlestick patterns into your trading strategy involves observing them in conjunction with other technical analysis tools, such as channel lines, support and resistance levels, and indicators.

For example, a Hammer candlestick pattern appearing at a significant support level may signal a potential bullish reversal, providing traders with a buying opportunity.