The Bullish Morning Star and Bearish Evening Star are important indicators among many candlestick patterns.

These patterns serve as visual representations of potential reversals in market direction.

Recognizing them can give you insights into upcoming price shifts, allowing for more informed trading decisions.

The importance of these patterns lies not just in their appearance but in their ability to offer a glimpse into the market’s sentiment and potential future direction.

What is The Bullish Morning Star Pattern?

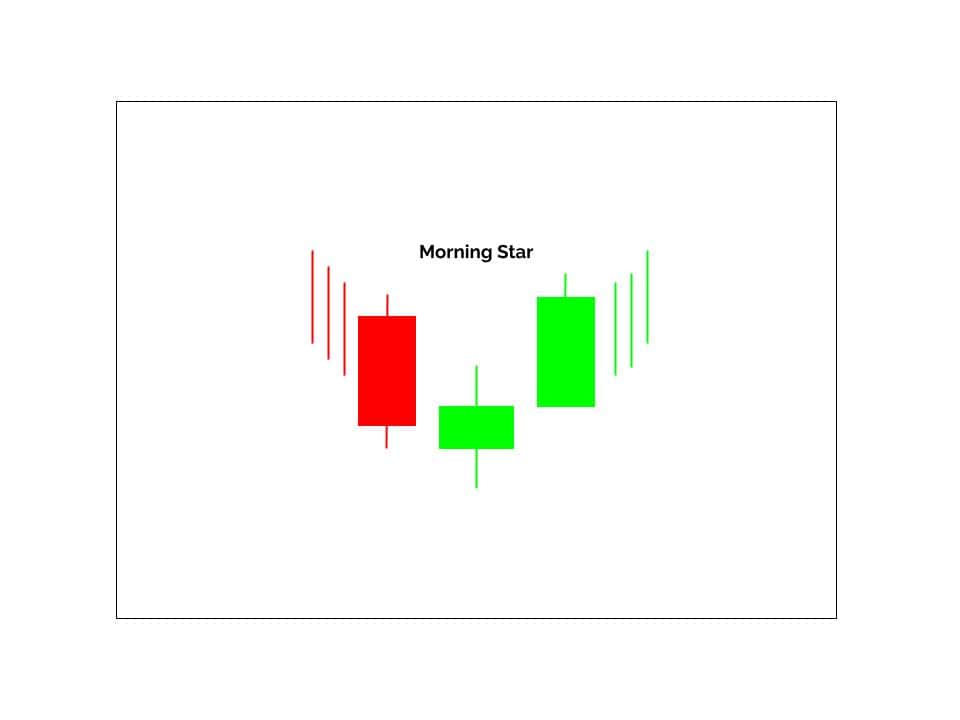

The Bullish Morning Star pattern is a compelling candlestick formation that you can monitor for signs of a potential upward shift in price.

Defined by a sequence of three candles, this pattern begins with a long Bearish candle, indicating intense selling pressure.

The small-bodied candle follows and can represent a period of indecision or consolidation in the market. It can be Bullish, Bearish, or Neutral. This candle is often a Doji or Spinning Top.

The sequence concludes with a long Bullish candle, signaling a resurgence of buying interest.

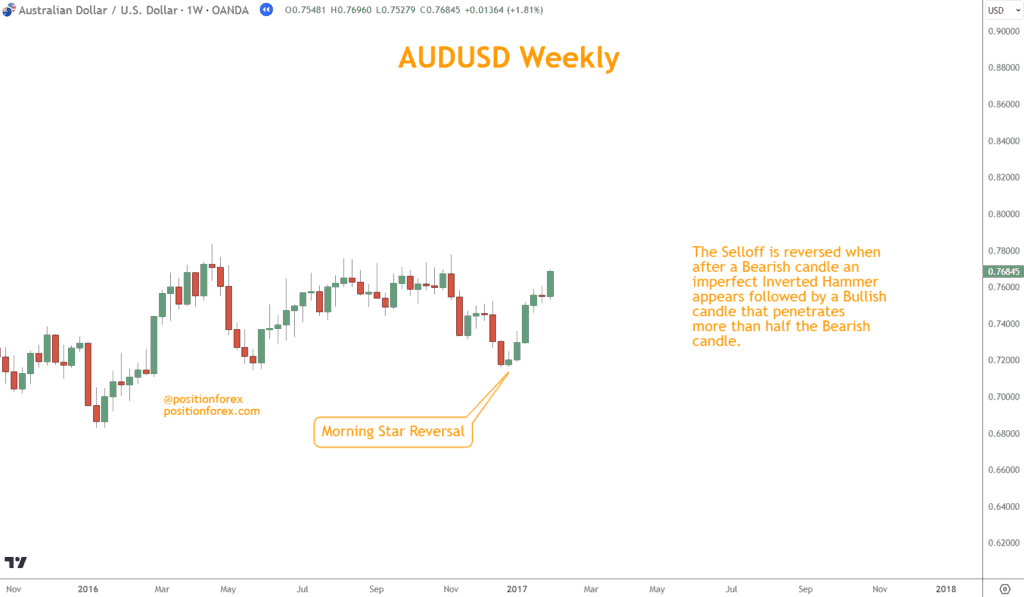

When observed after a pronounced Selloff, the Bullish Morning Star is seen as a potential reversal point, suggesting that the bears may be losing their grip and a Bullish Rally could be on the horizon.

For added confidence in this pattern, you might seek confirmation through other technical indicators, which I’ll cover shortly.

What’s a Bearish Evening Star Pattern?

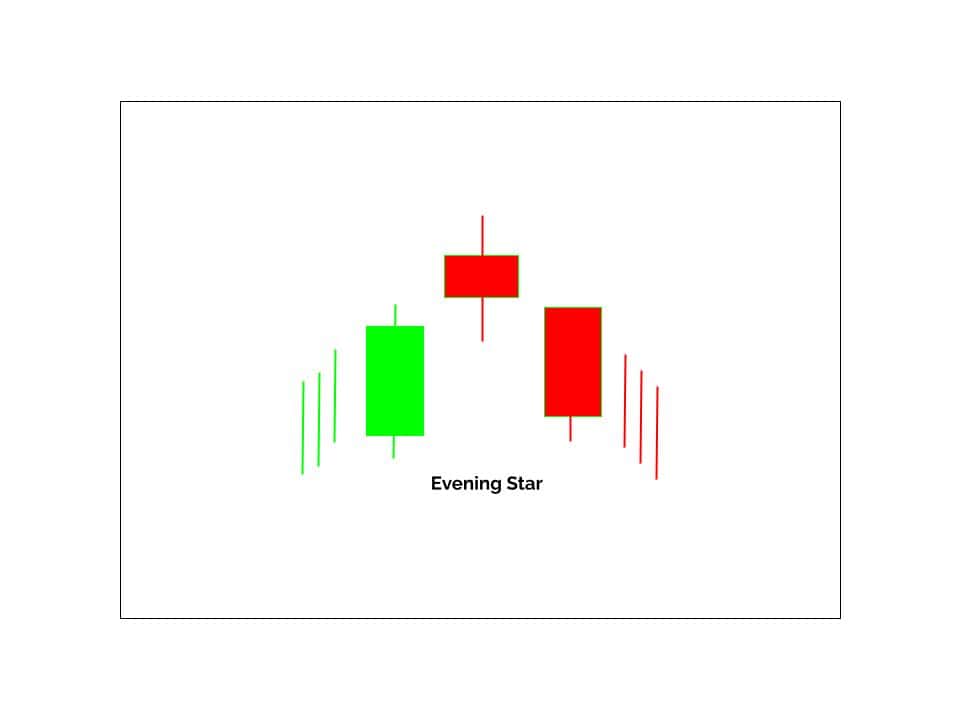

The Bearish Evening Star pattern is another crucial candlestick configuration that offers insights into potential market reversals.

The pattern has three candles. The first candle is long and Bullish, meaning buyers were dominant.

This Bullish candle is succeeded by a small-bodied candle, manifesting as Bullish, Bearish, or Neutral, indicating a pause or uncertainty in the prevailing direction. Often, this candle is a Doji or Spinning Top.

The pattern culminates with a long Bearish candle, suggesting a shift towards selling dominance.

Furthermore, integrating Chart Patterns, such as Triangles, Flags, or Head and Shoulders, can provide additional context and layers of confirmation.

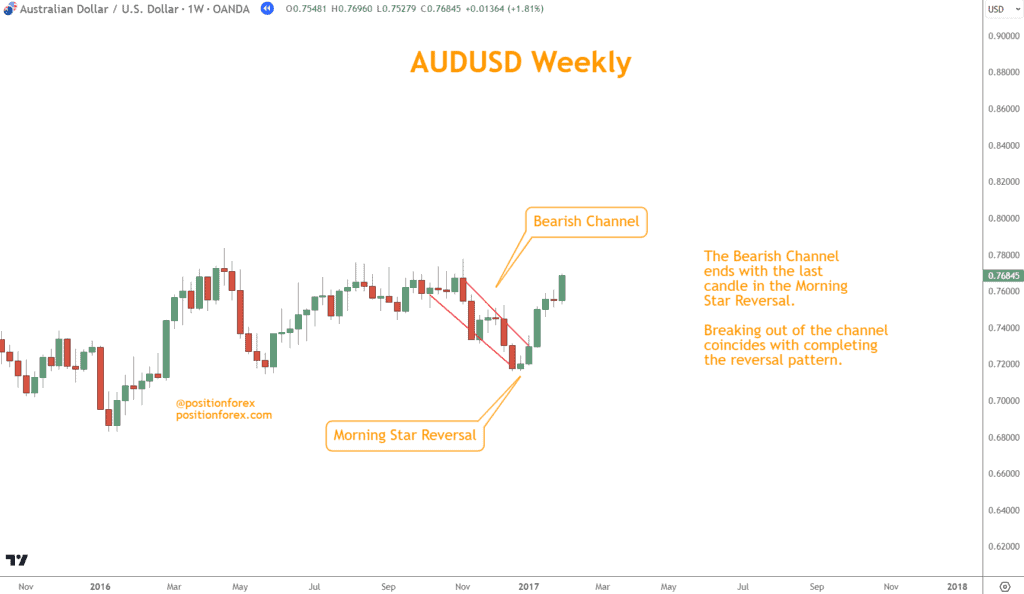

In this example, a Bearish Channel ends exactly where a Bullish Morning Star begins, and together, they form a potent Bullish signal.

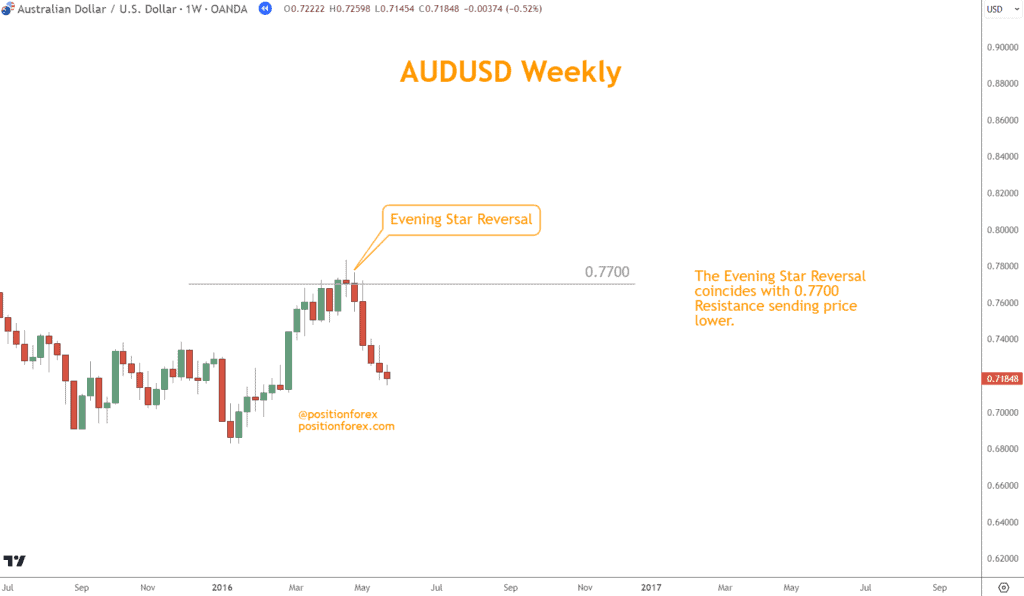

Lastly, the market considers Support and Resistance levels as crucial barriers, and when these levels form patterns, their predictive power strengthens.

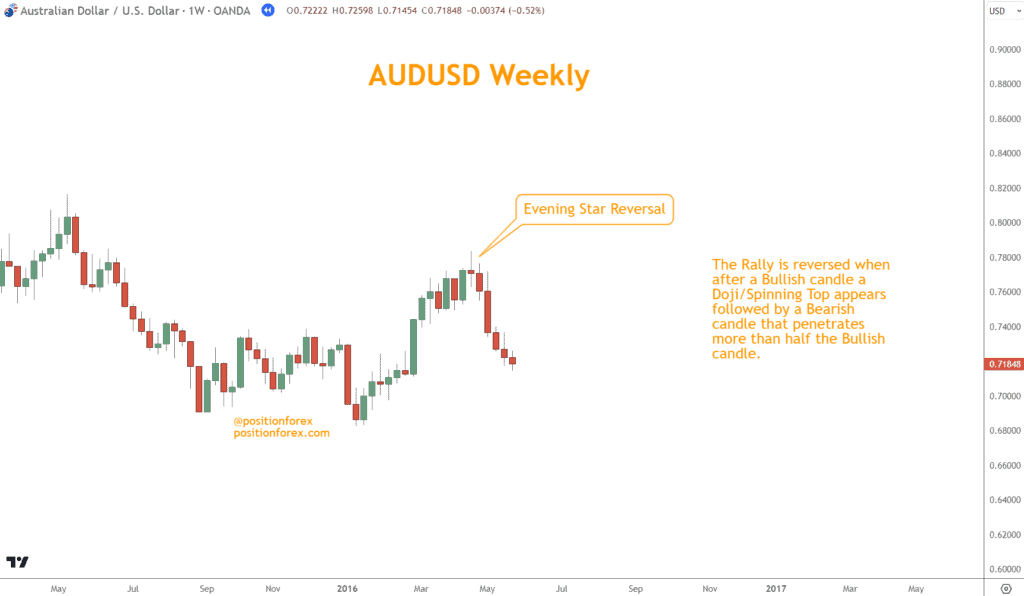

A Bearish Evening Star forming at a strong Resistance level might indicate a higher likelihood of a downward reversal.

By synthesizing these tools and indicators, you can craft a more holistic trading strategy around Bullish Morning Star and Bearish Evening Star reversals.

Conclusion

To sum up, the Bullish Morning Star and Bearish Evening Star patterns are essential in Forex trading.

Traders can use candlestick formations as a visual guide to possible market reversals. These formations act as signals amidst currency price changes.

However, as with all trading tools, it’s imperative to approach these patterns with a balanced perspective. Do not use them in isolation, even though they often indicate future price shifts.

Remember to seek confirmation through other technical indicators and be cautious when trading.

What’s the Next Step?

Select a favorite chart and look for Morning Star and Evening Star reversal patterns using what you learned in this article.

In addition, look for opportunities to coincide them with other technical analysis tools and techniques to see how they work together.

Combining Momentum, Chart Patterns, and Support and Resistance can give you a comprehensive view and understanding to make trading easier.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about these patterns.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions (FAQs)

What are the Main Differences Between the Bullish Morning Star and Bearish Evening Star patterns?

The Bullish Morning Star indicates a reversal from a Selloff to a Rally, while the Bearish Evening Star suggests a reversal from a Rally to a Selloff.

How Reliable Are These Patterns in Predicting Price Reversals?

While these patterns are considered reliable indicators of potential reversals, no pattern is a guarantee.

It’s essential to use them in conjunction with other technical analysis tools and to consider the broader market context.

Are There Variations of These Patterns?

There are variations like the Morning Doji Star and Evening Doji Star, where the small-bodied second candle is a Doji.