Trading with Momentum involves buying and selling Forex based on the energy moving a particular pair.

In other words, Momentum trading is purchasing an asset performing well and selling an asset not performing well.

You can use several technical analysis indicators to determine Momentum, such as:

- Relative Strength Index (RSI)

- Stochastic Oscillator

- Commodity Chanel Index (CCI)

- True Strength Index (TSI)

This article will cover Momentum trading and how to use it to your advantage while trading markets.

We will also introduce you to different Momentum indicators and how you can combine them with other strategies.

What is Momentum Trading?

Momentum trading focuses on shorter-term price movements rather than longer-term factors.

This type of trading looks for instruments emerging from pullbacks or consolidations, creating new trading opportunities.

The idea behind Momentum trading is that buying an instrument already moving in a given direction is the best chance for profitability.

Trend vs. Momentum: Is There a Difference?

These terms are often conflated but are very different and have different purposes.

For example, Momentum trading focuses on an instrument’s short-term energy, whereas Trend reflects the instrument’s overall direction.

Trends are Bullish, Bearish, or Neutral based upon periods of successive price movements.

Momentum can be used to find Overbought or Oversold periods for entries during a Bullish, Bearish, or Neutral Trend. These entries are opportunities within existing Trends.

Does Momentum Trading Work?

Momentum trading exploits short-term price fluctuations at a Trend’s beginning, during, or end.

You can use it to identify reliable trade entry and exit points, helping you progress your trading strategies.

These entries and exits are mispriced instruments giving you opportunities to capitalize and make profits. The mispricing is typically expressed as states of Overbought or Oversold.

You can use short-term price fluctuations measured by Momentum trading to achieve better returns while mitigating risk and increasing profitability.

Volatility: Opportunities and Dangers

Momentum involves trading an instrument when it continues moving in its current direction.

In the short term, high volatility or the lack of volatility in a forex pair is beneficial. Short-term rises and falls in the value of an instrument create pullbacks and breakthroughs, presenting opportunities for you to enter and exit trades.

If an instrument is Rallying, a sudden pullback in price can reduce Momentum and create an opportunity to enter a long trade.

Conversely, the opposite can be found in a Selloff.

During periods with little Momentum, look for opportunities to re-enter a Trend complementing the volatility with other indicators and techniques.

Periods of high volatility may result in rapid price swings necessitating a smaller position size since these trades are high risk.

Therefore, risk management must be taken into consideration with Momentum strategies.

Can you Find Perfect Entry and Exit Timing?

Entry and exit timing is essential when opening any trade, and Momentum can help.

Perfect timing can allow you to take advantage of entries and exits to generate profits.

Ideal timing depends on combining Momentum with Trend and other technical analyses such as Chart Patterns, Japanese Candlesticks, and Support and Resistance.

If an instrument is already in an established Bullish Trend but recently experienced a short-term pullback, this will be reflected in a Momentum indicator.

In all likelihood, this indicator has turned Neutral or even Bearish.

With patience, you can wait to see if the instrument’s price starts moving to a higher price, taking the indicator higher.

This is an opportunity to enter a long position believing the Trend and Momentum will move higher after a brief “dip.”

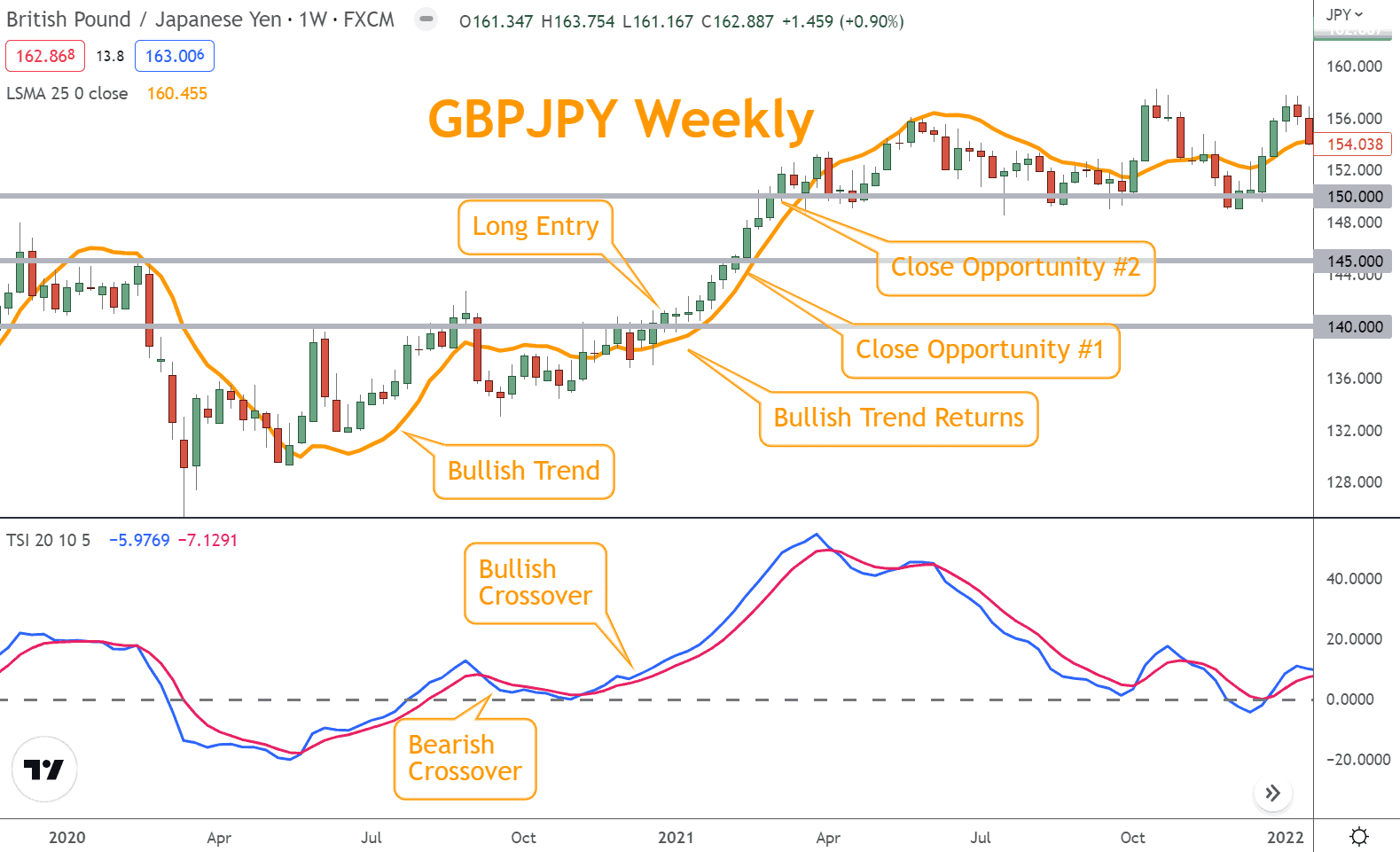

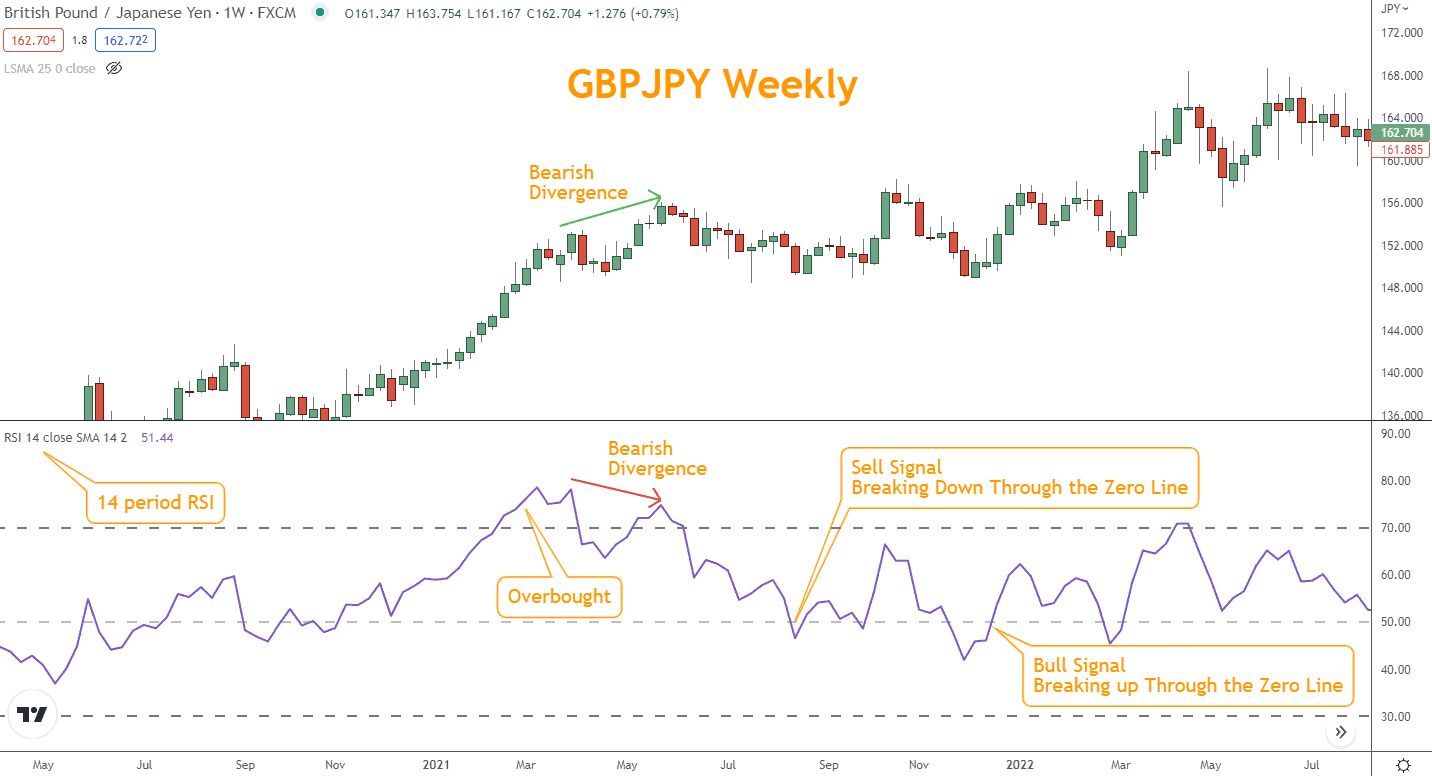

See the example below:

This “buy the dip” strategy is one of the most popular ways to use Momentum as a trading strategy. In addition, incorporating the change with other signals can increase the likelihood that your trade will be a winner.

Traders must carefully combine these elements and determine the best entry time for their situation to achieve success consistently.

Momentum Trading Advantages

Advantages:

- You can leverage market volatility to find opportunities.

- You are likelier to keep a higher percentage of the profits earned in an open trade.

- Keeping trades open until a Trend ends often returns much of your profit to the market.

- You can find multiple entries and exits during periods of long trends.

- It will help you avoid incorrect entries where Trend indicators give false signals.

Momentum Trading Disadvantages

Disadvantages:

- You may miss opportunities because a fast-moving market makes entry impossible.

- You may close trades earlier than you should have with an instrument reached an Overbought or Oversold state.

- It can complicate an opportunity since it can counter other tools and techniques.

- If you allow it, market sentiment can move Momentum enough to confuse you out of your trading rules.

What are the Popular Momentum Indicators?

Popular indicators are:

- Relative Strength Index (RSI)

- Stochastic Oscillator

- Commodity Chanel Index (CCI)

- True Strength Index (TSI)

These indicators can help you measure a forex pair’s energy and determine when to enter and exit trades.

Ideally, these indicators are used with others and techniques to optimize entries and exits.

These indicators are readily available on most charting platforms, including TradingView.

If you are looking for a charting platform and are interested in TradingView, you can get a free account here. However, we will receive a commission if you sign up for a paid version.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is an oscillator developed by J. Welles Wilder and is commonly used in trading. The RSI measures an instrument’s average rate of change over a specified period.

Fourteen days are used as default, but other periods can be substituted.

The RSI ranges from 0 to 100, with readings below 30 representing Oversold conditions and above 70 indicating Overbought territory.

Buy signals are generated when the RSI crosses back above its centerline after dipping below it during a Selloff; conversely, sell signals occur when RSI falls below its centerline after a Rally.

You can also use the RSI to identify periods of divergence where a forex pair is making new price highs, but the RSI is making lower price highs.

This divergence can indicate lower prices ahead (the converse is also true). However, while this is a popular idea, divergence strategies are unreliable.

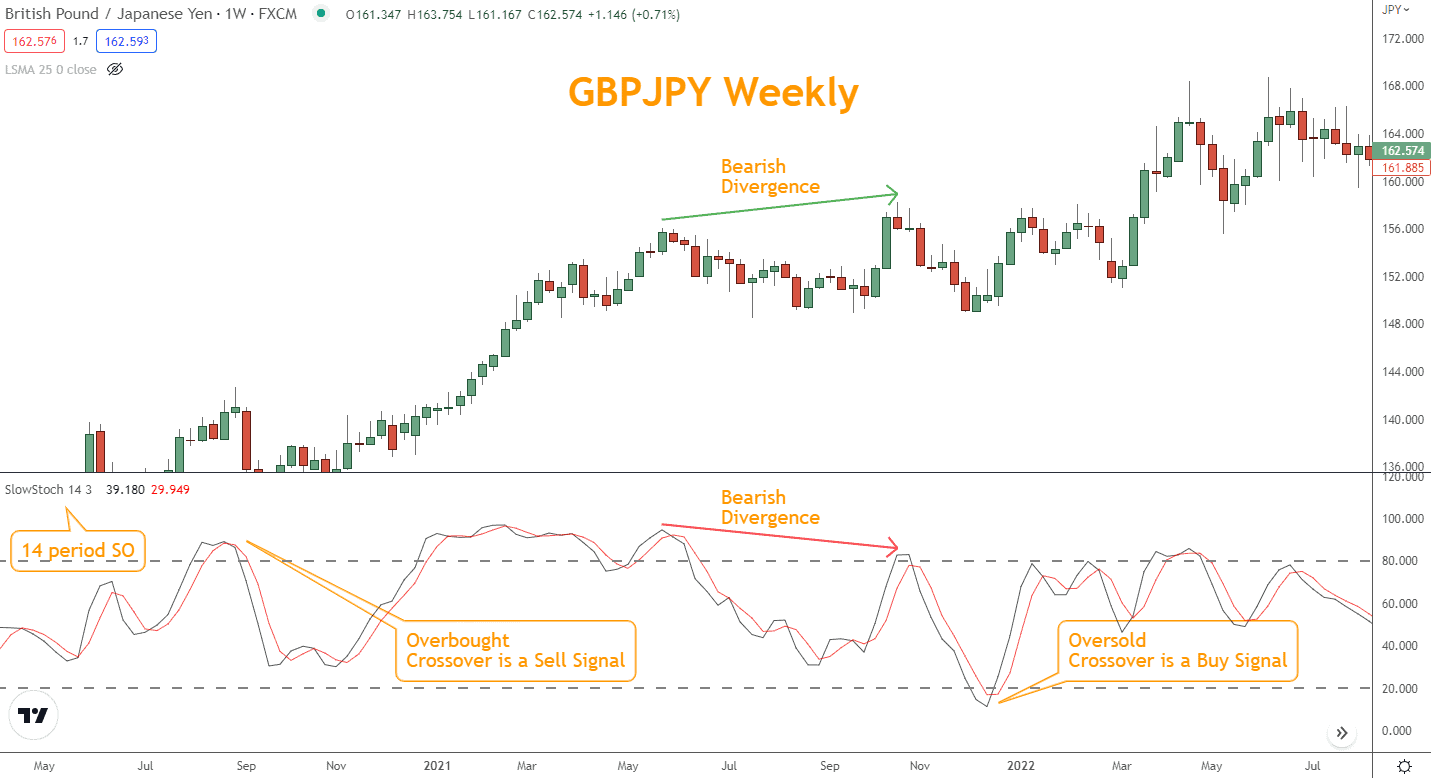

Stochastic Oscillator

The Stochastic Oscillator is another oscillator helping you identify Overbought and Oversold conditions similar to the RSI.

The indicator consists of an indicator line, which oscillates between zero and 100, and a signal line, which shows the average level of the day’s close relative to a 14-day average.

The market is overbought or oversold when the Stochastic Oscillator exceeds 80 or falls below 20.

When the indicators and signal lines cross in the overbought or oversold regions, traders can take it as a direct signal to buy or sell accordingly.

This indicator has a “fast” version and a “slow” version.

The slow version featured here smooths out the jittery nature of the fast variant.

The primary difference between the RSI and Stochastic Oscillator is in their calculation.

The Stochastic Oscillator is calculated using the highs and lows of price, whereas the RSI focuses on price differences over time. Although their calculation method differs, the result on a chart is similar.

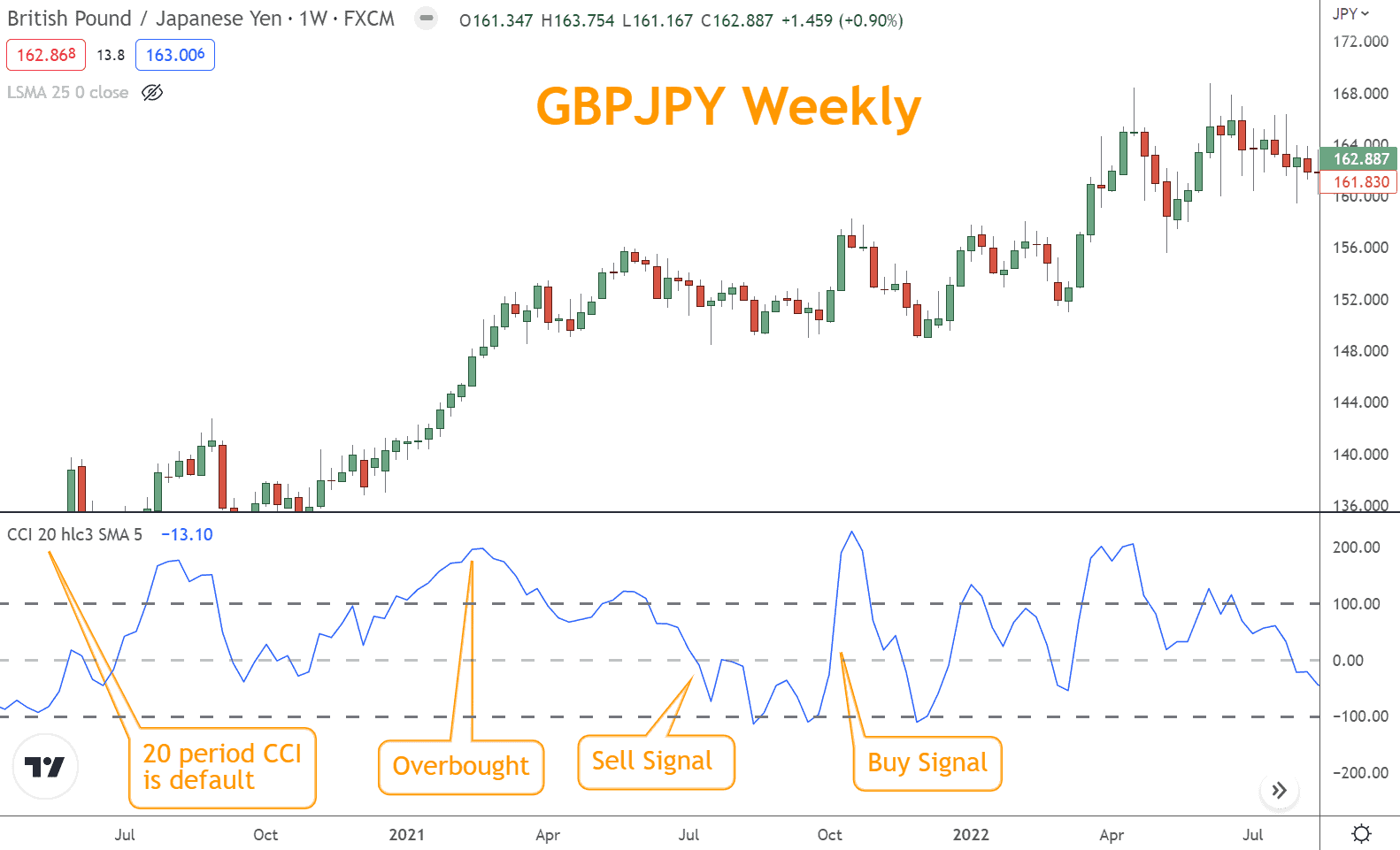

Commodity Channel Index

The Commodity Channel Index (CCI) is an indicator that can be used to identify Overbought and Oversold conditions similar to the RSI and Stochastic Oscillator.

Despite the “Commodity” in its name, it can be used in the forex and other financial markets.

The CCI measures the current price level relative to its average over a specific period.

The indicator consists of an oscillator that moves between positive and negative territory; readings above +100 indicate Overbought conditions, while readings below -100 represent Oversold territory.

Buy signals and sell signals occur when the CCI crosses above or below its centerline.

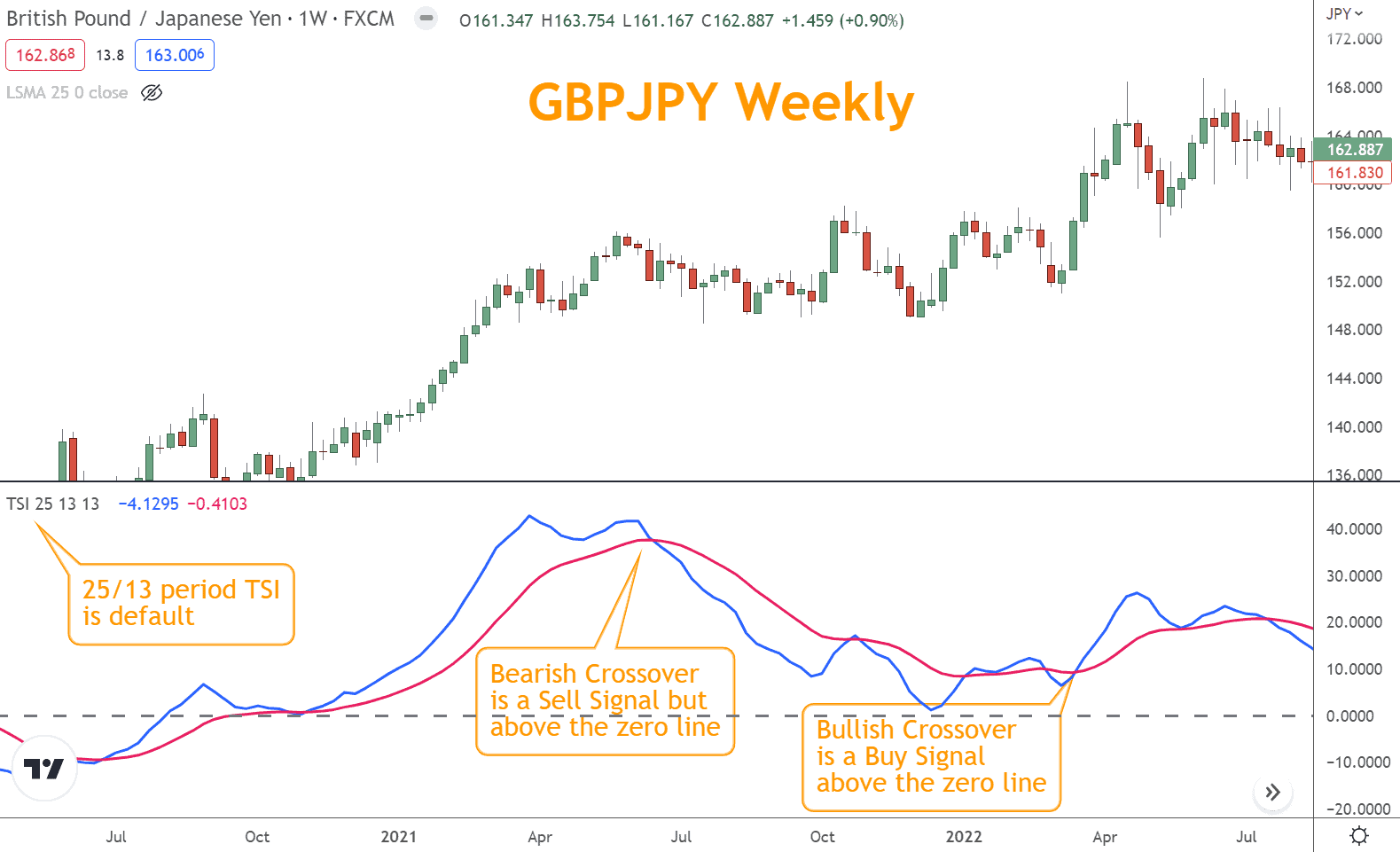

True Strength Index

The True Strength Index or TSI is an oscillator measuring buying and selling pressure using two moving averages, one fast and one slow.

When the fast-moving average crosses above or below the slow-moving average, it generates buy or sell signals.

The center or zero line also symbolizes a Bullish or Bearish bias depending on where the TSI lines are and where they are going relative to price.

Therefore, you can take long trades when the TSI is above the zero line and short ones below the “0” line.

The True Strength Index can also be used to identify divergence.

When price action makes a new high or low, but the indicator fails to do so, this may be a sign that a reversal could be imminent.

Like other indicators, however, divergence is an unreliable method.

Combining Momentum Indicators with Other Technical Analysis Indicators Best Practices

While Momentum is an exciting and valuable element in trading, it’s unreliable.

The primary reason is a need for more context. If a forex pair’s price has a sharp move higher, knowing whether that’s in context with a Bearish or Bullish Trend is essential.

In addition, did this move higher appear as part of a Japanese Candlestick reversal? Was it off Support, or did it close through Resistance?

Using Momentum without complementary indicators is like flying blind.

You can feel the plane rising, but you have no idea what altitude you’re flying.

Here are the essential technical indicators you must combine with Momentum indicators:

- Determine the Trend – Bullish, Bearish, or Neutral?

- Changes in Momentum start new Trends and move within Trends

- Momentum is more sensitive to short-term changes in price

- Did the change in Momentum coincide with a Japanese Candlestick reversal?

- If it did, this should increase your confidence Momentum is shifting

- Was the change in Momentum within a Chart Pattern? If so, how does that impact the opportunity?

- Use Support and Resistance levels for confirmation

- Did Momentum reverse off a significant price level?

- Did a news or economic event swing Momentum, and if so, why? What will that mean for the future?

Combining these tools isn’t a simple strategy, but it’s essential.

If you need a system like this for trading, you can learn the Six Basics of Chart Analysis for free here.

In addition, you’ll get free weekly analysis and much more at no cost with our Forex Forecast.

What’s Next?

Select a few of your favorite currency pairs, add a Momentum indicator, and start to identify Overbought and Oversold conditions and examine how they coincide with price movements.

Experiment with different Momentum indicators and their periods and see how it changes the results.

If you still need to learn how to use Momentum in trading, download the Six Basics of Chart Analysis, and you can apply the same strategies we use here every week.

Frequently Asked Questions

Is There a Difference Between Short-Term and Long-Term Momentum Trading?

Yes, there is a difference between short-term and long-term momentum trading.

Short-term, meaning days, hours, or minutes is less reliable since the most significant market participants aren’t involved.

In addition, only a few speculative traders operate on a short time frame, making trading these time frames riskier. The fewer traders participating, the market is thinner and more unpredictable.

Therefore, a longer-term approach, such as weeks or months, will create more reliable signals and, consequently, more reliable trading. This gives position trading an advantage over day trading or swing trading due to the extended timeframe.

The strategy can be similar for short and long-term traders, but the risk is more significant for short-term traders.

What are the Best Momentum Trading Strategies?

The best momentum trading strategies aim to take advantage of changes in price action combined with other indicators and techniques.

For example, one of the best momentum trading strategies is to buy on strength and sell on weakness within a broader context.

This strategy involves identifying instruments moving in one broad direction and then reversing temporarily. This “buy the dip” or “sell the rip” strategy means taking advantage of temporary mispricing or profit-taking and getting an excellent entry.

Another strategy is to look for breakouts as entry points.

For example, you can look for Chart Patterns such as Flags, Pennants, or Triangle patterns confirming Momentum through combined technical analysis.

Which Indicator is Best for Momentum Trading?

When it comes to Momentum trading, no single indicator works best.

It would be best to learn how an indicator reacts to price changes through practice and experimentation so your interpretation is accurate.

Experimenting with different indicators and chart patterns is essential to finding what works best for you.

How do I Become a Momentum Trader?

Trying to trade exclusively using only one toolset is not recommended.

Instead, use multiple toolsets to find the “message of the market” and improve your likelihood of success.

Momentum investing or day trading strategies are a recipe for losses if not combined with other tools and techniques.