In Forex trading, understanding momentum indicators can substantially impact your success.

These tools provide valuable insights into the strength and direction of price movements, empowering you to make informed decisions.

In this comprehensive guide, we’ll explore momentum indicators, how they work, and how you can effectively utilize them to enhance your trading strategy.

What are Momentum Indicators?

Momentum indicators are mathematical tools that evaluate the velocity and magnitude of price changes within a specified timeframe.

By examining the rate at which prices fluctuate, these indicators offer valuable insights into the underlying strength or weakness of a market’s energy, thus enabling you to make well-informed decisions.

The fundamental principle behind them lies in their ability to track the rate of price change over a given period.

Through this analysis, you can discern the momentum behind price movements, helping you anticipate potential shifts in market sentiment.

These indicators operate on the premise that as prices gain momentum in a particular direction, the probability of the direction persisting increases, presenting lucrative opportunities for traders.

Whether identifying emerging trends, pinpointing optimal entry and exit points, or anticipating trend reversals, momentum indicators are indispensable allies for traders seeking to capitalize on market fluctuations.

Moreover, they typically manifest as oscillators, fluctuating around a central reference point, such as the zero line.

This oscillatory behavior allows you to gauge the intensity of price movements and ascertain whether the market is overbought or oversold.

By recognizing these extremes, you can make informed decisions regarding the timing of your trades, mitigating risks, and maximizing potential profits.

Momentum indicators play a pivotal role in Forex trading by providing invaluable insights into the strength and direction of market trends.

How Do Momentum Indicators Work?

Momentum indicators function by analyzing the rate at which prices change over a specified period, offering insights into market trends’ strength and direction.

They operate on the fundamental principle that as prices gather momentum in a particular direction, the likelihood of the trend continuing increases.

Here’s a deeper dive into how these indicators work:

- Comparison with Historical Prices: They compare current prices to historical prices over a defined period, typically using mathematical formulas.

- These indicators assess the speed and magnitude of price movements relative to past data, generating signals that help you anticipate future price movements.

- Oscillation around Centerline or Zero Line: Most momentum indicators oscillate around a centerline or zero line, with values above the centerline indicating bullish momentum and values below it signaling bearish momentum.

- The distance of the indicator from the centerline reflects the strength of the momentum.

- Identification of Overbought and Oversold Conditions: Momentum indicators also help identify overbought and oversold conditions in the market.

- When the indicator reaches extreme levels, it suggests that prices may have moved too far in one direction and could be due for a reversal.

- Look for divergences between the indicator and price movements to anticipate potential shifts in market sentiment.

- Visual Representation of Momentum: These indicators visually represent momentum through line graphs, histograms, or other graphical elements.

- You can observe the ebb and flow of momentum over time, enabling you to make more informed decisions about when to enter or exit trades.

- Dynamic Nature: These indicators are dynamic, adjusting to changes in price movements and market conditions.

- As new price data becomes available, these indicators recalculate and provide updated signals, allowing you to adapt their strategies accordingly.

- Confirmation of Trend Strength: One of the primary functions of these indicators is to confirm the strength of a trend.

- When the indicator aligns with the direction of the price trend, it suggests that the trend is robust and likely to continue.

- Conversely, divergence between the indicator and price movements may indicate weakening momentum and potential trend reversal.

By understanding how momentum indicators work and interpreting their signals effectively, you can gain valuable insights into market dynamics and make more informed trading decisions.

However, using these indicators with other technical analysis tools and exercising proper risk management is essential to maximize their effectiveness in Forex trading.

Types of Momentum Indicators

Momentum indicators are essential tools in every Forex trader’s arsenal.

They offer valuable insights into the strength and direction of price movements.

These indicators provide a quantitative assessment of the rate at which prices change, aiding traders in identifying potential trading opportunities and managing risk effectively.

This section will explore some of the most widely used in Forex trading, each offering unique perspectives on market dynamics and trend analysis.

Understanding these indicators and how they function is crucial for traders seeking to navigate the complexities of the Forex market with confidence and precision.

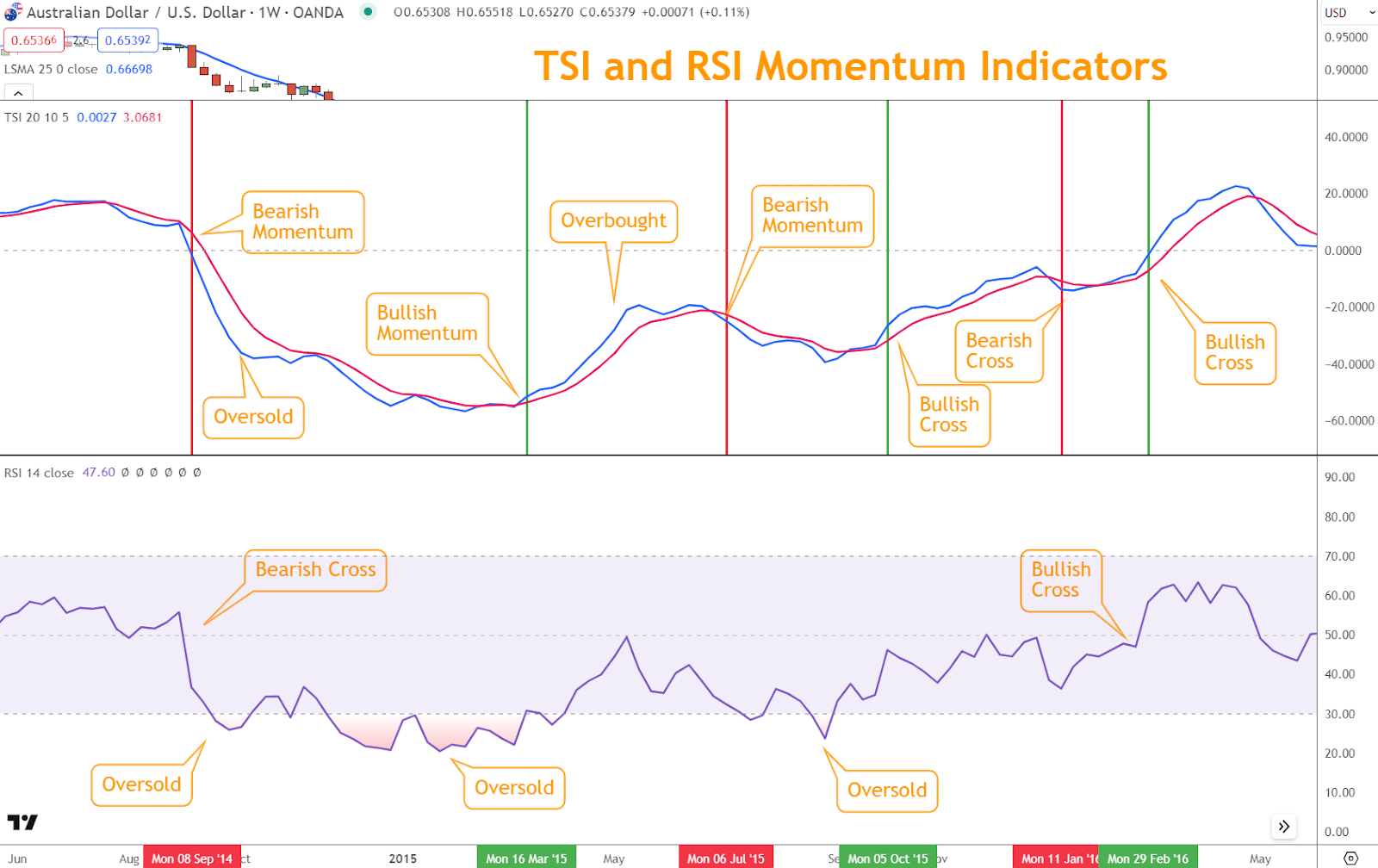

Relative Strength Index (RSI)

The Relative Strength Index, or RSI, is a widely used momentum indicator that measures the speed and change of price movements.

It oscillates between 0 and 100 and is calculated based on the ratio of average gains to average losses over a specified period, typically 14 periods.

A reading above 70 suggests that a security may be overbought, indicating a potential reversal or pullback, while a reading below 30 suggests oversold conditions, signaling a potential buying opportunity.

Look for divergences between the RSI and price movements to anticipate reversals.

True Strength Index (TSI)

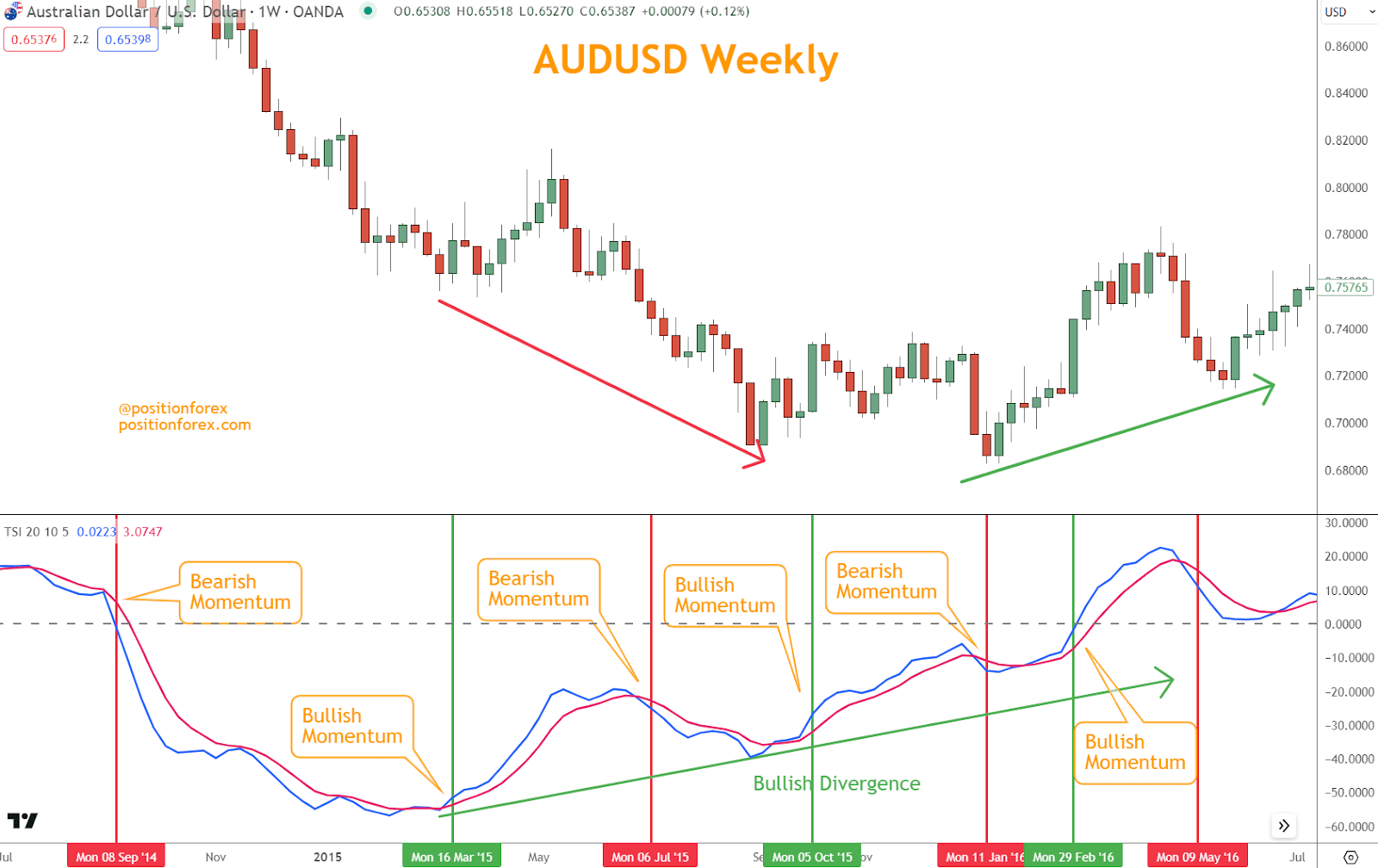

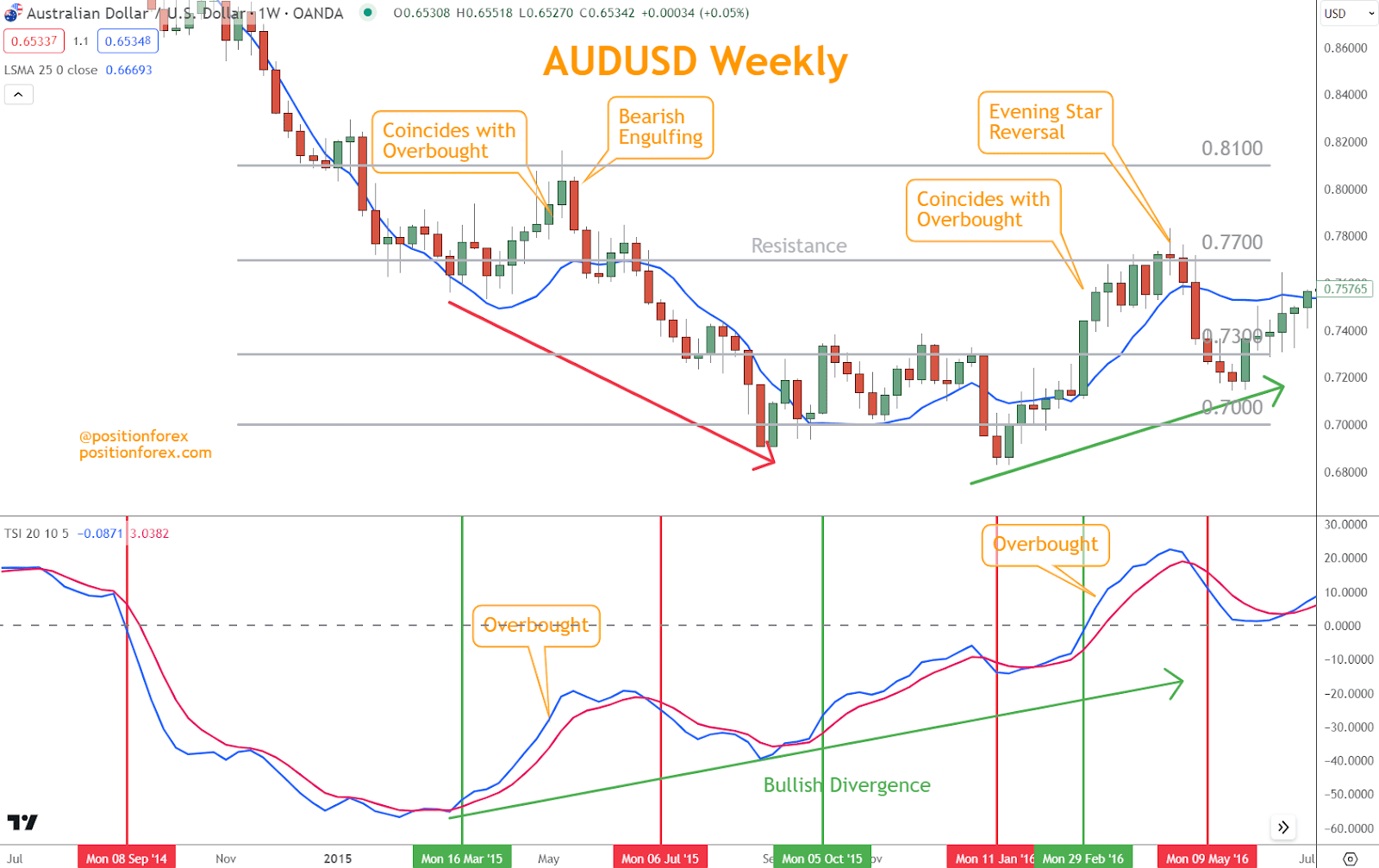

The True Strength Index (TSI) is a momentum oscillator that measures an instrument’s strength and direction of price movements.

The TSI is calculated using two smoothed moving averages of price changes: a short-term average and a long-term average.

The TSI generates oscillating signals around a centerline by comparing these averages’ differences to their absolute values, indicating overbought and oversold conditions.

Traders use the TSI to confirm potential reversals and gauge the strength of price momentum.

Bullish signals occur when the TSI crosses above the centerline or its signal line, suggesting increasing bullish momentum.

In contrast, bearish signals occur when the TSI crosses below the centerline or its signal line, indicating growing bearish pressure.

These two momentum indicators provide valuable insights into the strength and direction of price movements in the Forex market.

Understanding how each indicator works and incorporating them into your trading strategy can enhance your ability to identify trends and reversals and make more informed trading decisions.

How to Use Momentum in Forex Trading

Momentum indicators are versatile tools in a Forex trader’s arsenal, offering multifaceted insights into market dynamics.

Here’s a detailed exploration of how you can leverage these indicators effectively:

Spotting Reversals

Momentum indicators are adept at identifying potential reversals.

Divergence and hidden divergence are essential concepts in technical analysis, mainly when using indicators like the Relative Strength Index (RSI) or True Strength Indicator (TSI).

They provide valuable insights into potential trend reversals or continuations, aiding traders in making informed decisions.

Divergence

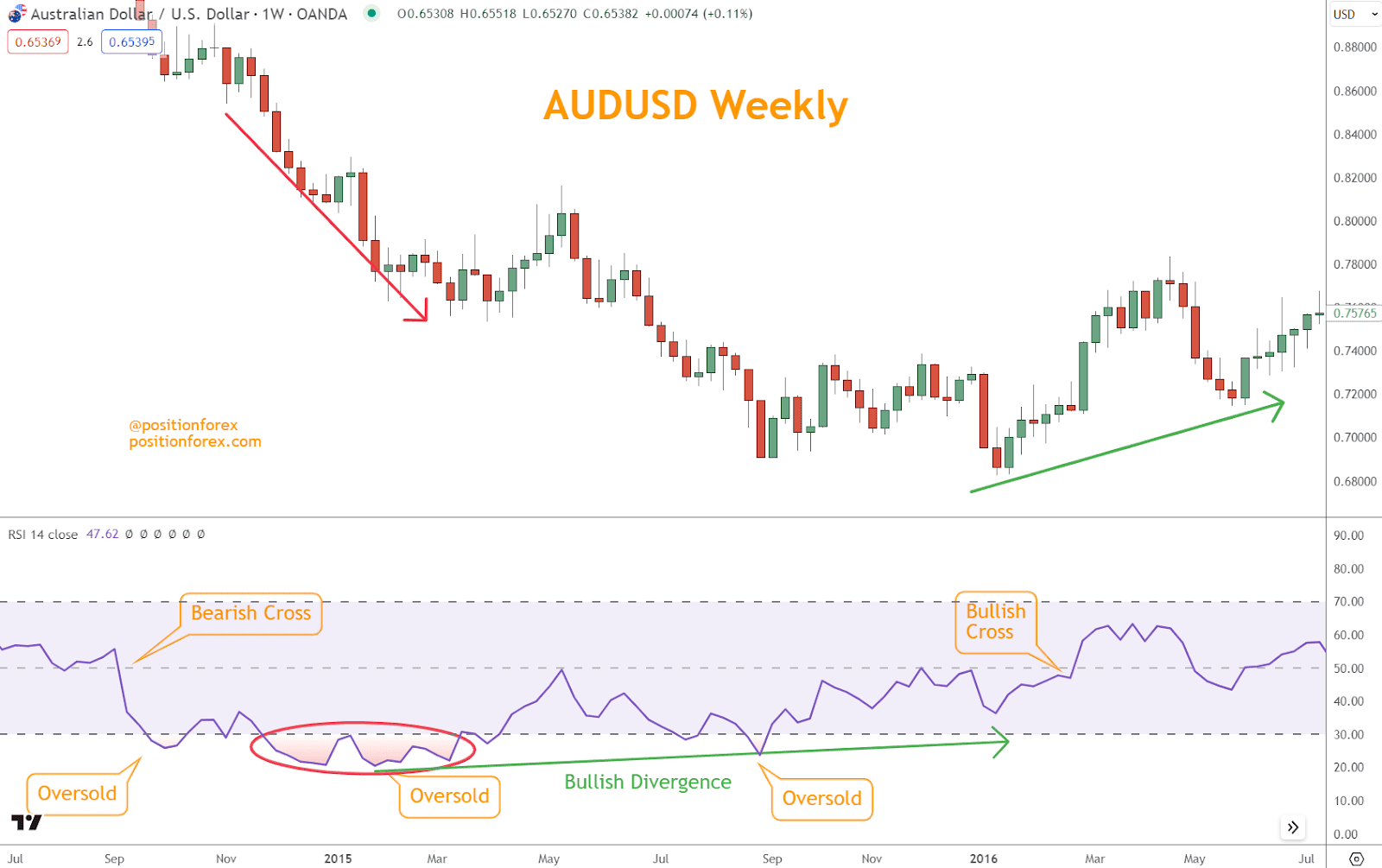

Divergence occurs when the price of a currency pair moves in the opposite direction of a momentum indicator, signaling a potential weakening or reversal of the current trend.

There are two types of divergence: bullish and bearish.

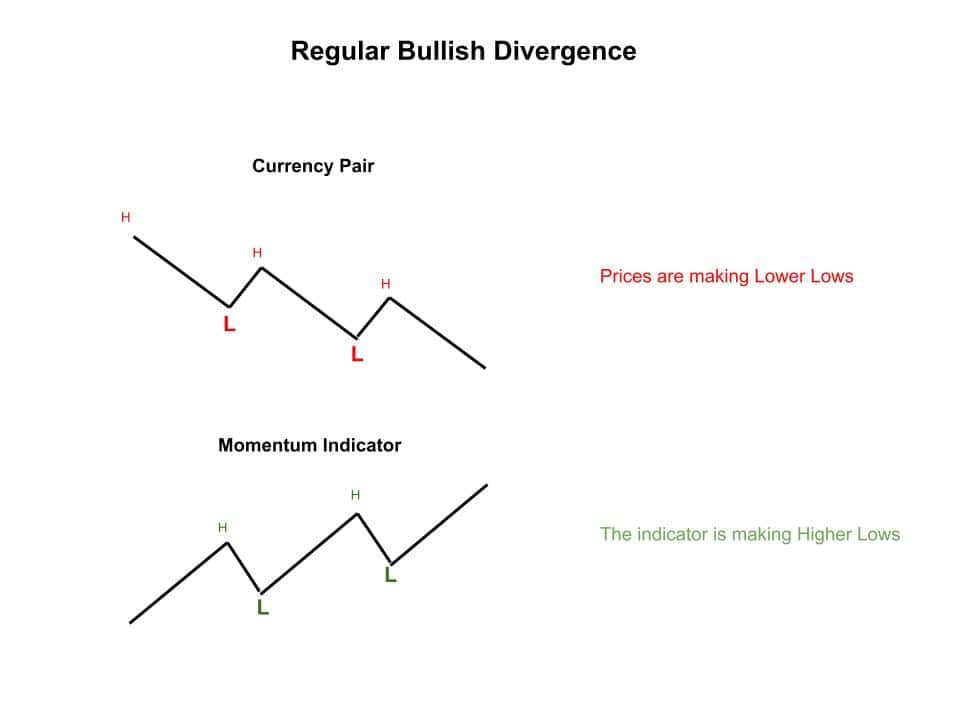

Bullish Divergence

Bullish divergence occurs when the price of a currency pair forms a lower low, but the momentum indicator forms a higher low.

This price and indicator action suggests that momentum is gaining strength while the price weakens, indicating a potential reversal from a downtrend to an uptrend.

Bullish divergence often precedes bullish price movements, allowing traders to enter long positions or tighten stop losses on short positions.

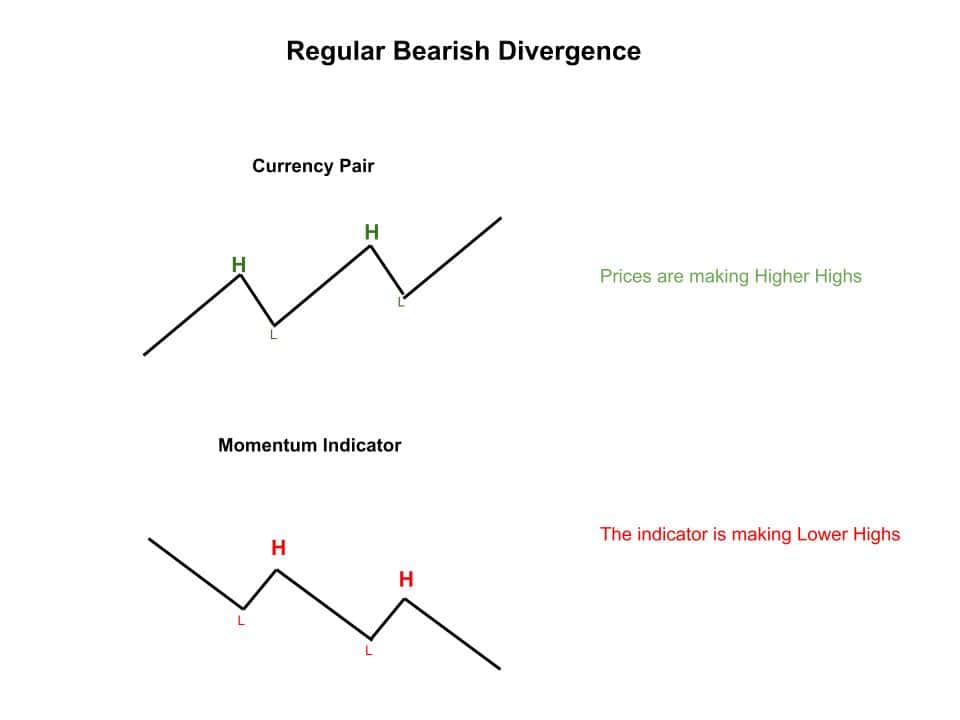

Bearish Divergence

Conversely, bearish divergence occurs when the price of a currency pair forms a higher high, but the momentum indicator forms a lower high.

This divergence suggests that momentum is weakening while the price is strengthening, signaling a potential reversal from an uptrend to a downtrend.

Bearish divergence often precedes bearish price movements, prompting traders to consider shorting the currency pair or adjusting stop losses on long positions.

Hidden Divergence

Hidden divergence, on the other hand, occurs when the price of a currency pair and the momentum indicator move in the same direction but with the indicator leading the price.

Hidden divergence typically indicates a continuation of the current trend rather than a reversal.

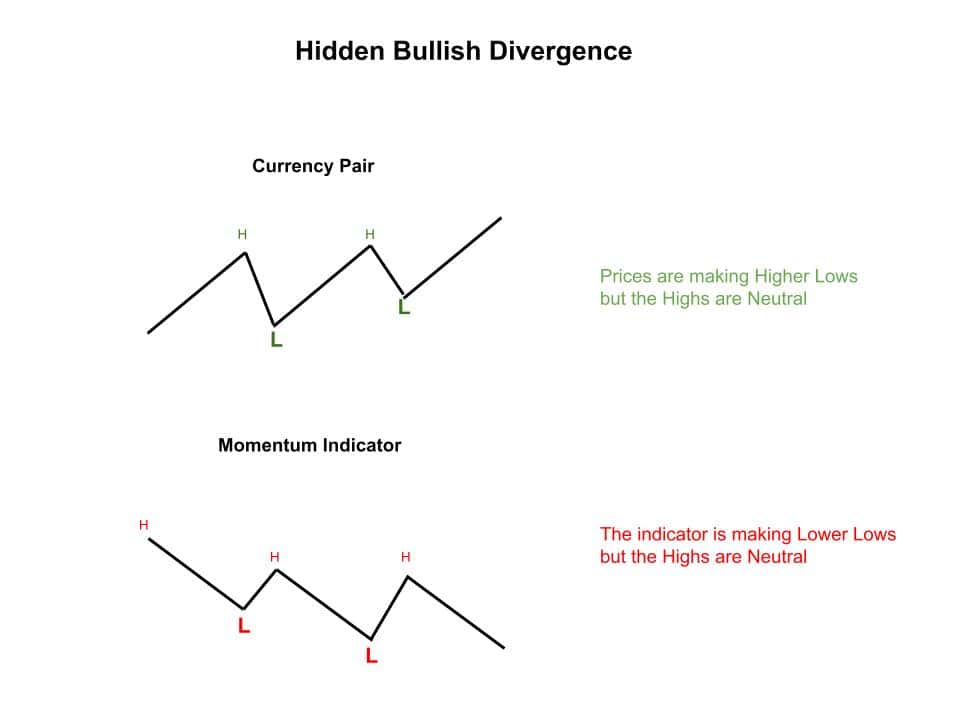

Bullish Hidden Divergence

Bullish hidden divergence occurs when the price forms a higher low, but the momentum indicator forms a lower low.

This price and indicator action suggests that momentum remains strong while the price is pulling back, indicating a potential continuation of an uptrend.

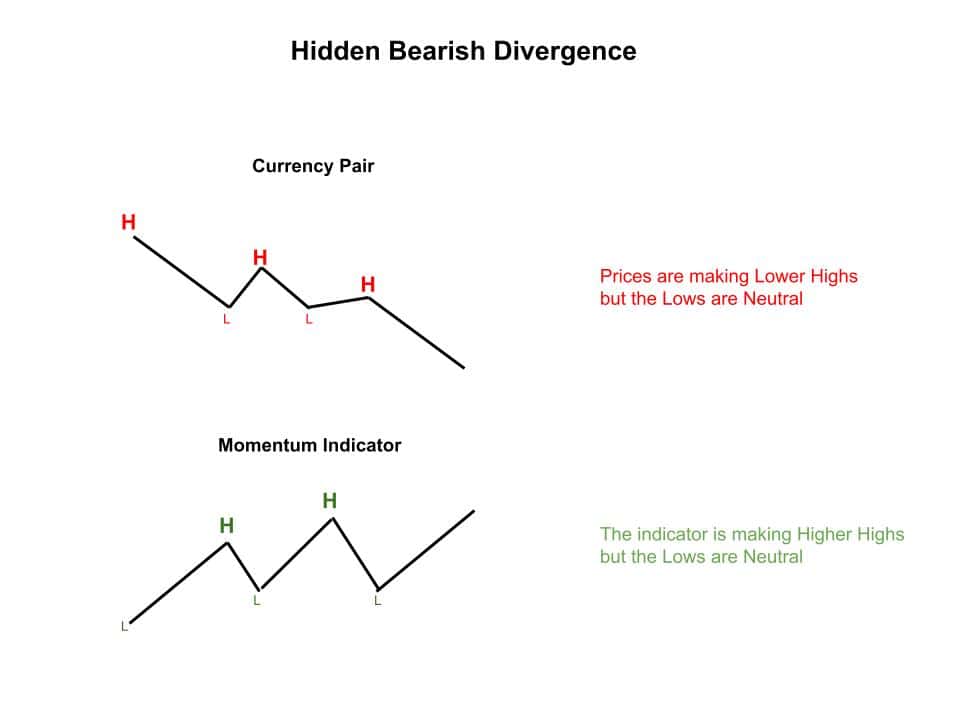

Bearish Hidden Divergence

Conversely, bearish hidden divergence occurs when the price forms a lower high, but the momentum indicator forms a higher high.

This price and indicator action suggests that momentum remains bearish while the price retraces or consolidates, signaling a potential downtrend continuation.

Bearish hidden divergence prompts you to consider entering new short positions.

Divergence and hidden divergence are potent tools in a trader’s toolbox, providing valuable insights into potential trend reversals or continuations.

By understanding and effectively identifying these patterns, you can enhance your trading strategies and capitalize on profitable opportunities in the Forex market.

Confirming Trade Signals

Momentum indicators complement other technical analysis tools by confirming trade signals.

For instance, you identify a bullish signal using a moving average strategy.

In that case, confirming strong momentum through a momentum indicator like the RSI adds weight to the validity of the trade setup.

Conversely, if they do not confirm the moving average signal, you may exercise caution or seek additional confirmation before entering the trade.

Timing Entries and Exits

Momentum indicators can help traders fine-tune their entry and exit points.

By analyzing the momentum behind price movements, you can identify optimal entry points during pullbacks within established trends or when momentum is building in the direction of a breakout.

Additionally, they can assist in determining exit points by signaling when momentum is waning or when the price reaches overbought or oversold levels, suggesting a potential reversal or consolidation phase.

Managing Risk

Effective risk management is crucial in Forex trading; momentum indicators can also aid this aspect.

By monitoring momentum alongside price action, you can adjust your position sizes and set appropriate stop-loss levels to protect profits as the trade progresses in their favor.

Mastering them in Forex trading requires technical proficiency, strategic insight, and disciplined execution.

Tips for Effective Use of Momentum Indicators

Combine with Other Indicators

While momentum indicators provide valuable insights into price movements, they are most effective with other technical analysis tools.

For instance, combining them with channel lines allows you to confirm direction and potential reversal points.

Additionally, incorporating support and resistance levels can help validate momentum signals and provide better entry and exit points for trades.

Use in Confluence with Fundamental Analysis

While momentum indicators focus on price movements and market psychology, incorporating fundamental analysis can provide additional context and insights into market trends.

Fundamental factors such as economic data releases, geopolitical events, and central bank policies can significantly impact currency prices and market sentiment.

Combining them with fundamental analysis allows you to better understand the underlying drivers of price movements and anticipate potential market shifts.

For example, suppose a momentum indicator signals a bullish trend while positive economic data supports a bullish outlook for a currency pair.

In that case, you will have increased confidence in your trading decisions.

Conclusion

Momentum indicators are invaluable tools for Forex traders seeking to gauge the strength and direction of price movements.

Understanding how these indicators work and incorporating them into your trading strategy can enhance your ability to identify trends and reversals and make more informed trading decisions.

Remember to practice proper risk management and continually refine your approach to effectively leverage their power in your trading journey.

What’s the Next Step?

Consider your trading experience and what Forex trading strategies you use today.

In addition, look for opportunities to use what you’ve learned and incorporate it into your trading habits.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about Forex trading strategies.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What is the Significance of these Indicators in Forex Trading?

Momentum indicators play a crucial role in Forex trading by providing insights into the strength and direction of price movements.

They help traders identify trends, spot potential reversals, and make informed trading decisions.

How does Momentum Work in Trading?

Momentum indicators compare current prices to historical prices over a specified period.

They generate signals based on the speed and magnitude of price movements, oscillating around a centerline or zero line to indicate overbought and oversold conditions.

What are Some Common Types of Momentum Indicators used in Forex Trading?

Some common types of momentum indicators include the Relative Strength Index (RSI), Stochastic Oscillator, Momentum Indicator, and True Strength Index (TSI).

Each of these indicators offers unique perspectives on market dynamics and trend analysis.

How can Traders Effectively Utilize Momentum in Their Trading Strategy?

Traders can effectively utilize momentum indicators by combining them with other technical analysis tools, such as trendlines, support and resistance levels, and volume indicators.

Additionally, considering multiple timeframes and incorporating fundamental analysis can enhance the accuracy of momentum signals and improve trading outcomes.

What are Some Tips for Successfully Applying Momentum in Forex Trading?

Some tips for successfully applying momentum indicators in Forex trading include practicing patience and discipline, regularly reviewing and adjusting trading strategies based on changing market conditions and using indicators in confluence with fundamental analysis.

Additionally, consider the reliability of signals, avoid overtrading, and prioritize risk management to maximize profitability and minimize losses.