Have you ever wondered why Momentum usually moves with price until it doesn’t? And when it doesn’t, what does that mean? What’s “Momentum divergence?”

In this article, I’ll share this technical analysis technique that can help with Forex trading.

In Forex trading, Momentum is a crucial indicator helping predict currency movements.

It’s recognized as a significant market force and provides insights into potential future price directions.

Moreover, considering Momentum divergence in technical analysis can help provide a clearer picture of the market’s direction. But again, it can also lead to confusion.

What is Momentum in Forex Trading?

In Forex trading, Momentum refers to the speed at which currency prices change over a specified period.

It’s a measure of the strength or weakness present in the market, providing a gauge for you to assess potential future price movements. Specifically, we are looking at the rate of change in price.

In simpler terms, if the Momentum is strong and positive, it indicates that currency prices are changing faster. Conversely, if it’s negative or decreasing, that suggests price changes are slowing.

By closely monitoring these changes, you can strategically position yourself in the market, anticipating moves rather than merely reacting.

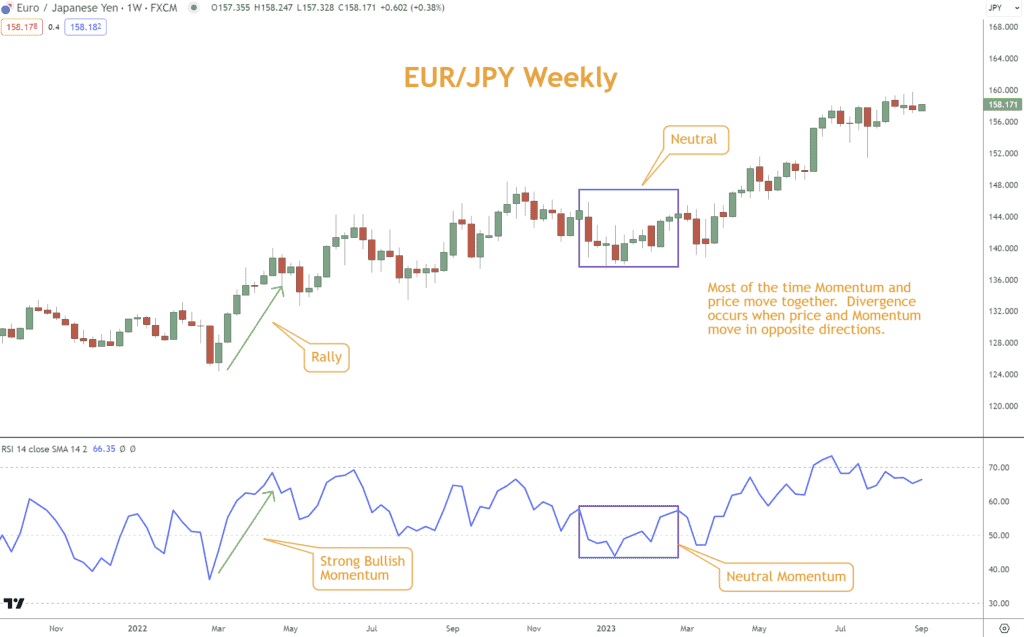

Divergence: Going Beyond the Surface

While Momentum can give you a view of the prevailing market force, divergence delves deeper, offering nuanced insights into potential shifts in an instrument’s direction.

At its core, divergence occurs when there’s a discrepancy between the price movement and its corresponding Momentum.

When price charts show a certain direction, but indicators suggest otherwise, a divergence is in play. Understanding this concept is further enriched by recognizing its main types: Bullish and Bearish divergences.

A Bullish one occurs when the price records a lower low, but the Momentum indicator shows a higher low, hinting at a potential Rally.

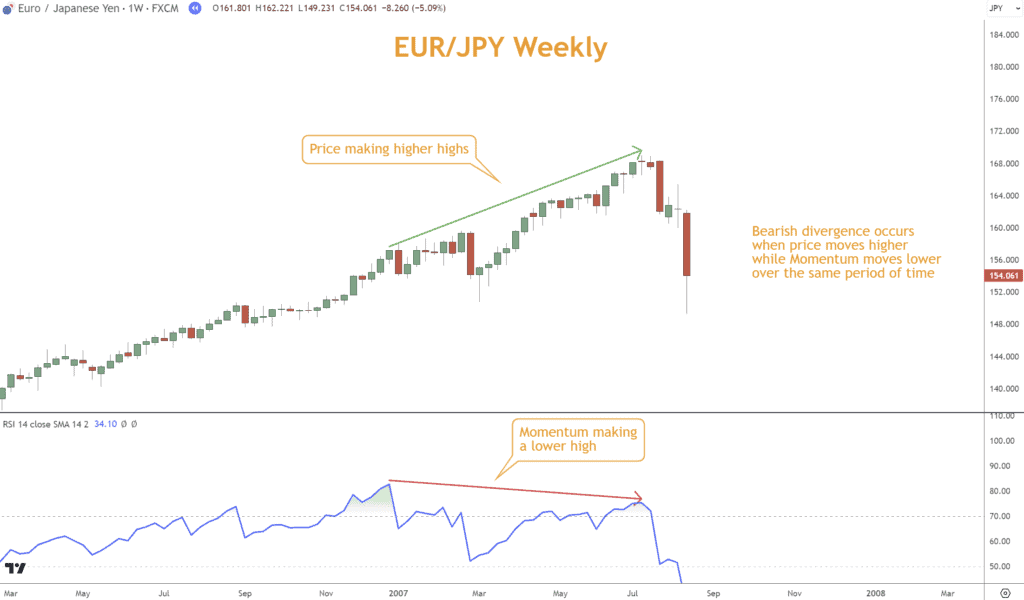

A Bearish one is where the price hits a higher high while the Momentum indicator shows a lower high, which could signal a Selloff.

When identified correctly, these intricate discrepencies can serve as pivotal signals for you, guiding entry and exit points in the market.

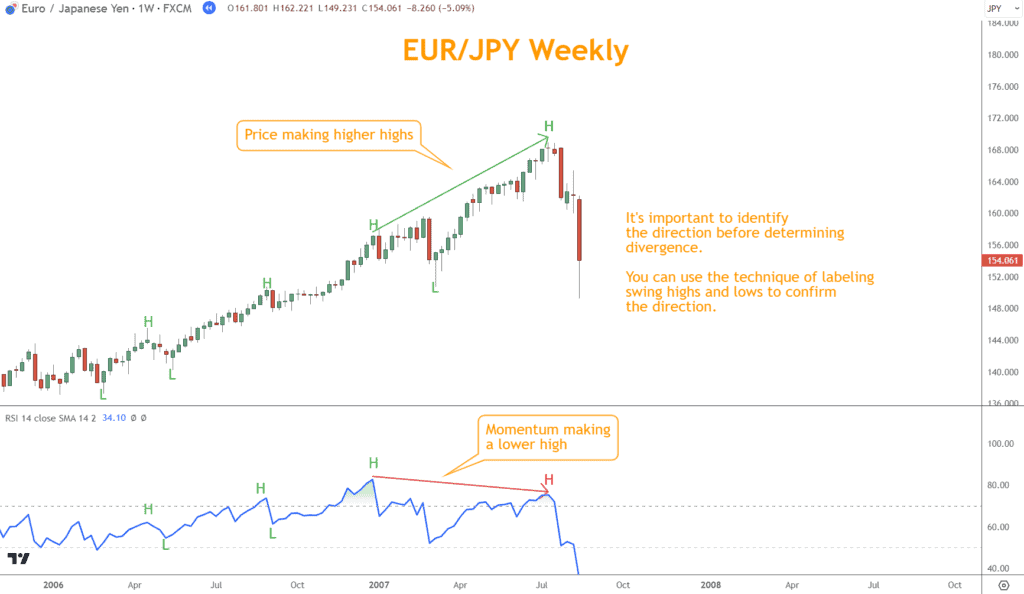

Spotting Divergences: A Step-by-Step Guide

The first step involves visualizing these divergences directly on Forex charts.

One can see discrepancies where the two don’t align using Momentum indicators alongside price charts.

Firstly, confirm that the price is making a definitive higher high or lower low compared to the previous direction. Concurrently, the Momentum indicator should move in the opposite direction, indicating a true divergence.

By following these steps and ensuring both price and indicator discrepancies, you can confidently identify true divergences, setting the stage for informed trading decisions.

Momentum Divergences in Forex: 4 Types

These differences in Forex aren’t one-size-fits-all; they manifest in varied forms, each providing unique insights into possible market movements.

You will want to familiarize yourself with two primary categories: Regular and Hidden.

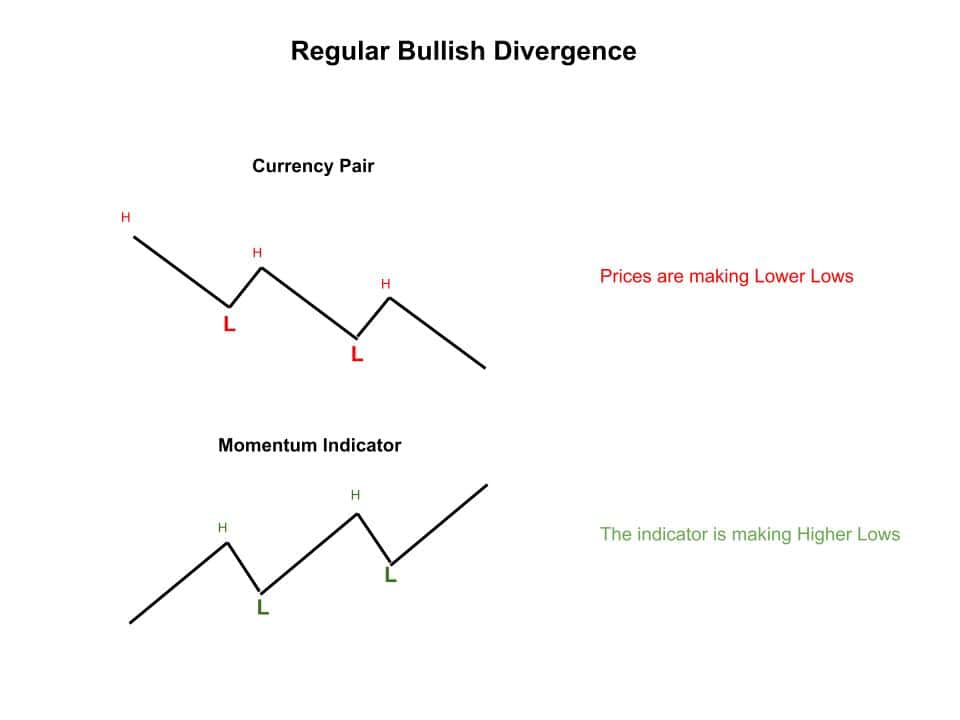

Regular Bullish Divergence: This occurs when the price of a currency pair creates a new lower low while the Momentum indicator, contrastingly, forms a higher low. This mismatch often signifies that the Selloff is losing steam, and an upward reversal might be on the horizon.

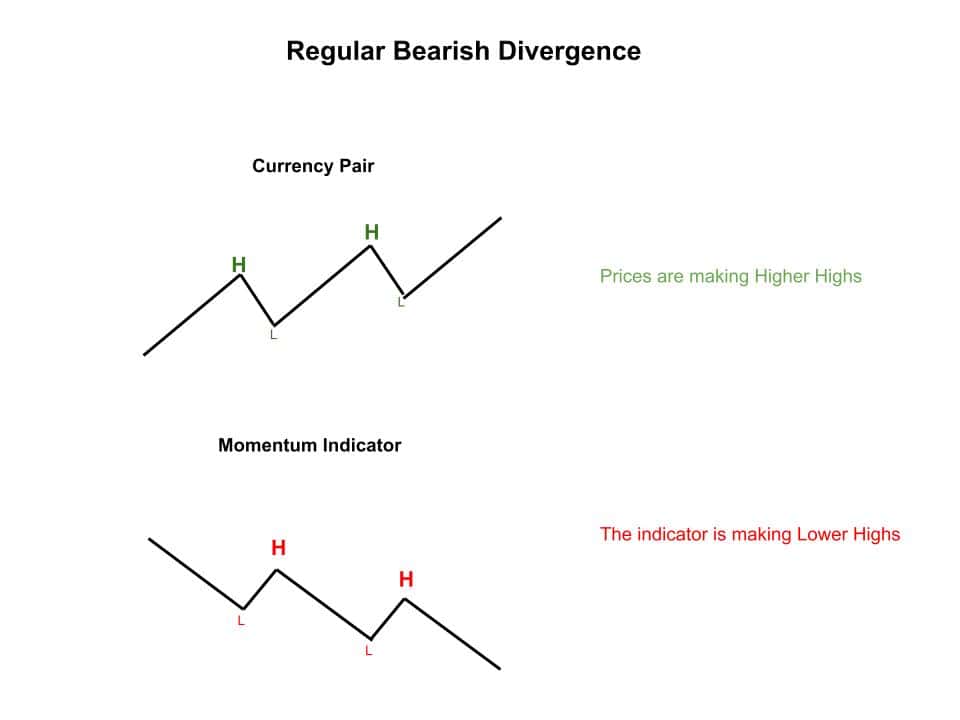

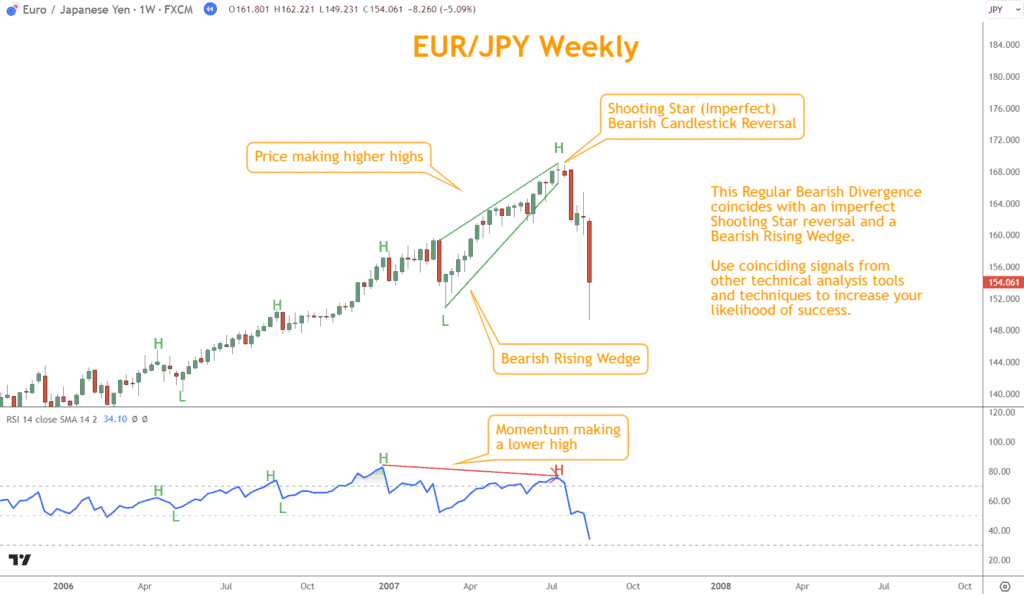

Regular Bearish Divergence: Here, the price charts a new higher high, but the Momentum indicator reflects a lower high. Such a scenario can indicate that the Rally might weaken, hinting at a possible reversal to the downside.

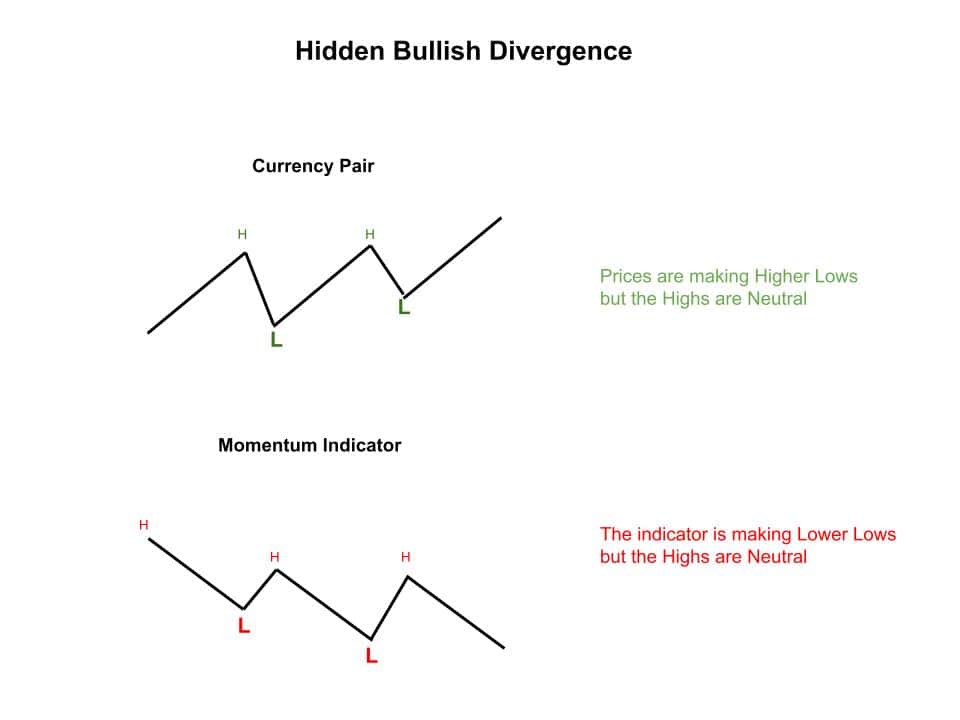

Hidden Bullish Divergence: In this instance, the price makes a higher low, but the Momentum indicator sets a lower low. Rather than signaling a reversal like its regular counterpart, a hidden Bullish divergence suggests continuing the Rally.

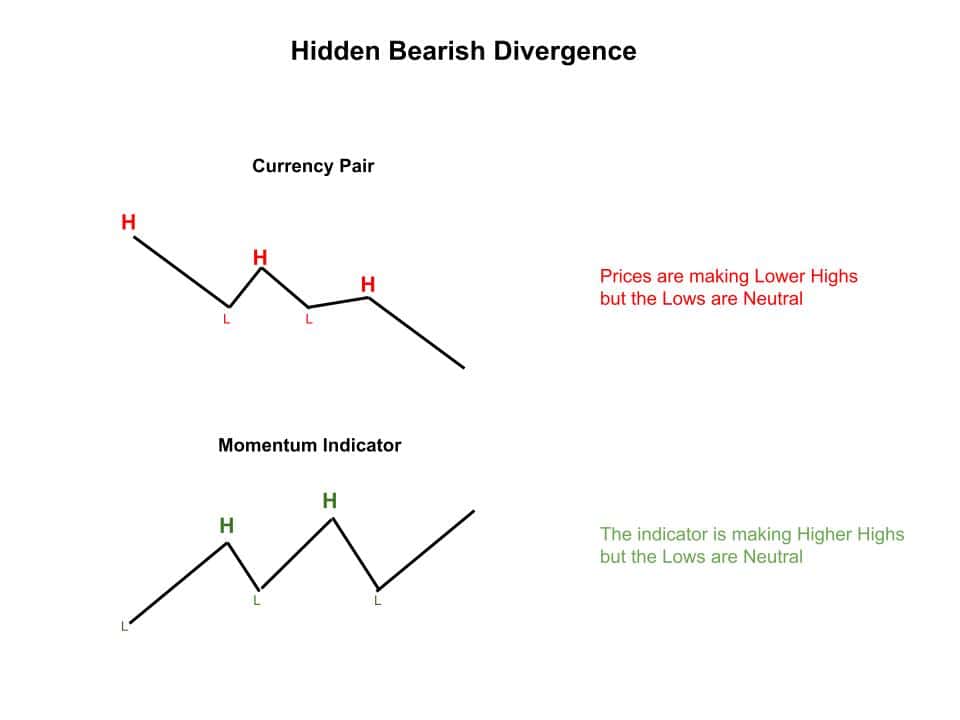

Hidden Bearish Divergence: When the price achieves a lower high, and the Momentum indicator shows a higher high, it typically indicates a continuation of the Selloff.

Understanding and distinguishing these differences will help you forecast a forex pair’s next move.

Implications of Regular Divergences

When accurately spotted, these distinctions offer actionable signals for potential market movements.

Regular Bullish Divergence:

- When you encounter one, it could indicate a change in market direction.

- Specifically, the Bears losing their grip as the price hits a new lower low and the Momentum indicator registers a higher low.

- This divergence often serves as a potential buy signal, indicating that the currency pair might witness an upward trajectory soon.

- Making an entry at this juncture can position you for the anticipated Rally.

Regular Bearish Divergence:

- As the price achieves a higher high while the Momentum leans towards a lower high, it’s often interpreted as the bulls running out of steam.

- This divergence typically serves as a warning sign of a potential Selloff.

Understanding these can help you feel more sure about forecasting reversals in the Forex market.

Decoding Hidden Divergences

While regular divergences offer signals for potential market reversals, hidden divergences serve as continuation markers, providing invaluable clues if you’re trying to ride the wave.

Hidden Bullish Divergence:

- This divergence is often an ally for those Bullish on a currency pair.

- When prices make a higher low, contrasted by the Momentum indicator’s lower low, it suggests that the underlying strength of the uptrend remains intact.

- Rather than signaling a reversal, this suggests the ongoing Rally will likely persist.

Hidden Bearish Divergence:

- Conversely, when prices register a lower high while the Momentum indicator points towards a higher high, you are alerted to the possibility that the prevailing Selloff isn’t over yet.

- This divergence reaffirms the Bearish stance on the currency pair, indicating that prices might continue to decline.

- Such insights empower you to either hold onto your short positions or scout for new opportunities to short, in line with the expected continuation of the Selloff.

- Hidden divergences, though subtler than their regular counterparts, offer a depth of insight into the market’s underlying currents.

- By accurately decoding them, traders can more effectively align their strategies with the market’s probable path, optimizing potential gains.

Tools & Techniques for Confirmation

In Forex trading, identification is just one part of the bigger picture. This includes both regular and hidden divergences.

To gain an edge, you must validate and corroborate these opportunities with additional tools and techniques, increasing the likelihood of success.

Pairing with Other Technical Indicators for Added Confidence:

- While divergences provide compelling signals, combining them with other technical indicators can amplify their reliability.

- For instance, overlaying a divergence observation with a Japanese Candlestick pattern can provide further context.

- If a Bullish divergence aligns with a Bullish candlestick reversal, it reinforces the potential buy signal.

- Similarly, if it coincides with a Bearish candlestick reading on the Stochastic Oscillator, it accentuates the potential of an impending Selloff.

Factoring in Economic Announcements and Their Impact

With its global nature, economic data releases, central bank decisions, and geopolitical events significantly influence the Forex market.

These macro factors can either validate or negate a technical divergence.

For example, if a Bullish divergence is observed, but an imminent economic report forecasts negative data for that currency, it might overshadow the technical signal.

Conversely, positive news aligned with a Bullish signal can amplify the strength of a potential upward move.

Being attuned to such announcements helps you be aware and benefit by integrating technical and fundamental elements into your analysis.

Adopting a multi-faceted approach to confirm divergences can fortify your analysis, reducing the chances of misinterpretation and enhancing the probability of successful trades.

Key Takeaways

Understanding the intricacies of this process can provide you with invaluable signposts. Here are the pivotal insights to remember:

- Momentum as a Core Indicator: Momentum, reflecting the rate of change in currency prices, acts as a foundational pillar in Forex trading. By gauging Momentum, traders can assess market movements’ strength or potential direction.

- The Role of Divergence: Divergence is an advanced warning system highlighting potential discrepancies between price actions and Momentum.

- Types of Divergences: While regular divergences often indicate potential market reversals, hidden divergences suggest continuing the current direction.

- Validation is Crucial: Don’t make trading decisions based solely on divergence. Confirm with other indicators and stay aware of economic news.

By mastering its nuances and applying it judiciously, you can position yourself for more consistent success in your trading endeavors.

What’s the Next Step?

Select a candlestick chart, add a Momentum indicator, and look for regular and hidden divergences using your knowledge.

In addition, look for opportunities to coincide them with other technical analysis tools and techniques to see how they work together.

Combining Japanese Candlesticks, Chart Patterns, and Support and Resistance can give you a comprehensive view and understanding to make trading easier.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned here about Momentum divergence.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions (FAQs)

What’s the Best Time Frame to Spot Divergences?

The ideal time frame for spotting divergences largely depends on a trader’s strategy and style. A divergence spotted on a longer time frame, like a weekly chart, often holds more weight than one observed on a shorter time frame.

How do I Differentiate Between a False Divergence and a True One?

Differentiating between true and false divergences can be challenging. However, a few techniques can aid in this distinction:

- Validation with Other Indicators: As mentioned earlier, pairing divergence observations with other technical indicators, like Japanese Candlestick Patterns or Chart Patterns, can help validate their authenticity.

- Wait for Confirmation: Before making a trade based on a divergence, wait for additional price action as confirmation. For instance, a break above a key resistance level can confirm a Bullish divergence.

Can this be Combined with Fundamental Analysis?

Absolutely. Blending Momentum divergence with fundamental analysis often yields a more holistic market view.

While divergence can highlight potential reversals or continuations, fundamental analysis offers insights into the ‘why’ behind those movements.

For instance, a Bullish divergence might be further validated by positive economic news or central bank decisions favorable to that currency.

How do I Integrate Divergence into my Existing Trading Strategy?

To incorporate divergence into an existing strategy:

- Assess Current Techniques: Review your trading techniques to identify where divergence can offer added value.

- Practice on Historical Data: Before applying divergence in real-time trades, practice spotting and validating them on historical price charts.

- Set Clear Rules: Define clear entry, exit, and stop-loss areas based on divergence signals to maintain consistency and reduce emotional trading decisions.

- Continuous Learning: Like all trading techniques, regularly review and refine your approach to divergence to adapt to changing market conditions.

Utilizing Momentum divergence in Forex trading can greatly enhance your decision-making abilities. By asking a few fundamental questions, you can effectively leverage this tool to succeed in your trading endeavors.