Are you looking for the most effective Momentum indicator for your Forex trading?

You will find it’s the True Strength Index or TSI (True Strength Indicator).

In this article, we will dive deep into what the TSI is and why it stands out among other Momentum indicators, especially Oscillators.

We will explore its unique features, such as using signal line crossovers for trading signals and identifying Overbought and Oversold conditions.

You can also expect to find real-life examples of how it can be used to make informed trading decisions and how to combine it with other technical analysis indicators for better signals.

What is the True Strength Index?

The TSI (True Strength Index) is a Momentum indicator you can use in technical analysis to assess the strength and direction of a forex pair’s price movement.

The TSI describes Overbought or Oversold conditions resulting in potential market reversals. The TSI also describes a lack of Momentum, which is equally valid.

Why is the True Strength Index different than other Momentum Indicators?

The True Strength Index (TSI) stands out from other Momentum Indicators because it utilizes a double smoothing technique to eliminate noise and deliver a more precise signal.

Including a signal line allows for the generation of buy and sell signals through crossovers. Identifying Overbought, Oversold, and Neutral conditions enhances trading decisions with more accurate signals.

This is different than a Momentum Oscillator such as the RSI (Relative Strength Index) or Stochastic, which use a centerline crossover (TSI has one, but you should ignore it), or the Average Directional Index, which provides Momentum and Trend information in one indicator.

The RSI has distinct levels defining Overbought and Oversold, leverages divergence to forecast reversals, and reports directional “trend” information when its centerline is crossed.

The method I’m describing here with the TSI uses no centerline and is focused exclusively on Momentum. Momentum is the energy between what’s happening now versus what’s been happening recently. No context is necessary.

Context is provided by complementary indicators such as the MACD, an EMA (Exponential Moving Average), Chart Patterns, or other technical analysis resources you may like.

How I Use Signal Line Crossovers for Forex Trading Signals

In technical analysis, signal line crossovers are valuable for traders identifying potential reversals.

The True Strength Index, developed by William Blau in 1991, is a Momentum indicator incorporating a signal line for generating buy and sell signals based on crossovers. By analyzing the TSI line in relation to the signal line, traders can identify potential shifts in trend direction.

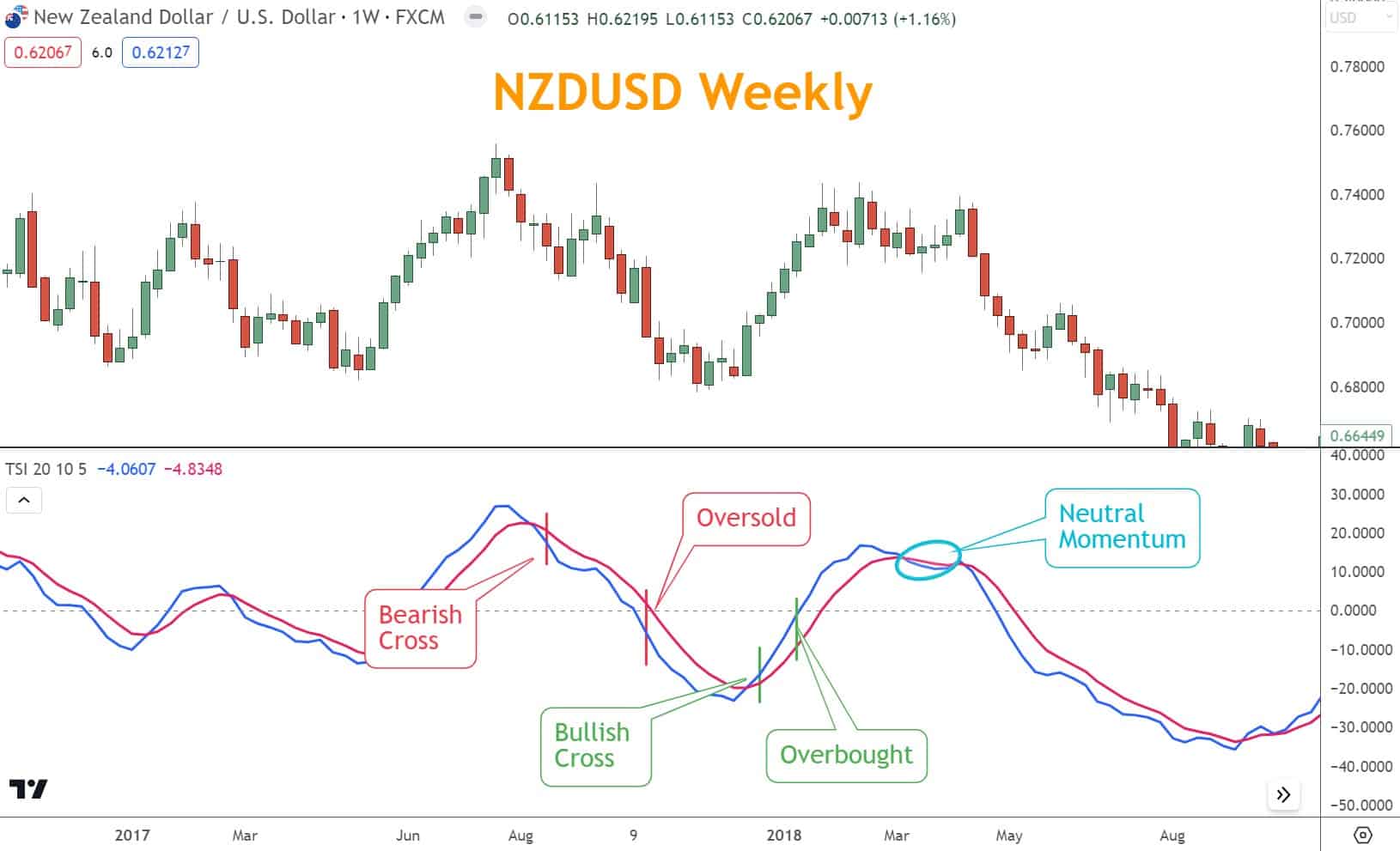

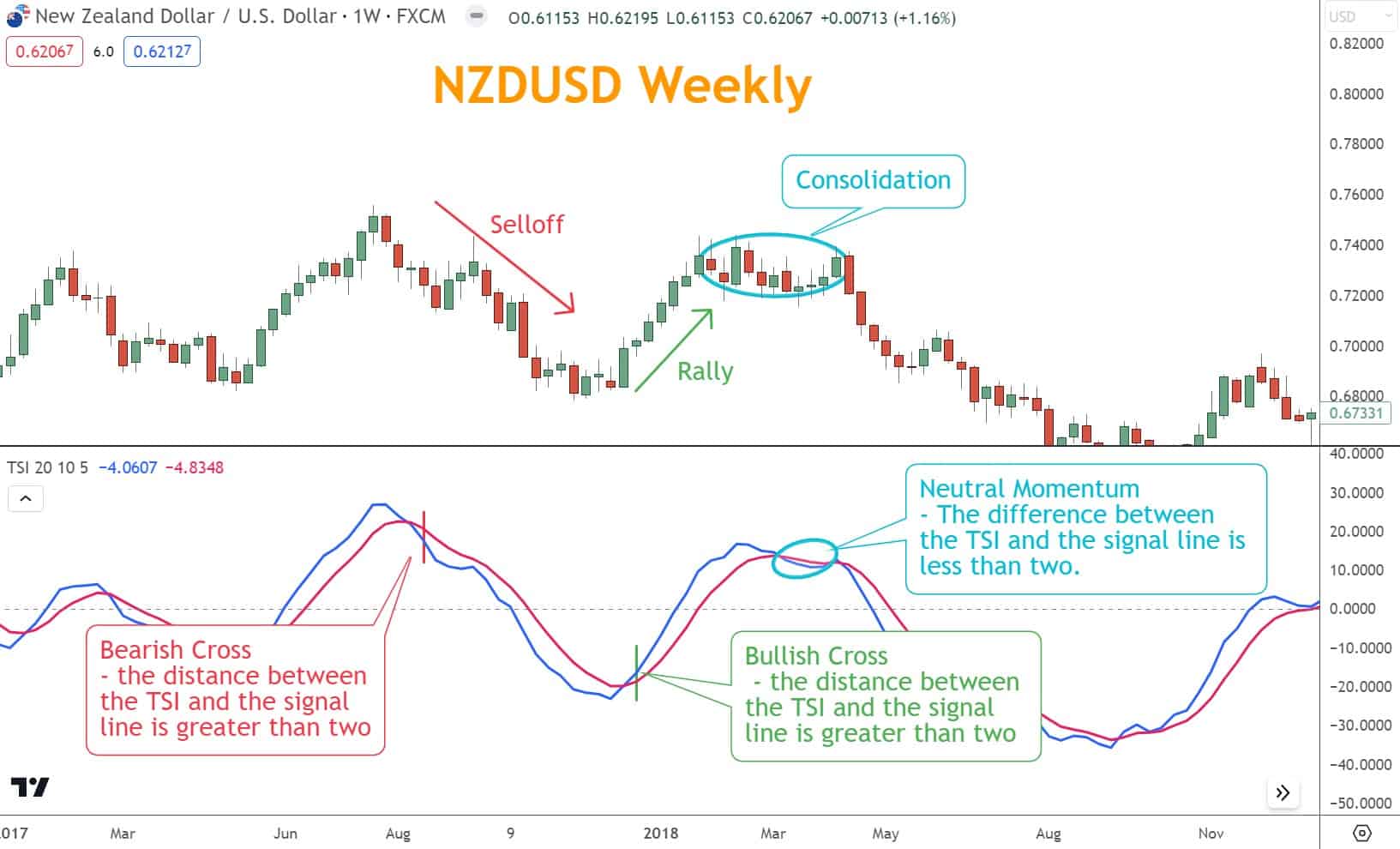

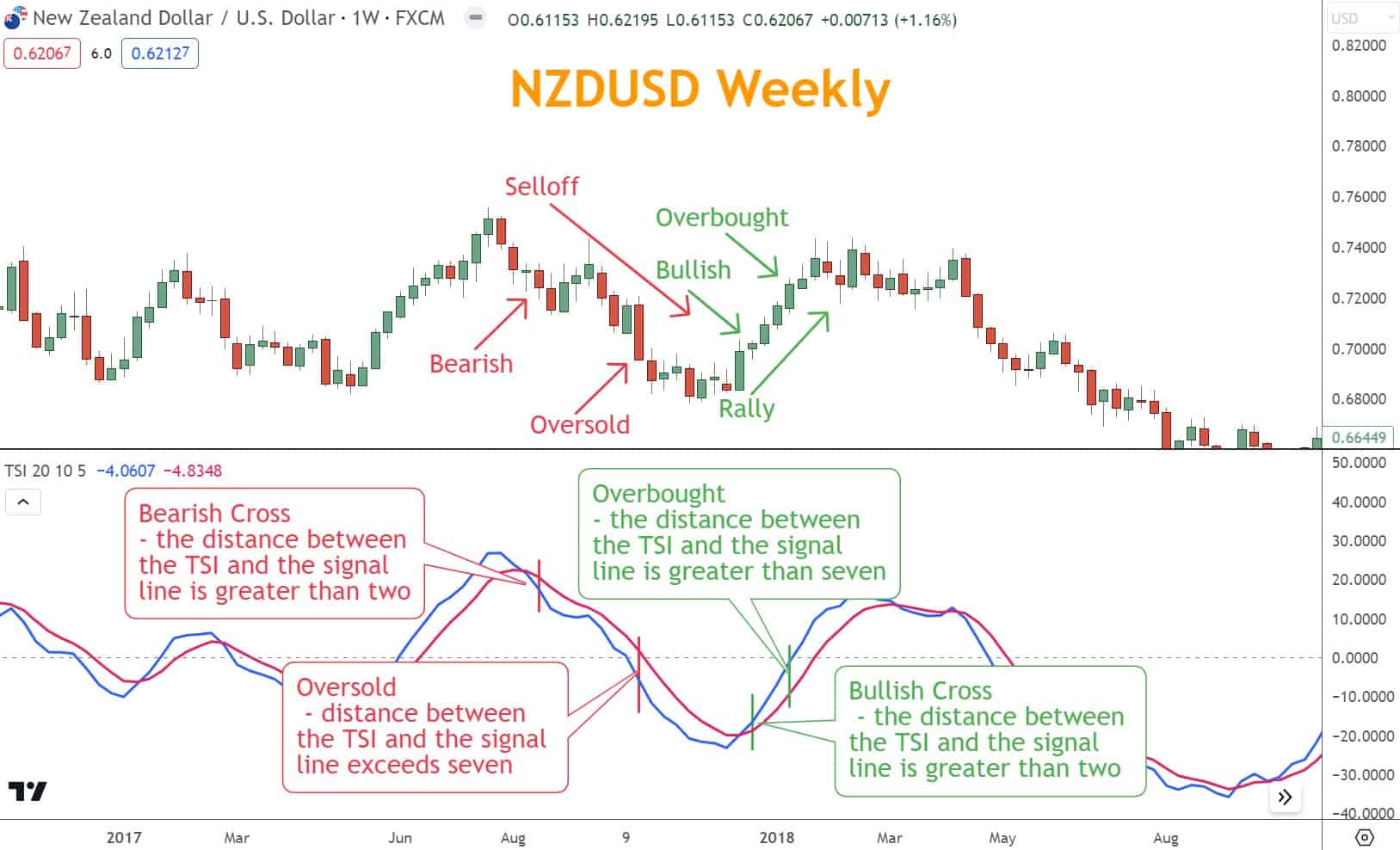

In our practice, if the difference between the TSI and the signal line is less than two, Momentum is considered Neutral.

Suppose the difference between the TSI and the signal line is greater than two but less than seven. In that case, Momentum is considered either Bullish or Bearish, depending on the direction of the crossover.

If the difference between the TSI and signal line exceeds seven, Momentum is considered either Overbought or Oversold, depending on the nature of the crossover.

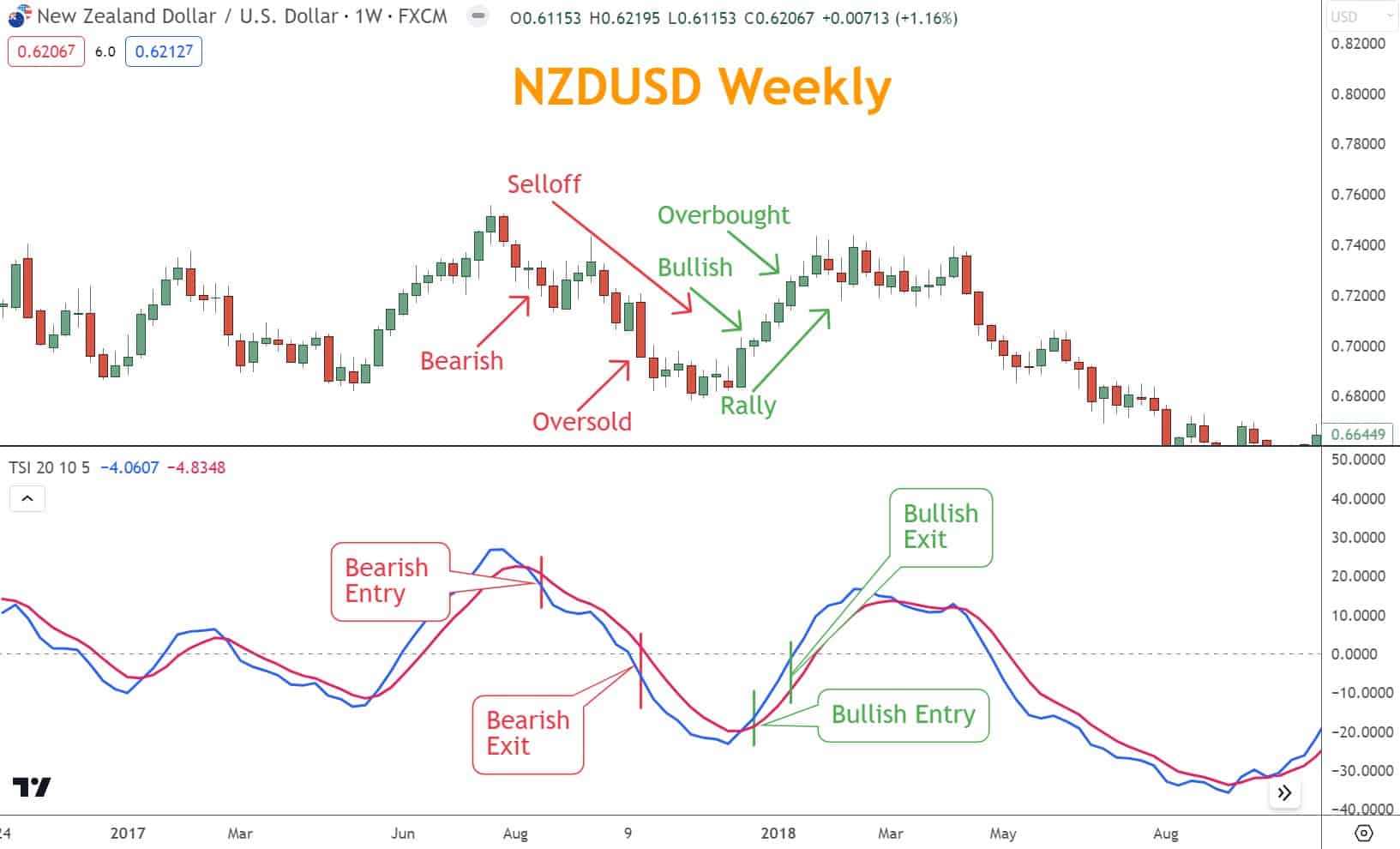

You can establish straightforward entry and exit points for your trades by incorporating signal line crossovers into your trading strategy.

Ideally, you want to enter as the crossover difference exceeds two, but before it exceeds seven. Entries can appear resulting from a reversal or a pullback.

Both scenarios usually include a degree of consolidation and Neutral Momentum; however, every situation is unique.

This approach can increase profitability and reduce risk, as it helps traders avoid false signals and make more accurate trading decisions.

Its ability to identify Overbought and Oversold conditions, combined with its smoothing technique, makes it a valuable tool for traders seeking to optimize their trading strategies.

A New Way of Identifying Overbought and Oversold Conditions

The TSI stands out from other Momentum indicators due to its unique double smoothing technique, which reduces noise and provides a clearer signal. This makes it an invaluable tool for traders seeking to enhance their buy and sell decisions.

By incorporating it into your trading strategy, you can avoid entering trades when the market is overextended and likely to reverse. You can also see consolidation patterns more easily with Neutral Momentum.

Additionally, it can be customized with different parameters to align with individual trading styles and preferences.

The settings I use are different than the default for a good reason. I recommend only trying to use the TSI for Momentum and not Trend.

The default settings are 25 for the long MA, 15 for the short MA, and 13 for the signal. These defaults, I believe, exist because traders want to use the TSI as a Trend and Momentum indicator.

Making it less sensitive reduces the risk of “whiplash” during consolidation periods but also late giving valid signals. I recommend reducing the parameters to 20 for the long MA, 10 for the short MA, and five for the signal.

These parameters will make the indicator more sensitive but use it only for Momentum. We want greater sensitivity to improve entry and exit timing in a Momentum indicator.

Combine the TSI with other less sensitive indicators to improve trading success.

How You Can Make Trading Decisions with the TSI

You can find signals to buy, sell, or wait. The three steps to consider when reading the TSI are:

- Entry Point: Look for a crossover of the TSI and signal line.

- If the signal crosses through and above the TSI, and the distance between the lines is greater than two, that’s a Bullish signal.

- If the signal line crosses through and below the TSI and the distance between the lines is greater than two, that’s a Bearish signal.

- If the distance between the lines is less than two, Momentum is Neutral.

- Neutral Momentum can change and often creates the best trading opportunities.

- Exit Point: When the distance between the TSI and the signal line exceeds seven, the Forex pair is considered Overbought or Oversold, a signal to exit the trade.

- Be aware that some Forex pairs are more volatile than others, impacting the distance between the TSI and the signal line.

The TSI Works Best in Combination with other Indicators

You can comprehensively understand a market and make more informed decisions by integrating the TSI with Trends, Japanese Candlesticks, Chart Patterns, and Support and Resistance.

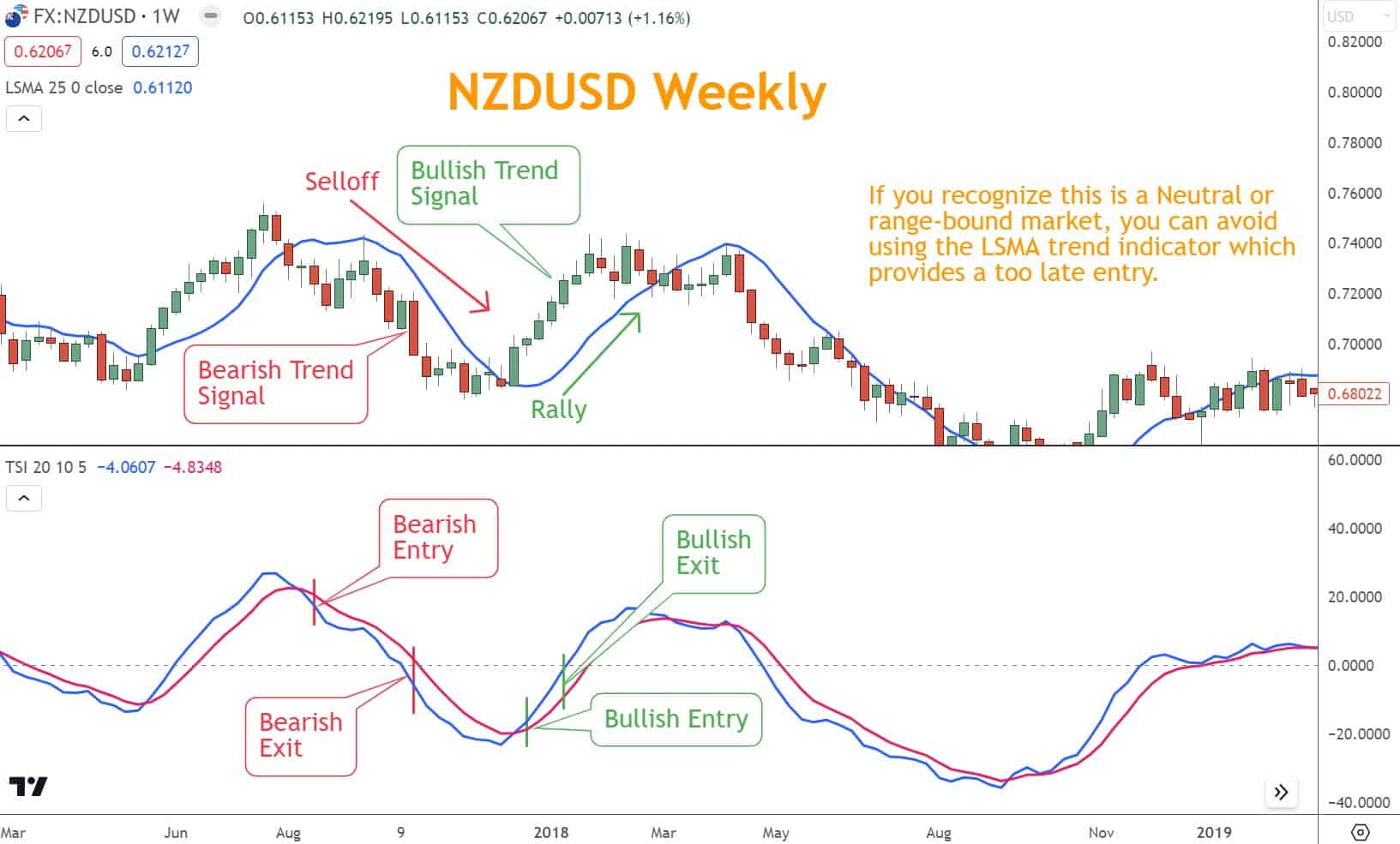

This example of using it with our preferred Trend indicator, the LSMA, shows how the Trend moves with the TSI in the same direction after a reversal but is less sensitive, and its signal comes too late.

The Trend signal arrives on the same candles as the exit signal. Don’t use a Trend indicator if you want to trade ranges, which I don’t usually recommend since they’re higher risk than Rallies or Selloffs.

This is an excellent example of how using Trend and Momentum together in a Neutral or range-bound market prevents you from opening a losing trade.

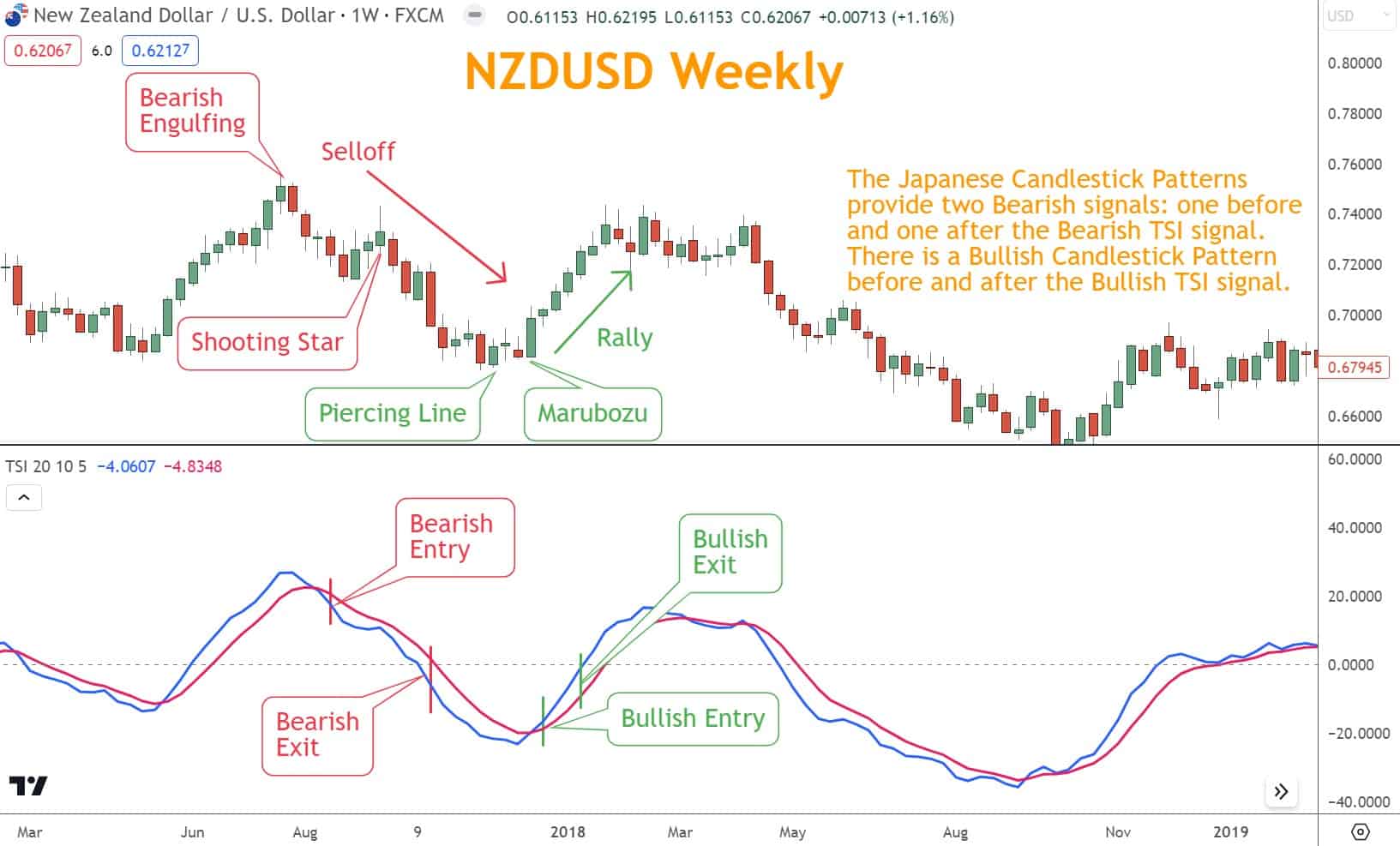

Japanese Candlestick patterns are reversal patterns that often coincide with TSI reversals, as seen in this example.

A Bearish Engulfing appears before the Bearish TSI signal, and a Shooting Star appears shortly after.

When NZDUSD turns Bullish, there is a Piercing Pattern before the signal and a large Marubozu candle after the signal, breaking the price consolidation.

Both of these signals complement the ongoing reversal.

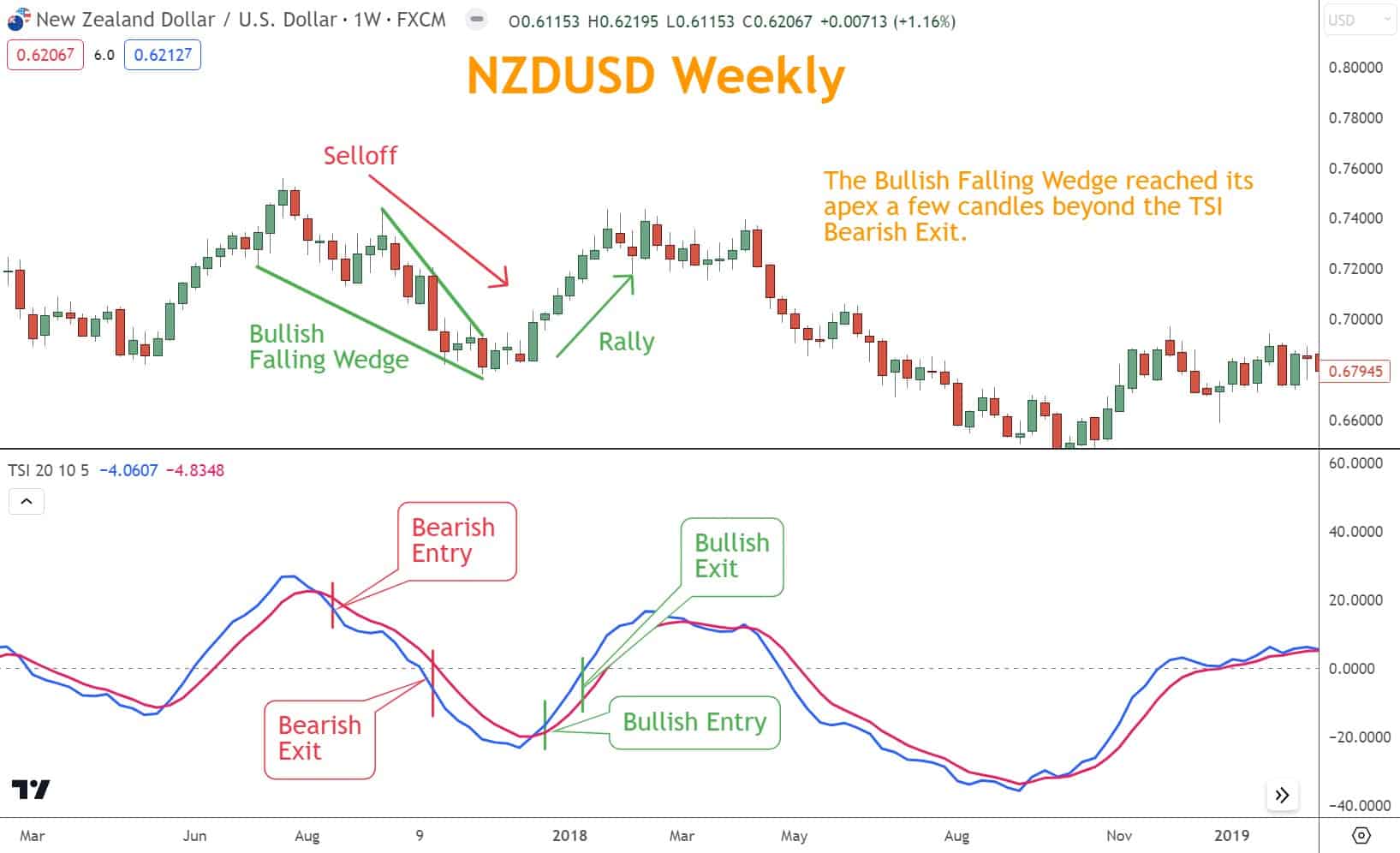

Reversal Chart patterns such as wedges can also be used to confirm a TSI reversal. In this example, the Bullish Falling Wedge apex reached a few candles beyond the TSI Bearish exit.

This is ideal since it confirms the Bearish trade is ending, and a new Bullish opportunity may come soon.

Support and Resistance areas are the typical reversal areas and can be used in coordination with TSI reversals.

With the TSI acting as a reliable Momentum technical indicator, traders can enhance their analysis and improve trading outcomes.

What’s the Next Step?

Select a favorite candlestick chart, add the TSI indicator, and, using your knowledge, look for Momentum signals.

In addition, look for opportunities to coincide it with other technical analysis tools and techniques to see how they work together.

Combining Trends, Japanese Candlestick Patterns, Chart Patterns, and Support and Resistance can give you a comprehensive view and understanding to make trading easier.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis which you can incorporate with what you’ve learned here about Support and Resistance.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and Advance Strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What is the True Strength Index and How Does it Work as a Momentum Indicator?

The TSI is a Momentum indicator measuring the strength of a security’s price movement.

It calculates the ratio of the double-smoothed moving average of the price change to the double-smoothed moving average of the absolute price change. Traders rely on it to spot Overbought/Oversold conditions and potential reversals.

Can You Combine the True Strength Index With Other Indicators for a More Accurate Analysis?

The True Strength Index can be used alongside other indicators to enhance analysis accuracy.

Combining multiple indicators like Trends, Japanese Candlesticks, Chart Patterns, and Support and Resistance gives you a more comprehensive understanding of markets and potential opportunities.

Experimenting with different indicator combinations is essential to find the best fit for your trading strategy.