Understanding Pennants, Flags, and Rectangles can help you find new trading opportunities and earn quick wins. Why?

They are each a continuation Chart Pattern, and unlike reversals, they already tell you the direction price is going. Wait for the breakout or breakdown and take advantage.

This article will dive deep into these patterns and show you how to trade them effectively in Forex trading.

You’ll find valuable insights on identifying and capitalizing on Bullish and Bearish Pennants, Flags, and Rectangles.

We’ll also discuss examples of these patterns in real-life trading scenarios and teach you how to combine them with other indicators for maximum profitability.

Understanding Trading Patterns: Pennants, Flags, and Rectangles

Pennants, Flags, and Rectangles are Chart Patterns commonly used in technical analysis to identify potential trading opportunities.

These patterns typically mark consolidation periods when there is a pause in the ongoing Rally or Selloff.

To identify these patterns, you can look for specific characteristics such as the shape and duration of the pattern, as well as the price movement within the design.

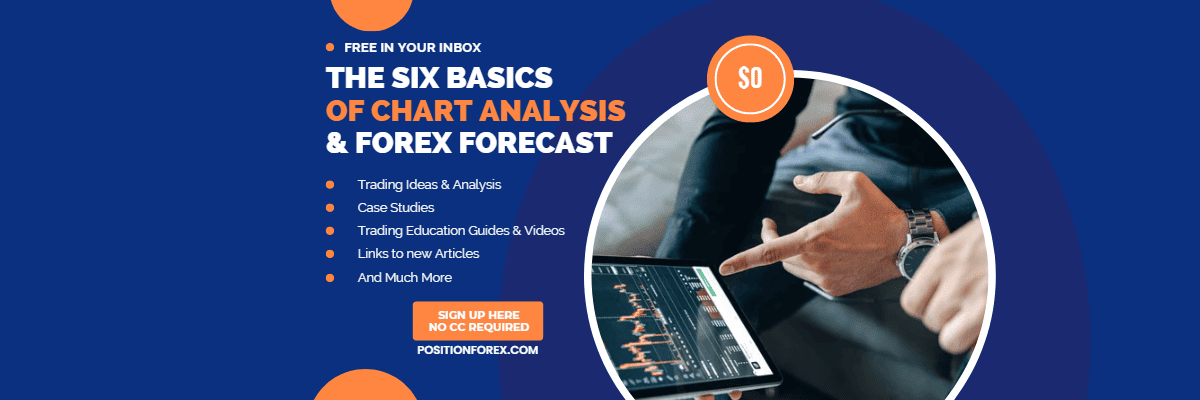

For example, a Pennant Chart Pattern is characterized by a triangular shape with converging lines, indicating a temporary pause in the direction before a potential continuation.

On the other hand, a Flag pattern is more rectangular, representing a brief consolidation phase before the price resumes its original direction.

You can utilize these patterns in various ways depending on your trading strategy. One common approach is to wait for a breakout, which occurs when the price breaks above or below the boundaries of the pattern.

This could indicate that the direction from before the breakout will continue.

A Rectangle is a pattern comprising price trapped between two horizontal lines. When prices leave the Rectangle, they can move in either direction.

It’s important to note that these patterns should not be considered in isolation but rather in conjunction with other indicators and tools.

You can combine them with Channel Lines, Momentum, Japanese Candlestick patterns, and Support and Resistance levels to increase the probability of successful trades.

By understanding and effectively utilizing Pennants, Flags, and Rectangles, you can enhance their ability to make informed trading decisions. In addition, it is crucial to have a trading plan in place, including stop loss and take-profit levels, to manage risks effectively.

How to trade Pennants in Forex Trading

Pennant formations are a typical trading pattern in Forex that indicates a continuation of the current direction.

They are formed by a consolidation period after a strong price move, characterized by converging lines. Traders can enter a trade when the price breaks out of the pennant pattern in the previous direction.

One way to manage risk in this trade is to place stop-loss orders below the lowest point of the Pennant and set take-profit targets based on the size of the previous price move. This technique is called a “Measured Move.”

The idea behind Measured Move is a Forex pair will move just as far after the Pennant as before.

I prefer not to use this approach and instead examine other technical analysis elements to choose a Stop and Target since I consider the Measured Move arbitrary.

Later in this post, we combine technical analysis indicators with these continuation patterns to illustrate better Stop and Target discovery options.

Confirming the validity of the pattern with other technical indicators and effectively managing risk is crucial when trading Pennants.

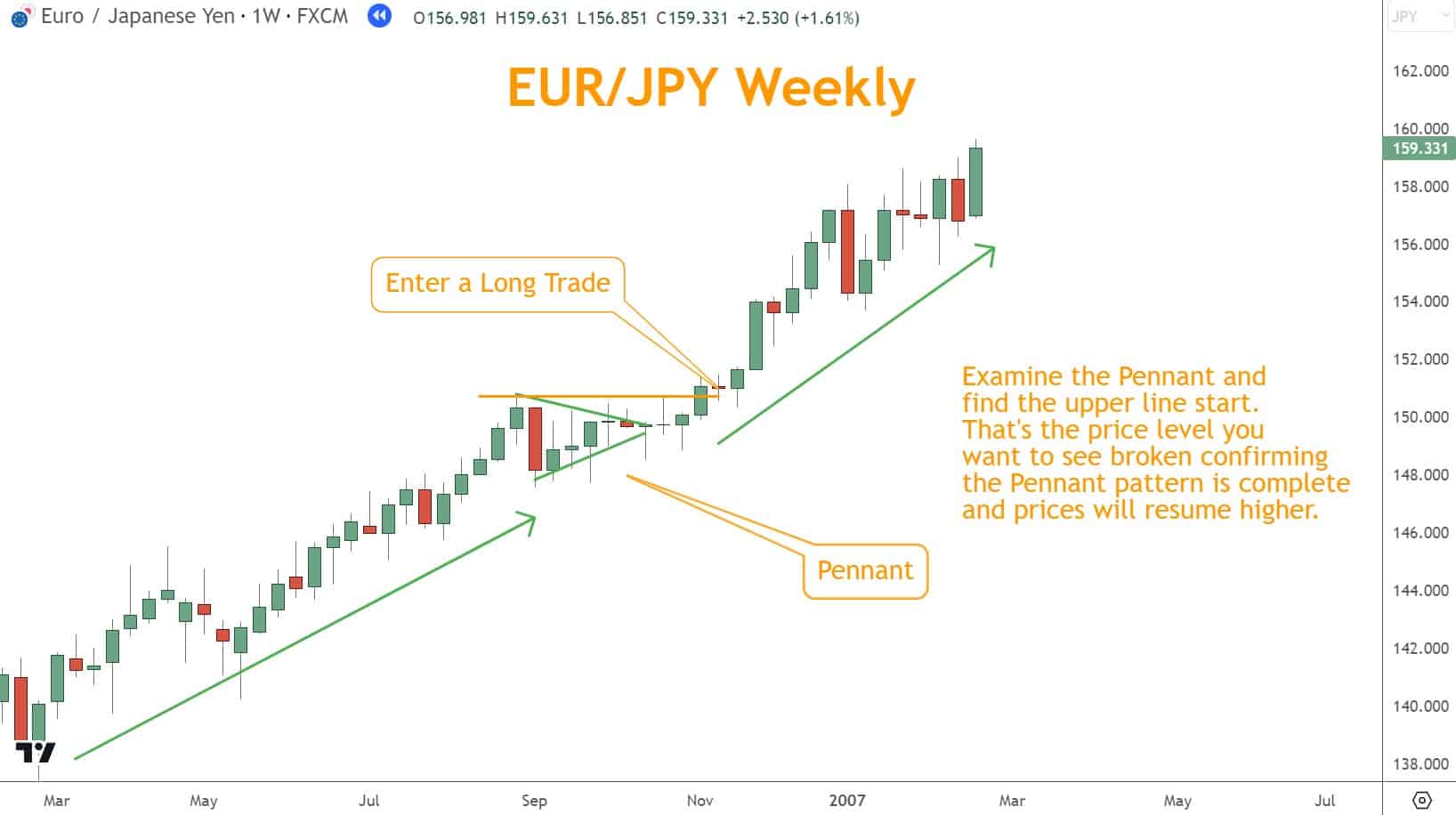

How to Trade the Bull Pennant

A Bull Pennant is a continuation pattern that forms after a significant upward move in price.

A small triangle with converging lines characterizes it. The pattern typically represents a temporary consolidation before the price continues to rise.

When trading, I search for a breakout above the upper boundary of the Pennant as a signal to enter a long position.

When identifying potential continuation opportunities, this technical analysis pattern is part of your arsenal.

By recognizing and understanding the Bullish Pennant pattern, you can make informed decisions based on price action and potentially profit from the subsequent price movement.

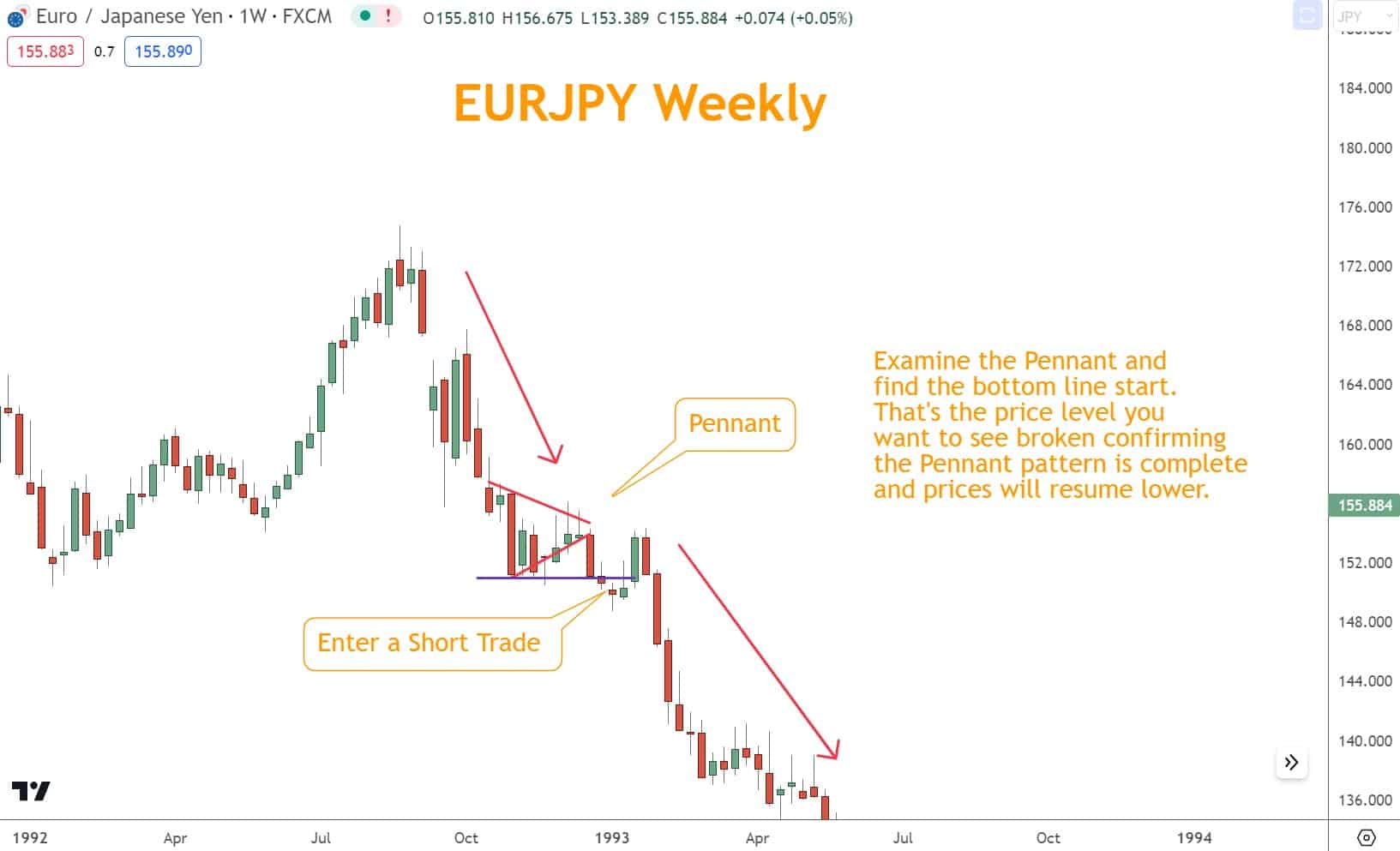

How to Trade a Bear Pennant

A Bear Pennant can be identified by a sharp price decline followed by a period of consolidation in the form of a triangle.

This continuation pattern is confirmed when the price breaks below the lower line of the triangle, indicating further downside movement.

You can see Bear Pennants as an opportunity to enter short positions and profit from the expected downward trend.

It’s important to note that, like other patterns, Bear Pennants should be confirmed with other technical indicators, and you should manage risk effectively with stop-loss levels.

How to Trade Flags in Forex Trading

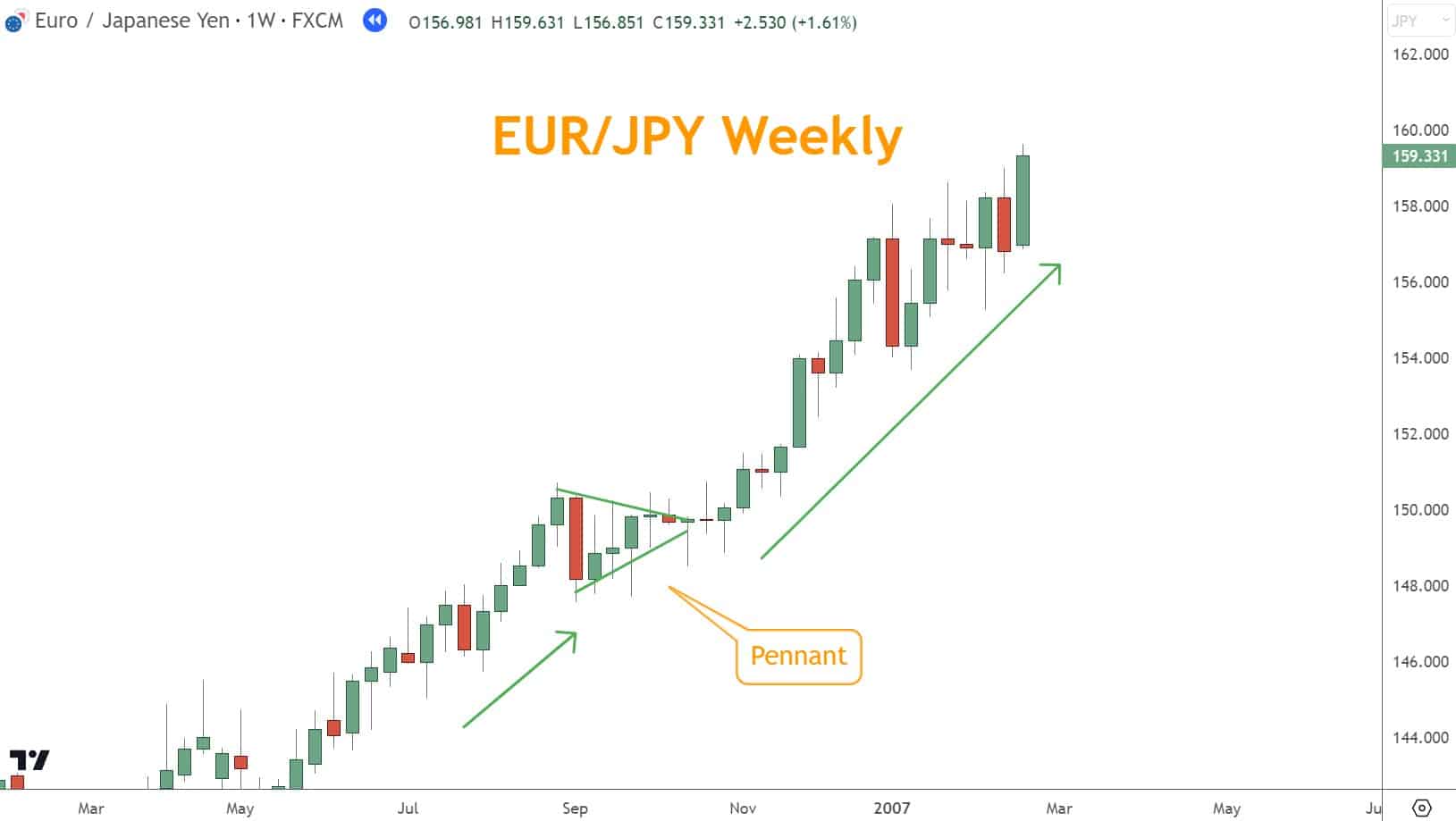

Flags are another typical chart pattern in Forex trading, representing a temporary pause or consolidation before the price resumes its previous direction.

To trade Flags effectively, it’s essential to understand their formation and confirm their presence on a price chart.

Once identified, you can implement a trading strategy that includes entry and exit points. By capitalizing on Flag patterns, you can take advantage of continuations.

It’s important to note that Flags can be both Bullish and Bearish, depending on the direction of the previous trend.

How to Trade a Bull Flag

A Bull Flag is a typical Chart Pattern in Forex trading that signals a continuation of a Rally.

This pattern is formed when there is a sharp upward price movement, known as the flagpole, followed by a consolidation period called the Flag.

To trade a Bull Flag, wait for the price to break out above the upper line of the Flag and enter a long position.

Stop-losses can be set below the lower line of the Flag or using another technical analysis approach to limit potential losses.

The profit target for a Bull Flag can also use a Measured Move approach or a different technical analysis mechanism. I discourage the use of Measured Move since it’s arbitrary.

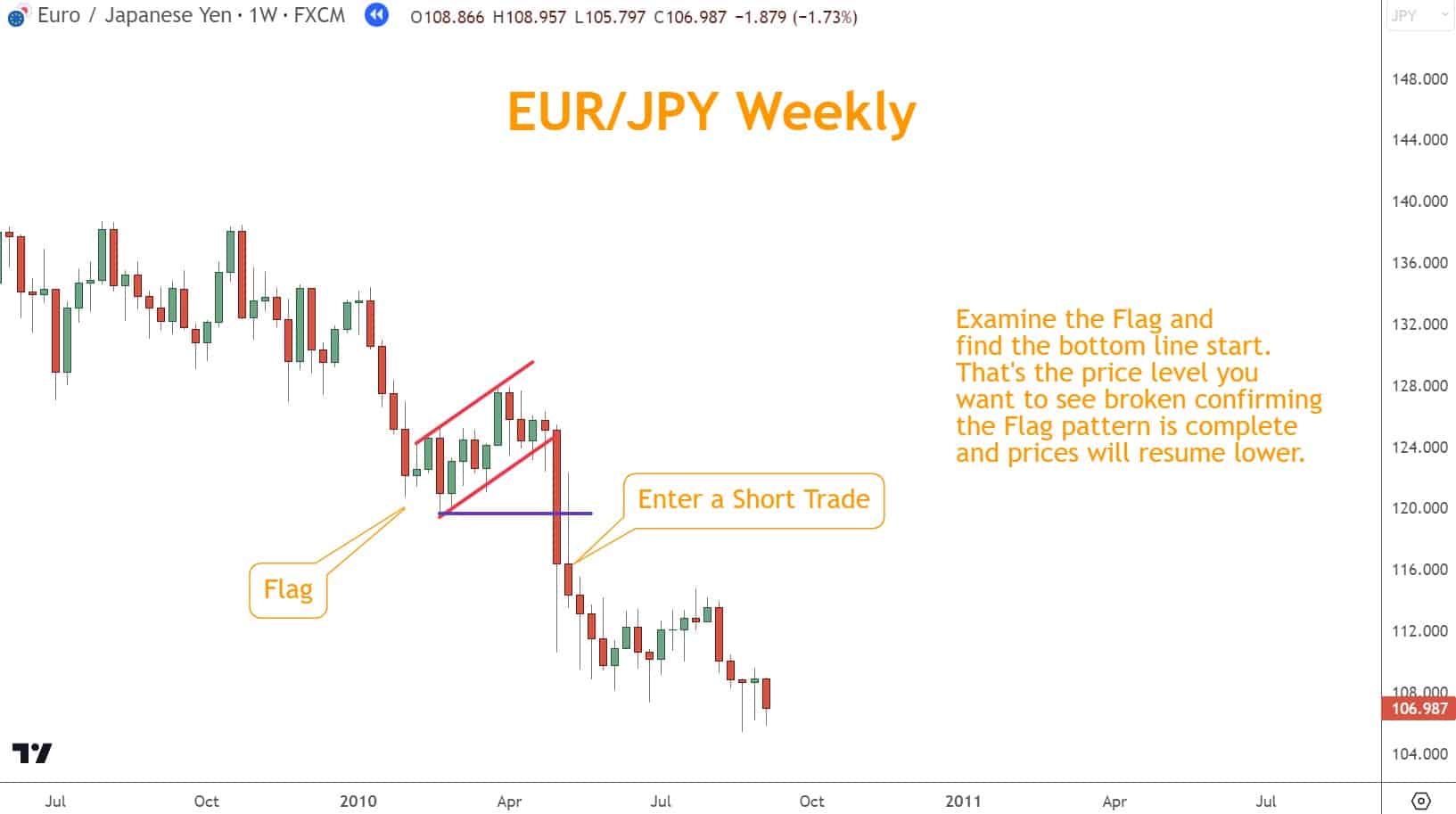

How to Trade a Bear Flag

Bear Flags are a typical Chart Pattern in Forex trading that suggests a potential continuation of a Selloff.

These patterns are characterized by a sharp price decline followed by a period of consolidation in the form of a Flag shape.

To trade a Bear Flag, wait for a break below the lower boundary of the Flag and enter a short position.

It is crucial to set stop-loss orders above the upper boundary of the Flag to manage risk effectively. By recognizing and trading Bear Flag patterns, you can take advantage of Selloffs in the market.

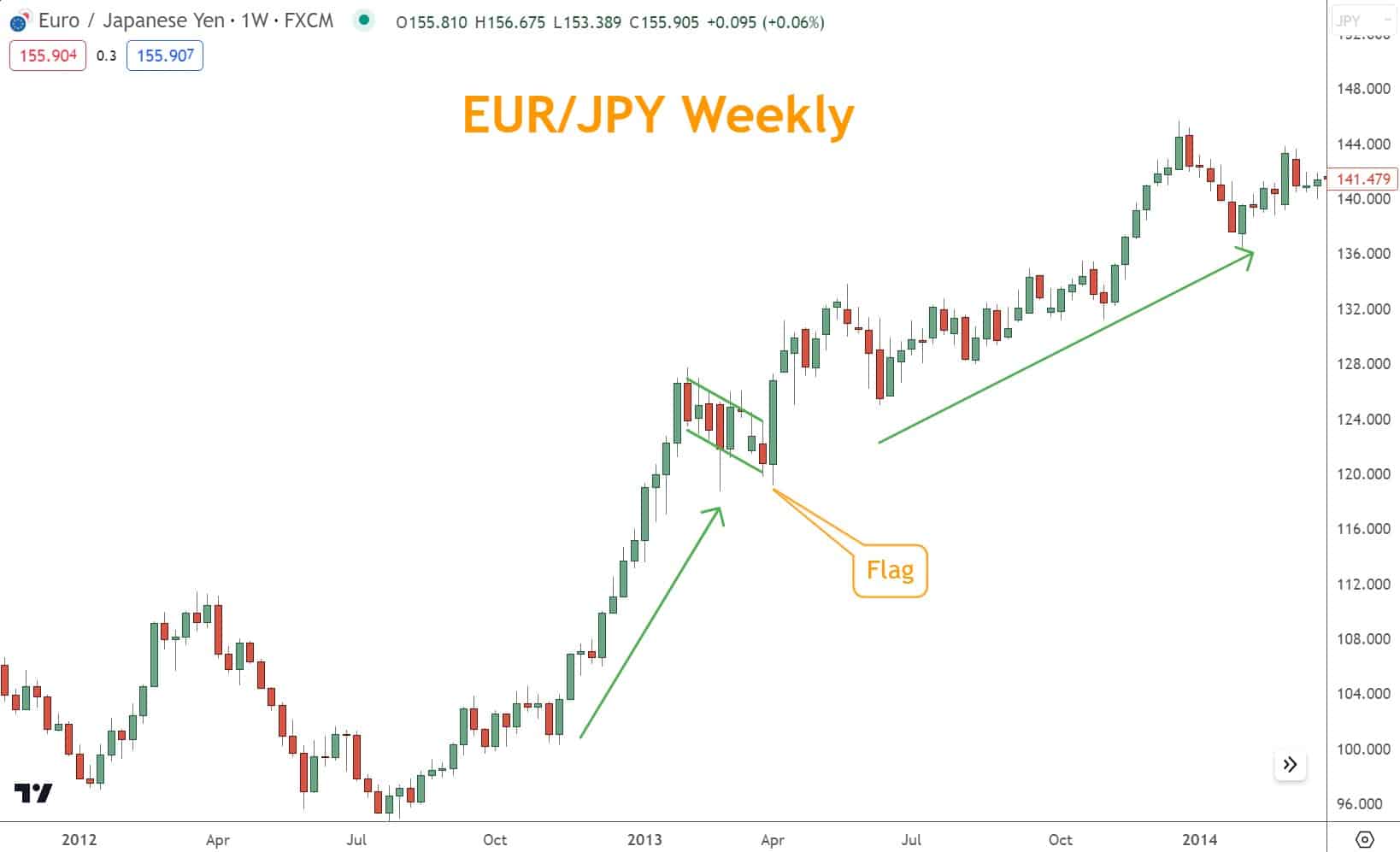

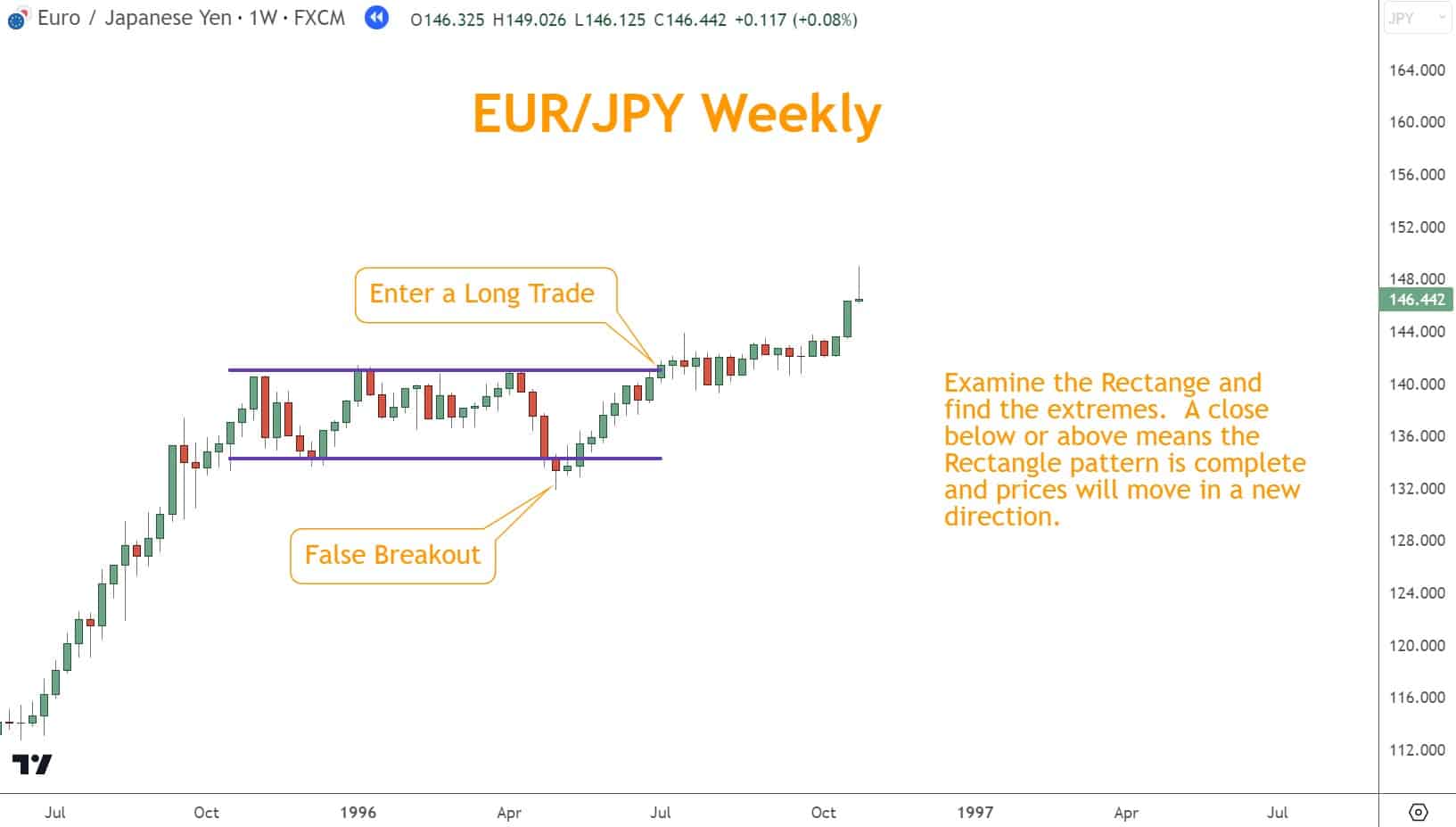

Understanding Rectangles in Forex Trading

Recognizing the formation of a Rectangle pattern on a price chart is crucial in trading. Once identified, you can wait for a clear breakout above or below the Rectangle pattern to confirm a potential trade.

Rectangles are sideways consolidations appearing at the end of Rallies or Selloffs. Unlike the Pennants and Flags, prices don’t always resume their original direction when leaving a Rectangle.

This is because a Rectangle is the most explicit expression of a battle between Bulls and Bears over time. Once the conflict is resolved, the “winner” will determine the new direction.

This differs significantly from Flags and Pennants, which are formed to relieve overextended price conditions.

Setting entry points, stop-loss levels, and profit targets based on the breakout direction helps traders manage risk effectively.

How to Trade a Rectangle in Forex Trading

Rectangles are a typical Chart Pattern in Forex trading and can provide opportunities for traders to enter and exit positions.

This pattern is formed when prices consolidate between two horizontal levels, creating a range-bound market.

You can identify Rectangles by drawing horizontal lines connecting the highs and lows of the consolidation period. Once a rectangle pattern is identified, look for potential breakouts or breakdowns from the range.

Breakouts occur when the price breaks above the upper boundary of the Rectangle, signaling a potential Bullish move. Breakdowns happen when the price breaks below the lower boundary of the Rectangle, signaling a likely Bearish move.

False breakouts are often strong signals to trade in the opposite direction, as seen in this Rectangle example.

Combining Continuation Patterns with Other Indicators

When trading continuation patterns like Pennants, Flags, and Rectangles, combining them with other indicators can be beneficial to confirm signals and increase the probability of successful trades.

You can gain further insight into a market by using indicators such as Momentum, Japanese Candlesticks, and Support and Resistance in conjunction with these patterns.

Momentum indicators can help identify a Forex pair’s energy, while Japanese Candlesticks provide valuable information on price action.

Meanwhile, Support and Resistance levels can act as confirmation points for potential breakouts or breakdowns. Incorporating these indicators into your trading strategy can enhance your analysis and make more informed trading decisions.

Combining with Momentum Indicators

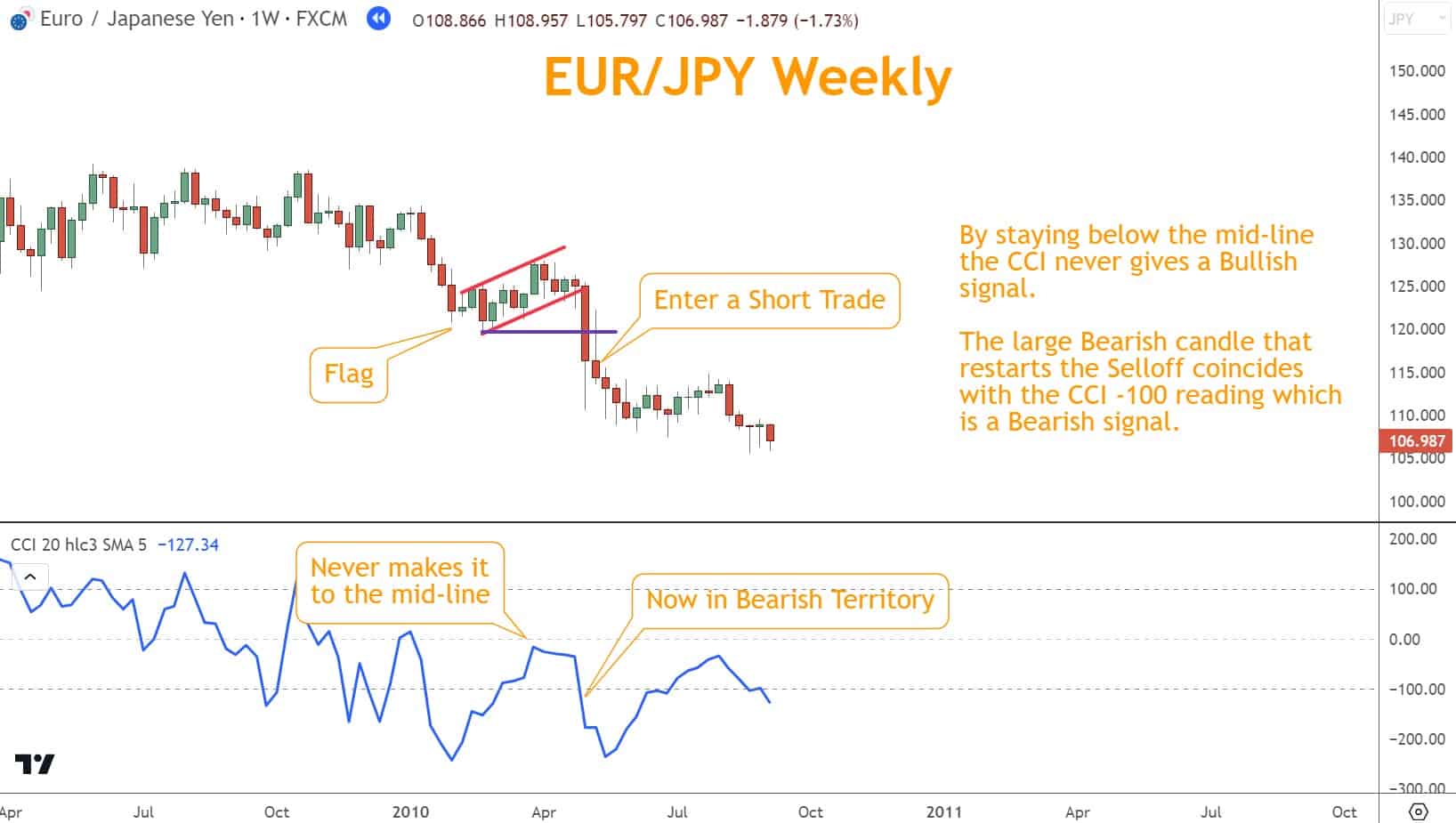

Momentum indicators, such as the CCI or Stochastic, can confirm signals provided by Continuation patterns.

For instance, when a Bullish Pennant pattern appears complete and the price is Oversold, it confirms a potential Rally to resume.

Conversely, if a Bearish Flag pattern is forming and the Stochastic is Overbought, it suggests a potential selloff soon.

Remember that while indicators and patterns are helpful, they should consider multiple factors before trading.

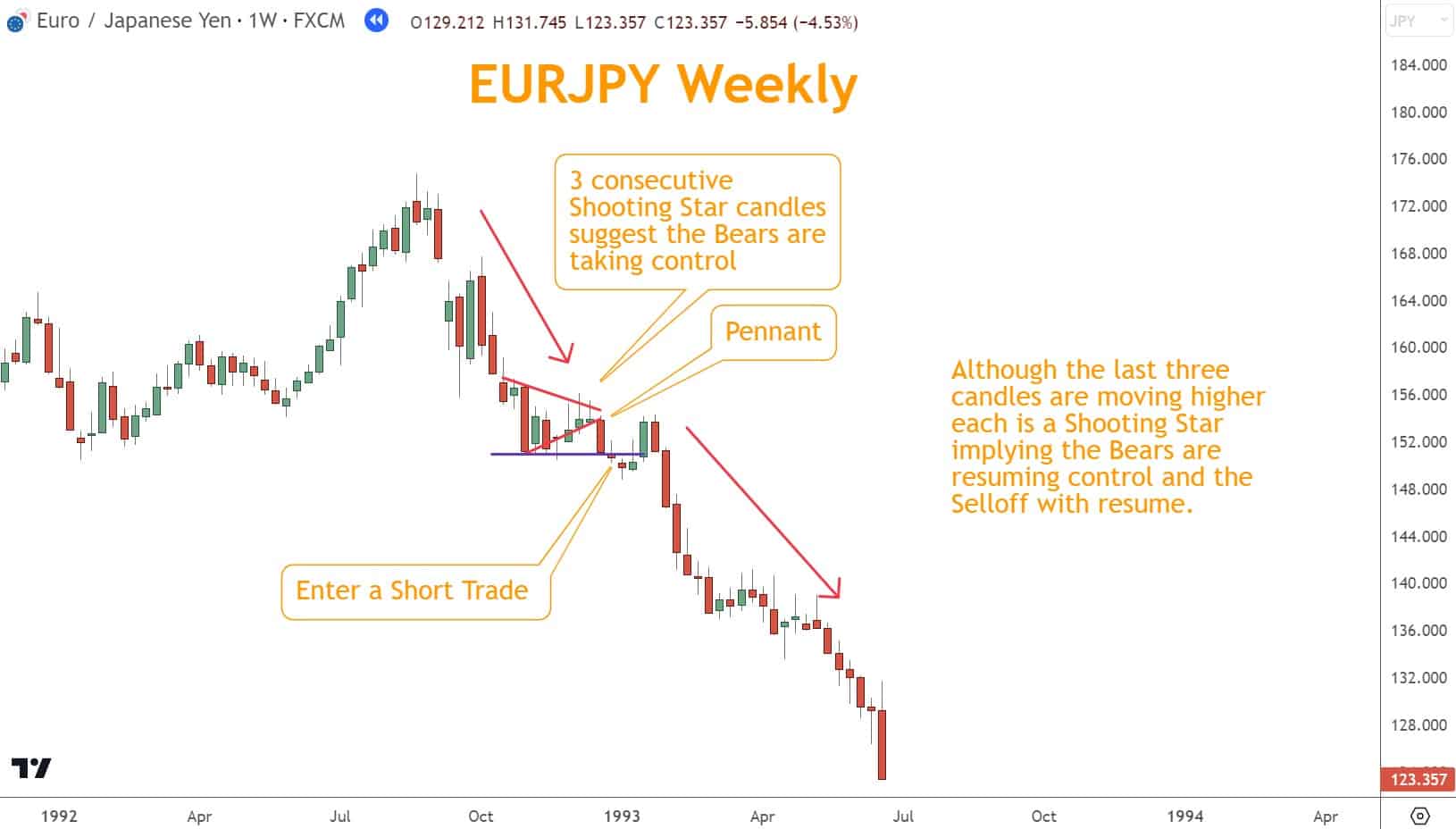

Combining with Japanese Candlesticks

Combining these continuation patterns with Japanese Candlestick patterns can help confirm reversals or continuations.

For example, if a Bearish Pennant pattern forms and is accompanied by a Shooting Star Candlestick pattern, it may indicate a strong continuation of a Selloff.

On the other hand, if a Rectangle pattern forms and a Hammer Candlestick pattern appears, it may suggest a Rally.

It’s essential to use these combinations of indicators in conjunction with other technical analysis tools and consider the overall market conditions before making trading decisions.

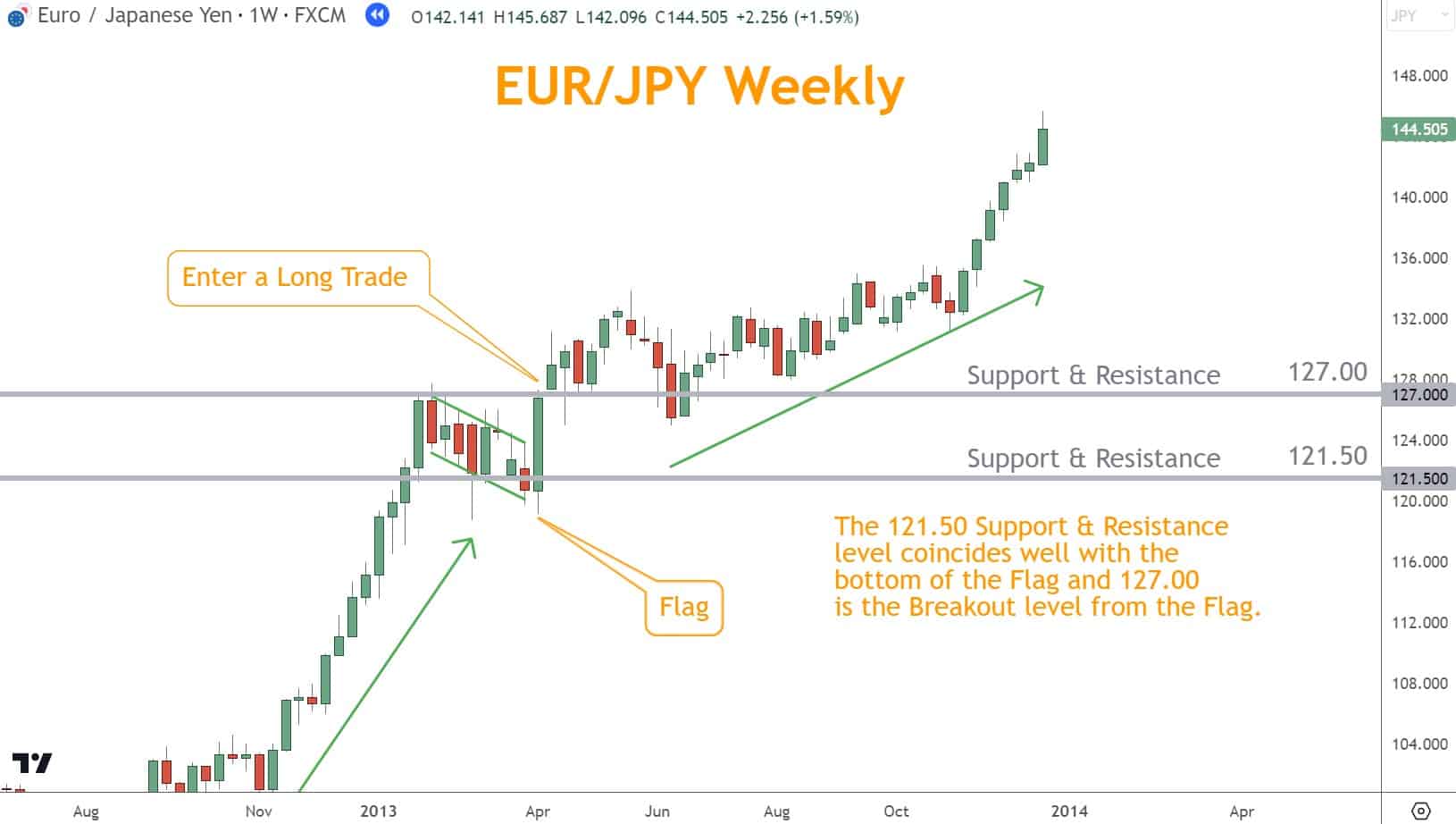

Combining Support and Resistance

Support and Resistance levels are significant areas on a price chart where the price has previously struggled to break through or fall below.

When a continuation pattern tests a Support or Resistance level, it further validates the continuation.

By combining these indicators, you can identify trade setups that offer higher probabilities of success and make more informed trading decisions.

What’s the Next Step?

Select a favorite candlestick chart, look for Pennant, Flag, and Rectangle patterns, and, using your knowledge, look for continuations.

In addition, look for opportunities to coincide it with other technical analysis tools and techniques to see how they work together.

Combining these patterns with Momentum, Japanese Candlesticks, and Support and Resistance can give you a comprehensive view and understanding to make trading easier.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis which you can incorporate with what you’ve learned here about Support and Resistance.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and Advance Strategies? I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

How do you Trade Flags and Pennants?

To trade Flags and Pennants, first, identify the pattern on a price chart – a consolidation phase followed by a breakout.

Confirm with other indicators, then enter a trade when the price breaks out in the previous direction.

Set stop-loss and take-profit levels to manage risk and potential profits.

What is the Difference Between a Flag and Pennant?

The Flag and Pennant differ in their shape on a price chart.

A Flag is a rectangular consolidation after a sharp price movement, while a Pennant is a triangle. Both patterns can be Bullish or Bearish depending on the price’s original direction.