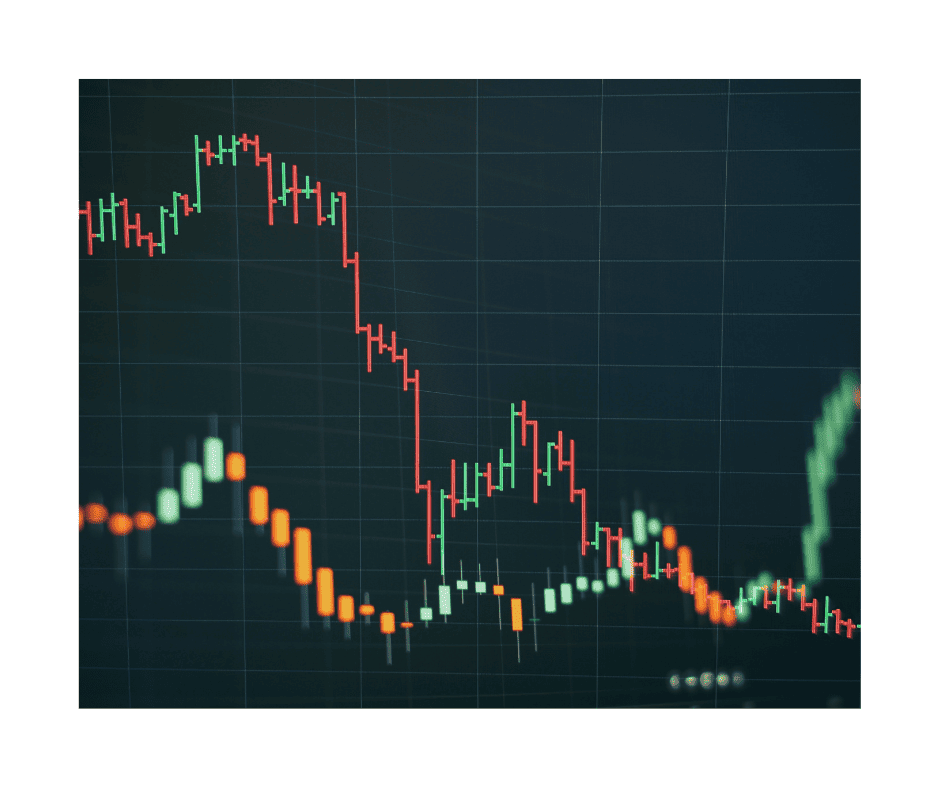

Understanding market phases is critical to your trading strategy.

In this article, I’ll discuss how price cycles impact trading decisions.

Each phase represents a distinct period characterized by unique trends and investor behaviors.

There are four primary segments of market phases: Accumulation, Markup, Distribution, and Markdown.

What are the Characteristics of the Accumulation Phase?

The accumulation phase is a period of significant interest often overlooked by traders.

In this article, I’ll describe these phases in terms of opening long trades. Everything applies similarly for short trades but in the inverse.

It typically follows a Bearish trend where asset prices have declined, sometimes sharply, leading to undervaluation.

During this phase, there is a general sense of pessimism in sentiment, with traders exhibiting skepticism.

However, savvy traders consider opening positions during this phase, anticipating future price appreciation.

Key Indicators of the Accumulation Phase

- Price Stabilization and Support Levels: One of the first indicators of Accumulation is the stabilization of price declines. The instrument stops making new lows, indicating that the selling pressure is diminishing. You will notice that the price tends to bounce back consistently after reaching Support levels.

- Improvement in Fundamentals: Accumulation often coincides with gradual improvements in the underlying fundamentals of the asset. For Forex, this could mean better-than-expected GDP or Retail sales reports, positive developments in employment, or favorable political news.

- Sentiment Shifts: While the general sentiment might still be Bearish, subtle shifts can indicate a change in outlook among select traders.

Strategic Implications for Traders

During the Accumulation phase, you can take advantage of the pessimism. The fundamental strategy is to identify undervalued Forex pairs.

This effort requires rigorous fundamental analysis, including evaluating economic statistics, political climate, and technical aspects.

- Risk Management: Accumulation presents opportunities but includes risks, as prices could remain Bearish longer than anticipated. Setting stop-losses and maintaining a disciplined approach to position sizing is crucial to managing potential downsides.

- Patience and Timing: Accumulation is a phase that requires patience. It may take time to fully recognize the instrument’s value, and premature selling can lead to missed opportunities. You should have a clear price target and be willing to hold positions for a prolonged period.

- Monitoring Signals: Continuous monitoring of trends and news is vital. You need to be alert to changes in pricing dynamics that could signal the end of the Accumulation phase and the beginning of the next phase, the Markup.

In summary, the Accumulation phase allows you to enter trades at advantageous prices.

It demands analytical skills, strategic foresight, and disciplined risk management.

Recognizing and capitalizing on this phase can set the foundation for substantial returns in the future.

What are the Defining Characteristics of the Markup Phase?

A sustained uptrend in prices marks the Markup phase. This phase typically begins when the consensus shifts from Bearish to Bullish, often triggered by improved economic conditions, positive news flow, or broader optimism.

Essential Conditions During the Markup Phase

- Consistent Price Increases: One of the most noticeable features of the Markup phase is a constant increase in instrument prices. Forex pairs undervalued during the Accumulation phase begin to see their actual value recognized by a broader segment.

- Growing Investor Confidence: As the price continues upward, trader confidence grows. This confidence is often accompanied by positive media coverage and Bullish forecasts by analysts, further fueling the Rally.

- Technical Indicators: Technical indicators such as Moving Averages, Momentum oscillators, and Channel Lines tend to show Bullish signals. Prices often trade above key Moving Averages, and there may be Bullish Chart Patterns and Breakouts.

Strategic Implications for Traders

The Markup phase presents significant profit opportunities but requires astute trading strategies to maximize gains and minimize risks.

- Riding the Rally: The primary strategy during the Markup phase is to capitalize on the Rally. You want to hold onto positions accumulated during the Accumulation phase, taking advantage of the increasing instrument prices.

- Selective Entry Points: Finding the right entry point becomes crucial for those not building positions during the Accumulation phase. It’s important to avoid chasing prices too high and to look for short-term pullbacks or consolidations as potential entry opportunities.

- Use of Technical Analysis: Technical analysis becomes particularly valuable during the Markup phase. Use technical indicators to identify potential sell signals indicating the phase’s end.

- Risk Management: While rising prices characterize the Markup phase, it is also prone to volatility and sudden reversals. Implementing effective risk management strategies, such as trailing stop-loss orders, can help protect gains and reduce exposure to sudden price shifts.

- Profit Taking: As the phase matures, be vigilant and ready to take profits. The challenge is to balance the desire to maximize gains with the need to protect against a sudden reversal, which can mark the transition to the next phase, Distribution.

Rising asset prices in the Markup phase can significantly benefit you.

Successfully navigating this phase requires a keen understanding of sentiment, technical analysis skills, and disciplined risk management.

Watch for signs of change so you can adapt your approach as needed.

What are the Characteristics of the Distribution Phase?

The Distribution phase is often the most challenging to identify and navigate.

It represents a period when prices are still rallying, but underlying weaknesses begin to surface.

This phase typically follows a decisive Markup phase, marked by institutional investors and whale traders gradually selling off their positions.

Price Dynamics During the Distribution Phase

- Increased Volatility and Inconsistent Price Movements: One sign of the Distribution phase is increased volatility. Prices may continue to make new highs, often followed by sharp sell-offs, indicating a tug-of-war between buyers and sellers.

- Divergence in Technical Indicators: Technical indicators may show divergence during this phase. For example, while prices may reach new highs, indicators like the Relative Strength Index (RSI) may fail to confirm these highs, signaling weakening momentum.

- Changes in Sentiment: Despite Bullish sentiment in media and analyst reports, more cautious or Bearish voices may emerge. This change in sentiment can often be subtle and requires careful attention to news and reports.

Strategic Implications for Traders

Navigating the Distribution phase requires an agile and cautious approach as the risk of a downturn increases.

- Portfolio Reassessment and Adjustment: You should reassess your trades to reduce exposure to overvalued Forex pairs showing weakness. It may be prudent to start taking profits on positions that have appreciated significantly during the Markup phase.

- Increased Focus on Technical Analysis and Sentiment: Technical analysis becomes even more crucial in identifying the early signs of a shift from Distribution to the Markdown phase. Pay close attention to Japanese Candlestick and Momentum reversals and Support and Resistance levels.

- Risk Management and Hedging: Implementing robust risk management strategies is vital during this phase. Risk management can include setting tighter stop-losses or reducing position sizing.

- Preparation for the Next Phase: As the Distribution phase progresses, prepare yourself for the potential onset of the Markdown phase. This preparation involves defensive measures to protect capital and identifying potential opportunities to profit from the coming reversal.

In summary, the Distribution phase is a transitional period that can test the mettle of even the most seasoned traders.

It demands a high level of vigilance, an ability to interpret subtle changes in market dynamics, and a readiness to adapt strategies quickly.

Successfully navigating this phase can help preserve capital and position traders advantageously for the ensuing Markdown phase.

What are the Characteristics of the Markdown Phase?

A sustained decline in asset prices typically marks the Markdown phase.

This phase follows the Distribution phase, characterized by widespread selling, Bearish sentiment, and a general aversion to risk.

Bad economic news, geopolitical uncertainty, or Forex pair imbalances often trigger it.

Price Conditions During a Markdown

- Rapid Price Declines: A defining feature of this phase is sharp and fast declines in instrument prices. The optimism of previous phases gives way to pessimism, leading to panic selling and significant price drops.

- High Volatility: The Markdown phase is often marked by high volatility, with significant price swings reflecting uncertainty and fear.

- Bearish Technical Indicators: Technical indicators show significant Bearish signals during the Markdown phase. Moving averages, channel lines, and Momentum indicators like the RSI often confirm the downward Selloff.

- Negative Sentiment and News: The media and analyst reports are predominantly negative, with frequent reports of economic woes, political instability, or other adverse news.

Strategic Implications for Traders

Navigating the Markdown phase requires a defensive strategy focused on opportunistic trading in the inverse direction.

- Inverse Portfolio Positioning: Traders should consider reducing their exposure in their long trades and shifting their focus in the other direction.

- Capital Preservation Focus: During the Markdown phase, the primary goal is to preserve capital for the next trade. Preserving capital means avoiding the urge to ‘catch a falling knife’ by prematurely buying assets that seem cheap but may still have further to fall.

- Looking for Bottoming Signals: Towards the end of the Markdown phase, watch for signals that the market may be bottoming out. These include slowing improving Momentum, reversal patterns, and improvements in sentiment.

- Preparation for Accumulation Phase: As the Markdown phase nears its end, forward-looking traders begin to prepare for the next Accumulation phase. This preparation involves researching and identifying undervalued instruments that may offer significant upside potential in the following cycle.

In summary, the Markdown phase is a challenging period marked by declining prices and negative sentiment.

Successful navigation requires focusing on risk management, defensive positioning, and remaining disciplined and unemotional in the face of turmoil.

For the astute trader, it also offers the opportunity to lay the groundwork for future gains as the cycle eventually turns back to Accumulation.

How Can an Integrated Approach to Analysis Help?

Identifying these cycles is not solely based on technical analysis.

A comprehensive approach involves integrating technical indicators with fundamental analysis and sentiment analysis.

Understanding broader economic trends is crucial. Interest rate changes, inflation data, GDP growth rates, employment figures, and other macroeconomic indicators can signal shifts in market phases.

Sophisticated Technical Analysis Techniques

- Price Action: Price patterns are crucial to identifying phases. For instance, Candlestick patterns and Chart Patterns provide valuable insights.

- Moving Averages and Channel Lines: Moving averages help signify the overall trend. Similarly, Channel lines and Support and Resistance levels offer insights into Momentum and potential phase shifts.

- Momentum Indicators and Oscillators: Tools like the RSI and Stochastics help identify Momentum shifts that often precede phase changes. Divergences between these indicators and price action can be particularly revealing.

Sentiment Analysis and Behavioral Economics

Market Psychology and News Analysis: It is crucial to understand the psychological underpinnings of market behavior, such as fear, greed, and herd mentality.

Analyzing news and commentary can also provide insights into the prevailing sentiment and potential phase shifts.

Risk Management Considerations

Correlation and Diversification Analysis: Monitoring the correlation between different Forex pairs can provide early warning of market shifts.

Continual Learning and Adaptation

Market phases are not static; their identification requires constant learning and adaptation. You must stay abreast of the latest developments and economic news.

In summary, advanced identification of these cycles is a multifaceted process combining various analysis forms.

It requires a deep understanding of technical indicators, economic fundamentals, sentiment, and risk management.

This comprehensive approach enables you to make more informed decisions, align strategies with conditions, and better manage the risks associated with each of them.

Are There any Other Considerations?

- Careful Use of Leverage: While leverage can amplify returns, it also increases risk. It is crucial to manage leverage ratios and ensure they align with one’s risk tolerance and outlook.

- Margin Requirements and Liquidity Considerations: Understanding and managing margin requirements and ensuring sufficient liquidity to meet these requirements under different conditions is essential to avoid forced liquidations.

Psychological Aspect of Risk Management

- Emotional Discipline: Maintaining emotional discipline to avoid impulsive decisions based on fear or greed is critical to risk management.

- Continuous Learning and Adaptation: It is vital to stay informed about developments and continually adapt risk management strategies to evolving market conditions.

- Assessment of Risk-Reward Ratio: Before entering any trade, it is essential to assess the potential risk versus the potential reward. Trades with a favorable risk-reward ratio are generally preferred.

In summary, risk management in trading encompasses various strategies and techniques.

It involves careful order management, leverage control, psychological discipline, and a continuous assessment of risk-reward dynamics.

Conclusion

Exploration of market phases reveals pricing dynamics and their cyclical nature.

Each phase – Accumulation, Markup, Distribution, and Markdown – presents unique challenges and opportunities.

If you can effectively identify these phases and adapt strategies accordingly, you will make informed decisions that align with the current environment.

Importance of Understanding Market Phases:

- Informed Decision-Making: They empower you with the knowledge to make more informed decisions. Recognizing which phase prices are in can dictate whether to adopt a Bullish, Bearish, or Neutral stance in trading strategies.

- Strategic Positioning: Each phase demands different trading tactics. From the accumulation of undervalued assets during the Accumulation phase to profit-taking and risk management during the Distribution and Markdown phases, strategic positioning is vital to capitalizing on prices’ cyclical nature.

- Risk Management and Capital Preservation: An in-depth understanding is essential for effective risk management. It allows you to recognize when to shift focus from profit maximization to capital preservation, especially during transitional and bearish periods.

Understanding and navigating through different cycles is not just about technical proficiency; it’s about developing a comprehensive trading approach that combines analysis, strategic positioning, and robust risk management.

By mastering the art and science of phase identification and employing advanced trading and risk management strategies, you can position yourself to take advantage of the opportunities presented in each phase while safeguarding your capital against risk.

What’s the Next Step?

Select your favorite chart and try determining market phases using the abovementioned ideas.

In addition, look for opportunities to use what you’ve learned here to make trading analyses and strategies.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about determining market phases.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What are Market Phases in Trading?

These refer to the cyclical patterns prices follow, characterized by distinct trends and investor behaviors.

These phases include Accumulation (early trend reversal and buying), Markup (price rise and bullish sentiment), Distribution (selling off and market top formation), and Markdown (price decline and bearish sentiment).

How Can Traders Identify the Start of a New Cycle?

A new cycle involves a combination of technical, fundamental, and sentiment analysis.

You can look for price pattern changes, economic indicator shifts, and changes in overall sentiment.

Technical indicators such as Moving Averages and RSI can also explain phase transitions.

Why is Understanding These Important for Traders?

Understanding is crucial for traders as it helps them align their strategies with the prevailing conditions.

Each phase requires different trading approaches – from accumulation and long positions in Bullish phases to selling and possibly shorting in Bearish phases.

This understanding aids in maximizing profits and minimizing risks.

How Do Economic Indicators Make an Impact?

Economic indicators play a significant role in shaping price cycles.

Positive indicators like solid GDP growth, low unemployment, and healthy Retail sales can drive the Markup phase.

In contrast, negative indicators such as economic recessions, high inflation, or geopolitical conflicts can trigger a Markdown phase.

Traders should closely monitor these indicators for signs of potential phase shifts.