Identifying Swing Highs and Swing Lows helps define a currency pair’s price action structure. When you can understand the structure of a market, you can determine the current market direction and forecast future prices.

This capability is essential in trading, so having a method of identifying this price action is vital.

This activity has nothing to do with a swing trade or swing trading, which is trading over two to five trading days. Identifying market peaks and troughs has everything to do with tracking an instrument’s movements through time.

In this article, we will cover the basics of identifying peaks and troughs with three simple rules:

- Have a system for determining peaks and troughs

2. Determine the Forex pair’s direction before opening a trade. Is there a defined trend?

3. Find complementary indicators before opening a trade.

Additionally, we will discuss how to use technical indicators and techniques to discover trading opportunities, including retracements.

By the end of this article, you will better understand how to trade this technique and increase your chances of success in the market.

What are Swing Highs and Lows?

Labeling these swings are essential in determining direction, retracement points, and trading opportunities.

Conventionally you may refer to this as “Trend trading.” Trend trading is an expression for trading within a defined direction or “Trend.”

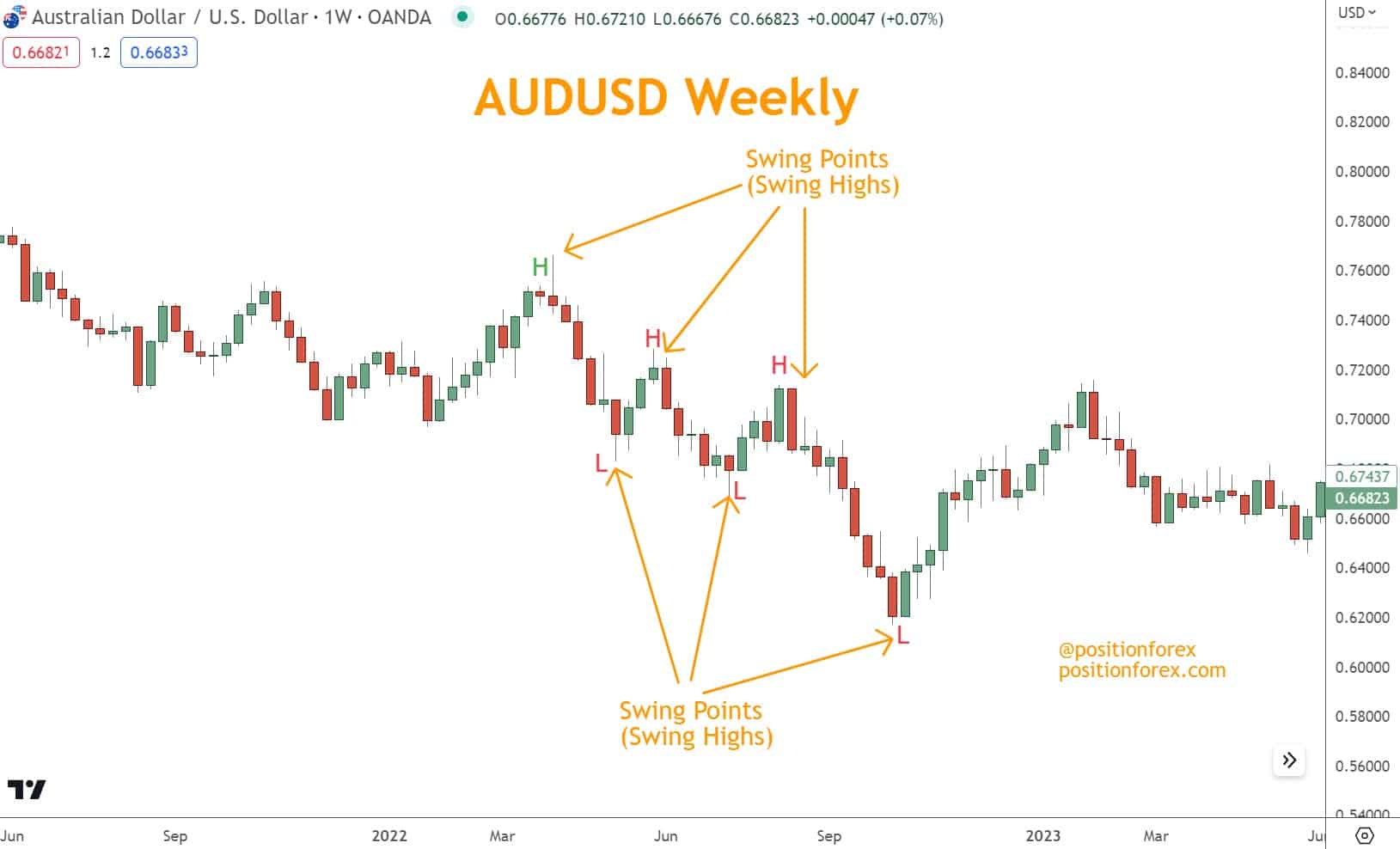

A Swing High represents where the price moves upward in a step-like fashion, whereas a Swing Low represents the point where the price moves downward in a step-like manner.

These levels help forex traders find possible setups for profitable trades.

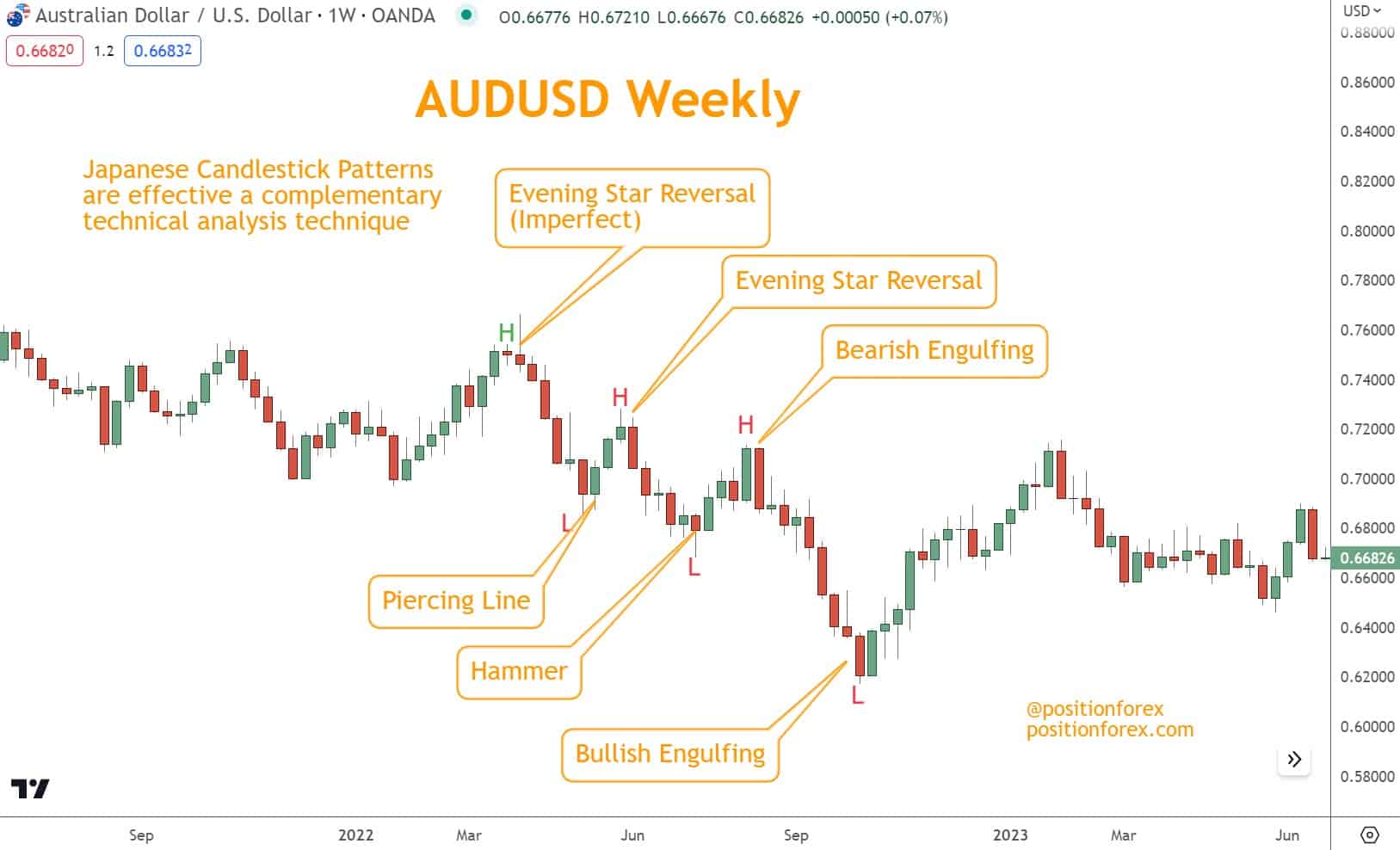

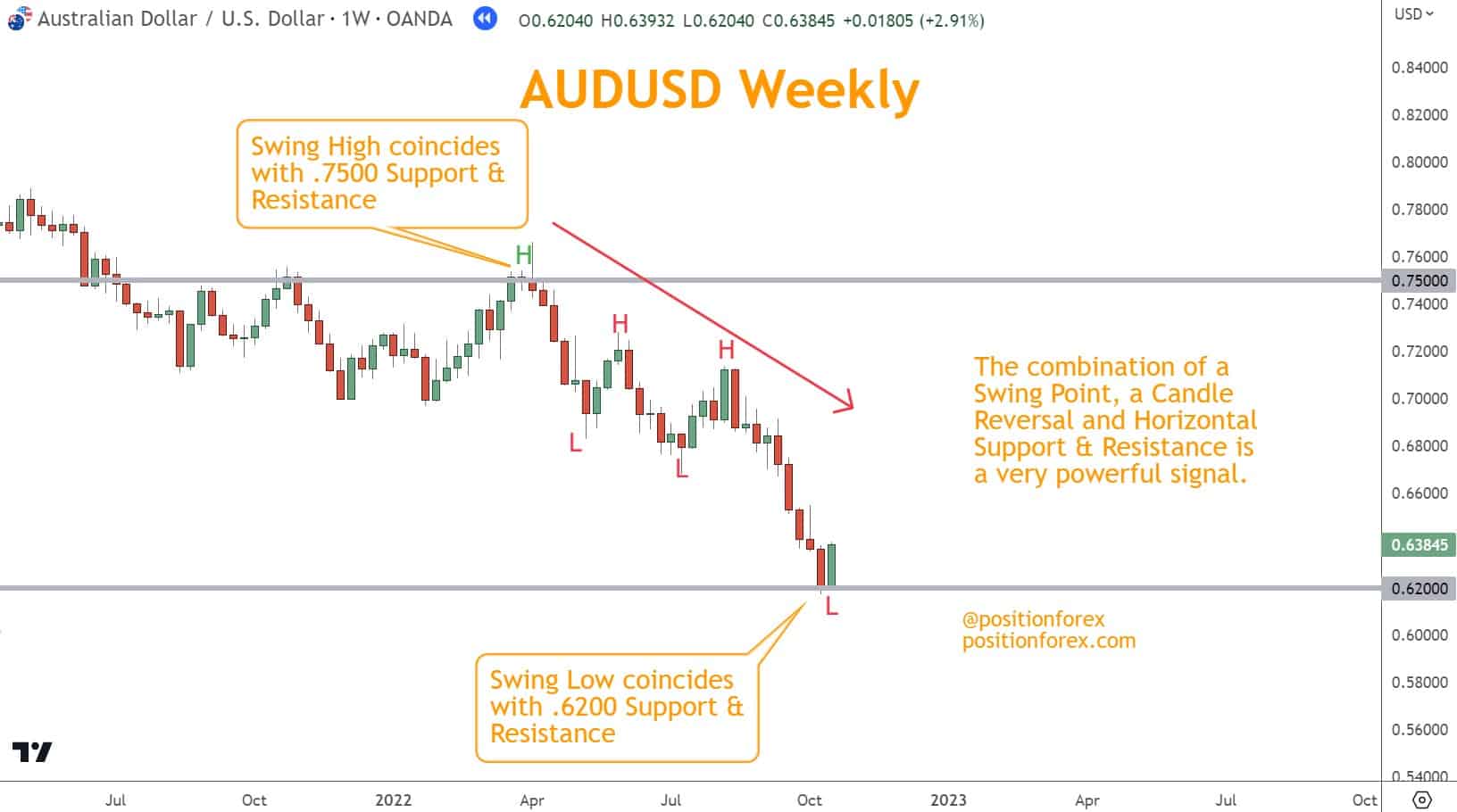

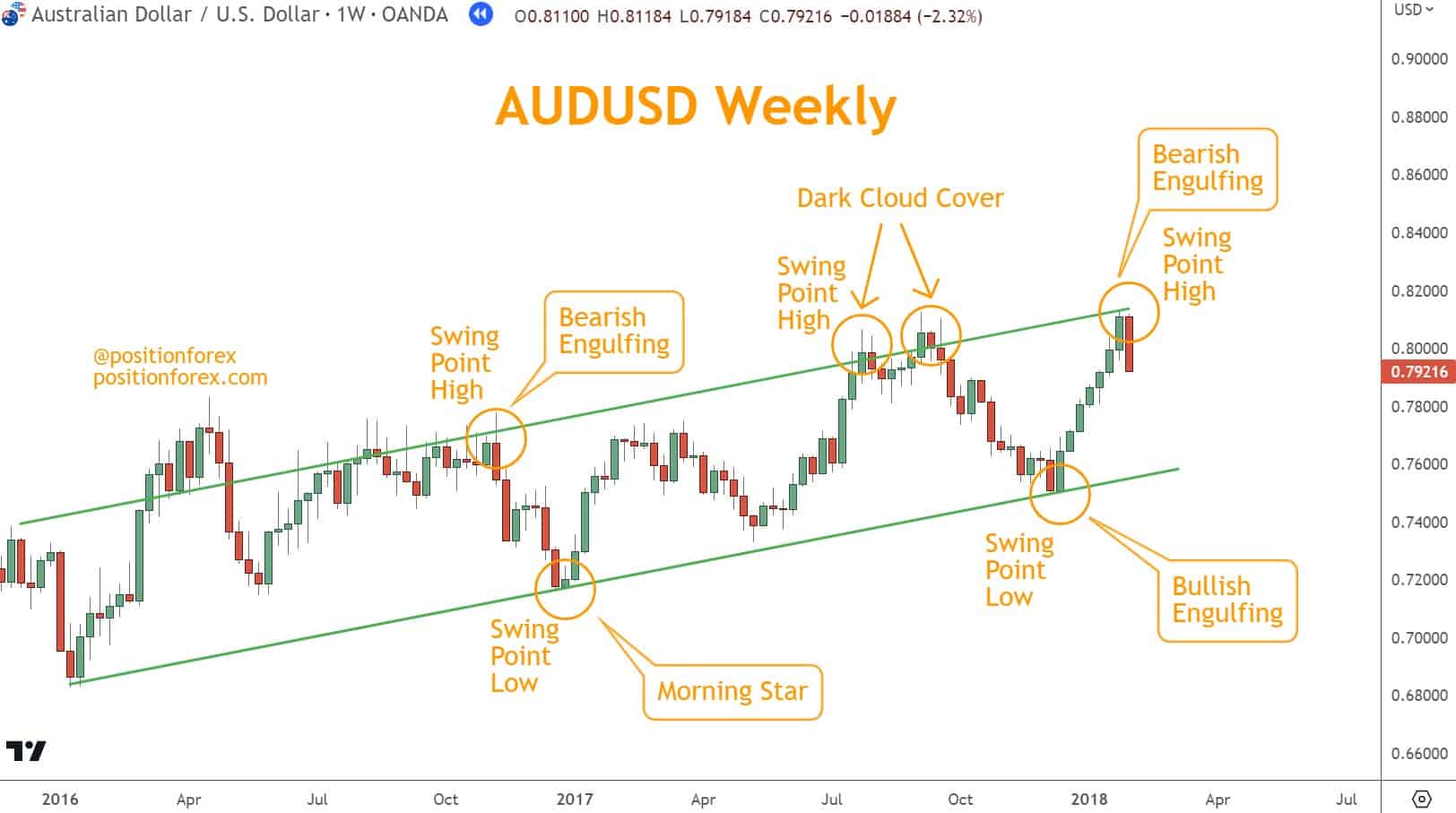

Identifying coinciding peaks and troughs with technical indicators like candlesticks or chart patterns can help you enter trades with a higher probability of success.

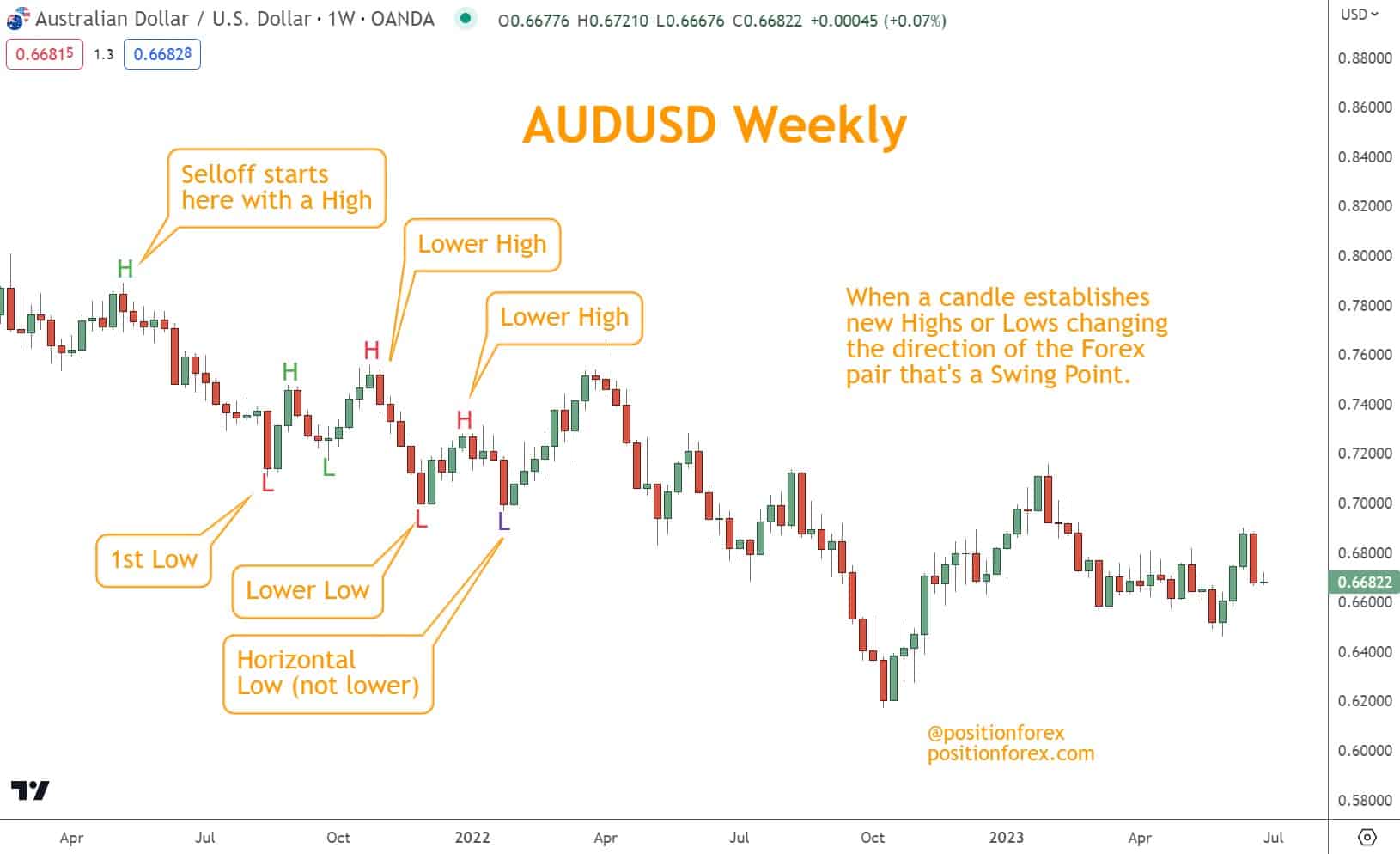

What are Swing Points?

Swing points refer to the highest or lowest price point a Forex pair reaches before changing in the opposite direction.

These changes are usually short and within a larger context. Their price movements, in many cases, define the context.

Traders use these to predict market direction, identify entry and exits, and sometimes determine key Support and Resistance levels.

Can you Identify Market Direction with Swing Points?

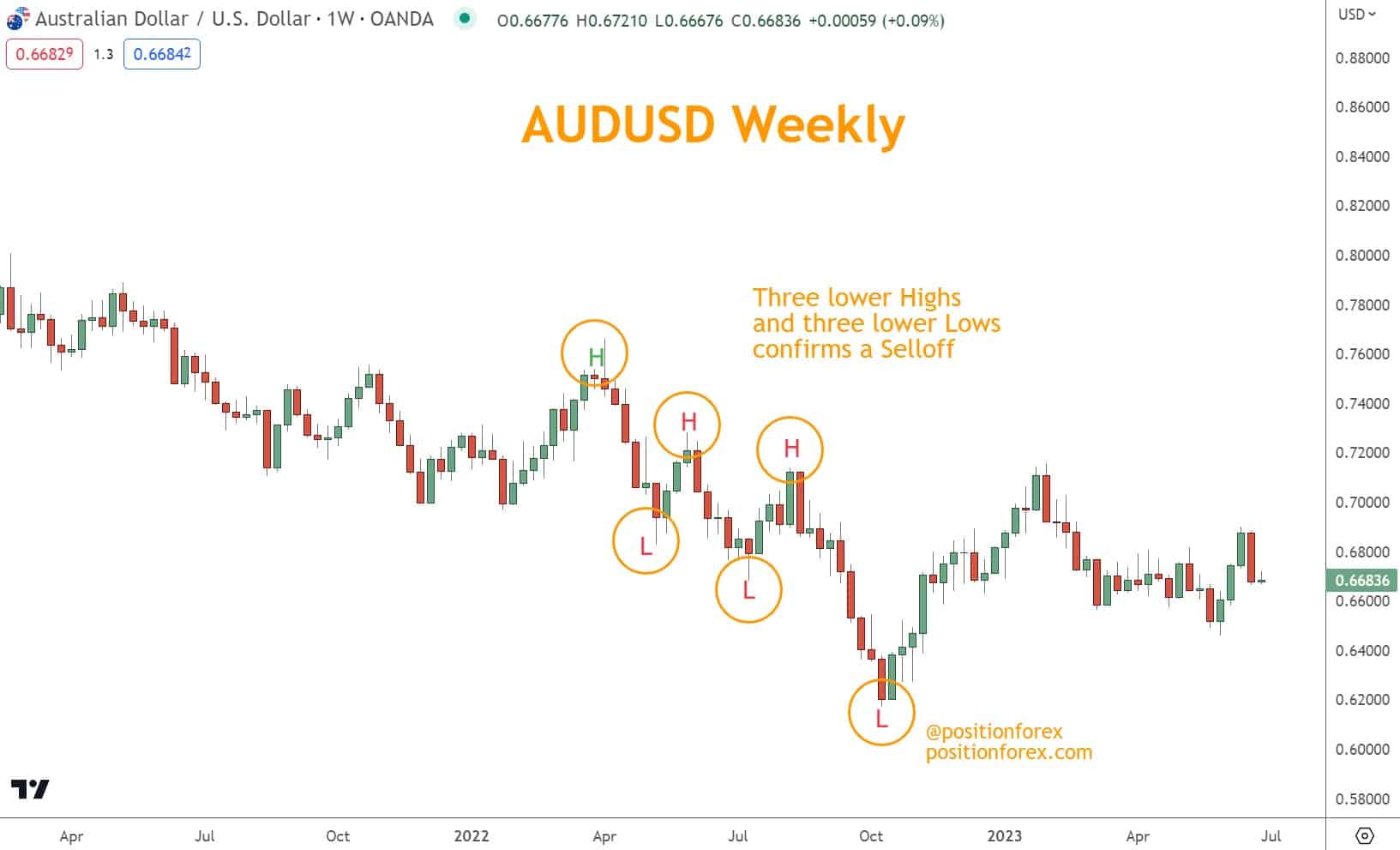

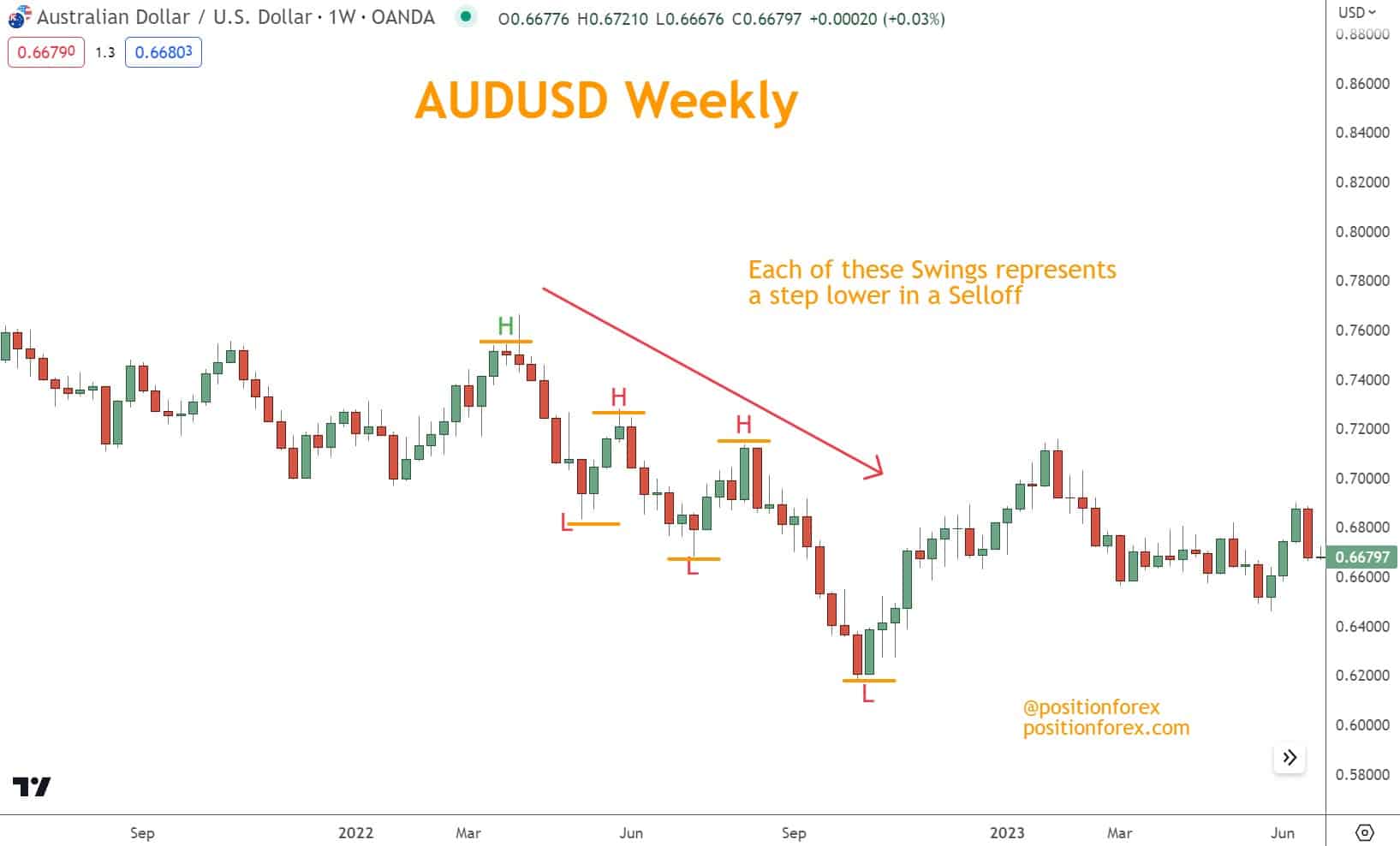

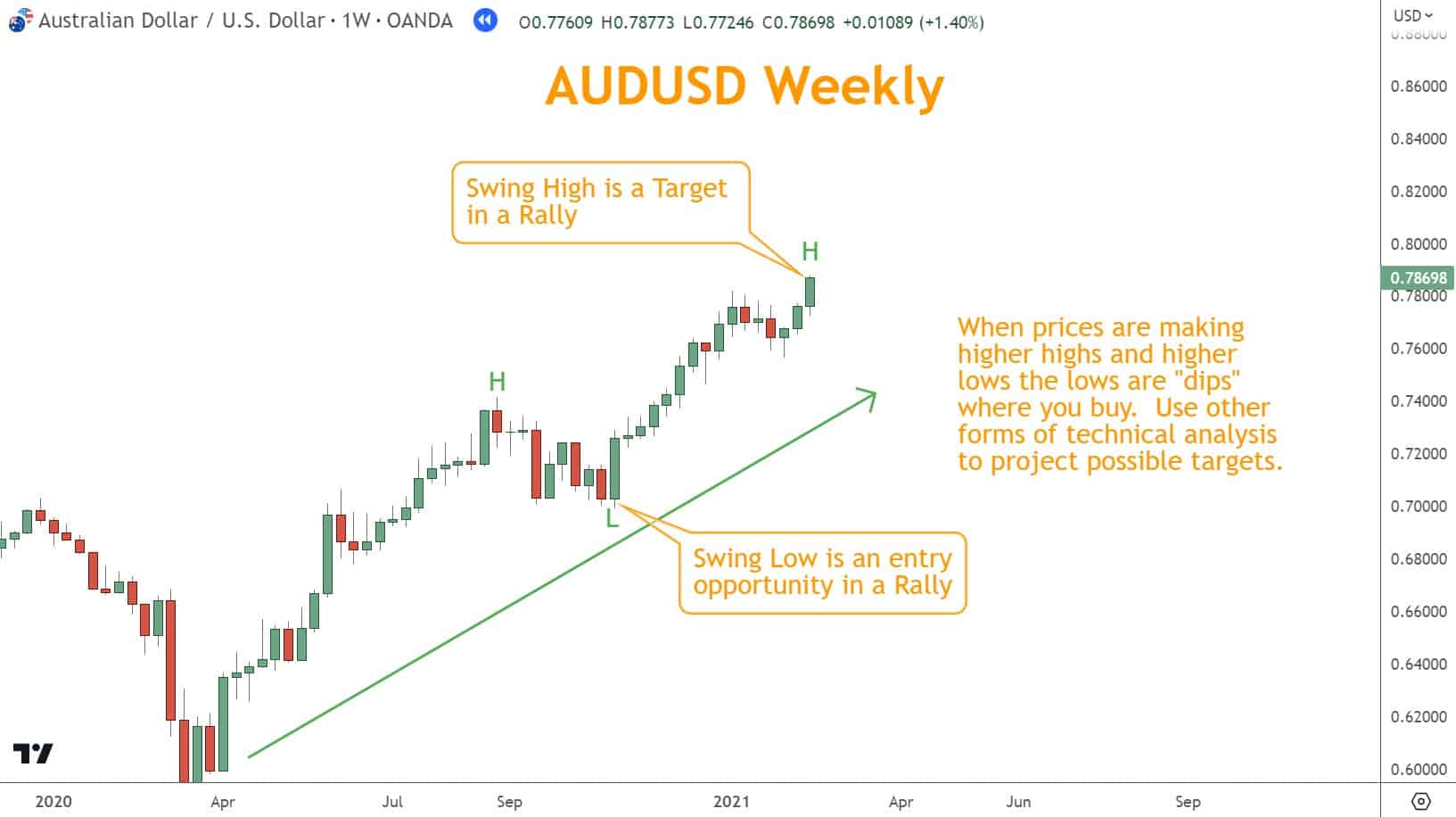

When highs are making higher highs and lows are making higher lows, this is considered a Rally. The opposite is also true. Some traders will refer to this as a Bullish or Bearish Trend.

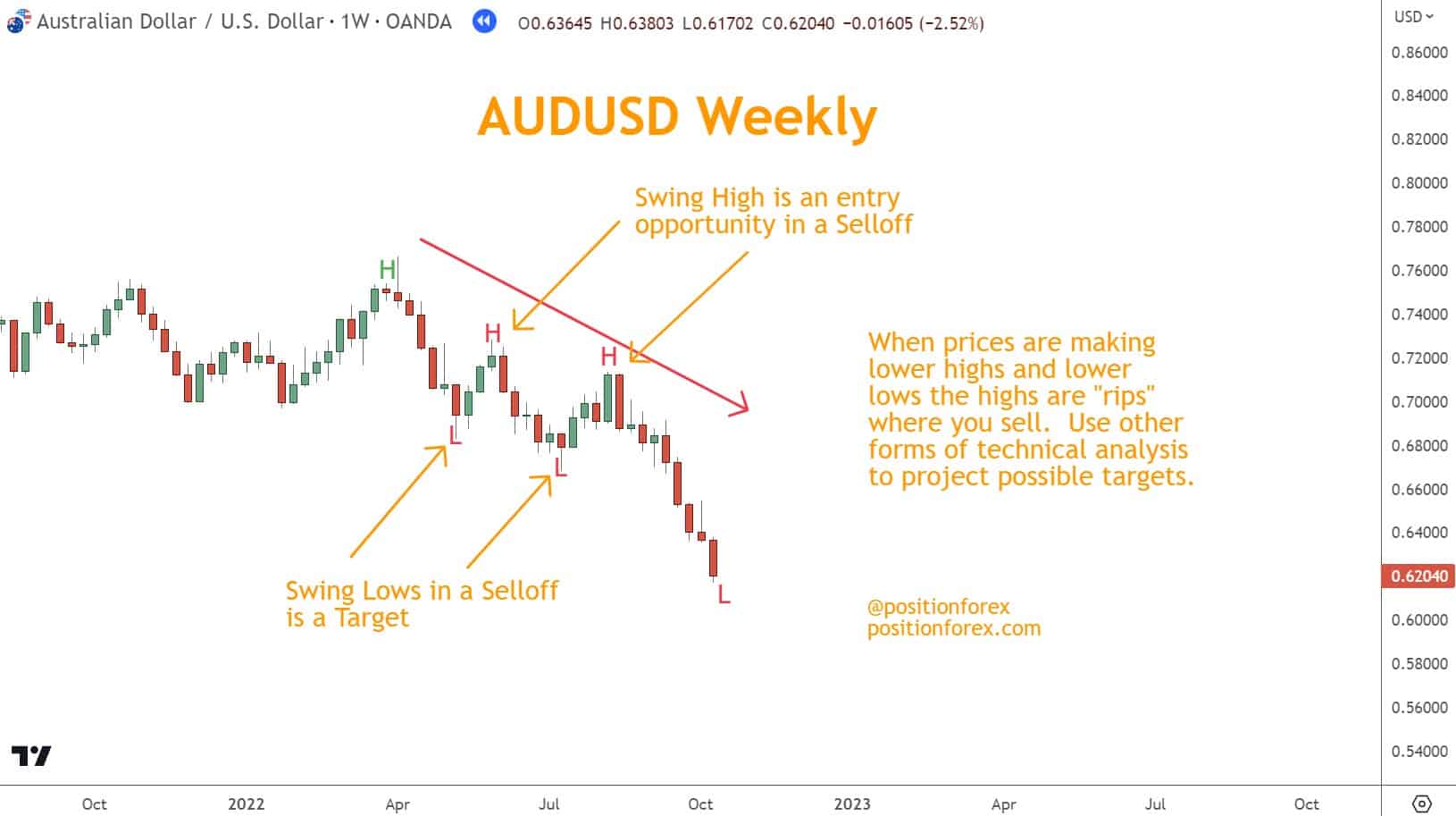

If highs are making new lows and lows are making new lows, this is a Selloff.

If there’s no pattern in the Swings, the market is considered Neutral (sometimes called Sideways).

Swing Points are an excellent resource for defining a Rally, Selloff, or Neutral market.

How can Swing Points improve Risk Management?

If you’re looking for a tool to help select Stops and Targets, Swing Points are beneficial.

Identifying a key level of Support and Resistance from price action helps determine entry and exits for trades.

Technical indicators such as Japanese Candlestick patterns and Chart Patterns can provide confirmation signals for traders’ analysis. Applying these tools alongside price action setups can improve high-probability trade setups.

What Method Works Trading Swing Lows?

New lows will present entry opportunities on Rallies if you want to trade with an instrument’s direction.

When a higher low forms, traders can enter long positions and set Stop Loss orders below the recent low.

Profit Targets can be set at the next high point or Resistance Level.

Identifying Support Levels and Entering Trades with Swing Lows

Traders aiming to identify the critical Support levels with lows can use Swings as a reference.

A strong level of Support is confirmed when multiple lows are identified at the same price level. Traders should place their stop-loss orders below the lowest determined low to limit potential losses in a Rally.

This approach is often called “buying the dip” or “buying a retracement or pullback.” Opening a long trade when prices in a Rally move lower and then reverse is often a great opportunity.

When an instrument’s price moves in a Neutral fashion, a Swing Low can also be a long trade entry area.

Since a Neutral state often means prices are moving in a horizontal channel, a low can be an entry at the bottom of a range. However, horizontal channels are riskier to trade than Rallies or Selloffs due to a lack of Momentum.

Techniques such as Japanese Candlesticks and Chart Patterns can also be employed to establish and further confirm identified support levels.

What Method Works Trading Swing Highs?

If you want to trade with an instrument’s direction, highs will present entry opportunities on Selloffs.

When a lower high forms, traders can enter short positions and set Stop Loss orders above the recent low.

Profit Targets can be set at the next low point or Resistance Level.

Identifying Resistance Levels and Entering Trades with Swing Highs

Traders aiming to identify critical Support levels with Highs can use peaks as a reference.

A strong level of Resistance is confirmed when multiple highs are identified at the same price level. Traders should place their stop-loss orders above the highest recognized high to limit potential losses in a Selloff.

This approach is often referred to as “selling the rip.” Opening a short trade when prices in a Selloff move higher and then reverse is often a great opportunity.

When an instrument’s price moves in a Neutral fashion, a Swing High can also be a short trade entry area.

Since a Neutral state often means prices are moving in a horizontal channel, a high can be a short entry at the top of a range. However, horizontal channels are riskier to trade than Rallies or Selloffs due to a lack of Momentum.

Techniques such as Japanese Candlesticks and Chart Patterns can also be employed to establish and further confirm identified support levels.

Swing Points are Technical Analysis Too

When using price action to trade, combining this price action with other forms of analysis creates high-probability opportunities.

Momentum, Japanese Candlestick Patterns, and Chart Patterns are the ideal techniques to combine with peaks and troughs.

Since these techniques primarily focus on reversals and breakouts, they complement each other. This allows you to set up trades with attractive risk-reward ratios.

To identify these setups, traders should look for areas where other patterns agree with your identified price action.

Once you see the agreement, you can consider fundamental factors, too, such as economic and political news.

Using Candlestick Patterns with Swing Points

Candlestick Patterns offer valuable insights into potential direction changes in the Forex market.

Combined with Swing Point analysis, you can identify trading setups by identifying Bullish or Bearish signals like Hammers or Shooting Stars.

Always wait for confirmation before leveraging the Candlestick Patterns; the same Position Sizing rules still apply.

Using Chart Patterns with Swing Points

Traders looking to use Chart Patterns with Swings in Forex trading can identify opportunities by watching Chart Patterns develop and creating their opportunities.

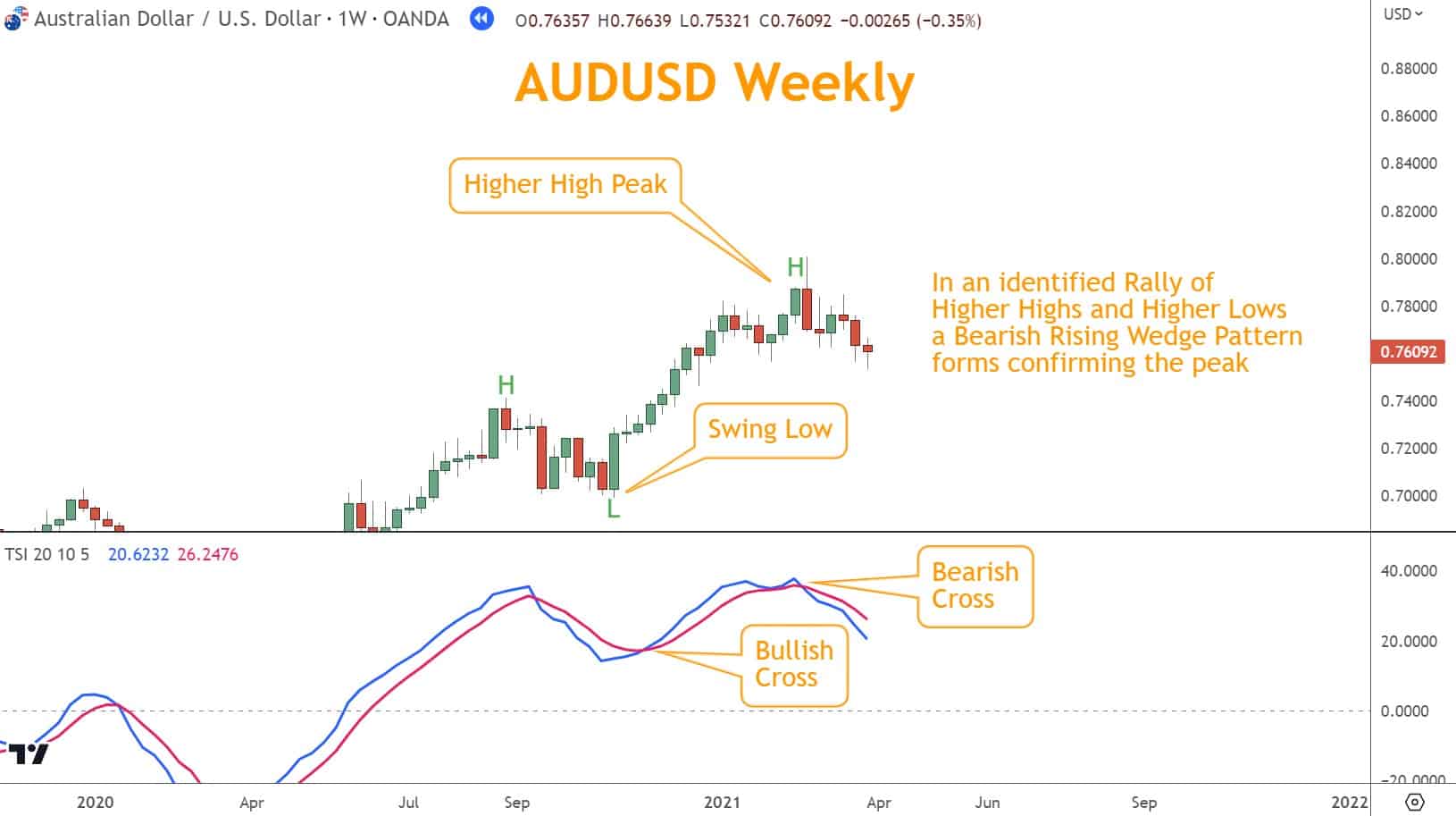

Wedges or Flags are examples of Chart Patterns easily combined with labeled swings to help determine signals for buying or selling.

If a Chart Pattern creates an opportunity and complements a series of peaks and troughs, this increases the likelihood of trading success.

Use Indicators to Confirm Your Trade Ideas

Traders can use Momentum indicators such as the RSI or TSI to confirm entry and exit areas for trades.

Using peaks and troughs with these indicators increases the probability of a successful trade.

If the Momentum indicator is signaling a potential reversal, combine it with other tools and price swings to improve your chance of a winning trade.

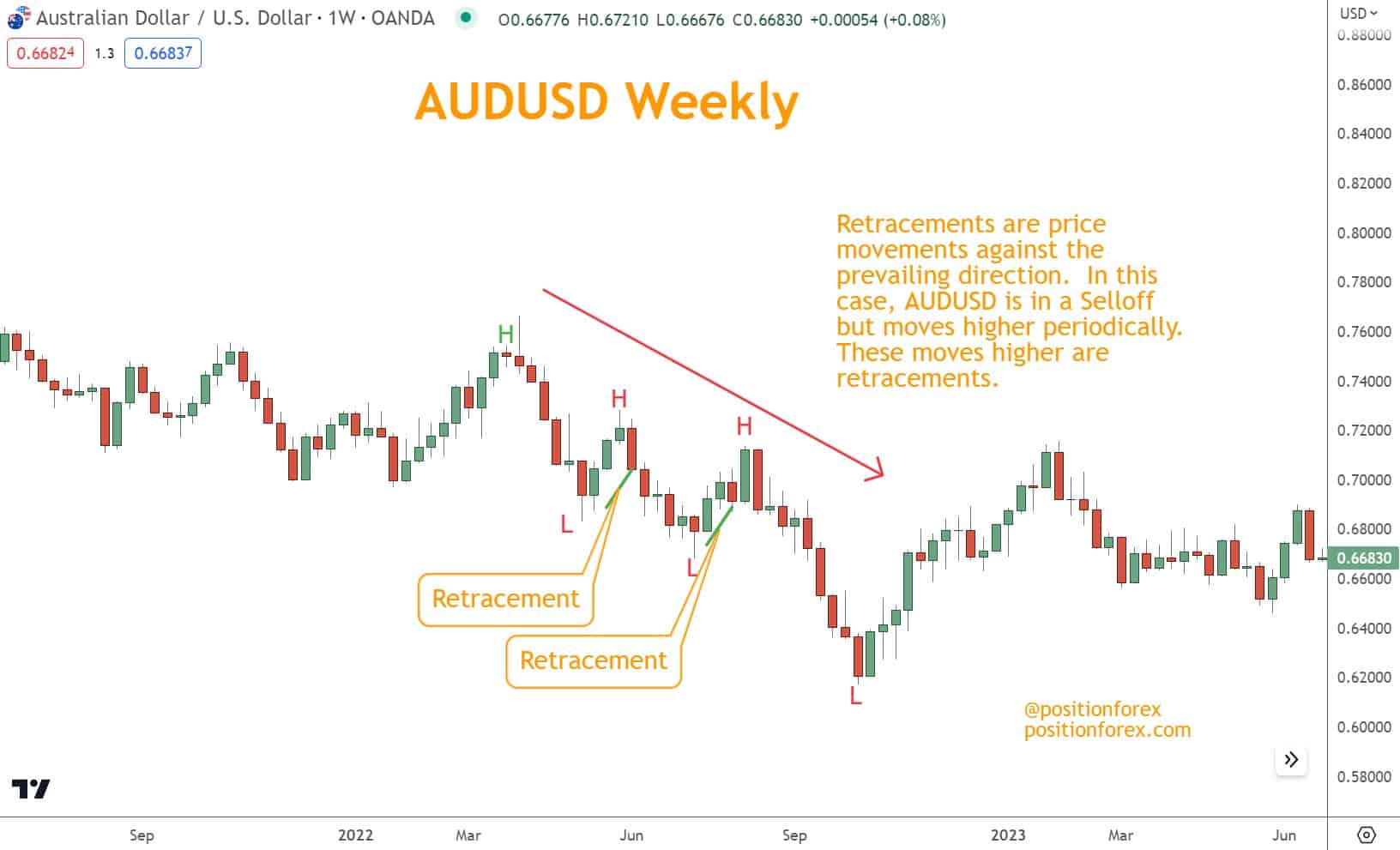

What are Retracements, and What are They Used For?

Retracements are the ideal trading strategy swings will offer. During either a confirmed Rally or Selloff, you can find high-probability trade setups when prices temporarily move against a Rally or Selloff.

Traders analyze previous price movements to identify retracements effectively and efficiently to determine critical Support and resistance levels.

These could be horizontal or channel line level prices reaching extremes and reversing. Try to find price extremes and match them with other technical indicators and techniques for confirmation.

What’s the Next Step?

Select a favorite candlestick chart and look for Support and Resistance zones using what you’ve learned.

In addition, look for opportunities to coincide them with other tools and techniques to see how they work together.

Combining Japanese Candlestick Patterns, Momentum, and Chart Patterns can give you a comprehensive view and understanding to make trading easier.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis which you can incorporate with what you’ve learned here about Support and Resistance.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and Advance Strategies? I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The greatest part – it’s completely free.

Frequently Asked Questions

What are Swing Highs and Swing Lows in Trading?

Swing Highs and Lows are crucial pivots on a chart that indicate an asset’s price direction shift. A high is a peak, and a low is a trough.

You can use these peaks and troughs to identify a forex pair’s direction and find trading opportunities.

What are the Three Essential Rules for Trading Swing Points?

The three essential rules are:

- Have a system for determining peaks and troughs

- Determine the forex pair’s direction before opening a trade

- Find complementary indicators before opening a trade