Hammer and Hanging Man Patterns are two of the most basic single candlestick patterns you want to know.

These two candlestick patterns are prevalent and can help you execute profitable trades.

But what exactly are they? How do you identify them? And most importantly, how do you trade them?

In this article, I’ll cover the basics of Hammer and Hanging Man Patterns, their features, and how to trade them. I’ll also share three tips to help you effectively incorporate these patterns into your trading strategy.

If you’re interested in other one-candle Japanese Candlestick patterns, I have an article reviewing all of them here.

After reading this, you can confidently identify these patterns like a pro and execute profitable trades. Let’s get started!

Learn the Basics of These Patterns

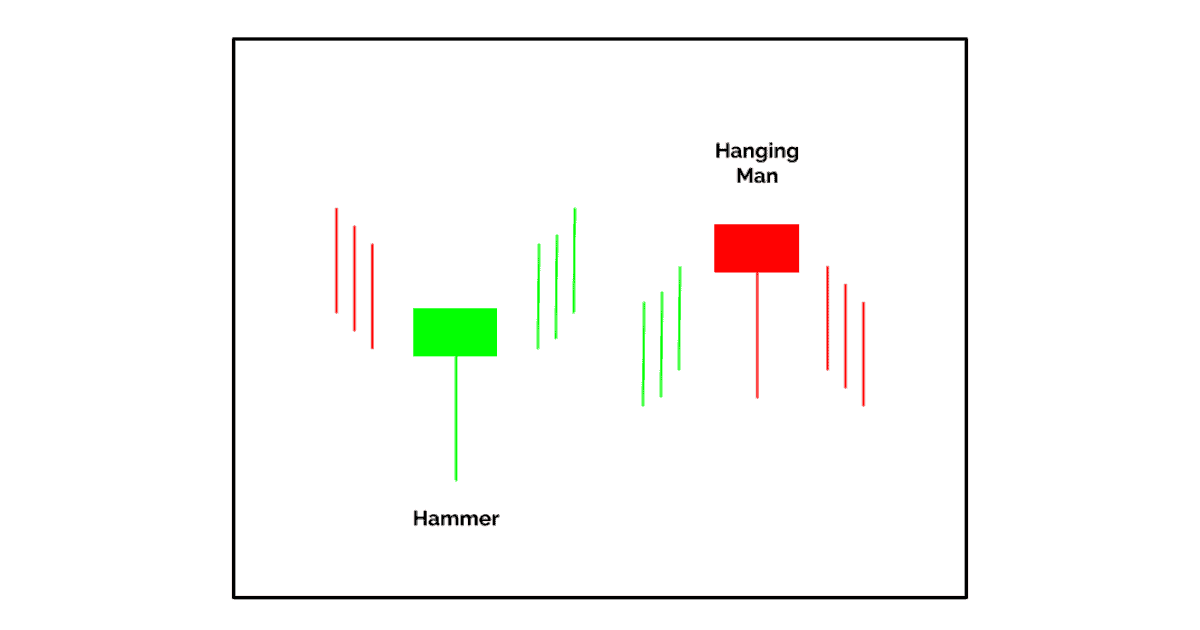

Hammer and Hanging Man patterns are important candlestick patterns technical analysts use to identify potential trend reversals.

To identify these patterns, look for specific characteristics in a candlestick, such as a small body with a long lower shadow (also called a long lower wick) for a Hammer pattern or a small body with a long upper shadow for a Hanging Man pattern.

When trading Hammer and Hanging Man patterns, waiting for confirmation before taking action is crucial.

Traders must also set entry and exit points and stop loss levels to manage risk effectively.

To enhance the accuracy of these patterns, combine them with other technical indicators.

You can increase your chances of making successful trades by incorporating indicators like Momentum, Chart Patterns, and Support and Resistance.

This approach allows you to thoroughly analyze the market and develop a better understanding before making a trade.

Identifying the Hammer Pattern in Forex Trading

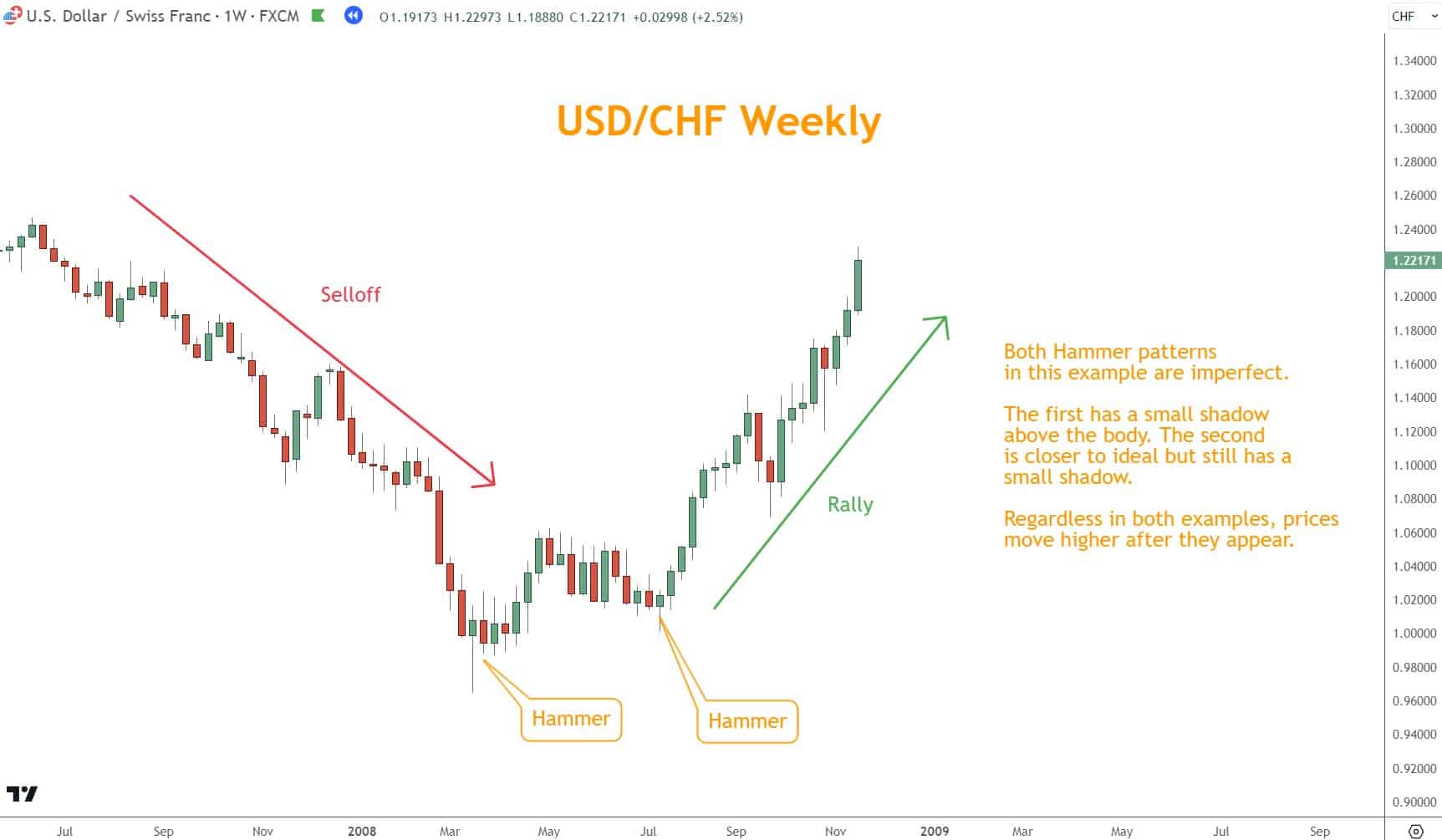

The shape, position, and candlestick arrangement of this specific pattern possesses the power to signal a potential market reversal.

The Hammer candlestick pattern consists of a small body with a long lower shadow and little to no upper shadow.

It forms at the bottom of a Selloff and indicates that selling pressure might be exhausted. Traders can use this information to set appropriate stop-loss and take-profit levels based on market conditions and their trading strategy.

By understanding the nature of this Bullish reversal pattern and incorporating it into their technical analysis, traders can enhance their ability to identify reversals and make informed trading decisions.

Trading This Bullish Pattern Unlocks a New Perspective

To trade Hammer candles, wait for confirmation that the Bullish reversal is occurring. This can be done by buying with confirmation from other tools and techniques.

In addition, it’s crucial to have position sizing and risk management in place, including setting a stop-loss below the pattern’s low to limit potential losses in case the reversal fails.

By incorporating these strategies, traders can use the Hammer pattern to profit from reversals.

Identifying the Hanging Man Pattern

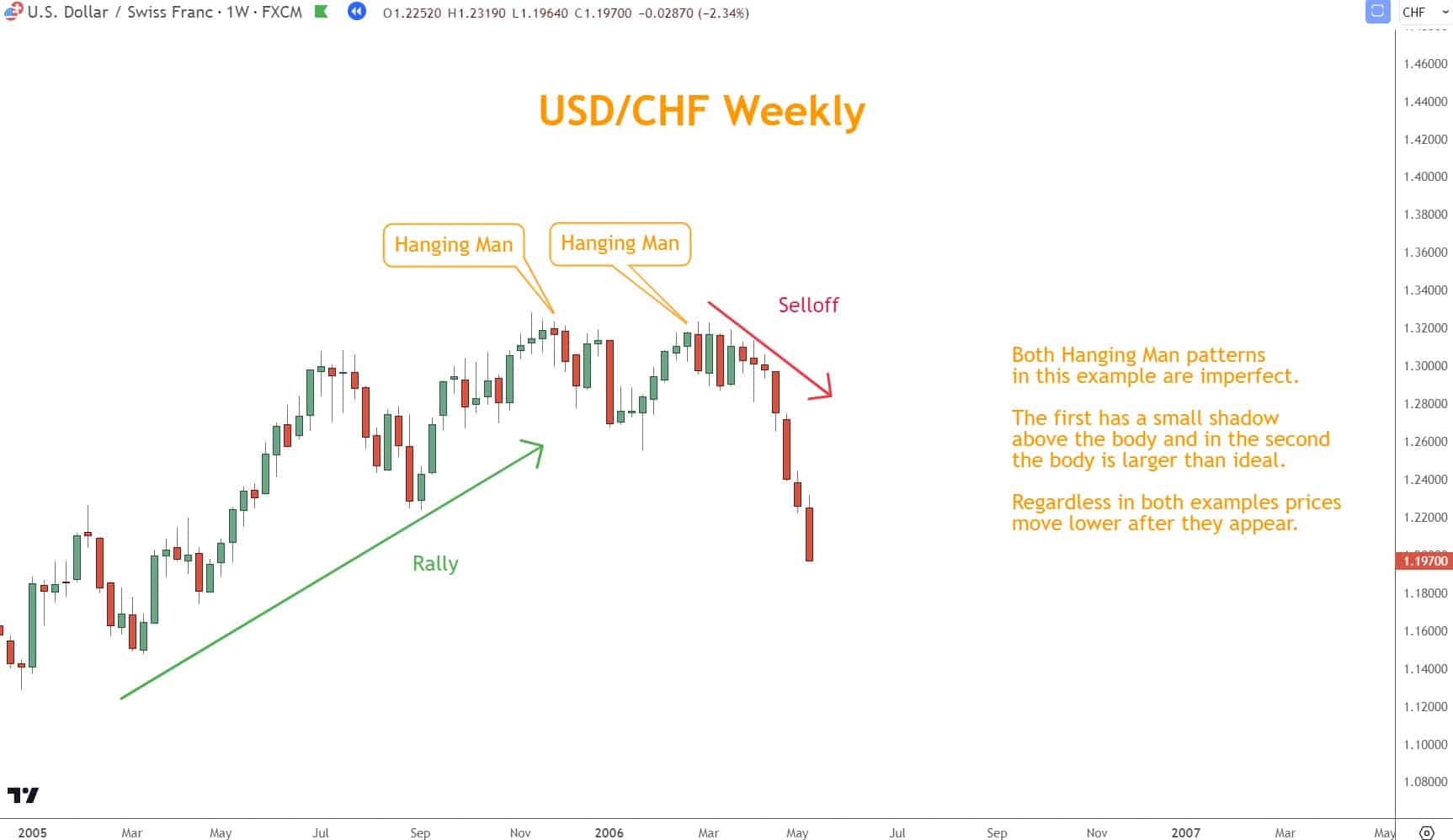

This Bearish pattern is a candlestick pattern that signals a potential reversal.

You can identify it by the small body and a long lower shadow, which typically appears at the end of a Rally in the market.

Setting appropriate stop-loss and take-profit levels is essential to effectively trade this pattern based on market conditions and your trading strategy.

By recognizing and understanding the Hanging Man pattern, traders can make informed decisions and potentially profit from trend reversals.

Trading This Pattern Can Change Your Views

This pattern appears at the end of an uptrend and indicates a potential Bearish reversal in the market.

To identify this pattern, look for a small body and a long lower shadow, with little to no upper shadow.

Once you have identified the pattern, waiting for confirmation before opening a trade position is crucial.

Incorporate stop-losses to manage risk and take-profit orders to secure your gains.

Three Tips for Trading Hammer and Hanging Man Patterns

There are three essential tips to use when trading these patterns.

- Consider the market context when trading these candlestick patterns. These patterns should not be relied upon solely for making trading decisions.

- Incorporate other technical indicators and techniques into your analysis to gain a broader understanding.

- Lastly, waiting for confirmation before entering a trade based on these patterns is essential.

- Confirmation can come in various forms, such as a Bullish or Bearish reversal signal from another indicator or a break of a critical level of Support or Resistance.

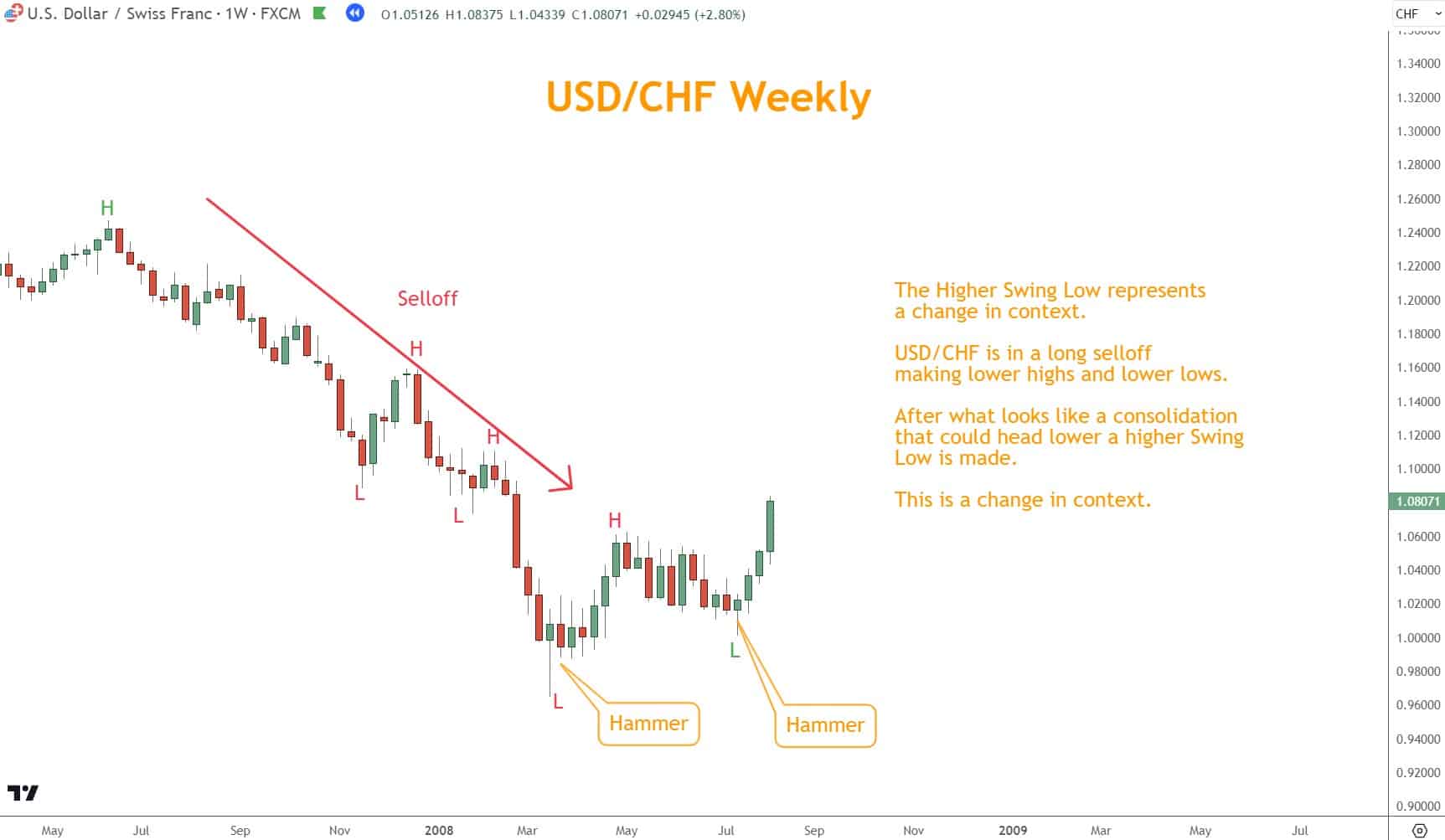

You Need to Identify the Context First

When analyzing these candlestick patterns, it is crucial to identify the context in which they appear.

For the Hammer pattern, only identifying it at the bottom of a Selloff is essential. This pattern signifies a potential Bullish reversal characterized by a small body and a long lower shadow.

On the other hand, the Hanging Man pattern should only be identified at the top of a Rally. This Bearish reversal pattern has a small body and a long lower shadow with little to no upper shadow.

To strengthen your analysis, it is also essential to consider what else is happening in the news and economics, as this information can provide additional confirmation for the validity of the candlestick pattern.

You can make better trades by incorporating these factors and correctly identifying the context.

Incorporate other Indicators

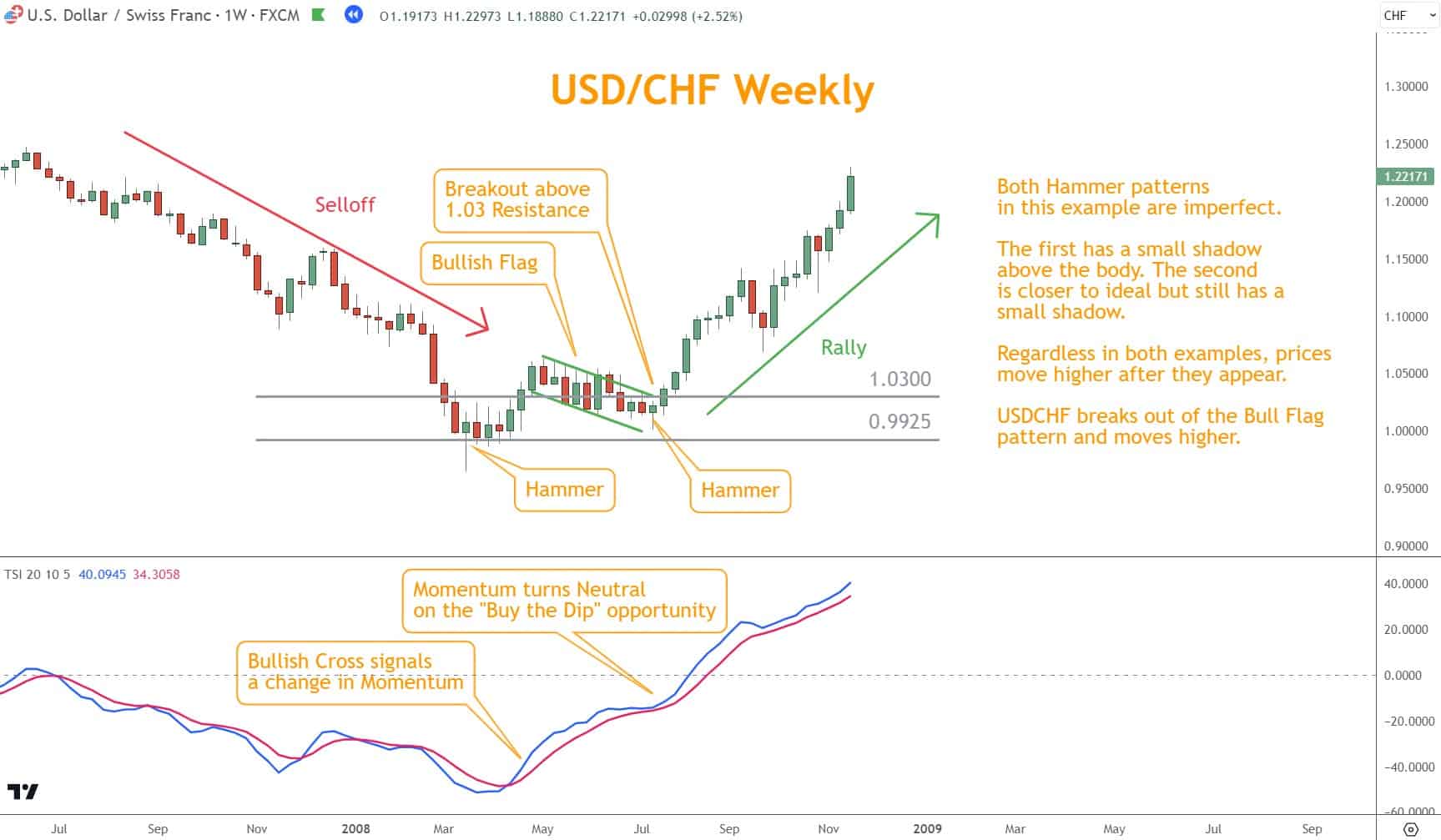

Combining these patterns with other indicators is beneficial to increase trading accuracy.

Momentum Indicators, such as the TSI (True Strength Index), can help confirm the signals these candlestick patterns provide.

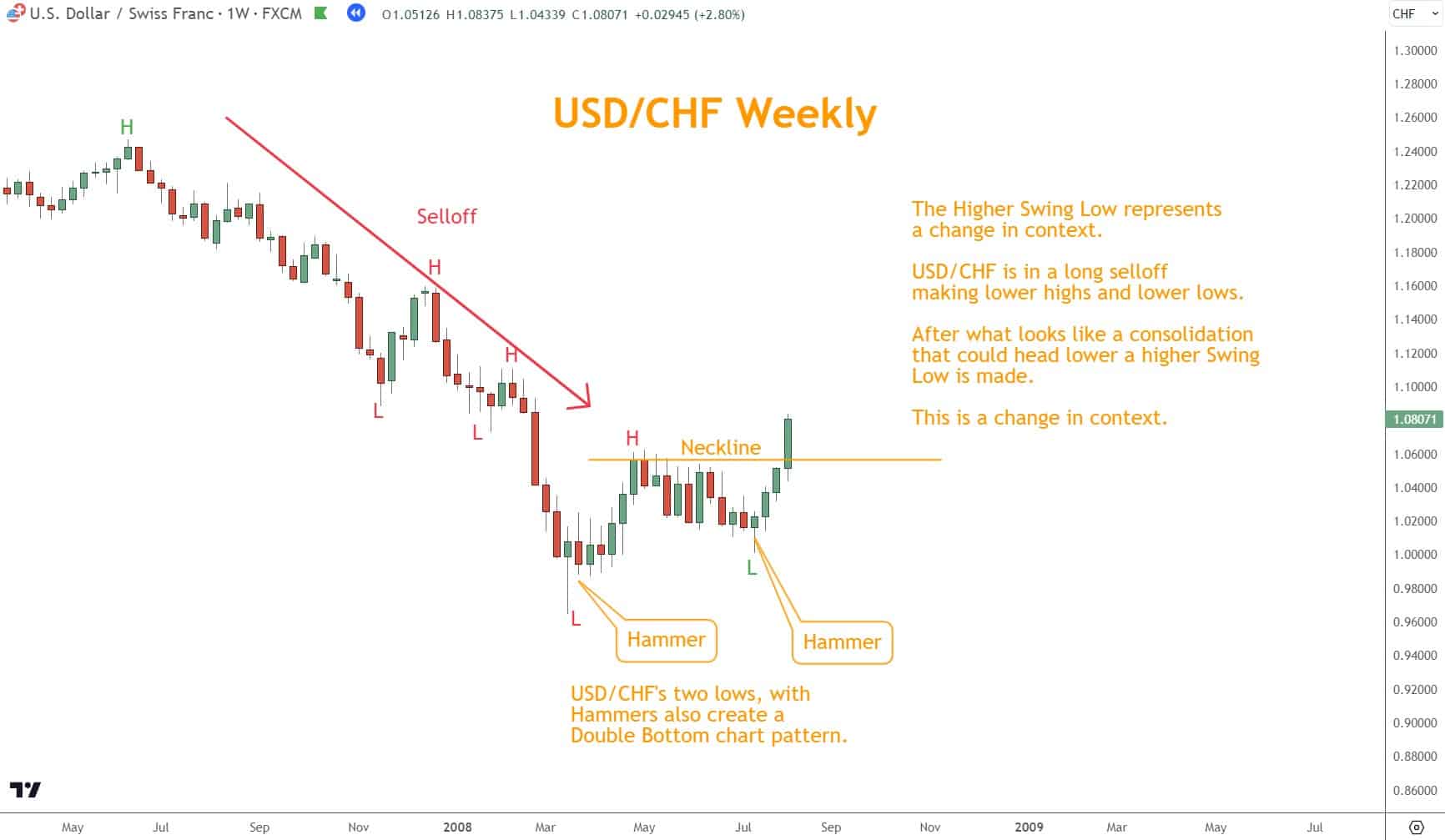

Additionally, looking for a coinciding Chart Pattern, such as a wedge, can provide further confirmation of a potential reversal.

Support and Resistance levels can also confirm the likelihood of a reversal.

Don’t rely solely on one signal, as false signals can occur. Incorporating other indicators into your analysis can enhance your understanding of the market and improve your trading.

Wait for Confirmation

The last and most important tip is to wait for confirmation. Whether you only want to wait for a second candlestick to close in the opposite direction or use another tool or technique (which I recommend), confirmation is necessary before any trading action.

In the above examples, we have confirmation sources from the TSI, a breakout from a Bullish Flag pattern, a breakout of Resistance, and a close above the Neckline of a Double Bottom.

Waiting for confirmation can help minimize risks and improve trading accuracy.

What’s the Next Step?

Select a favorite candlestick chart and look for these candlestick patterns using your knowledge.

In addition, look for opportunities to coincide them with other technical analysis tools and techniques to see how they work together.

Combining Momentum, Chart Patterns, and Support and Resistance can give you a comprehensive view and understanding to make trading easier.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis which you can incorporate with what you’ve learned here about these candlestick patterns.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and Advance Strategies? I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What are Some Common Mistakes to Avoid When Using These Patterns in Trading?

Common mistakes to avoid include relying solely on the pattern without considering other indicators, not waiting for confirmation, failing to choose appropriate stop-loss levels, overtrading, and not sticking to a well-defined trading plan.

Are There Any Other Similar Patterns That Traders Should Know?

Yes, traders should know other candlestick patterns such as the Shooting Star, Inverted Hammer, Doji, and Spinning Top.

These are also single-candle Japanese Candlestick patterns that foreshadow potential reversals.