Forex trading is not easy, and it can be tricky for beginners.

However, with the proper education and practice, forex can be profitable and fun.

This beginner’s guide to forex will provide the basics, including how to trade currency pairs, forex terminology, and what you will need to succeed.

What Is Forex and How Does It Work?

The forex market is enormous compared to stocks and commodities. The global forex market size is $2.09 quadrillion as of 2021.

In this market, currencies from different countries are traded with each other.

The forex (fx) market is open 24 hours daily, five days weekly.

Major currencies traded in forex are all exchanged with the U.S. Dollar (USD):

- Euro (EUR/USD)

- Japanese Yen (USD/JPY)

- British Pound (GBP)/USD)

- Swiss Franc (USD/CHF)

- Australian Dollar (AUD/USD)

- New Zealand Dollar (NZD/USD)

- Canadian Dollar (USD/CAD)

Minor currencies are cross pairs, not including the U.S. Dollar, such as EUR/JPY or NZD/JPY.

Exotic currency pairs include the Mexican Peso, Hong Kong Dollar, Swedish Krona, Thai Baht, and many others against any other currency.

Beginner traders are encouraged to trade with major currencies only.

Forex transactions include various terms and processes that may be unfamiliar to beginners, especially those only exposed to stocks. However, it is essential to understand these principles before embarking on trading.

Are Forex Markets Regulated?

The forex market is regulated by various government bodies, such as the Financial Conduct Authority (FCA) in the U.K. and the Commodities Futures Trading Commission (CFTC) in the U.S.

Each nation has a regulatory body assigned to monitor currency trading.

In addition, most brokers must also be licensed and abide by strict guidelines concerning market manipulation, foreign exchange transactions, and more.

Unfortunately, in some countries, unregulated brokers are not required to follow guidelines or regulations.

Therefore, it pays to carefully read reviews and analyze forex platforms before choosing a broker.

As a best practice, only open an account with a broker from the same nation you reside in or a broker regulated by your nation’s regulatory body.

What Types of Forex Markets are There?

If you’re new to the world of currency trading, it can be a difficult and overwhelming market to navigate.

However, with some forex knowledge and practice, you can begin to understand the market and develop strategies that work for you.

Once you’ve understood the market basics, it’s time to dive into different types of forex trading strategies.

Through technical and fundamental analysis, traders can analyze the market and make trading decisions in many ways.

Spot Market

Retail forex traders typically trade the spot market. The forex spot market is where you trade currencies “over the counter (otc),” meaning only a broker is on the other end of the transaction.

The broker is a market maker and trades with multiple banks to settle your trades.

Traders don’t need to be concerned with this process, but it’s essential to understand the broker is competing with you like the “house” in a casino.

Forwards and Futures Markets

The forwards and futures markets allow traders to make trades based on the future value of a currency.

As a result, these markets often hedge against risks associated with fluctuating foreign exchange rates.

For example, a trader may use a forward contract to lock in a specific exchange rate while using a futures contract to hedge against potential gains and losses in exchange rates over a particular period.

In addition, forwards and futures contracts can be used to negotiate prices for buying or selling currencies at a later date.

At their core, the forwards and futures markets rely on market participants’ ability to predict a currency’s future value accurately.

Forwards are traded over the counter; however, Futures trade at an exchange such as the Chicago Mercantile Exchange in the United States.

Forwards and Futures are typically traded only by financial institutions and hedge funds due to the amount of money required to participate.

Where is Forex Traded?

Spot trading occurs “over the counter,” meaning there is no central currency exchange where currencies are bought and sold.

Instead, transactions occur between two parties directly – a trader and a broker.

The foreign exchange market is broken into trading sessions in different parts of the world, such as the “Tokyo session,” the “London session,” and the “New York session” following the sun.

Futures contracts in the U.S. are traded at the Chicago Mercantile Exchange and are available through popular brokers.

How You Can Start Trading Forex

If you’re interested in trading forex, the first step is to research brokers available in your country and what features they offer.

For example, different brokers have different minimum deposit requirements, trade size minimums, and other rules and features.

You can learn more about brokers and their strengths and weaknesses in this article on benzinga.com. Once you’ve chosen a forex broker, you need to deposit currency in an account, select a trading platform, and implement your trading plan once you develop one.

Most of these brokers also offer a demo account with which you can familiarize yourself with the mechanics of using their platform and test your trading plan.

You can often keep your demo account open if you have a real account with a deposit.

What Forex Terminology do you Need?

While trading in the forex market is similar to other markets, it’s also very different. There are terms unique to trading forex you will want to know and understand before you start trading.

What is a Currency Pair?

A currency pair is a set of two currencies traded against each other in the forex market.

The base currency is the one you buy or sell, while the quote currency determines the price.

For example, in the currency pair (also called a forex pair), EUR/USD (or EURUSD), the Euro is the base currency, whereas the U.S. Dollar is the quote currency.

If you buy EUR/USD, you buy Euros and sell U.S. Dollars. Buying a currency pair is also known as going “long,” whereas selling is referred to as going “short.”

The difference in price between buying or selling a forex pair is called the spread.

When choosing which pairs to trade, it is essential to consider factors such as liquidity, volatility and spreads.

What are Pips?

Pips are the smallest unit of measure in forex trading.

A pip is a given exchange rate’s most minor price move. It is usually expressed as the fourth decimal place in an exchange rate.

For example, if the EUR/USD exchange rate moves from 1.2000 to 1.2001, that is one pip of movement. But, of course, the value of a single pip can vary depending on the currency pair being traded and the size of the trade.

Recently brokers have offered a fifth digit called a pipette for scalpers and very short-term traders. However, most traders will not use the pipette since it’s small amounts of currency value.

Traders use pips to calculate profits and losses on their trades and assess their trades’ performance. They also play an essential role in calculating risk and determining the profitability of trading strategies.

The value of a single pip can change daily, depending on market conditions and other factors.

What Order Types are Available?

Understanding the different order types available in the forex market is essential.

For example, market orders are used to buy or sell at the best current price, while limit orders allow traders to specify a price and will execute if that price is reached.

Finally, stop orders help traders limit losses by setting a trigger to execute a trade automatically if the price moves beyond a certain point.

Stop-limit orders are similar but allow traders to limit how much they will lose on a trade.

Trailing stop orders help traders lock in profits by setting a trigger that will move along with favorable price movements.

You Need to Understand Leverage and Margin

Understanding leverage and margin is essential when trading forex.

Leverage is the ratio of money you borrow to trade compared to your own money.

Margin is the minimum amount of money required in your account to open a position.

Using leverage can increase your profits but also increases your losses. To give you choices, brokers offer leverage as low as 2:1 and as high as 500:1.

In the United States, the maximum available leverage is 50:1.

What is Lot Size in Forex?

In forex trading, a lot is the standard unit of measure for a trade.

A lot equals 100,000 units of the base currency in a forex trade.

So, if you’re buying EUR/USD and one pip equals $10, each lot will cost $1,000.

Micro lots are available to trade if your broker offers them, and they are one-tenth the size of a mini lot or one-hundredth the size of a standard lot.

Most brokers today encourage retail traders to use micro lots.

What is Rollover?

When trading forex, rollover is the interest paid or earned for holding a currency pair overnight based on central bank interest rates.

When one currency in a pair is sold, the other is bought simultaneously.

The position remains open until the next trading day, when it is closed out and rolled over to the new day’s rate. Rollover can add to your profits or increase your losses depending on market conditions and Interest rates.

Are Candlestick Charts Used in Forex Trading?

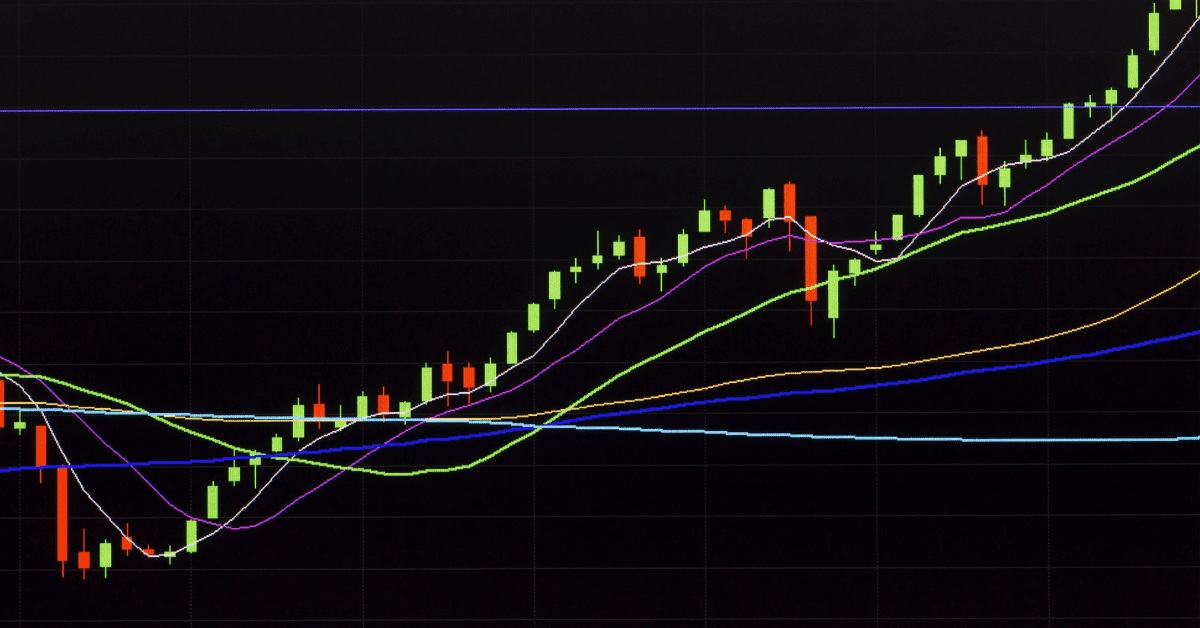

Candlestick charts are the predominant charting method for trading in the forex market.

They give traders an easy way to analyze a given currency pair’s price movement over time. Each candlestick represents the price action of a given period and can be used to identify patterns and trends in the market.

Each candle’s open, high, low, and close prices are critical when interpreting the chart.

Candlestick charts can be combined with other indicators and techniques in your market analysis.

In our article “Candlestick Patterns: Profit with 3 Reversal Types,” you can learn how to trade Japanese Candlesticks.

Overall, candlestick charts are helpful for traders who want an easy and intuitive way to analyze market movements over time.

What are the Pros and Cons of Trading Forex?

Forex trading is a global market where you can access the currency market 24 hours a day, five days a week.

It boasts high liquidity and low transaction costs, making it many traders’ most popular trading options.

However, Forex trading involves a substantial risk of loss due to leverage and market volatility.

What’s the Next Step?

Select an online broker from the abovementioned article and fund a live account.

However, before trading, ensure you have learned the broker’s platform software and developed a trading plan you wish to execute to find trading opportunities.

Then, take advantage of a demo account and build confidence before making real money to work.

If you’re unsure how to find trading opportunities learn the Six Basics of Chart Analysis, which you can download for free here.

The “Six Basics” will give you a strong foundation in chart analysis which you can incorporate with what you’ve learned here about forex trading.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast is delivered weekly to your inbox and provides the following:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and Advance Strategies? I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

Why do Most Forex Traders Fail?

Most forex traders fail due to a lack of knowledge, experience, and discipline.

Unfortunately, many new traders jump in without learning about the markets, trading strategies, or market psychology, leading to decisions based on luck rather than sound trading principles.

Additionally, trading with too much leverage can lead to significant losses if the market moves against you. Leverage can magnify your profits and losses, so appropriate trading capital is essential before investing in forex trading.

Finally, poor money management practices, such as not using stop-loss orders and overtrading, can also lead to failure.

Having a trading plan and sticking to it is vital to success when trading the forex market.

In addition, it’s essential to exercise prudent risk management while trading Forex markets so that you don’t become one of those traders who eventually fail.

What are the Best Strategies to use in the Forex Market?

Forex trading can be an excellent opportunity to make money but it requires strategy and careful planning. Here are some of the best methods to use in the forex market:

1. Fundamental Analysis: Forex traders use this as one of the most popular approaches. It involves studying news, financial reports, and market events to better understand the currency pair’s movements and make more informed trading decisions.

2. Technical Analysis: Another popular forex trading strategy is technical analysis, which involves looking at past market prices to predict future movements in currency prices. Using technical indicators and techniques, you can apply tradeable strategies.

3. Risk Management and Position Sizing: Risk management and position sizing are vital for long-term success as a Forex trader. Proper management methods and position size calculations will help you stay profitable even during market volatility.

4. Position Trading: This approach provides more low-risk, high-reward opportunities than swing trading, day trading, or scalping. Traders must show more patience with position trading but are more easily rewarded than other styles.

Which is Better: Crypto or Forex?

Comparing the two is difficult when deciding between crypto and forex trading because they are different markets.

Forex trading involves trading between foreign currencies, while crypto trading involves trading cryptocurrencies. Both offer profit potential; however, different challenges are associated with each market.

Forex trading may be your better option if you prefer trading in a more established and regulated market. However, crypto trading may be the way to go if you want higher risk and reward.

Ultimately, it all boils down to what type of trader you are and what kind of market suits your needs the best.