Regarding Forex trading, horizontal support and resistance can help predict reversals.

These levels act like “walls” that prices have difficulty moving beyond.

Recognizing these walls helps you decide when to buy or sell.

Additionally, leveraging technical indicators can provide more insights about these levels.

This article will explain these areas, their importance, and how to use these tools effectively.

What are Horizontal Support and Resistance Basics?

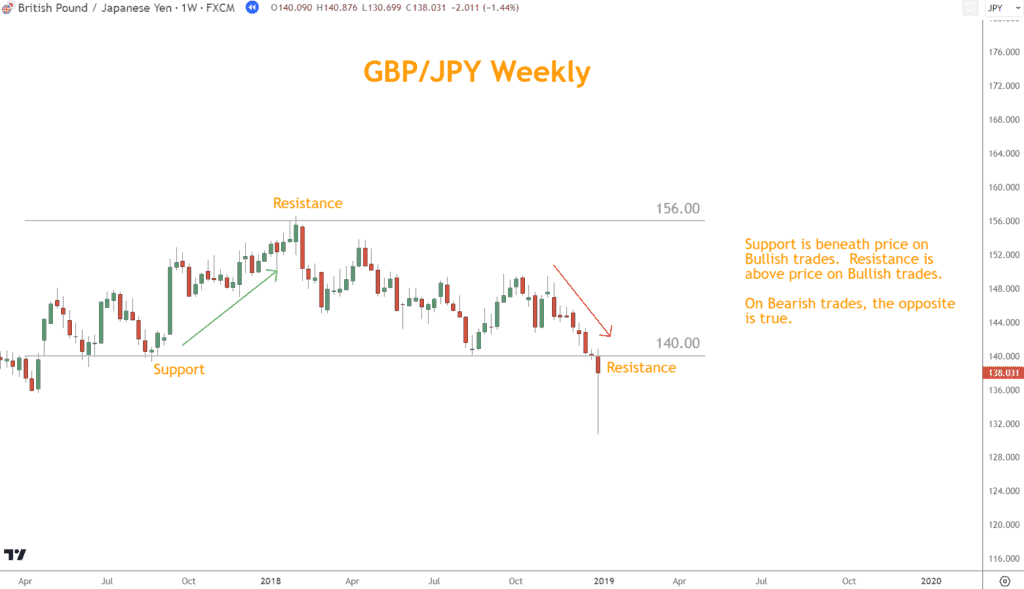

In any form of trading, the terms “Support” and “Resistance” are vital concepts all traders need to know.

Support is the level at which a currency stops falling and may move upward due to high demand.

On the other hand, Resistance is the level at which the currency tends to stop rising where more people are interested in selling than buying.

This description is accurate if you are considering a Long trade. The opposite is true in a short trade.

Support is above the price level during a Short trade, and Resistance is below.

These levels are determined from past data, showing where buyers and sellers have previously caused prices to stop and reverse direction.

Recognizing and understanding these levels provide valuable insights, allowing you to anticipate potential price reversals and strategize accordingly.

How Can I Identify Them?

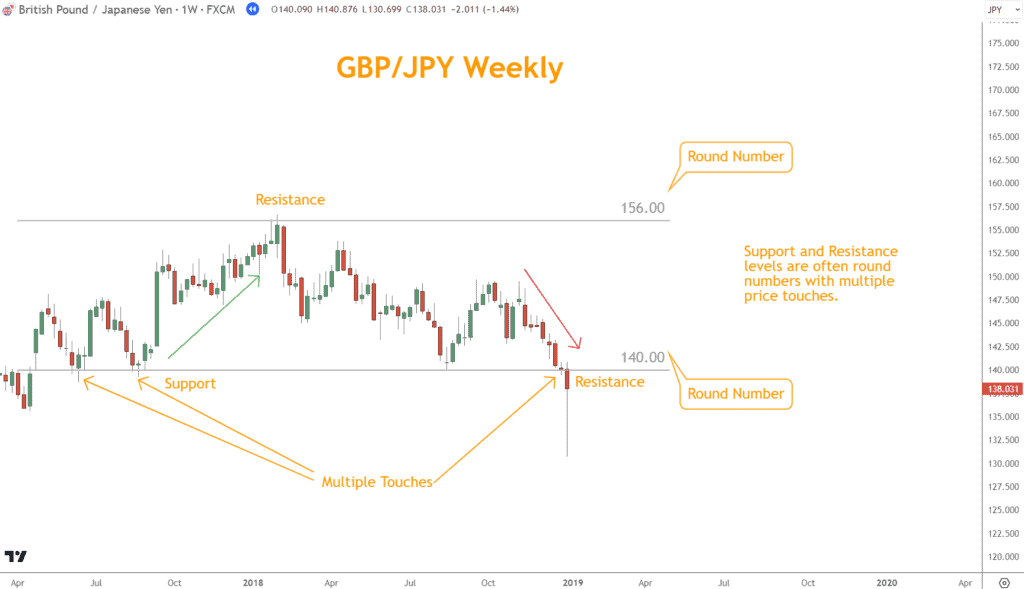

Unfortunately, selecting Support and Resistance levels isn’t easy and is both an art and a science.

Traders analyze previous price areas where a currency struggled to move to determine these levels.

Often, these areas are at round numbers ending in multiple zeros, serving as psychological benchmarks. These numbers attract attention because many people place orders at these points.

How Significant are These Levels in Forex Trading?

Traders often utilize Horizontal Support and Resistance levels, which are considered one of the most effective tools in Forex trading.

These levels serve as crucial benchmarks, assisting traders in formulating risk management strategies by setting clear boundaries for stop-loss and take-profit orders.

In addition, they give important information about when to buy or sell. These levels help you take advantage of opportunities when prices go higher or lower.

Furthermore, you can gauge the strength or weakness of a prevailing direction by observing how prices react upon approaching these levels.

This knowledge can help you make better decisions and increase your accuracy in predicting outcomes.

Should You Trade it Alone?

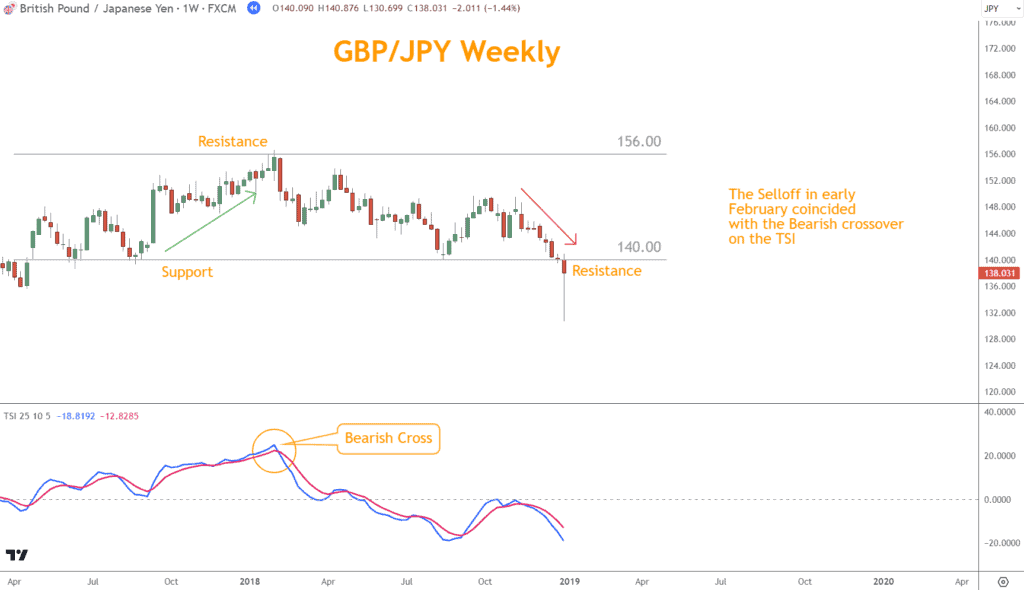

Combining these levels with other technical indicators helps you better understand price action in Forex markets.

Momentum, Japanese Candlesticks, and Chart Patterns can all help you improve your analysis and increase your chances of making a successful trade.

For example, one of these three Momentum indicators can contribute to your analysis.

Each indicator signals Bullish and Bearish Momentum and Overbought or Oversold conditions:

- The Relative Strength Index (RSI)

- The True Strength Index (TSI)

- Stochastic Oscillator

In the above example, GBPJPY finds Resistance in early February, coinciding with a Bearish Cross on the True Strength Index.

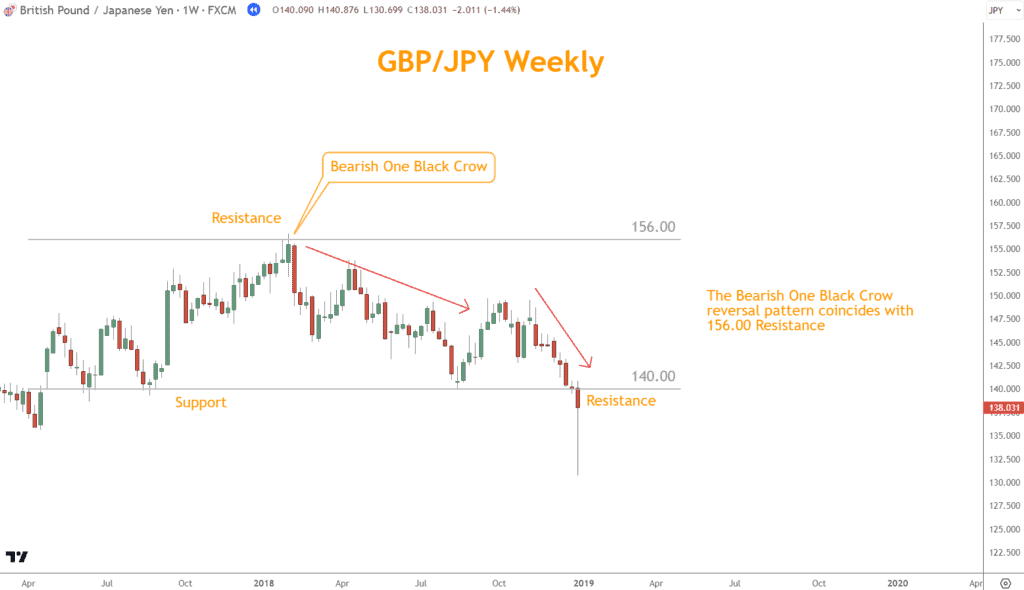

Combining Japanese candlestick analysis with these levels is another powerful approach in Forex trading.

Japanese candlesticks visually represent price action, revealing the market participant’s psychology, especially highlighting reversals.

They can indicate potential reversals through patterns like Hammers, engulfing formations, star formations, and many others.

By overlaying candlestick patterns on critical levels, you can gain enhanced insights into potential market turning points.

For instance, a Bullish Engulfing pattern at a significant Support level might signal a substantial buying opportunity, while a Shooting Star at Resistance could indicate a potential sell-off.

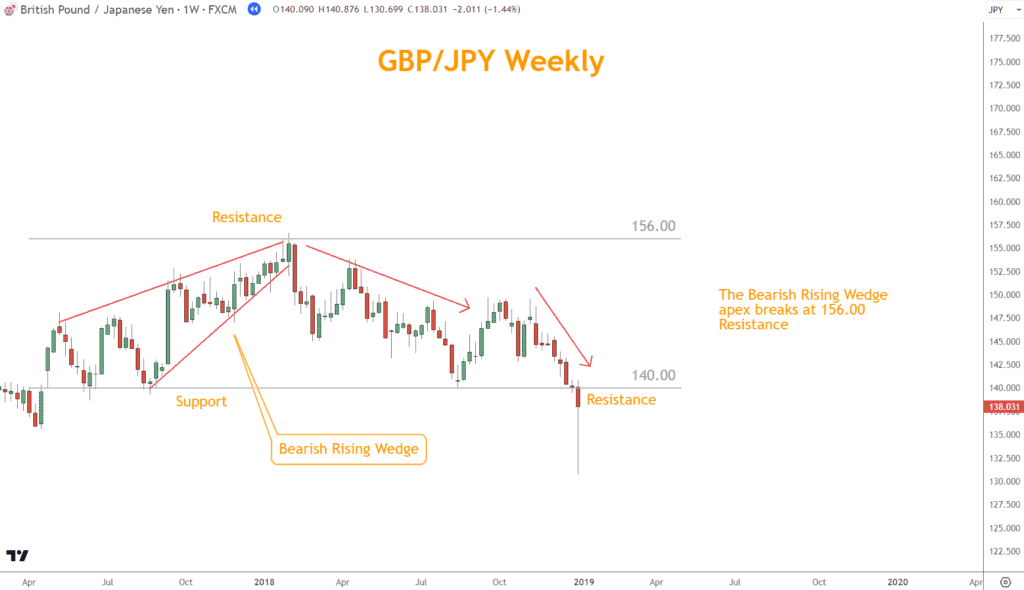

In the above example, a Bearish One Black Crow reversal pattern coincides with 156.00 Resistance.

Chart Patterns are also strong indicators of reversals and complement Support and Resistance well.

Patterns like Triangles, Wedges, and Head and Shoulders often signal reversals, giving you a heads-up on potential breakout or breakdown scenarios.

Patterns near established Support or Resistance levels have a stronger ability to predict.

The Bearish Rising Wedge apex breaks at the 156.00 reversal area in this example.

By identifying these complementary indicators near these areas, you can better pinpoint high-probability entries and exits, manage risk more effectively, and anticipate potential price targets.

Mastering the Nuances: Tips for Accurate Analysis

Identifying and interpreting these levels is crucial in Forex trading, and here are a few tips to improve your analysis:

- The more a price revisits a Support or Resistance level without breaking through, the more significant that area becomes.

- Traders should also remain vigilant for false breakouts when prices momentarily breach a level only to revert.

- Additionally, when multiple technical indicators come together, they can be a robust method for confirming decisions.

- This approach helps to ensure that decisions are not based solely on one signal but on a combination of Supporting evidence.

You can navigate the Forex market more confidently and successfully if you follow these guidelines and improve your analytical skills.

Wrapping Up: Why They Matter in Forex Trading

In simpler terms, they serve as guideposts in Forex trading. They can help you figure out where prices go next.

Think of them as lines on a map showing where prices have stopped or changed direction. By looking at these lines, you can make smarter choices about when to buy or sell.

When we add in other technical indicators, it’s like getting a detailed map with precision directions.

In short, combining Support and Resistance with other technical indicators can help you make better, more informed market decisions.

What’s the Next Step?

Select a favorite candlestick chart and look for reversal areas using what you learned in this article.

In addition, look for opportunities to coincide them with other technical analysis tools and techniques to see how they work together.

Combining Momentum, Japanese Candlesticks, and Chart Patterns can give you a comprehensive view and understanding to make trading easier.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about these crosses.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What are Support and Resistance Levels in Forex Trading?

These are horizontal lines drawn on a price chart to indicate where the price of a currency pair has historically had a hard time moving above or below. These levels act as psychological barriers for traders.

How do you Identify and Draw Support and Resistance Levels?

Identifying Support and Resistance levels involves analyzing a price chart and looking for price points where the currency pair has previously reversed or consolidated. Here’s a simple method to draw them:

- Historical Reversals: Look for areas on the chart where the price has reversed direction multiple times. The more times the price touches a level and reverses, the more it reflects that level’s strength.

- Round Numbers: Prices like 1.1000, 1.2000, or 1.5000 often act as psychological Support or Resistance levels because traders place orders around these numbers.

- Use Horizontal Lines: Once you’ve identified these levels, draw horizontal lines on your chart to mark them. Remember, these levels are zones rather than exact price points.

Can Support and Resistance Levels Break? If so, What Does it Signify?

Yes, Support and Resistance levels can and often do break. When they break, it can signify a potential shift in the market sentiment. From the perspective of a Bullish long trade:

- Break of Support: If a Support level is broken with a strong move downward, it might indicate that the selling pressure has become dominant, and the price may continue to decline. The broken Support can then become a new Resistance level.

- Break of Resistance: If a Resistance level is broken with a strong move upward, it might suggest that buying pressure has taken over, and the price may continue to rise. The broken Resistance can then act as a new Support level.