GDP in Forex trading has the power to move a nation’s currency, but trading this statistic is filled with challenges.

To understand this relationship, you must grasp the basics of GDP and Forex trading.

In What Way is Gross Domestic Product (GDP) a Fundamental Economic Indicator?

Gross Domestic Product, commonly known as GDP, is a cornerstone economic indicator measuring the monetary value of all finished goods and services produced within a country’s borders in a specific period.

It’s a comprehensive scorecard of a nation’s economic health and an essential gauge for economists, policymakers, investors, and Forex traders.

- Components of GDP: GDP comprises several key elements: consumer spending, government spending, business investment, and net exports, which is the difference between exports and imports.

- Each of these components reflects different aspects of a country’s economic activity.

- For example, high consumer spending may indicate increased consumer confidence and economic growth, while economic downturns often lead to stimulus measures in government spending surges.

- Nominal vs. Real GDP: It’s important to distinguish between nominal and real GDP.

- Nominal GDP calculates the economic output using current prices without adjusting for inflation. This approach can sometimes give a skewed picture, especially during high inflation or deflation.

- In contrast, real GDP adjusts for inflation, providing a more accurate reflection of an economy’s size and how it’s growing over time. Real GDP is considered a more reliable indicator for comparing economic performance over different periods.

- GDP Growth Rate: The GDP growth rate is a crucial metric in assessing economic health. It measures how fast a country’s economy is growing.

- A positive growth rate indicates economic expansion, which benefits the country’s currency in Forex markets.

- In contrast, a negative growth rate can signal economic problems and potential depreciation in currency value.

- GDP Per Capita: Another essential aspect is GDP per capita, which divides the GDP by the country’s population. It’s a valuable measure of average economic output per person, often indicating living standards and economic prosperity.

- Countries with high GDP per capita typically have more robust economies and, therefore, more stable and attractive currencies.

- Limitations of GDP: While GDP is a critical economic indicator, it has limitations.

- It doesn’t account for the income distribution among residents of a country, nor does it consider whether the nation’s growth rate is sustainable in the long term.

- GDP also doesn’t measure the environmental impact of growth. Moreover, it does not include the value of non-market transactions, such as volunteer work and household work.

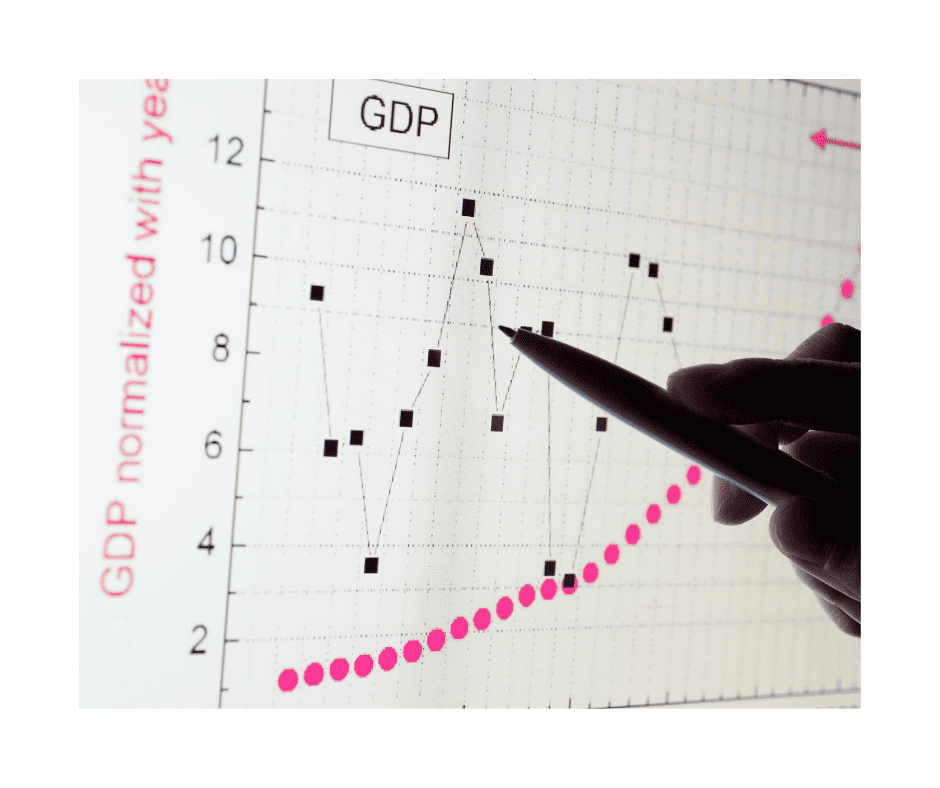

- GDP and Global Economies: In the context of global economies, comparing GDP across countries provides a perspective on their relative economic strengths and weaknesses.

- It’s also essential for understanding global economic trends and patterns, which can have far-reaching implications in Forex markets.

GDP in Forex trading is a fundamental economic indicator that offers invaluable insights into a country’s economic performance.

However, it’s essential for you to consider the limitations of GDP and to interpret it in conjunction with other economic data and global economic trends for a more comprehensive analysis.

What’s the Relationship Between Forex Trading and Economic Indicators?

The foreign exchange market, also known as Forex, facilitates the trading of currencies.

It’s the largest financial market globally, with a daily trading volume exceeding $5 trillion.

Forex traders buy and sell currencies, betting on the changes in their value relative to each other.

These traders pay close attention to various economic indicators, including GDP, as they provide insights into a country’s economic condition and, consequently, the potential value of its currency.

What’s the Impact of GDP on Currency Value?

The relationship between a nation’s Gross Domestic Product (GDP) and the value of its currency is a fundamental aspect of Forex trading.

- GDP as a Reflection of Economic Strength: Many people view GDP as an indicator of a nation’s economic prowess.

- A growing GDP suggests that an economy is robust, which can attract both domestic and international investors.

- The logic is simple: a strong, growing economy usually translates into higher corporate profits, a better job market, and increased consumer spending, all attractive to investors.

- Currency Demand and GDP Growth: The link between GDP and currency value primarily revolves around demand.

- When a country’s economy grows, as a rising GDP indicates, investors and businesses are more likely to invest in that country.

- This investment requires them to purchase the country’s currency, increasing demand for it and potentially its value on the Forex market.

- Market Perception and Expectations: The Forex market doesn’t just react to the actual GDP figures; it also responds to how they compare to market expectations.

- If GDP growth exceeds market forecasts, the currency might strengthen significantly.

- Conversely, the currency might weaken if GDP growth is below expectations, even positive growth.

- Interest Rates and GDP: Central banks often use GDP as a key indicator when setting interest rates.

- A growing GDP may lead to higher interest rates to control inflation, which can increase the attractiveness of a currency to foreign investors seeking higher yields.

- Higher interest rates can lead to a stronger currency as investors exchange more of their currency for the high-yielding currency.

- Global Context and Relative GDP: The impact of GDP on currency value also depends on the global economic context.

- A country’s currency might not appreciate due to high GDP growth if other countries are experiencing even higher growth rates.

- Forex traders often compare GDP growth rates across countries to gauge relative economic strength and potential currency movements.

- Sudden Changes in GDP: Significant and sudden changes in GDP, whether positive or negative, can lead to volatility in the Forex market.

- Sharp increases in GDP can trigger rapid currency appreciation, while unexpected drops in GDP can lead to currency depreciation.

- Long-term Trends vs. Short-term Fluctuations: Short-term GDP announcements can cause immediate market reactions, but long-term GDP trends are more important for sustained currency value movements.

- Consistent growth in GDP over several years generally strengthens a currency, while prolonged periods of weak GDP growth can weaken a currency.

- Risks and Limitations: It’s important to note that GDP is not the sole determinant of currency value.

- Political stability, fiscal policies, commodity prices (especially for commodity-dependent economies), and global economic conditions also play significant roles.

GDP plays a significant role in influencing the value of a nation’s currency in Forex trading.

A healthy, growing GDP can attract investment and increase demand for a currency, leading to appreciation, whereas a declining GDP can have the opposite effect.

However, this impact should be considered with other economic indicators and global market conditions to fully understand and anticipate currency value changes in the Forex market.

Will you see Market Volatility from GDP Announcements?

Gross Domestic Product (GDP) announcements are pivotal events in the Forex market, often driving significant market volatility.

The anticipation and response to these announcements highlight how crucial economic data is in shaping market sentiment and currency valuation.

- Anticipation and Speculation: Before the release of GDP figures, there is often considerable speculation in the Forex market.

- Traders try to predict the outcome and position their trades accordingly.

- This speculation can increase market volatility, as different traders have varying expectations and interpretations of potential GDP outcomes.

- Immediate Market Reaction: The Forex market can react dramatically to a GDP announcement.

- Suppose the GDP data is better than expected. In that case, it can lead to a swift appreciation of the national currency, often interpreted as a sign of a healthy, robust economy.

- Conversely, if the GDP data falls short of expectations, the national currency might depreciate quickly.

- Comparative Analysis: Traders compare the absolute GDP figures to previous quarters and the forecasts.

- The difference between the actual data and the market expectations often drives the market reaction.

- Even if the GDP growth is positive, the currency might still fall if it’s less than anticipated.

- Long-term Trends vs. Immediate Reactions: While the immediate market reaction to GDP announcements is essential, traders also consider long-term economic trends.

- For instance, a single positive GDP report might not have a lasting impact if the overall trend shows a slowing economy.

- People might overlook a one-off negative report if the broader economic outlook remains positive.

- Global Impact: In today’s interconnected global economy, the GDP data of one country can have ripple effects across the Forex market.

- Major economies like the United States, China, and the Eurozone have a significant impact.

- Strong or weak GDP data from these economies can influence investor sentiment globally, affecting not just their currencies but others.

- Economic Context and Analysis: Traders often analyze GDP data in the context of other economic indicators like inflation, employment data, and manufacturing output.

- This holistic approach helps understand the broader economic picture and make more informed trading decisions.

GDP announcements are significant events that can cause substantial volatility in the Forex market.

What are GDP’s Long-Term vs. Short-Term Effects on a Nation’s Currency?

Developing a comprehensive trading strategy requires understanding the long and short-term effects of economic indicators such as GDP in Forex trading.

These two periods offer different insights and implications for currency value and market dynamics.

- Short-Term Effects of GDP Announcements: In the short term, the announcement of GDP figures can lead to immediate and sometimes sharp reactions in the Forex market.

- The difference between the reported figures and market expectations primarily drives these reactions.

- A higher-than-expected GDP can quickly boost a currency’s value, while a lower-than-expected GDP can lead to a rapid decline. Short-term traders, like day traders or scalpers, often attempt to capitalize on these quick movements.

- Market Sentiment and Momentum: Short-term market movements following GDP announcements are not just about the data but also about market sentiment and Momentum.

- If the market sentiment is Bullish, even slightly positive GDP data can lead to significant currency appreciation.

- In a Bearish market, traders may only lift the currency with good GDP data if they focus on other negative aspects.

- Long-Term Economic Trends: In the long term, consistent GDP growth or weakness can lead to more sustained currency value movements.

- A country showing a steady increase in GDP over several years is likely to have a stronger currency, which indicates a robust and growing economy.

- In contrast, long-term GDP decline or stagnation can weaken a currency, reflecting a struggling economy.

- Investor Confidence and Foreign Investment: Long-term GDP trends significantly impact investor confidence and foreign investment levels.

- Consistent economic growth can attract long-term investment from abroad, which involves converting substantial amounts of foreign currency into local currency, potentially strengthening it.

- Policy Implications and Interest Rates: Central banks closely monitor GDP growth to set monetary policies.

- Economic growth might lead to higher interest rates to curb inflation, making the currency more attractive to Forex traders due to higher returns.

- Conversely, prolonged economic slowdowns often result in lower interest rates, which can decrease the currency’s appeal.

- Economic Stability and Currency Strength: Over the long term, a stable and steadily growing GDP contributes to the perception of financial stability, a critical factor in a currency’s strength.

- Long-term Forex traders and investors are often attracted to stable economies with predictable growth, considering them safer investments.

- External Factors and Global Context: It’s important to remember that various external factors, including global economic conditions, political stability, and other financial markets, influence both short-term and long-term currency effects of GDP.

- Therefore, Forex traders should consider these factors alongside GDP data to form a well-rounded view of a currency’s potential movement.

You need to understand GDP’s short-term and long-term effects on currency values.

While short-term effects can provide opportunities for quick profits, long-term trends in GDP offer insights into the underlying economic health of a country and the potential long-term strength or weakness of its currency.

Balancing these two perspectives enables traders to make more informed decisions and develop strategies suited to their trading style and risk tolerance.

How to Interpret GDP Data for Forex Trading

Clear interpretation of GDP data is vital for informed currency decisions.

Understanding the nuances of GDP data and its implications for the Forex market requires a multifaceted approach.

- Analyzing GDP Components: The first step in interpreting GDP data is to analyze its components: consumer spending, investment, government spending, and net exports.

- You should look at which sectors are driving GDP growth or decline. For instance, growth driven by consumer spending might have different implications for currency value than growth driven by government spending.

- Real vs. Nominal GDP: Forex traders should differentiate between real and nominal GDP.

- Adjusted for inflation, real GDP provides a more accurate picture of economic growth and purchasing power, which is more relevant for currency valuation than nominal GDP.

- Historical Context and Trends: It’s essential to place current GDP figures within a historical context.

- You should compare current data with previous periods to identify trends, such as accelerating or decelerating growth.

- Consistent trends often have more impact on currency value than one-off figures.

- Global Comparison: Forex trading is relative, involving pairs of currencies. Therefore, it is essential to compare a country’s GDP data in isolation and against the GDP data of its trading partners and competitors.

- This comparative analysis can provide insights into relative economic strength and potential currency movements.

- Market Expectations and Sentiment: The market’s reaction to GDP data often hinges on how the figures compare to market expectations.

- Even if GDP growth is positive, the corresponding currency might still weaken if it falls short of market expectations.

- Understanding market sentiment and expectations before the release of GDP data is crucial.

- Correlation with Other Economic Indicators: You should interpret GDP data with other economic indicators like employment rates, inflation, consumer confidence, and manufacturing indices.

- This broader economic perspective can provide a more comprehensive view of the country’s health and potential currency movements.

- Impact on Monetary Policy: GDP data significantly influences central bank policies.

- You should consider how current or expected GDP growth rates may impact central bank decisions, particularly concerning interest rates, since these can significantly affect currency values.

- Geopolitical and Socioeconomic Factors: While GDP is a vital economic measure, it doesn’t exist in a vacuum.

- Geopolitical events, trade policies, and other socioeconomic factors can influence a nation’s economic health and currency.

- Traders should factor in these elements when interpreting GDP data.

- Technical Analysis Correlation: Combining the analysis of GDP data with technical analysis tools can be beneficial.

- The GDP data may reinforce reasons for currency purchase if technical indicators align with Bullish patterns and indicate economic strengthening.

A comprehensive approach is necessary to analyze the impact of GDP on Forex trading.

What are the Risks and Considerations of Using GDP in Forex Trading?

When trading Forex based on GDP data, you must be aware of various risks and considerations to make informed and cautious decisions.

While offering opportunities, this market is also fraught with complexities that can pose significant challenges.

- Overreliance on GDP Data: One risk in Forex trading is the overreliance on GDP data.

- While GDP is a critical economic indicator, it’s not the only factor influencing currency movements.

- Relying solely on GDP figures without considering other economic indicators, geopolitical developments, and market sentiments can lead to misinformed trading decisions.

- Timing and Market Reaction: The timing of trades around GDP announcements is crucial.

- Forex markets can react swiftly and sometimes unpredictably to GDP data.

- The immediate market reaction may not reflect long-term economic trends, leading to potential losses if trades are mistimed or reactions misinterpreted.

- Volatility and Speculation: GDP announcements can cause significant market volatility, both an opportunity and a risk.

- High volatility can lead to significant gains and substantial losses, especially if leveraged positions are involved.

- Speculative trading around GDP releases requires a careful approach and sound risk management strategies.

- Economic Calendar Congestion: GDP data is typically published concurrently with other economic metrics.

- This congestion can create complex market conditions where different data points pull the market in different directions.

- You need to be able to parse out the relative importance of these indicators and understand their combined effects on currency values.

- Global Economic Interdependencies: In today’s interconnected global economy, the economic conditions in one country can have far-reaching effects.

- A strong GDP in one nation can impact currencies and economies worldwide, especially in countries that are major trading partners or have significant financial connections.

- Political and Policy Implications: Government policies and political stability are crucial in economic growth and currency valuation.

- You must consider how political events and policy changes might affect a country’s GDP and, by extension, its currency.

- These factors include monitoring elections, fiscal policies, and international trade agreements.

- Data Accuracy and Revisions: GDP figures, like all economic data, are subject to revisions, and initial estimates may not always be accurate.

- You must be cautious about reacting too quickly to preliminary GDP data and stay informed about any revisions that might alter the economic outlook.

While GDP data is a powerful tool in Forex trading, it comes with risks and considerations.

Considering various economic, political, and global factors, you must approach this data with a comprehensive market understanding.

A cautious approach, combined with robust risk management strategies, is essential for effectively navigating the complexities and volatilities of Forex trading.

Conclusion

You must understand the relationship between a nation’s GDP and the value of its currency as a Forex trader.

This understanding aids you in making informed decisions and spotting potential trading opportunities.

However, you must view GDP within the broader scope of other economic indicators and global trends.

By doing this, you’ll be able to seize the opportunities that emerge from the interaction between national economies and currency values more effectively.

What’s the Next Step?

Select your favorite chart and try determining market phases using the abovementioned ideas.

In addition, look for opportunities to use market phases to make trading analyses and strategies.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about determining market phases.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What is GDP in Forex Trading?

GDP, or Gross Domestic Product, in Forex trading, refers to a measure of the total economic output of a country and its impact on the value of that nation’s currency.

It’s a crucial economic indicator that Forex traders use to gauge a country’s financial health and to predict potential movements in its currency market.

How Does GDP Affect Currency Values in Forex Trading?

In Forex trading, a higher GDP typically indicates a strong economy, which can attract more investors and increase demand for that nation’s currency, leading to a rise in its value.

Conversely, a lower GDP suggests a weaker economy, potentially decreasing investor interest and lowering the currency’s value.

Can GDP Data be the Sole Factor for Trading Decisions in Forex?

While GDP data is significant, it should not be the sole factor in Forex trading decisions.

To make informed trading decisions, consider economic indicators like inflation, unemployment, political stability, and global trends.

What are the Risks of Trading Based on GDP Announcements?

Trading based on GDP announcements carries risks like market volatility, speculative trading, and the potential for rapid currency value changes.

Misinterpreting GDP data or failing to consider other market factors can lead to significant losses, especially when using leverage.

Therefore, understanding the broader economic context and employing risk management strategies is crucial.

How can you Prepare for GDP Announcements in Forex Trading?

You can prepare for GDP announcements by staying informed about economic forecasts and market expectations, analyzing historical GDP data, and understanding the potential impact on currency pairs they are trading.

Risk management strategies, such as setting stop-losses and avoiding overleverage, are crucial during market volatility.