The Fed held rates at 4.50%, matching market expectations. Powell highlighted high uncertainty over the outlook, stressing that tariffs are a significant factor driving inflation expectations.

Economic forecasts saw notable shifts: 2025 GDP growth was trimmed to 1.7% from 2.1%, while core PCE inflation was revised up to 2.8%. The US dollar weakened as the Pound surged, with GBPUSD touching a fresh 4‑month high.

The concern amongst traders and myself is slowing growth and rising inflation. While the Fed holds rates steady, the USD will weaken, reflecting slower economic activity.

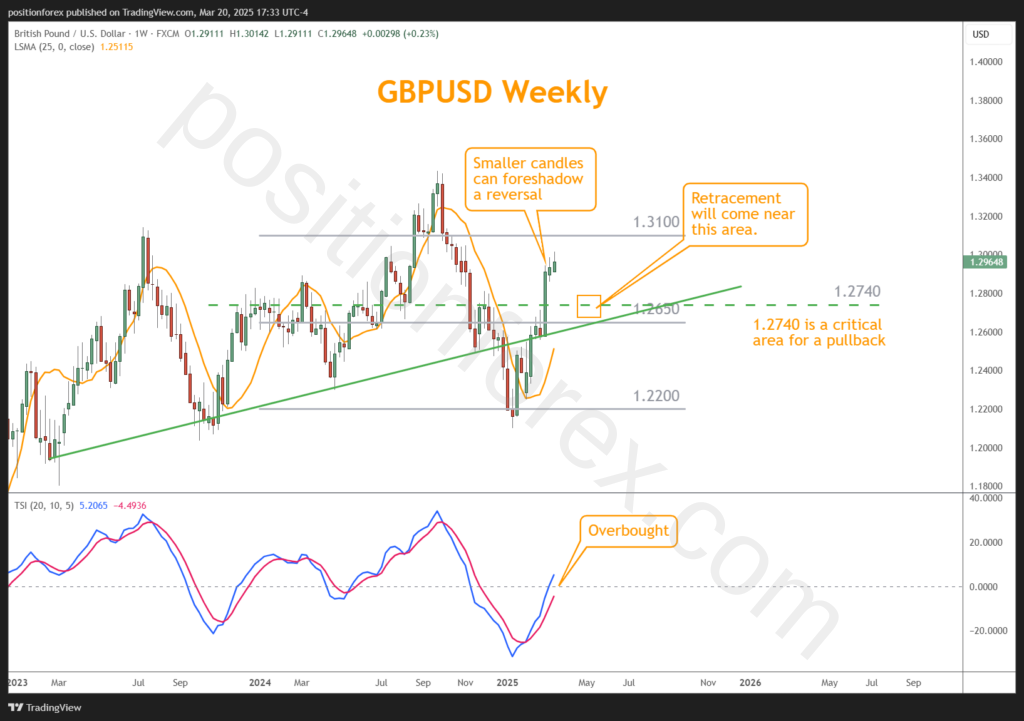

I believe the GBPUSD rally will be short-lived since prices have rapidly increased.

This is similar to other USD pairs where the knee jerk market reaction to tariff announcements sends the USD plunging.

If and when the tariffs or softened or removed entirely the USD rebounds but never to the extent of the correction.

This is because the tariff threat slows economic activity whether it’s implemented or not. The threat of the tariff is enough to slow investments, hiring, and other business decision.

The uncertainty of the future for the remainder of 2025 weighs on markets, GDP forecasts, and the USD.

Once the market decides the scope of the trade war is fully defined, some optimism is likely to return, but while there are questions, confidence recedes.