Forex trend types are essential since this is usually the first component any trader wants to find on a chart.

Why?

What makes trend analysis the most critical signal traders follow?

There are multiple ways to discover and measure price direction, and we have an article discussing the tactics of trend trading here.

But if it’s so important, why do traders fail?

Shouldn’t identifying the trend be enough for success?

Aren’t many “trend traders” doing this now?

Isn’t this taught to beginners because it’s essential?

The challenge is that there are many ways traders identify trends and different rules on how to trade them.

As a result, what seems like an obvious strategy is a complicated minefield.

In this article, I’ll teach you how to avoid the minefield by using a different perspective and, with this, a more successful trader.

The lessons taught come from thousands of trades I’ve made since 2007 across many markets.

What’s the Relationship Between Trends and Currency Values?

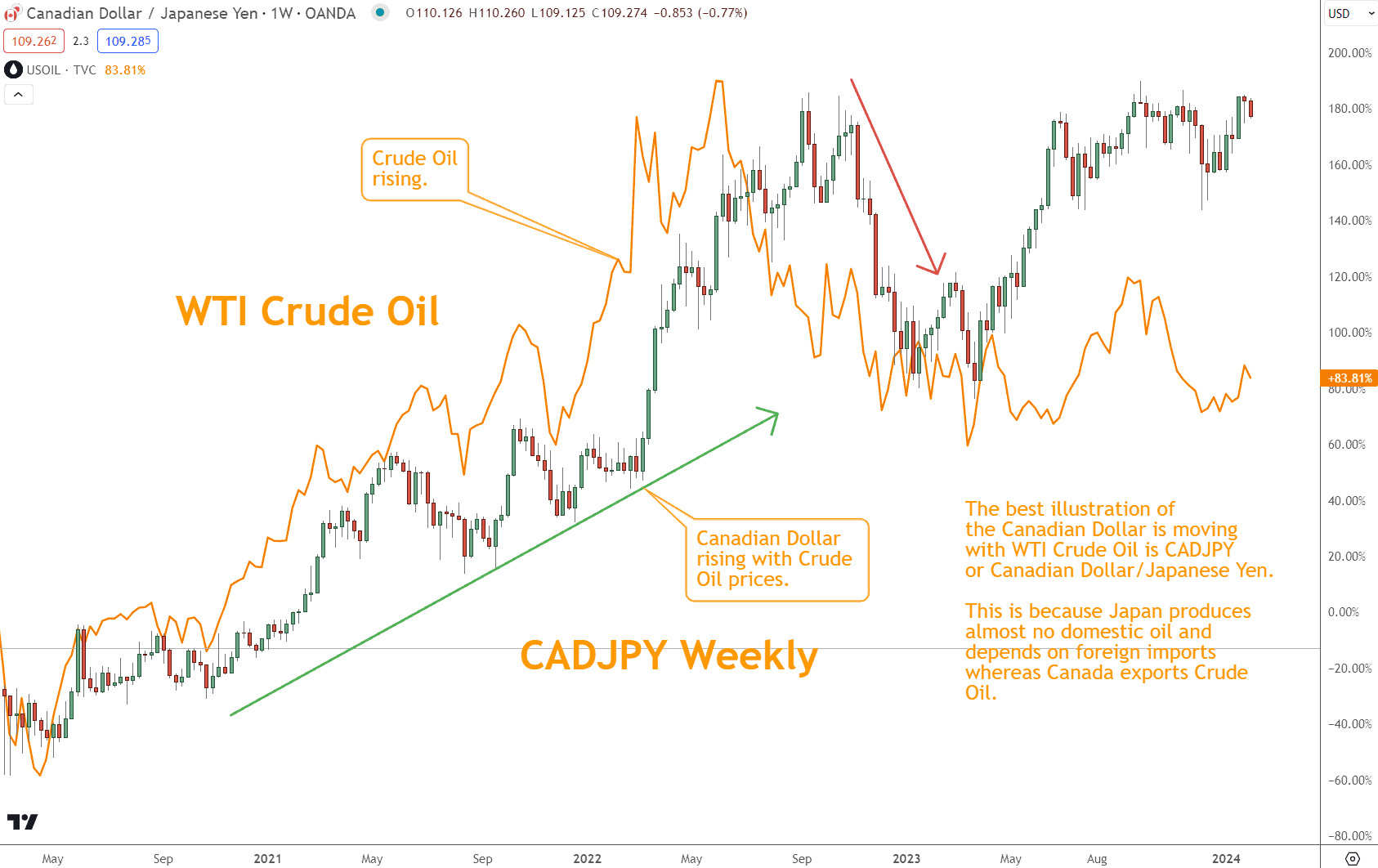

The relationship between the price of crude oil and the value of the Canadian dollar is well-established and highly correlated.

Canada is one of the world’s largest exporters of crude oil, with the oil and gas sector playing a significant role in its economy.

As such, when global crude oil prices rise, Canada’s export revenue generally increases, strengthening the Canadian dollar.

Conversely, when oil prices decline, the Canadian dollar tends to weaken as export earnings from the energy sector decrease.

This connection is often referred to as the “petrocurrency” effect, and it underscores the importance of monitoring crude oil prices for Forex traders when trading the Canadian dollar, as it can significantly influence its value and exchange rates.

Why Follow Market Uptrends and Downtrends?

The premise of trend following in trading is if you can find a primary trend early enough, ride it for some time (whatever that is), and leave before it ends; this is a consistent strategy for success.

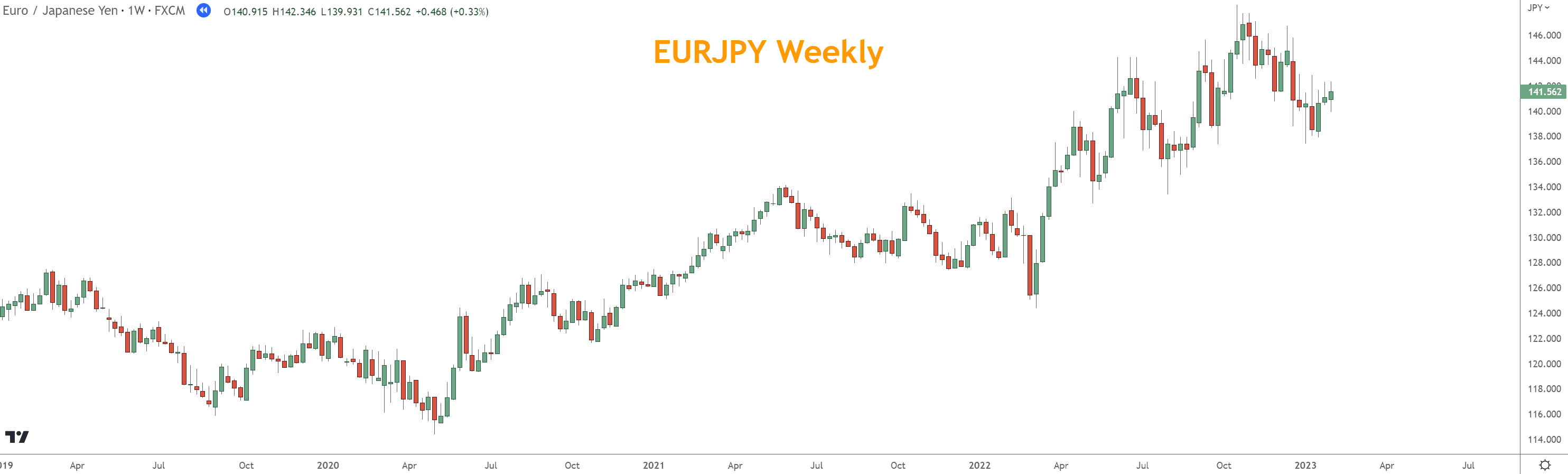

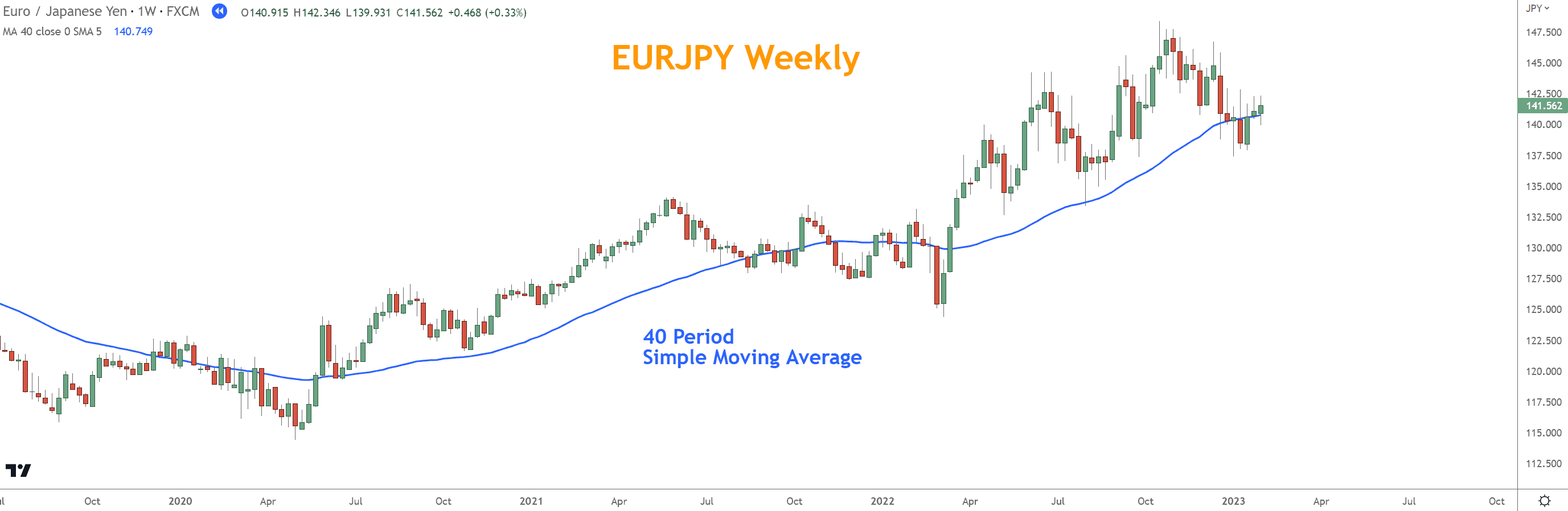

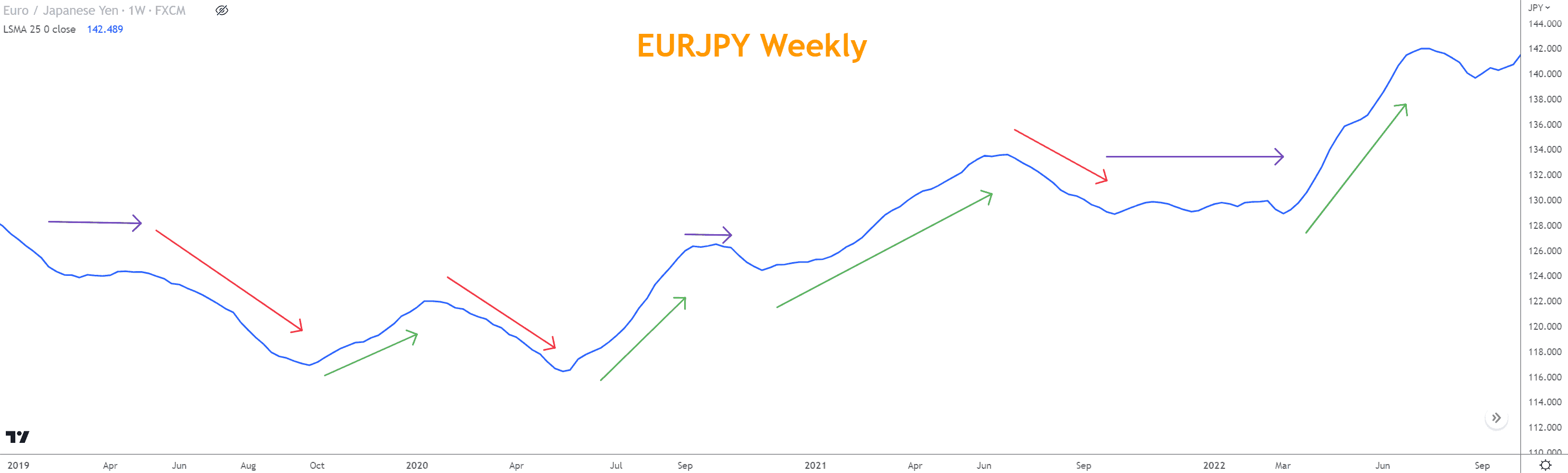

Here’s the truth. Look at this chart of EUR/JPY from January 2019 to January 2023. There are no indicators of any kind, and to the naked eye, this chart mostly looks like an “uptrend” or a Rally.

EURJPY will begin in the 115 area starting in May 2020 and reach the 140 area by January 2023. This is an uptrend – no?

While EURJPY moved upward during these two and a half years, there were also frequent downward retracements and nine months of consolidation between 05/31/21 and 02/28/22, during which time EURJPY moved lower from the 134 area to the 124 area.

Considering this, how useful is it to know that prices moved higher between January 2019 and January 2023?

If you were wise enough or lucky enough to purchase in January 2019, would you have held through the long consolidation to get the additional 11 months of gains between March 2022 and January 2023?

Most traders wouldn’t, and most struggle with how to identify a trend, trade it, and what to think of it.

Let’s examine how price direction is identified and how it traps traders into bad trades.

Ultimately, I’ll show you a better way to trade.

What are the Different Types of Trends?

There are three possibilities – upward, downward, and neutral (neutral is also called a sideways trend). Therefore, before considering opening a trade, you must know the current state.

How you choose to identify them is up to you.

Various indicators (MAs, MACD, ADX) and techniques (trend line, price swings) are available.

What Rules Can Be Applied?

Here are some rules commonly applied and their associated problems.

The rules can be summarized into two groups:

- Technical analysis indicators: Moving Averages, MACD, ADX, etc.

- Technical analysis techniques: Swing Highs and Swing Lows, Channel Lines (also called trend lines)

Technical Indicators include applying a mathematical construct onto a chart and creating rules such as when one line crosses another, it means one thing, or if an instrument’s price crosses a line, it means something else.

These rules are loosely based on probability. If prices move sufficiently, a line calculated against them should reflect their behavior.

If true, this will continue until the indicator’s behavior changes.

Technical analysis techniques for labeling price swings or connecting peaks or troughs depend on one’s ability to use one’s eyes and discern price direction.

A set of rules determines where a peak or trough is, and if there are consecutive peaks and troughs, then there is a trend.

Again, the assumption is you now know the instrument’s direction and can expect it to continue.

While this could be interesting information, is it useful in trading?

Unfortunately, no, it isn’t, and you probably know why. Three reasons:

- These tools and techniques are highly subjective and laggards.

- The indicators create rules that don’t relate to the market structure made by participants.

- Their results are arbitrary, and creating rules against them doesn’t have any relation to reality.

To be successful, you need to trade tracking information closer to other traders’ mindsets and actions.

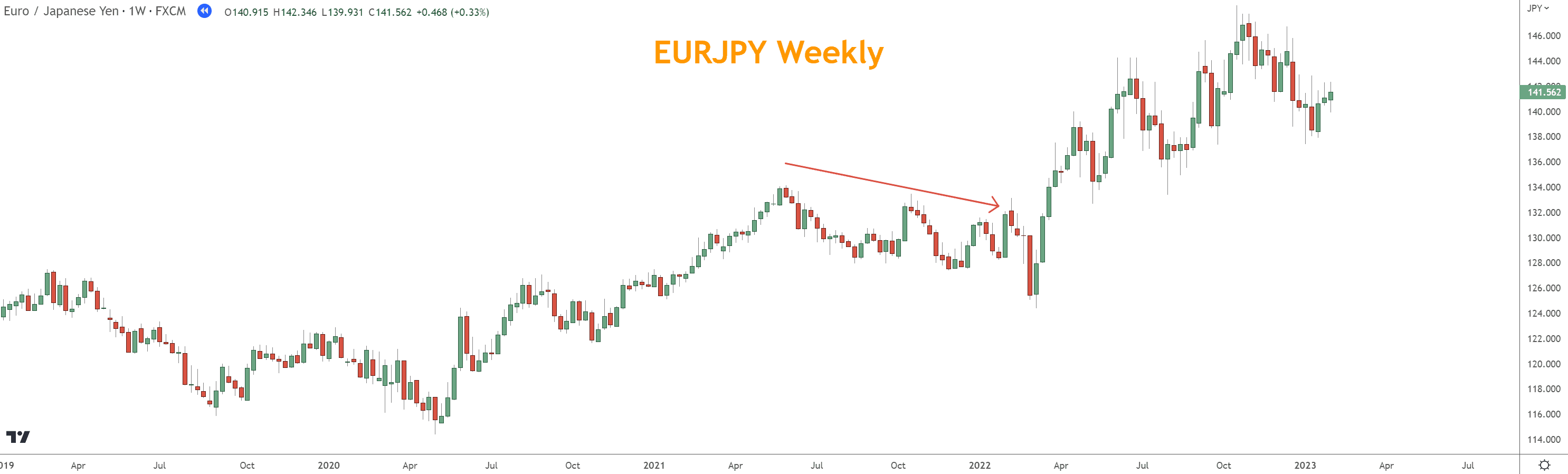

Let’s examine some popular techniques using the EUR/JPY chart and see where they succeed and fail.

Different Trend Indicators Will Provide Different Answers

Trend trading strategies are too numerous to list, but they all are built around moving averages.

Moving averages are simple and famous indicators traders and analysts use to track a market’s price movements.

This tool provides an average of a market’s price movements over a given period; however, as you will see, it is late entering a trend and late exiting it.

To address this problem, traders will try shortening the time frame calculation to make the indicator more sensitive to price changes.

This will allow them to enter sooner and exit near their ends, helping them get better trades.

The problem with shortening the time frame is that the indicator is now too sensitive.

A short-term moving average is subject to “whipsawing,” which means small price changes produce false signals.

There is no winning with a moving average-based indicator, yet all the popular indicators are moving average-based.

Let’s look at a few and see the results.

Moving Averages

Moving averages (MA) are among many indicators popular with traders. They track the average price over time and show whether prices are above or below that moving average.

Prominent time frames include 20-day, 50-day, and 200-day MA. Let’s look at each and consider whether this is useful for trading.

In this study, we’ll use simple moving averages. You can try exponential, smoothed, and other calculations as an experiment. The problems are the same with all of them.

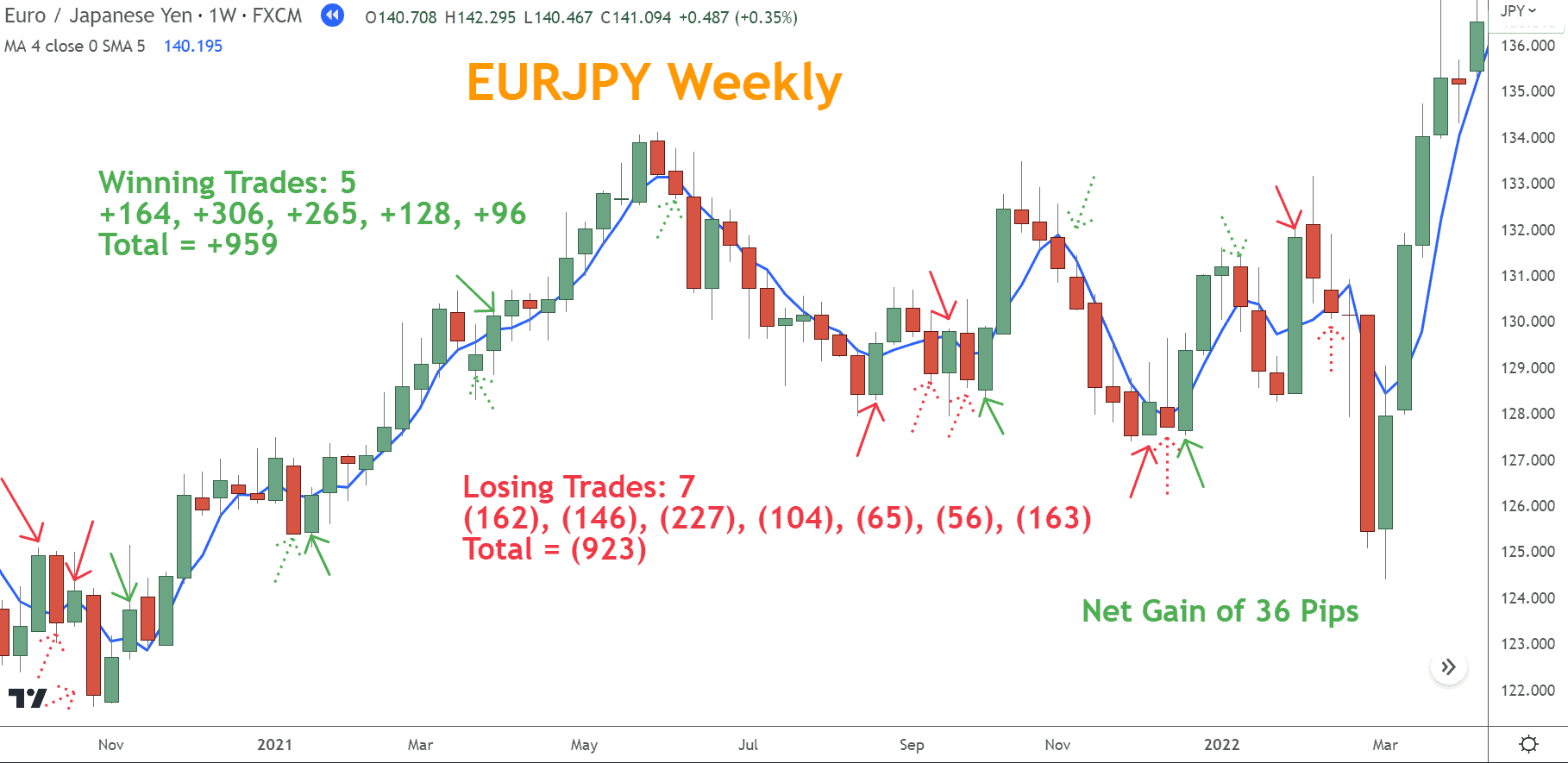

To stay with weekly charts as position traders, we’ll reduce the charts by a fifth (five-day trading week), so the charts will show a 4-period, 10-period, and 40-period, respectively. But, again, the result is the same.

In this example, the rule is simple. Open a trade when the price closes above the moving average and close it when it closes below the moving average. Only long transactions are attempted.

We’ve zoomed in on the period between 08/03/20 and 02/14/22 to make the chart legible.

I’ve labeled winning open and closing trades with green arrows and losing trades with red arrows.

We can agree that trading for 18 months, yielding 36 pips, isn’t the desired result, but that’s not the worst part. I selected this chart because it has a clear uptrend from 11/02/20 to 05/31/21, constituting 30 of the 81 bars in this chart.

This means that even though 37% of the time, this chart is in an obvious uptrend, and only long trades were taken; trades with these rules struggled to break even.

Also worth noting is that these results don’t include the spread or any price slippage. Eight months is break-even for this trader.

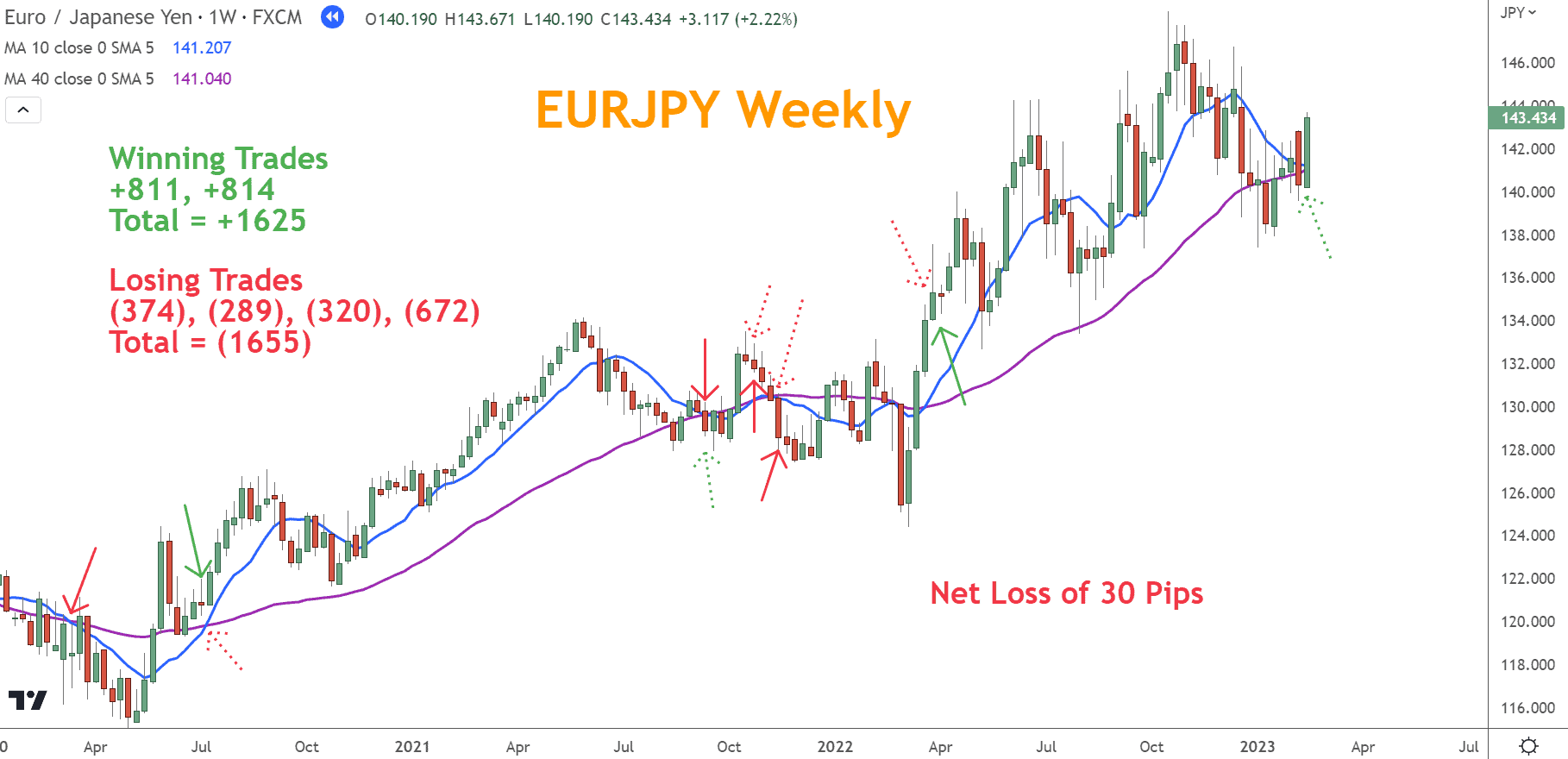

Let’s try another trading strategy using a different technique: crossing the 10-period weekly (50-day) with the 40-period weekly (200-day).

We’ll use the same chart with a longer time frame since we use longer moving averages. We’ll also trade with new rules.

When the ten period crosses above the 40 period, it’s a buy signal, and if the ten period crosses below the 40 period, it’s a sell signal.

In this scenario, performance is again poor, even though price’s direction for most of the chart is higher.

This is also a good illustration that regardless of the length of the period and the process, the negatives outweigh the positives.

A more sensitive moving average, like the 4-week (20-day), produces too many wrong signals, whereas a longer-term moving average system is insensitive. Either way, the result is disappointing.

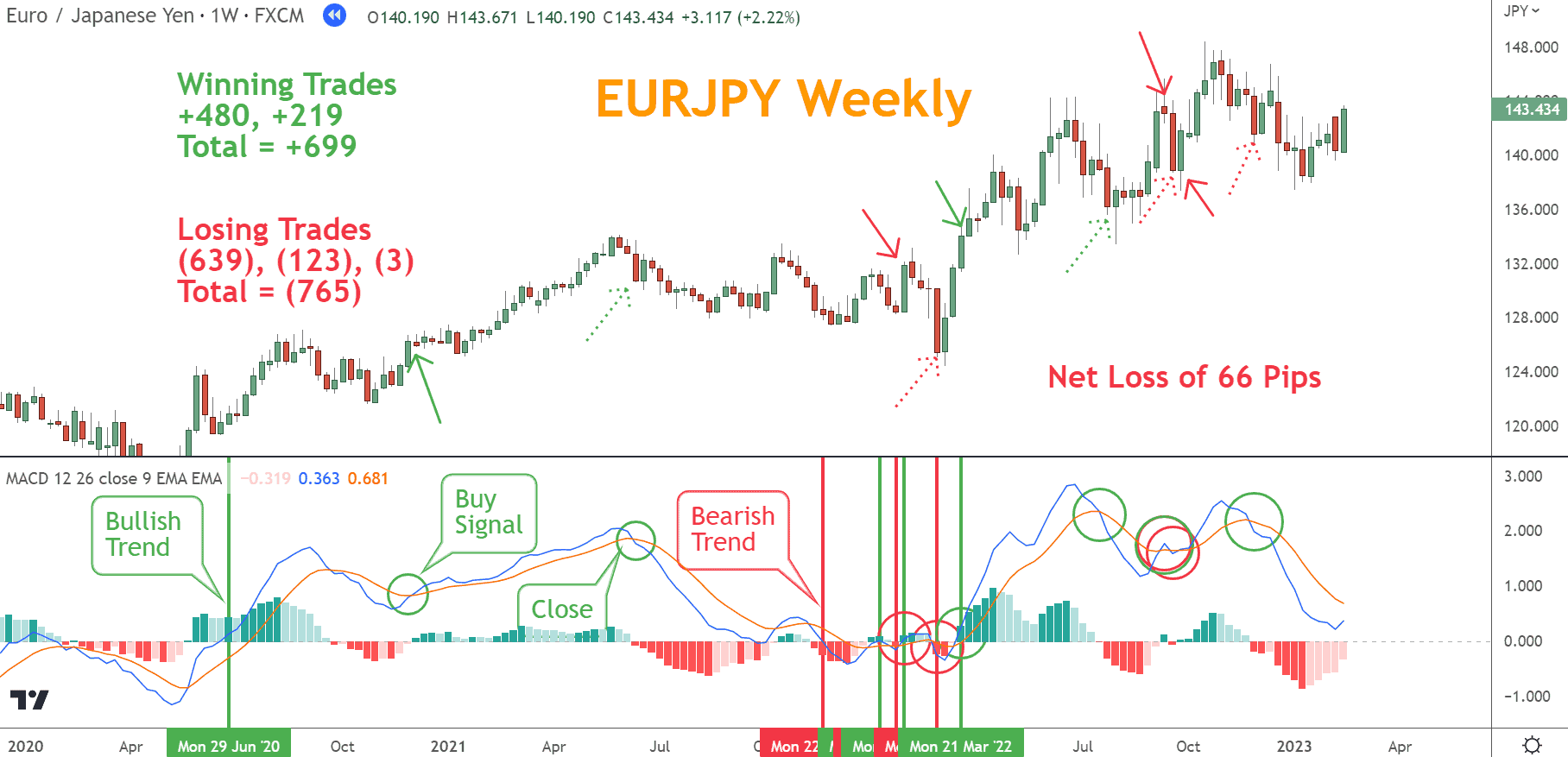

Next, we’ll look at the MACD, which uses exponential moving averages and a smoothing process to address some problems with the simple moving average.

Moving Average Convergence Divergence (MACD)

MACD is a technical indicator that uses multiple moving averages and a process to improve its predictive accuracy. The instrument signals Bullish or Bearish when the MACD line crosses above or below its zero line.

Buy signals are generated when the MACD line crosses above the signal line, while sell signals occur when the MACD line crosses below the signal line.

In this example, we’ll take long and short trades on EUR/JPY. If the MACD is in a Bullish state and provides a buy signal, we’ll buy, and also take the inverse when Bearish and provides a sell signal, we’ll sell.

As you can see, the MACD doesn’t do any better than the simple moving average for the same reasons.

There is no “sweet spot” with moving averages. There is no one set of numbers or math that can accommodate the market’s volatility.

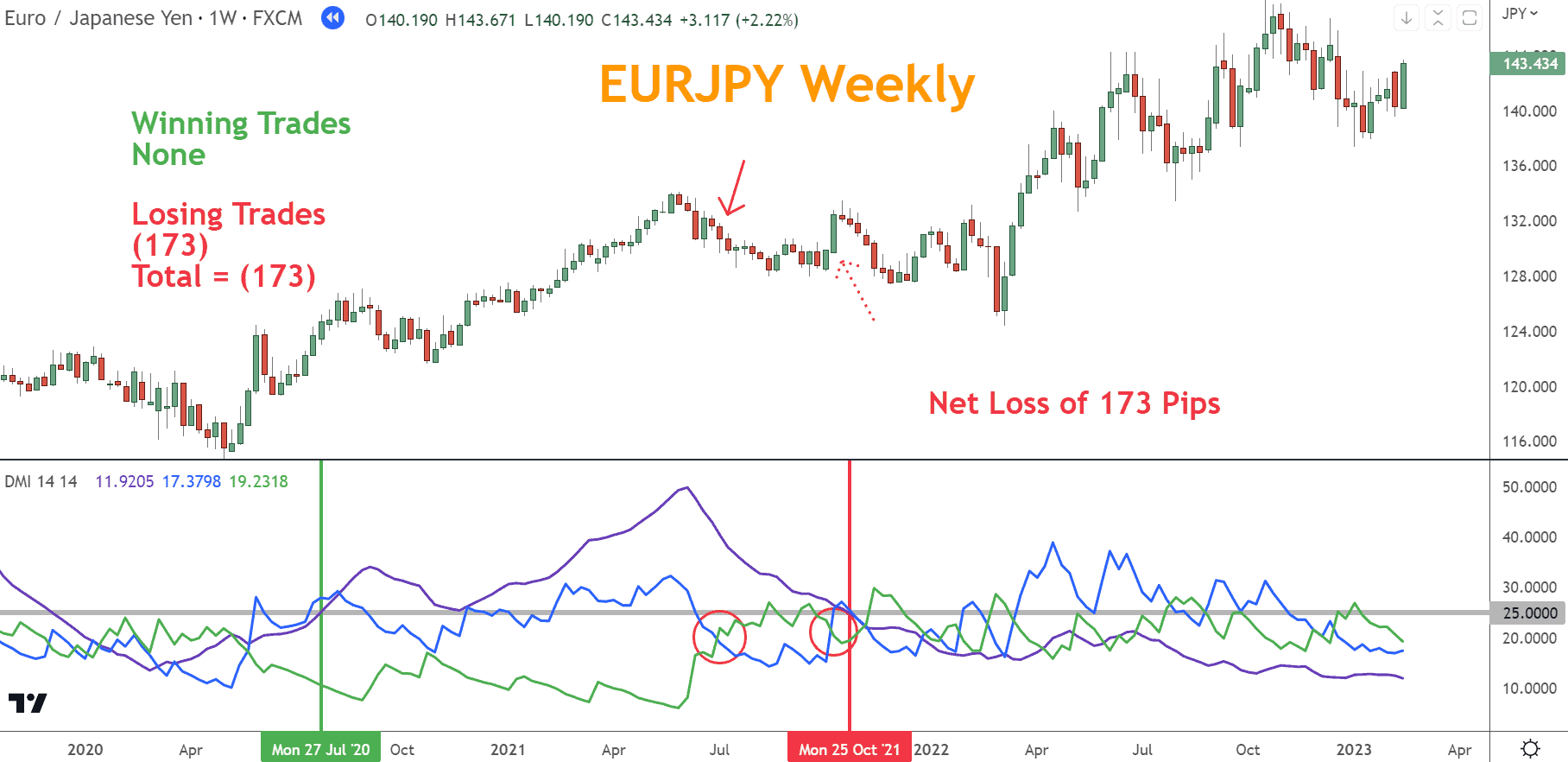

Average Directional Index (ADX) and Directional Movement Index (DMI)

The Average Directional Index (ADX) and Directional Movement Index (DMI) are unique indicators that combine trend and momentum into one indicator.

Together, they can define any of the three types.

The ADX works by plotting a line that moves between a value of 0 and 100, with values above 25 indicating growing Momentum and values below 25 showing weakening Momentum.

The ADX is often plotted alongside the Directional Movement Index (DMI), which is composed of two other lines: the negative directional indicator (-DI) and the positive directional indicator (+DI).

When +DI crosses -DI while the ADX is above 25, it is a buy signal, and when the -DI crosses the +DI while the ADX is above 25, this is a sell signal.

As you can see, the ADX and DMI suffer some of the same problems as the other indicators because they always lag the price action.

You might be tempted to open a trade after the ADX catches up to the positive DMI cross in June 2020; however, not following best practices will expose you to whipsaws in other situations, creating a worse performance.

If you factor that trade in, though, it’s worth 603 pips.

That creates a net gain of 430 pips, making this combination the best performer but still a terrible performance for a chart of 38 months.

One last strategy to consider is to use no indicator but rather identify price swings. If three can be found, a trade can be entered.

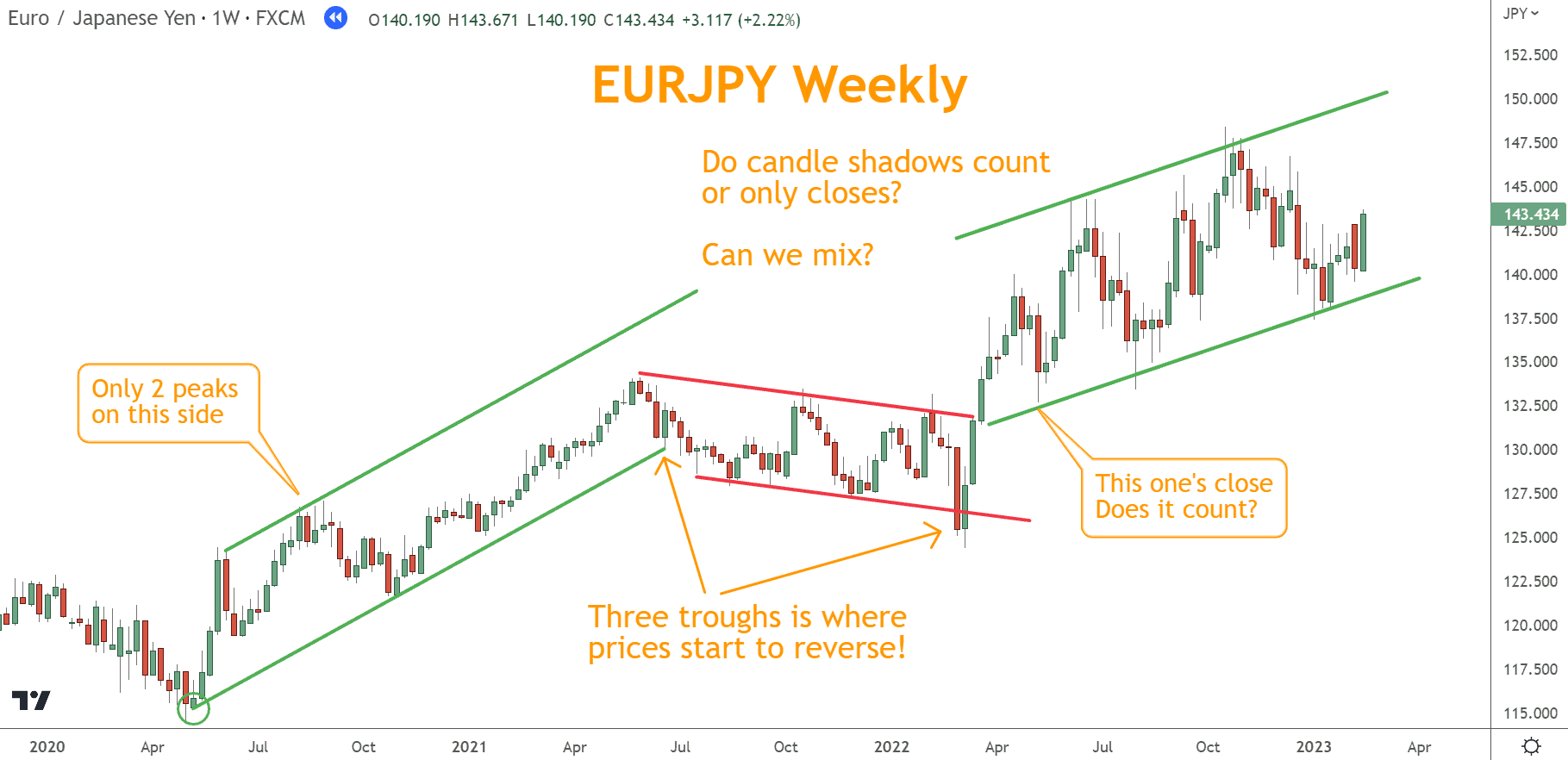

Channel Lines or Trendlines

Channel Lines (also called Trendlines) are drawn by connecting peaks on one side of prices and troughs on the other side of prices on a chart.

These peaks and troughs are labeled as Higher Highs, Higher Lows, Lower Highs, or Lower Lows.

Conventional wisdom is if you can find three peaks or three troughs, you have a confirmed price’s direction.

Once confirmed, you can enter a trade in the direction of the trade.

Taking a closer look could be more helpful for a few reasons.

First, you must decide if shadows and near misses count since they come into play often. The other challenge is if you wait for three peaks or troughs, you may have missed the move entirely.

Even if you include shadows and near misses, you will need help using this strategy.

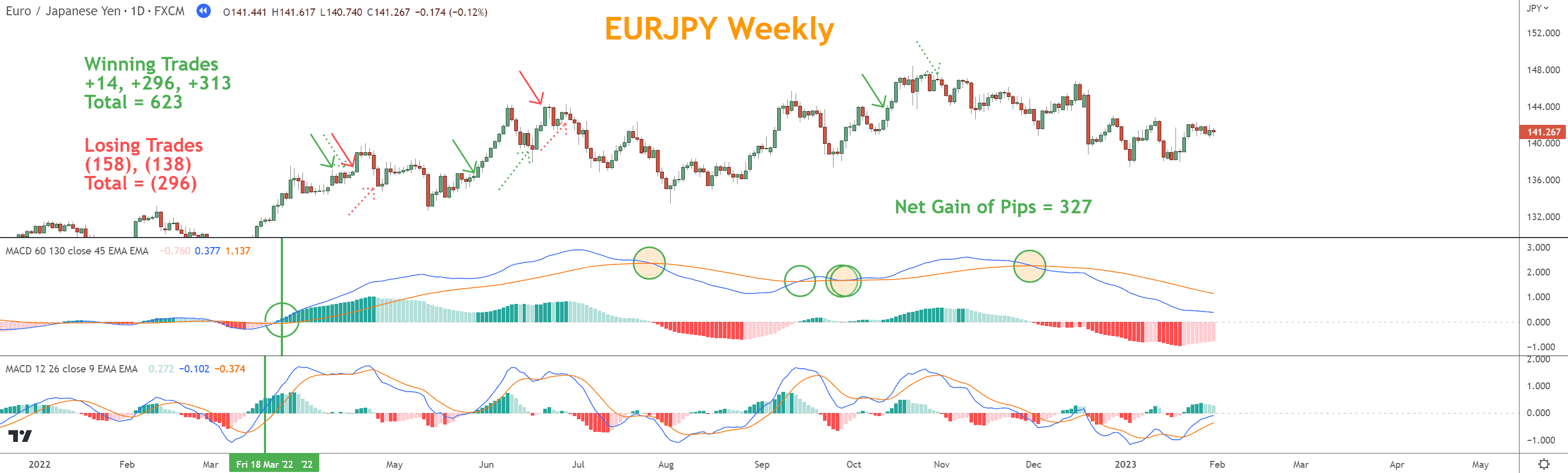

Does Using Different Time Frames Help?

Many traders try to use indicators more effectively by combining time frames.

If you are a swing trader (intermediate-term) looking at daily charts, is there value in using the longer-term weekly indicator and a daily indicator? Can they work better together?

In this example, we’ll reset the EUR/JPY chart to daily and add two MACD indicators, each on a unique period. One set was as if it were on a weekly chart, and the other was for the daily chart.

If the weekly MACD gives a Bullish or Bearish signal, we’ll take trades on the daily chart that coincide with that signal on the daily MACD.

Using the two-time frame, the MACD strategy worked better but still underperformed. Three hundred twenty-seven pips earned over 13 months is an unacceptable performance.

Even using the longer-term MACD as a filter, the shorter-term MACD fails to make better trades because it lags. One early trading opportunity is missed out on because the longer-term MACD lags.

You can experiment with different time frames and strategies; however, as you can see, trying to use trend this way as a basis for trading doesn’t work.

This is because of the flawed ideas behind these tools. The trend is different from what these tools measure.

Allow me to explain.

How Does Momentum Influence Analysis?

If a trend describes the general direction of prices, then what does momentum measure?

If we examine the ADX/DMI indicator, we can see DMI trying to tell us when prices are Bullish or Bearish.

The ADX is telling us how aggressively Bullish or Bearish. The indicator doesn’t produce winning trades but has the right idea.

The trend is only a general direction. Momentum is the energy in that direction.

If you are sitting in your car heading west on a highway, you are trending west, whether sitting in traffic at 20 miles per hour or speeding along at 70.

The speed at which you are moving is the momentum.

To be successful in trading, we need to know in what direction we have been moving recently and with how much energy.

We can incorporate other tools and techniques to help identify reversals, continuations, etc.

I suggest reframing the idea of trend as a shorter-term strategy and stopping trying to use it as a filter.

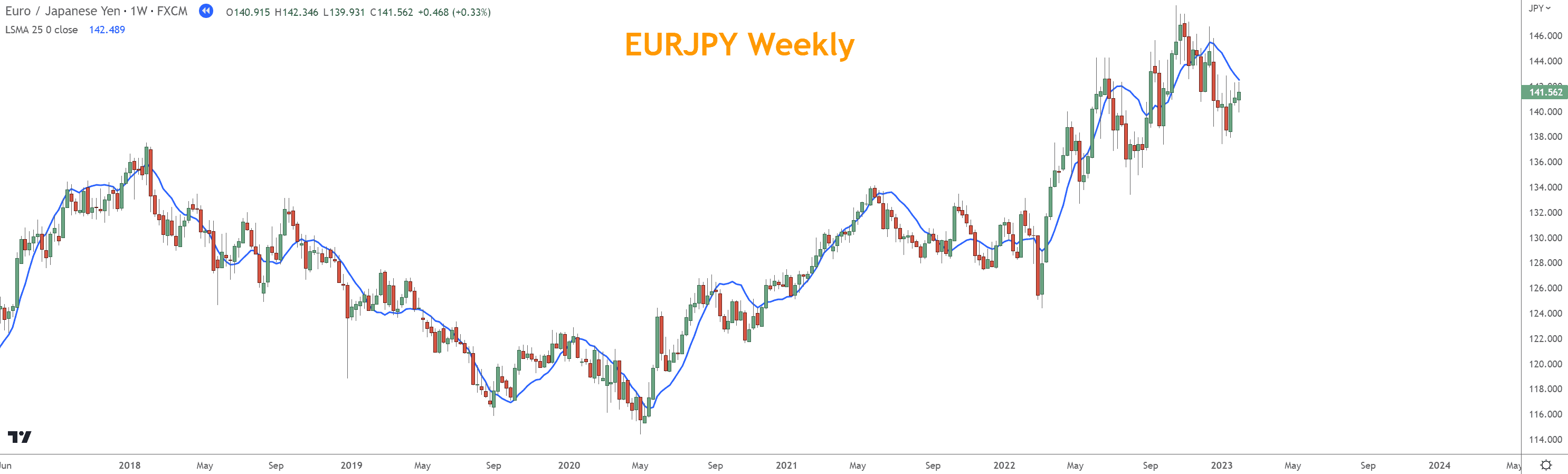

For example, look at the chart below, which uses a 25-period Least Square Moving Average.

Notice a difference between the LSMA, SMA, or the EMA used in the MACD indicator.

The LSMA is a regression moving average, which tries to track prices as closely as possible to give you a line reflecting the actual price movements.

The shorter the period, the closer it tracks price movement, which is very different from the SMA or EMA, which averages price movements.

Now you have an indicator telling you the general direction of price, and the chart clearly shows that price direction is constantly changing.

So, let’s zoom in on a portion of the chart and remove the candles.

Without the distraction of the price chart, you can easily see Bullish, Bearish, and Neutral (purple) trends on the price chart.

This is because you no longer use trends as a filter but instead track how prices identify trends.

You can use the LSMA with rules, supporting tools, and techniques such as:

- Momentum

- Japanese Candlesticks

- Chart Patterns

- Support and Resistance

and start trading in the direction of prices.

With this mindset, you are looking for how price is most recently trending, which is helpful.

You will also want to use other tools to help identify whether any trends might change soon.

The combination of knowing how the price is trending right now, the Momentum in price, and other complementary elements will let you build a trading system with a better chance of success than those with Simple Moving Averages, MACD, ADX, or many others.

What’s the Next Step?

Select a favorite forex pair and use the LSMA to identify the trend and what type.

Combine what you find with some favorite complementary indicators and develop a trading strategy. Then, use this strategy to find opportunities.

If you need help finding trading opportunities, learn the Six Basics of Chart Analysis, which you can download for free here.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned here about trends and their types.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your email inbox every Sunday.

Forex Forecast is delivered weekly to your inbox and provides the following:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies? I produce Videos and Guides to help you learn and improve your trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.