Achieving consistent profitability in Forex trading requires a deep understanding of the market and its driving forces.

The Forex market is the world’s largest financial market, and it operates 24 hours a day, five days a week, providing you with many trading opportunities.

To be successful in this market, however, it’s crucial to understand how global events, economic indicators, and political developments affect currency values.

Currencies are influenced by a country’s economic health, interest rates, employment rates, political stability, and more.

If you stay well-informed and analyze these factors, you will have a better chance of making informed trading decisions.

Additionally, understanding the market structure, major currency pairs, and the role of market participants, such as banks, institutions, and retail traders, is also crucial.

How do you Develop a Trading Plan?

A well-constructed trading plan is the cornerstone of sustainable success in the Forex market.

Critical components of a robust trading plan include clear trading goals, risk tolerance levels, evaluation criteria, and a well-defined trading strategy.

This plan should outline specific conditions under which you will enter and exit trades and set rules for money management and risk exposure.

Your chances of achieving consistent profitability increase when you follow a structured trading plan.

A trading plan helps you avoid being influenced by your emotions and ensures a disciplined approach to the market.

You can improve your trading skills by going through an iterative process that involves refining your strategies, learning from past mistakes, and enhancing your overall proficiency.

This process is essential for traders who want to achieve consistent profitability in Forex trading.

Do Risk Management and Consistent Profits Equal Forex Success?

Forex trading is risky, and to consistently make profits, it is essential to manage risks—risk management safeguards against the market’s uncertainties.

To execute a trade, you need to identify, assess, and determine the level of risk to take while ensuring that you do not become excessively exposed to market fluctuations.

Effective risk management strategies include setting stop-loss rules to limit potential losses and using take-profit targets to secure profits at predetermined levels.

Additionally, you should adhere to the principle of not risking more than a small percentage of your trading capital on a single trade.

This approach ensures that even a series of unsuccessful trades will not deplete your trading account, allowing you to remain in the market and recover over time.

Proper leverage usage is also crucial, as excessive leverage can amplify losses and lead to significant financial setbacks.

By employing prudent risk management techniques and maintaining a disciplined approach to trading, you can create a stable foundation, enabling you to Forex success.

How You Should Choose the Right Trading Strategy

Choosing the right trading strategy is essential for you to achieve consistent profitability.

The Forex market offers various trading styles, including day, swing, and position trading, each with unique characteristics and time commitments.

Day traders capitalize on short-term market movements, requiring constant market monitoring and quick decision-making.

Swing traders take a slightly longer-term approach, holding positions for several days to capitalize on expected upward or downward market shifts.

Position traders, on the other hand, adopt a long-term perspective, basing their trades on fundamental analysis and long-term trends.

To choose the right strategy, you must introspectively assess risk tolerance, time availability, and trading goals.

Additionally, it’s crucial to consider the emotional and psychological aspects; some may find the high-pressure environment of day trading stressful, while others may thrive in it.

Experimenting with different strategies in a demo account setting can provide valuable insights and help traders identify the approach that best aligns with their personality and trading objectives.

Ultimately, the right trading strategy is a foundation for disciplined trading actions, contributing significantly to consistent profitability in Forex trading.

How Psychology Will Impact Your Trading

Trading psychology is indispensable in your journey toward consistent profitability in Forex trading.

The market’s volatility can evoke strong emotional responses, and learning to manage these emotions is crucial.

Successful traders maintain emotional control, staying rational and objective regardless of market conditions.

Common psychological pitfalls include overtrading, in an attempt to recover losses quickly, and revenge trading, where a trader tries to “get back” at the market for a losing trade.

These behaviors often lead to rash decisions and increased risk-taking, undermining profitability.

To combat these challenges, you can implement strategies such as setting clear trading goals, maintaining a trading journal to reflect on successful and unsuccessful trades, and taking regular breaks to prevent burnout.

Additionally, cultivating a mindset of patience and discipline is vital, as these traits help you stick to your trading plan and strategy, even when faced with the inevitable ups and downs of the Forex market.

Can You Learn to be Consistently Profitable?

In the ever-evolving world of Forex trading, continuous learning and self-improvement are vital to maintaining and enhancing profitability.

The market is influenced by many factors, including economic indicators, political events, and global news, making it imperative to stay informed and adapt your strategies accordingly.

This need means regularly reviewing and analyzing past trades to identify areas of strength and areas needing improvement.

A commitment to education through trading courses, webinars, and reading material can provide valuable insights and deepen a trader’s understanding of market dynamics.

Participating in trading forums and networking with other traders can offer diverse perspectives and trading strategies, further enriching the learning experience.

It’s crucial to approach trading with an open mind and a willingness to learn from successes and failures.

Continuous learning and improvement equip traders with tools to navigate Forex, leading to achieving consistent profitability.

Conclusion

In summarizing the essential facets of Forex trading, it becomes clear that achieving consistent profitability requires a comprehensive and disciplined approach.

This approach ensures that decisions are made based on strategy, not emotions. By developing a clear plan and sticking to it, you can set yourself up for success.

Take advantage of risk management, as it will protect you from severe financial setbacks, allowing you to stay in the game and capitalize on future opportunities.

Selecting the right trading strategy aligns your actions with your goals and lifestyle, and mastering the psychological aspects of trading enhances resilience and decision-making under pressure.

Committing to continuous learning and improvement keeps you adaptable and informed, ready to navigate the market’s volatility.

What’s the Next Step?

Select a broker and a strategy using what you learned in this article.

In addition, look for opportunities to familiarize yourself with trading techniques and fundamental analysis.

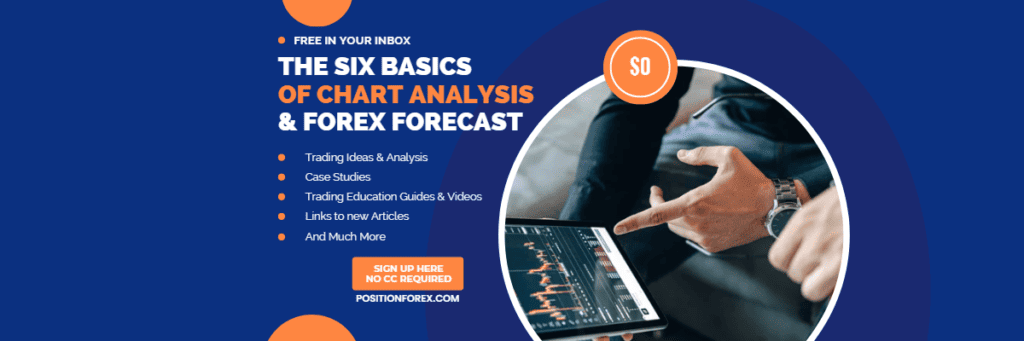

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about these crosses.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions (FAQs)

How Much Money do I Need to Start Forex Trading?

The amount required varies by broker, but starting with as little as $2000 is possible.

However, starting with a more considerable amount may provide more flexibility in trading strategies.

Can I Trade Forex Without Previous Experience?

Yes, but educating yourself and practicing with a demo account is highly recommended before trading with real money.

How Much Can I Expect to Make from Forex Trading?

Profitability varies widely and depends on factors such as the trading strategy, risk management, and market conditions. There are no guaranteed profits in Forex trading.

Is Forex Trading Risky?

Yes, Forex trading involves significant risk, and it’s possible to lose more money than invested. Implementing solid risk management strategies is crucial.

How do I Choose the Best Trading Strategy for me?

Consider your risk tolerance, time commitment, and trading goals. Testing different strategies with a demo account before committing real funds is also beneficial.

How Important is it to Stay Updated on Global Events?

Staying informed is crucial for making educated trading decisions in the forex markets, as economic indicators, political events, and other global news can highly influence them.

What are the Most Common Psychological Traps in Forex Trading?

Typical traps include overtrading, revenge trading, and letting emotions drive trading decisions.

Developing a trading plan and maintaining discipline is critical to avoiding these traps.