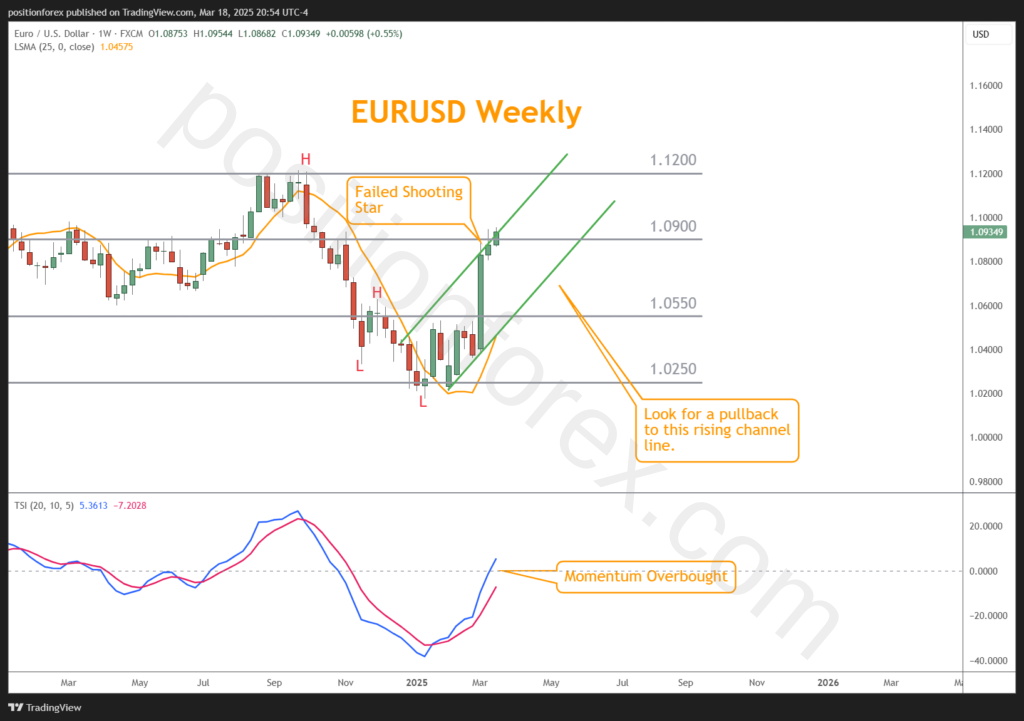

The EURUSD is overbought in the short term and a pullback is likely soon.

If prices can find the lower rising channel line an entry may present itself.

The Euro rally is justified since Germany is increasing public spending increasing GDP projections while the U.S. trade activity is lowering it’s projected GDP.

Together this is creating upward pressure on EURUSD but for the moment prices have moved too far to fast. A pullback represents and entry opportunity.

Don’t be surprised if EURUSD consolidates around the 1.0900 area for a while. Last week’s Shooting Star candle could have resulted in a reversal but higher prices quickly negated that possibility.

By the end of the week we are most likely to finish where we’ve started. Dojis and Spinning Tops are most likely in my opinion.

Trend: LSMA is moving higher this week but is not valid until close on Friday

Momentum: Bullish but Overbought

Japanese Candles: Last week’s Shooting Star was unconfirmed and failing this week.

Chart Pattern: Bullish Channel but very vertical. Looking for a pullback.

Support and Resistance: 1.0900 is broken resistance so far this week.

Fundamentals: Eurozone CPI and Fed this week, but both are overshadowed by Germany’s raising spending and the U.S. trade war.

Trade: None

Stop: None