Single indicator Forex trading strategies involve using just one technical tool to guide trading decisions, prioritizing simplicity and focus in market analysis.

Each strategy uses a specific indicator to predict future market behaviors.

By choosing to use just one indicator, traders aim to reduce complexity, allowing them to concentrate on mastering the intricacies of that particular market signal.

Is this a good idea? In this article, I’ll leverage my trading experience since 2007 and share my thoughts and experience on this topic.

What Are Single Indicator Strategies?

Single indicator Forex trading strategies involve using one specific technical tool to inform trading decisions.

Each indicator is designed to interpret certain market data — such as price movements, momentum, and trader sentiment, to predict future market behavior.

Popular Single-Indicator Strategies

- Moving Average (MA): This indicator calculates the average currency price over a designated period, helping traders identify the trend’s direction. There are numerous types, but each has the same goal – to signal both the beginning of new trends and the end of old ones.

- Relative Strength Index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements from 0 to 100. It’s useful for identifying potential reversal points by detecting overbought or oversold conditions.

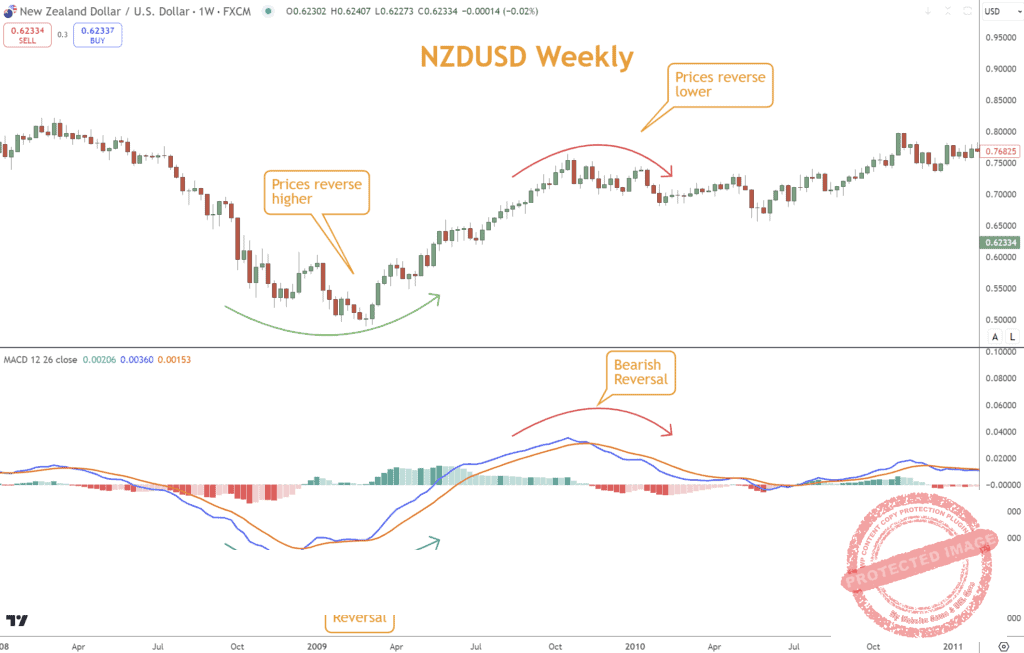

- MACD (Moving Average Convergence Divergence): This trend and momentum indicator helps track the relationship between two moving averages of a currency’s price. Its moving average lines and histogram attempt to spot changes in trend direction, momentum, and duration.

- Stochastic Oscillator: This indicator compares a currency’s closing price to its price range over a specific period. It signals changes in momentum, indicating buy or sell opportunities.

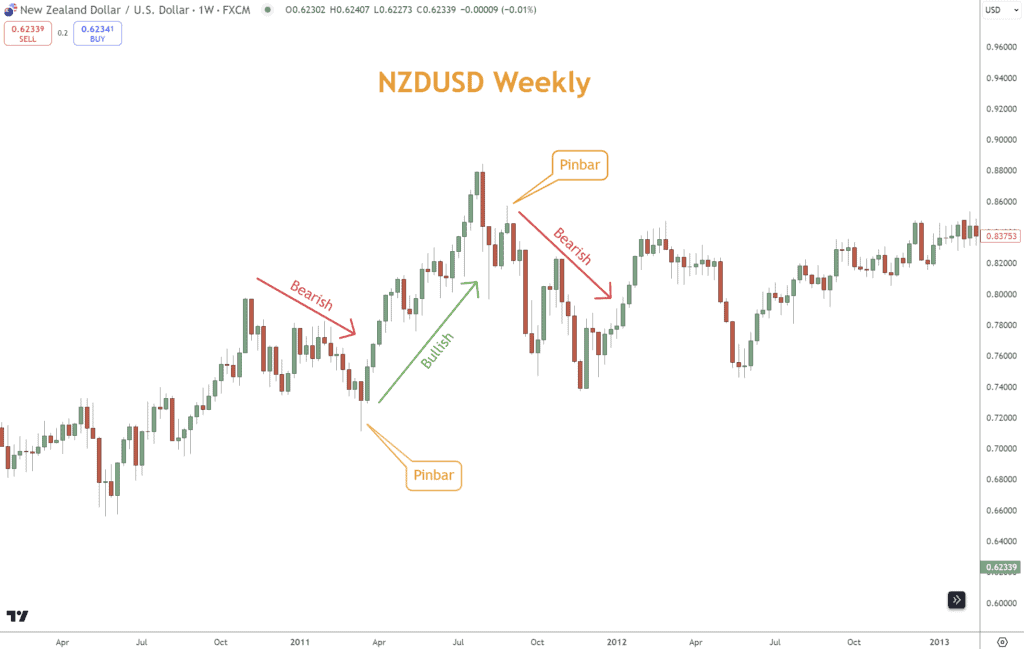

- Pin Bar Strategy: This strategy centers around a distinct candlestick pattern characterized by a long wick and a small body, suggesting price rejection. Pin bars indicate that despite strong price movements in one direction, the opposing pressure was significant enough to reverse the direction, signaling potential bullish or bearish reversals.

Pros of Single-Indicator Strategies

- Simplicity: The key advantage of using a single indicator is its simplicity. New traders can avoid the confusion associated with multiple indicators and focus on mastering one, which helps build confidence and decision-making skills.

- Speed: Decisions need to be made quickly in the volatile Forex market. A single indicator can provide fast signals without cross-verification, which can be crucial in capturing profitable opportunities or avoiding sudden losses.

- Clarity of Strategy: Using one indicator allows a trader to understand its mechanisms and nuances across different market conditions thoroughly. This deep familiarity can improve strategic decisions over time.

Cons of Single-Indicator Strategies

- Limited Data: One significant downside is the reliance on limited data. A complex set of factors influences Forex markets, and a single indicator may overlook critical elements, leading to potentially erroneous trades.

- Potential for Over-reliance: Traders might become overly dependent on one indicator, assuming it can consistently predict market movements. This over-reliance can lead to ignoring other important market signals, thus increasing the risk of losses.

- False Signals: No indicator is foolproof. Depending on one can increase the chance of reacting to false signals, resulting in poor trading decisions without secondary confirmation.

Strengths and Weaknesses of Popular Single Indicators

Moving Average (MA)

The Moving Average (MA) is a fundamental tool in technical analysis. It provides a streamlined view of previous price direction by averaging price data over specific intervals. This indicator is especially popular among traders for its versatility and ease of interpretation.

- Strengths: MAs help clarify the trend direction by smoothing out price volatility, making them invaluable for trend confirmation and identifying potential support or resistance areas. They can be customized to any time frame, providing flexibility in their application across different trading strategies.

- Weaknesses: The main limitation of MAs is their lagging nature; they are based on past prices and, therefore, react with a delay. This delay can cause traders to enter or exit trades later than optimal, particularly in fast-moving markets where timing is crucial.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It is designed to identify overbought and oversold conditions in the market and offer insights into potential price reversals.

- Strengths: RSI is excellent for indicating when a currency might be overextended and due for a reversal, making it useful for predicting short-term movements in market prices.

- Weaknesses: RSI can provide misleading signals during strong, persistent trends, as the currency might stay overbought or oversold territories for an extended period. This can lead to false signals and potentially unprofitable trades.

MACD (Moving Average Convergence Divergence)

MACD is a multi-functional indicator that follows the trend and gauges momentum. It utilizes moving averages in a unique setup to reveal a trend’s direction, momentum, and duration changes.

- Strengths: MACD’s crossover system and divergence signals can be extremely helpful in identifying the beginning and end of trends. This dual capability makes it a robust tool for various trading environments.

- Weaknesses: MACD’s downside is its susceptibility to producing delayed signals in fast-paced markets. Additionally, it might not provide enough actionable signals in low-volatility situations, which can disadvantage traders looking for frequent trades.

Stochastic Oscillator

The Stochastic Oscillator is renowned for its sensitivity to market movements. It helps detect changes in momentum before they are reflected in prices, making it particularly valuable for traders who rely on timing precision.

- Strengths: It signals potential reversal points early, crucial in securing entry and exit positions in volatile markets. This early detection helps traders capitalize on price movements before they become apparent.

- Weaknesses: However, its sensitivity can lead to an abundance of false signals, especially in volatile trading conditions. This requires traders to use additional filters or confirmation signals to avoid premature trades.

Pin Bar Strategy

The Pin Bar Strategy focuses on a specific candlestick pattern, notable for its distinctive tail that signals a strong rejection of prices. This pattern is a favorite among price action traders because it directly affects market sentiment.

- Strengths: Pin bars provide straightforward and powerful reversal signals, offering insights into market psychology and potential shifts in trend direction. They are particularly effective in clear trending markets where false signals are minimized.

- Weaknesses: However, the effectiveness of pin bars can diminish in range-bound or choppy markets where these formations are less reliable. False positives may occur without proper context or confirmation from other technical indicators or fundamental factors.

Pin bars appear as Hammer and Shooting Star candles in Japanese candlesticks but are interpreted differently.

Disadvantages of Using a Single Indicator Strategy

While single indicator strategies can simplify the trading process, especially for new traders, they come with significant drawbacks that can compromise trading effectiveness and risk management. Here are some of the key disadvantages:

Over-Simplification of Market Analysis

Forex markets are complex systems influenced by many factors, including economic indicators, political events, and market sentiment.

Relying on a single indicator inherently simplifies this analysis, potentially overlooking critical signals that could indicate a change in market conditions.

This over-simplification may lead to misinformed decisions, as crucial aspects of the broader market context are not considered.

Increased Risk of Misleading Signals

Every indicator has its own set of limitations and can sometimes produce false signals.

When traders rely solely on one indicator, they risk basing their trading decisions on these potentially misleading signals without the benefit of cross-verification from other sources.

For example, a momentum indicator like the RSI might remain overbought or oversold during strong trending periods, suggesting a reversal that never materializes.

Lack of Confirmation

In technical analysis, confirmation is key to increasing the reliability of trading signals.

Traders often use multiple indicators to confirm a potential trade setup to minimize false entries.

With a single indicator strategy, the absence of confirmation from other indicators or analytical tools means there is no secondary validation of signals, which increases the risk of entering into unfavorable positions.

Inadequate Response to Market Volatility

Market conditions can change rapidly, and different indicators react in various ways.

A strategy based on a single indicator may not adapt quickly or effectively enough to sudden market movements or unusual volatility, potentially resulting in significant losses.

For instance, trend-following indicators might lag during sudden market reversals, while oscillators could provide too many false signals in highly volatile conditions.

Limited Scope for Diversification

Using multiple indicators can help diversify analysis techniques, spread risk, and offer a more balanced view of market opportunities.

A single indicator strategy lacks this diversification, placing undue reliance on one analysis method. This can limit a trader’s ability to capture different market movements and conditions, potentially reducing profitability.

Why a Single Indicator Strategy Isn’t Advisable

Given the complexities of the Forex market, relying on a single indicator is generally not advisable.

The risks associated with misleading signals and oversimplification can significantly outweigh the benefits of simplicity. Moreover, the inability to confirm signals and adapt to volatile market conditions makes it difficult for traders to succeed consistently using this approach.

I encourage you to integrate multiple analysis tools into your strategies to mitigate these risks.

This can include a combination of technical indicators, fundamental analysis, and sentiment analysis, providing a comprehensive view of market conditions and a higher probability of successful trades.

For those who prefer simplicity, focusing on a small set of complementary indicators that cover different aspects of market behavior is a more balanced approach than relying on just one.

Conclusion

Trading Forex with a single indicator simplifies decision-making and can speed up the trading process.

While single-indicator strategies have advantages due to their simplicity and focus, they also carry significant risks, such as limited data analysis and susceptibility to false signals.

Considering their trading style and risk tolerance, you should weigh these pros and cons carefully.

As expertise grows, integrating more comprehensive analysis techniques or additional indicators may be necessary to enhance accuracy and trading success.

What’s the Next Step?

Consider whether a single indicator Forex strategy is a good plan for you. I don’t recommend this approach for most traders.

In addition, look for opportunities to use multiple tools and indicators in your trading. Once you’re ready to trade, choose a strategy and process you believe will work for you.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis.

If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about how to end a losing streak.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will use the Six Basics of Chart Analysis and Advanced Strategies to show you the trade opportunities I’m watching.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce videos and guides to help you learn and improve trading practices.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What Are Single Indicator Forex Strategies?

Single-indicator Forex strategies use one technical tool to guide trading decisions, simplifying the trading process by concentrating on specific market data, such as price movements or volume, to predict future behaviors.

How Does the Moving Average Indicator Work in Forex Trading?

The Moving Average (MA) calculates the average price of a currency pair over a defined period, smoothing price fluctuations and providing insight into the trend direction. It is used to identify support or resistance levels and signal potential trading opportunities.

What Are the Risks of Relying on a Single Indicator Such as RSI?

Relying solely on the Relative Strength Index (RSI) can lead to misleading signals, especially during strong market trends. The indicator might stay in overbought or oversold territory for extended periods, resulting in premature or incorrect trades.

Why Is It Important to Use Confirmation in Single Indicator Strategies?

Confirmation is crucial in single-indicator strategies to enhance the reliability of trading signals. It involves verifying signals with additional indicators or analysis methods, reducing the risk of false entries, and ensuring that decisions align with broader market conditions.

How Can Traders Mitigate the Risks Associated With Single Indicator Strategies?

Traders can reduce the risks of single indicator strategies by incorporating multiple analysis tools, including complementary technical indicators and fundamental and sentiment analysis.

This integrated approach offers a fuller market view and helps adapt to market changes. Additionally, practicing with a demo account before live trading is essential to validate the effectiveness of any strategy.