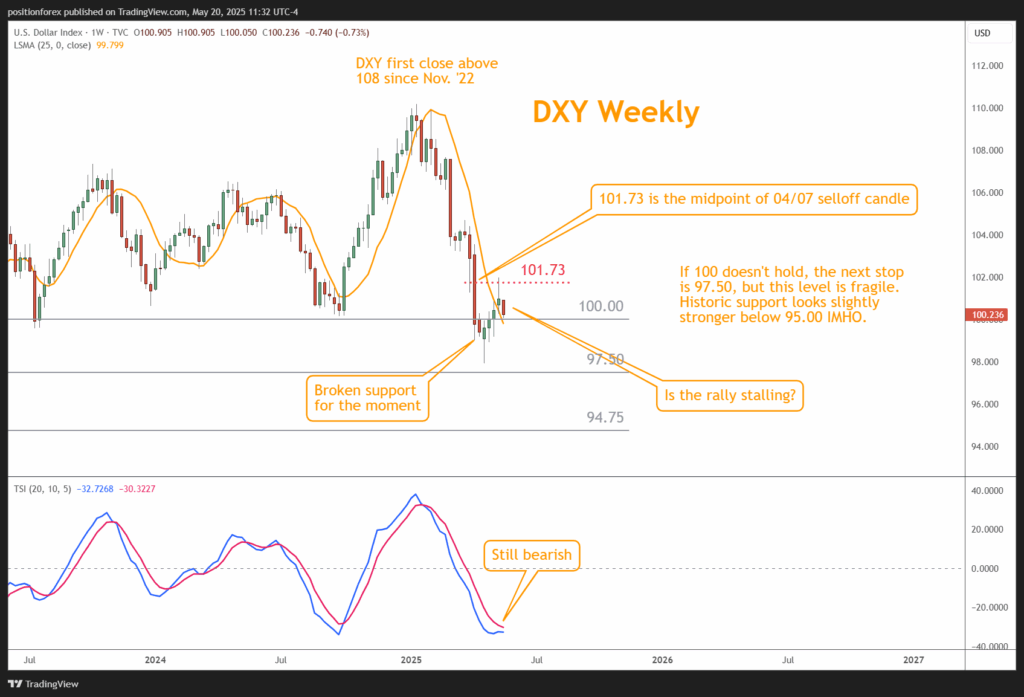

This week’s selloff has a chance of validating last week’s Shooting Star candle.

It’s only Tuesday, so there’s still much time left, but if the DXY does fall here, the next stop is 97.50, and then 94.75.

I don’t consider 97.50 a strong level, so somewhere near 95 is more likely.

Thursday’s PMI numbers could push the USD in either direction. The last print was 50.6, and anything below 50 is considered a contraction, so little room for downside is available.

I believe this report will be watched more carefully than usual.