In Forex trading, mastering a technical analysis technique such as convergence areas is crucial for informed decision-making and success.

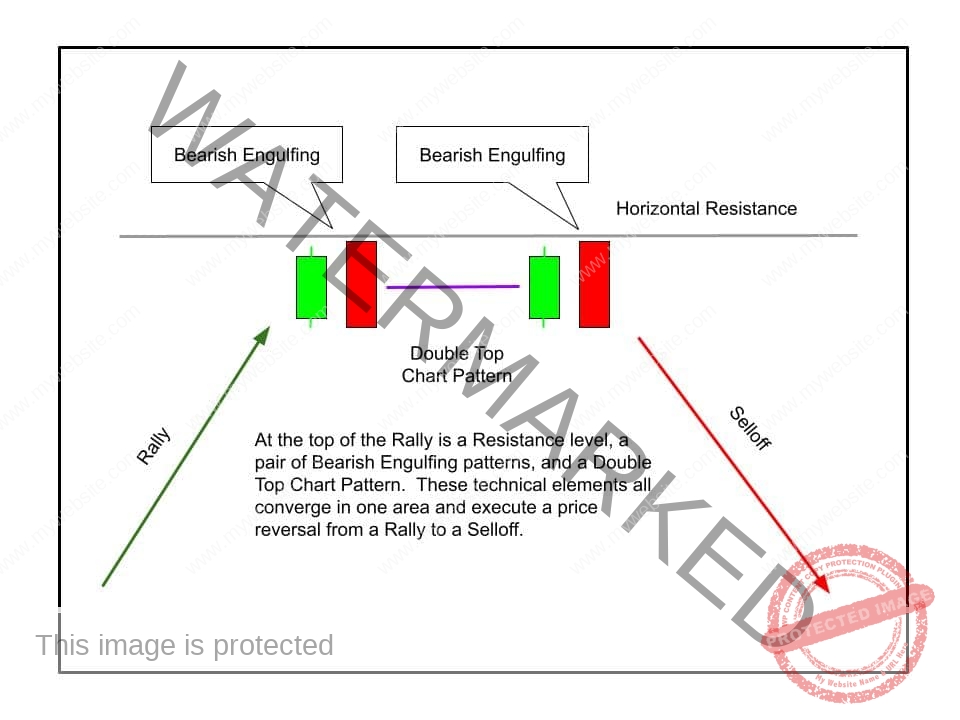

Convergence areas combine Japanese candlesticks, Chart Patterns, and Support and Resistance levels to create a powerful indicator.

In this article, I’ll discuss how convergence areas can be a crucial asset for you when seeking to enhance your trading strategies.

By the end, you’ll have a deeper understanding of how these convergence areas work and how they can help you make more profitable trades.

Understanding Convergence Areas

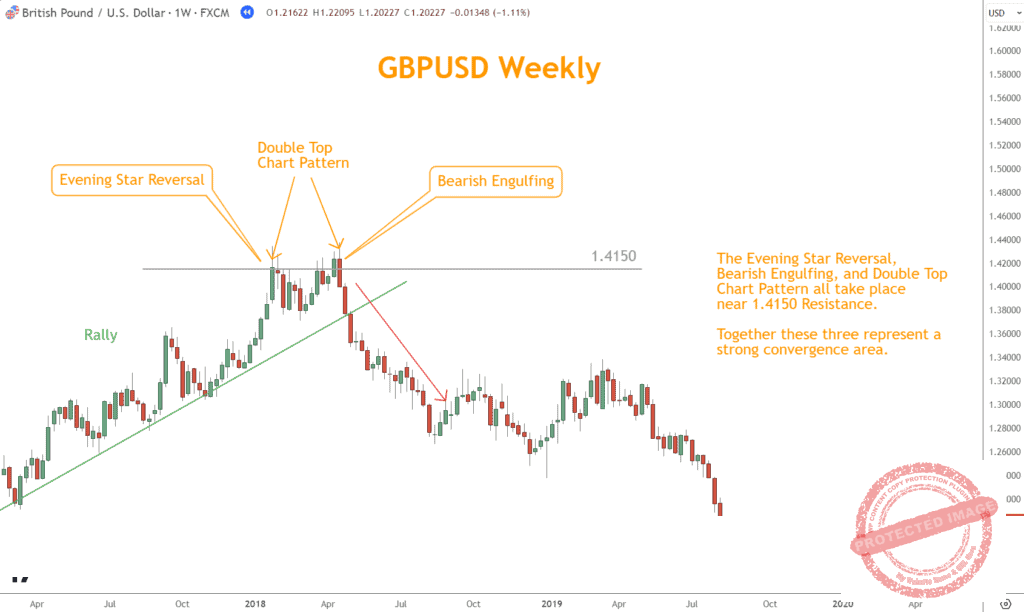

A convergence area is a region on a Forex chart where multiple technical indicators align, providing you with a high-probability trading opportunity.

It’s important to remember that Forex trading involves analyzing historical price data to predict future price movements.

Convergence areas facilitate this process by consolidating different elements that can influence price direction.

The three primary components of convergence areas are Japanese Candlesticks, Chart Patterns, and Support and Resistance levels.

Japanese Candlesticks

Forex traders widely use Japanese candlestick charts due to their effectiveness in depicting price movements.

Each candlestick consists of a body representing the price range between the opening and closing prices during a specific time frame and wicks or shadows showing the highest and lowest prices within that time frame.

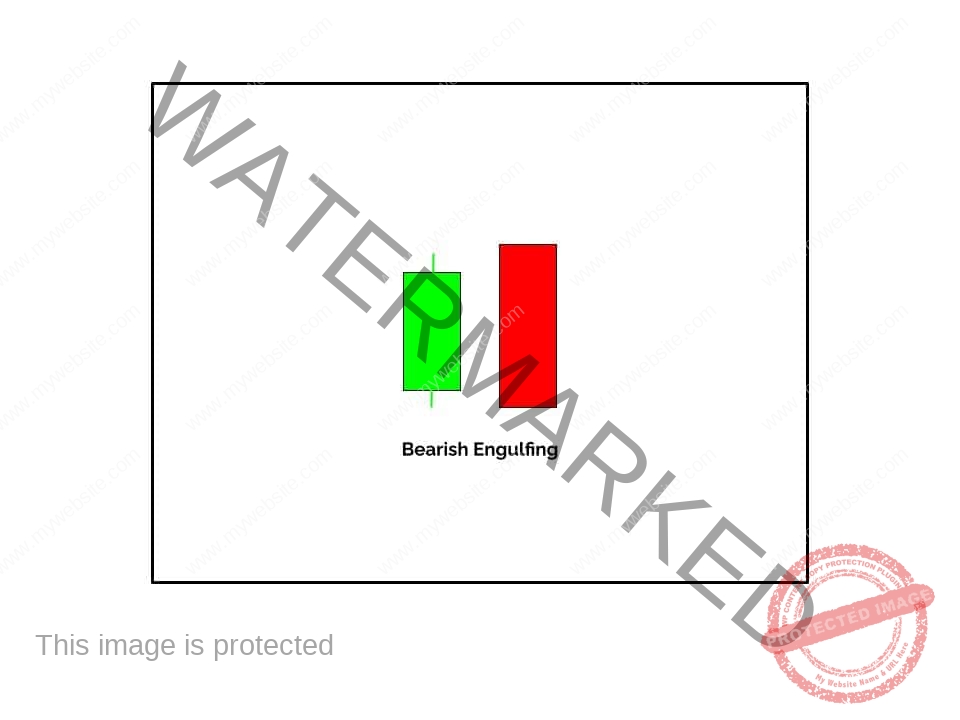

Traders analyze candlestick patterns to gauge market sentiment. Some common candlestick patterns include Doji, Hammer, Engulfing, and Shooting Star, among others.

When these patterns align with other indicators, they form convergence areas.

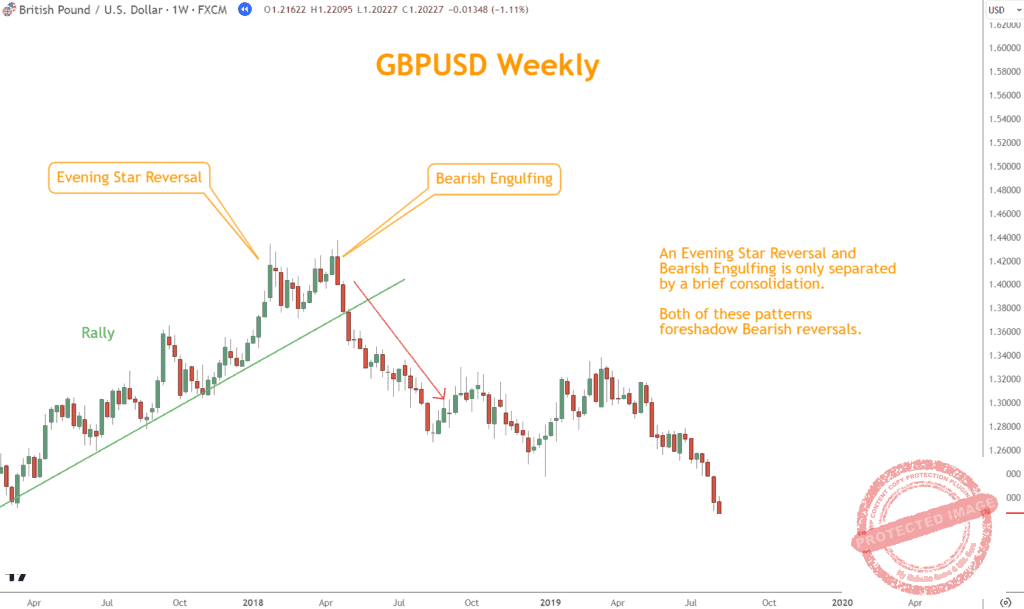

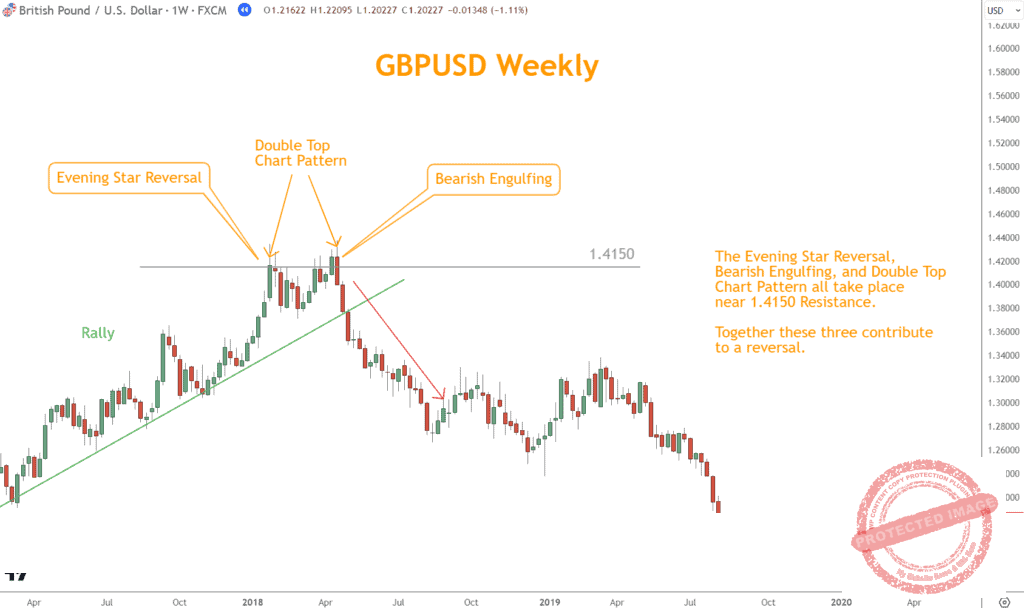

For instance, a Bearish Engulfing pattern, where a larger Bearish candle completely engulfs the previous Bullish candle, may suggest a potential Bearish convergence area when other factors align positively.

Chart Patterns

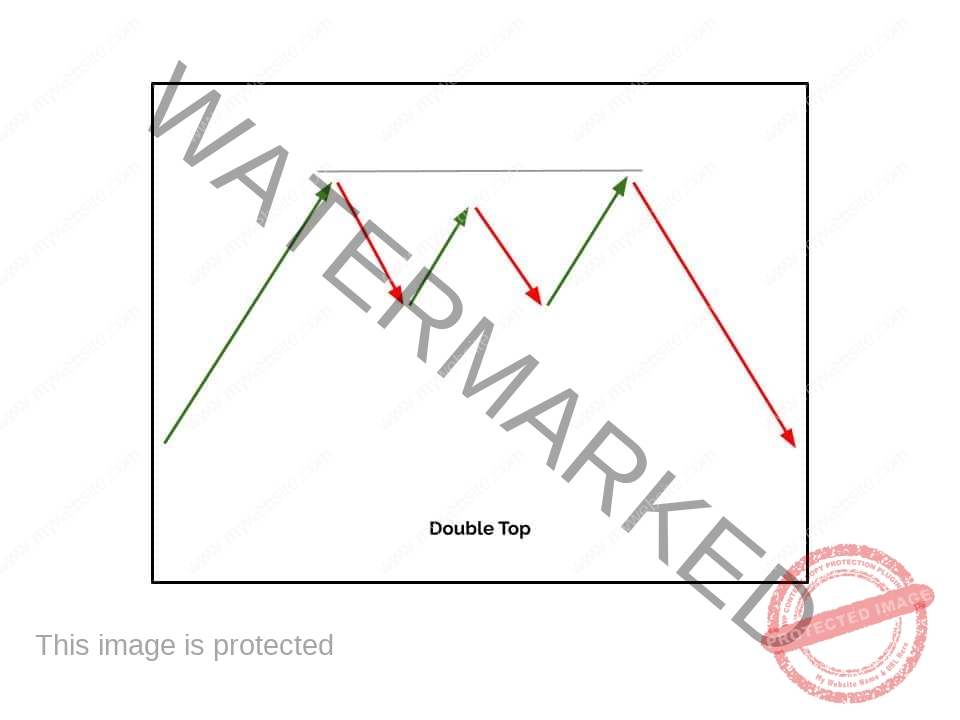

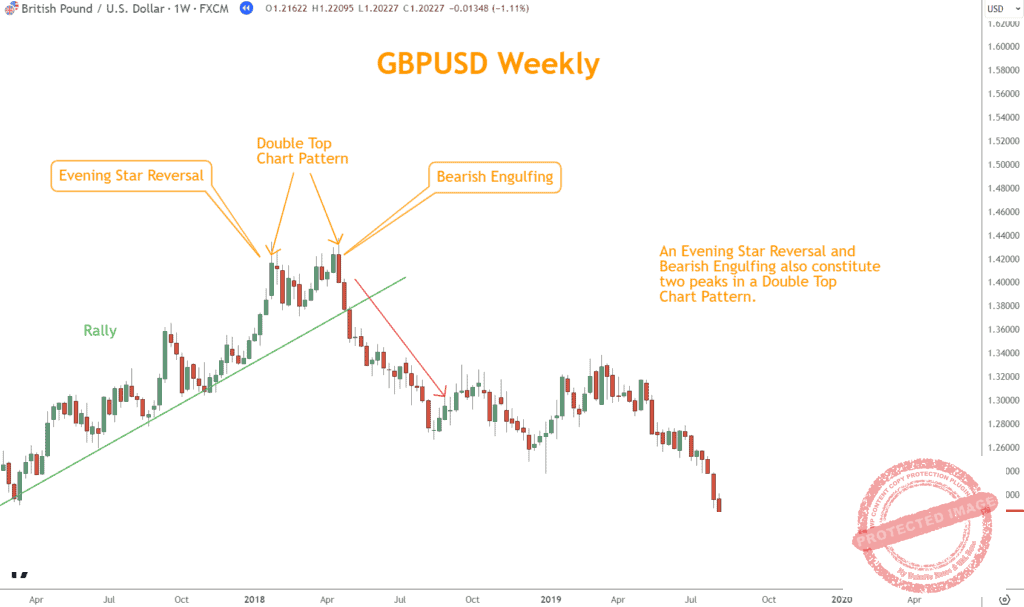

Chart Patterns are another vital aspect of convergence areas. Price movements form these patterns and can help traders predict future price movements.

There are two main types of Chart Patterns: continuation and reversal patterns.

Continuation patterns, such as Flags, Pennants, and Triangles, suggest that the prevailing trend will likely continue.

Reversal patterns, like Head and Shoulders, Double Tops, and Double Bottoms, indicate a potential change in the instrument’s direction.

When a chart pattern aligns with other technical indicators, it enhances the significance of the convergence area.

You can look for these patterns to confirm potential trading opportunities.

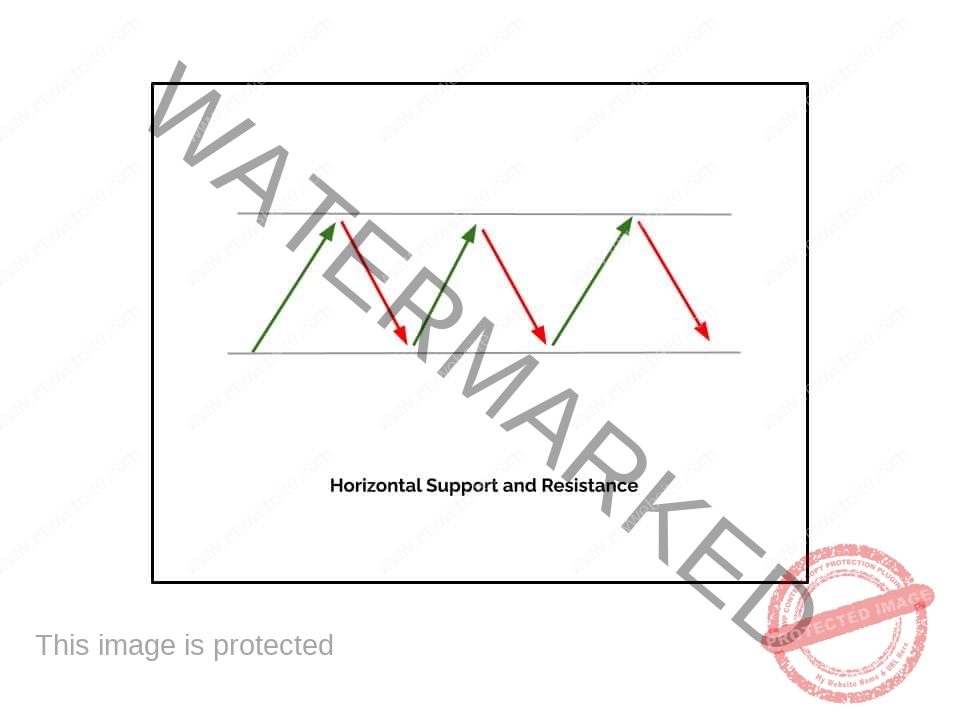

Support and Resistance Levels

Support and Resistance levels are key price points on a Forex chart where the price tends to stall or reverse.

These levels are areas where buying interest is significant enough to prevent the price from falling further.

In contrast, Resistance levels are areas where selling interest prevents the price from rising further.

When Support and Resistance levels align with Candlestick patterns or Chart Patterns, they can create vital convergence areas.

For example, if a significant Resistance level coincides with a Bearish Engulfing candlestick pattern, it may signal a potential Bearish reversal.

How to Identify Convergence Areas in Trading

Now that we’ve explored the components of convergence areas let’s discuss how to identify them effectively in your Forex trading charts.

Candlestick Patterns

Start by scanning your Forex charts for candlestick patterns that stand out. Pay attention to the size and direction of the candles, as well as any patterns formed by consecutive candles.

Look for Bullish or Bearish Engulfing patterns, Doji formations, and other significant candlestick patterns.

Chart Patterns

Next, analyze your charts for Chart Patterns. Identify continuation or reversal patterns that may be forming.

Remember that Chart Patterns take time to develop, so patience is crucial. Look for Triangles, Head and Shoulders formations, and Flags or Pennants.

Support and Resistance Levels

Determine Support and Resistance levels by identifying where the price has reversed in the past.

The more a level acts as Support or Resistance, the stronger it becomes.

Combining Components for Convergence Areas

Once you’ve identified Candlestick patterns, Chart Patterns, and Support and Resistance levels, look for areas where these elements converge.

These are the regions on your chart where multiple technical indicators align, creating a convergence area.

What are Trading Strategies with Convergence Areas?

Now that you know how to identify convergence areas, let’s explore some trading strategies that can be employed using this valuable technical indicator.

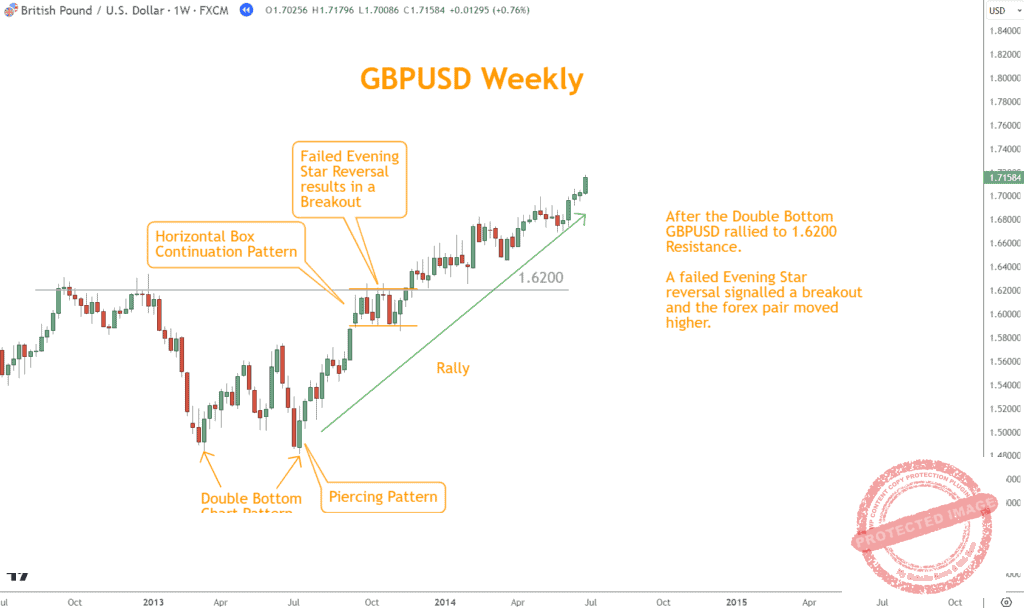

Breakout Trading

One common strategy is breakout trading. When a convergence area forms, it often precedes a significant price movement.

Traders can enter a trade when the price breaks out of the convergence area in the direction indicated by the various technical indicators.

For example, if a Bullish convergence area forms, you might enter a long position when the price breaks above the Resistance level.

Reversal Trading

Another way to use convergence areas is for reversal trading. When a convergence area aligns with a reversal pattern, it suggests a potential change in the direction.

Traders can enter a trade in anticipation of the reversal. For instance, if a Bearish convergence area forms with a Head and Shoulders pattern, you may consider shorting the currency pair.

Risk Management

Risk management is crucial when trading convergence areas. Implement stop-loss orders to limit potential losses if the trade goes against you.

Additionally, consider setting take-profit levels to secure profits when the trade moves in your favor.

Conclusion

In Forex trading, mastering technical analysis will help you find the best opportunities.

By combining Japanese candlesticks, Chart Patterns, and Support and Resistance levels, convergence areas provide a holistic view of price action.

As you gain experience, you’ll become adept at identifying and utilizing convergence areas to make more informed and profitable trading decisions.

Remember to practice sound risk management and continually refine your trading strategies to maximize your success in the Forex market.

What’s the Next Step?

Select your favorite chart and try to find convergence areas that are good to trade.

In addition, look for opportunities to familiarize yourself with trading techniques and fundamental analysis.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about converged areas.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What Exactly is a Convergence Area in Forex Trading?

A convergence area in Forex trading is a region on a price chart where multiple technical indicators align.

It combines Japanese candlestick patterns, Chart Patterns, and Support and Resistance levels.

Convergence areas are significant because they provide traders with high-probability trading opportunities by consolidating various factors that can influence price movements.

How do I Identify Convergence Areas on my Forex Charts?

Start by recognizing significant candlestick patterns, such as Engulfing patterns or Doji formations.

Next, spot Chart Patterns like Triangles or Head and Shoulders formations.

Finally, identify key Support and Resistance levels on your charts.

Convergence areas are the regions where these elements converge, creating a strong technical signal.

What Trading Strategies can I Employ Using Convergence Areas?

Several trading strategies can be employed with convergence areas. Two common approaches include breakout trading and reversal trading.

Breakout trading involves entering a trade when the price breaks out of a convergence area in the direction indicated by the technical indicators.

Reversal trading, on the other hand, entails entering a trade in anticipation of a trend reversal when a convergence area aligns with a reversal pattern.