The CCI indicator, a tool for assessing market momentum and potential reversals, differs from other momentum oscillators, such as the Relative Strength Index (RSI) or Stochastic Oscillator.

It focuses on deviations from the average price rather than comparing current price levels to historical prices, allowing it to more effectively identify overbought and oversold conditions in varying market conditions.

What is the CCI Indicator?

When trading in Forex, it’s essential to understand market dynamics quickly.

Technical analysis tools are valuable assets that help traders analyze these dynamics.

Among these tools, the Commodity Channel Index (CCI) offers a window into market momentum and potential reversals.

Developed by Donald Lambert in 1980, the CCI is a momentum-based oscillator designed to highlight deviations from the typical price movement.

The indicator calculates the current price level’s deviation from an average price over a specified period, typically 20 periods.

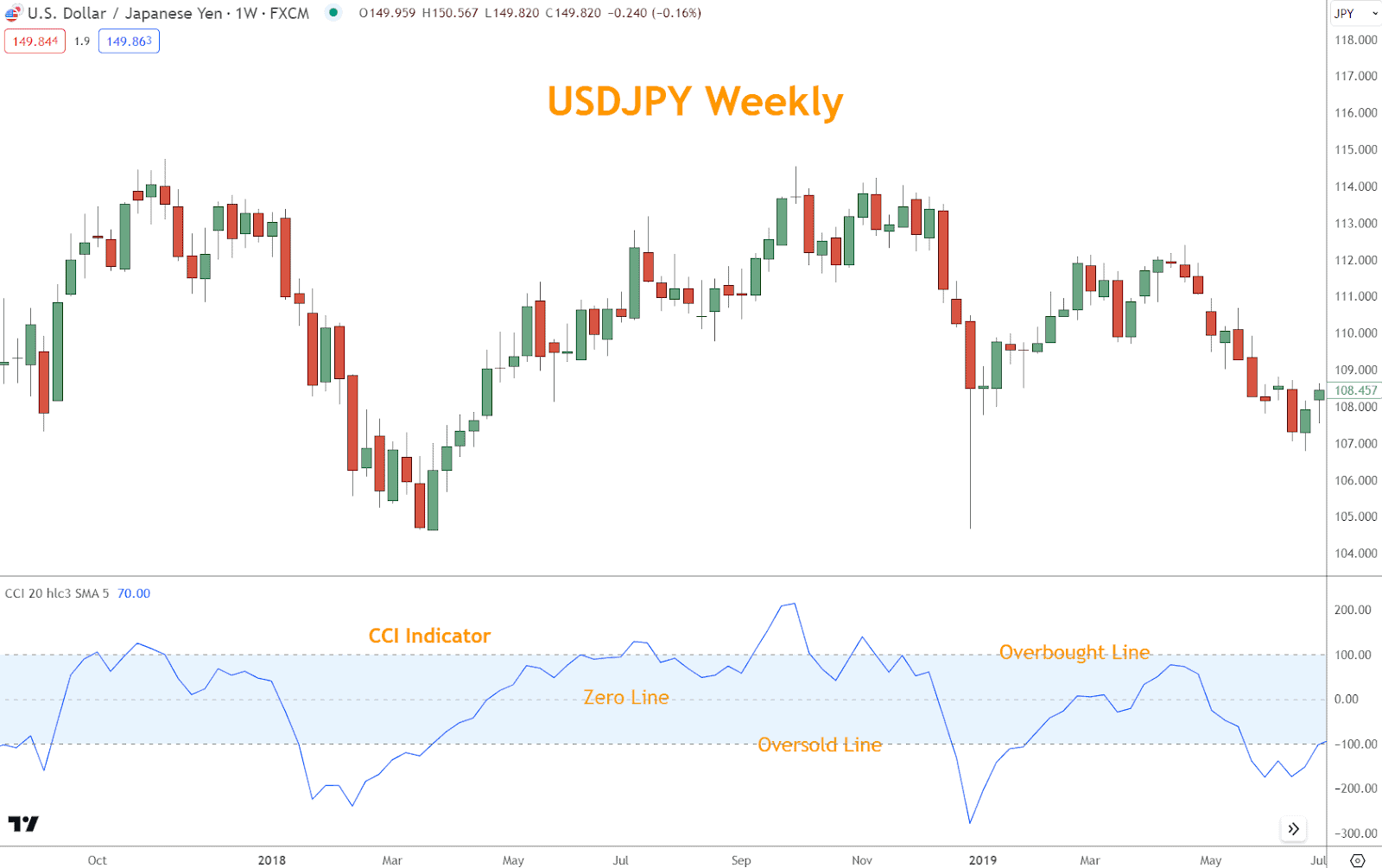

The resulting value oscillates around a zero baseline, with positive values indicating overbought conditions and negative values signaling oversold conditions.

How to Interpret CCI Values

A CCI value above +100 suggests that the price is significantly above its average and may be overextended, potentially signaling an impending reversal or a pause in the uptrend.

Conversely, a value below -100 indicates that the price is substantially below its average, hinting at oversold conditions and the possibility of a bullish reversal.

Pay close attention to the divergence between price action and the CCI.

A bullish divergence occurs when prices form lower lows while the CCI forms higher lows. This indicates weakening bearish momentum and a potential upward reversal.

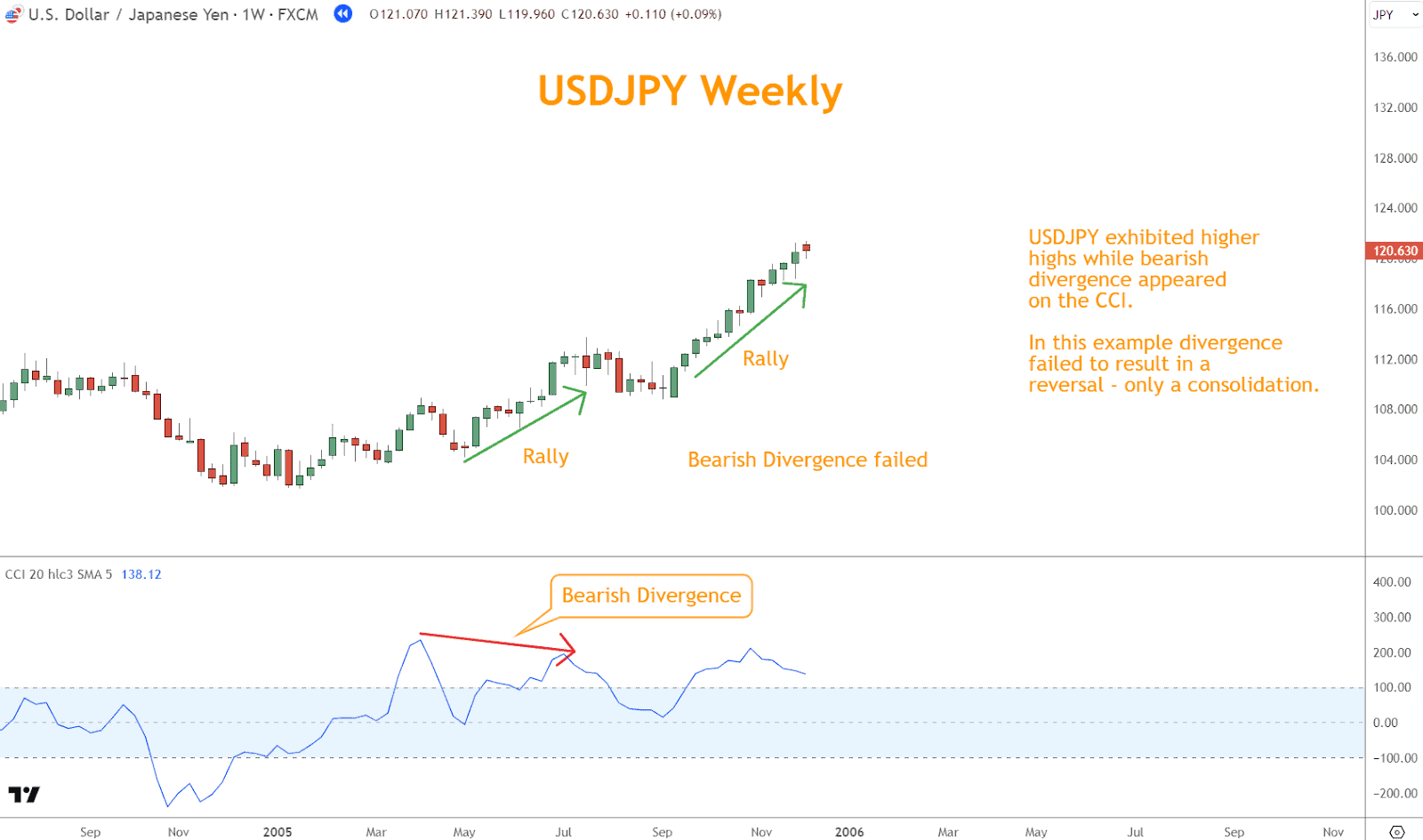

Conversely, bearish divergence materializes when prices form higher highs while the CCI forms lower highs, signaling waning bullish momentum and a potential downward reversal.

Remember, divergence isn’t foolproof and can often give false signals, as seen in the example below.

How to Choose Periods

The choice of the period for calculating the CCI can influence its sensitivity to price movements.

Shorter periods yield more sensitive values, providing timely signals but increasing the risk of false positives.

Conversely, more extended periods smooth out fluctuations, offering a clearer picture of the overall trend but potentially delaying signals.

Experiment with different periods to tailor the momentum indicator to your trading style and the specific characteristics of your currency pair.

Combining the CCI Indicator with the LSMA Trend Indicator

When paired with the Commodity Channel Index (CCI), the Least Squares Moving Average (LSMA) trend indicator offers a coinciding indicator to identify trends and use momentum for confirmation.

Understanding the LSMA Trend Indicator

The LSMA trend indicator is a variation of the traditional moving average that aims to smoother represent price trends by minimizing the impact of short-term fluctuations.

Unlike simple moving averages, which assign equal weight to all data points within the selected period, the LSMA assigns greater weight to more recent data points, resulting in a more responsive indicator.

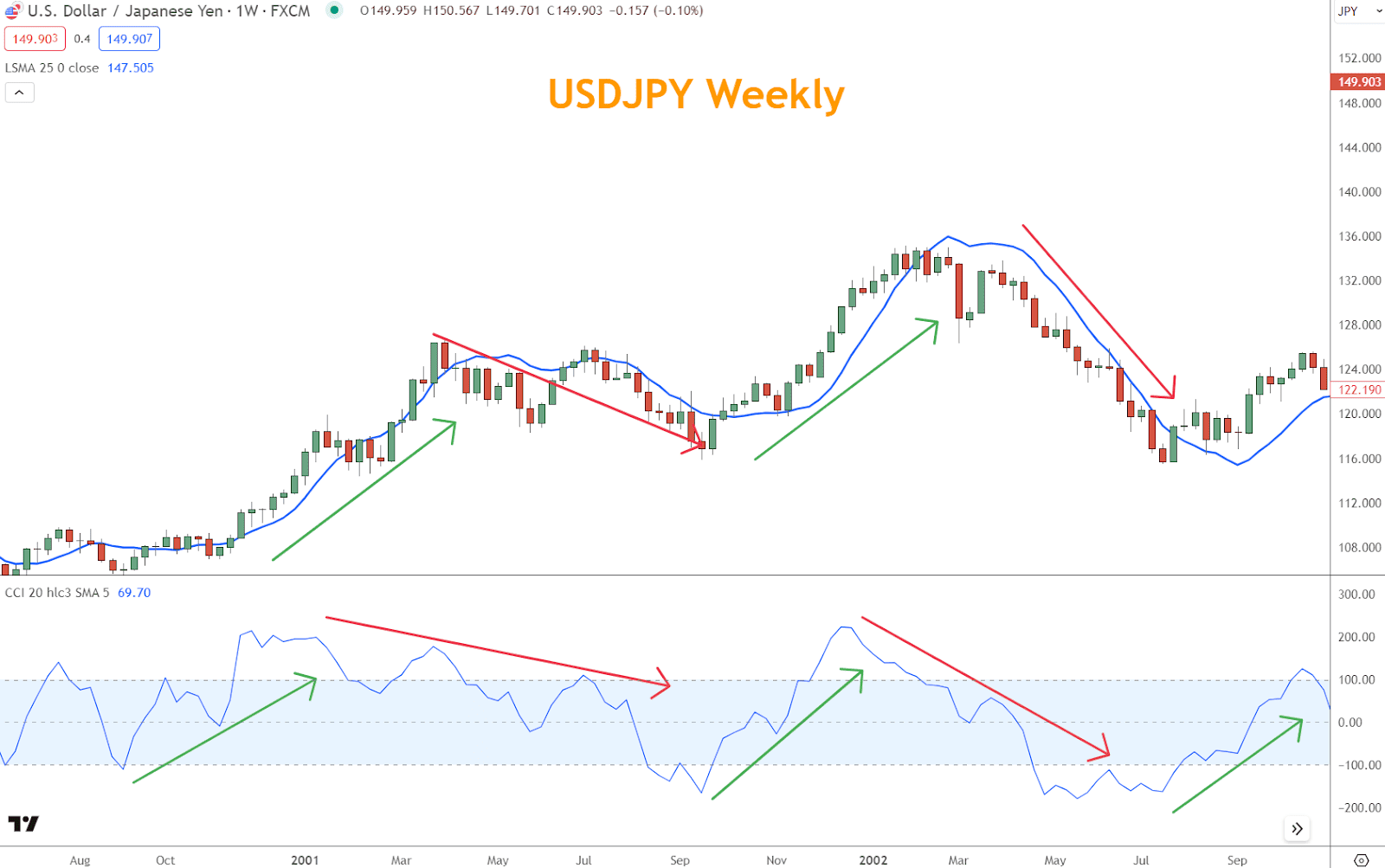

Traders often use the LSMA to identify the direction of the prevailing trend, using the indicator line’s slope as a visual cue.

An upward-sloping LSMA suggests a bullish trend, while a downward-sloping LSMA indicates a bearish trend.

The LSMA helps identify potential entry and exit points more accurately by filtering out noise and focusing on the underlying trend.

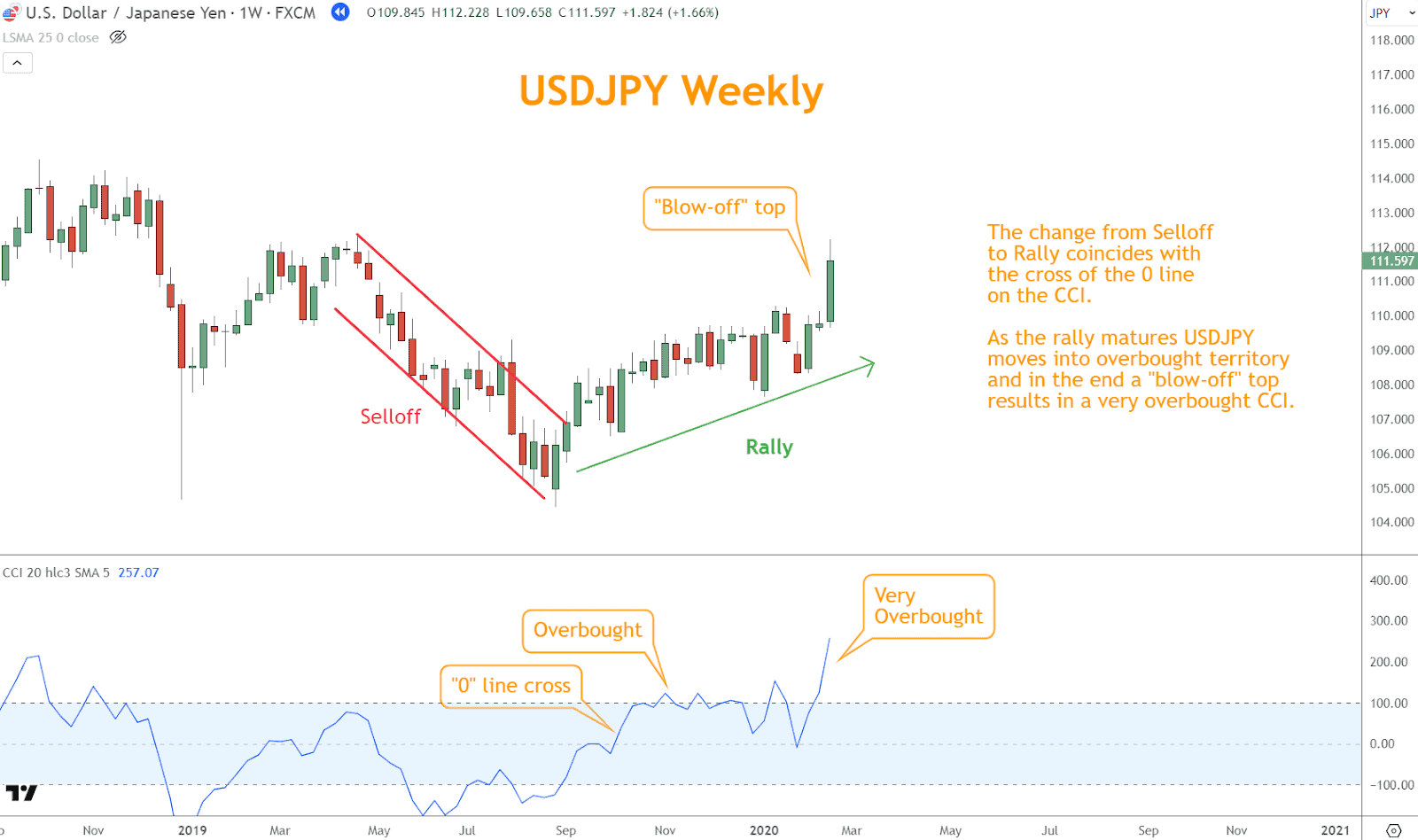

Integrating the CCI with LSMA

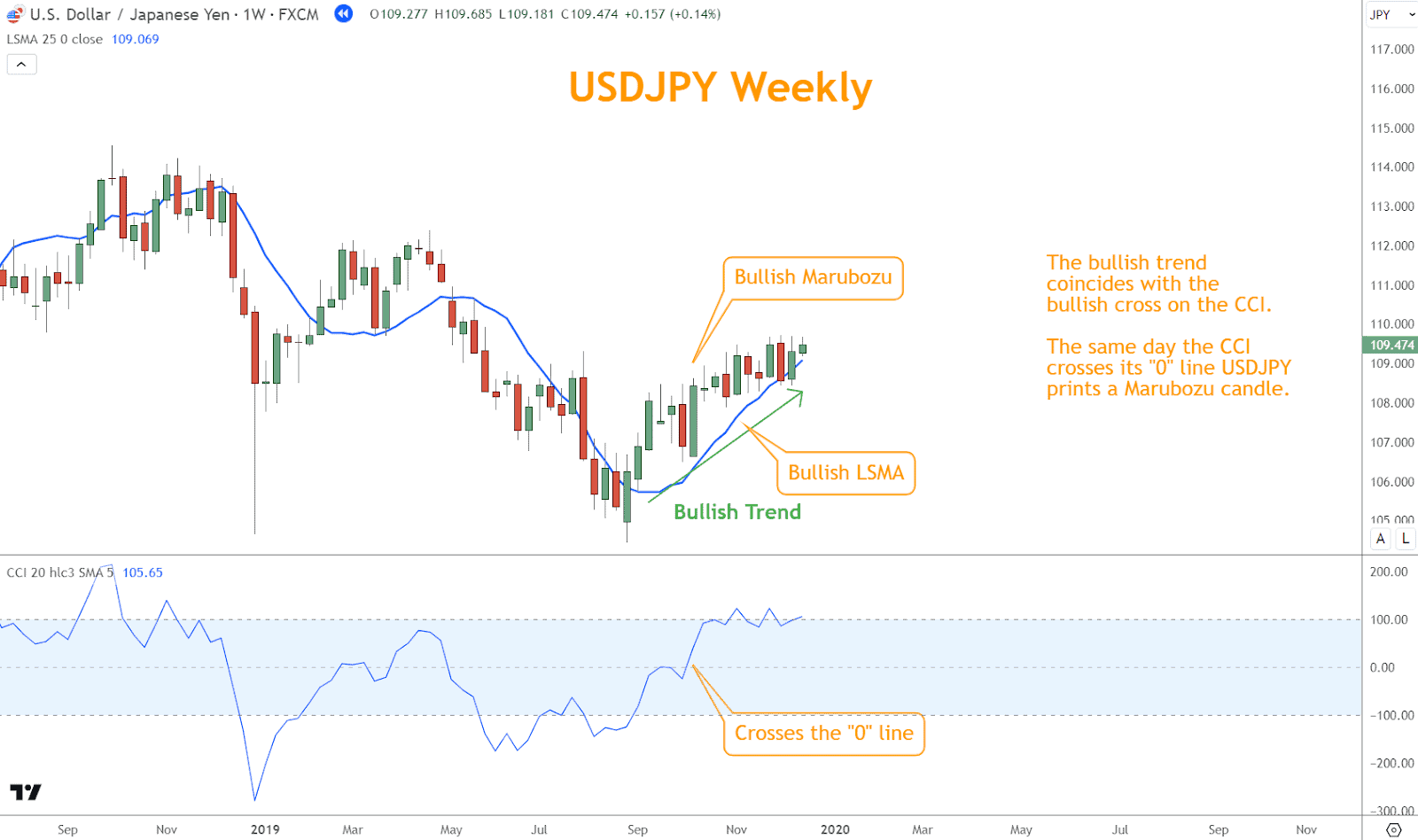

When combined with the CCI, the LSMA trend indicator becomes even more powerful, offering traders enhanced insights into market dynamics.

One common approach is confirming the trend direction the LSMA indicates.

For instance, if the LSMA slows upwards, signaling a bullish trend, traders can look for CCI values consistently above zero to validate the bullish bias.

Additionally, traders can use the CCI to identify potential trend reversals with LSMA crossovers.

When the CCI crosses above or below critical levels, such as +100 or -100, with an LSMA direction change, it can signal a potential trend reversal.

For example, if the LSMA transitions from an upward to a downward slope and the CCI crosses below +100, it may indicate a shift from a bullish to a bearish trend.

Can You Integrate Japanese Candlesticks with the CCI Indicator?

Japanese candlestick patterns offer insights into market sentiment and price action.

Combined with the Commodity Channel Index (CCI), these candlestick patterns can provide a comprehensive view of potential market movements, enhancing decision-making and trading strategies.

Understanding Japanese Candlesticks

Japanese candlestick charts display price movements over a specific period using candlestick shapes and colors.

Each candlestick represents the period’s opening, closing, high, and low prices.

Bullish candlesticks, typically depicted in green or white, indicate that the closing price is higher than the opening price, suggesting bullish momentum.

Conversely, bearish candlesticks, often shown in red or black, signify that the closing price is lower than the opening price, signaling bearish sentiment.

Identifying Candlestick Patterns

Various candlestick patterns exist, conveying different messages about market dynamics and potential price movements.

Common patterns include Doji, Hammer, Engulfing, and Evening Star.

Traders often look for these patterns to anticipate trend reversals, continuations, or indecision in the market.

Combining with Candlestick Patterns

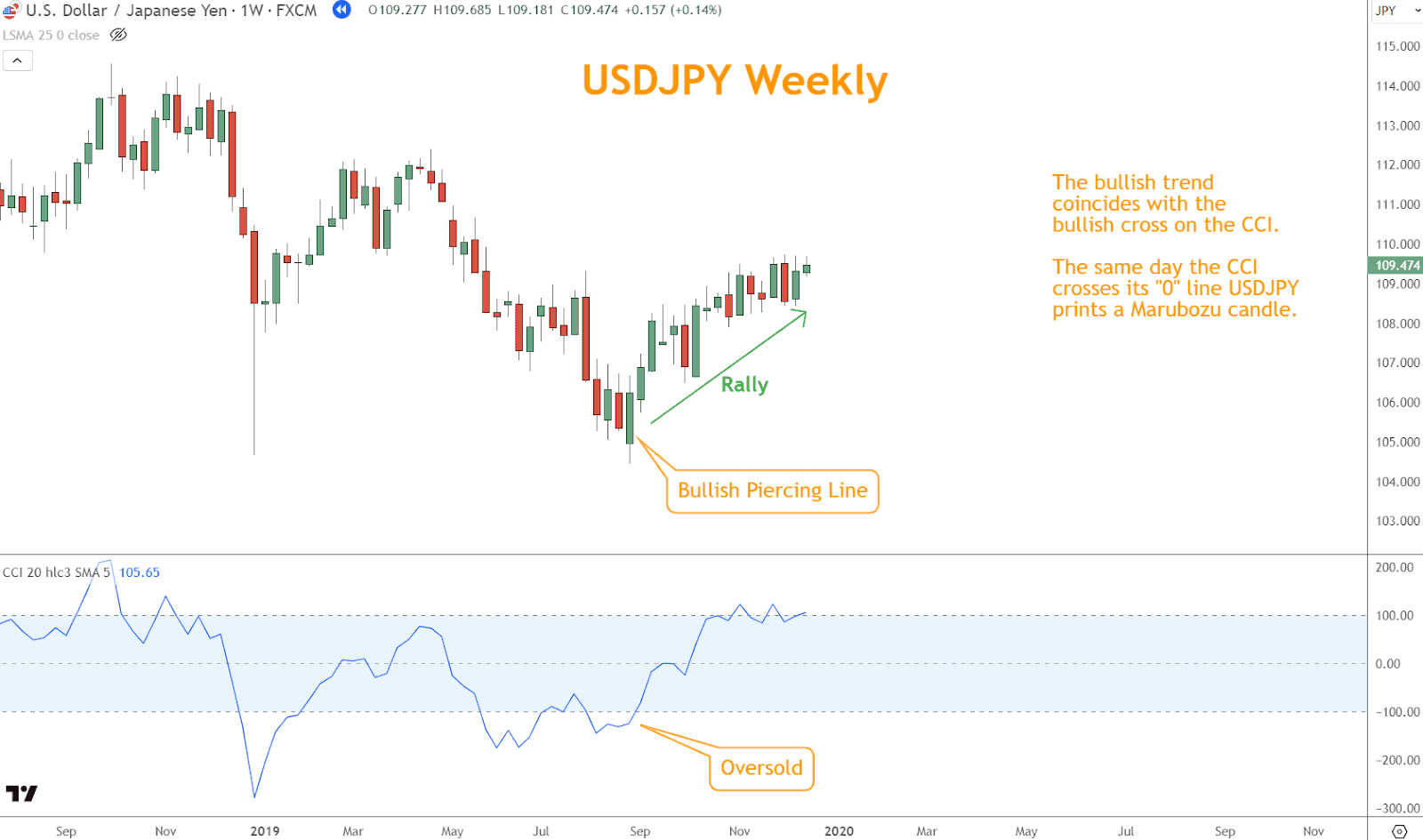

When integrating with Japanese candlestick analysis, traders can more confidently validate potential entry and exit points.

For example, if a bullish Piercing Line forms—a bullish reversal signal—accompanied by a 0 line cross on the CCI, it strengthens the case for a potential upward reversal.

Similarly, a bearish engulfing pattern—indicating a bearish reversal—supported by a negative divergence may signal a potential downward reversal.

Additionally, traders can confirm the strength of candlestick pattern reversals.

For instance, if a bearish engulfing pattern occurs with the CCI crossing above +100, meaning it’s overbought, it suggests the likelihood of a bearish reversal.

Conversely, if a bearish engulfing pattern coincides with the CCI crossing below -100, it reinforces oversold sentiment and validates the potential for a reversal.

Can Chart Patterns leverage the CCI Indicator?

In Forex trading, chart patterns are pivotal in identifying potential market reversals, continuations, and breakout opportunities.

When integrated with the Commodity Channel Index (CCI), these patterns can provide additional confirmation signals and insights into market dynamics, bolstering trading strategies and decision-making processes.

Understanding Chart Patterns

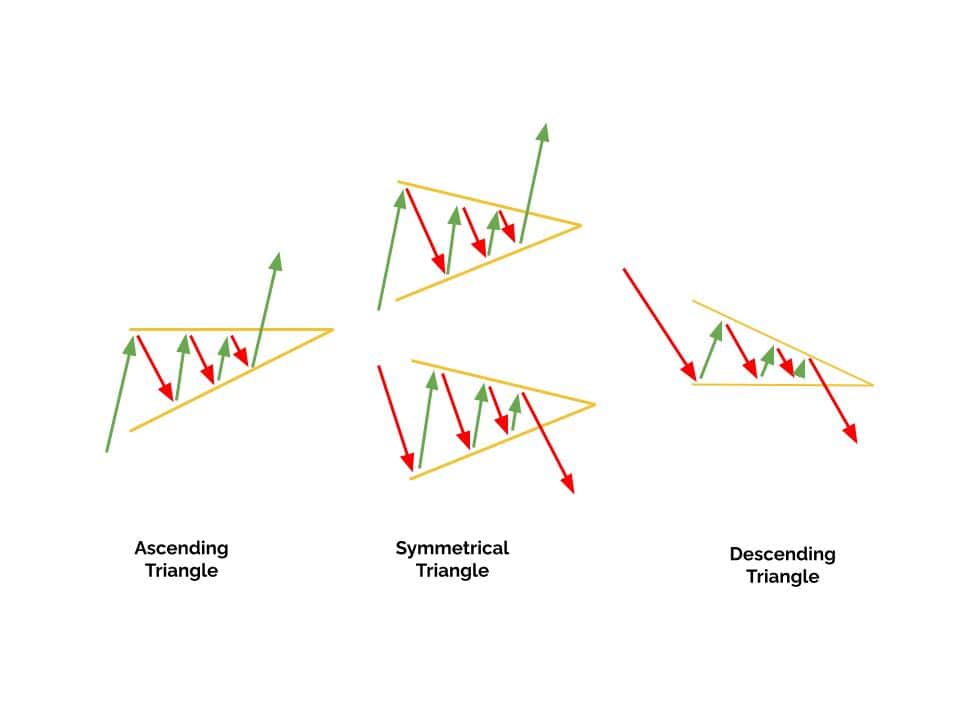

Chart patterns are visual representations of price movements over a specific period, offering traders valuable insights into market sentiment and potential future price movements.

Common chart patterns include head and shoulders, triangles, flags, pennants, double tops, and double bottoms.

Each pattern carries unique characteristics and implications for market direction.

Identifying Chart Patterns

Traders employ various techniques to identify patterns, such as visually scanning price charts or utilizing pattern recognition tools on trading platforms.

Once identified, traders analyze the pattern’s structure and context to gauge its significance and potential implications for future price movements.

For instance, a head and shoulders pattern typically signals a potential trend reversal, while a triangle pattern suggests a period of consolidation before a breakout occurs.

Combining with Chart Patterns

Integrating with chart pattern analysis can enhance traders’ ability to identify high-probability trade setups and validate potential entry and exit points.

The CCI is a complementary tool that offers confirmation signals or early warnings of potential trend reversals when used with chart patterns.

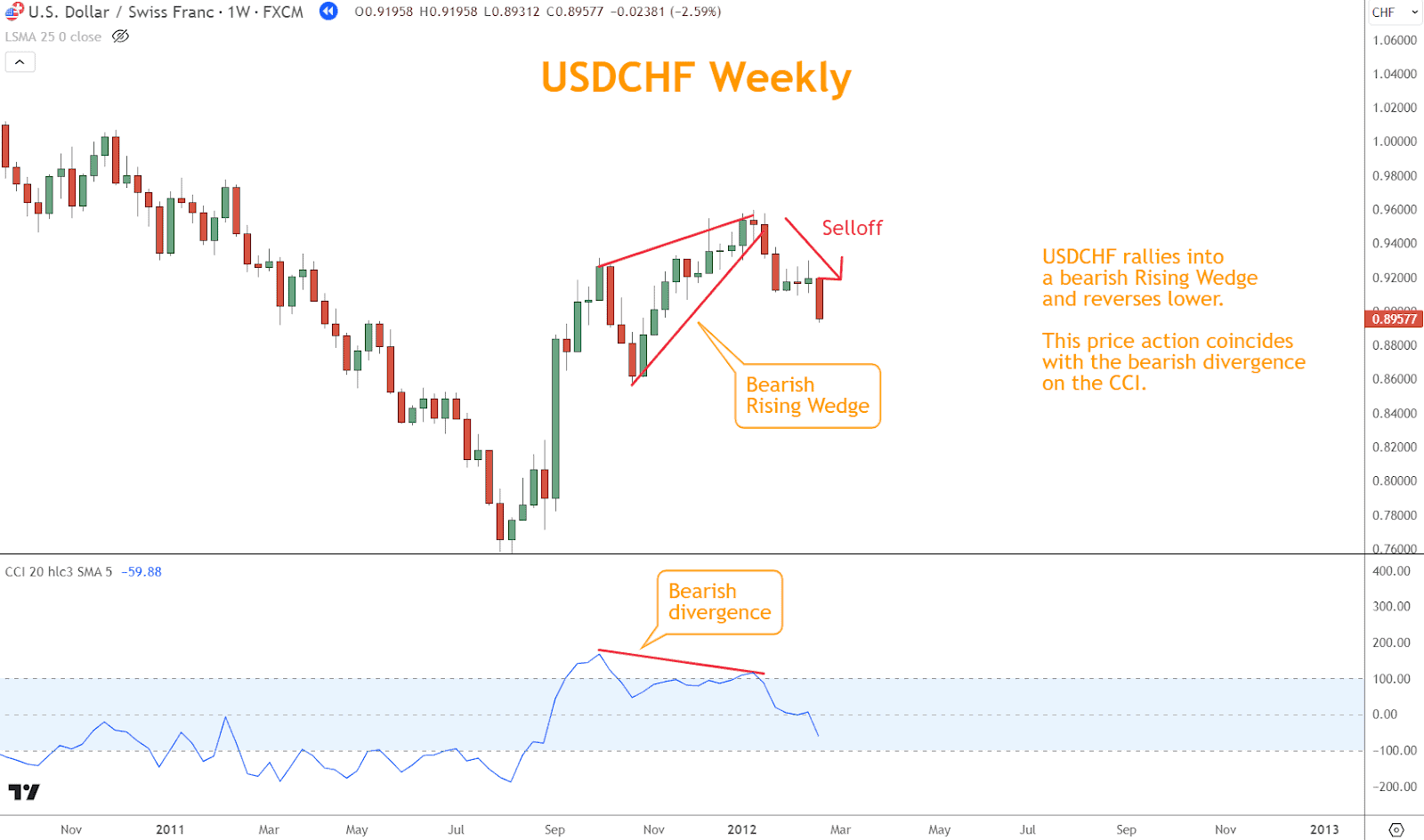

For example, if a bearish Rising Wedge forms in a rally —a bearish reversal signal—accompanied by bearish divergence on the CCI, it strengthens the case for a downward reversal.

Conversely, if a bullish triangle pattern develops—a continuation pattern—supported by bullish divergence on the CCI, it reinforces the bullish bias and increases the likelihood of an upward breakout.

Additionally, traders can use the CCI to confirm the strength of chart patterns.

For instance, if a breakout from a chart pattern occurs with the CCI crossing above +100, it suggests robust bullish momentum, increasing the conviction in the upward move.

Conversely, if a breakdown from a chart pattern coincides with the CCI crossing below -100, it reinforces the bearish sentiment and validates the potential for a downward move.

Integrating the Commodity Channel Index (CCI) with chart pattern analysis provides traders with a comprehensive approach to identifying and capitalizing on market trends.

Where can Support and Resistance coordinate with the CCI Indicator?

Support and resistance levels are critical concepts in Forex trading. They represent areas where the price tends to stall or reverse due to underlying supply and demand dynamics.

Combined with the Commodity Channel Index, you can gain valuable insights into potential entry and exit points, enhancing your ability to navigate market movements effectively.

Understanding Support and Resistance

Support levels are price levels where buying interest is sufficiently strong to prevent further price declines.

They are often represented by historical lows or areas where buyers accumulate.

Conversely, resistance levels are price levels where selling pressure outweighs buying interest, hindering further upward movement.

They are typically depicted by historical highs or areas where sellers emerge.

Identifying Support and Resistance Levels

Traders employ various methods to identify support and resistance levels, including horizontal lines drawn across significant price levels, trendlines connecting successive highs or lows, and pivot points derived from previous price action.

Once identified, these levels are reference points for assessing potential trade opportunities and managing risk.

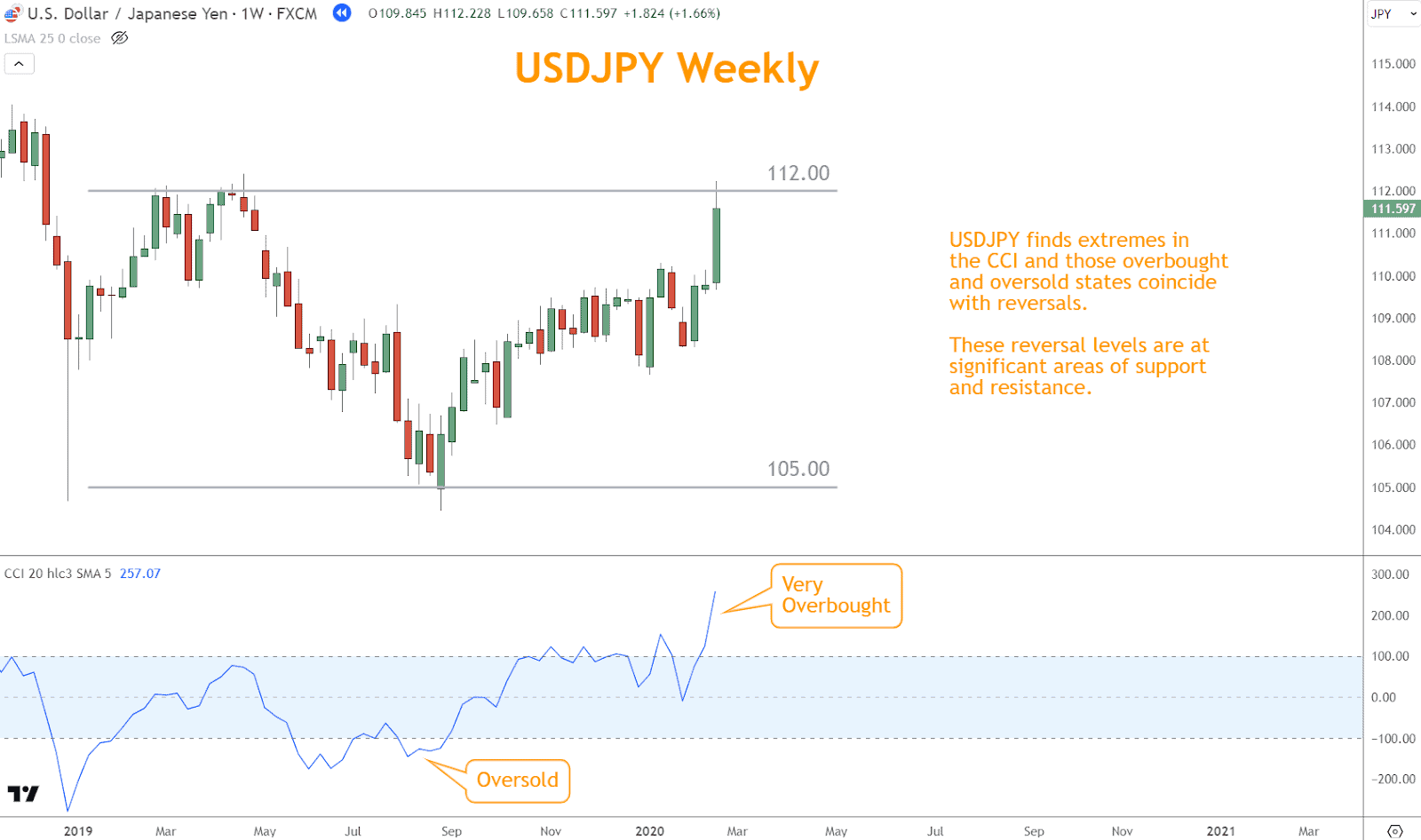

Integrating CCI with Support and Resistance

Integrating with support and resistance analysis allows traders to validate potential entry and exit points more confidently.

The CCI is a complementary tool that offers confirmation signals or early warnings of potential reversals near crucial support and resistance levels.

For example, suppose there are oversold conditions—a negative value—near a significant support level. In that case, it may present a favorable opportunity to enter a long position, anticipating a potential bounce from support.

Conversely, suppose the CCI indicates overbought conditions—a positive value—near a strong resistance level. In that case, it may signal a potential opportunity to enter a short position, anticipating a possible reversal from resistance.

Additionally, you can use the CCI indicator to confirm the strength of support and resistance levels.

If a price approaches a support level and the CCI crosses above -100, it suggests bullish momentum and increases the likelihood of a successful bounce from support.

Similarly, if a price approaches a resistance level and the CCI crosses below +100, it indicates bearish momentum and validates the potential for a reversal from resistance.

Conclusion

Incorporating the Commodity Channel Index (CCI) into your Forex trading strategy can provide valuable insights into market dynamics, helping you make informed trading decisions.

By leveraging it alongside other tools and indicators, such as the LSMA trend indicator, Japanese candlesticks, chart patterns, and support/resistance levels, traders can enhance their ability to identify high-probability trade setups and manage risk effectively.

However, like any technical indicator, it has its limitations, and it’s essential to combine it with other forms of analysis and exercise prudent risk management.

What’s the Next Step?

Use what you’ve learned about the CCI indicator and look at your favorite charts.

Look for opportunities to incorporate what you’ve learned here in your trading.

Once you’re ready to trade, choose a strategy and process you believe will work for you.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about trading with the CCI indicator in Forex.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will use the Six Basics of Chart Analysis and Advanced Strategies to show you the trade opportunities I’m watching.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce videos and guides to help you learn and build better trading practices.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

How Does it Differ from Other Momentum Oscillators?

The Commodity Channel Index differs from other momentum oscillators like the Relative Strength Index (RSI) or Stochastic Oscillator by focusing on deviations from the average price rather than comparing current price levels to historical prices.

This unique approach allows the CCI to identify overbought and oversold conditions more effectively in varying market conditions.

Can the CCI Indicator Be Used as a Standalone Tool for Trading?

While it can provide valuable insights into market momentum and potential reversals, it is typically more effective with other technical analysis tools and indicators.

Combining with tools like trend indicators, Japanese candlestick patterns, chart patterns, and support/resistance levels can enhance its effectiveness and provide a more comprehensive view of market dynamics.

What Are Some Common Mistakes Traders Make?

One common mistake is relying solely on extreme values (+100 or -100) as buy or sell signals without considering other factors such as trend direction or market context.

Additionally, you may pay more attention to the importance of confirmation signals from other indicators or adjust the period to suit the specific characteristics of the traded currency pair.

How Can Traders Identify Divergence Signals?

Divergence occurs when the price of a currency pair moves in the opposite direction of the its indicator.

A bullish divergence occurs when prices form lower lows while the CCI forms higher lows, indicating potential upward momentum.

Conversely, bearish divergence occurs when prices form higher highs while the CCI forms lower highs, suggesting potential downward momentum.

Identifying divergence signals can provide valuable insights into potential trend reversals.

What Role Does Risk Management Play?

Risk management is crucial in any trading strategy.

Implement stop-losses to limit potential losses and adhere to proper position sizing principles to protect your capital.

Additionally, patience and discipline are essential when executing trades and waiting for confirmation signals from the CCI and other technical indicators before entering or exiting positions.

You can mitigate potential losses and maximize trading success by managing risk effectively.